5 Ways Chainlink Supercharges Growth for Stablecoin Issuers

Stablecoins are becoming a key foundation of onchain finance. By combining the relative stability of major fiat currencies with the programmability of blockchains, stablecoins enable global 24/7 transferability, composability with tokenized assets, and other entirely new financial use cases. Today, stablecoins move hundreds of billions of dollars in daily volume and represent one of the first use cases spanning traditional and onchain finance.

While stablecoins unlock major opportunities, they also introduce serious challenges for issuers responsible for securing large amounts of value. To gain increased adoption, a stablecoin must be backed by secure, battle-tested infrastructure that can prove its asset reserves in real time, adhere to compliance requirements in the jurisdictions where it operates, and interoperate with both traditional financial market infrastructure and the many public and private blockchains in use today.

Chainlink is the only all-in-one oracle platform capable of solving these challenges for issuers and powering the entire lifecycle of a stablecoin. Already trusted by leading banks, asset managers, and financial market infrastructures, Chainlink actively secures over 70% of DeFi and has enabled more than $28 trillion in onchain transaction value. By solving core infrastructure challenges, the Chainlink platform enables stablecoin issuers to unlock critical capabilities:

- Real-time data and verified reserves

- Built-in privacy and programmable compliance

- Cross-chain liquidity without fragmentation

- Customizable workflows managed from existing systems

- Access to global distribution channels

Below we explore how Chainlink enables each of these capabilities to help stablecoin issuers achieve scale, security, and institutional adoption.

1. Real-Time Data and Verified Reserves

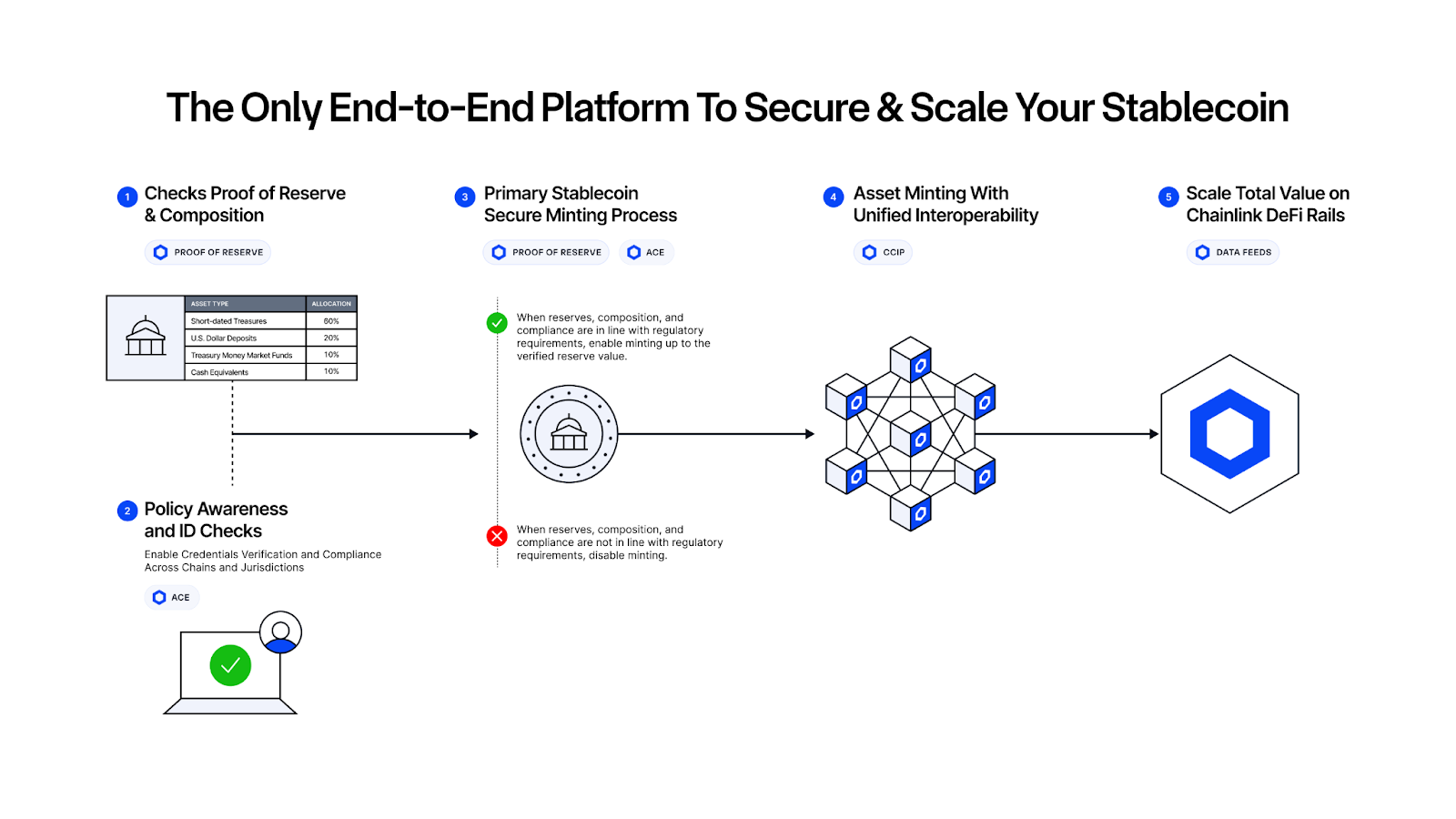

Manual attestations and delayed audits no longer meet institutional standards for transparency or timeliness. Chainlink Proof of Reserve addresses this by providing automated, onchain verification of a stablecoin’s underlying collateral in near real time.

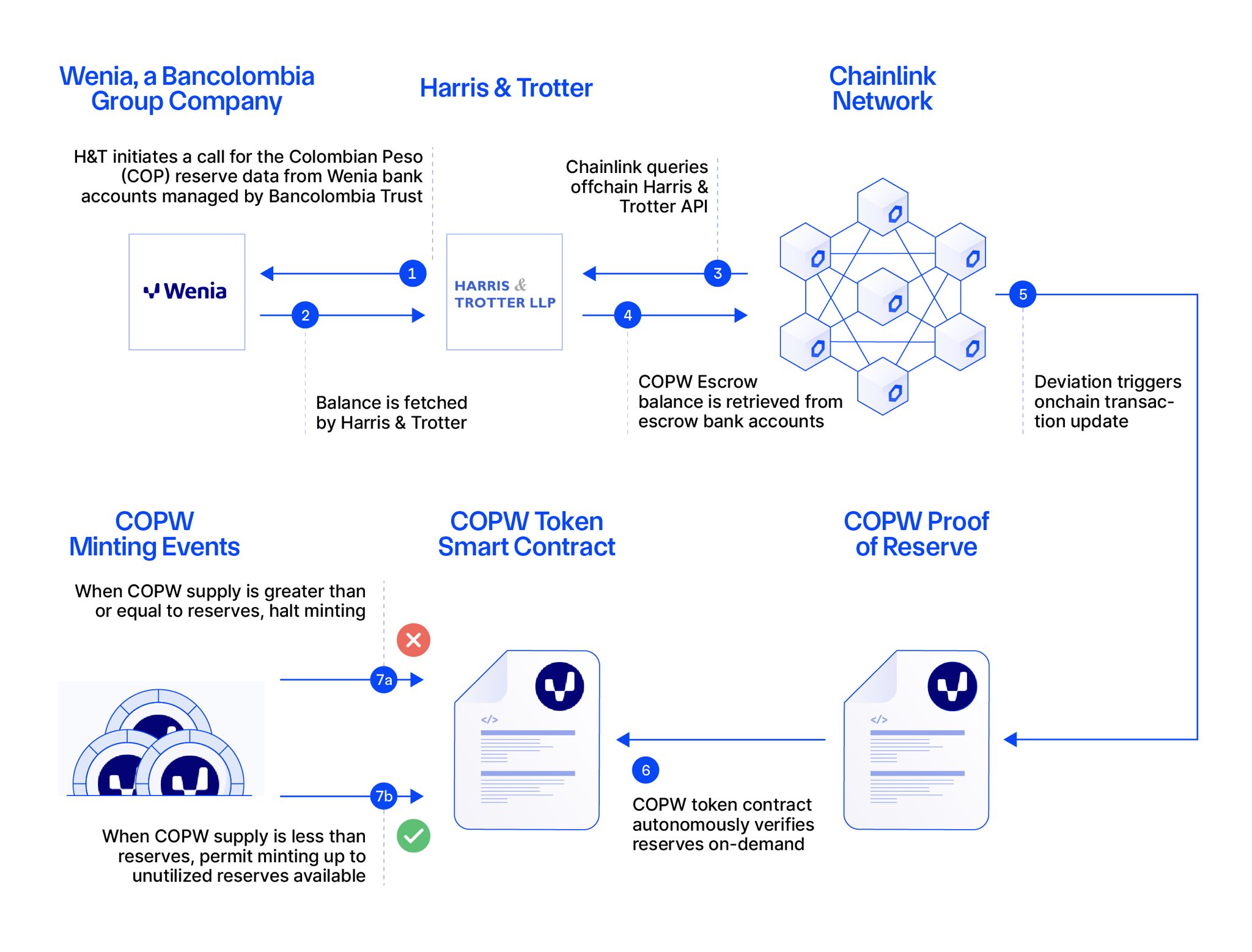

Using decentralized oracle networks, Proof of Reserve continuously monitors on- and offchain assets, publishing cryptographic proofs to blockchains whenever reserve balances change. This eliminates reliance on manual attestations and ensures that a stablecoin’s collateralization ratio is always visible to regulators, exchanges, and end users.

Proof of Reserve also verifies and publicly reports the aggregated total of distributed holdings without revealing individual wallet addresses, enabling issuers to maintain both transparency and privacy. Even if funds are moved for key rotation or other operational purposes, Proof of Reserve helps ensure that reserves remain continuously verifiable.

Issuers can also connect Proof of Reserve data directly to their minting and redemption logic with Secure Mint, establishing automated guardrails around token supply. When reserve assets are verified as deposited, Secure Mint can automatically authorize minting operations; when collateral is withdrawn or redeemed, the same workflows can initiate token burns, all without manual intervention.

This automated control framework eliminates human and procedural errors that, in recent years, have led to catastrophic over-minting events. By tying issuance directly to verified collateral, Secure Mint ensures that the onchain supply of a stablecoin always matches its underlying reserves.

Wenia—the digital asset company from the Bancolombia Group, one of the largest financial conglomerates in Latin America, uses Proof of Reserve to deliver continuous, automated verification of its fiat reserves. In addition, OpenEden has integrated Proof of Reserve to provide independent, onchain verification of USDO’s backing by tokenized U.S. Treasuries

Chainlink Price Feeds, SmartData, and DataLink deliver secure, high-frequency, institutional-grade data directly onchain, which, together with Proof of Reserve, provide the full spectrum of data infrastructure required to scale any stablecoin or tokenized asset. This infrastructure is already in use across both institutions and DeFi protocols.

S&P Global Ratings is bringing its Stablecoin Stability Assessments (SSAs) onchain via DataLink, enabling real-time, independently verified risk evaluations to be embedded directly into DeFi protocols and institutional risk frameworks. Mento, a decentralized FX infrastructure processing ~$20B in annualized volume and supporting 15+ stablecoins used by 7M+ people for remittances, adopted Price Feeds to ensure each asset is backed by real-time, verifiable data.

2. Built-in Privacy and Programmable Compliance

As stablecoins become embedded in regulated financial systems, compliance can no longer exist as an external process; it must operate natively within the token’s infrastructure.

Chainlink’s Automated Compliance Engine (ACE) makes this possible by embedding compliance logic directly into the smart contract layer. ACE enables issuers to codify and programmatically enforce compliance rules, from jurisdictional restrictions to KYC/AML requirements and counterparty eligibility, directly within onchain workflows. Each transaction can be automatically approved, flagged, or blocked based on pre-defined regulatory conditions.

Complementing ACE, Chainlink Confidential Compute protects sensitive information such as identity credentials and transaction logic while still enabling verifiable, privacy-preserving computation. This allows critical workflows like whitelist management, sanctions screening, or creditworthiness validation to execute securely without exposing private data onchain.

Together, these capabilities allow issuers to maintain regulatory alignment, data privacy, and operational efficiency simultaneously.

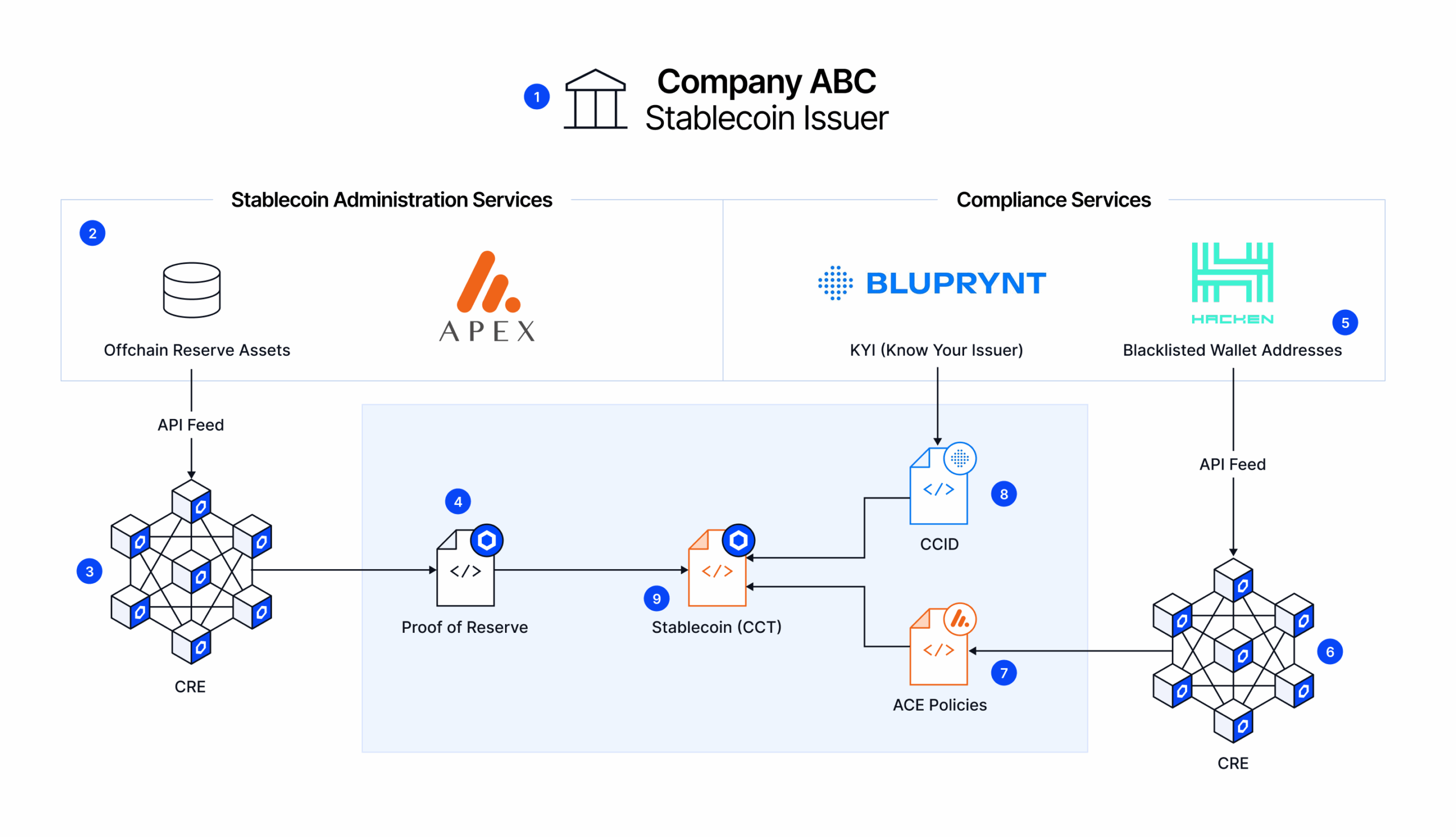

Chainlink and Apex Group have partnered and successfully created a solution for regulatory-grade stablecoin infrastructure with the Bermuda Monetary Authority. The solution comprises several features, each fulfilling a critical role in enabling compliant, secure stablecoin operations:

- Posting real-time reserve data onchain via Chainlink Proof of Reserve, providing continuous visibility into the stablecoin’s underlying collateral.

- Securing minting via Secure Mint helps ensure that the circulating supply will not exceed reserves to prevent unauthorized issuance.

- Using the Automated Compliance Engine (ACE) to programmatically enforce Bermuda-specific regulatory and operational policies directly onchain.

- Enabling seamless cross-chain interoperability with zero-slippage transfers through the Cross-Chain Token (CCT) standard.

- Relaying data onchain from Apex Group that provides stablecoin asset servicing, including custody of underlying assets, reserve management, and tokenization powered by Tokeny.

- Hacken Extractor provides onchain visibility and intelligence through real-time security and compliance dashboards, alerting on stablecoin risks, sanctioned wallet activity, and suspicious onchain anomalies.

- Linking verified entities to their mint authority wallets through Bluprynt’s Know Your Issuer (KYI) identity solution and Policy Protocol for embedding compliance controls and enabling transparent asset issuance.

3. Cross-Chain Liquidity Without Fragmentation

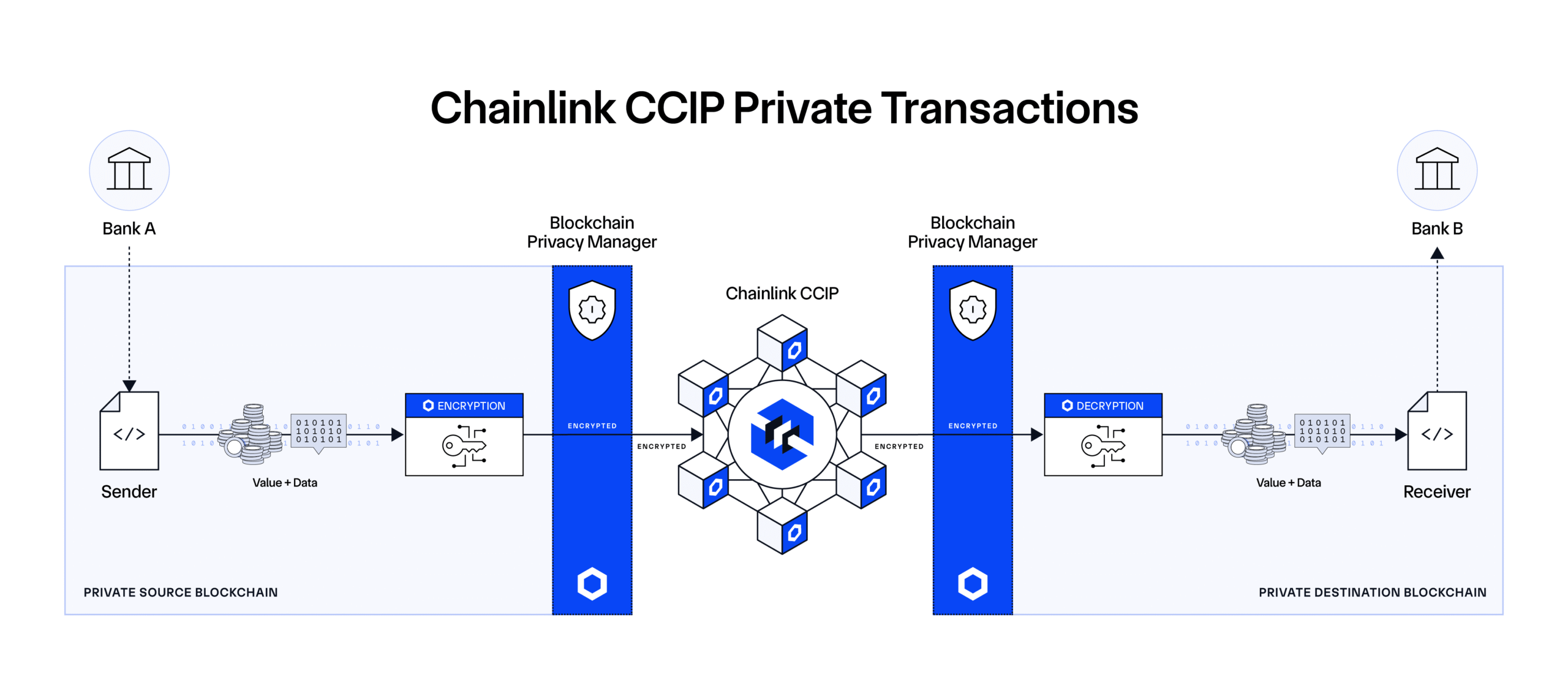

Stablecoins today operate across fragmented pools of liquidity. This means a stablecoin deployed on one blockchain can’t easily serve users, apps, or markets on another. Chainlink addresses this challenge through the Cross-Chain Interoperability Protocol (CCIP) and the Cross-Chain Token (CCT) standard.

CCIP provides a universal messaging and value transfer layer, allowing stablecoins to move seamlessly between chains with the same level of assurance as traditional payment systems. The CCT standard ensures that a stablecoin’s total supply, reserve data, and transaction logic remain synchronized across all connected chains. Designed as a self-serve, issuer-controlled framework, the CCT standard gives end users full ownership over deployment, configuration, and policy management.

This ensures that stablecoin issuers can define how their assets move across chains, retaining complete control over security, compliance, and governance while leveraging Chainlink’s proven interoperability infrastructure.

CCIP is already being used by leading financial institutions to enable secure interoperability across public and private blockchains. ANZ Bank, one of Australia’s largest financial institutions, has used Chainlink CCIP Private Transactions to enable secure cross-chain transfers between a private and public network. In addition, leading stablecoin issuers such as Falcon Finance (USDf), World Liberty Financial (USD1), and Aave (GHO) are also leveraging the Chainlink interoperability standard to achieve unified liquidity across multiple blockchains. FairsquareLab, a leading digital asset infrastructure technology provider, is integrating CCIP into Project PAX, an initiative involving some of the largest financial institutions in Asia, including Shinhan Bank, NH NongHyup Bank, K Bank in South Korea, and Progmat.

4. Customizable Workflows, Managed From Existing Systems

Stablecoin issuers often find it cumbersome to manage operations like reserve attestations, token issuance workflows, and compliance approvals, leading them to build custom infrastructure for each chain they launch on. But as these operations scale, they become harder to manage, requiring issuers to rebuild the same workflows repeatedly.

The Chainlink Runtime Environment (CRE) solves this by providing a programmable, verifiable orchestration layer that securely connects onchain smart contracts with offchain financial systems, compliance tools, and data providers. Using CRE, stablecoin issuers can automate critical workflows like reserve attestation and liquidity management. Each workflow can be triggered automatically by offchain events such as fiat settlement confirmations, compliance approvals, or treasury instructions, and executed atomically onchain to eliminate reconciliation gaps and manual intervention.

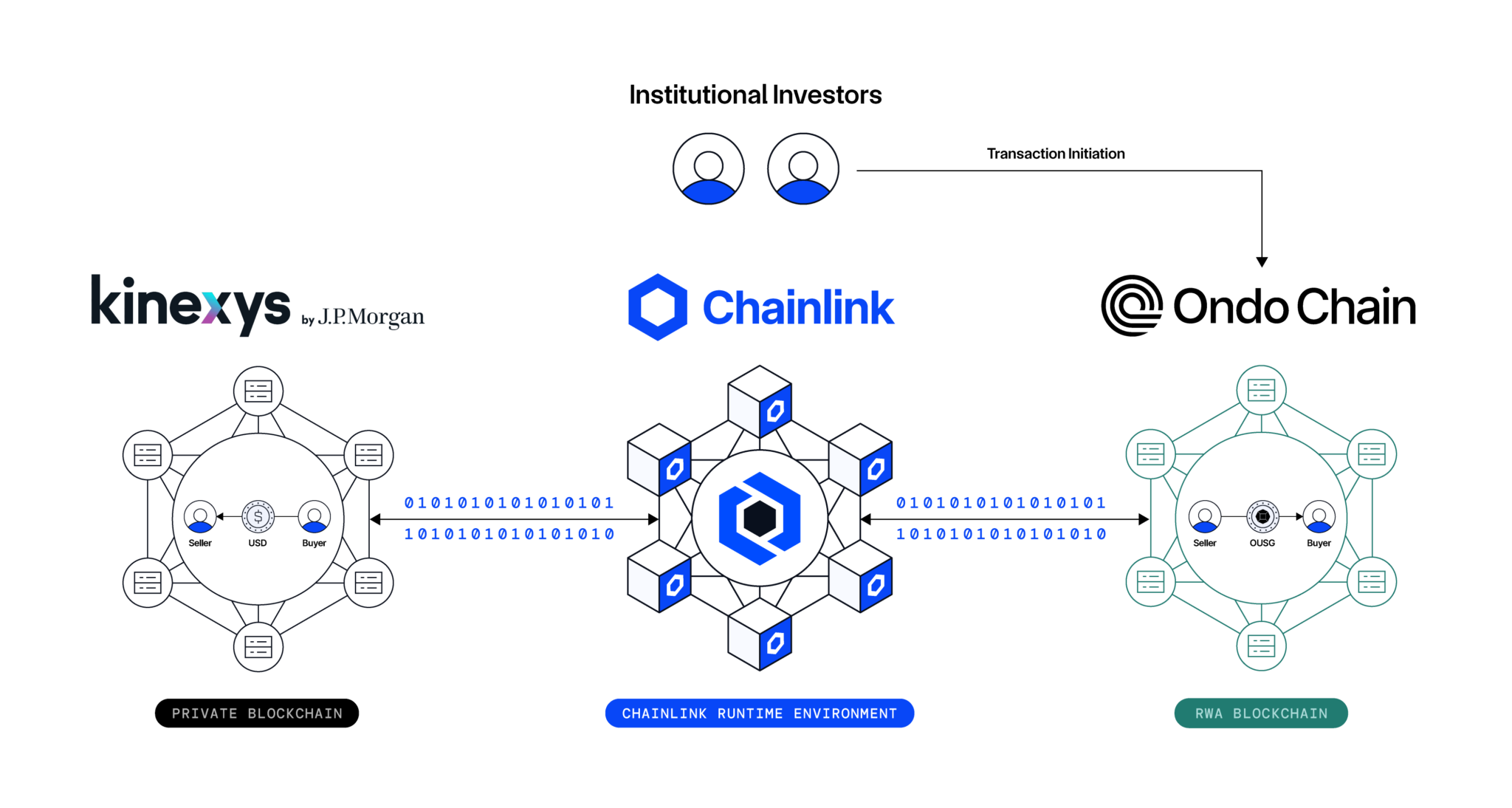

This is already proven through work with large financial institutions, where CRE workflows have enabled institutions to use the same standardized data structures that underpin today’s global financial system. Chainlink, Kinexys by J.P. Morgan, and Ondo Finance successfully executed a cross-chain Delivery versus Payment (DvP) transaction between Kinexys Digital Payments’ permissioned blockchain network and Ondo Chain testnet, with the Chainlink Runtime Environment (CRE) orchestrating end-to-end settlement.

5. Access to Distribution Channels

Chainlink is driving the convergence of traditional and onchain finance. With thousands of projects in the Chainlink ecosystem, Chainlink provides stablecoin issuers with access to a global network.

For issuers, this connectivity translates into instant access to liquidity, integrations, and new distribution channels. To accelerate stablecoin adoption, Chainlink and GSR are launching a stablecoin enablement program aimed at supporting qualified issuers throughout the lifecycle of their stablecoin projects. The program aligns Chainlink’s data, interoperability, privacy, and compliance standards with GSR’s deep experience in capital markets.

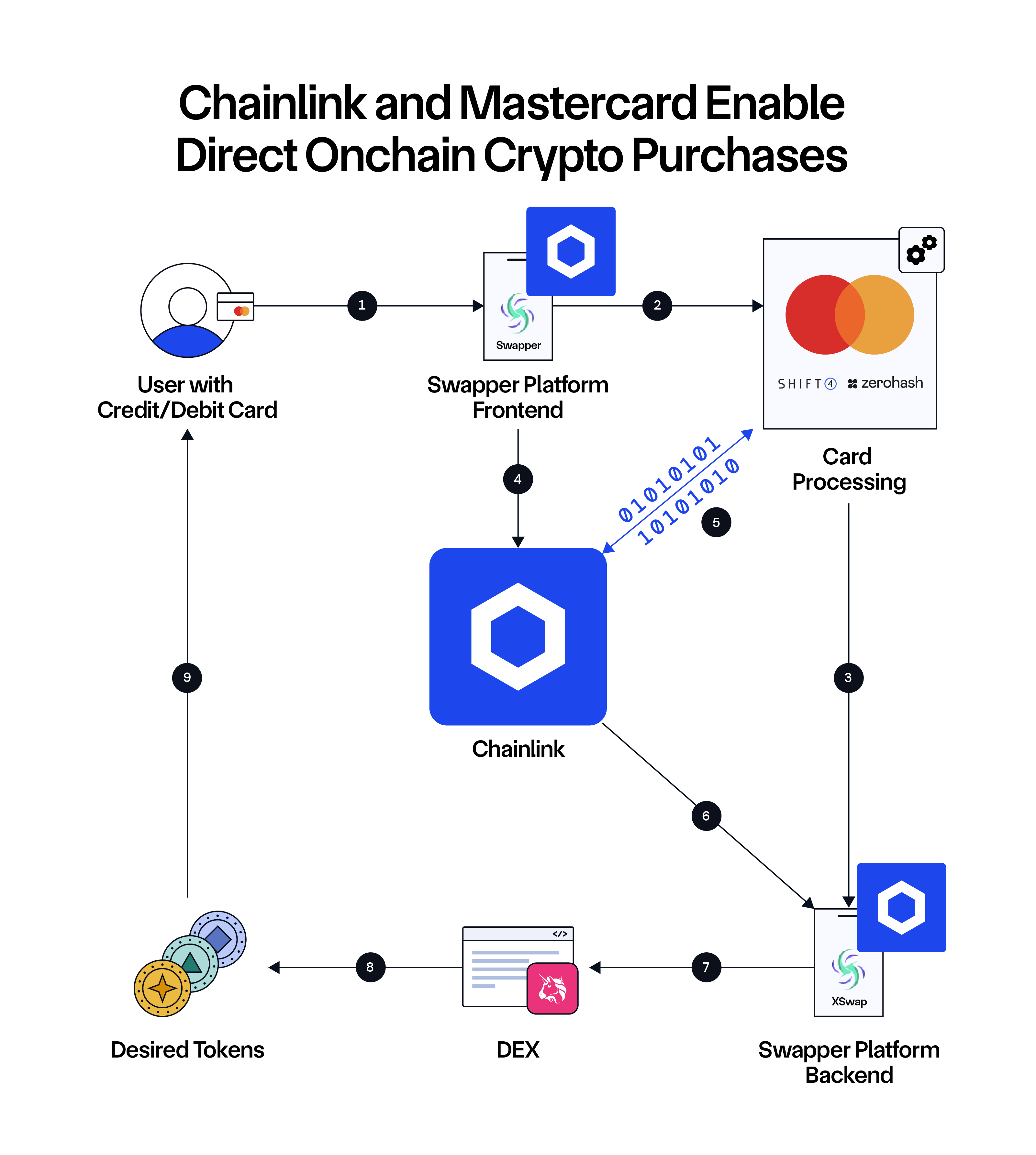

Mastercard and Chainlink have teamed up to power Swapper Finance—a new way to buy crypto directly from decentralized exchanges (DEXs) using any Mastercard. Mastercard’s 3.5+ billion cardholders will now be able to directly purchase crypto onchain, through instant and secure crypto-to-fiat conversion. Swapper is powered by XSwap, a leading DEX incubated in the Chainlink Build program. Swapper leverages the Chainlink standard for data and interoperability via an integration between zerohash and Shift4 Payments, and is backed by Mastercard’s global payment rails.

Building the Next Era of Digital Money

Stablecoins are emerging as a key layer of the digital economy, embedding trusted fiat value into systems that can operate across markets, jurisdictions, and technologies. But to fulfill that role, they require infrastructure that is secure, compliant, and interoperable by design.

With over $28 trillion in transaction value enabled and adoption by leading financial institutions and market infrastructures worldwide, Chainlink delivers the reliability, scalability, and connectivity that stablecoin issuers need to operate with confidence.