Chainlink Staking: Exploring the Long-Term Goals, Roadmap, and Initial Implementation

Chainlink is foundational infrastructure for the smart contract economy, supporting nearly a thousand oracle networks that collectively secure tens of billions of dollars across hundreds of projects. With Chainlink continually being integrated on more blockchains and supporting new categories of oracle services, it’s important to further scale the security of Chainlink in order to match the increasing amount of value within Chainlink-powered applications. This new era of sustainable growth and security—Chainlink Economics 2.0—begins with staking.

Staking is a key mechanism that aims to bring a new layer of cryptoeconomic security to Chainlink, where crypto rewards and penalties are applied to help further incentivize the network’s proper operation. The overarching mission of Chainlink staking is to give ecosystem participants, including node operators and community members, the ability to increase the security guarantees and user assurances of oracle services by backing them with staked LINK tokens. The staking of LINK in turn enhances the ability for nodes to receive jobs and earn corresponding fees within the Chainlink Network.

The following blog post highlights the long-term goals underpinning Chainlink staking, the initial implementation planned for the second half of 2022, and a roadmap for its anticipated expansion over time.

The Long-Term Goals of Chainlink Staking

Chainlink staking is being built around four long-term goals. These goals serve as the guiding principles behind its development and will be the pillars upon which to define its success over time as the staking system matures.

1. Increase the Cryptoeconomic Security and User Assurances of Chainlink Services

The primary goal of Chainlink staking is to increase both the cryptoeconomic security and user assurances of Chainlink oracle services. This is achieved by enabling LINK tokens to be locked up as a form of service-level guarantee around network performance. If an oracle network fails to meet the obligations outlined in its on-chain service-level agreement (SLA), then a portion of staked LINK can be slashed and redistributed. Loss protection is also being explored, in which a certain amount of slashed LINK could be used to protect sponsors of Chainlink oracle services.

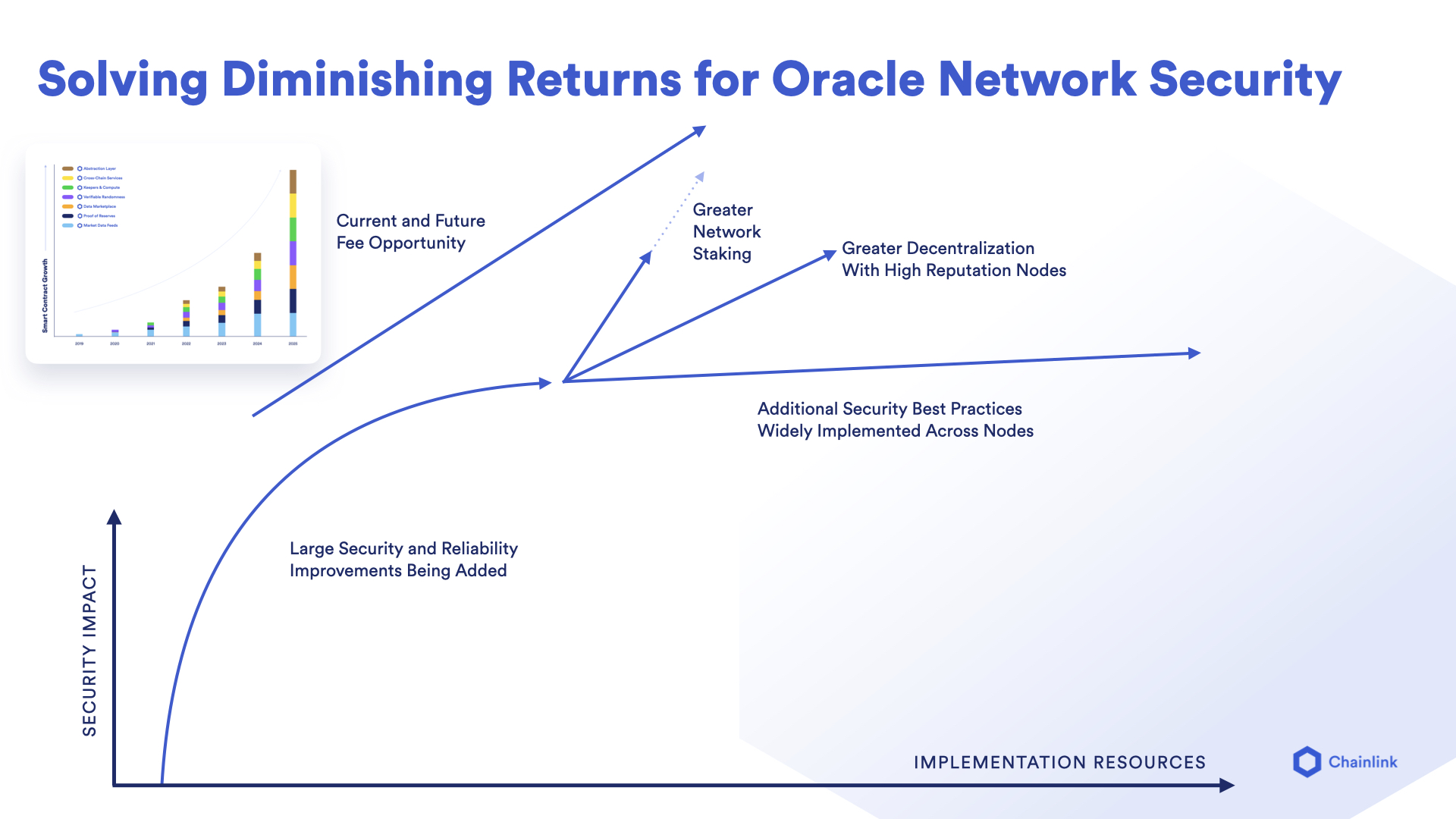

Staking introduces another powerful incentive and penalty mechanism for Chainlink nodes to consistently generate accurate oracle reports and deliver them to specific destinations in a timely manner. Staking serves as a part of a larger defense-in-depth approach to Chainlink security that already includes a multitude of other key safeguards including decentralization, cryptography, implicit incentives, future fee opportunity, and modular configurability.

Given the deep integration of Chainlink within leading smart contract applications, the increase in oracle security and user assurances brought about by staking will be key in helping the multi-chain smart contract economy scale to eventually secure multi-trillion-dollar markets across major global industries.

2. Enable Community Participation in the Chainlink Network

Another key goal of staking is empowering a greater number of community members to directly participate in the Chainlink Network by enabling them to stake their LINK tokens to support the performance of oracle networks. Importantly, stakers can raise alerts if they believe an oracle service has not met predefined performance standards, with the opportunity to earn a reward for timely and valid alerts. Community monitoring and alerting plays a key role in further decentralizing the Chainlink Network and enabling a robust reputation system and slashing mechanism.

Ecosystem participants including community members and node operators can stake their LINK tokens in distinct allotments within a staking pool. Furthermore, node operators can create or use a delegation system, serving as an additional avenue for community members to stake their LINK.

3. Generate Sustainable Rewards From Real Long-Term Use

The third goal of staking is the creation and distribution of rewards to stakers. We expect that there will be various sources of rewards provided to stakers over time. As network adoption increases and more protocol fees are generated, a greater portion of staking rewards can be sourced from non-emissions-based sources.

- Native token emissions from the LINK token supply will be used to create an initial base level of rewards for stakers, with the goal of tapering off over time as other sources of rewards grow and begin to be directed to stakers.

- User service fees from sponsors of Chainlink oracle services, with a portion directed to the stakers. The more users pay for Chainlink oracle services, the greater the amount of fees that can become available to reward stakers who help secure those services.

Another anticipated source of benefits for stakers is the Partner Growth Program (PGP)—an initiative where Chainlinked protocols and DAOs provide various incentives to accelerate their growth and facilitate cross-ecosystem participation. It’s expected that a number of projects benefiting from Chainlink’s security will take part in the Partner Growth Program.

Furthermore, we are exploring the possibility of loss protection, which would drive additional user service fees from sponsors of Chainlink oracle services seeking protection against supported oracle networks not abiding by their SLAs. The more value secured, the greater the potential demand for protection and the greater the amount of rewards potentially available to stakers.

4. Empower Node Operators to Access Higher-Value Jobs by Staking

The last goal of Chainlink staking is to establish a robust reputation framework for how nodes are selected to participate in Decentralized Oracle Networks (DONs). As Chainlink nodes approach parity in terms of their reliability and infrastructure security—reflected in metrics such as response time and accuracy—the next logical distinction for defining the node set within a DON is by the amount of LINK each node is willing to stake to back their oracle services. Over time, this will make staking a key mechanism for node operators wanting to gain access to higher-value jobs and more fee opportunities in the Chainlink Network.

Importantly, a reputation-and-stake-based node selection mechanism can bring even more cryptoeconomic security to end users of Chainlink oracle services. This evolution towards a holistic reputation system for node operators can also open up more insight for users regarding the performance and incentives of node operators.

The Initial Implementation of Chainlink Staking

Before outlining some of the initial parameters and design decisions planned for launch, it’s important to note that Chainlink staking will evolve over time, especially as more oracle networks across a wider range of services accrue greater amounts of fees. The initial implementation is focused on creating a simple and secure foundation, through which feedback can be gathered prior to expanding scope and adding more complexity to the staking design.

The rollout of the staking mechanism will be similar to Chainlink Price Feeds, which went from a single ETH/USD Price Feed on Ethereum operated by three oracle nodes to now supporting nearly a thousand Price Feeds powered by 50+ leading node operators across twelve blockchains and layer-2 solutions. This pragmatic approach allowed risks and opportunities to be identified in the early stages of the implementation before scaling to meet growing user demand.

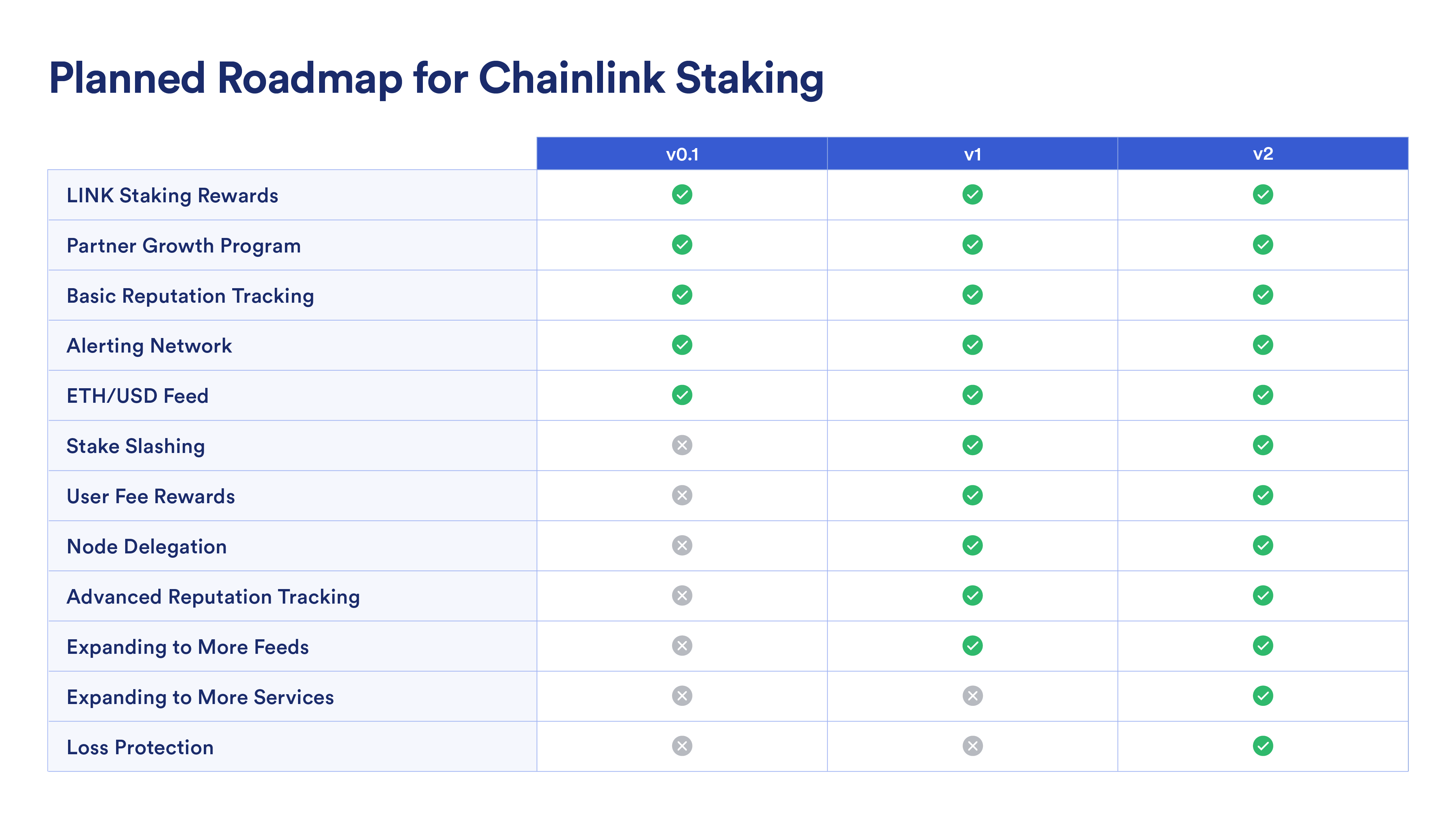

Following this approach, Chainlink staking will evolve across multiple versions, with the initial v0.1 release projected for later this year. This first release focuses on introducing a reputation framework and staker alerting system. After sufficient validation from in-production usage and community feedback, a v1 release will introduce additional functionality such as the slashing of stake for stronger cryptoeconomic security and the incorporation of user fees as rewards. Furthermore, a v2 release will explore introducing loss protection to help protect participating sponsors when a supported oracle network deviates from its SLA.

The below roadmap reflects an overview of the planned approach to rolling out some of the key functionalities of Chainlink staking across multiple versions. As user feedback and in-production data is collected, priorities in this roadmap may shift and features may change in order to better serve user requirements. Furthermore, specific functionalities within each version of staking may roll out on different schedules to manage risk and simplify deployment.

Reputation and Alerting

The initial v0.1 release of Chainlink staking is focused on introducing a reputation framework and alerting system, which are key requirements for slashing and other planned functionalities that will roll out in later release versions. To ensure robustness in an in-production environment, these systems will be used to track the performance of the ETH/USD Price Feed on the Ethereum mainnet.

Importantly, stakers will have the opportunity to monitor the feed, raise an alert, and get rewarded if they successfully detect in a timely manner that the ETH/USD feed has not met the conditions of the SLA agreement. In v0.1, alerting conditions will be focused on feed uptime but will expand in scope in later versions.

Once an alert has been raised, an adjudication smart contract will automatically verify that the conditions of the smart contract SLA were breached and that the alert was valid. After this process is complete, the alerter will be issued a reward later in time. The results of a valid alert will then be fed into a reputation system where the individual reputation of the at-fault node operators is updated. In v1, it is planned for the reputation system to expand to track a greater number of key metrics around the performance of node operators and play an increasingly important role as the Chainlink Network scales.

Ultimately, v0.1 of Chainlink staking represents the core framework of the reputation and alerting system, which is planned to evolve to provide linear security guarantees, and later scaling to support super-linear security guarantees as described in the Chainlink 2.0 whitepaper.

Participation in Staking

The initial staking pool in v0.1 will be capped in size, offering distinct allotments to node operators, community members, and the coordinator of oracle networks. The pool will start with an aggregate size of 25M LINK tokens, with the planned goal of scaling to a pool size of 75M LINK tokens in the months after launch, based on demand. For future releases, it is planned for the pool size to further expand and for additional Data Feeds and oracle services to be supported.

To initially fill the community alerter allotment, a fair entry mechanism will be used to help ensure participation from a wide range of community members. This entry mechanism will aim to prioritize long-term token holders, who are most likely to actively participate in the alerting mechanism. Node operators that actively service Chainlink Data Feeds will be provided their own distinct allotments to fill. A third-party node delegation system is being explored and is currently planned to be supported in the v1 release.

Stakers participating in the v0.1 release will have their staked LINK locked until at least the release of v1, where they will then be able to choose commitment periods of varying lengths.

Staking Rewards

In v0.1, it’s expected that native token emissions directed to stakers will target a base level of annualized staking rewards of up to 5%. After the release of v1, annualized rewards will vary based on user fees and the length of the commitment period, with stakers choosing longer commitment periods having the opportunity to receive a greater share of the rewards.

Furthermore, stakers in v0.1 will also be eligible to earn additional benefits from the Partner Growth Program (PGP). This program is an initiative planned to launch alongside Chainlink staking where Chainlinked projects provide various benefits to accelerate their growth and align their economic incentives with the Chainlink community. This alignment creates incentives for Chainlink stakers to become active participants in a project’s ecosystem, providing an avenue for accelerated adoption. An early version of PGP is planned for v0.1, with a more complete version slated for v1. More details will be provided in the future.

As staking transitions to v1, it is planned that a portion of user fees will begin to be awarded to stakers, coinciding with the cryptoeconomic security provided by the slashing of staked LINK. Furthermore, fees associated with loss protection, which is being explored for v2, may become a source of rewards in addition to emissions, user fees, and PGP benefits. Additional details and specifics on each release version will be released over time.

Conclusion

The introduction of staking is a pivotal moment that marks the evolution to Chainlink Economics 2.0—a new era in Chainlink’s long-term security and network economics. While the initial implementation of Chainlink staking is designed to minimize risk for participants and create a strong foundation, the long-term goals revolve around scaling Chainlink into a global standard with a growing and sustainable user base, which in turn offers greater opportunity of rewards for stakers who increase the network’s cryptoeconomic security and user assurances.

Check your eligibility today for Chainlink Staking v0.1 Early Access.

If you want more technical context, we suggest you read the original Chainlink whitepaper, Chainlink 2.0 whitepaper, and developer documentation. To learn more about Chainlink, visit chain.link, subscribe to the Chainlink newsletter, and follow Chainlink on Twitter, YouTube, and Reddit.

—

Disclaimer: This post contains statements about the future, including anticipated product features, development, and timelines for rollout of these features. These statements are not guarantees, and they involve risks, uncertainties, and assumptions. Community participation is necessary to conduct this next phase of testing and development, which will depend on successful testing and validation at each stage. Any contributors who choose to participate in the initial implementation do so at their own risk. There can be no assurance that actual results will not differ materially from those expressed in these statements, although we believe them to be based on reasonable assumptions. These statements may not reflect future developments due to user feedback or later events and we may not update this post in response.