How Does Today’s Global Financial System Work?

The global financial system underpins the world’s economy by facilitating the efficient allocation of resources, managing risks, and processing payments.

Connecting savers and investors via marketplaces for buying and selling financial assets like stocks, bonds, and derivatives helps funds flow to their most productive uses. Insurance, derivatives, and other risk management tools help reduce the financial impact of unexpected market events. All of these complex transactions, along with our everyday purchases, are facilitated by interbank settlement systems and payment processors like Mastercard.

In this post, we provide an overview of the institutions and infrastructures underpinning the global financial system, walk through step-by-step examples, and explore the future of finance. We then touch on how Chainlink is working with these institutions and infrastructures to build tomorrow’s global financial system.

The Institutions and Infrastructures Powering the Global Financial System

| Category | Description | Functions/Services | Examples |

| Asset Managers | Offer investment products and services to clients, including pension funds, corporations, and government entities. | Investment research, portfolio construction and management, trade facilitation, risk management. | BlackRock, Vanguard, Fidelity International |

| Brokerage Firms | Help clients buy and sell securities, providing additional advisory and financial services. | Trade execution, account management, investment advisory, margin lending, prime brokerage services. | Charles Schwab, UBS, Barclays |

| Central Banks | Oversee and regulate financial markets, control monetary policy, and manage financial stability. | Monetary policy control, financial stability regulation, currency issuance, lender of last resort, FX management. | Federal Reserve, European Central Bank |

| Central Securities Depositories (CSDs) | Hold and manage securities on behalf of financial institutions, maintaining records and facilitating settlement. | Securities registration, safekeeping, settlement, and corporate actions processing. | DTCC, Clearstream, Euroclear |

| Clearing Houses (CCPs) | Act as intermediaries in securities transactions, mitigating counterparty risk and ensuring trade settlement. | Novation, margin requirements, default funds, and risk management techniques. | CME Clearing, LCH Group, Eurex Clearing, HKSCC |

| Commercial Banks | Provide banking services to individuals, businesses, and governments, including deposits, loans, and payments. | Deposits and loans, payments and transfers, wealth management, trade financing, foreign exchange. | JPMorganChase, Bank of America, HSBC |

| Credit Rating Agencies | Assess the creditworthiness of corporations, governments, and financial instruments, indicating default risk. | Credit assessments, ratings publication for bonds, loans, and structured products. | Moody’s, S&P Global Ratings, Fitch Ratings |

| Custodian Banks | Safeguard financial assets for institutional investors, corporations, and high-net-worth individuals. | Custody services, transaction settlement, corporate actions processing, tax reporting, foreign exchange. | BNY Mellon, State Street |

| Exchanges | Centralized platforms where buyers and sellers trade financial instruments like stocks and derivatives. | Trade facilitation, price discovery, enforcement of trading rules. | NYSE, NASDAQ, Hong Kong Stock Exchange (HKEX), London Stock Exchange (LSE) |

| Insurance Companies | Pool risk to protect policyholders against financial losses and underwrite policies for various sectors. | Underwriting, premium collection, claims processing, investment of policyholder funds. | MetLife, Prudential, Allianz |

| Investment Banks | Provide advisory and capital-raising services to corporations, governments, and institutions. | Capital raising, mergers & acquisitions advisory, underwriting, market making and trading. | J.P. Morgan, Goldman Sachs, Morgan Stanley |

| Messaging Standards | Enable secure and standardized financial communication, ensuring efficient transaction processing. | Standardized messaging formats, data privacy, interoperability, cross-border transaction support. | Swift (ISO 20022) |

| Payment Processors | Enable digital payments and card-based transactions between consumers and businesses. | Transaction authorization, payment settlement, fraud prevention, integration with e-commerce. | Mastercard, Visa |

| Pension Funds | Manage retirement funds, making investments to ensure long-term returns for pension beneficiaries. | Contribution collection, investment management, retirement benefit payouts. | CalPERS, Universities Superannuation Scheme (USS) |

| Transfer Agents | Maintain security ownership records, facilitate dividend distribution, and process investor communications. | Shareholder record maintenance, certificate issuance, investor communications, dividend distribution. | Computershare, Equiniti, American Stock Transfer & Trust Company |

| Trade Repositories | Collect and maintain records of OTC derivatives transactions, providing regulators with trade data. | Data collection, validation, reporting to regulators for financial oversight. | CME Group, UnaVista |

For brevity, this overview excludes several types of financial institutions, such as family offices, fintech companies, hedge funds, market makers, microfinance institutions, mutual fund companies, neobanks, primary dealers, private equity firms, real estate investment trusts (REITs), sovereign wealth funds, and venture capital firms.

The Global Financial System In Action: Step-by-Step Examples

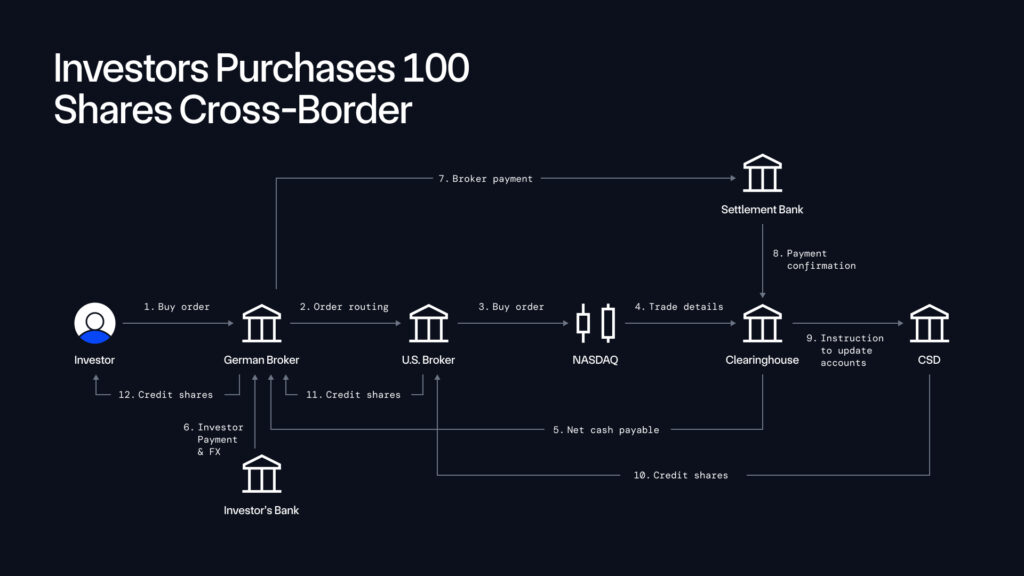

Example 1. Investor Purchases 100 Shares Cross-Border

- Investor buy order: A German investor instructs their German broker to buy 100 shares. As they’re a non-U.S. investor looking to purchase U.S. equities, they must complete a W-8BEN tax form.

- Order routing: The German broker uses the FIX trading protocol to send the order to a U.S. broker that’s a member of NASDAQ.

- Broker buy order: The U.S. broker places the buy order on NASDAQ, which matches it against a corresponding sell order. Once matched, the trade is considered executed, and a binding contract between the buyer and seller is formed. The U.S. broker sends a trade confirmation to the German broker via FIX in near real-time, who then notifies the investor that their order was filled.

- Trade details: Trade details go to the clearinghouse, which acts as the central counterparty (CCP) for U.S. equities. The clearinghouse guarantees both sides of the trade.

- Netting: The clearinghouse aggregates all trades for each participant via Continuous Net Settlement (CNS). It then calculates a single net long/short position in each security, along with a net cash payable/receivable position. The 100 shares and their price are included in this calculation.

- Investor payment and FX conversion: The German broker debits Euros in the investor’s bank account to cover the final USD share purchase price, as well as any fees. The broker also records the FX conversion rate to match the transaction value to the investor’s local currency for settlement and reporting. The German broker (or its affiliated FX desk) converts Euros into USD at the prevailing exchange rate, either at the time of trade execution or settlement.

- Broker payment: If the broker has a net cash payable position, they initiate a wire transfer via Fedwire sending USD to the clearinghouse’s settlement bank, such as BNY Mellon, J.P. Morgan, or Citi. If they have a receivable cash position, they’ll receive funds from the clearinghouse.

- Payment confirmation and settlement: The clearinghouse instructs the CSD to settle the broker’s net position upon payment confirmation. The CSD updates the U.S. broker’s account as part of a delivery vs. payment (DvP) settlement. If the broker wasn’t a direct participant, the trade would be processed via a clearing firm or custodian bank.

- Update ownership accounts: The transfer agent checks whether it needs to update ownership accounts. In this case, it is not required to update the company’s shares register for this trade as ownership remains in the nominee name recorded by the CSD.

- Credit U.S. broker’s account: The U.S. broker gains economic ownership rights over the 100 shares through book-entry updates at the CSD. Legal ownership remains registered under the CSD’s nominee, meaning no share certificates are issued or re-registered.

- Credit German broker’s account: The U.S. clearing broker updates its internal records to show the position is now credited to the German introducing broker in an omnibus account (which does not identify the end customer as opposed to a segregated account).

- Credit investor’s account: In turn, the German broker updates its own internal record to show the German investor as the ultimate beneficiary. Note that in this case, custody refers to the electronic book-entry safekeeping of assets on behalf of the owner–rather than physical possession or nominee ownership of the stock certificate.

Example 2. Tech Company Issues Bond To Fund Expansion

-

- Issuer’s capital-raising decision: A U.S. technology company requires USD 800 million to fund a new data center in Virginia. The CFO and treasurer decide to offer a corporate bond to qualified institutional buyers (QIBs) under Rule 144A of the Securities Act.

- Investment bank mandate: The tech company solicits proposals from leading investment banks to underwrite the transaction and then grants a mandate to the lead underwriter. Other banks join as co-managers. The underwriters’ corporate finance and syndicate teams conduct due diligence on the company’s financials and expansion plans.

- Credit rating: The tech company collaborates with credit rating agencies (e.g., S&P, Moody’s, Fitch) and obtains a BBB+ rating, which appeals to institutional investors such as asset managers and pension funds.

- Offering memorandum and indenture: Working with the issuer and legal counsel, the lead underwriter coordinates the offering memorandum, which details the issuer’s financials, risks, and bond features. A commercial bank is appointed as trustee, and an indenture is prepared. This formal agreement between the issuer (tech company) and the trustee outlines the bond’s terms and conditions. Because this is a Rule 144A offering, no public SEC registration is required.

- Private roadshow and book-building: The syndicate desk holds a private roadshow for QIBs, presenting the company’s credit profile and bond terms. QIBs place indications of interest with desired amounts and yields. This feedback helps the underwriters gauge demand and refine pricing.

- Determine allocations: The investment banks set the coupon at 5.2% with a 10-year maturity. The investment bank determines allocations based on the final order book, verifying each QIB’s KYC compliance before finalizing those allocations.

- CUSIP is assigned: A unique CUSIP (or ISIN, if applicable) is assigned to the bond, facilitating identification and settlement within depository and trading systems.

- Settlement: Pricing and allocations are confirmed. Each investor then wires USD to the underwriter’s designated settlement account, typically by T+2. The underwriter confirms receipt, then instructs the CSD to credit the bonds (identified by the CUSIP) to each investor’s CSD participant account, typically a custodian bank. The CSD updates its internal ledger, while investors’ custodian banks reflect beneficial ownership. The underwriter then wires the net proceeds—minus fees—to the issuer’s bank account, completing the transaction.

- Post-issuance:

- The trustee helps ensure compliance with the indenture by monitoring default triggers and corporate actions.

- A paying agent processes principal and coupon payments on behalf of the tech company. Funds typically flow from the agent to the CSD’s nominee and credits participant accounts, which then pass funds to the ultimate custodians and end investors.

- Transfer agents are not required to update bond ownership as Rule 144A bonds remain book-entry at the CSD.

- Regulatory reporting: Under the SEC’s Rule 144A exemption, no public registration is required. However, if these bonds are traded in the secondary market, broker-dealers must report the trade details (price, volume, time) to FINRA’s Trade Reporting and Compliance Engine (TRACE).

Example 3. Dual Stock Listing To Access U.S. and Chinese Markets

- Board approval: The tech company’s board of directors decides to pursue a dual listing to access both U.S. and Asian capital markets. The board approves the IPO strategy, defining the total amount to be raised and outlining the scope of the offering across NASDAQ and HKEX.

- Underwriter engagement: The company hires global investment banks (often with separate teams or affiliates experienced in each market) to structure the dual listing, determine initial pricing ranges, and prepare regulatory filings. The banks also underwrite the offering—committing to buy any unsold shares if necessary. One bank may act as the lead underwriter in both markets, or there may be joint bookrunners for each exchange.

- Exchange and symbol reservation: The company requires unique identifiers to ensure a distinct market identity in each listing venue:

-

-

- NASDAQ: The company reserves a unique trading symbol through the Intermarket Symbols Reservation Authority (ISRA).

- HKEX: The company applies for a stock code via the Hong Kong Exchanges and Clearing Limited (HKEX) system.

-

- Transfer agent and share registrar appointment:

-

-

- Computershare is appointed as the U.S. transfer agent to maintain the official shareholder register for its NASDAQ-listed shares and to process ownership updates.

- The Hong Kong Share Registrar is appointed to handle local share registration and coordinate with HKEX’s Central Clearing and Settlement System (CCASS) for the HK-listed shares.

-

- Independent audit: An independent public accountant conducts or updates a thorough audit of the company’s financials, ensuring compliance with both SEC (U.S. GAAP or IFRS permitted) and Hong Kong (HKFRS or IFRS) standards. This provides confidence to investors and regulators in both markets.

- Security identifiers: The company acquires the necessary security identifiers:

-

-

- CUSIP Number: A 9-character code for the U.S. listing, aiding in clearing and settlement through U.S. systems.

- ISIN: They also obtain an International Securities Identification Number recognized by global custodians.

-

- Clearing eligibility:

-

-

- NASDAQ: The common stock is made eligible at a CSD, allowing shares to be held in “street name” and supporting electronic settlement.

- HKEX: Shares are admitted to CCASS—the Central Clearing and Settlement System operated by Hong Kong Securities Clearing Company (HKSCC)—which enables electronic book-entry settlement in Hong Kong.

-

- Regulatory filings:

-

-

- Form S-1 with the SEC: The underwriter prepares and submits a prospectus detailing the U.S. offering. The SEC reviews and approves the disclosures, financial statements, and risk factors.

- HKEX application proof and prospectus: The company files its listing application and draft prospectus with Hong Kong’s Securities and Futures Commission (SFC) and HKEX. Both review for compliance with HK listing rules.

-

- Roadshows and investor demand: Investment banks coordinate roadshows targeting institutional investors across the U.S. and Asia. Asset managers, pension funds, and high-net-worth individuals in both regions evaluate the offering. Retail investors may also participate via local brokerage channels. Order books are created to guide final pricing.

- Final IPO pricing and allocation: The underwriters build separate books for NASDAQ and HKEX investors, refining the offer price based on demand in each market. The company and underwriters set the share price(s), possibly aligning or allowing a small variation between the U.S. and Hong Kong tranches. Shares are allocated among institutional and retail investors in both locales, ensuring each investor meets KYC/AML requirements.

- Dual listing launch:

-

-

- NASDAQ listing: Once approved by the SEC and NASDAQ, the shares begin trading under the reserved symbol on a designated listing day in the U.S.

- HKEX listing: Simultaneously (or with a slight time offset), the shares debut on HKEX under the assigned stock code.

-

- Clearing and settlement:

-

-

- U.S. side: NASDAQ trades are cleared through the clearinghouse and settled in T+2 typically via Fedwire for cash movements and the CSD book-entry for shares.

- Hong Kong side: HKEX trades settle via CCASS, operated by HKSCC, ensuring DvP in Hong Kong dollars.

-

- Custodian and share registrar updates:

-

-

- U.S. custodians: Update internal systems to reflect beneficial ownership for clients holding NASDAQ-listed shares.

- Hong Kong Registrar: Updates local registers for HKEX-listed shares in CCASS.

- Synchronization: Transfer agents (U.S.) and share registrars (HK) regularly synchronize records with brokers and custodians, often using secure SWIFT messaging (e.g., MT540/MT543).

-

- Regulatory and market reporting:

-

- FINRA/TRACE (U.S.): Brokers report trades (price, volume, time) to FINRA for transparency (though TRACE specifically covers corporate bonds; equity trades typically go through different reporting facilities—e.g., the consolidated tape).

- HKEX disclosures: Trades on the Hong Kong market are recorded through the HKEX system; volumes and prices are publicly available.

- Public Trading: With both listings now active, the company’s shares are traded independently in each market, subject to local regulations, reporting rules, and liquidity dynamics.

How Will Tomorrow’s Financial System Work?

The financial system of tomorrow will fulfill the same role—facilitating the efficient allocation of resources, managing risks, and processing payments. It will also continue to be powered by today’s leading institutions. However, it will run on blockchains, smart contracts, and oracles.

BlackRock CEO Larry Fink identified tokenization as “the next generation for markets,” with 97% of asset managers agreeing that tokenization will revolutionize asset management. According to Boston Consulting Group, the market for tokenized assets could reach $16 trillion by 2030.

Advantages of tokenization include:

- 24/7/365 access—Continuous trading without the limitations of traditional market hours.

- Atomic settlement—Near-instantaneous settlement and with minimized counterparty risk through atomic DvP.

- Enhanced liquidity—Faster, broader, and more direct asset distribution across multiple markets.

- Tighter lending windows—Reduced to hours or even minutes through intra-day repos of swaps, improving capital efficiency.

- Enhanced monitoring—Real-time visibility into the status of an asset and comprehensive audit trails.

- Programmable assets—Smart contracts can automate compliance, payments, and corporate actions, and more.

- Fractional ownership—Investors can own smaller portions of high-value assets.

- Greater transparency—Unified golden records provide real-time auditability and a source of truth.

- Automated workflows—Streamlined operations with fewer intermediaries and administrative expenses, significantly reducing costs.

- Increased accessibility—Financial institutions can more easily serve new markets and provide access to unbanked populations.

- Composable architecture—Modular architectures enable the creation of integrated financial products.

- Expanded collateral use—Assets can be more easily used as collateral in lending markets.

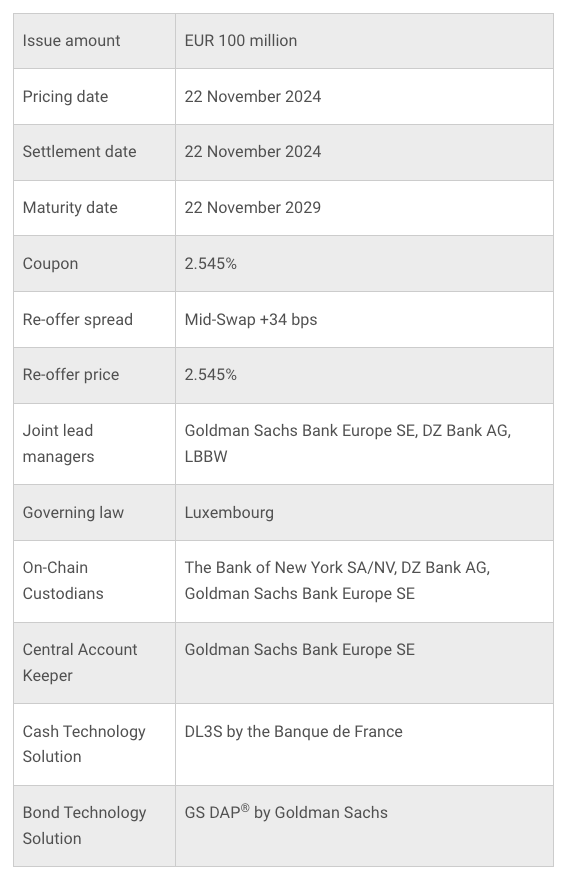

In a recent example highlighting the increasing digital asset adoption, the European Investment Bank (EIB) issued a EUR 100 million digital bond, in collaboration with Banque Centrale du Luxembourg, Banque de France, and Goldman Sachs. The tokenized bond was issued on Banque de France’s DLT platform and offers a coupon of 2.545% and matures in 2029.

How Chainlink Is Bringing The Global Financial System Onchain

Working alongside existing institutions and infrastructures such as Swift, Fidelity International, and ANZ Bank, Chainlink is powering next-generation applications for banking, asset management, and other major sectors.

Next-Generation Tokenized Funds

SBI Digital Markets, UBS Asset Management, and Chainlink successfully demonstrated how to automate fund subscriptions and redemptions with blockchains and smart contracts as part of the Monetary Authority of Singapore’s (MAS) Project Guardian initiative. The new model unlocks efficiency gains in fund management by leveraging Chainlink to coordinate operations between the asset manager, fund distributor, and fund administrator across different blockchains and existing financial systems.

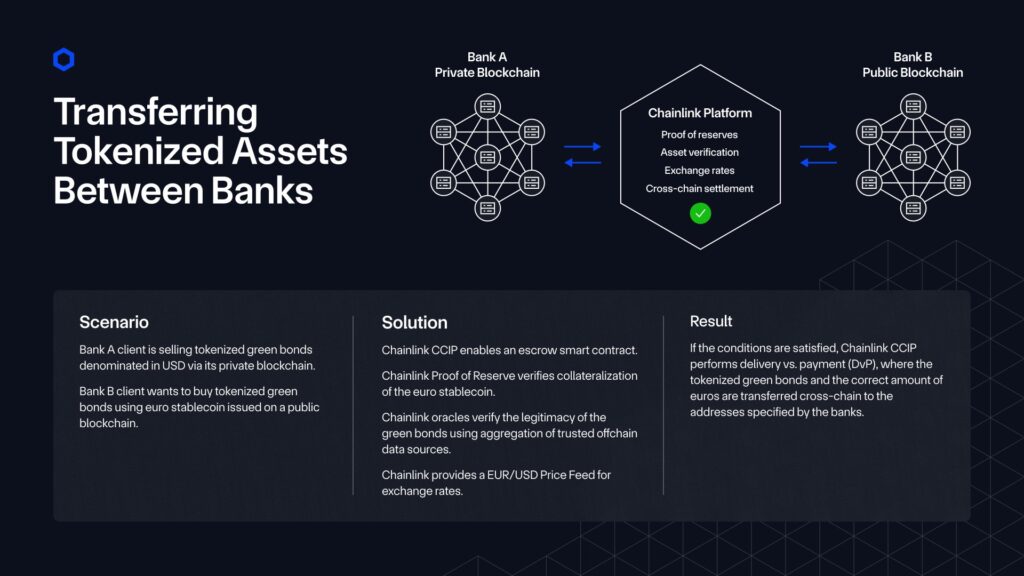

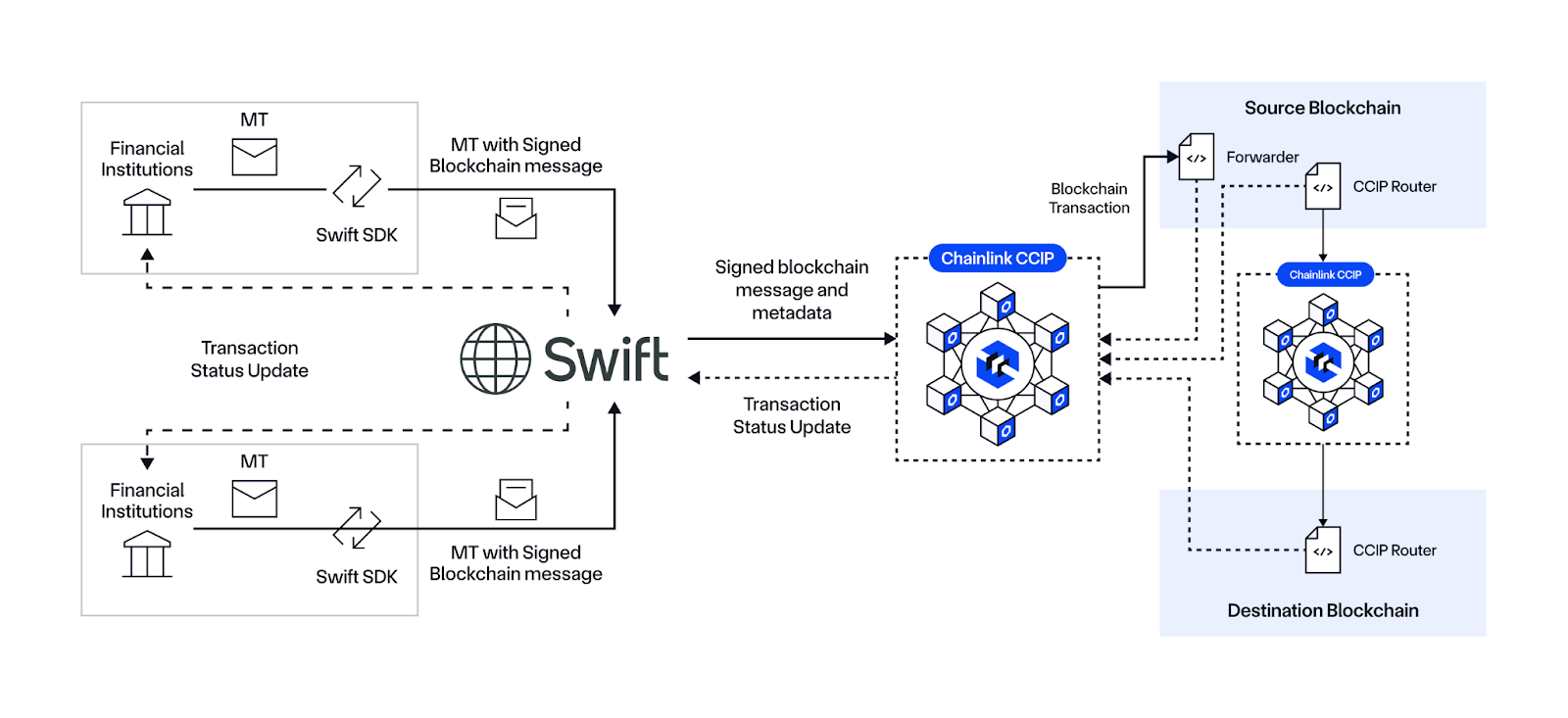

Transferring Tokenized Assets Cross-Chain

Swift—the international bank messaging standard for 11K+ banks—is working with Chainlink to unlock tokenization at scale. Swift and Chainlink demonstrated a secure and scalable way to transfer tokenized assets cross-chain using CCIP. The successful collaboration featured 12+ world-leading financial institutions, including Euroclear, Clearstream, ANZ, Citi, BNY Mellon, BNP Paribas, Lloyds Banking Group, and SDX.

Establishing a Unified Standard for Asset Servicing With the Chainlink Platform, Blockchains, and AI

Chainlink and 24 of the world’s largest financial institutions and market infrastructures, including Swift, DTCC, Euroclear, UBS, and Wellington Management, continued their work on corporate actions processing. Building on the foundations established in Phase 1, the second phase introduces a production-grade system that includes new data attestor and data contributor roles. These roles enable trusted institutions to validate and enrich the LLM-extracted corporate actions records, allowing data accuracy for confirmed records to reach 100%.

This solution unlocks an onchain golden record for corporate actions, an attested, real-time source of truth that can be accessed simultaneously by smart contracts, custodians, and post-trade systems. It also enables tokenized equities, an increasingly adopted category of tokenized assets, to reference the same confirmed records across public and private blockchains, laying the groundwork for better synchronization and increased automation across onchain markets.

By standardizing how corporate actions data is extracted, validated, and delivered, the initiative creates a shared foundation for asset servicing across both blockchain networks and traditional financial infrastructure.

Privacy-Enabled, Cross-Chain, Cross-Border Tokenized Commercial Paper

Under the Monetary Authority of Singapore (MAS) Project Guardian, ANZ Bank, ADDX, and Chainlink collaborated on a use case supporting the entire lifecycle of tokenized commercial paper. It expands access to tokenized assets across borders while helping users meet confidentiality requirements using Chainlink CCIP’s Private Transactions capability.

Europe’s First Tokenized Securities Trading and Settlement System

21X is leveraging the Chainlink standard to enrich tokenized assets with high-quality data and enable cross-chain interoperability on the first EU-regulated financial market infrastructure (FMI). It will provide order matching, trading, settlement, and registry services for tokenized money and securities.

CBDC Project for Trade Finance

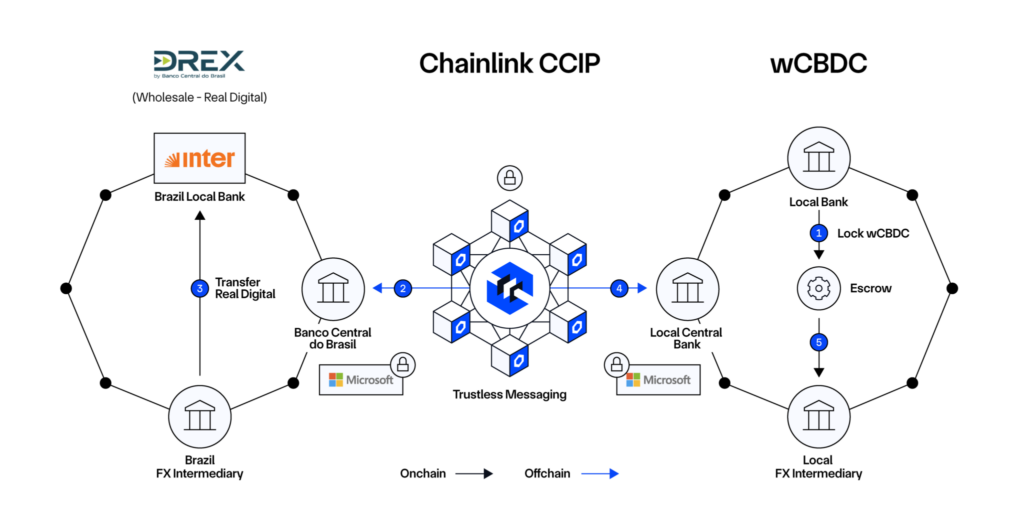

The Central Bank of Brazil (BCB) has selected Banco Inter alongside Chainlink, Microsoft Brazil, and 7COMm to build a trade finance solution for the second phase of Brazil’s Drex CBDC project. It leverages the Chainlink standard and blockchain technology to automate supply chain management and improve trade finance processes.

Conclusion

2025 is a pivotal moment for the global financial system. The convergence of traditional systems with blockchain technologies paves the way for a new era of financial products and services, driving unprecedented innovation in capital markets and reshaping the future of finance.

The real-world adoption of tokenization is already underway, demonstrating a fundamental transformation in how capital markets operate. By enhancing accessibility, improving liquidity, and fostering cross-border connectivity, these innovations will create financial systems that are more efficient, resilient, and inclusive.

To get more insights into the future of finance, dive into Chainlink’s Definitive Guide to Tokenized Assets, with contributions from BCG, 21Shares, Paxos, and Backed, and watch Chainlink’s Future Is On series featuring leaders from Citi, Standard Chartered, Deutsche Bank, and more.