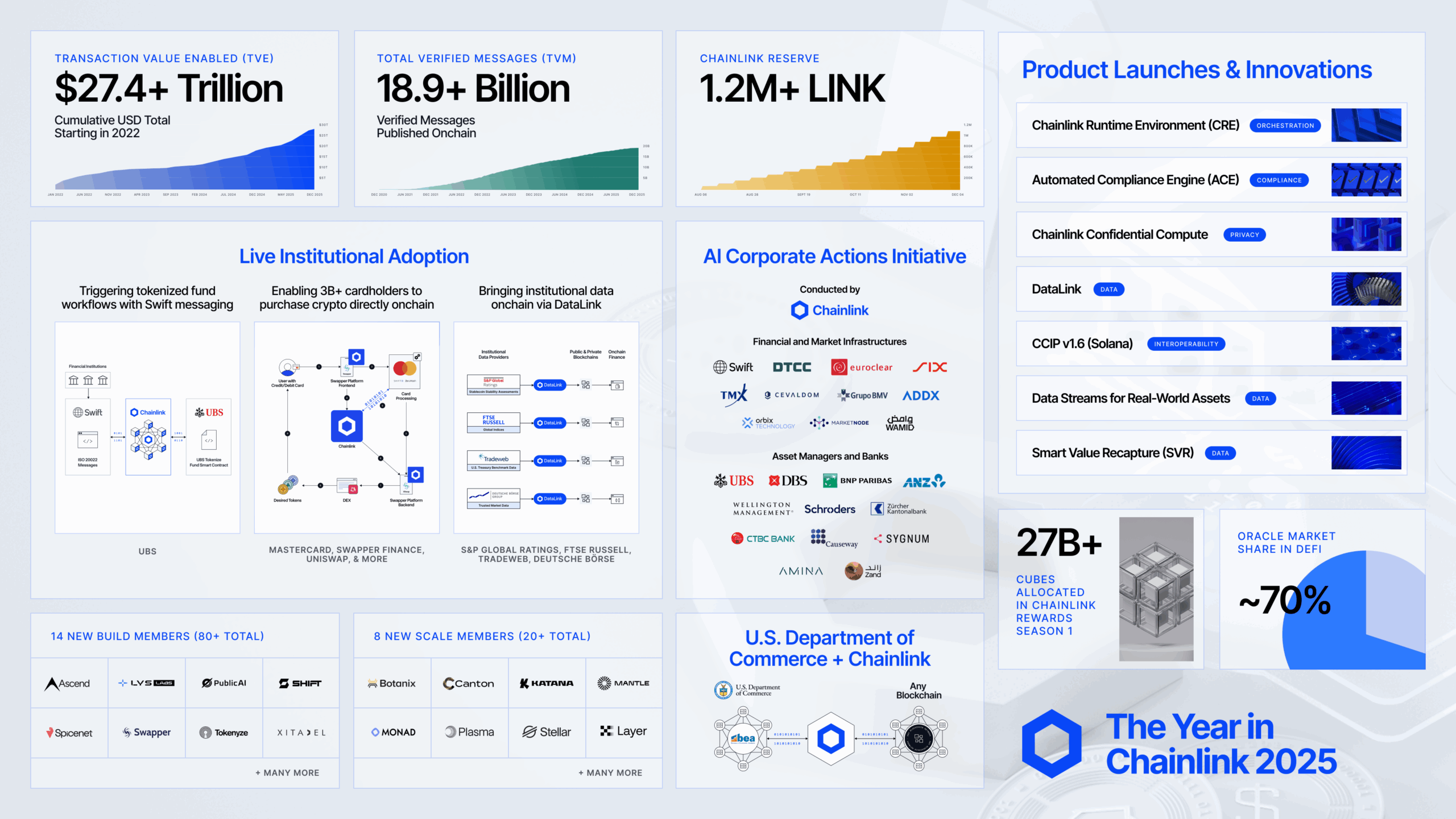

Chainlink’s Dominance Across Onchain Finance in 2025

2025 has been the year Chainlink’s role as the industry-standard oracle platform for onchain finance became undeniable. Governments are publishing critical economic datasets onchain. Global banks are executing cross-chain transactions. Major asset managers are running tokenized funds on public blockchains. Financial market infrastructures are aligning around Chainlink standards.

The Chainlink oracle platform now underpins some of the most important financial and economic systems in production. As a result, the Chainlink ecosystem is expanding at unprecedented speed, with more governments, financial institutions, and DeFi protocols adopting Chainlink’s technology to unlock the power of onchain finance.

This blog recaps the most notable Chainlink milestones of 2025.

Government

2025 marked a breakthrough year in government adoption of Chainlink and blockchain technology for modernizing the public sector.

- The United States Department of Commerce and Chainlink partnered to bring U.S. government macroeconomic data onchain. These new Chainlink Data Feeds securely deliver critical information around key U.S. economy metrics onchain, sourced from the Bureau of Economic Analysis.

- Chainlink Co-Founder Sergey Nazarov attended the White House Digital Asset Summit alongside President Donald Trump, Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick, Crypto Czar David Sacks, and many more industry leaders and representatives.

- Sergey Nazarov met with key U.S. government representatives in Washington, D.C., including Rep. Bryan Steil, Rep. Tom Emmer, and Tyler Williams.

- Sergey Nazarov joined senior government and digital asset leaders as U.S. President Donald Trump signed the GENIUS Act into law.

Banking & Capital Markets

The largest financial institutions in the world continued to adopt Chainlink infrastructure in 2025 as the standard for bringing financial markets onchain.

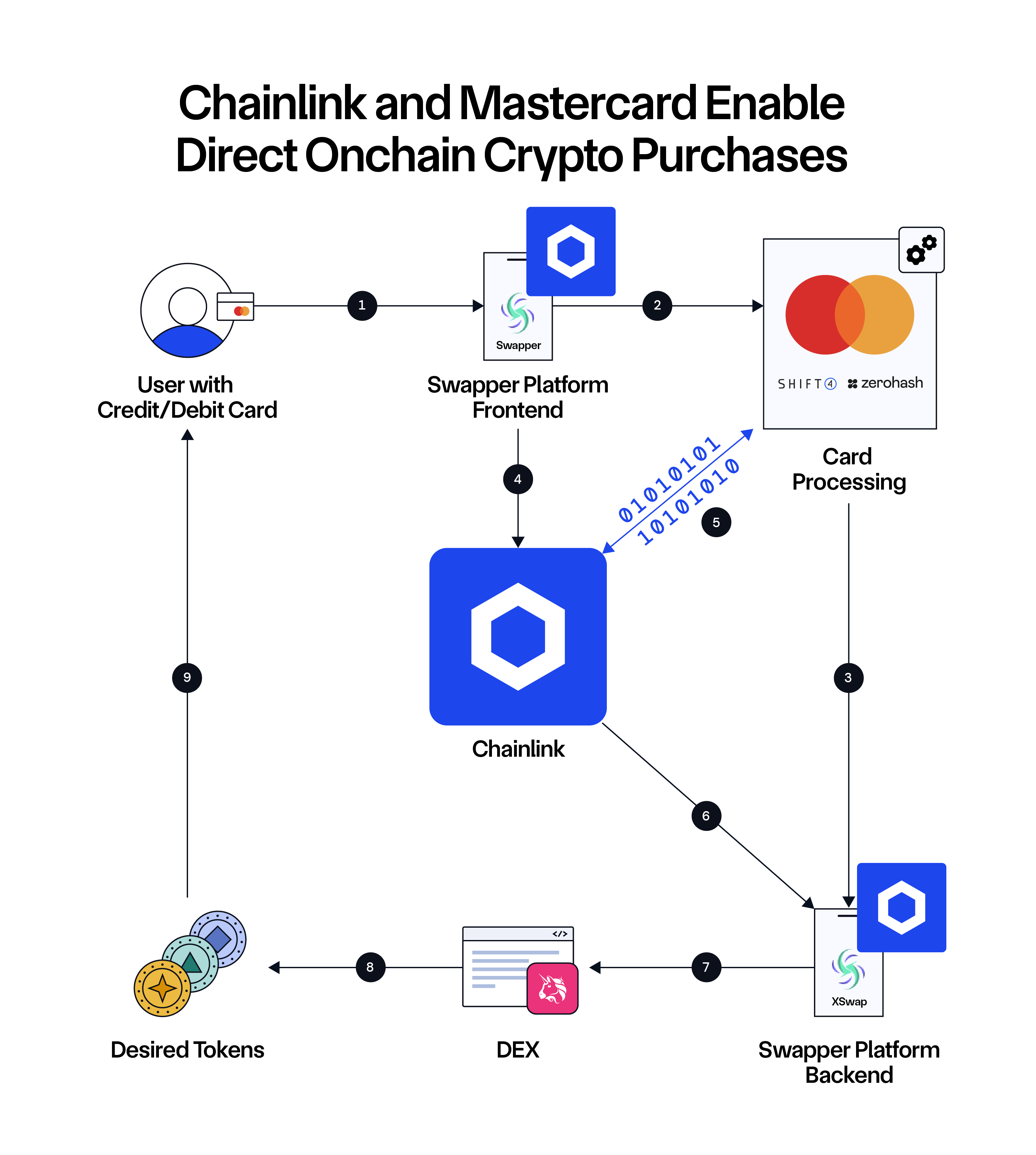

- Mastercard and Chainlink partnered to allow over 3 billion payment cardholders to purchase crypto assets directly onchain for the first time via the new Chainlink-powered Swapper app. Chainlink verifies and synchronizes key transaction details to enable Mastercard holders to access crypto directly onchain.

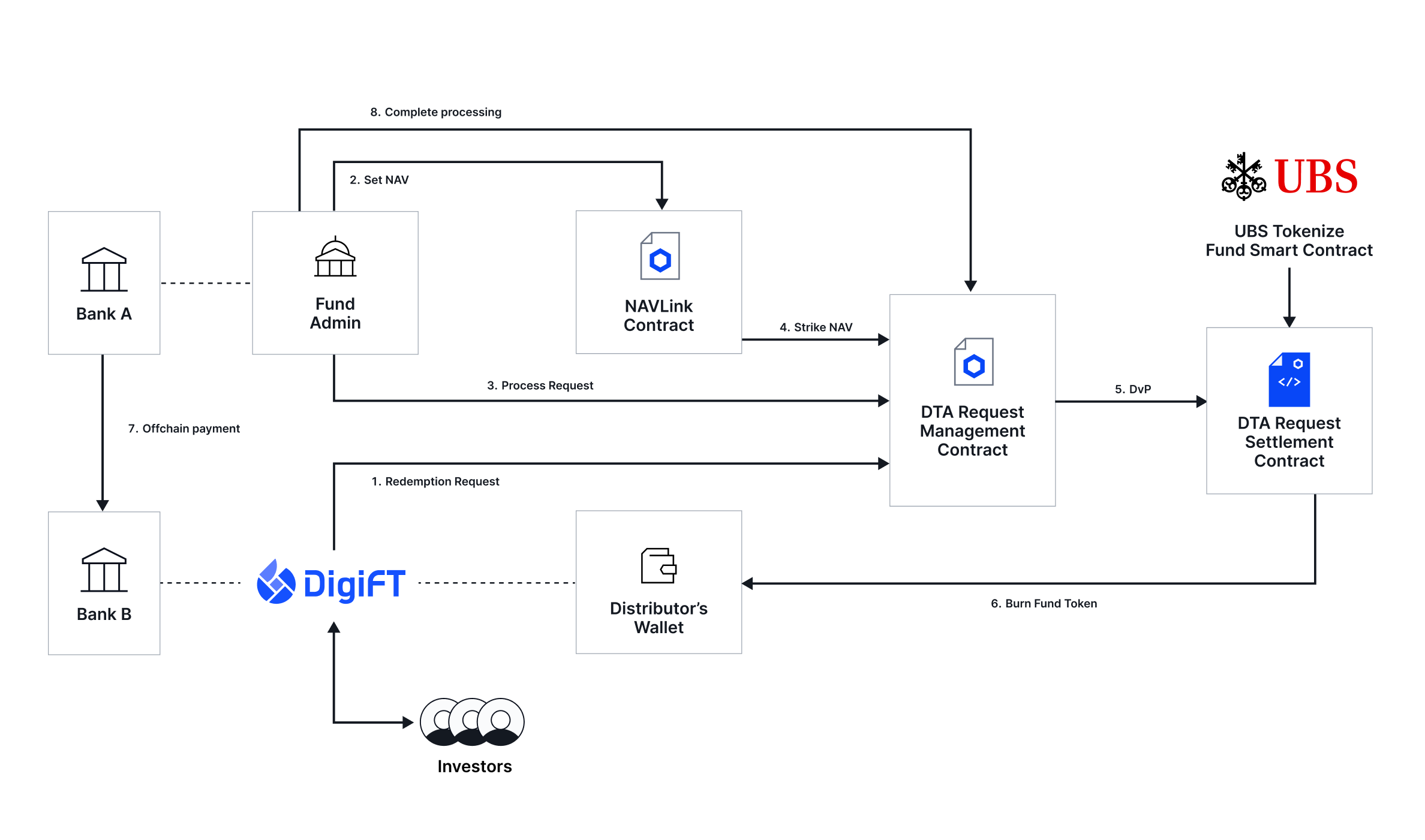

- UBS completed the world’s first in-production, end-to-end tokenized fund workflow leveraging the Chainlink Digital Transfer Agent (DTA) technical standard. In the live transaction, DigiFT functioned as the onchain fund distributor and leveraged the Chainlink DTA technical standard to successfully request and process a subscription and redemption order of the UBS USD Money Market Investment Fund Token (“uMINT”) on Ethereum.

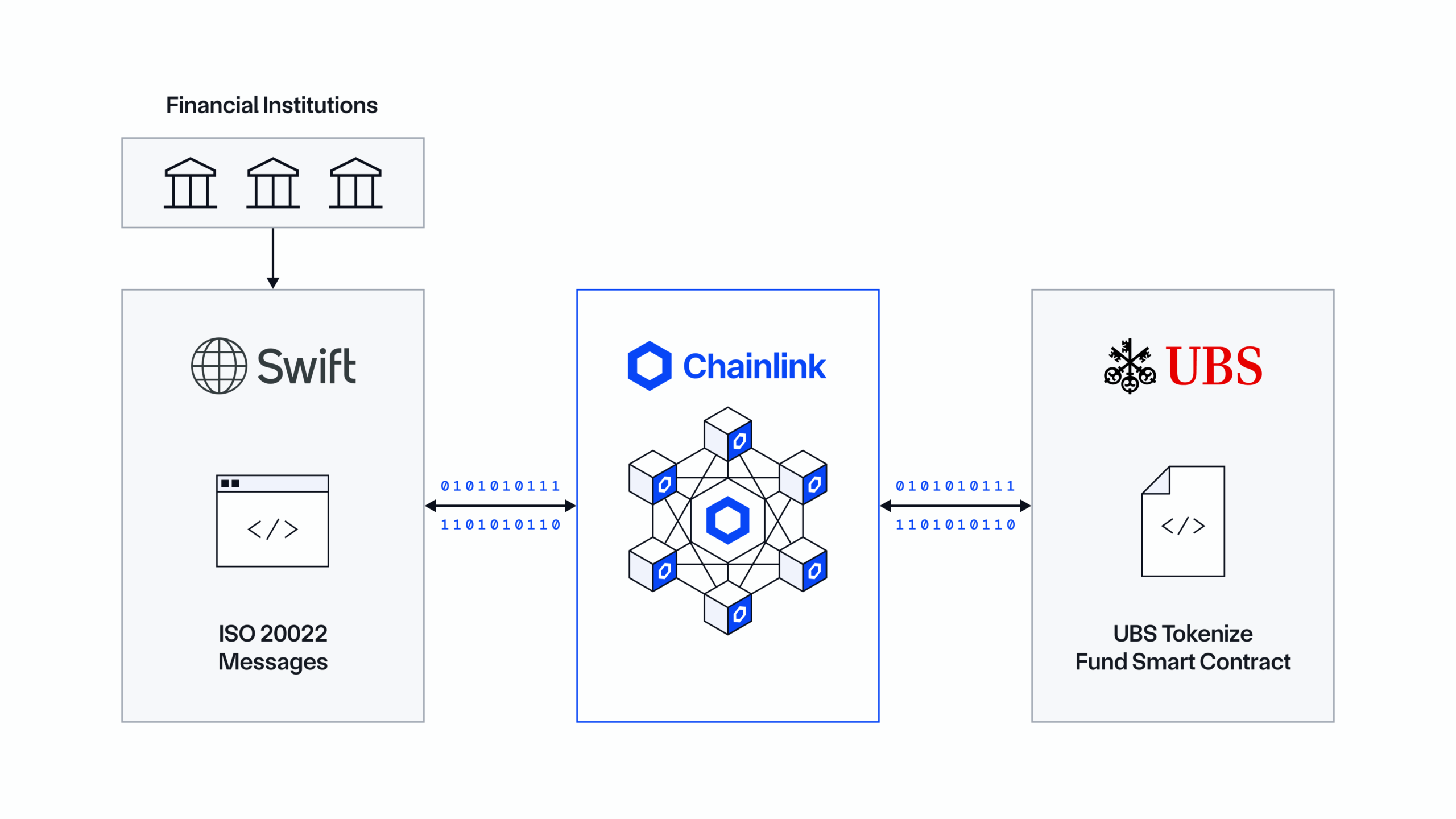

- Chainlink advanced tokenized workflows through a landmark technical solution enabling financial institutions worldwide to manage digital asset workflows directly from their existing systems using Swift messaging and the Chainlink Runtime Environment, in collaboration with UBS.

- Chainlink, Swift, DTCC, and Euroclear, together with 24 of the world’s largest financial market infrastructures and institutions, created a new, unified infrastructure for streamlining corporate actions processing. The initiative successfully demonstrated how the Chainlink platform, blockchains, and AI help solve one of finance’s most complex data challenges in a production-grade solution with unparalleled data accuracy, ISO 20022 messaging functionality via Swift, connectivity across DTCC AppChain as well as additional public and private blockchains, and more.

- Kinexys by J.P. Morgan, Ondo Finance, and Chainlink completed a cross-chain Delivery versus Payment (DvP) transaction that combined a permissioned interbank payment network, a public blockchain, and a tokenized U.S. Treasuries Fund using Chainlink’s cross-chain orchestration infrastructure. The successful settlement of Ondo Finance’s Tokenized Fund (OUSG) with J.P. Morgan’s permissioned Kinexys Digital Payments network on the Ondo Chain network was facilitated using Chainlink as the secure cross-chain orchestration layer.

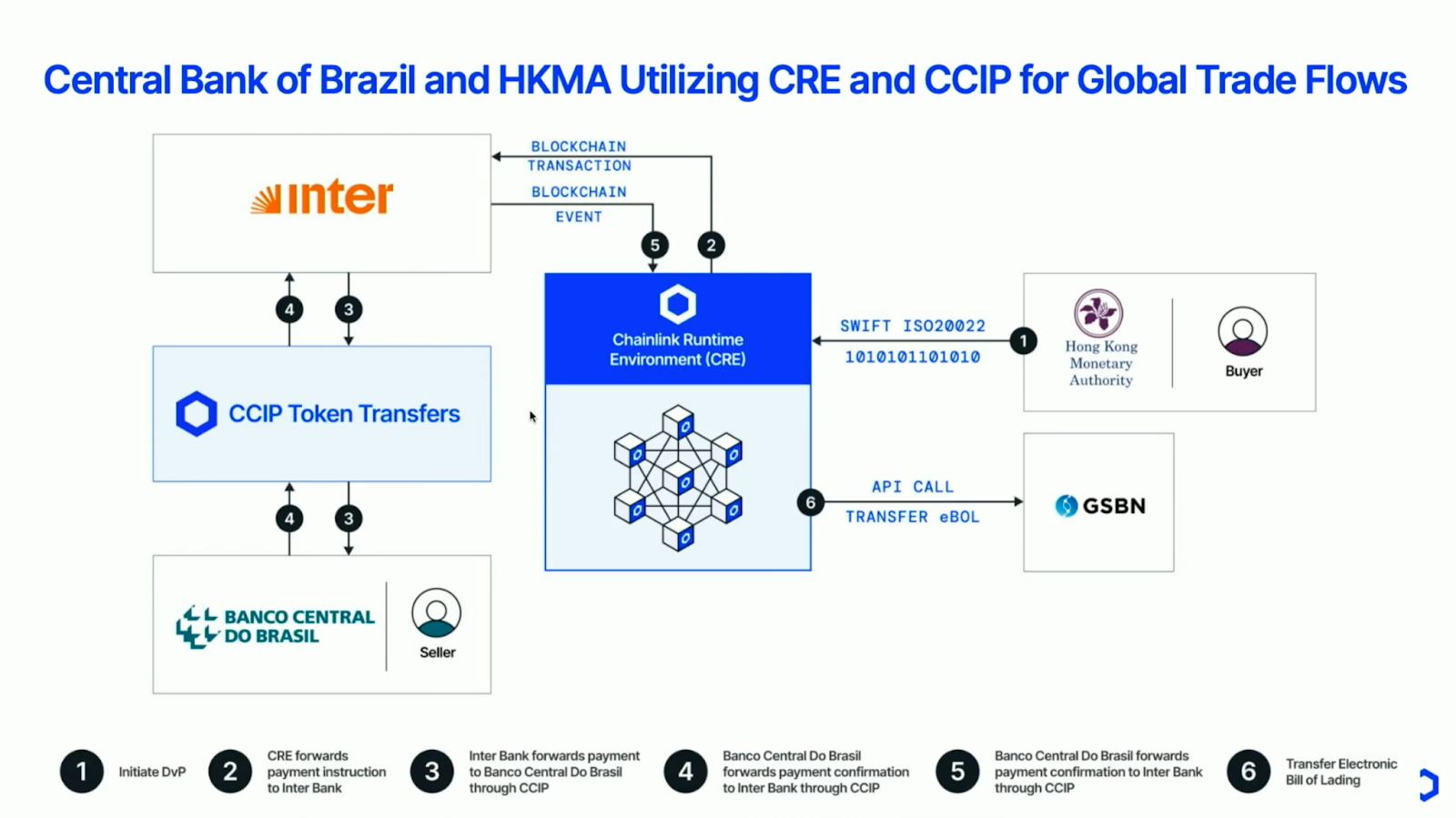

- The Central Bank of Brazil and Hong Kong Monetary Authority alongside Banco Inter, Standard Chartered, GSBN, and 7COMm partnered with Chainlink in the Drex program to power the first cross-border, cross-chain trade Experiment between BCB and HKMA. Powered end-to-end by Chainlink, the DvP model automatically escrows and releases funds while transferring the eBL, removing the need for manual coordination between banks, platforms, and shipping parties.

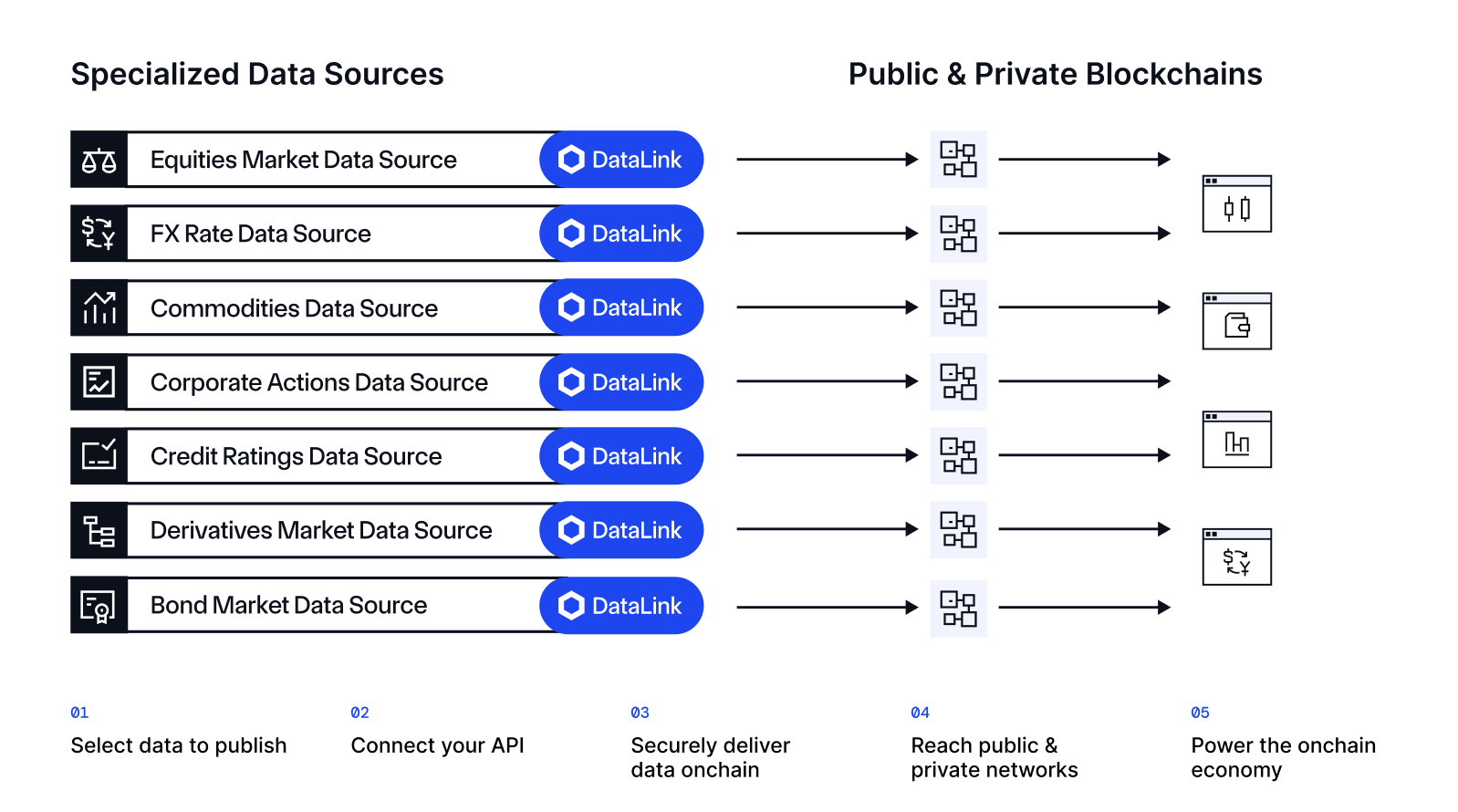

- S&P Global Ratings, the world’s leading provider of credit ratings, benchmarks, and analytics, partnered with Chainlink to publish S&P Global Ratings’ Stablecoin Stability Assessments (SSAs) onchain via DataLink. This initiative makes S&P Global Ratings’ deep, independent stablecoin risk analysis directly accessible within decentralized finance (DeFi) protocols and smart contracts for the first time.

- WisdomTree, a global asset manager with $130+ billion AUM, and Chainlink partnered to bring institutional-grade NAV data onchain to power subscriptions and redemptions for its CRDT tokenized fund on Ethereum. This initial collaboration begins with CRDT and is on track to expand to additional WisdomTree tokenized funds.

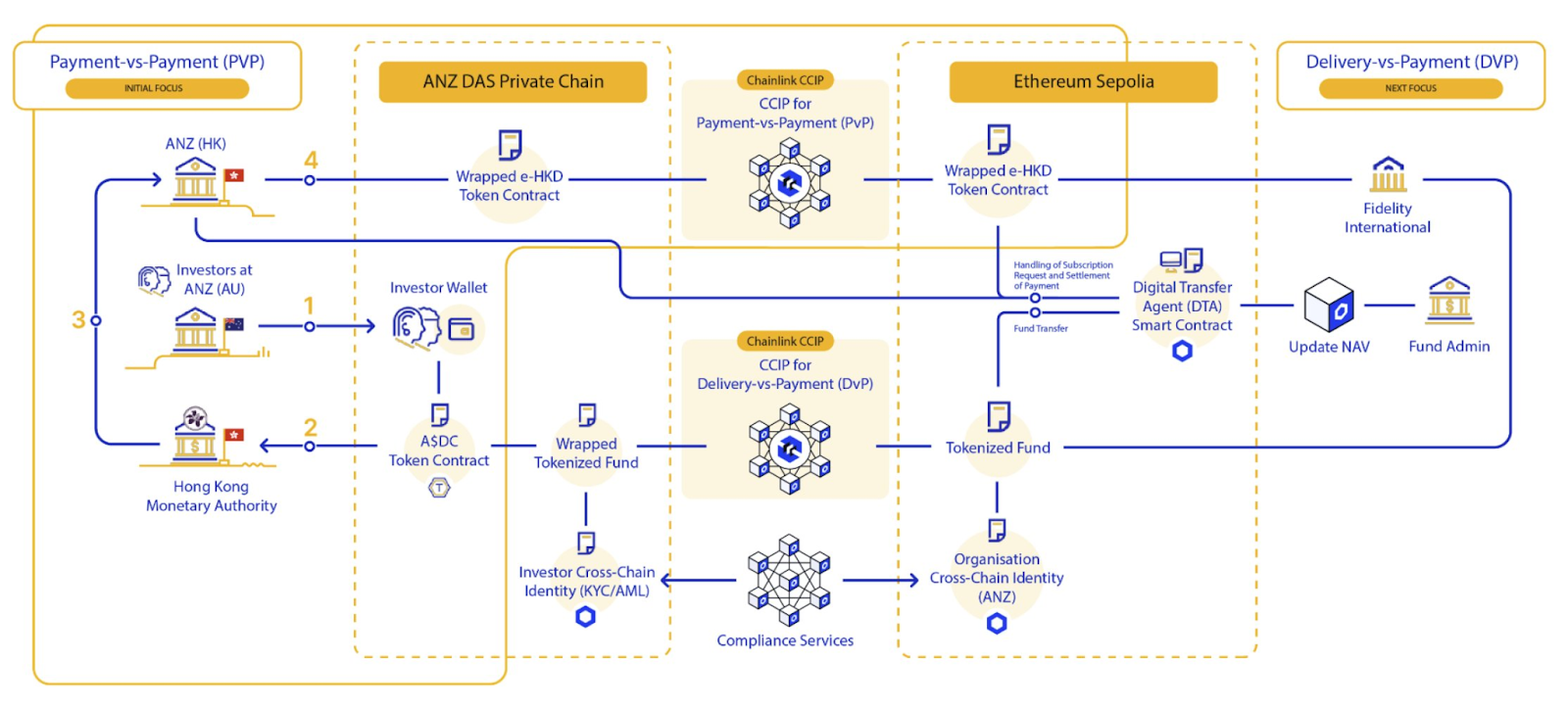

- A Visa report highlighted Chainlink’s work with ANZ Bank and Fidelity International under phase 2 of the Hong Kong Monetary Authority’s e-HKD program. The participants demonstrated a Payment-vs-Payment (PvP) settlement workflow involving an Australian Stablecoin on ANZ’s DAS Chain and a wrapped Hong Kong CBDC on Ethereum Sepolia—using Chainlink for cross-chain connectivity and compliance verification.

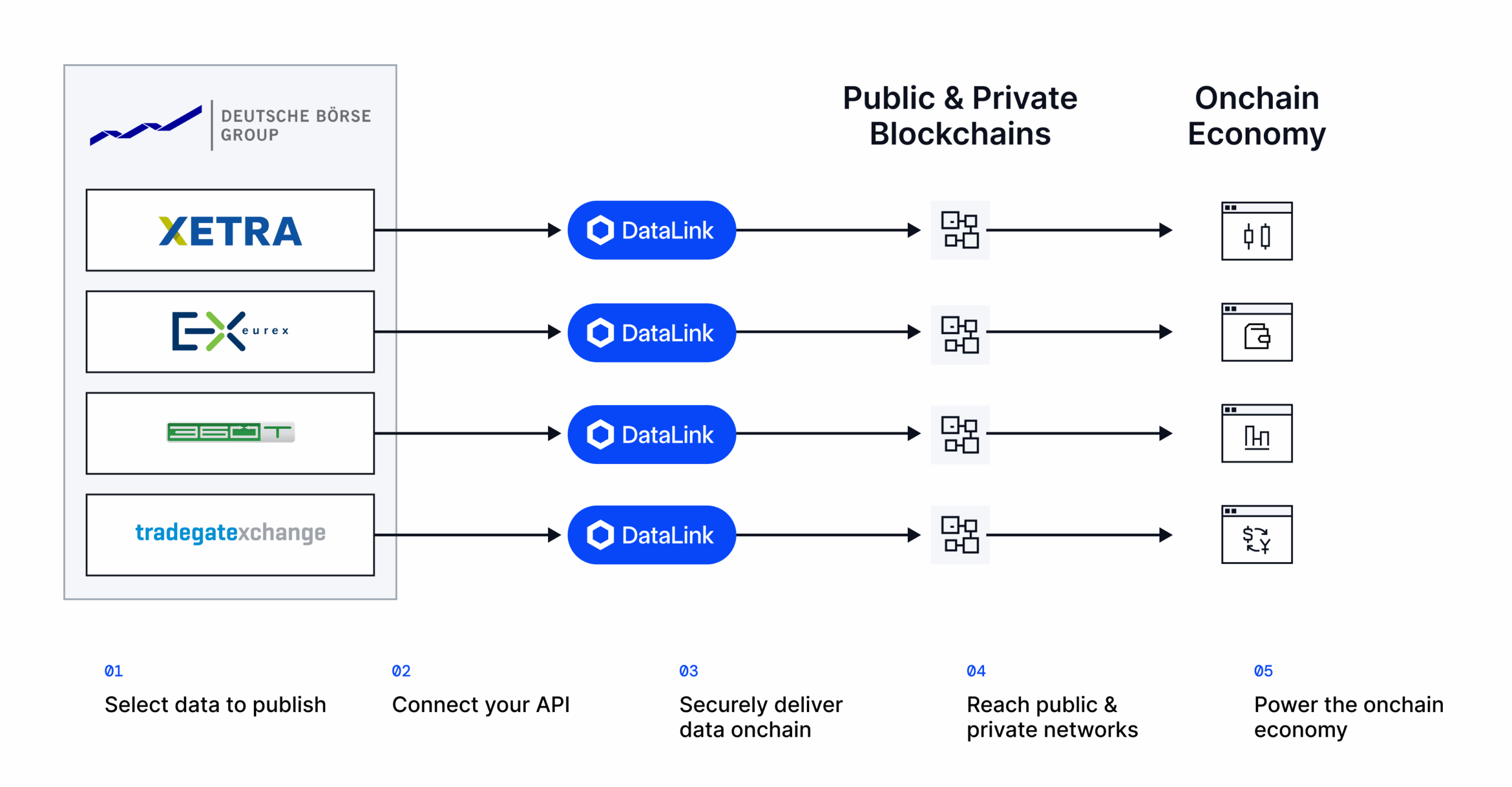

- Deutsche Börse Group’s Market Data + Services, a business unit of Deutsche Börse Group, formed a strategic partnership with Chainlink to bring its multi-asset class market data to blockchains for the first time. Real-time data from the largest derivatives exchange in Europe, Deutsche Börse Group’s Eurex, Xetra, 360T, and Tradegate trading venues covering equities, derivatives, forex instruments, and more are being made available across blockchains via DataLink.

- SBI Group (SBI), one of Japan’s largest financial conglomerates with over $200 billion in total assets, and Chainlink, announced a strategic partnership focused on accelerating blockchain and digital asset adoption across global markets. Furthermore, SBI Digital Markets, the digital asset arm of SBI Group, is adopting Chainlink as its exclusive infrastructure solution to power its digital assets platform.

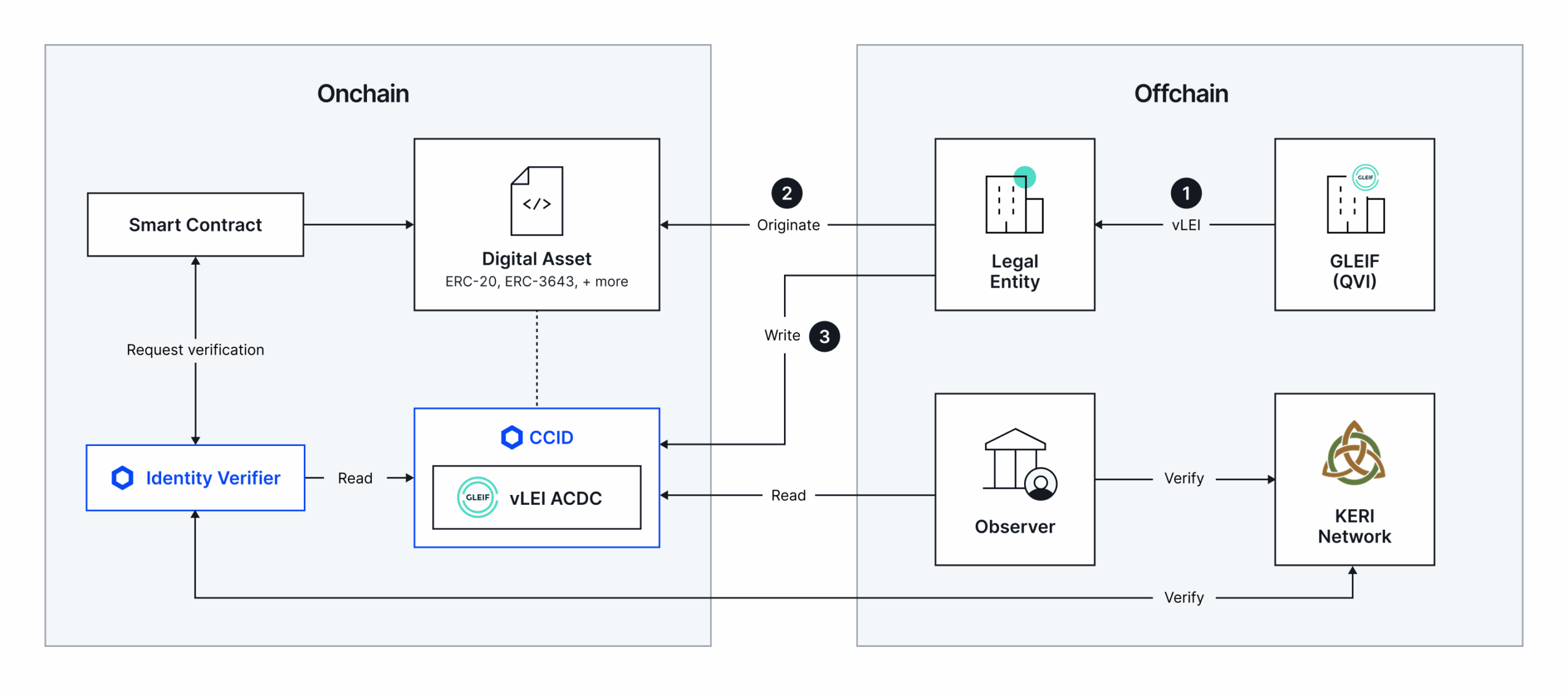

- Global Legal Entity Identifier Foundation (GLEIF) entered into a strategic partnership with Chainlink to establish a new institutional-grade identity solution for the blockchain industry.

- Apex Group and Chainlink successfully created an institutional-grade stablecoin infrastructure solution supporting the Bermuda Monetary Authority’s embedded supervision initiative.

- Intercontinental Exchange (ICE) and Chainlink are bringing high-quality forex and precious metals data onchain. FX and precious metals rates from ICE’s consolidated feed are now available to 2,000+ applications, leading banks, asset managers, and infrastructures in the Chainlink ecosystem.

- Westpac Institutional Bank and Imperium Markets are implementing Chainlink in Project Acacia, a new joint initiative between the Reserve Bank of Australia and Digital Finance CRC (DFCRC). The Chainlink Runtime Environment is orchestrating secure, seamless, and compliant Delivery vs. Payment settlement of tokenized assets across blockchain markets and the existing PayTo Australia domestic payments system.

- FTSE Russell is collaborating with Chainlink to publish global indices onchain for the first time via DataLink, including data for the Russell 1000, Russell 2000, Russell 3000, and FTSE 100 Indexes; WMR FX benchmarks; FTSE DAR Digital Asset Prices; and FTSE Digital Asset Indices.

- Tradeweb is publishing its FTSE U.S. Treasury Benchmark Closing Prices onchain for the first time using DataLink, bringing real-world financial data from one of the world’s largest electronic marketplaces into the onchain economy.

DeFi & Tokenization

DeFi protocols and tokenization platforms adopted Chainlink at scale in 2025 to enable institutional-grade onchain assets and applications.

- Coinbase selected CCIP as its exclusive bridge infrastructure for all Coinbase Wrapped Assets, including cbBTC, cbETH, cbDOGE, cbLTC, cbADA, and cbXRP, which have an aggregate market cap of approximately $7 billion as of December 2025.

- Base, the leading L2 blockchain ecosystem incubated by Coinbase, integrated CCIP to secure the Base-Solana Bridge alongside Coinbase, unlocking native Solana asset support on Base and unified liquidity between both ecosystems.

- Solana support was added to CCIP, the first non-EVM chain to feature CCIP’s v1.6 upgrade. The integration unlocked access to $19B+ of assets through projects leveraging the CCT standard, such as ElizaOS, The Graph, Maple Finance, Pepe, Zeus Network, and more.

- Lido, the leading liquid staking protocol and one of the largest DeFi protocols with $33+ billion TVL, upgraded to CCIP as the official cross-chain infrastructure for wstETH across all chains.

- Aave Horizon, the institutional lending and borrowing market for tokenized assets from Aave, adopted Chainlink’s Automated Compliance Engine (ACE) to support secure and compliant-focused tokenized asset markets. Horizon’s oracle infrastructure is secured by Chainlink’s NAVLink and Llamaguard NAV, delivering risk-adjusted NAV data for tokenized assets, including Securitize-managed tokenized funds like VBILL.

- Ondo, a leader in tokenized real-world assets, selected Chainlink as the official oracle infrastructure powering data for its regulated tokenized stocks platform and establishing CCIP as the preferred interoperability solution for financial institutions collaborating with Ondo.

- xStocks, a leading tokenized equities platform, adopted Chainlink as the official oracle infrastructure powering the pricing of all of xStocks’ tokenized equities and ETFs, including 50+ of the world’s largest equities and ETFs. xStocks also adopted CCIP to power xBridge, the cross-chain bridge that enables tokenized equities to be transferred between Solana, Ethereum, and more.

- Spiko, a regulated tokenization platform with $500+ million in tokenized money market funds, adopted CCIP to enable its funds to be securely transferred across chains while remaining compliant with regulatory requirements.

- Maple Finance, an onchain asset manager with $4+ billion AUM, upgraded syrupUSDC to the Cross-Chain Token (CCT) standard, making it natively transferable across chains via CCIP. Powered by Chainlink, Maple’s cross-chain deposits have surpassed $3 billion.

- Chainalysis, a leading onchain intelligence and compliance platform, entered into a strategic partnership with Chainlink to power advanced cross-chain compliance workflows using Chainlink ACE.

- Lighter, a leading perp DEX and Ethereum-based zk rollup, adopted Chainlink Data Streams as its official oracle solution powering its RWA markets, including equity perp markets.

Product Launches & Innovations

Chainlink introduced major new platform capabilities in 2025 that significantly expanded what developers and institutions can build onchain.

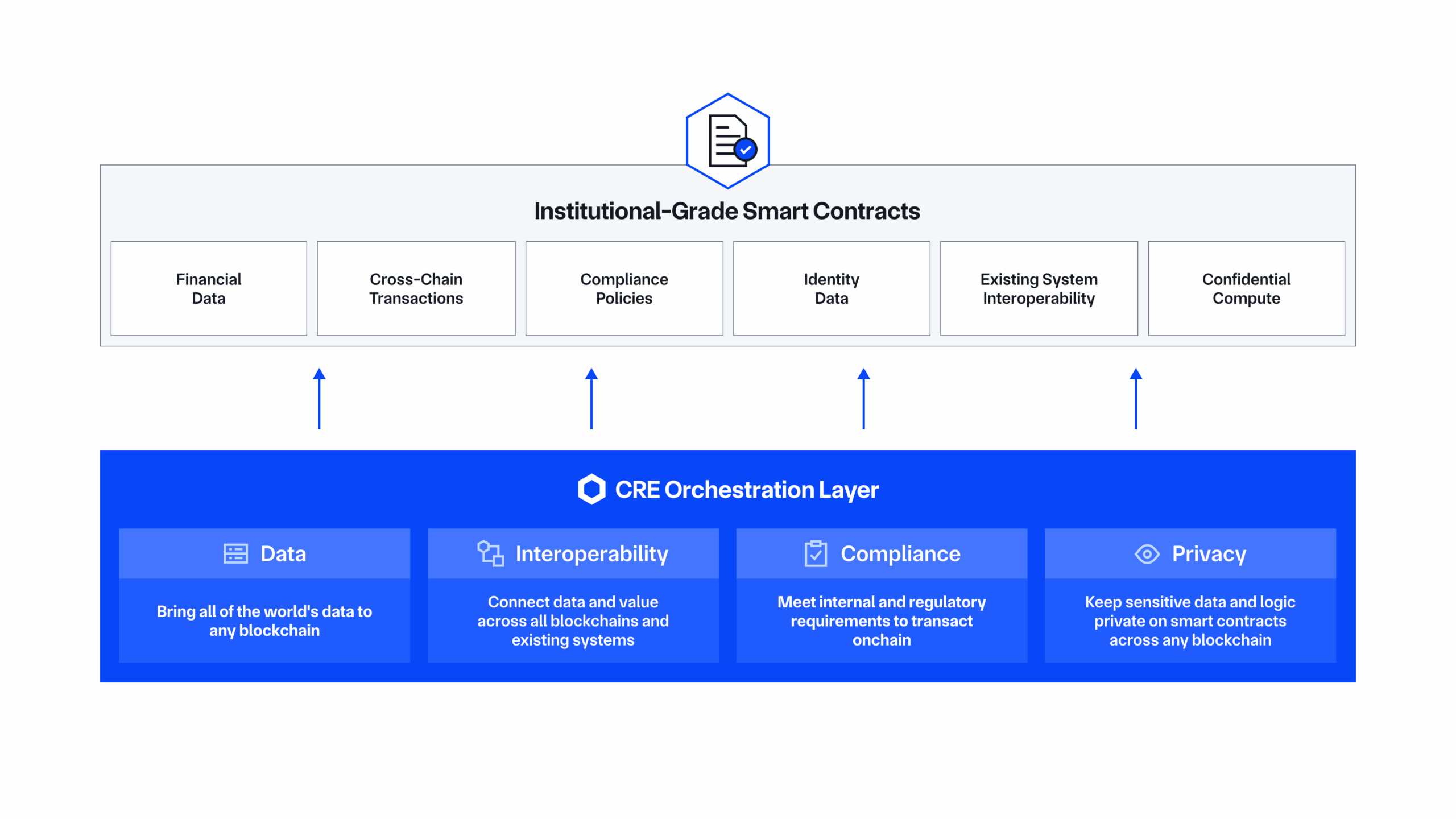

- Chainlink Runtime Environment (CRE) is now live—the all-in-one orchestration layer powering the next massive leap in the adoption of onchain finance. If you’re a developer, you can start building on CRE today. If you’re an institution ready to deploy, reach out to us.

- Launched the Chainlink Automated Compliance Engine—a unified and modular standard to solve all onchain compliance problems and bring institutional capital onchain. We also launched the ACE partner ecosystem, featuring 20+ leading compliance providers, frameworks, and regulators.

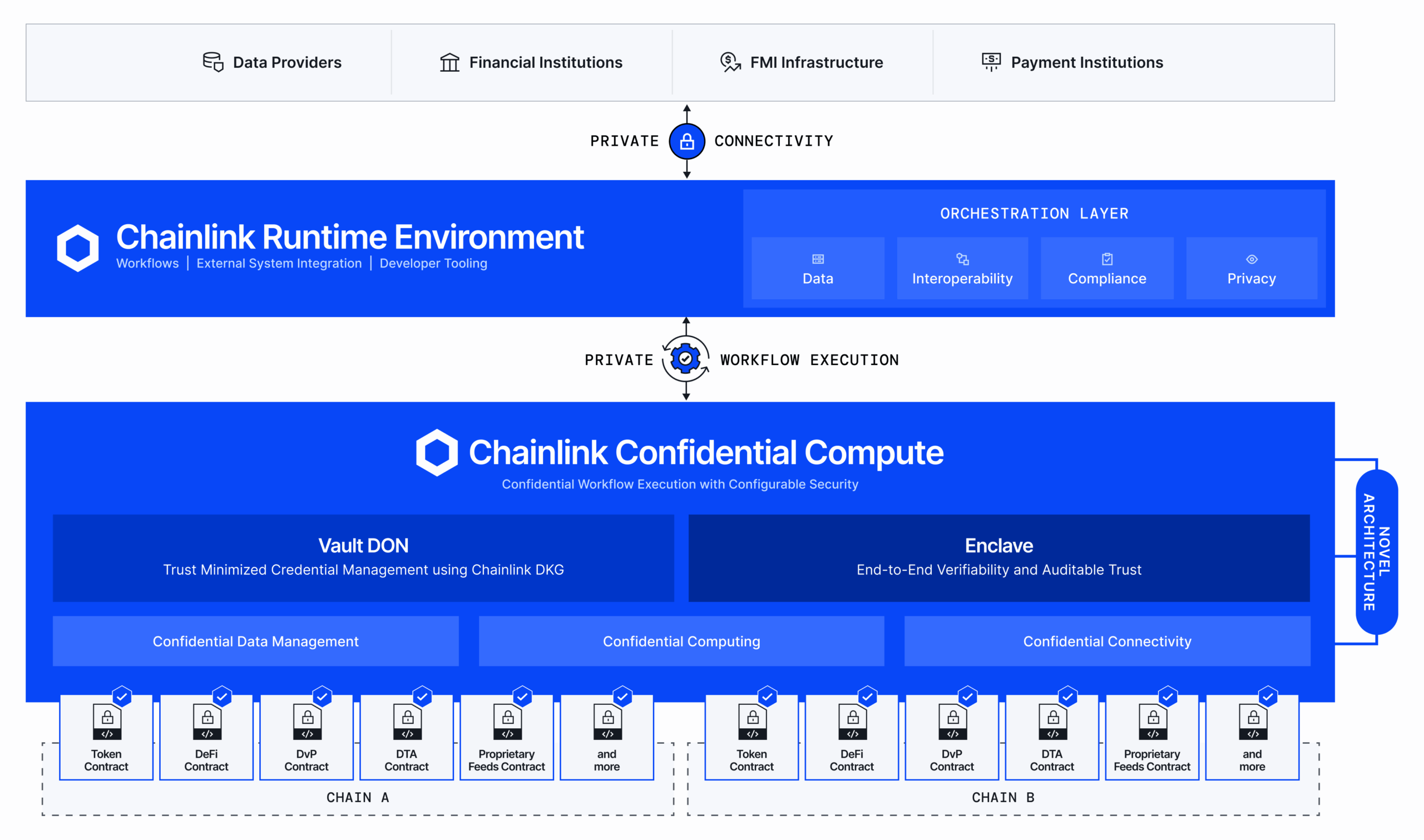

- Chainlink Confidential Compute, a breakthrough service that unlocks private smart contracts on any blockchain, was announced at SmartCon. Read the whitepaper to learn more and sign up for early access today.

- Launched the Chainlink Digital Transfer Agent (DTA) technical standard—a set of technical standards that define how transfer agents and fund administrators can expand their operations onchain while remaining aligned with existing regulatory frameworks. UBS uMINT, UBS Asset Management’s tokenized money market investment fund, is the first smart contract to begin adopting the DTA technical standard.

- DataLink was launched—the institutional-grade data publishing service powered by Chainlink, with initial users including Deutsche Börse Market Data + Services, Tradeweb, S&P Dow Jones Indices & Dinari, and FTSE Russell.

- The CCIP v1.6 upgrade launched on mainnet, introducing support for non-EVM blockchains, starting with Solana mainnet.

- Launched Data Streams for U.S. equities and ETFs. With this update, Data Streams is delivering robust pricing for major U.S. equities and ETFs, including SPY, CRCL, QQQ, NVDA, AAPL, MSFT, and more.

- Launched Smart Value Recapture (SVR) on Ethereum mainnet, which featured Aave as the first user. SVR is a novel oracle solution that enables DeFi apps to recapture the non-toxic MEV derived from their use of Chainlink Price Feeds.

- Chainlink has been selected as the winner of the Swift Hackathon 2025 Business Challenge.

Economics

2025 brought major advancements in strengthening network sustainability and enhancing user participation.

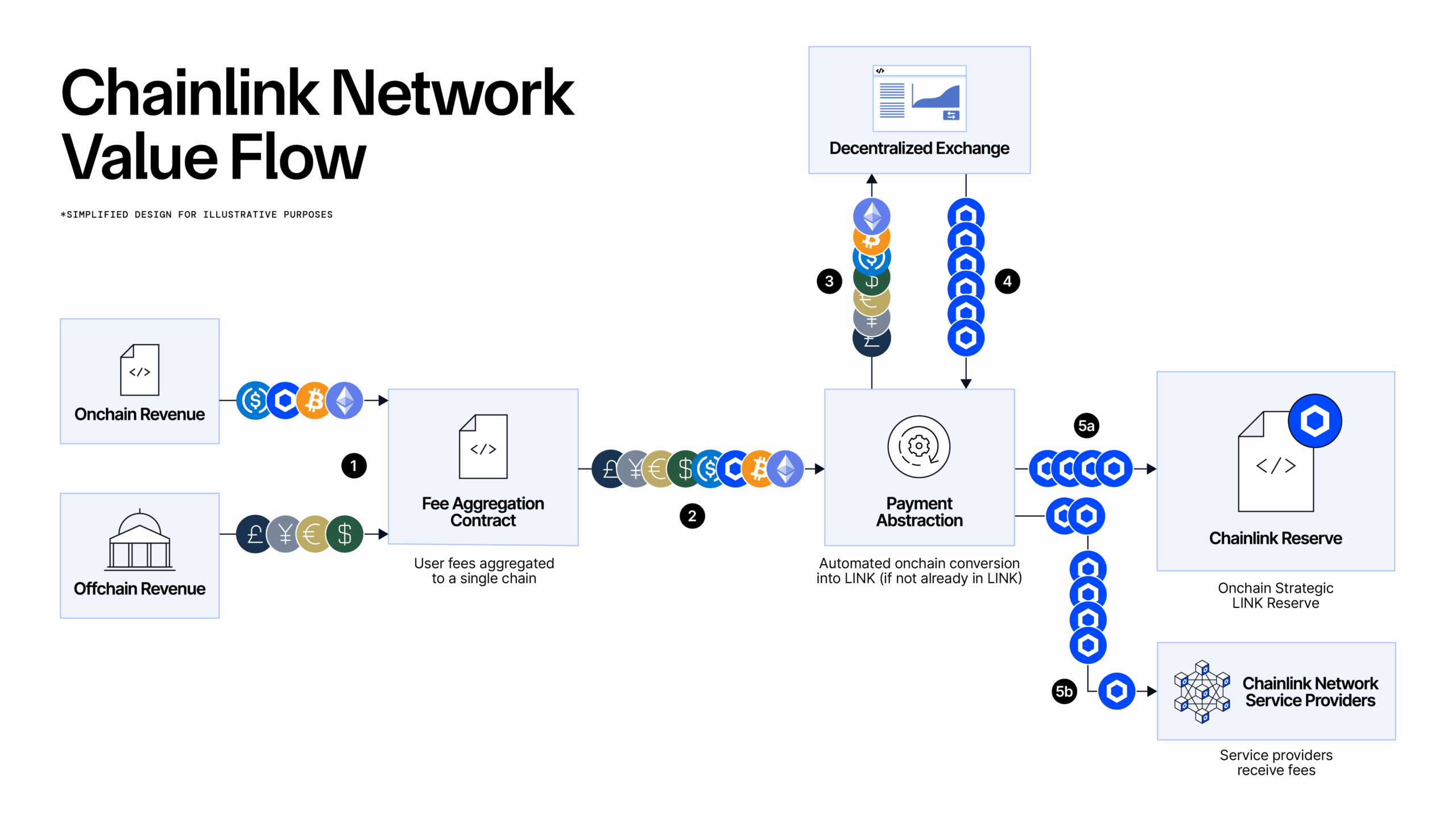

- Launched the Chainlink Reserve, a strategic onchain reserve of LINK tokens designed to support the long-term growth and sustainability of the Chainlink Network. The Reserve accumulates LINK tokens by using Payment Abstraction to convert offchain revenue from large enterprises adopting the Chainlink standard and onchain fees from service usage into LINK.

- Payment Abstraction went live on mainnet, enabling user fees to be converted into LINK. Payment Abstraction reduces payment friction by enabling users to pay for Chainlink services in their preferred form of payment (e.g., gas tokens and stablecoins), which are programmatically converted into LINK using a decentralized exchange.

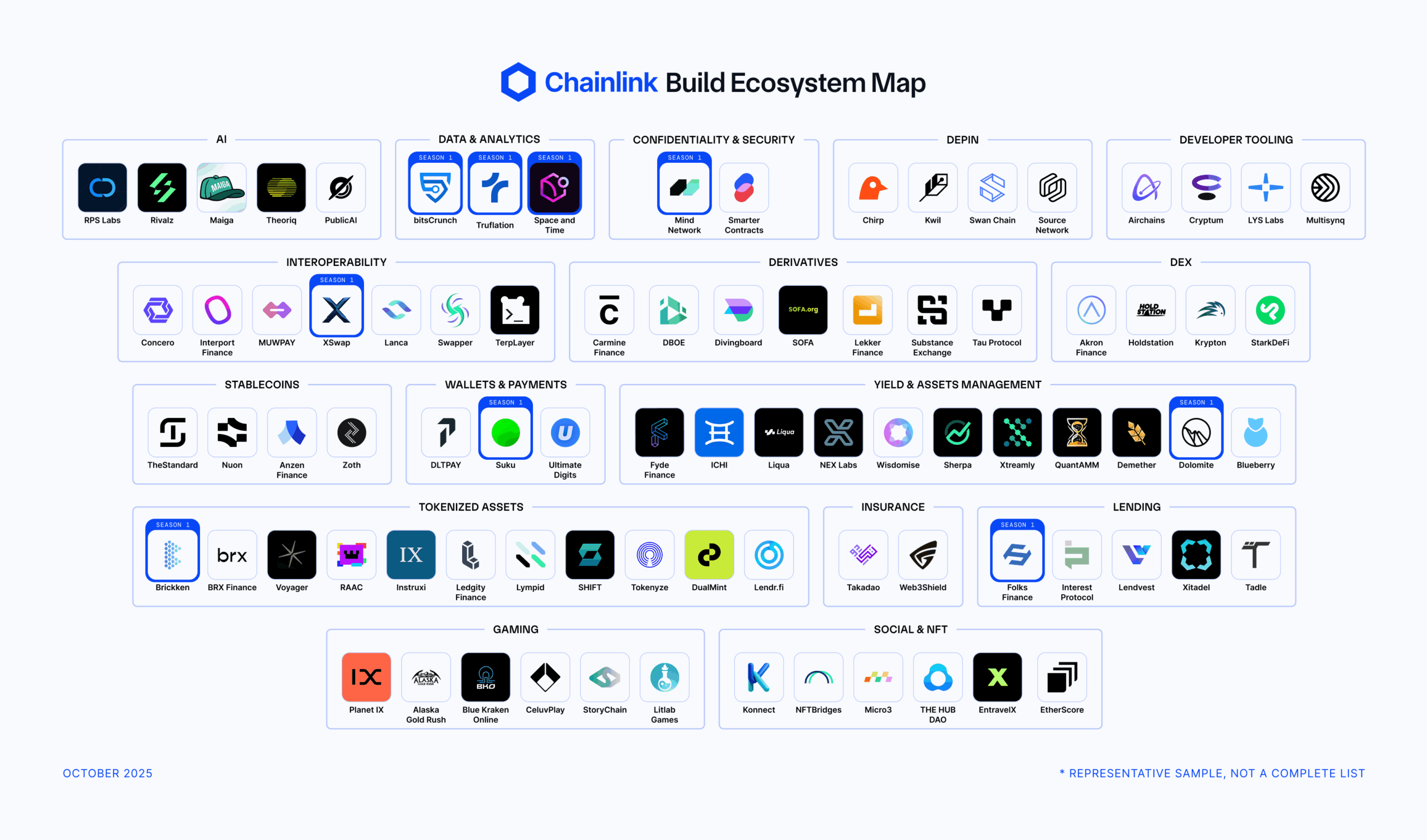

- Introduced Chainlink Rewards, a new community engagement and rewards program designed to incentivize active participation in the Chainlink Network. The program enables Chainlink Build projects to make their native tokens claimable by Chainlink ecosystem participants, including eligible LINK Stakers. Season Genesis launched in collaboration with Space and Time, while the follow-up Season 1 featured nine Build projects and introduced a more advanced engagement and claiming mechanism.

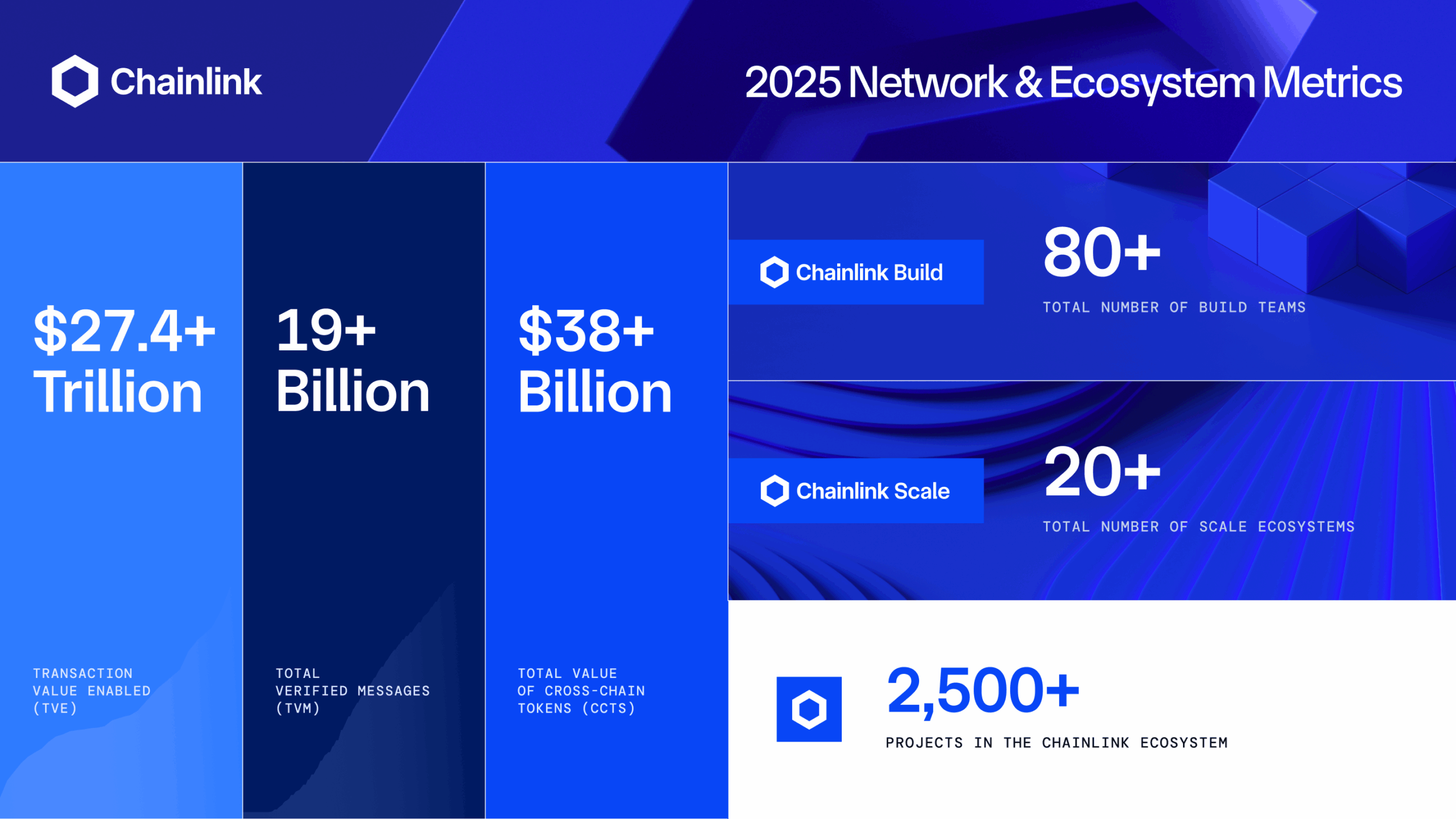

Network & Ecosystem Metrics

Chainlink’s 2025 metrics highlight record adoption and sustained growth across the global onchain finance ecosystem.

Continuing To Win in 2026

2025 was a defining year for Chainlink, with governments, financial institutions, and market infrastructures adopting it as the standard platform for bringing capital markets onchain. 2026 is set to be the year that tokenization adoption accelerates at scale, further cementing Chainlink as the core infrastructure powering the global shift to onchain finance.

Learn more about the next era of Chainlink: chain.link/everything