Growing the Smart Contract Ecosystem With New Data Types

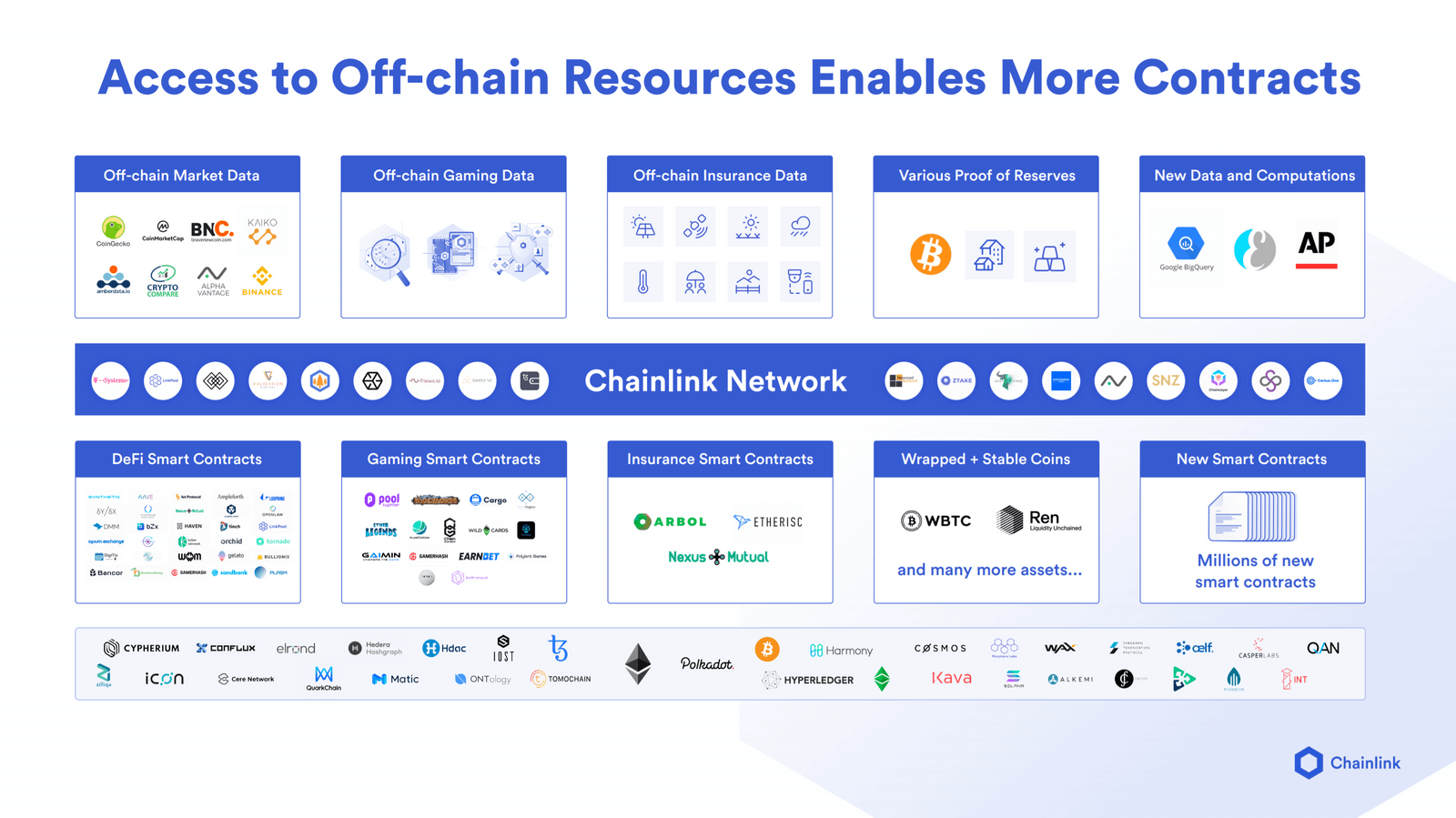

Over the past year, the smart contract ecosystem has expanded rapidly, driving an increase in demand for secure and reliable oracles that can provide high-quality data to DeFi protocols and decentralized applications. As the market-leading decentralized oracle solution, Chainlink is meeting this growing demand by continually expanding the types of data available to smart contracts across all the leading blockchains, including market data, gaming data, insurance data, proof of reserves, and a wide range of additional datasets and computations.

Sergey Nazarov, Co-founder of Chainlink, recently gave a presentation on this topic at ETHOnline DeFi Day 2020, where he covered the categories of off-chain datasets that the Chainlink Network is making available to smart contract applications. This blog post is an excerpt of his presentation that captures a key point on how the Chainlink Network is enabling more contract use cases by providing access to additional off-chain resources.

Off-Chain Market Data

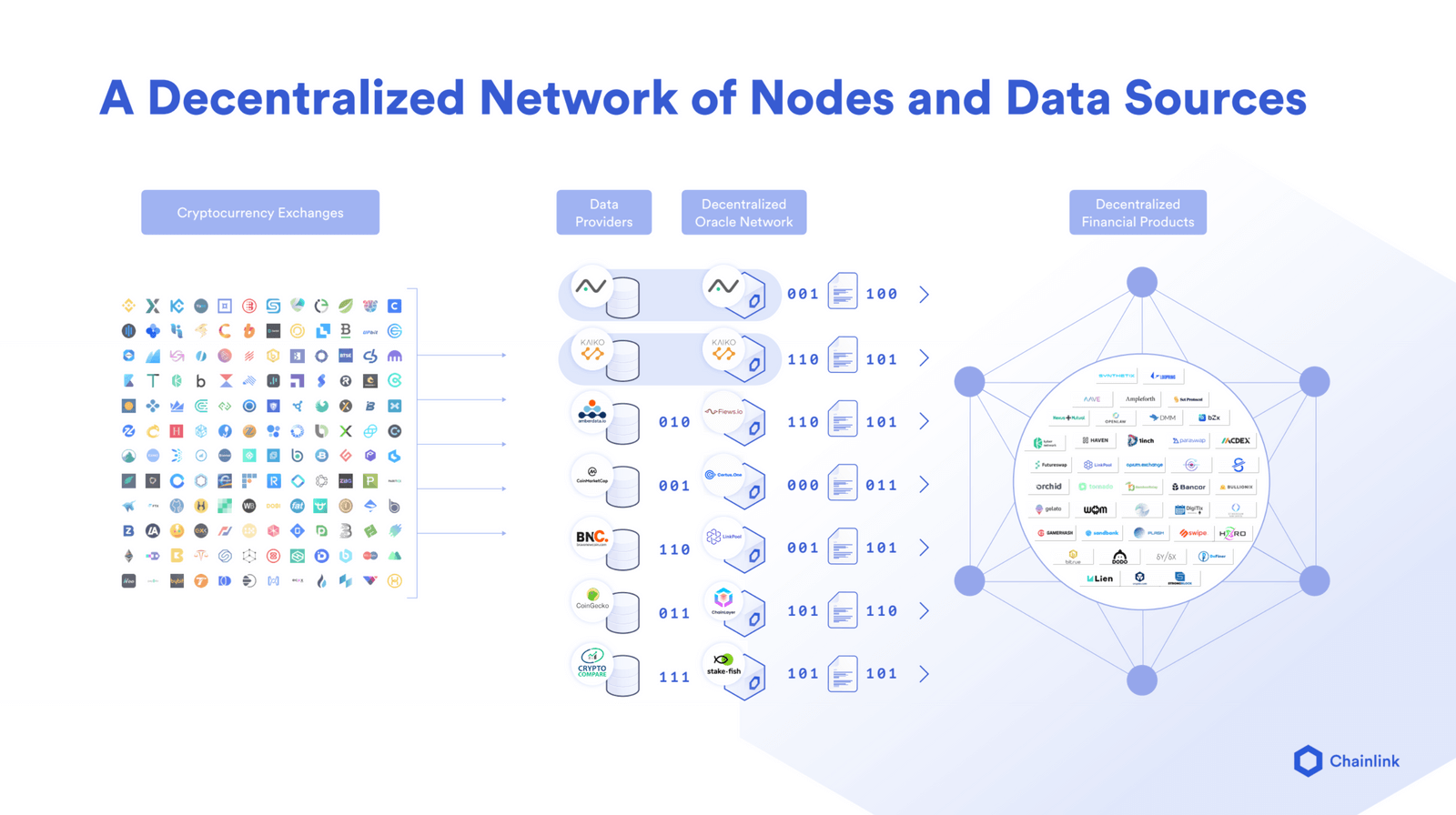

An exciting dynamic that I’m now seeing is that we are driving forward the existence of multiple types of smart contracts. If we started out by providing market data from tens of different data providers, whether they’re running their own Chainlink node or selling data just directly into the Chainlink Network, you basically had aggregations of data that were sold to a multitude of DeFi contracts, which enabled them to quickly and securely launch, as well as quickly and securely launch more markets. On a weekly basis now, we’re enabling the launching of new markets and new useful DeFi smart contracts.

But this year, we’ve seen an expansion into other categories of contracts. What we have noticed is that as we put new categories of data, off-chain resources, and essentially new services that can be consumed on-chain in the form of an oracle contract or a Chainlink representation of an off-chain resource, we see additional use cases coming into existence.

On-Chain Gaming Data

One of these categories is gaming, in which you have randomness, sports scores, and various other datasets that people want to bet on and game around, as well as the generation of NFTs, which interestingly enough then get popped back into DeFi as collateral. We’ve seen a pattern where, as DeFi protocols provide more services and as Chainlink provides more services, or more individual contracts that can act as services for other contracts, you see an explosion of use cases and a rapid improvement of the existing offerings to the point where they become more attractive and useful for users. In gaming, you see the provision of randomness, off-chain gaming, data for sports events, and more.

Off-Chain Insurance Data

We’ve also seen a lot of improvement in the insurance industry. I’m very proud to say that we have crop insurance live using weather data fed in by Chainlink oracles into a system like Arbol, which determines the weather and automatically pays out contractual outcomes to farmers in both developed economies and emerging markets where they wouldn’t traditionally have insurance. A lot of that is possible because we’re able to provide an on-chain service through the Chainlink Network that aggregates data to a sufficiently high level of security to trigger a certain amount of value.

Proof of Reserve Data

Another category that recently arrived using the Chainlink Network is Proof of Reserve, which shows you that an underlying asset is there and that its value has been retained, proving that to DeFi protocols. Proof of Reserve allows the use of that asset, whether that’s Bitcoin, real estate, gold, a bank account, or whatever, in the use of DeFi protocols. Not only does data generate more DeFi markets—it generates new collateral by enabling things like NFTs and insurance which can then become their own units of value that act as collateral within DeFi.

So you enable the ability for DeFi to function, you enable the ability for more collateral to function within DeFi, while you’re also enabling new use cases like gaming and insurance. Then there’s a whole large world of collateral that isn’t proven or understood by DeFi protocols because they can’t know its stability or solvency. Once you prove that, then that world of collateral can make its way into DeFi products, both diversifying away their risk and growing the value secured by DeFi.

New Data and Computations

We’re also seeing a number of other categories of data become available to smart contracts. For example, Everipedia’s recent Chainlink integration allowed election data for all 50 states to be fed on-chain in a very reliable manner from The Associated Press API. That will also enable new use cases because once a service is available, people begin to utilize it and compose in all kinds of interesting ways. Then the real question is how did they compose it into their protocol such that that protocol creates a new highly valuable service that other protocols then use, the way that Aave, Synthetix, and Yearn interoperate right now to create large amounts of value. This is really the world that we’re going to see more and more of.

If you’re a developer and want to connect your smart contract to existing data and infrastructure outside the underlying blockchain, explore the Chainlink developer documentation or reach out to our integration experts.

- 77 Smart Contract Use Cases Enabled by Chainlink

- Chainlink Proof of Reserve: Bringing Transparency to DeFi Collateral

- How Smart Contracts Decrease Information Asymmetry in the Insurance Industry

Website | Twitter | Discord | Reddit | YouTube | Telegram | Events | GitHub | Price Feeds | DeFi