Introducing the Chainlink Reserve: Creating a Strategic LINK Token Reserve

We’re excited to announce the launch of the Chainlink Reserve—a new upgrade centered on the creation of a strategic onchain reserve of LINK tokens.

The Chainlink Reserve is designed to support the long-term growth and sustainability of the Chainlink Network by accumulating LINK tokens using offchain revenue from large enterprises that are adopting the Chainlink standard and from onchain service usage.

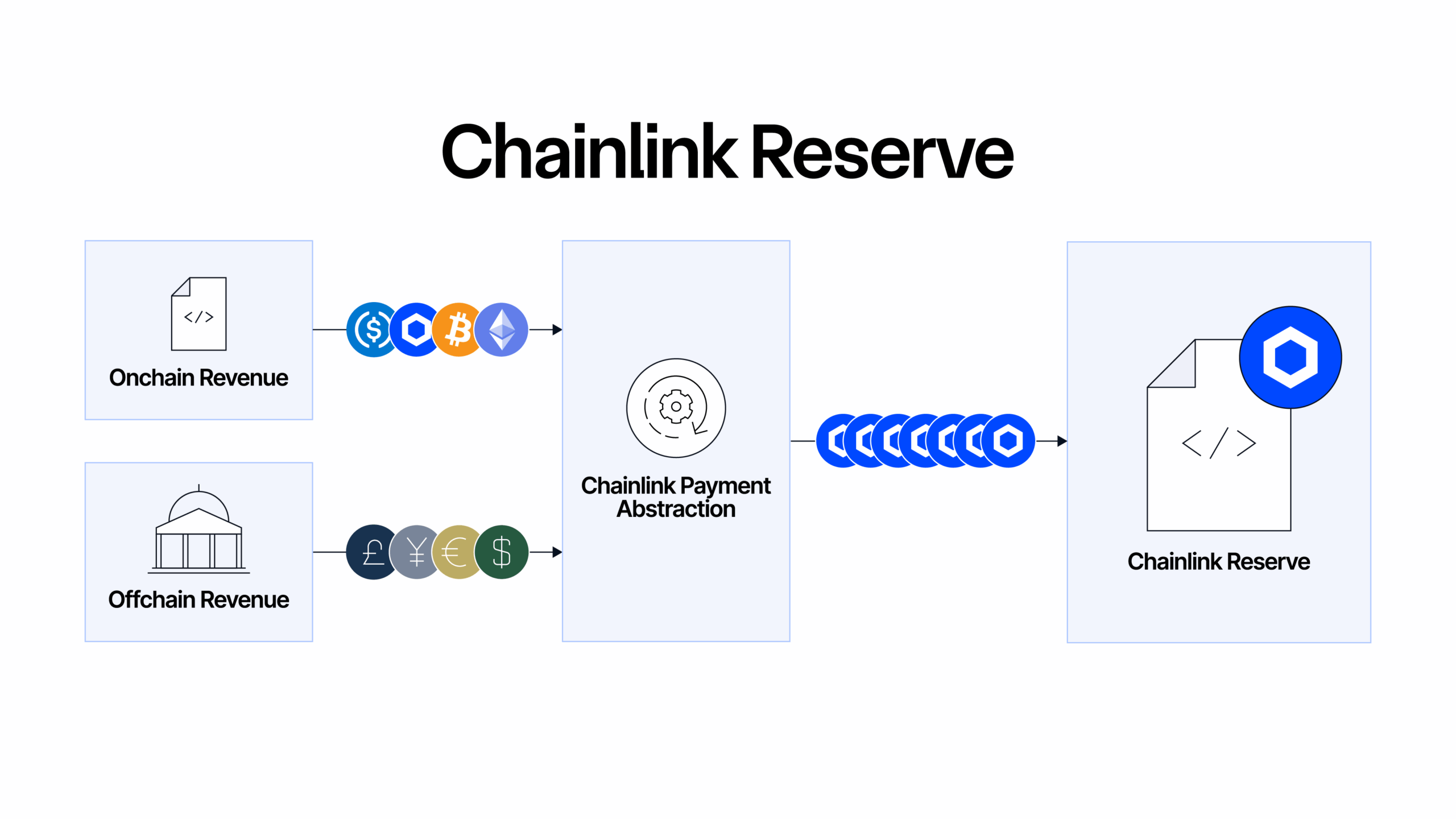

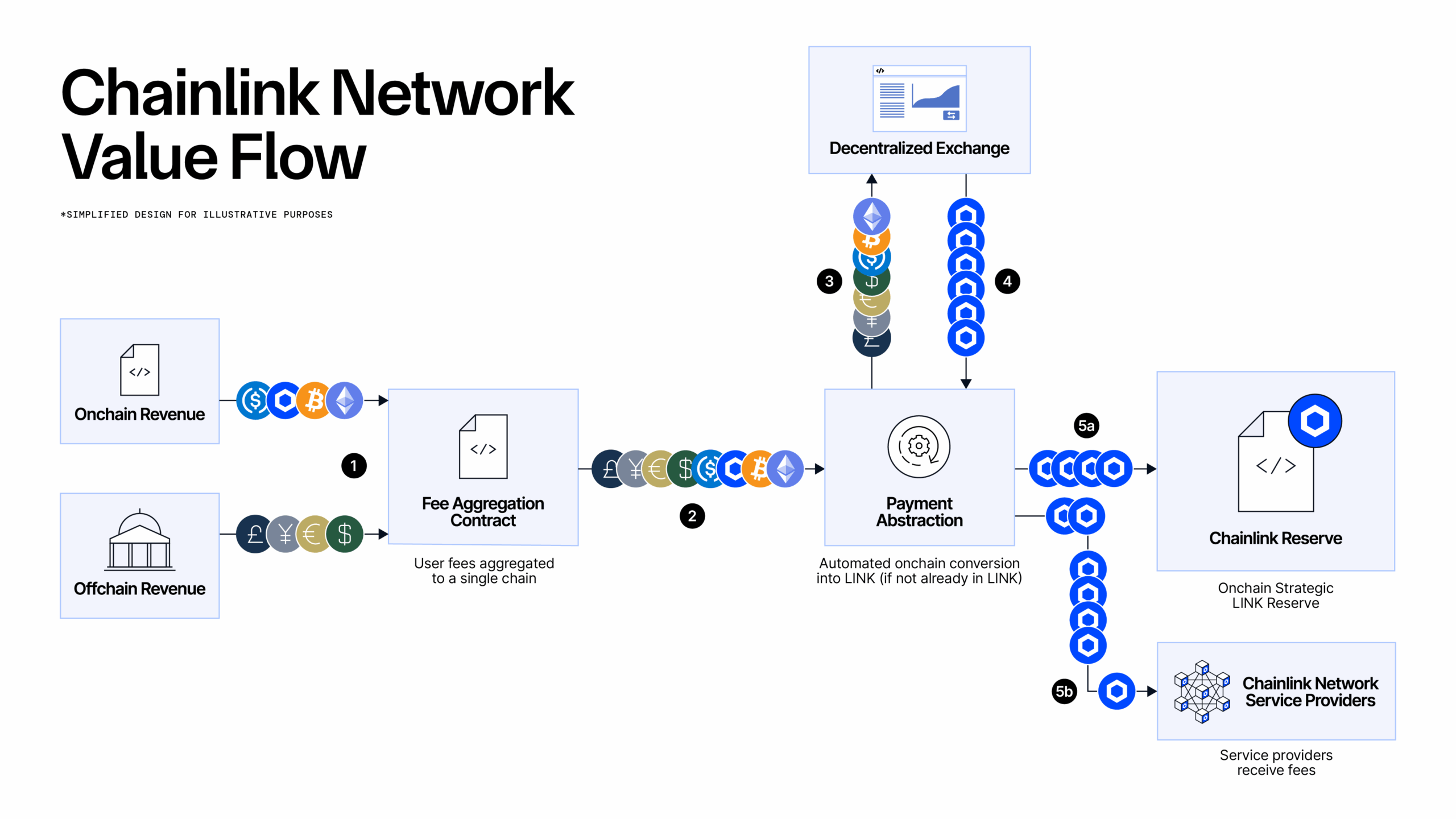

The Chainlink Reserve is being built up by using Payment Abstraction to convert offchain and onchain revenue into LINK. Introduced earlier this year, Payment Abstraction is onchain infrastructure that reduces payment friction by enabling users to pay for Chainlink services in their preferred form of payment (e.g., gas tokens and stablecoins). Payments are then programmatically converted to LINK using a combination of Chainlink services and decentralized exchange infrastructure.

To make the Chainlink Reserve upgrade even more effective, Payment Abstraction has now officially expanded to support offchain payments for Chainlink and multiple onchain services. This enables revenue from both onchain service usage, as well as significant offchain revenue from existing and ongoing enterprise integrations, usage and maintenance, to be programmatically converted to LINK (if not already paid in LINK).

Demand for Chainlink has already created hundreds of millions of dollars in revenue, substantially from large enterprises that have paid offchain for access to the Chainlink Platform. With increasing demand from a number of the world’s largest banking and capital markets institutions, this form of paying for the Chainlink standard is expected to grow into the future as the industry grows. The Reserve has already accumulated over $1MM worth of LINK from this early stage launch phase, which is expected to gradually grow in the coming months as more revenue is converted into LINK and placed into the Reserve.

We do not expect any withdrawals from the Reserve for multiple years and thus it is expected to grow over time. We believe that as the industry demand for Chainlink’s unique capabilities increases, that adoption of Chainlink services will enable the Reserve to grow further.

To support community visibility into the Chainlink Reserve, we have created an analytics dashboard, which can be found on reserve.chain.link. Information about the circulating supply of LINK can be found here and the Reserve contract address can be found here on Etherscan.

This blog will dive further into the competitive advantage of the Chainlink Platform and its ability to create revenue, how Payment Abstraction powers the Chainlink Reserve, and how the Reserve is planned to complement existing Chainlink economic initiatives.

The Competitive Advantage of the Chainlink Platform

Chainlink initially established its market leadership through the invention of the “decentralized oracle network” and its application to decentralized price oracles. Chainlink Price Feeds not only enabled the rise of DeFi, but have become the industry standard price-oracle solution, with 67.77% total market share (including 83.67% on Ethereum) and $80B+ in Total Value Secured. Today, over 2,000 Chainlink Price Feeds, Data Streams, and other oracle networks are used in production by the industry’s leading protocols across 60+ blockchains, already enabling tens of trillions in transaction value.

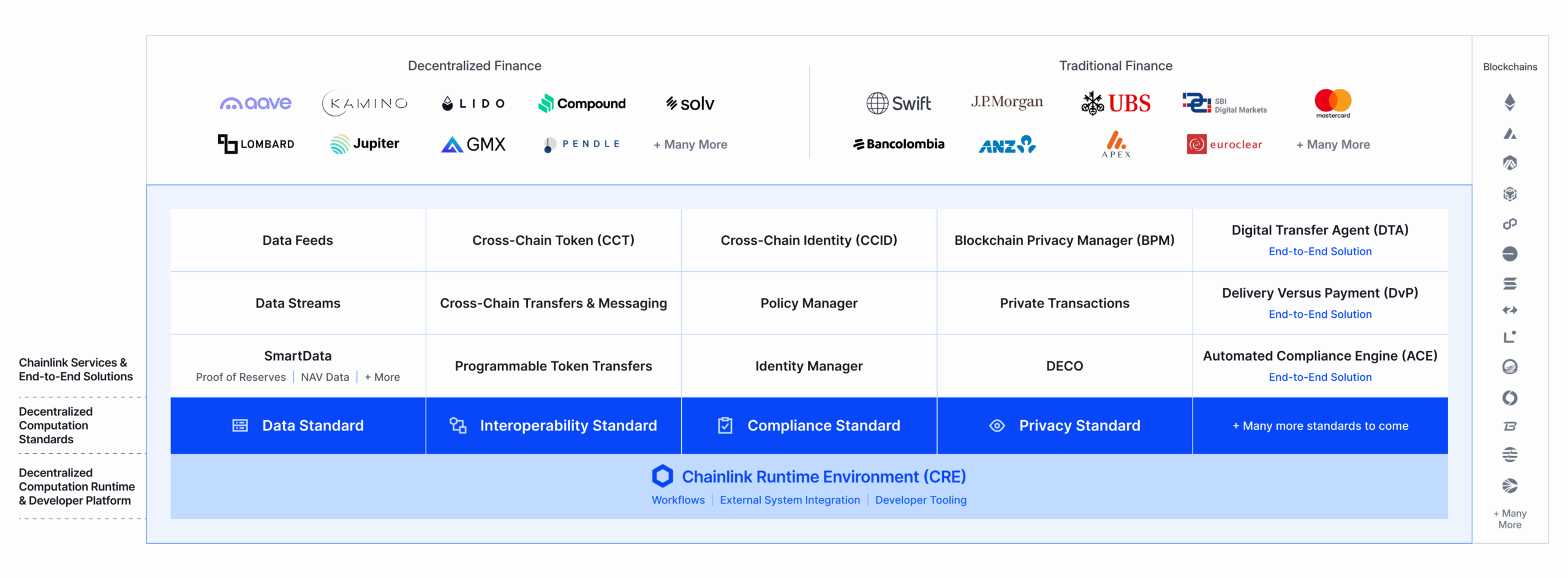

After addressing the immediate need for market data, the Chainlink platform has since expanded in scope to provide a wide array of standards and protocols that not only power DeFi applications, but also provide the critical infrastructure and ecosystem connectivity required to scale the adoption of tokenized assets—a multi-trillion dollar opportunity.

Today, the Chainlink platform consists of a collection of modular, composable services built upon a set of standards, protocols, and infrastructure that can be seamlessly combined to create and execute advanced blockchain applications. Chainlink is a unique platform where institutions and developers can combine different blockchains, external data sources, and legacy systems together while embedding critical compliance and privacy capabilities into a unified workflow.

In contrast to alternative solutions—that only address a small fraction of common application requirements, requiring a complex patchwork of service providers with different interfaces, security assumptions, and economic models—developers can instead leverage the Chainlink platform to access all of the data, cross-chain, privacy, compliance, and legacy system connectivity solutions they need for many advanced blockchain applications.

With Chainlink, complex applications that span multi-chain, multi-asset, multi-jurisdictional, and multi-system are not only possible, but easy to create and orchestrate. Through Chainlink’s unique offering, institutions can create these advanced onchain applications that mirror the complexity seen in existing financial systems, yet do so with more efficiency, automation, and trust thanks to the superior composability, programmability, and reliability of blockchains.

Through a modular and unified platform offering, Chainlink is uniquely positioned to power and benefit from the growing tokenization trend as more and more of the world’s largest financial institutions adopt blockchain technology to tokenize trillions of dollars of assets onchain. We expect this to create an acceleration in the adoption of Chainlink services, which are directly connected to Payment Abstraction and the Chainlink Reserve.

How Payment Abstraction Fuels the Growth of the Chainlink Reserve

Chainlink Payment Abstraction is onchain infrastructure that processes user fee payments in LINK and reduces payment friction by enabling users to pay for Chainlink services in their preferred form of payment. Payments are then programmatically converted to LINK using a combination of Chainlink services and decentralized exchange infrastructure. Launched earlier this year, Payment Abstraction was initially connected to Chainlink Smart Value Recapture (SVR) to enable Chainlink’s portion of recaptured liquidation MEV fees to be converted into LINK.

With this new upgrade, Payment Abstraction has been expanded to cover more categories of revenue, enabling revenue from enterprise integrations, usage and maintenance, as well as revenue from onchain service usage, to be automatically converted to LINK.

Payment Abstraction uses multiple Chainlink services in combination to facilitate automated operations, including:

- CCIP: Consolidate fee tokens across the various chains that Chainlink services support onto a single payment chain (Ethereum).

- Automation: Automate the initiation of conversion transactions without the need for manual interactions.

- Price Feeds: Provide an official source of truth on the pricing of supported tokens to minimize certain transaction costs.

The initial decentralized exchange used by Payment Abstraction is Uniswap V3 on Ethereum, given its liquidity profile for supported tokens and the fact it can be permissionlessly integrated by other smart contracts while minimizing centralized points of control. In the future, additional DEX services could be integrated to enhance MEV protection and support features like smart order routing.

The Chainlink Reserve is an onchain smart contract on Ethereum that operates as an extension of Payment Abstraction and stores a strategic reserve of LINK. The Reserve contract also features a multi-day timelock as an additional security measure before withdrawal requests are processed.

Additionally, 50% of fees from staking-secured SVR services—originally planned to be used to cover the existing oracle rewards paid to node operators—is now planned to be used to help fund the Chainlink Reserve via Payment Abstraction.

The Core Pillars of Chainlink Economics

The introduction of the Chainlink Reserve complements Chainlink’s existing economic pillars for creating a sustainable oracle economy. These pillars are centered around user fee growth and operating cost reductions.

User Fee Growth

- Enterprise integrations, usage and maintenance: Demand for Chainlink has already created hundreds of millions of dollars in revenue, often from large enterprises that have paid offchain for access to Chainlink. These deals position Chainlink as the secure connectivity layer for the entire blockchain industry, connecting legacy systems to public and private blockchains as well as the key interoperability layer for data and value into, out of and across blockchains. Chainlink is positioned to play a key role in accelerating the issuance and adoption of digital assets, while enabling the stablecoin market and many other forms of asset tokenization that rely on the Chainlink standard to operate successfully. Capital markets adoption of Chainlink continues to accelerate with a number of production use cases already live, as well as pre-production use cases that are approaching fully live deployment for some of the world’s largest financial institutions.

- Usage-based payments: A model of payment where users pay for oracle services based on their usage. This currently includes a subscription-based model (VRF, Automation, Functions) where applications keep fee balances within an onchain subscription contract that is drawn upon by service providers as services are consumed. Additionally, there are per-call payments (CCIP) where users pay from their wallet when executing a transaction involving an oracle service.

- Revenue-Sharing: An approach where applications share a portion of their generated fees with Chainlink service providers as a way to pay for the oracle services they consume. This includes certain Data Streams deals, such as GMX, which pays 1.2% of total fees for its use of low-latency market data. This also includes SVR users, such as Aave, where 35% of recaptured liquidation MEV on SVR-integrated Aave markets is collected by Chainlink.

- Build program: An economic initiative that aims to accelerate the growth of early-stage projects by providing enhanced access to Chainlink services and technical support in exchange for projects committing a portion of their native token supply to be paid to Chainlink service providers, including stakers. This is suitable for pre-revenue projects who need access to oracle services and want support in accelerating their adoption until they earn sustainable revenue flows that can support other pricing models.

The above are current sources of user fees connected to Payment Abstraction, supporting the growth of the Chainlink Reserve. Note, these payment structures and methods may change over time based on the evolving architecture of the Chainlink platform and the needs of users. Additional sources of user fees and methods of fee payment in relation to the use of Chainlink services may emerge over time and other sources of funding for the Reserve may be used in the future.

Operating Cost Reductions

- Chainlink Runtime Environment (CRE): A new architectural upgrade to the Chainlink platform that reduces operating costs through the modularization of oracle capabilities. For example, rather than having multiple redundant instances of ETH/USD oracle networks on each supported blockchain, there can be a single ETH/USD network used for each blockchain that Chainlink is integrated with. DON-to-DON communication and additional technical optimizations further reduce operating costs with the result of a leaner offchain infrastructure.

- Additional Cost-Saving Measures: Improvements around the cost efficiency of the Chainlink platform are continually ongoing, which includes initiatives such as optimizing the node configuration of DONs, deprecating Data Feed DONs based on shifting usage patterns, and streamlining processes that lower operational overhead. Collectively, these efforts aim to reduce user costs while upholding the network’s security and reliability.

Creating an Economically Sustainable Chainlink Network

The launch of the Chainlink Reserve marks a pivotal evolution in Chainlink’s economic system by expanding the use of Payment Abstraction to cover more categories of revenue contributing to a strategic onchain reserve of LINK funded by offchain and onchain revenue. The Reserve is intended to support the growth of the Chainlink Network in future years in line with some of the key goals for sustainability that were initially defined in Chainlink Economics.

Together with initiatives centered around user fee growth and operating cost reductions, the introduction of the Chainlink Reserve supports Chainlink adoption across DeFi and TradFi, and establishes Chainlink as the infrastructure standard for mass adoption of tokenized assets.

—

Disclaimer: This post is for informational purposes only and contains statements about the future, including anticipated product features, development, and timelines for the rollout of these features. These statements, including, without limitation, with respect to the size or growth of the Chainlink Reserve, the makeup or growth of offchain or onchain revenue within the Chainlink Reserve or generated by adoption of the Chainlink Standard, and anticipated uses of the Chainlink Reserve, are only predictions and reflect current beliefs and expectations with respect to future events; they are based on assumptions and are subject to risk, uncertainties, and changes at any time. There can be no assurance that actual results will not differ materially from those expressed in these statements, although we believe them to be based on reasonable assumptions. Please review the Chainlink Terms of Service, which provides important information and disclosures. Note that revenue from enterprise integrations, usage and maintenance includes existing and historical revenue from the Chainlink Scale program as well as other sources. All statements are valid only as of the date first posted. These statements may not reflect future developments due to user feedback or later events and we may not update this post in response.