Chainlink for Enterprises: The Gateway to All Blockchains

The major value proposition of blockchain technology is evolving from cryptocurrency to smart contracts—a transition that mirrors the Internet’s transition from email to the World Wide Web.

Smart contracts are primed to become the dominant form of digital agreement because they enable more efficiency with less counterparty risk. Analysts already see huge opportunity across several smart contract-based markets, as evidenced by the NFT collectibles market surpassing $40 billion in value in 2021, the addressable market of the metaverse being estimated at $8 trillion, and blockchain adoption in capital markets could disrupt markets valued at over $867 trillion.

Recently, Chainlink and Swift announced a collaboration with over a dozen leading financial institutions—including ANZ, BNP Paribas, BNY Mellon, Citi, Clearstream, Euroclear, Lloyds Banking Group, SIX Digital Exchange (SDX), and The Depository Trust and Clearing Corporation (DTCC)—to test how financial institutions can leverage their existing Swift infrastructure in combination with Chainlink CCIP to seamlessly connect with the multitude of blockchain networks across the globe.

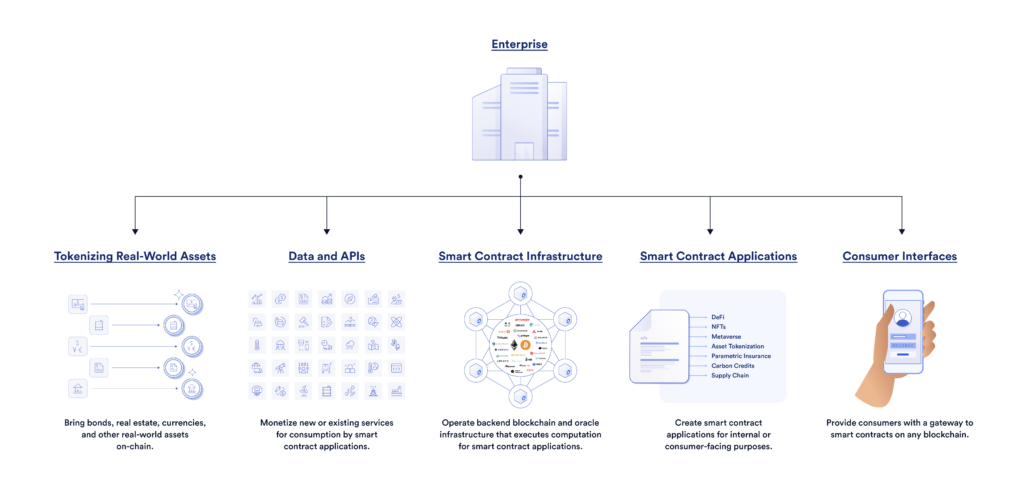

Given the imminent economic shift on-chain, every enterprise must consider how they can capture value in the emerging smart contract economy. We believe enterprises have five key roles to play:

- Monetizing data and API services that enable smart contracts.

- Operating backend infrastructure that provides computation for smart contracts.

- Building smart contracts that support new and existing business processes.

- Moving real-world assets on-chain to increase liquidity, transparency, and efficiency.

- Launching consumer interfaces that allow users to access smart contract applications on any blockchain.

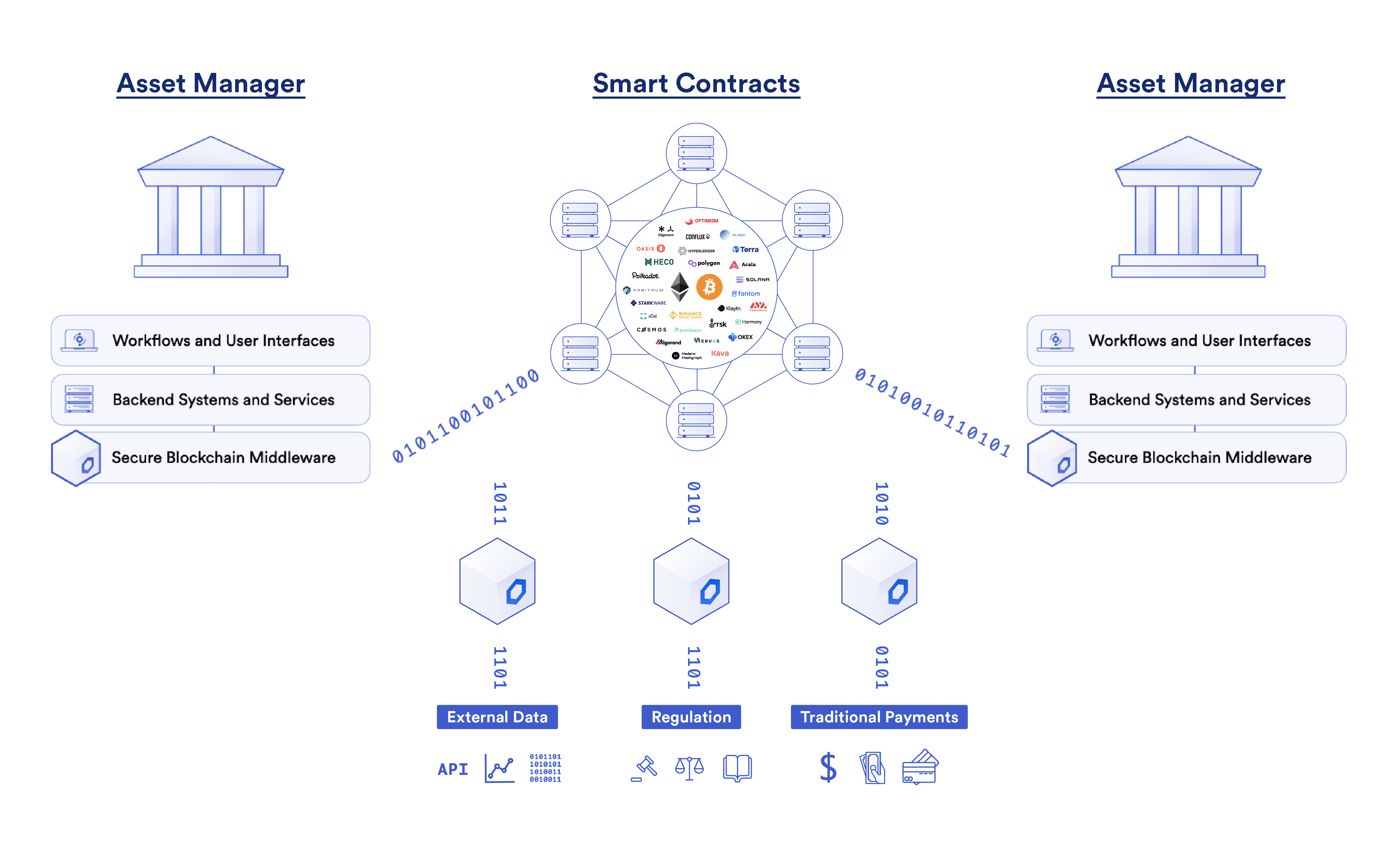

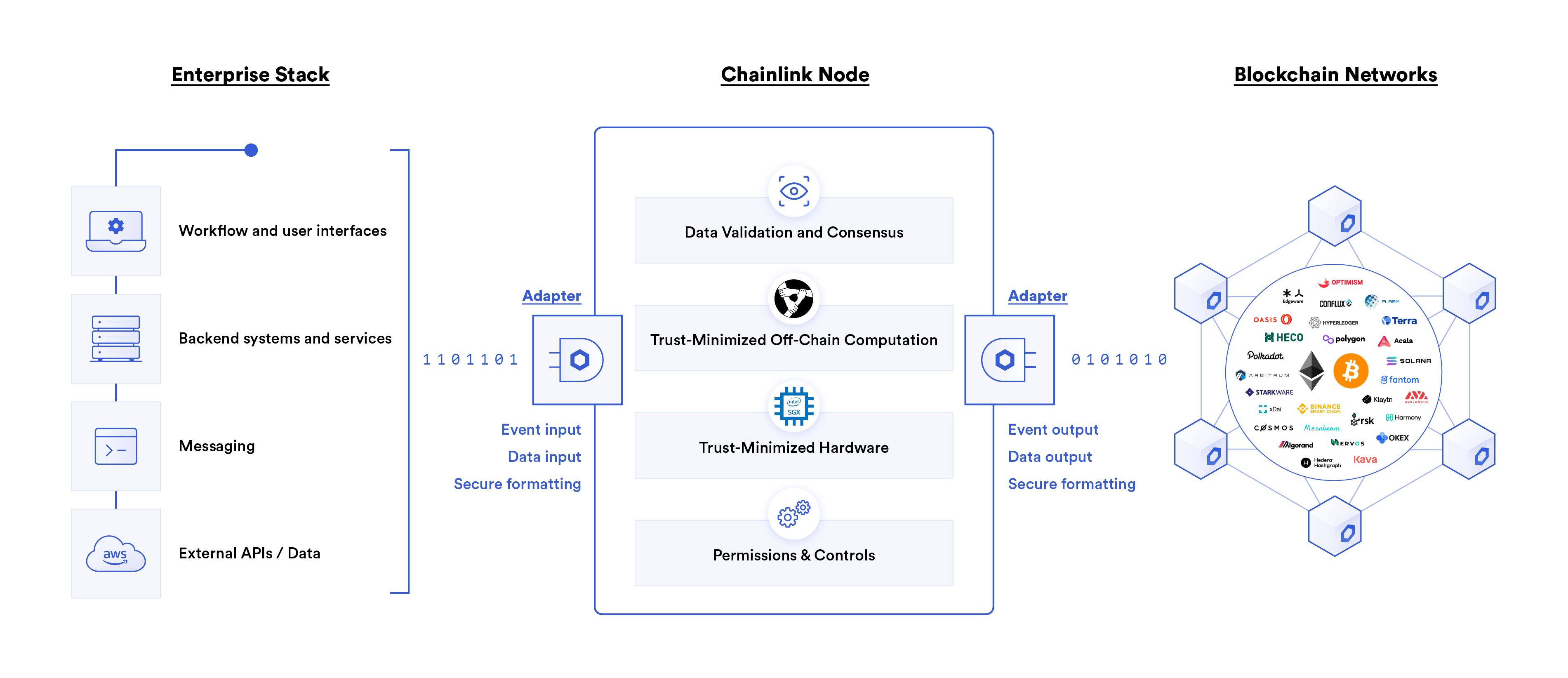

Chainlink empowers enterprises to capitalize on innovation in the smart contract economy by providing them with secure blockchain middleware that can read from and write to any blockchain based on customizable logic and security. This gives enterprises a future-proof abstraction layer for seamlessly interacting with any smart contract in any manner directly from existing backends and legacy tools—all with minimal-to-no server-side modifications. For this reason, many leading enterprises and institutions are already working with Chainlink to open up additional revenue streams and pioneer the next generation of smart contract applications.

The following article will dive deeper into why Chainlink is essential for enterprise adoption of blockchains and smart contracts. It begins by laying out the value proposition of smart contracts before explaining what Chainlink is and why it’s the market leader in oracle technology. It then concludes by outlining the functionalities that Chainlink opens up for enterprises.

The Value of Blockchains and Smart Contracts

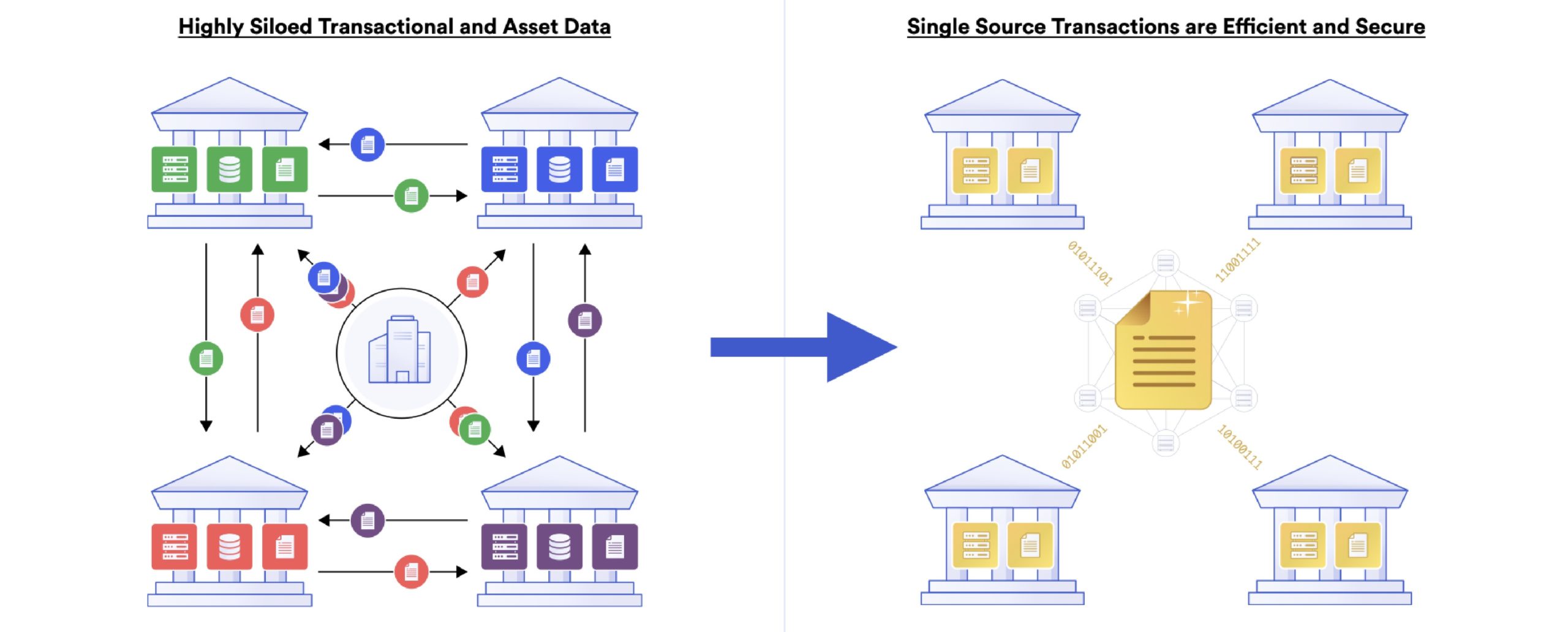

A blockchain is a distributed ledger for tracking the ownership and facilitating the transfer of assets and data between two or more parties. Blockchains use decentralized infrastructure to remove single points of failure and control; cryptography to secure the integrity of ownership and increase the immutability of appended records; financial incentives to extend the network’s ledger and arrive at honest consensus; and transparent record-keeping to enable users to audit the validity of new entries.

The goal is that users don’t need to trust the blockchain to operate as stated. Instead, all variables that could prevent the code from executing exactly as submitted are removed or reduced to near statistical impossibilities via proper game-theoretical design. The end result is multi-party processes transitioning to a shared, credibly neutral backend that maintains a single source of truth and facilitates value exchange in a trust-minimized manner. Decentralized validation plays a key role in generating trust-minimization, as all new transactions must be approved by a distributed network—removing asymmetrical advantages derived from having centralized administrators and IP owners.

Note: Not all blockchains are created equal, so it’s important to understand the various tradeoffs and optimizations of each before utilizing a specific permissionless or permissioned blockchain.

Smart contracts are programs deployed on blockchains that store and transfer data/assets only once specific conditions are met (i.e. if x event happens, then execute y action). In this sense, smart contracts are parametric because they automatically generate outputs based on data inputs. Smart contracts codify the terms and conditions of digital contracts, with multiple smart contracts combining to form a decentralized application (dApp).

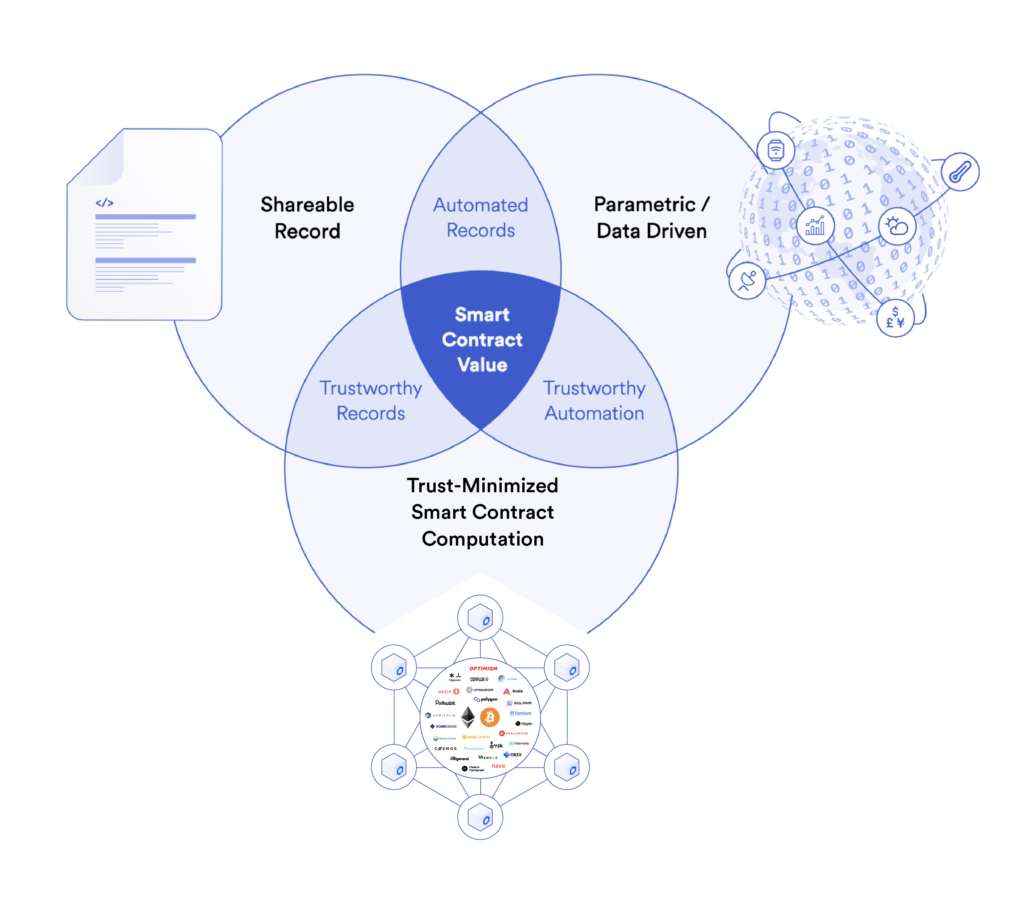

By transforming digital agreements into smart contracts, several benefits are realized:

- Trustworthy Automation—because smart contracts are executed parametrically by a decentralized network, they can automate value exchange with less counterparty risk and fewer potential points of failure.

- Trustworthy Records—since new record entries appended to blockchains are shared between all parties and redundantly validated, they are inherently high integrity, immutable, and auditable.

- Automated Records—given that blockchains automatically record smart contract metadata in ledgers, processes are reliably tracked by default for improved efficiency and reduced reconciliation disputes.

Despite the enormous potential of smart contracts, they have an underlying limitation—blockchains are inherently disconnected from the outside world. As a result, smart contracts are unable to interact with data and systems external to their native blockchains, akin to a computer without an Internet connection. Referred to as “the oracle problem,” this limitation severely inhibits most types of smart contract use cases from being developed. Enter Chainlink.

Chainlink: Secure Blockchain Middleware for Enterprises

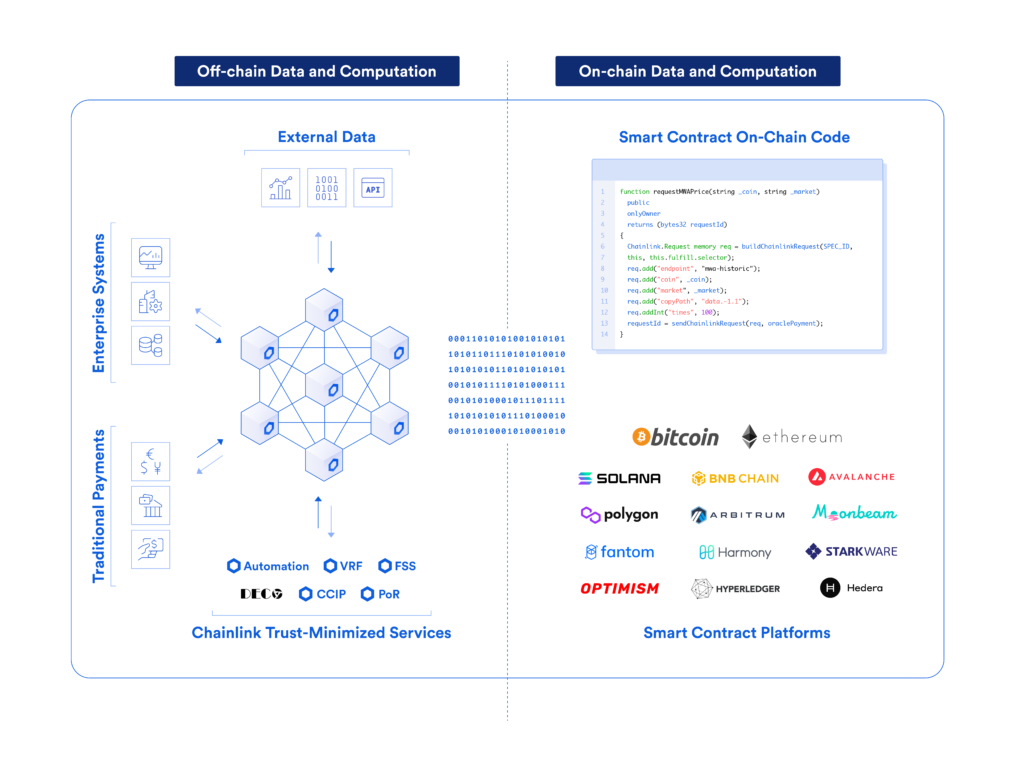

Chainlink is secure, open-source blockchain middleware (referred to as an “oracle”) that provides smart contracts with any type of data or computation that they cannot inherently obtain on their native blockchain due to technical, financial, governance, or legal constraints.

Unlike blockchains, which maintain internal consistency around transaction validation, Chainlink aims to generate and deliver oracle reports to blockchains that accurately reflect the state of external events and computation. Chainlink oracles are able to generate oracle reports because the Chainlink oracle node software can read data from and write data to blockchains and APIs and perform off-chain computation.

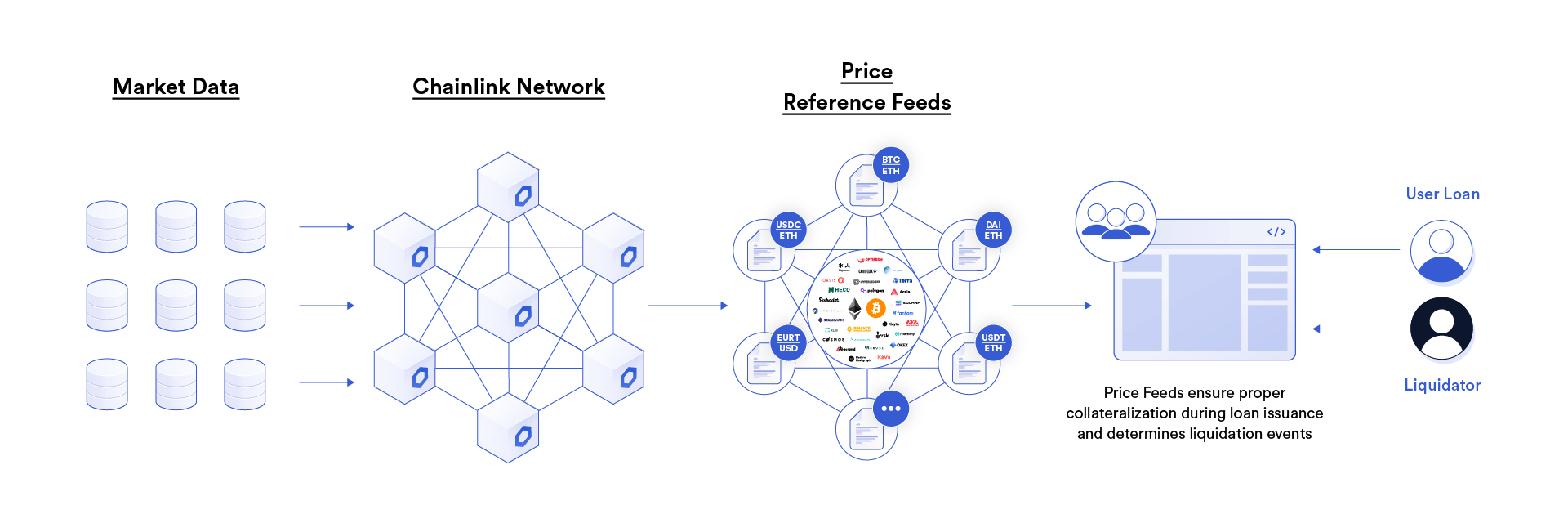

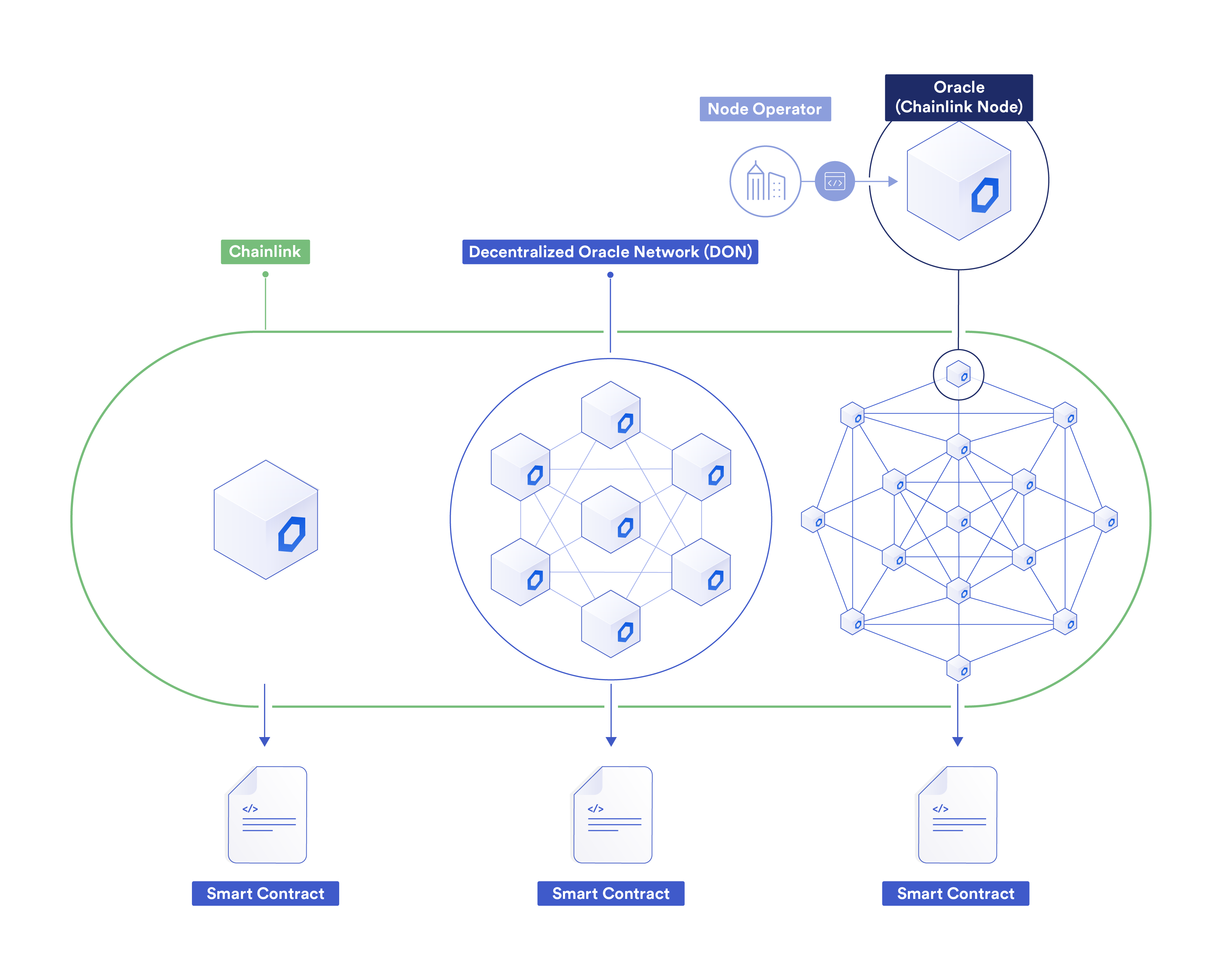

Chainlink generates trust-minimization for oracle reports through mechanisms similar to those used by blockchains, such as decentralized validation, cryptographic signatures, and financial/reputational incentives outlined in service level agreements (SLAs). For instance, Chainlink makes use of decentralized oracle networks (DONs) to provision aggregated Data Feeds, reducing single points of failure and control in the sourcing, computing, and delivery of external data to blockchains.

By providing external resources to smart contracts in a trust-minimized manner, Chainlink enables hybrid smart contracts—a combination of on-chain and off-chain code to create a single application that remains secure, accurate, and reliable end-to-end.

Chainlink uses its broad functionality to offer six general types of oracle services to hybrid smart contracts:

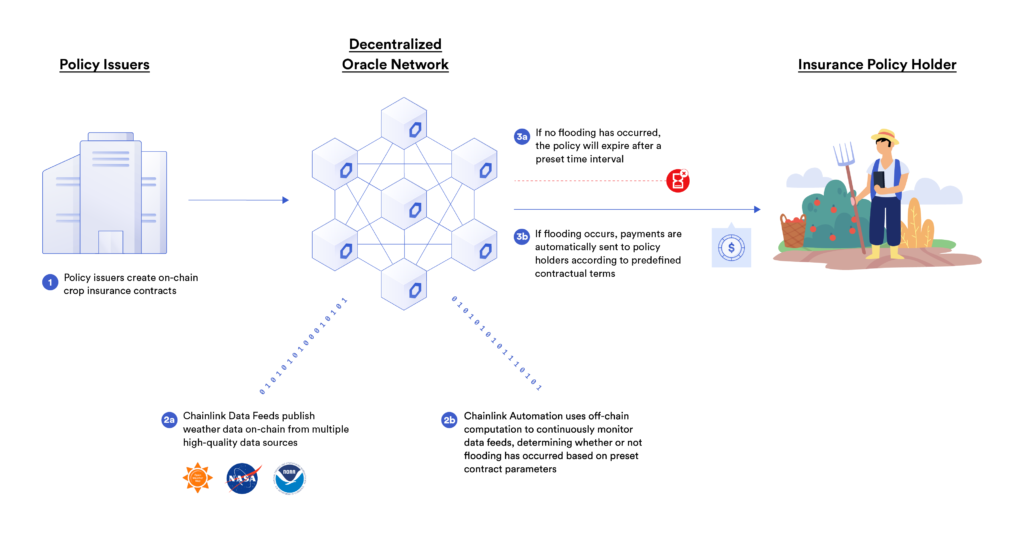

- Delivering external data inputs to blockchains to trigger the execution of smart contracts. E.g., report seasonal rainfall data from a trusted weather data provider that’s used to settle a parametric crop insurance policy.

- Relaying smart contract outputs to external systems to settle smart contracts or move along business processes. E.g., send a payment message to a bank in order to settle an agreement in the user’s preferred currency, then confirm back to the smart contract that the payment has occurred.

- Performing trust-minimized off-chain computation to generate highly accurate and tamper-proof aggregated data feeds or increase the determinism of computation that can’t or isn’t practical to perform on a blockchain. E.g., continually check the collateralization of loans off-chain, and call the liquidation function of a lending smart contract only if a loan is under-collateralized—reducing the computation costs required to maintain solvent on-chain money markets.

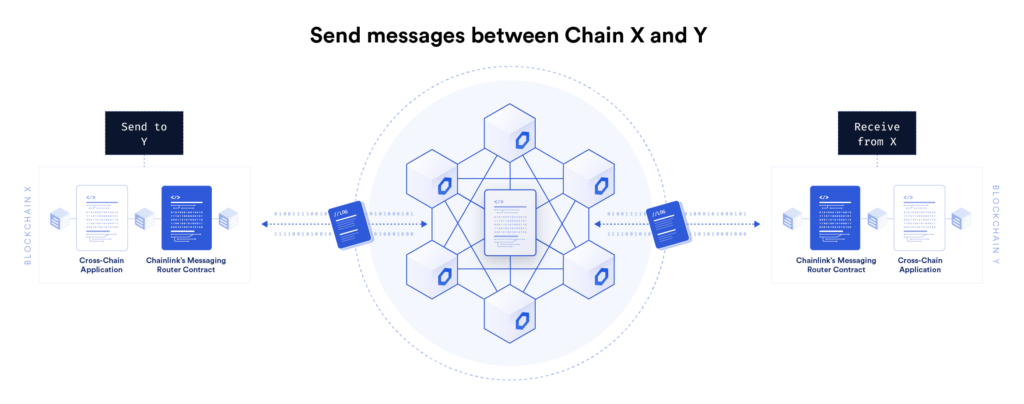

- Enabling blockchain interoperability to allow smart contracts on one blockchain to interact with smart contracts on another blockchain. E.g., allow Ethereum smart contracts to trigger a payment on Hyperledger’s permissioned enterprise blockchain.

- Providing a blockchain abstraction layer to enable enterprises to interact with any blockchain from their existing backend. E.g., empower a bank to give their customers access to popular smart contract applications directly from their existing mobile app.

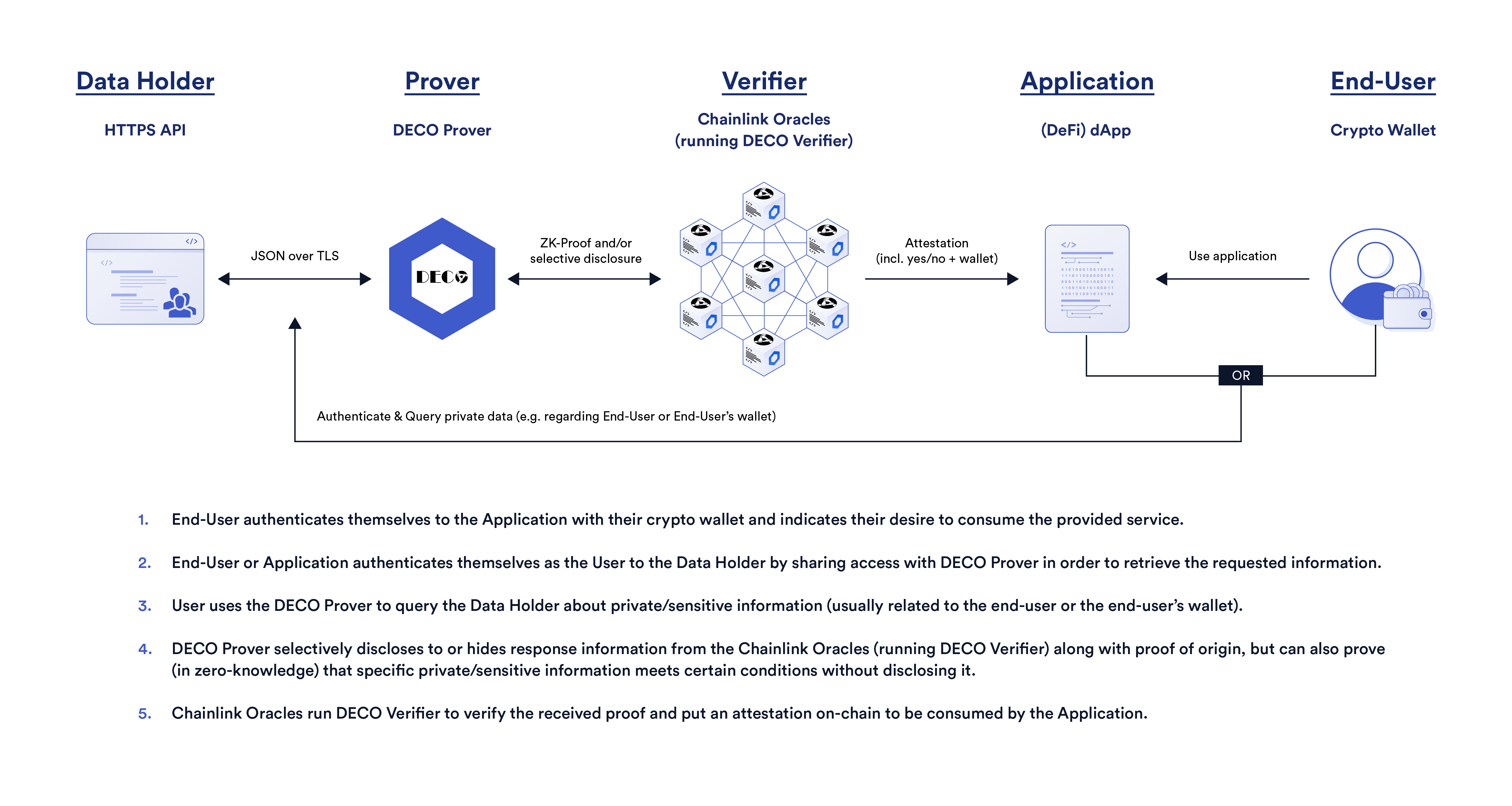

- Verifying the identities of users in a privacy-preserving manner to give enterprises the ability to know who they are interacting with on-chain and meet various KYC/AML requirements. E.g., attest to a personal identifier a user stores via a bank API, which proves they don’t reside in certain jurisdiction without actually revealing their address on the blockchain.

Importantly, Chainlink is not a single monolithic network. Instead, it’s a heterogeneous network where any number of DONs can run in parallel without cross-dependencies. Each DON is customizable, empowering users to pick specific node operators and data sources, the level of decentralization, the type of computation performed, the update frequency, the blockchain it’s deployed on, and various other optimizations that align with the user’s own budget, performance requirements, privacy needs, and trust assumptions.

Chainlink is also blockchain- and API-agnostic, meaning enterprises can connect their current backends to any blockchain (public or permissioned) and existing legacy system. By being highly generalized, Chainlink is future-proof middleware that allows enterprises to easily react to changes in the blockchain industry and make adjustments to internal workflows.

How Enterprises Can Earn Revenue in the Smart Contract Economy Using Chainlink

Enterprises can use Chainlink as middleware to both sell data and services to smart contracts and to build their own applications. Below are four broad ways they can open additional revenue streams with Chainlink.

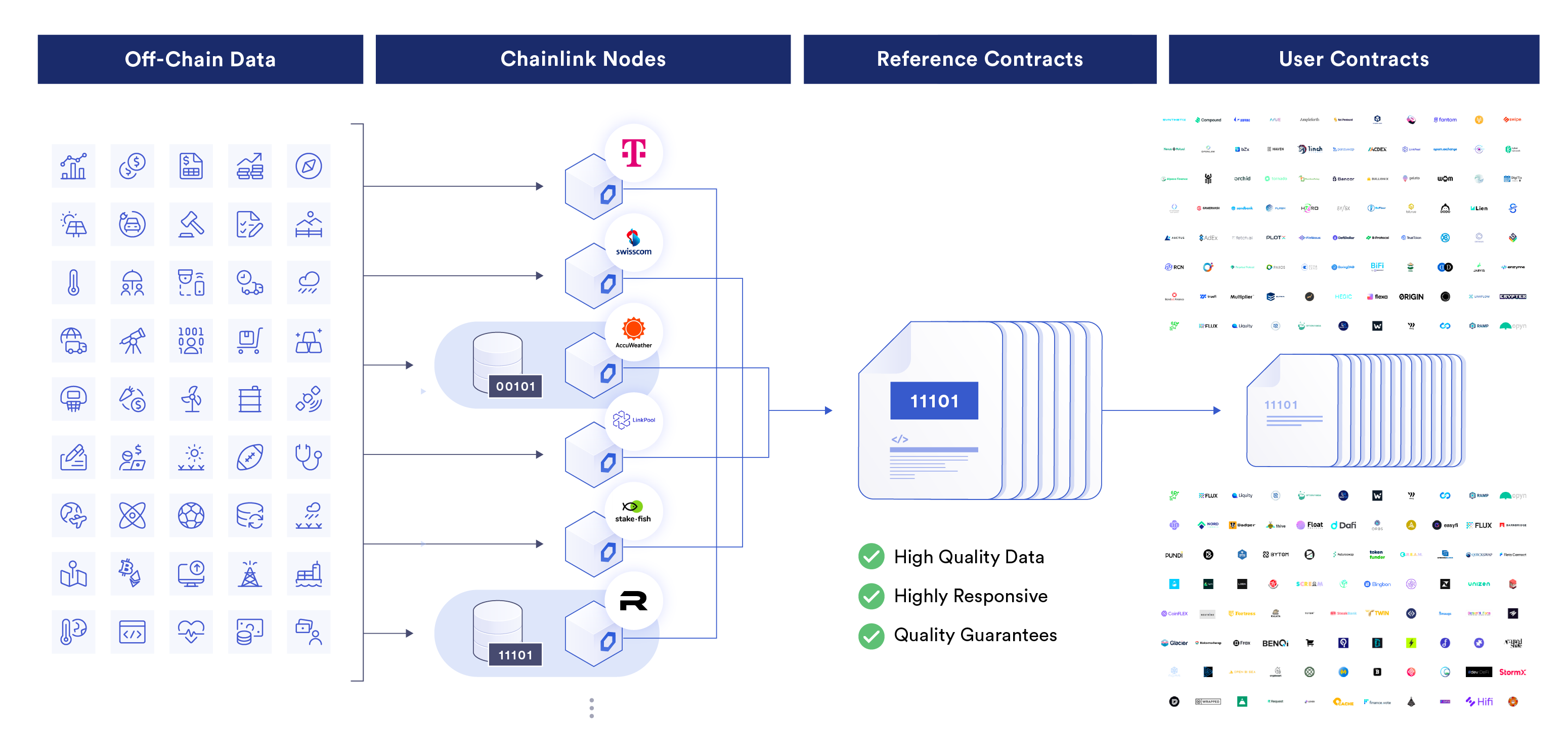

Selling Data and API Services That Enable Hybrid Smart Contracts

Smart contact applications require a plethora of external inputs and outputs to facilitate end-to-end workflows. For instance, smart contracts need to consume external data to trigger their execution, such as financial asset prices, sports match results, weather information, IoT sensor readings, and various other data types. Smart contracts also need to interact with legacy systems to support functions such as settlement payments, regulatory compliance, and communications with internal backends.

Chainlink enables enterprises to monetize their data and services as inputs and outputs for smart contracts on any blockchain. Enterprises can monetize their data and APIs by both selling them through existing professional Chainlink nodes and by running their own Chainlink nodes. When selling through Chainlink, enterprises don’t have to change anything about their existing API business model. Chainlink nodes have built-in credential management capabilities that allow them to store API keys and pay for data licensing subscriptions in fiat currencies. However, enterprises can also choose to run their own Chainlink node to sell data directly to smart contracts and cryptographically sign data as a way to prove its origin for increased security.

Many traditional data providers are already integrating Chainlink to provision data for smart contract applications, including the Associated Press, Accuweather, and Google Cloud.

Chainlink is also developing privacy-preserving oracle solutions for enterprises, such as DECO. DECO uses zero-knowledge proofs to allow Chainlink oracles to attest to data stored in off-chain systems without publicly revealing it. For instance, DECO could prove that a particular invoice was paid without revealing what the invoice was for, how much was paid, or who was paid by attesting to information stored in the user’s bank API. Chainlink can also make use of trusted-execution environments, such as Town Crier, to conceal oracle computation while proving data and computation integrity.

Operating Backend Oracle Infrastructure that Supports Hybrid Smart Contracts

Another way for enterprises to capture value from the smart contract economy is by running backend oracle infrastructure on the Chainlink Network. Enterprises can leverage their existing computing infrastructure and technical expertise to participate in decentralized oracle networks that support hybrid smart contracts. Similar to how cloud or telecommunications companies provision backend infrastructure for enterprises today, decentralized oracle networks can both provide essential services and abstract away the need for data providers and other enterprises to host their own oracle infrastructure.

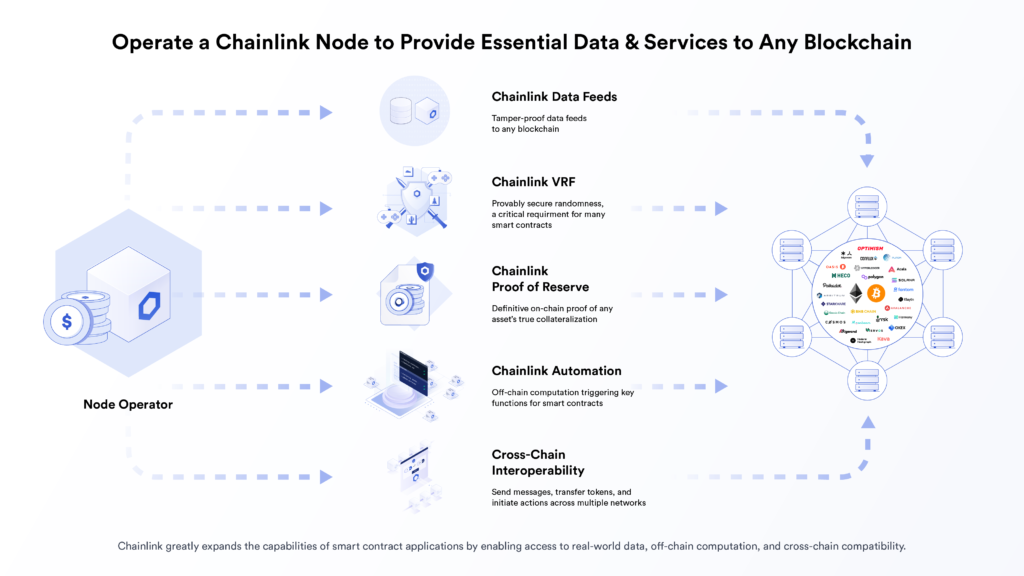

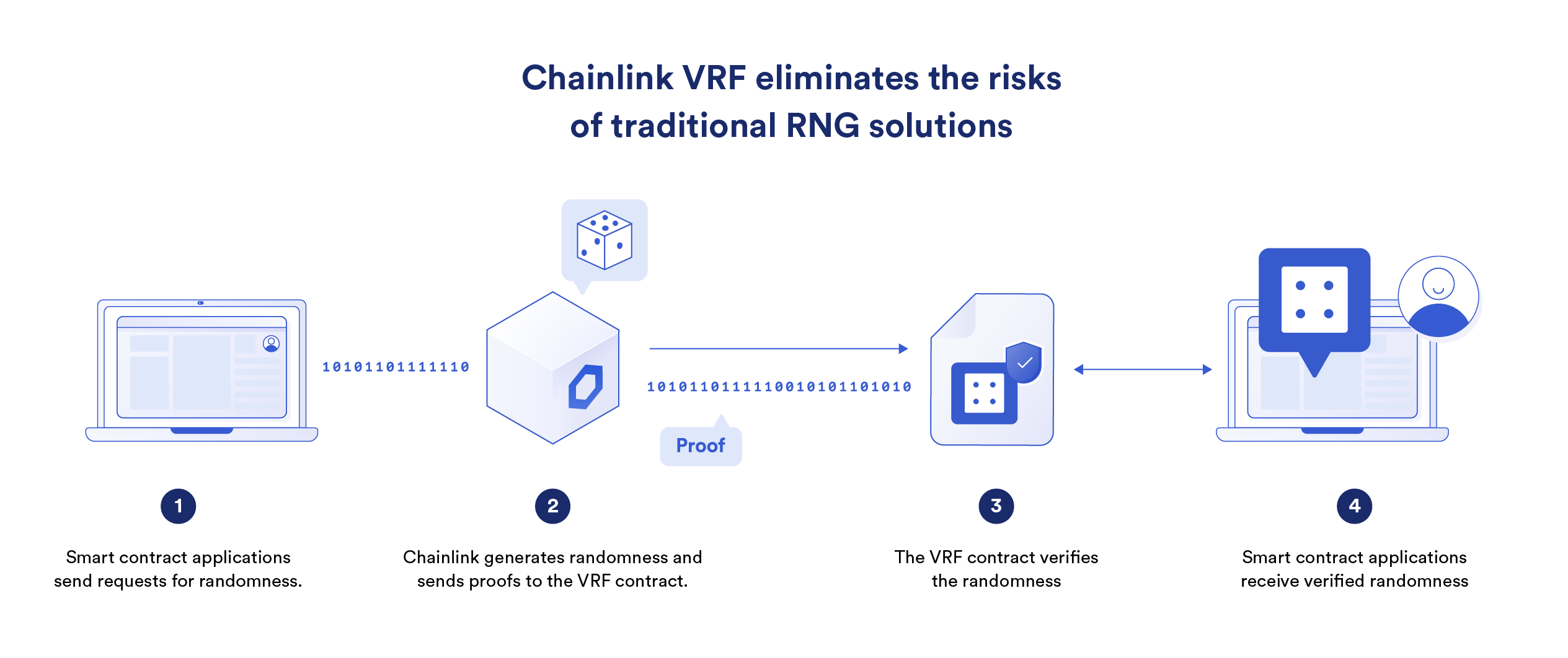

By launching Chainlink nodes, enterprises can get in on the ground floor of the most widely used and fastest-growing oracle network in the industry, with services that actively secure tens of billions of dollars in value for smart contract applications across leading blockchains. Chainlink nodes earn a percentage of user fees across all the oracle services they participate within. Some of the initial oracle services being offered by Chainlink include maintaining persistent data feeds, generating verifiable random numbers, conducting audits of off-chain reserves, automating DevOps functions that maintain dApps, and facilitating cross-chain interoperability.

Several major telecommunications companies are already running Chainlink nodes and earning revenue via participation in widely used Chainlink oracle services, such as Deutsche Telekom MMS, Swisscom, and stc Bahrain.

Building Your Own Hybrid Smart Contracts to Create New or Transform Existing Business Models

Enterprises can also leverage Chainlink to build their own hybrid smart contract applications as a way to upgrade existing business processes and create completely new products. There are a plethora of ways for enterprises to benefit from hybrid smart contracts, but some of the initial possibilities include:

Using trust-minimized inputs in backend business processes to improve their reliability via more transparency, less unilateral control, and increased market coverage. Chainlink Data Feeds can supply trust-minimized inputs that trigger enterprise workflows, such as exchange rates offered within financial services and events data that settles parametric insurance.

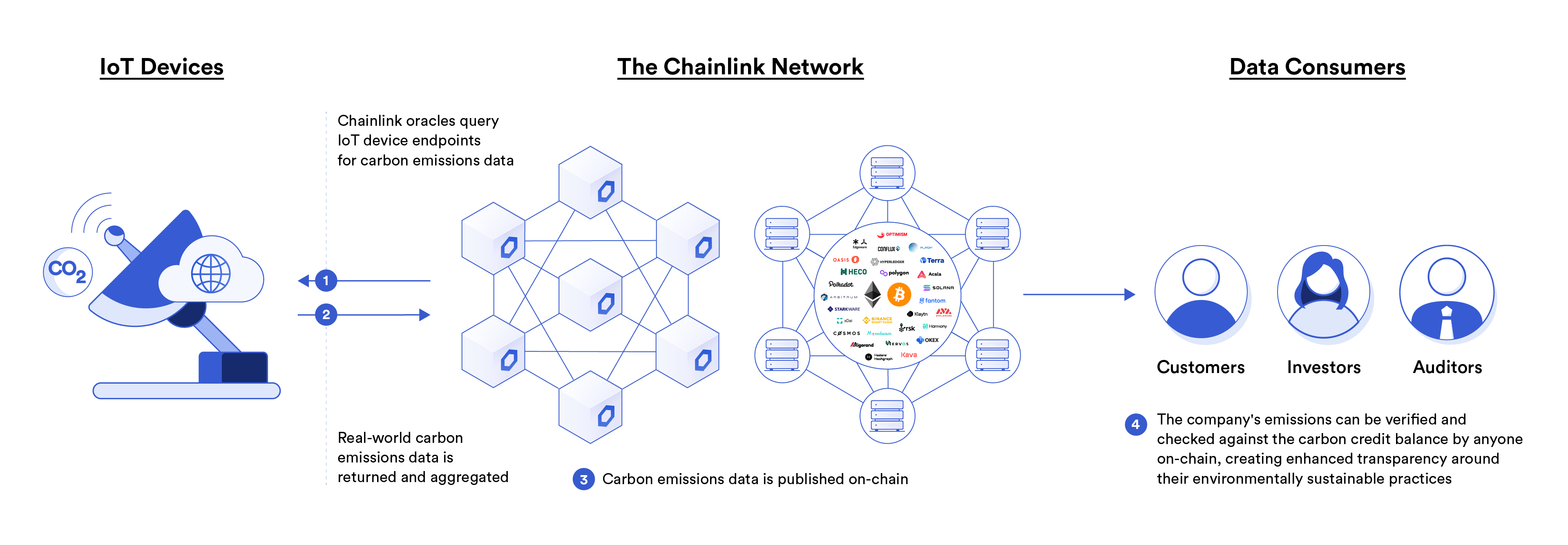

Increasing operational transparency by proving the integrity and follow-through of previously stated commitments. Chainlink Proof of Reserve provides a way to perform timely, trust-minimized audits that are stored on-chain as immutable records, enabling use cases such as verifying the off-chain reserves backing on-chain tokenized assets or demonstrating ESG commitments like carbon emission reductions.

Conducting verifiably fair giveaways and promotions to reward loyal consumers and increase engagement with marketing campaigns. Chainlink VRF is a verifiable random number generator service that can be used to fairly select random winners in a manner that anyone can verify as being tamper-proof and unbiased.

Automating existing multi-party workflows using data-driven hybrid smart contracts. Chainlink Data Feeds and Chainlink Automation can be used to connect smart contracts to any input and output and automate their execution at specific times, enabling use cases such as triggering smart contracts with data, settling smart contracts via a bank payment, and adding in regulatory checks when needed.

Connecting islands of fragmented liquidity that are emerging as financial institutions bring real-world assets on-chain. Chainlink Cross-Chain Interoperability Protocol (CCIP) can be used to securely and seamlessly transfer tokenized assets and send instructions between various public and private blockchain networks, enabling tokenized assets to flow across on-chain financial markets.

Creating entirely new decentralized applications to expand the set of product offerings made available to consumers. Chainlink DECO can be used as part of an on-chain identity solution for verifying the off-chain KYC/AML information of users in a privacy-preserving manner before they interact with the dApp. Other Chainlink services can also be incorporated for end-to-end execution, such as trust-minimized inputs, outputs, computation, and blockchain interoperability.

Launching Consumer Interfaces for Interacting With Smart Contracts on Any Blockchain

Instead of provisioning backend data and computation for smart contracts, enterprises can also opt to build frontends that give their existing user bases access to cryptocurrency, Decentralized Finance (DeFi) services, NFT marketplaces, decentralized insurance, and various other smart contract applications. Easy-to-use consumer interfaces for interacting with smart contract applications will help abstract away technical complexities for everyday users, such as account management, as well as provide much-needed customer support solutions.

The Cross-Chain Interoperability Protocol (CCIP), which is powered by Chainlink oracle infrastructure, will support consumer interfaces by enabling enterprises to securely move assets across blockchains from their existing backends using their own customized logic. CCIP is being built to serve as the backbone of an abstraction layer that allows enterprises to not only provide data/services to any on-chain environment but also to build their own cross-chain applications and frontend gateways for accessing blockchains and layer-2 networks.

Access the Entire Smart Contract Economy Today With Chainlink

To start exploring how to integrate Chainlink within your enterprise system and begin realizing the transformative power of smart contracts, reach out to experts at [email protected].

To learn more about Chainlink, visit chain.link, subscribe to the Chainlink newsletter, and follow @chainlink on Twitter. To understand the full vision of the Chainlink Network, read the Chainlink 2.0 whitepaper.