16 Ways to Create Dynamic Non-Fungible Tokens (NFT) Using Chainlink Oracles

The Chainlink Fall 2021 Hackathon kicks off October 22. Sign up today.

A Non-Fungible Token (NFT) is a cryptographically secured token existing on the blockchain that represents ownership of something unique. NFTs can represent tokenized ownership claims to real-world assets like a specific piece of land, or actual ownership of digital assets as in a rare digital trading card. Unlike fungible tokens such as Bitcoin where one BTC can be exchanged for any other BTC, each NFT is completely unique and represents verifiable digital scarcity.

Most of the NFT community is familiar with the idea of storing unique items as pieces of data on the blockchain. The blockchain acts as a standardized medium for listing and trading non-fungible assets that are transparent, globally accessible, and more liquid. It also provides a protected environment to store a trusted set of historical records about an asset dating back to its provenance.

Registering unique assets and freely trading them on a common decentralized platform (blockchain) has standalone value. The limitation is that the blockchain creates its value of decentralized security by disconnecting from all other systems, meaning NFT-based assets do not interface with data and systems outside the blockchain (static). Oracles have the ability to resolve this connectivity problem by allowing NFTs to interact with the outside world.

Dynamic NFTs that Respond to Data and Interface with Existing Infrastructure

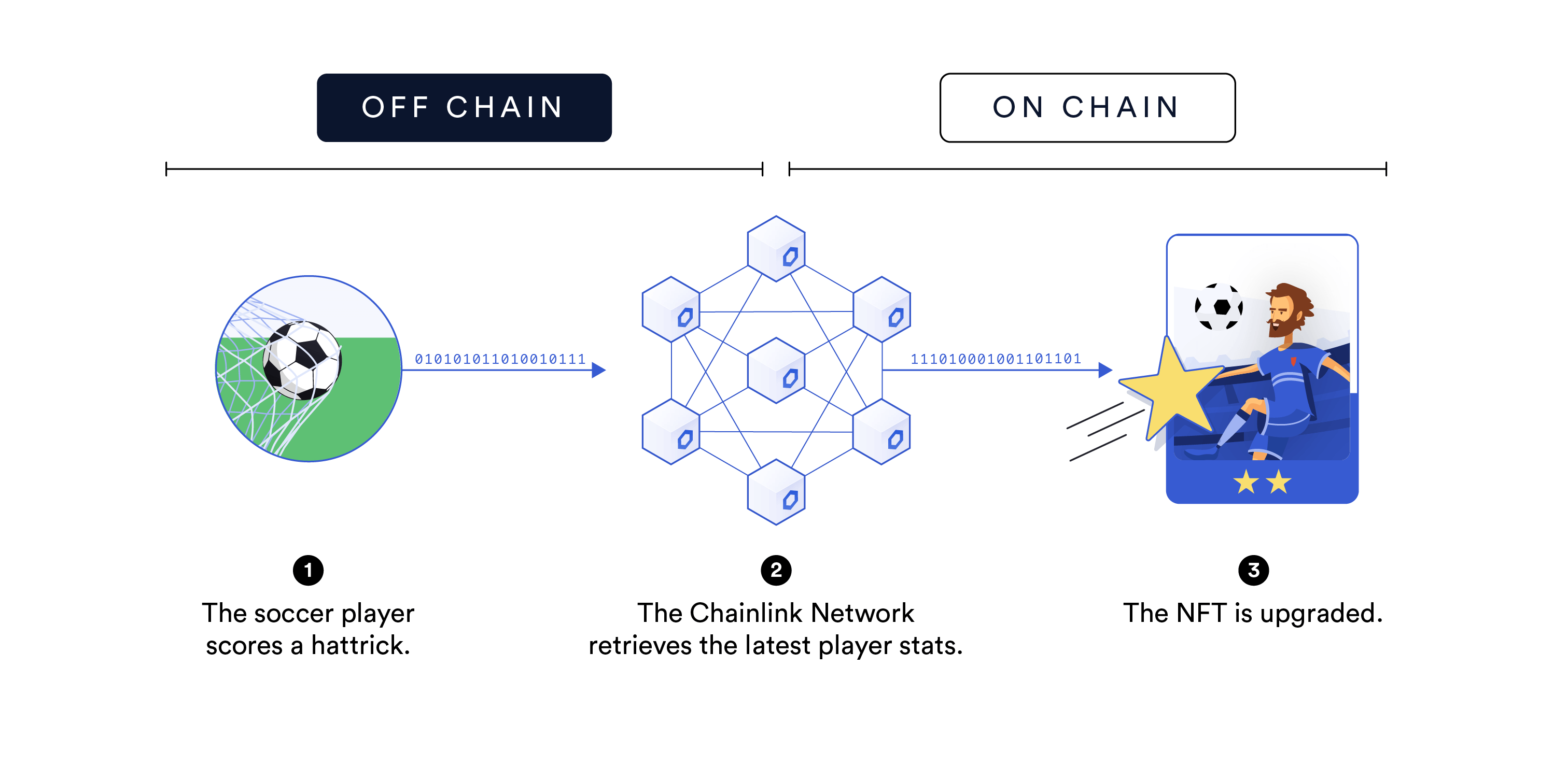

The next evolution in NFTs is moving from static NFTs to dynamic NFTs— perpetual smart contracts that use oracles to communicate with and react to external data and systems. The oracle allows the NFT to use external data/systems as a mechanism for minting/burning NFTs, trading peer-to-peer, and checking state. For example, a smart contract that automates the minting of a limited edition digital soccer card if the oracle informs it that a player scored a hat-trick.

Chainlink is a decentralized oracle network that securely and reliably connects smart contracts to external data and systems. By using multiple independent oracles to verify data and/or aggregating data from multiple sources, Chainlink’s oracle framework allows users to source and deliver data to their smart contracts without a single point of failure.

Using Chainlink, developers can securely connect their NFTs to IoT data, web APIs, and any other data provider. Additionally, they can leverage Chainlink VRF to access verifiable randomness, interface with existing backend systems, and even trigger cyber-physical systems. All these connections can be used to create dynamic NFTs that react to data and fully integrate with existing infrastructure.

To better understand the evolution towards Dynamic NFTs, let’s explore 16 use cases currently accessible to developers.

Competition Based NFTs

Multiplayer online games often involve unique in-game items that give players special advantages over opponents. Games can mint rare in-game items as NFTs on the blockchain, wherein ownership of the NFT allows special privileges within the game. Chainlink oracles can use data to create NFTs, transfer ownership, and settle competition outcomes by assigning value to the assets.

1. Game Performance

One compelling way to determine how NFTs get transferred between players is in-game performance. For example, if the current owner fails to maintain a certain performance level (or accelerating performance to ensure more turnover) or he loses a battle to another user, then that NFT (e.g. special sword) is taken away and given to the victor or placed randomly within the game. It’s not hard envisioning games where people compete over who can keep hold of the item the longest. Chainlink can be used to retrieve off-chain game performance data and feed it to the smart contract responsible for transferring ownership.

2. Verifiable Randomness

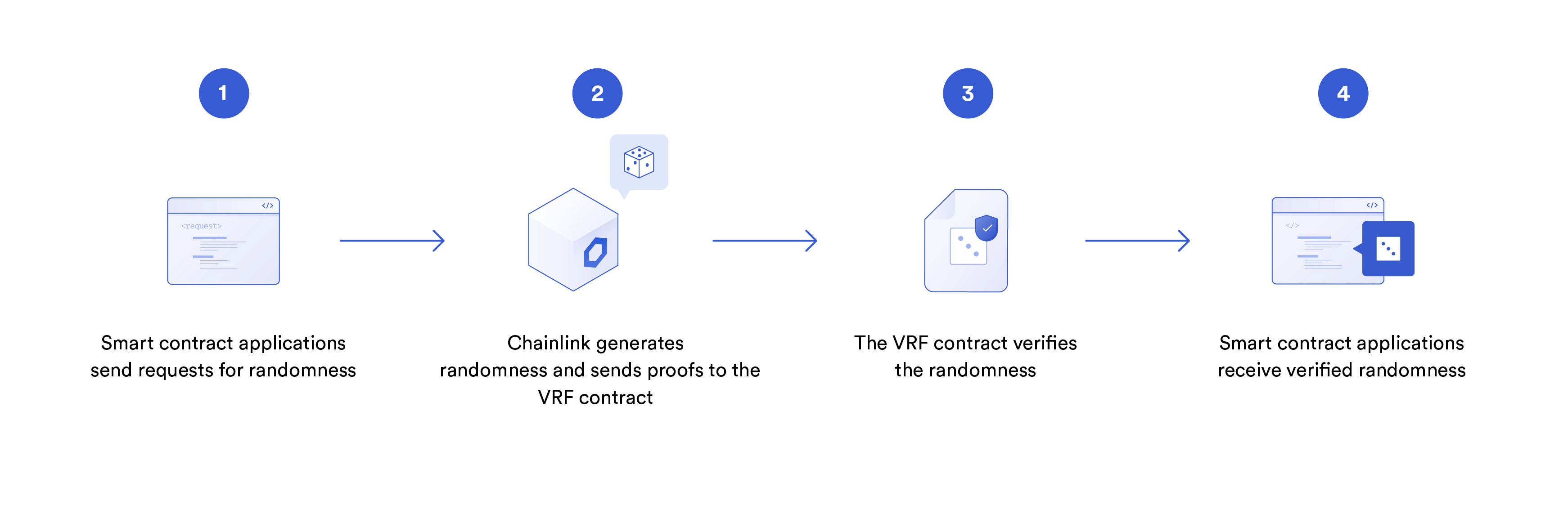

Through Chainlink VRF (Verifiable Randomness Function), developers are able to apply random traits to an NFT. Chainlink VRF can be used as an input to randomize the placement, creation, and/or distribution of in-game items. For example, fair and unbiased randomness can determine each in-game item’s rarity and power ranking when it is minted.

3. Augmented Reality

Pokemon GO showcased how games can interface with the real world to create global competitions and experiences. Chainlink enables the minting of NFTs in real-world locations based on subjective (user-specific) or objective data. NFTs can be placed at random locations using Chainlink VRF or be placed at sponsored locations.

4. Real Life Fantasy Sports

NFTs as digital trading cards can represent real-world sports players or gamers to facilitate fantasy sports competitions. Users can pool money and play against each other, where the value of the cards depends on the real-life statistical outputs of the associated player. Chainlink oracles can source real-life performance data to determine the value of cards, which is used to decide the winners of tournaments and trigger winning payouts.

Reward and Governance Systems

Companies are always looking for innovative ways to incentivize and reward certain consumer behaviors, as well as re-engage a consumer base. NFTs introduce new tools for incentivizing desired consumer behavior via digital token rewards.

5. Digital Collectibles

Similar to how baseball cards are collectible items, NFTs can represent rare digital assets that become collectibles for interested hobbyists. These collectibles can be issued as rare cards based on specific real-world events. For example, WAX and Topps have discussed the minting of rare baseball cards based on statistical achievements, such as a player breaking the home run record. Chainlink can connect smart contracts to web APIs for verifiable sports data to facilitate card creation.

6. Lifestyle Rewards

An interesting avenue of exploration is giving users access to rare in-game items based on the completion of specific off-chain objectives. For example, games can incentivize kids to exercise or study by rewarding them with special NFT tokens like rare in-game powers when they register enough steps on their Fitbit or get good grades. Merging healthy lifestyles or academic success with gaming rewards encourages positive feedback loops in society. Chainlink can connect IoT data to the minting smart contract to determine whether or not the user receives the NFT.

7. Event-Based Rewards

Event-driven NFTs can also serve as fan rewards. For example, if a soccer player scores a hat-trick, there will be three limited edition tokens minted throughout the city that rewards the finders with special access to meet the players. Another scenario is if the Lakers score 100 points, there will be 20 half-off coupons for Mcdonalds scattered around the city in an augmented reality type retrieval process.

8. Consumer Participation Rewards

Companies offer rewards to consumers who engage with them regularly. Instead of issuing paper or digital coupons, companies can mint limited-time coupons as NFTs that are directly linked to a consumer’s participation. Chainlink can use IoT data to mint these coupons based on verifiable attendance, such as every 1000th attendee into the store or an individual’s 10th visit.

9. Crowd Sourced Voting

NFTs can also be issued based on crowdsourced voting. By enabling voting, DAOs emerge where decisions about NFT token schedules can be based on democratized participation. This can be as simple as deciding which new digital trading card will be minted next, or involve high stakes decisions like determining how a decentralized hedge fund will distribute equity percentage to new investors. Chainlink oracles can be used as unbiased vote aggregators, which source and deliver the voting data to the smart contract responsible for setting token schedules.

Authenticity Verification

The other way to transform NFTs is through interfacing them with existing systems. This is especially useful for tracking unique assets and incorporating them into existing financial and supply chain processes. Without existing infrastructure being able to interact with the NFT-enabled blockchains, NFTs will be isolated assets that struggle to find real-world adoption.

10. Provenance

NFTs can be especially useful in tracking physical assets, such as luxury items, rare artifacts, and products in a supply chain. Two major advantages of tokenizing these assets are quality control and counterfeit reduction, as anyone can verify the provenance of goods by querying the blockchain. Companies using smart contracts as part of their global trade processes can use Chainlink to interconnect payment systems, provenance blockchains, and existing backend systems. This creates a highly transparent and fully integrated process where goods are verified, payments are made, and each company’s backend systems are automatically updated. The NFTs can even be burned on the blockchain once a certain expiration date/process point is hit.

11. Identity

Several projects are already working on how to develop digital identities that can interface with many existing applications. By doing so, users can plug’n’play it with other applications to keep control of their private data. Chainlink allows smart contracts to query identity-based blockchains to verify personal credentials, as well as to append data to a person’s identity based on an output from another business process. Interestingly, identity may interplay with cyber-physical systems in the future, wherein a digital identity will give authorized users access to a physical system.

12. Certification

Certifications are an important component of verifying someone’s credentials, but are sometimes difficult to verify or subject to manipulation. Credentials can be automatically minted as immutable NFTs on the blockchain directly through data that showcases performance-based completion or authority-based approval.

Valuation Updates

The value of assets is not static and therefore requires consistent updates when traded or used as collateral for loans and accreditation processes. Chainlink oracles provide a gateway to access external data sources that bring reliable valuations to these on-chain assets, whether that be through a trusted API, an aggregation of multiple sources, or crowdsourced.

13. Property

Several projects are working to showcase the tokenization of property and property-based assets on the blockchain. This can include tokenized mortgages, rental income, and titles. Chainlink can relay external data to help adjust rates on crypto mortgage payments or provide an updated valuation of a property. It can also serve as a bridge for external applications wanting to verify a user’s property ownership for accreditation purposes, or to distribute rental income by relaying payment instructions to traditional payment providers.

14. Land

Land ownership is another asset that is increasingly being tokenized on the blockchain. Chainlink oracles can function as land appraisers by using IoT devices/drones to determine its productive state, hiring appraiser companies to provide independent valuations, and incorporating web APIs for historical data (e.g. weather). Chainlink can use this data to create more objective land valuations that become valuable when trading and collateralizing.

15. Financial Cash Flows

NFTs can also represent the cash flows of real-world assets, such as owning a percentage of the interest received on loans. In a decentralized money market, smart contracts need on-chain valuation updates to ensure off-chain assets continually collateralize the money market. Chainlink oracles are able to source trusted data sources to provide consistent collateralization checks, which ensure decentralized money markets are always way above solvency. NFTs can then be used to represent users’ equity percentage in the interest generated.

16. Physical Commodities

Commodities are another class of physical assets that can be represented as NFTs. Tokens can be minted in various sizes, such as individual diamonds, barrels of oil, and all the way up to whole shipments of rice. Oracles can be used to provide the GPS location of goods within the supply chain process, as well as source the current market rates for these commodities.

Start Building Dynamic NFTs Today

If you are a blockchain project looking to support NFTs, a Dapp looking to upgrade to dynamic NFTs, or a startup/enterprise looking to branch into this exciting new market, reach out to us here.

You can also visit the developer documentation or join the technical discussion on Discord.