Chainlink Powers 3 Major Use Cases Under the Monetary Authority of Singapore’s Project Guardian

Chainlink is the foundational platform underpinning the rapid adoption of tokenization and onchain finance by the world’s largest institutions and market infrastructures. As part of this shift, Chainlink is playing a significant role in enabling three landmark capital markets solutions under the Monetary Authority of Singapore’s (MAS) Project Guardian, an industry initiative led by what is considered to be one of the most progressive regulatory bodies globally when it comes to integrating blockchain technology within financial markets.

The following industry participants collaborated:

- Swift—Global member-owned cooperative and the world’s leading provider of secure financial messaging services to more than 11,500 banks.

- UBS Asset Management—Large-scale investment manager with over $1.6T assets under management (AUM).

- ANZ Bank—Australian institutional bank with $1T+ AUM.

- SBI Digital Markets—Singapore-based subsidiary of the digital asset arm of Japan’s leading conglomerate SBI Group providing digital asset solutions.

- ADDX—Singapore-based fully regulated digital securities exchange.

MAS’s Project Guardian is a collaborative initiative involving policymakers and the world’s largest financial institutions and market infrastructures. Project Guardian’s goal is to use blockchain infrastructure to tangibly demonstrate how tokenization and smart contracts are transforming the financial markets through asset tokenization.

The first two Project Guardian solutions Chainlink is powering focus on streamlining traditional fund operations end-to-end. Traditional fund operations often face inefficiencies in subscription and redemption processes, including manual interventions, delayed settlements, and a lack of real-time transparency. These inefficiencies lead to increased operational costs, reduced liquidity, and missed investment opportunities across the $63 trillion global mutual fund market. The third Project Guardian solution addresses regulatory requirements for keeping tokenized asset transaction details confidential, even when they use the public Cross-Chain Interoperability Protocol (CCIP) network to settle across different private and public blockchains.

Swift, UBS Asset Management, and Chainlink Bridge Tokenized Assets With Existing Payment Systems

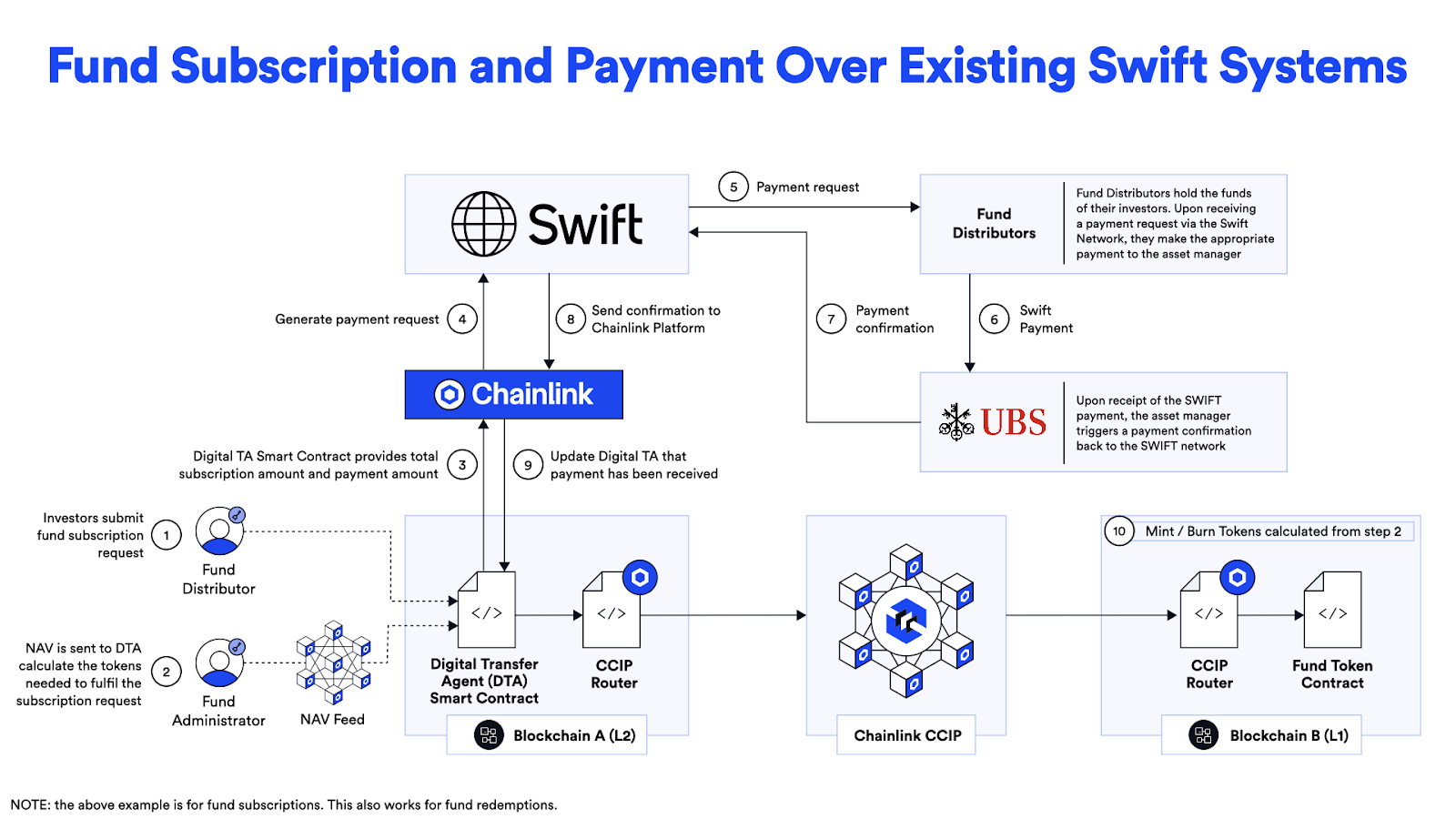

Swift, UBS Asset Management, and Chainlink successfully settled tokenized fund subscriptions and redemptions using the Swift network. This initiative enables digital asset transactions to settle offchain in fiat using an established payment system that’s already widely adopted by more than 11,500 financial institutions, across over 200 countries and territories.

Swift, UBS, and Chainlink’s work proves how financial institutions can leverage blockchain technology, the Chainlink Platform, and the Swift network to settle subscriptions and redemptions for tokenized investment fund vehicles, thereby allowing the straight-through-processing of the payment leg without the need for global adoption of an onchain form of payment. This helps in the automation of the entire lifecycle of the fund redemption and subscription process.

The solution builds on the previous use case described above where UBS Asset Management and SBI Digital Markets created a digital subscription and redemption system for tokenized funds. The project used existing Swift payment rails, which enable end-to-end payment orchestration capabilities to settle fund subscriptions and redemptions. Swift previously demonstrated how its existing infrastructure can provide a secure, scalable way for financial institutions to connect to multiple types of blockchain, and the latest solution with Chainlink’s platform orchestrated the necessary interactions between each of the respective actors to fulfill the pre-conditions for which a UBS tokenized investment fund will automatically mint or burn fund tokens for investors.

“Our work with UBS Asset Management and Chainlink in MAS’ Project Guardian leverages the global Swift network to bridge digital assets with established systems.”—Jonathan Ehrenfeld, Head of Strategy at Swift

Key Takeaways:

- Leverages existing payment infrastructure

- Enables broad market participation without requiring onchain cash

- Combines benefits of tokenization with traditional settlement

- Accelerates institutional adoption

At this year’s Singapore FinTech Festival, industry leaders from Swift, UBS, and Chainlink dove into the details of their landmark solution and showed how institutions can leverage the Chainlink Platform to enable digital asset transactions to settle along existing payment rails. Watch the full session below:

SBI Digital Markets, UBS Asset Management, and Chainlink Unlock Automated Fund Administration and Transfer Agency

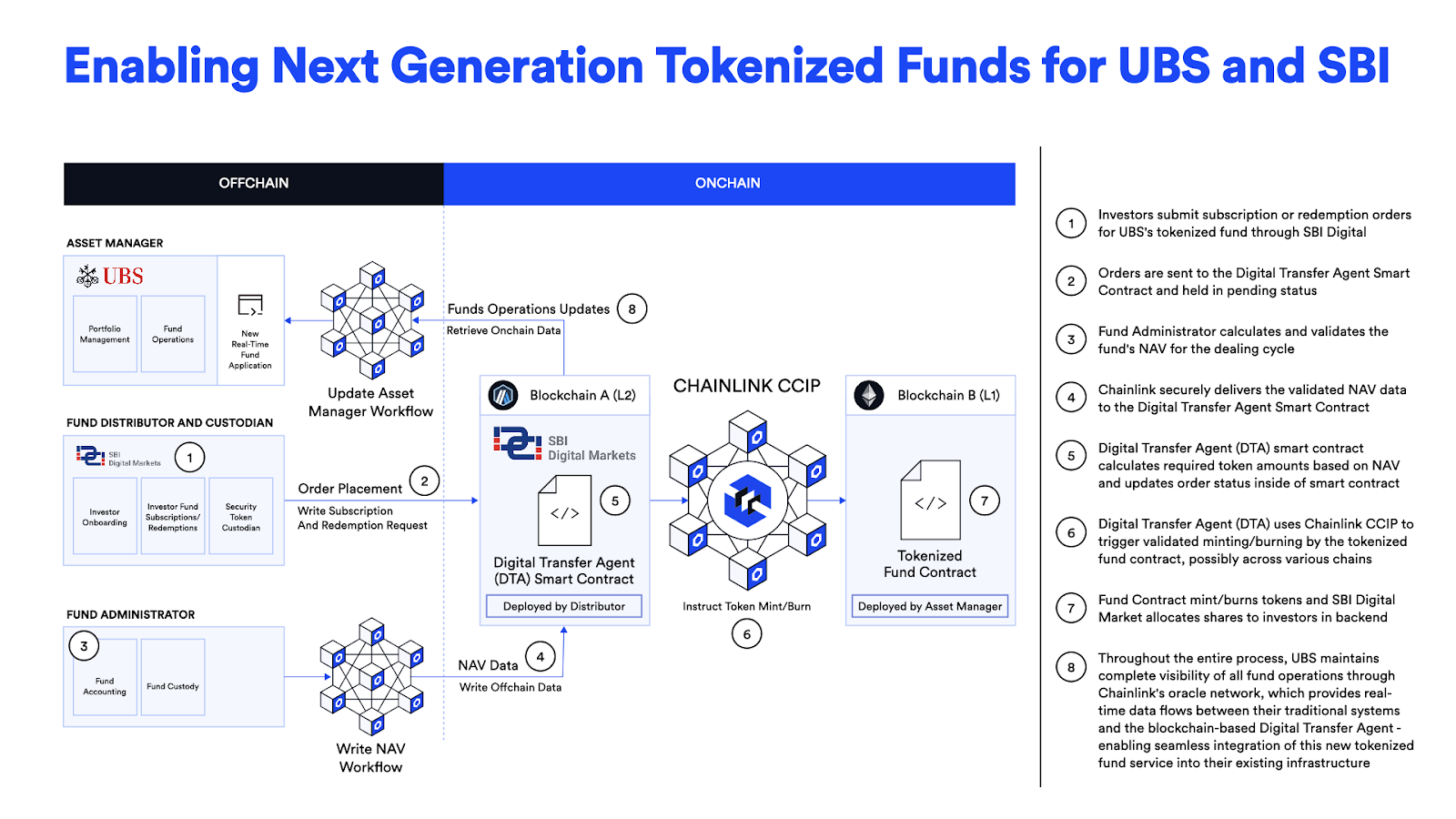

SBI Digital Markets, UBS Asset Management, and Chainlink successfully completed their implementation of a tokenized fund, showcasing how tokenization, smart contracts, and Chainlink infrastructure can automate the fund management process for traditional fund administrators and transfer agents. This unlocks a fundamental shift in how the industry’s $132T global assets under management can begin to operate using blockchains.

The adoption of tokenized funds by the world’s largest asset managers has created a need for the fund administration industry to evolve into an onchain format. The UBS, SBIDM, and Chainlink solution shows how existing fund administration processes can apply to tokenized funds across multiple chains. The key insight is that existing systems already widely in use for fund administration processes can become compatible with tokenized funds once they’re made compatible with blockchains and smart contracts via Chainlink.

Today, 93% of fund services firms have yet to fully automate data inputs, data checks, and key workflow processes. It’s part of why traditional fund operations face inefficiencies in subscription and redemption processes, as they are still subject to manual interventions, delayed settlements, and a lack of real-time transparency. These inefficiencies can potentially lead to increased operational costs, reduced liquidity, and missed investment opportunities.

One of the key components of the new model is the digital transfer agent (DTA) smart contract, made possible by using multiple oracle networks from Chainlink and deployed by SBI as the custodian and fund distributor. This set up a successful workflow that enabled significant efficiency gains in the fund administration process through the combined use of smart contracts, oracle networks, and multiple blockchains. While UBS’s tokenized fund lives on Ethereum, Chainlink’s Cross-Chain Interoperability Protocol (CCIP) enables subscriptions and redemptions to occur seamlessly across multiple blockchains where fund tokens may be deployed. This blockchain-agnostic architecture delivers real-time processing while meeting the rigorous security and compliance standards that institutional funds demand.

The solution enables the fund management industry to realize enhanced efficiencies and decreased costs due to fewer errors and less manual communication from fund distributors to fund issuers, along with much higher levels of security and transparency for investors. There are also large benefits from the levels of transparency around transaction histories and balances since there is real-time reconciliation between the fund distributor and the fund issuer.

SBIDM’s choice to start implementing this approach and deploying their own Digital Transfer Agency (DTA) smart contracts shows the large value in creating an onchain golden record for tokenized funds, ultimately benefiting all market participants. As one of the world’s largest asset managers with over $1.6 trillion in AUM, UBS Asset Management is a leader in the adoption of automating fund administration and transfer agency processes using smart contracts. Their involvement demonstrates how major financial institutions can revolutionize their fund operations while maintaining regulatory compliance.

“This new way of launching fund structures and administering them via smart contracts empowers both fund managers and their service providers to deliver new onchain financial products and lower operational costs to investors.”—Winston Quek at SBI Digital Markets

Key Takeaways:

- Streamlines fund operations through smart contract-based automation

- Reduces operational costs and errors in fund management

- Enhances transparency and real-time processing

- Improves fund liquidity management

At this year’s Singapore FinTech Festival Sergey Nazarov, Co-Founder of Chainlink, along with Avanee Gokhale, Strategy at Swift, Andrew Wong, Director at UBS, Winston Quek, and CEO of SBI Digital Markets sat down together to showcase this innovative solution and highlight how asset tokenization is redefining the fund management lifecycle and bringing enhanced liquidity and efficiency to financial markets. Watch the full session below:

ADDX, ANZ, and Chainlink Introduce Privacy-Enabled Cross-Chain, Cross-Border Connectivity for Tokenized Commercial Paper

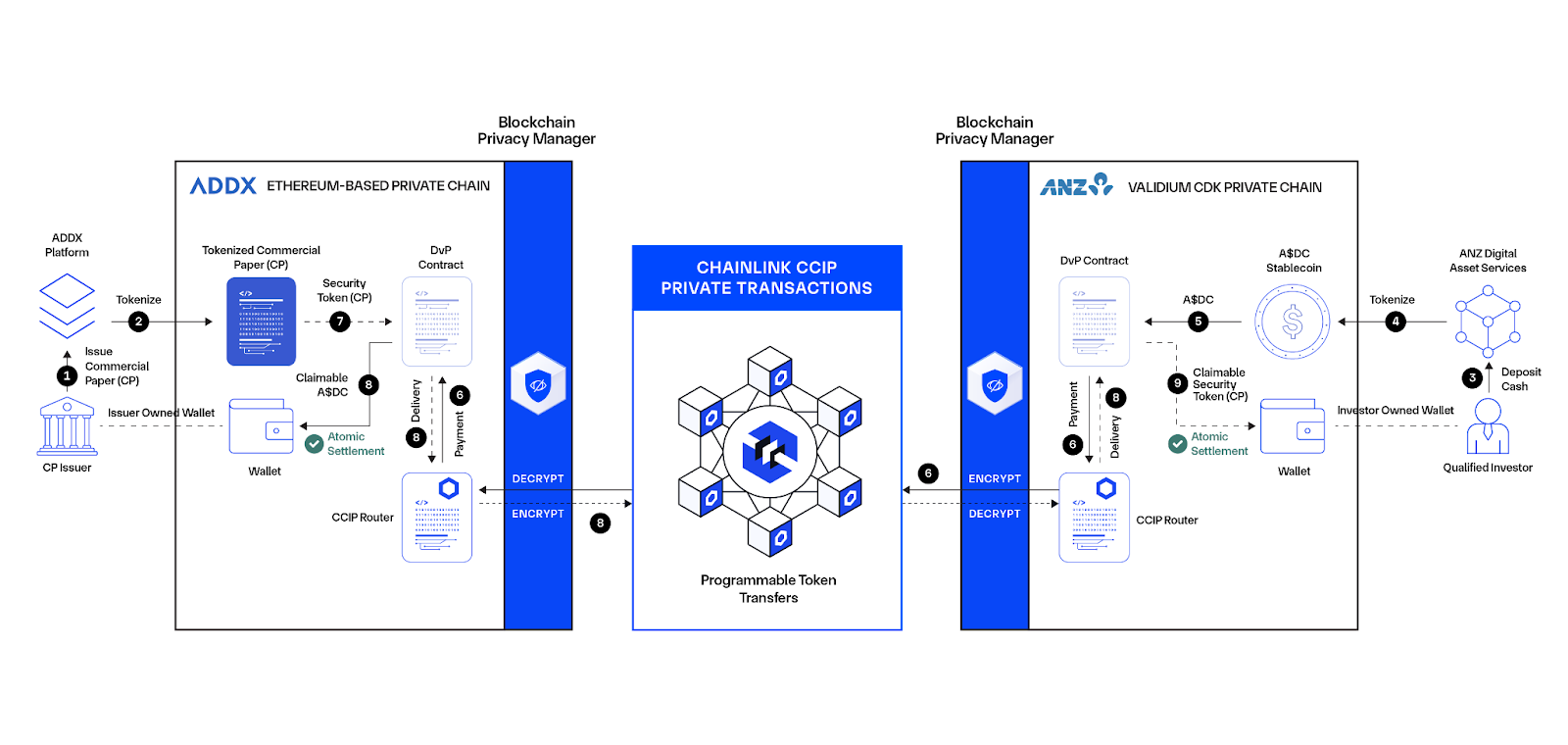

ADDX, in collaboration with ANZ and Chainlink, presented a solution focused on the entire asset lifecycle of tokenized commercial paper for cross-border transactions. The solution leverages ADDX’s investment platform, ANZ’s Digital Asset Services, and Chainlink’s Cross-Chain Interoperability Protocol (CCIP), including its recently announced Private Transactions capability.

For this solution, the participants have selected commercial paper as the candidate asset class. The short duration of the commercial paper makes it possible to showcase the entire asset lifecycle, from issuance and subscription to settlement and redemption. This transaction shows that regulated financial entities can securely tokenize and execute digital asset transactions using their existing systems while staying within the regulatory frameworks that ensure the integrity of financial markets.

Moreover, the solution demonstrates how an Australian-based investor can purchase and redeem tokenized commercial paper issued on the platform of a licensed, recognized Singaporean market operator, such as ADDX. Chainlink CCIP orchestrates the transaction settlement across two private, permissioned blockchain environments. To help institutions meet their regulatory requirements, these transaction details must remain confidential, even as the tokenized assets use the public CCIP network to move across two separate private blockchains. This is achieved through the use of CCIP Private Transactions, which prevents third parties from accessing private data within institutional chains and cross-chain transactions, including amounts, counterparty details, bid/ask sides, and settlement instructions.

“By leveraging Chainlink CCIP for secure and compliant blockchain interoperability, this use case showcases the utility of tokenized financial assets within a regulated environment.”—Inmoo Hwang, Co-Founder and Group CFO at ADDX

Key Takeaways:

- Demonstrates secure delivery vs. payment across multiple chains

- Reduces costs and time-to-market for asset issuers

- Broadens access to tokenized real-world assets

- Enables increased cross-border investment flows

At this year’s Singapore FinTech Festival, Sergey Nazarov was joined by Robert Porter, Director Digital Asset Services at ANZ, and Inmoo Hwang, Group Chief Financial Officer at ICHX (ADDX), to highlight how banks are leveraging Chainlink as the industry-standard interoperability platform to drive adoption of digital assets. Watch the full panel below:

Paving the Way For Production-Level Blockchain Use Cases in Banking and Capital Markets

Chainlink is key infrastructure for Project Guardian applications as it is the only platform capable of powering interoperability between existing financial systems and any private or public blockchain, while also helping institutions meet their confidentiality, compliance, and security requirements. Chainlink enables an onchain golden record (OGR) for tokenized assets, in which all the key data and asset servicing requirements persist with the asset as it moves across different blockchain environments and existing systems—unlocking increased liquidity and more efficient, automated workflows for financial instruments and services.

The Chainlink Platform is the standard connecting the financial market infrastructures and systems of today to any blockchain so that institutions don’t have to modify their existing backends. The past several years have seen many traditional finance blockchain proof of concepts hampered by integration issues and the fragmentation challenge of the increasing number of available blockchain ecosystems that banks and institutions may deal with. The fact that Chainlink enables financial institutions to interact with tokenized assets across any public and private blockchain directly from existing infrastructures, such as through Swift messages, APIs, mainframes, and other standard formats, makes it indispensable to these Project Guardian use cases. Chainlink is crucial to the ongoing work MAS and participating financial institutions are doing with Project Guardian to reimagine global financial markets infrastructure with blockchain technology.

View a complete list of the major work Chainlink is doing with the world’s largest financial market infrastructures and institutions: Chainlink’s Major Announcements in Banking and Capital Markets.

Chainlink in the News

- Tokenisation in Financial Services: Pathways to Scale: MAS Deputy Managing Director Mr. Leong Sing Chiong’s opening keynote address at Layer One Summit which highlighted Chainlink’s work with UBS and Swift.

- UBS and Chainlink Use Swift Network for Tokenized Fund Transactions (Finextra)

- Swift, UBS Asset Management, and Chainlink Successfully Bridge Tokenized Assets With Existing Payment Systems (Fintech Finance)

- Swift, UBS AM, and Chainlink Integrate Tokenised Assets (Private Banker International)

- Swift, UBS, Chainlink Settle Tokenised Fund Subscriptions and Redemptions Over Swift’s Network (Asian Banking & Finance)

- Swift, UBS, Chainlink Innovation to Revolutionize $63T Fund Market (CCN)