How Chainlink Proof of Reserve Accelerates Stablecoin Adoption in Capital Markets

With financial institutions looking to innovate by offering faster and lower-cost payment options for their customers, stablecoins represent an intriguing proposition given their global reach and instantaneous settlement. Beyond central bank digital currencies (CBDCs), the global financial system is also coalescing around individual institutions issuing their own versions of stablecoin products. For instance, PayPal, JP Morgan, and The Australia and New Zealand Banking Group Limited (ANZ) are just a few examples of financial institutions issuing their own stablecoin or tokenized cash/deposit tokens.

This new landscape of onchain finance has exciting potential for bringing increased efficiency, transparency, and programmability to financial assets, but it also comes with new challenges as it pertains to understanding a range of technologies that exist to support stablecoin efforts. Monetary authorities must navigate these complexities if they are to ensure a scalable, secure, and robust risk management framework is in place.

Below, we explore why Chainlink Proof of Reserve is a critical risk management tool for safeguarding consumers against stablecoin and tokenized asset risk, ultimately accelerating the rate at which capital markets can adopt digital assets and blockchain technologies.

Mitigating Stablecoin Risks With Chainlink Proof of Reserve

Chainlink is uniquely positioned to contribute to solving key challenges posed by the adoption of stablecoins within existing financial economies. Chainlink offers a suite of Web3 services that facilitate bidirectional communication between blockchains and external systems, along with a multitude of other decentralized computational services for privacy, automation, and more.

Already in operation for several years, Chainlink Proof of Reserve aggregates auditor verifications and valuations of the collateral backing stablecoins and is then able to relay the data onto blockchains and/or offchain databases. On a technical level, Chainlink Proof of Reserve uses decentralized infrastructure and an open-source, autonomous system for providing information regarding the real-time collateralization of stablecoins so customers have more transparency and stronger assurances of solvency.

This can be done by simply reporting the existence of assets (e.g., are there X number of Bitcoin stored at a specific address?) or go further by providing an independent valuation of those assets (e.g., is a portfolio of offchain assets sufficient to fully collateralize the stablecoin circulating supply?).

Banks and monetary authorities can adopt Chainlink Proof of Reserve to access flexible, scalable, and proven infrastructure for monitoring stablecoin risk in real-time. This is made possible through three distinct components of Chainlink Proof of Reserve:

- Secure, near real-time data aggregation of a stablecoin issuer’s offchain reserve assets for trusted reserve reporting and valuations.

- A blockchain-agnostic design for managing onchain liability balances across public and private blockchains.

- Synchronization of offchain assets and onchain liabilities for robust risk management and reporting.

Let’s now look at how each component can work in practice in the context of onchain capital markets.

Chainlink DONs for Near Real-Time Offchain Balance Sheet Aggregation

The management of stablecoin assets is quite similar to the management of a money market fund. However, how the assets and liabilities backing stablecoins are managed is often opaque because there is no prospectus that defines the guidelines or investment criteria on which securities will be purchased as collateral to back the stablecoin supply.

While certain jurisdictions have clear rules regarding reserve assets, many issuers only claim to maintain a strategy of short-term fixed-income securities. This leaves a persistent risk that higher interest-bearing securities can be purchased, often with credit quality and liquidity concerns. Therefore, the proof of reserve solution should utilize a standard format where security valuations are checked as close as possible to real-time and derived from multiple independent sources (when possible).

When it comes to valuations, we’ve identified four key risks that must be considered.

- Market Value Risk: The overall value of the collateral held by the issuers in one or many different custody accounts.

- Liquidity Risk: The depth at which the market could absorb a large redemption from an issuer without significant changes in quoted vs. transacted prices.

- Duration Risk: The sensitivity of the underlying collateral to interest rate movements.

- Liability Risk: Whether specific positions are pledged as collateral or on loan to other institutions.

Based on the risks highlighted above, we have defined an API schema that can give banks and monetary authorities the necessary information to fully assess all four risks that currently exist with stablecoins. These risks would be represented as data fields in the API, with their combination providing full coverage of stablecoin balance sheets. Furthermore, the API would directly interface with any bank custodian, and be available via a push or pull mechanism.

| Data Field | Description |

| ISIN | A universal way to identify any security. |

| Maturity Date | The date on which the security matures. |

| Units | The quantity of the position held in custody. |

| Pledged as Collateral | A binary value that gives banks and monetary authorities insight into whether a security is being used as collateral or on loan. |

Providing frequent mark-to-market valuations using a collection of independent data sources offers numerous benefits, including increased transparency, reduced risk, and enhanced trust in financial markets. These valuations provide insights into asset prices, which help banks and monetary authorities make informed decisions and monitor market stability.

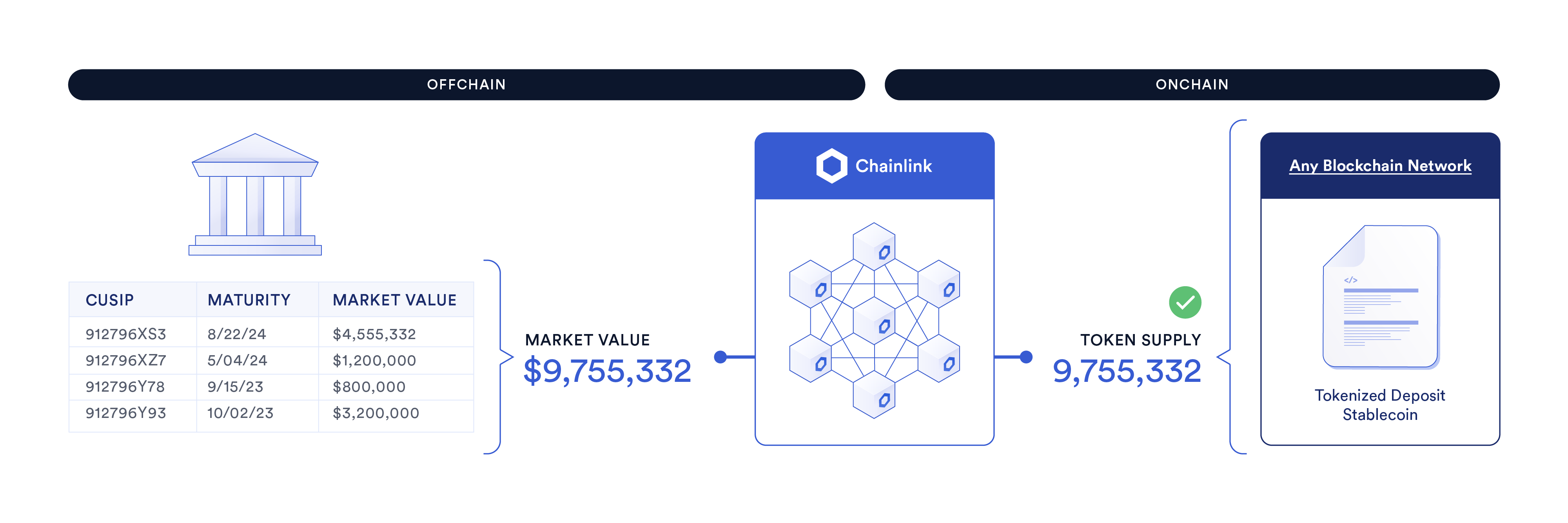

Chainlink can play a pivotal role as a decentralized aggregation solution for obtaining mark-to-market valuations. A Chainlink decentralized oracle network (DON) can securely access stablecoin reserve asset data and verify their current market value from various sources. This not only streamlines the valuation process but also enhances the credibility and integrity of financial data, benefiting stakeholders across the financial industry.

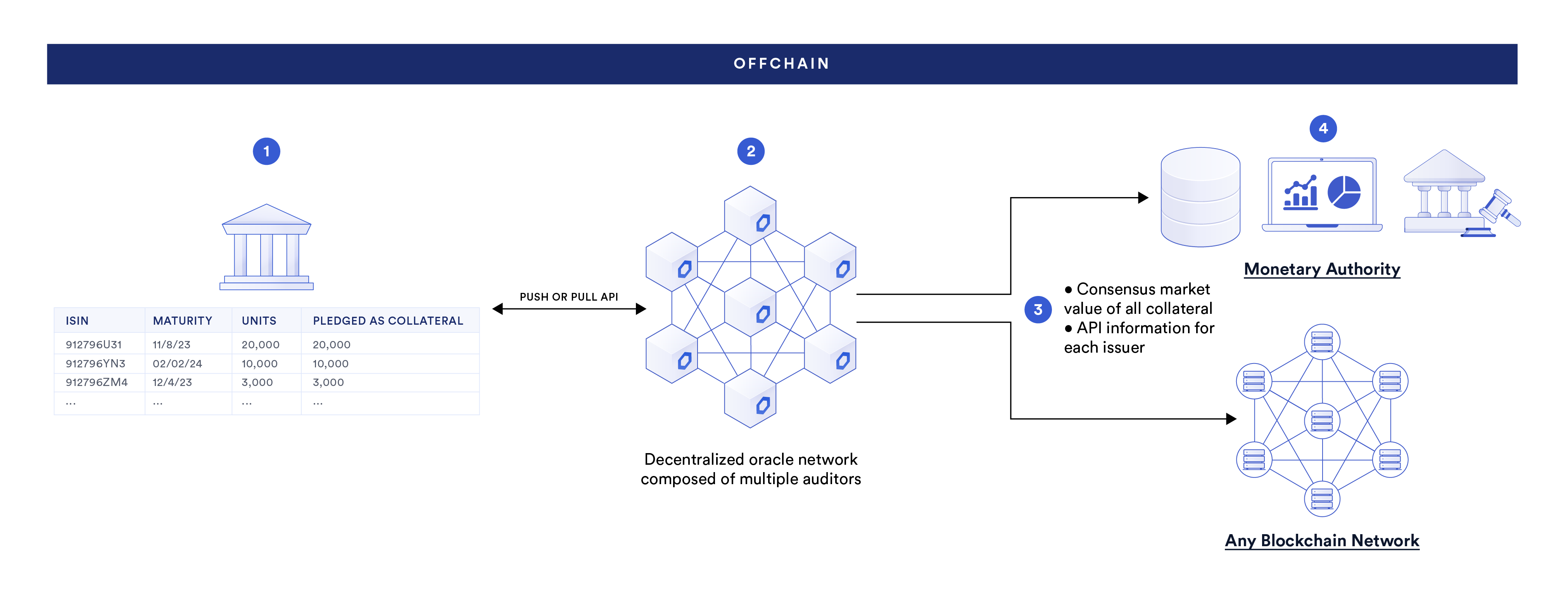

The diagram below presents a high-level overview of how the Chainlink-powered decentralized aggregation solution would work.

| Diagram Component | Description |

| 1 | The automated push or pull API service connects to any bank custodian holding the issuer’s stablecoin collateral (and supports the API schema highlighted in the section above). |

| 2 | Each node in the Chainlink DON calls the API and comes up with its own independent valuation of the reserves portfolio. The nodes could be represented by top-tier auditing firms and/or market data providers that specialize in creating independent valuations of OTC fixed-income securities. |

| 3 | Once the Chainlink DON comes to a consensus value (e.g., the median), the final collateral valuation and supporting data are made available onchain for applications and/or to an offchain database used by a monetary authority. |

| 4 | The monetary authority can build a reporting dashboard based on the output from the Chainlink DON. |

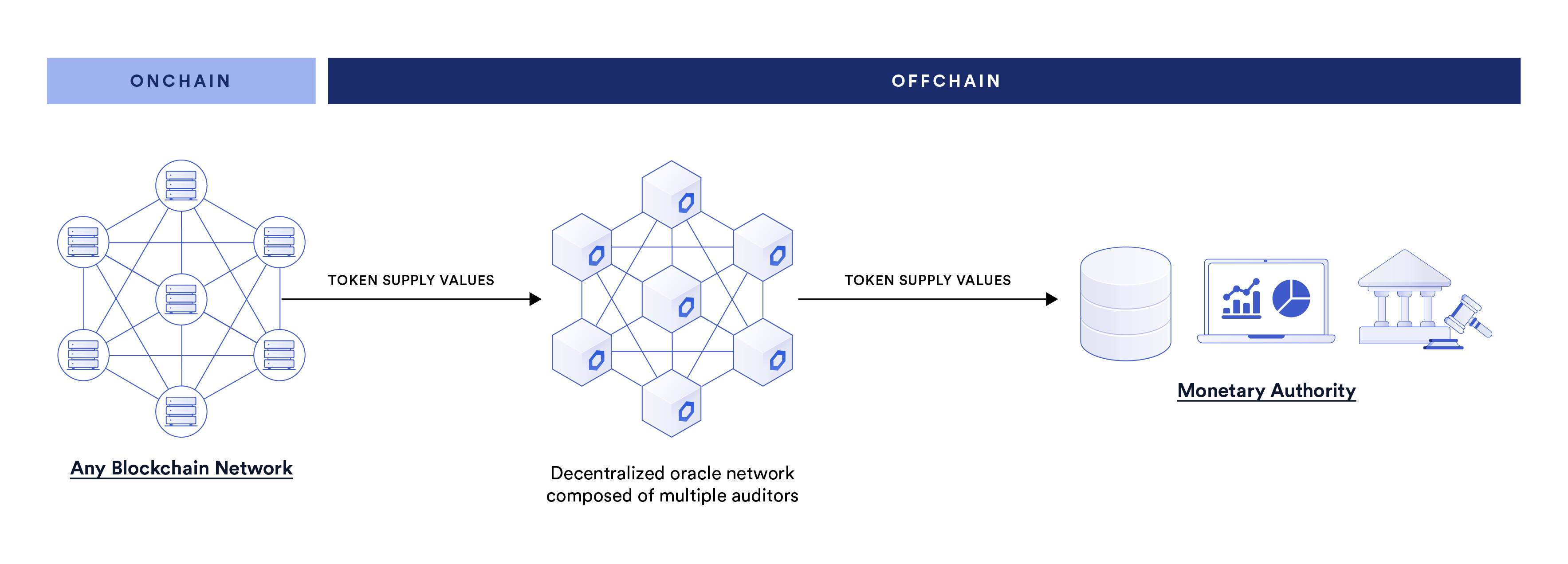

Chainlink’s Blockchain Agnostic Design Helps Manage Onchain Liabilities Across Networks

Chainlink is blockchain-agnostic, meaning it can seamlessly connect to and interact across any private or public blockchain. This flexibility is a key strength of Chainlink since agnosticism ensures that developers and users have access to secure and reliable data inputs and outputs regardless of their chosen blockchain platform, enabling a broader range of use cases and applications.

Having a blockchain-agnostic design for monitoring stablecoin token supplies is crucial for three main reasons:

- Multi-Platform Coverage: Stablecoins are issued on various blockchain platforms such as Ethereum and Hyperledger Besu. A blockchain-agnostic solution ensures that token supply monitoring can be conducted uniformly across all these platforms, enabling a comprehensive view of the entire stablecoin ecosystem.

- Compliance: Different jurisdictions may have their own set of requirements for stablecoin issuers, with some even preferring to operate on specific blockchain platforms. A blockchain-agnostic solution can adapt to varying requirements by facilitating compliance on multiple platforms.

- Future-Proofing: The blockchain landscape is dynamic, with new platforms emerging regularly. A blockchain-agnostic approach ensures adaptability and readiness to integrate with emerging blockchain technologies, safeguarding against vendor lock-in and obsolescence.

Chainlink Synchronizes Assets and Liabilities to Support Robust Risk Management Standards

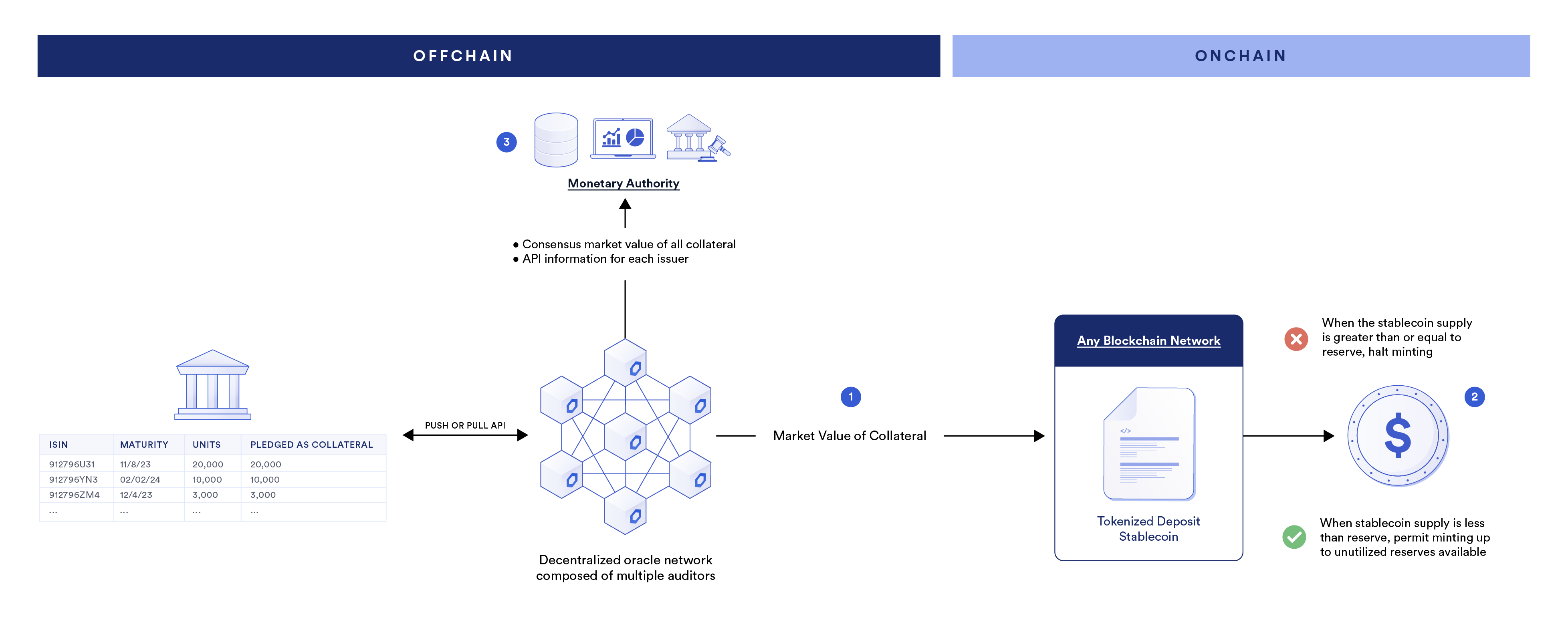

The composability of smart contracts makes it possible to create a near real-time risk management framework. One of the key risks on the liabilities side is the “minting” of more stablecoins than the current market value of the collateral residing offchain. This invalid minting of unbacked tokens risk can introduce systemic failure and contagion, as the token supply would be much greater than the underlying collateral.

Given Chainlink’s role as the industry standard in connecting data to any smart contract, the market value of the collateral can now be directly compared to the token supply within the stablecoin smart contract. Chainlink Proof of Reserve can also be used to aggregate a proof of total supply for stablecoins issued natively across multiple blockchains.

This data can then be used to trigger a circuit breaker connected to the minting function, which prohibits the minting of more stablecoins if the collateral falls below a certain threshold. The data can also be used by smart contract applications supporting stablecoins to trigger their own circuit breakers, helping further mitigate the contagion risk of unbacked stablecoins.

| Diagram Component | Description |

| 1 | The market value of the stablecoin’s reserve assets is posted to the blockchain it’s issued on via a Chainlink DON. The nodes could be represented by top-tier auditing firms and/or market data providers that specialize in creating independent valuations of OTC fixed-income securities. |

| 2 | The minting function references the latest value posted onchain by the Chainlink DON. A circuit breaker is programmed into the minting function of the stablecoin. If the liabilities (supply) are greater than or equal to the reserves, the minting function is halted. If the liabilities are less than the reserves, minting is permitted up to the unutilized reserves available. |

| 3 | The market value of the stablecoin’s reserve assets can also be made available to an offchain database used by a monetary authority. The monetary authority can build a reporting dashboard based on the output from the Chainlink DON. |

Start Building Capital Market Use Cases With Chainlink

If you want to explore how your stablecoin implementation or risk management network can benefit from using Chainlink Proof of Reserve, reach out to one of our experts. If you want to learn more about how Chainlink can also support the tokenization of real-world assets, check out How Chainlink Unlocks the Full Capabilities of Tokenization for Capital Markets.