Introducing the Chainlink Digital Transfer Agent (DTA) Technical Standard

We’re excited to introduce the Chainlink Digital Transfer Agent (DTA) technical standard—a comprehensive set of technical standards that define how transfer agents and fund administrators can expand their operations onchain to support tokenized assets, while remaining aligned with existing regulatory frameworks.

The Chainlink DTA technical standard leverages multiple time-tested Chainlink capabilities to provide the easiest and most reliable path for market participants to launch their own onchain transfer agency services and capture the emerging opportunity of tokenized financial markets.

Now live in production, and starting with tokenized investment funds as the initial product use case, the Chainlink DTA technical standard allows transfer agents, fund administrators, issuers, distributors, and custodians to quickly and easily offer the following services:

- Real-time subscription and redemption processing of tokenized funds across multiple blockchains.

- Seamless integration of pre-built fiat and digital asset settlement workflows, reducing the need for manual reconciliation.

- Programmable compliance enforcement directly in the transaction flow, powered by Chainlink Automated Compliance Engine (ACE), eliminating fragmented eligibility checks.

- An onchain golden record of fund lifecycle activities that is automatically synchronized with each transaction rather than via delayed reconciliation.

- Cross-chain interoperability for tokenized funds, removing the siloed nature of single-chain tokenization initiatives.

- Transparent, auditable records that build regulator and market participant confidence, with extensibility to additional products beyond investment funds such as ETFs, corporate debt, and private equity.

UBS uMINT, the token corresponding to UBS Asset Management’s tokenized money market investment fund, is the first smart contract to begin adopting the DTA technical standard.

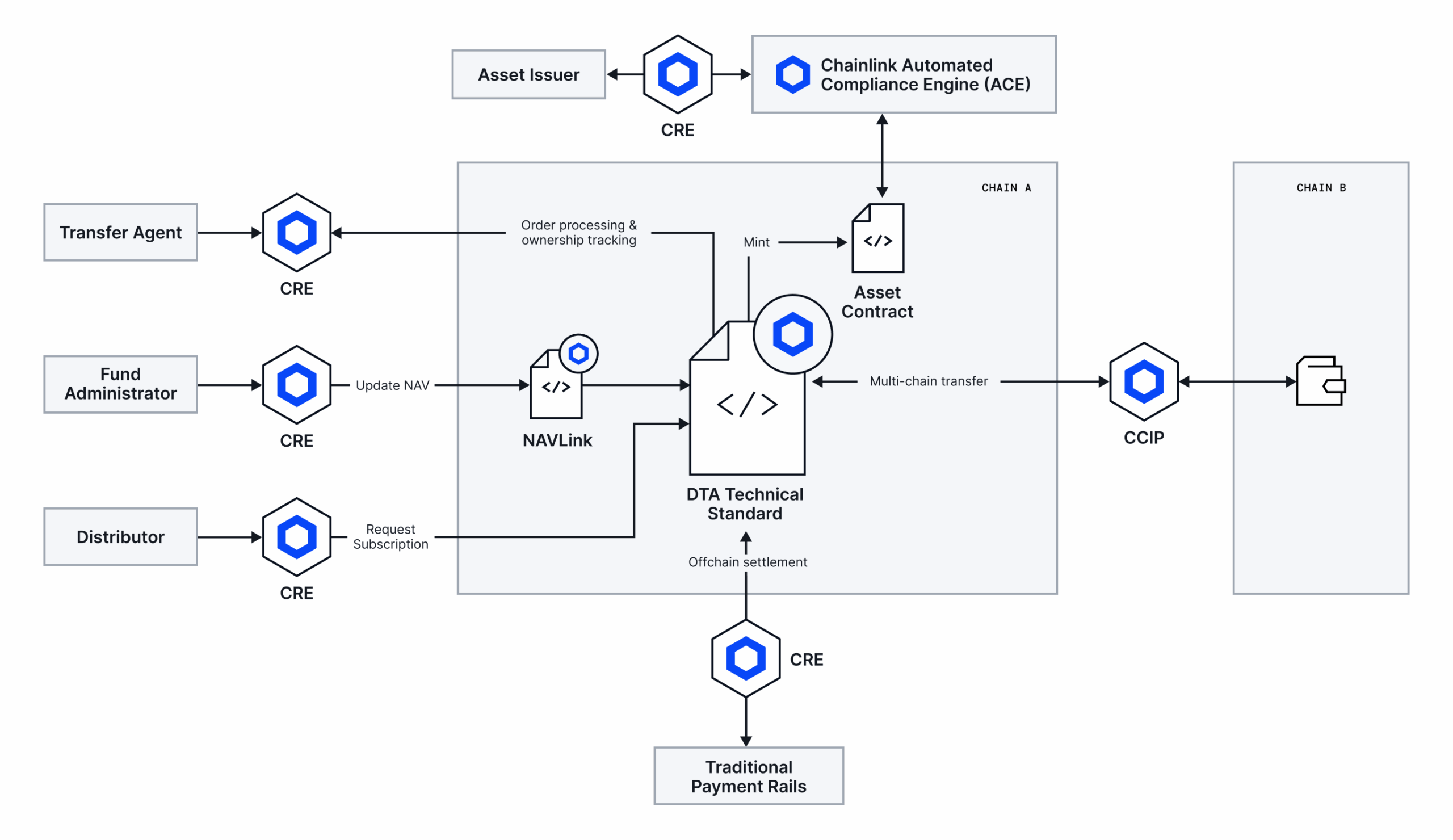

Chainlink is the only platform that combines data, cross-chain, compliance, and orchestration oracles in one unified and modular system. The Chainlink Runtime Environment (CRE) functions as the orchestration layer of the Chainlink platform, unifying blockchain networks, offchain systems, and oracle services to enable institutions to run complex, multi-chain workflows through a single, cohesive system.

The Chainlink DTA technical standard is being built to seamlessly run on top of CRE to leverage its core capabilities such as compatibility with legacy systems, access to fiat settlement via established payment rails, and record reconciliation with offchain systems. Furthermore, the Chainlink DTA technical standard leverages multiple standards and services within the Chainlink platform, including:

- Cross-Chain Interoperability Protocol (CCIP) to enable multi-chain distribution of tokenized assets.

- Automated Compliance Engine (ACE) to enforce role-based controls and compliance requirements onchain.

- NAVLink Feeds to ensure accurate NAV pricing for tokenized fund subscriptions and redemptions.

If you are a financial institution and see the rising demand in tokenized assets as a large opportunity, contact Chainlink Labs to see how the Chainlink DTA technical standard can help you launch onchain transfer agency services. You can also explore the technical documentation and developer resources for a deeper look into the architecture and functionality of the Chainlink DTA technical standard.

The Multi-Trillion Dollar Market Opportunity of Tokenized Assets

The global asset management industry oversees trillions of dollars in value across mutual funds, ETFs, and private markets. Each of these assets relies on critical operational activities performed by transfer agents and fund administrators, including order processing, share allocation calculations, fund accounting, maintaining ownership records, and reliable reporting. With the advent of tokenized funds, there is a unique opportunity for the asset management industry to modernize its infrastructure, increase efficiency, and unlock composability by building on standards.

Enabled by the Chainlink DTA technical standard, transfer agents and fund administrators can launch their own blockchain-based services to better support their customers in their tokenized journey. This helps unlock:

- Accelerated innovation: Technical and operational changes to lifecycle activities can be deployed in days through modular smart contract updates, in contrast to the months or years it can take for traditional IT systems upgrades.

- Global and instant distribution: By adopting the Chainlink DTA technical standard, distributors, transfer agents, fund administrators, and tokenized fund issuers become technically and operationally integrated, unlocking key network effects.

- Composability and enhanced utility: The Chainlink DTA technical standard introduces programmable infrastructure that counterparties across the fund lifecycle can jointly build upon. Examples include corporate treasuries accessing tokenized assets for automated cash management, payment providers enabling instant stablecoin settlement, and DeFi protocols using tokenized assets as collateral.

- Reduced operating costs: Traditional servicing costs for a portfolio of different funds scale non-linearly as an increased number of counterparties result in reconciliation complexity. The Chainlink DTA technical standard addresses this scaling challenge by eliminating the need for point-to-point integrations.

- Access to new distribution channels: The 220M+ active blockchain wallets represent a new distribution frontier. In contrast to traditional brokerage accounts, these wallets are globally accessible, 24/7 operational, and can plug directly into various settlement workflows.

The Chainlink DTA technical standard unlocks value for all market participants interested in bringing fund administration and transfer agency services onchain.

Asset Managers: Capture the Full Potential of Tokenized Assets

Asset Managers need onchain fund administration and transfer agency services to unlock the full potential of their tokenized products. Using the Chainlink DTA technical standard, they can:

- Reduce their operating costs.

- Expand distribution across multiple blockchains and tap into new onchain customers.

- Leverage existing systems and partners via CRE integration.

- Rapidly test innovative offerings and scale gradually.

Transfer Agents: Become Infrastructure Providers for the Tokenized Economy

Transfer agents have a unique opportunity to expand their existing capabilities into also servicing tokenized assets. The Chainlink DTA technical standard provides a path forward to offer tokenized servicing without requiring a rebuild from scratch. With the Chainlink DTA technical standard, transfer agents can:

- Offer digital transfer agency services without costly technology investments.

- Maintain their role as the trusted record keeper.

- Access new revenue streams from blockchain-native funds.

- Provide enhanced services like real-time NAV updates and instant settlement.

Fund Administrators: Make Your Data More Valuable

Fund administrators calculate and publish critical fund metrics like Net Asset Value (NAV) data. In traditional markets, NAV data is published through various, often proprietary, channels to reach different audiences. Chainlink DTA technical standard transforms this dynamic by enabling new channels for NAV publication that are compatible with onchain workflows. By publishing NAV data through Chainlink’s infrastructure, administrators can:

- Monetize data across multiple blockchain networks simultaneously.

- Maintain data quality and authoritative status.

- Enable new use cases without additional infrastructure (e.g., intra-day NAV).

- Reach blockchain-native applications and protocols directly.

Components of the Chainlink DTA Technical Standard

The Chainlink DTA technical standard consists of multiple components that enable licensed market participants to launch their own onchain transfer agency services:

- DTA Technical Standard Contracts: Enable onchain subscription and redemption of tokenized assets across multiple blockchains, supporting both onchain and offchain settlement.

- CCIP: Support transfer agency services across multiple blockchains. This allows subscription and redemption requests to be submitted on one chain and settled on another. Furthermore, fund tokens can be made available to investors across multiple blockchain ecosystems.

- Chainlink ACE: Provide flexible, programmable compliance enforcement (e.g., eligibility checks, rate limits, role-based access) to ensure regulators’ and institutions’ requirements are adhered to onchain.

- NAVLink Feeds: Securely link tokenized funds to the fund administrators’ NAV reporting systems to ensure accurate pricing for subscriptions and redemptions.

- CRE: Ensure compatibility with legacy systems, facilitate access to fiat settlement via established payment rails, and enable record reconciliation with offchain systems.

How the Chainlink DTA Technical Standard Unlocks Streamlined Tokenized Fund Operations for UBS Asset Management

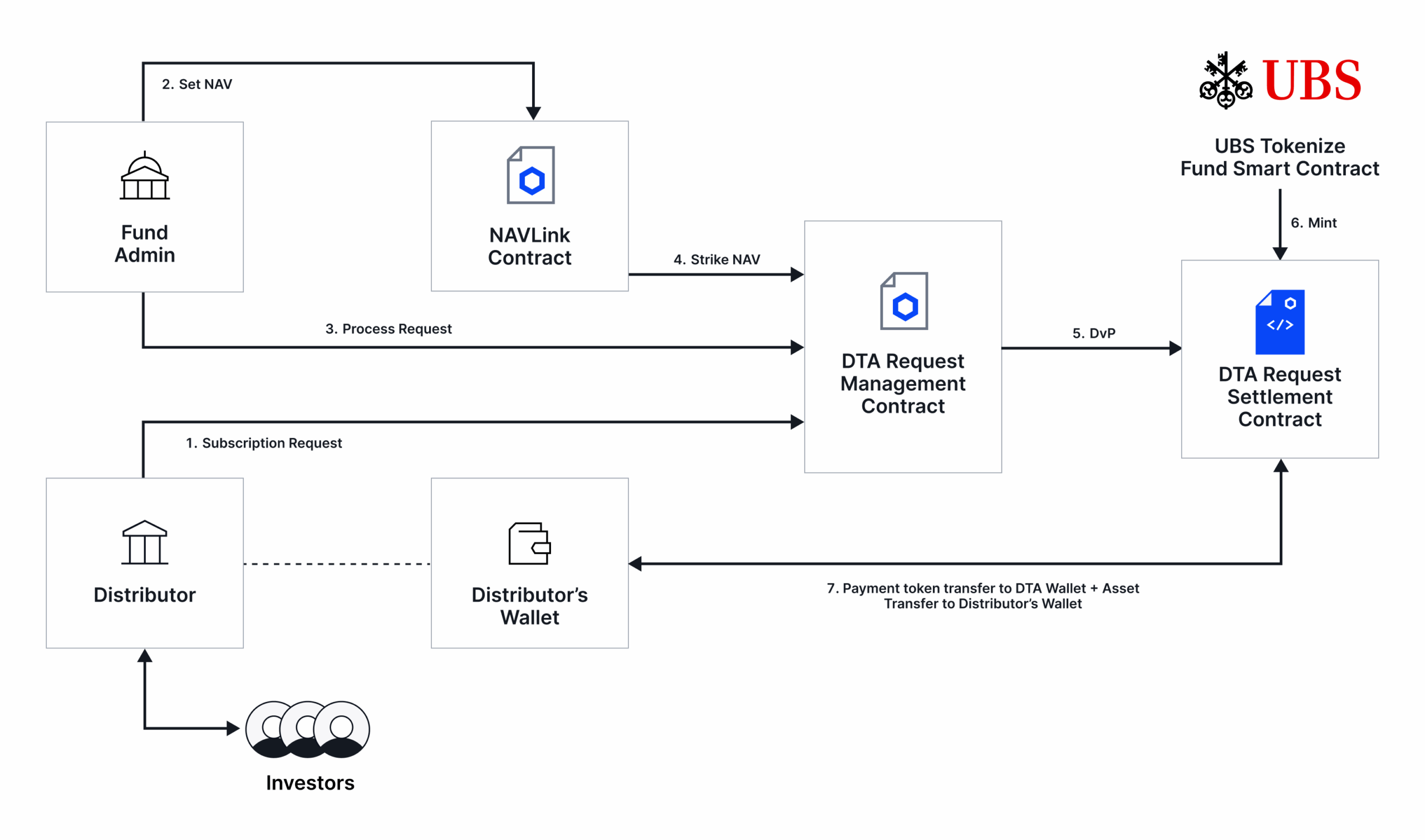

UBS Asset Management, working with its in-house tokenization unit UBS Tokenize, is the first global asset manager to use the Chainlink DTA technical standard. Starting on Ethereum, UBS Asset Management uses the DTA standard to underpin progressive automation of fund lifecycle workflows like subscriptions and redemptions for enhanced operational efficiencies and new possibilities for product composability with others using the standard. UBS uMINT, the token corresponding to UBS Asset Management’s tokenized investment fund, is the first smart contract to begin adopting the DTA technical standard.

Using UBS uMINT smart contract as an illustrative example, the end-to-end fund lifecycle following the Chainlink DTA technical standard involves the following steps for a subscription:

- Fund distributor submits a subscription request on the DTA Request Management contract.

- Chainlink NAVLink fetches NAV data from a trusted source (e.g., fund administrator) and publishes it onchain.

- The fund administrator processes the distributor’s request on the DTA Request Management contract.

- The DTA Request Management contract fetches the latest NAV data from the NAV contract to calculate the number of shares to issue.

- The DTA Request Management contract sends a settlement instruction to the DTA Request Settlement contract.

- Fund tokens (corresponding to shares of the tokenized investment fund) are issued (minted) to the DTA Request Settlement contract.

- A payment token is transferred to the DTA Request Settlement contract, while the fund tokens are transferred to the distributor’s wallet atomically.

Accelerating the Adoption of the Tokenized Asset Economy With the Chainlink DTA Technical Standard

The adoption of the Chainlink DTA technical standard by a global asset manager underscores how the world’s largest financial institutions are rapidly adopting tokenized assets as a new format for financial transactions and business value creation. The launch of the Chainlink DTA technical standard builds on years of collaboration across the financial community to develop standards that meet institutional requirements for compliance, interoperability, and scale. These collaborations include:

- As part of the Monetary Authority of Singapore (MAS) Project Guardian, SBI Digital Markets, UBS Asset Management, and Chainlink successfully demonstrated how the combination of Chainlink infrastructure and DTA smart contracts enable automated fund management operations and transfer agency processes. The solution highlighted how tokenized funds can maintain their share register on one blockchain while using Chainlink CCIP for the processing of intensive fund lifecycle activities like subscriptions and redemptions on another blockchain.

- Building on the previous use case, under the Monetary Authority of Singapore (MAS) Project Guardian, Swift, UBS Asset Management, and Chainlink demonstrated the settlement of tokenized funds using traditional Swift fiat payment rails, showing how digital asset transactions can be settled via existing systems already used by 11,500+ financial institutions across 200+ countries and territories.

- Recently, Visa highlighted Chainlink’s work with ANZ Bank and Fidelity International under phase 2 of the Hong Kong Monetary Authority’s e-HKD program. In the first phase of the use case, the participants demonstrated a Payment-vs-Payment (PvP) settlement workflow involving an Australian Stablecoin (A$DC) on ANZ’s DAS Chain and a wrapped Hong Kong CBDC (e-HKD) on Ethereum Sepolia—using Chainlink for cross-chain connectivity and compliance verification. The next phase will demonstrate a Delivery-vs-Payment (DvP) workflow involving an Australian investor purchasing a tokenized asset in Hong Kong, leveraging Chainlink for cross-chain connectivity, compliance verification, and NAV pricing, along with the Chainlink Digital Transfer Agent technical standard.

By working hand-in-hand with global leaders, Chainlink is helping accelerate tokenized asset adoption—bringing together fund managers, fund administrators, transfer agents, custodians, and distributors into a unified ecosystem powered by secure, production-grade infrastructure.

If you are an institution interested in seeing how Chainlink DTA technical standard can bring your transfer agency operations onchain to accelerate the adoption of tokenized assets, contact Chainlink Labs for more information. To learn more about the architecture and operation of Chainlink DTA technical standard, explore the technical documentation and developer resources.