Chainlink Economics 2.0: One-Year Update

Just over one year ago, the Chainlink Staking roadmap was published, marking the beginning of Chainlink Economics 2.0.

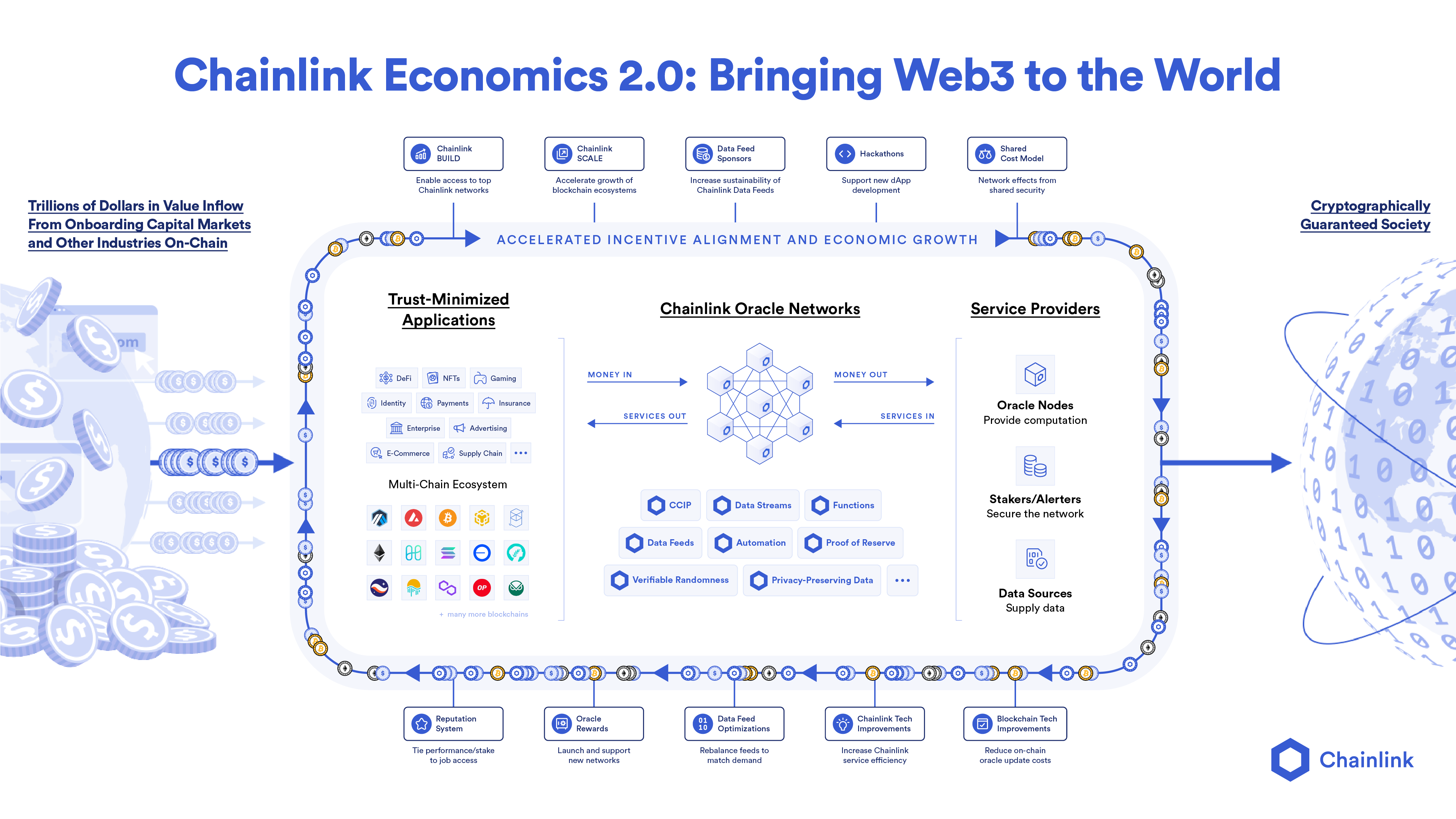

Chainlink Economics 2.0 represents a new era of sustainable growth, cryptoeconomic security, and deeper value capture in the Chainlink Network. It consists of an array of initiatives that focus on improving the security and utility of oracle services while also reducing their operating costs, increasing the amount of user fees that support them, and enabling a broader scope of service providers, such as stakers, to participate in the network.

Since its debut, Chainlink Economics 2.0 has expanded with the BUILD and SCALE programs, introduced in Sergey’s keynote at SmartCon 2022, and Staking v0.1, launched in December. There are now 38 projects in the BUILD program and there are seven blockchain ecosystems in SCALE.

The following blog will cover key milestones in Chainlink Economics 2.0 over the past year that have put the Chainlink ecosystem on an accelerated path toward economic sustainability.

Chainlink Staking v0.1

Chainlink Staking is a mechanism that aims to bring a new layer of cryptoeconomic security to the Chainlink Network, with rewards and penalties applied to further incentivize the network’s proper operation. Staking increases the participation within and decentralization of the Chainlink Network by giving ecosystem participants—including node operators and community members—the ability to stake their LINK tokens in order to earn rewards for helping increase the security guarantees and user assurances of oracle services.

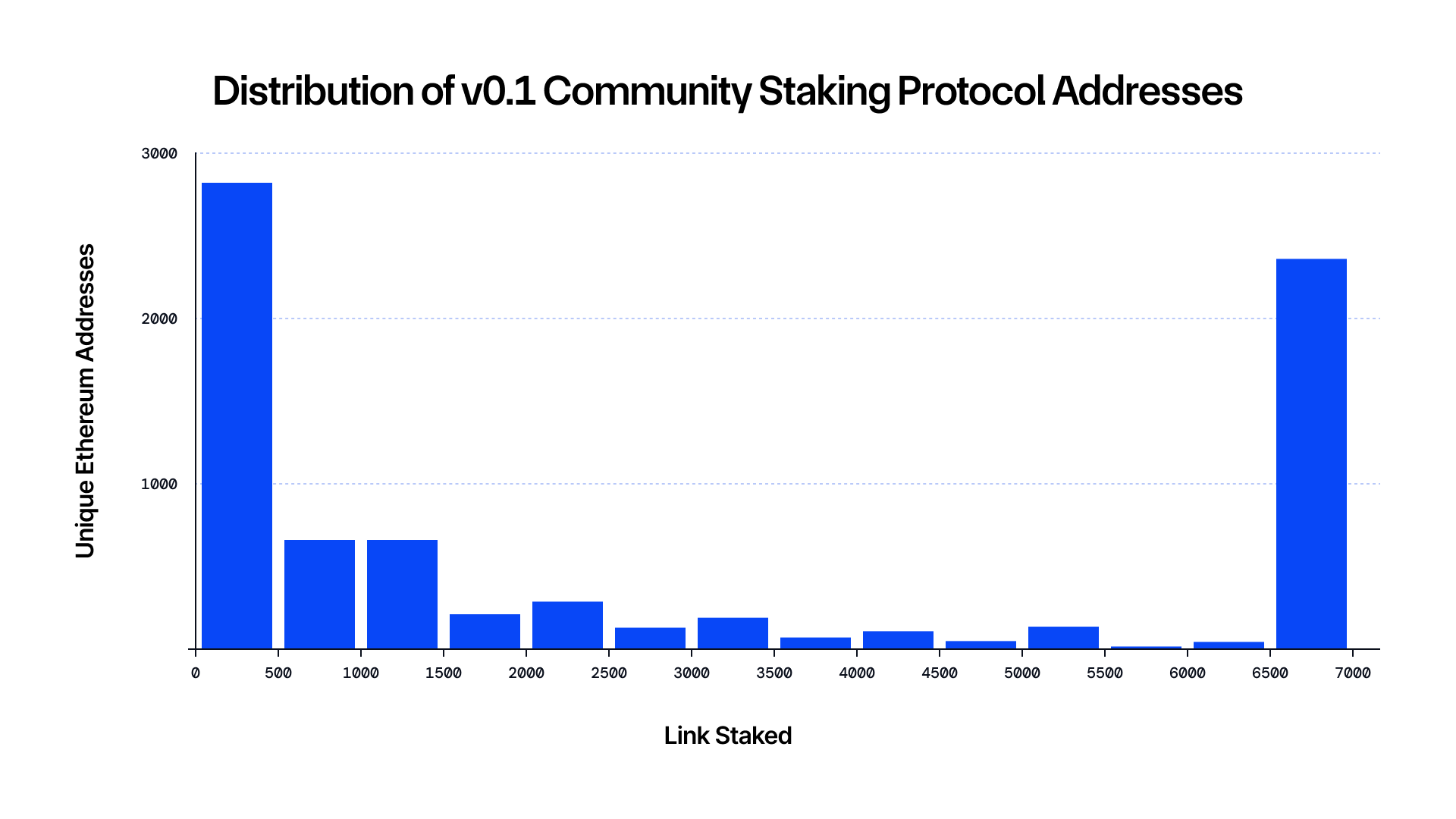

On December 6th, 2022, the initial beta v0.1 of the Chainlink Staking protocol was launched on Ethereum mainnet. Community members on the Early Access Eligibility List had the chance to stake up to 7,000 LINK. Two days later, the Staking protocol opened to General Access, with anyone able to stake up to 7,000 LINK per address until the initial 25M LINK cap was hit. A total of 22.5M LINK was allotted to Community Stakers, while 2.5M LINK was allotted to Node Operator Stakers.

The Community Staker allotment of 22.5M LINK was filled within three hours of the General Access launch, with stakers committing over 7.2M LINK to the protocol in the first hour after Early Access opened.

The Early Access period and per-address staking cap played a key role in minimizing the chance that the v0.1 staking protocol would be dominated by just a few participants, ultimately enabling a more diverse range of community members to join. In total, 7,846 Community Staker addresses staked in the v0.1 protocol, with a median staked amount of 1,161 LINK.

The next version of Chainlink Staking (v0.2) is currently on-track to launch this year, at which point v0.1 stakers can unlock or migrate their stake and LINK rewards. Staking v0.2 will feature various upgrades, such as greater flexibility around lockups and LINK rewards, improved security guarantees, and a more modular architecture that enables new functionalities to continue being added in a more iterative manner.

Chainlink BUILD

Chainlink BUILD is a Chainlink Labs initiative that aims to accelerate the growth of early-stage and established projects within the Chainlink ecosystem by providing them with enhanced access to Chainlink services and technical support in exchange for commitments of fees and other incentives to Chainlink service providers, including stakers. This alignment of economic incentives between communities helps foster mutual, long-term success across ecosystems.

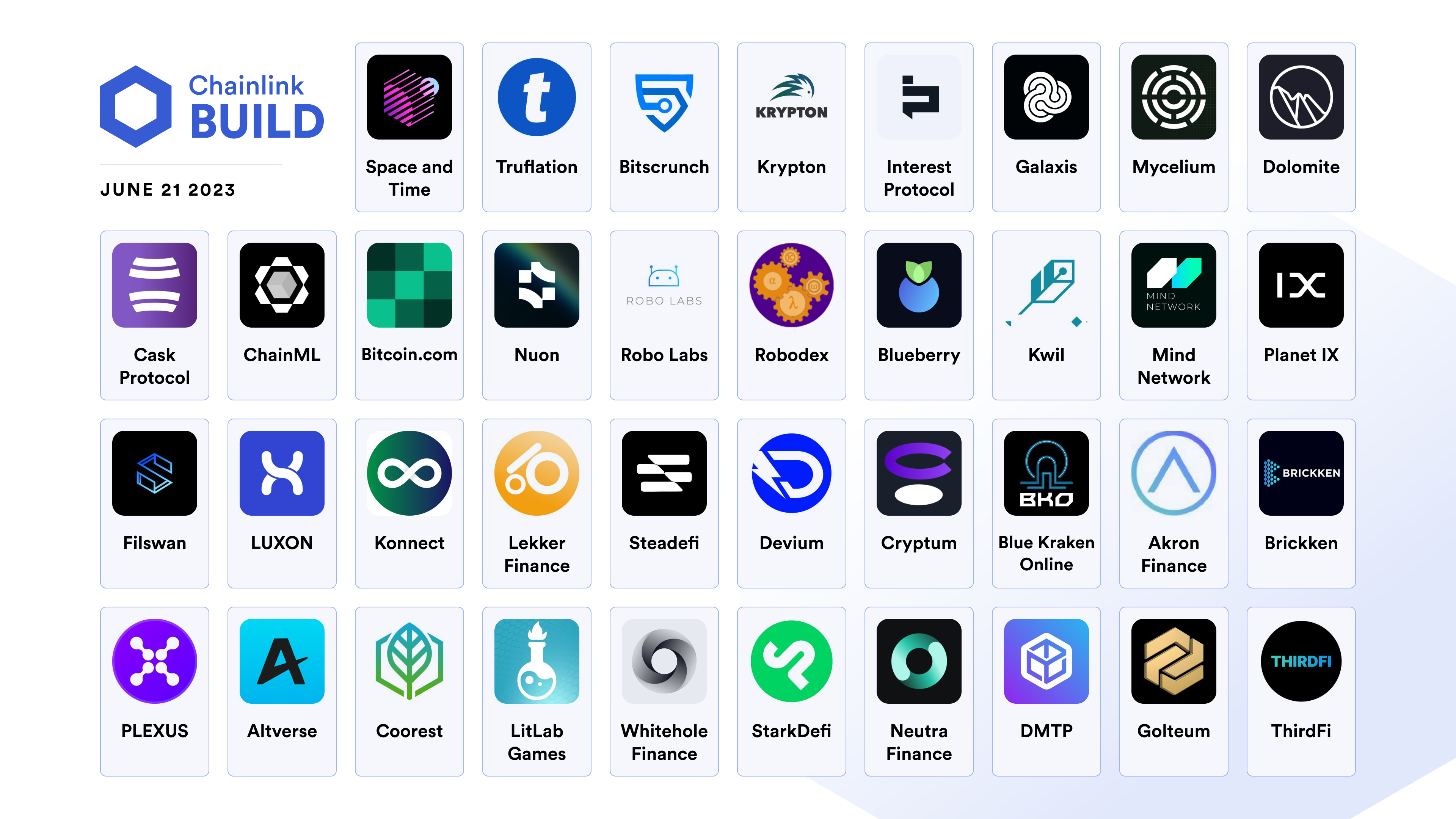

Since its launch in September 2022, a total of 38 projects have joined the BUILD program, with 23 joining in 2023 alone. These projects—representing a wide range of Web3 use cases—have been able to accelerate their growth by getting priority access to new Chainlink services in alpha and beta releases, custom Data Feeds with robust monitoring and maintenance, cryptoeconomic security from Chainlink Staking, technical support from service providers in the Chainlink ecosystem, and more. In exchange, BUILD participants are making a percentage of their native token supply, often 3-7%, available to Chainlink service providers, including stakers, over time.

At the time of writing, the following projects have joined the Chainlink BUILD and committed a percentage of their native token supply to the program.

If you’re an early-stage or established project and want to maximize the advantages of Chainlink, reach out to join the BUILD program using the following Typeform.

Chainlink SCALE

Chainlink SCALE (Sustainable Chainlink Access for Layer 1 and 2 Enablement) is a Chainlink Labs initiative where blockchain projects commit to offsetting operating costs of oracle networks in order to accelerate their ecosystem’s growth and support the long-term sustainability of Chainlink oracle services.

Chainlink SCALE enables blockchains and layer-2 networks to fast-track smart contract innovation in their native ecosystems by covering the operating costs (e.g. transaction gas fees) of Chainlink oracle networks for a period of time. In doing so, their developers get increased access to a variety of oracle services that are critical to blockchain application development. This can also include configurations specific to their ecosystem needs, such as Data Feeds with higher update frequencies to support low-latency use cases.

Since its announcement in September of last year, seven layer-1 and layer-2 blockchain ecosystems have joined or committed to join the SCALE program. At SmartCon 2022, it was announced that Avalanche, Metis, Moonbeam, and Moonriver had joined SCALE, followed by announcements in 2023 that Starknet, Base, and Celo had committed to join. In the case of Celo, its community approved a proposal to join Chainlink SCALE through an on-chain vote. With a 99.9% approval, the vote demonstrates the high demand for Chainlink oracle services as a way to accelerate the growth of blockchain ecosystems.

As on-chain ecosystems in the Chainlink SCALE program mature, the operating costs of oracle networks can increasingly transition toward being fully covered by user fees from applications that run on those blockchains. The result is a holistic economic model that is more viable long-term for all participants.

Fee-Sharing

Economics 2.0 also involves an expansion of the Chainlink Network monetization model to increase aggregate volume of user fees from applications, in part by reducing payment friction. Some approaches being explored include fee-sharing, usage-based fees, and subscription models.

The expansion yielded a fee-sharing agreement between GMX and Chainlink, where the GMX community approved, in an on-chain vote with 96.28% approval, a proposal to integrate Chainlink’s new low-latency oracles as the launch partner of the new oracle service. The integration is designed to enhance the performance of the GMX protocol, harden its data security, reduce frontrunning risks, and help ensure long-term sustainable access to Chainlink oracle services.

As part of this proposal, 1.2% of the total fees generated by GMX V2 and later protocol versions will be paid to Chainlink service providers in exchange for the usage of the low-latency oracles and technical support. As Chainlink Staking evolves over time to support a greater scope of oracle services, a portion of the fees from this proposal are planned to be sent directly to stakers as user fee rewards for increasing the cryptoeconomic security of Chainlink services used by GMX. The passage of this proposal showcases how win-win collaborations accelerate innovation in the DeFi ecosystem while supporting the economic sustainability of oracle infrastructure.

Additional Cost Reduction Initiatives

Technical improvements and periodic maintenance are also important to sustainable oracle economies, as they reduce the operating costs of oracle services and thus lower the user fee threshold at which such services can become economically sustainable.

Chainlink low-latency oracles—a new pull-based oracle solution for data feeds where oracle reports are regularly generated off-chain—were deployed on testnet for testing by GMX. The low-latency oracle solution supports economic sustainability as oracle reports are only placed on-chain when required, as opposed to continuously publishing reports on-chain based on predefined triggers. Additionally, since the cryptographically signed oracle reports are made available off-chain, the responsibility of paying transaction gas fees shifts from the oracle node operators to the applications/users, either directly or via Chainlink Automation. Chainlink low-latency oracles will continue to evolve and support a wide range of smart contract use cases requiring secure and reliable data feeds.

In parallel, Data Feeds within the Chainlink ecosystem are continuously evaluated for their usage and economic viability across all the networks they are deployed upon. Data Feeds that do not have publicly known users or have no clear path to sustainability may be scheduled for deprecation in order to help reduce unnecessary costs for the network and node operators. As a result, a number of Data Feeds meeting these conditions have been deprecated over the past year, particularly on high-cost blockchains not in the SCALE program. This has resulted in a more efficient allocation of economic resources to match evolving user demand, such as adjusting to an increasing number of applications transitioning to layer-2 networks and launching across various blockchains.

Creating an Economically Sustainable Web3 Ecosystem

Sustainable oracle economics are crucial to the long-term growth and security of the Chainlink Network and its ability to provide all of the data, compute, and interoperability services needed for Web3 ecosystems to thrive. Chainlink Economics 2.0 is designed to make Chainlink services sustainable and increasingly more innovative, enabling developers to unlock more value through smart contract applications.

—

Disclaimer: This post is for informational purposes only and contains statements about the future, including anticipated product features, development, and timelines for the rollout of these features. These statements are only predictions and reflect current beliefs and expectations with respect to future events; they are based on assumptions and are subject to risk, uncertainties, and changes at any time. There can be no assurance that actual results will not differ materially from those expressed in these statements, although we believe them to be based on reasonable assumptions. All statements are valid only as of the date first posted. These statements may not reflect future developments due to user feedback or later events and we may not update this post in response.