Chainlink Digital Asset Insights | Stablecoin Rails Come Into Focus

By Daeil Cha, Product at Chainlink Labs

Key Takeaways

- This quarter, we discuss two emerging legislative bills that address payment stablecoins — the GENIUS and STABLE Acts.

- The bills prohibit stablecoin issuers from paying yield to holders, which necessitates alternative methods for holders to generate returns, such as DeFi lending markets, where Chainlink’s CDY Indexes can play a crucial role in tracking yields.

- The GENIUS Act outlines specific reserve requirements for stablecoin issuers, with the potential inclusion of tokenized versions of reserve assets, where Chainlink Proof of Reserve, Data Feeds, and CCIP can add significant value.

- To prepare stablecoin holders for potential insolvency scenarios, Chainlink Proof of Reserve can provide valuable capital structure data.

- The GENIUS Act emphasizes interoperability standards for stablecoins, and Chainlink CCIP can facilitate secure cross-chain transfers of tokens and data, helping issuers comply with future regulations.

Introduction

During the first quarter of the year, global markets faced heightened volatility driven by geopolitical tensions and potential macroeconomic shifts. While traditional financial markets are grappling with this uncertainty, stablecoins have emerged as a key focal point for issuers, users, protocols, and now legislators. The U.S. dollar is uniquely positioned as the premier stablecoin reserve asset, as it is backed by the largest economy in the world, and it should be no surprise that USDT and USDC have risen in such prominence with market caps of \$140 billion and $60 billion, respectively. Stablecoins have become a vital component of decentralized finance (DeFi) by offering a source of liquidity, a hedge against volatility, and a base for pricing nearly all major digital assets.

Given this utility of stablecoins, if decentralized finance approaches the scale of traditional finance, and digital assets continue to be priced in U.S. dollars while dollar-denominated stablecoins remain dominant in DeFi, then the impact on U.S. economic, monetary, and political influence could be far-reaching. To ensure stablecoins serve U.S. interests, U.S. legislators are starting to define potential stablecoin rails, which could have profound implications for stablecoin issuers, users, DeFi protocols, and even traditional financial institutions. As these developments unfold, Chainlink stands well-positioned to add significant value to stakeholders through 1) its battle-tested, industry-leading Data Feeds, 2) Proof of Reserve, 3) Cross-Chain Interoperability Protocol (CCIP), and 4) Chainlink DeFi Yield (CDY) Indices. While it’s difficult to know precisely how financial markets will change, Chainlink can help ensure that stablecoins remain reliable, transparent, interoperable, and compliant in a more clearly defined regulatory framework.

Defining Payment Stablecoins

Two pending bills, the GENIUS Act and the STABLE Act, lay out regulatory frameworks for payment stablecoins that could have significant impact on both traditional and decentralized financial systems. To understand this impact, first we must examine the proposed definitions of payment stablecoins. In sum, both acts define payment stablecoins as tokens backed by fiat currency that maintain a fixed value with no expectation of profit or return. As the name implies, payment stablecoins are to be used as a means for payment or settlement. Below, we show each bill’s definition of payment stablecoin and highlight their differences. Note: We present the draft of the GENIUS Act that was advanced by the Senate Banking Committee in March 2025 and the STABLE Act that was reported to the House on May 6, 2025. They are both provided for analytical purposes only and should not be considered final versions.

The GENIUS Act defines payment stablecoins as follows (some parts are redacted; bold emphasis is ours):

The term ‘‘payment stablecoin’’—

(A) means a digital asset—

(i) that is or is designed to be used as a means of payment or settlement; and

(ii) the issuer of which—

(I) is obligated to convert, redeem, or repurchase for a fixed amount of monetary value, not including a digital asset denominated in a fixed amount of monetary value;

(II) represents that such issuer will maintain or creates the reasonable expectation that it will maintain a stable value relative to the value of a fixed amount of monetary value; or …

(B) that—

(i) is not a national currency;

(ii) is not a deposit … including a deposit recorded using distributed ledger technology;

(iii) does not offer a payment of yield or interest; and

(iv) is not a security … other than a bond, note, evidence of indebtedness, or investment contract satisfying the conditions described in subparagraph (A).

The text in bold represents differences with the STABLE Act’s definition, which includes another difference:

The term “payment stablecoin” means a digital asset … (B) that is denominated in a national currency;

While the GENIUS Act’s definition does not mention “national currency,” its definition of “monetary value” in another section is “a national currency or deposit denominated in a national currency.”

Stablecoin Yields

Both acts explicitly prohibit issuers from paying yield to holders. The GENIUS Act’s definition of stablecoins includes:

“The term ‘payment stablecoin’ … does not offer a payment of yield or interest; and … is not a security …”

While the STABLE Act’s definition of payment stablecoin does not mention yield, a later section explicitly prohibits passing yield to holders:

“PROHIBITION ON YIELD.–A permitted payment stablecoin issuer may not pay interest or yield to holders of its payment stablecoins”

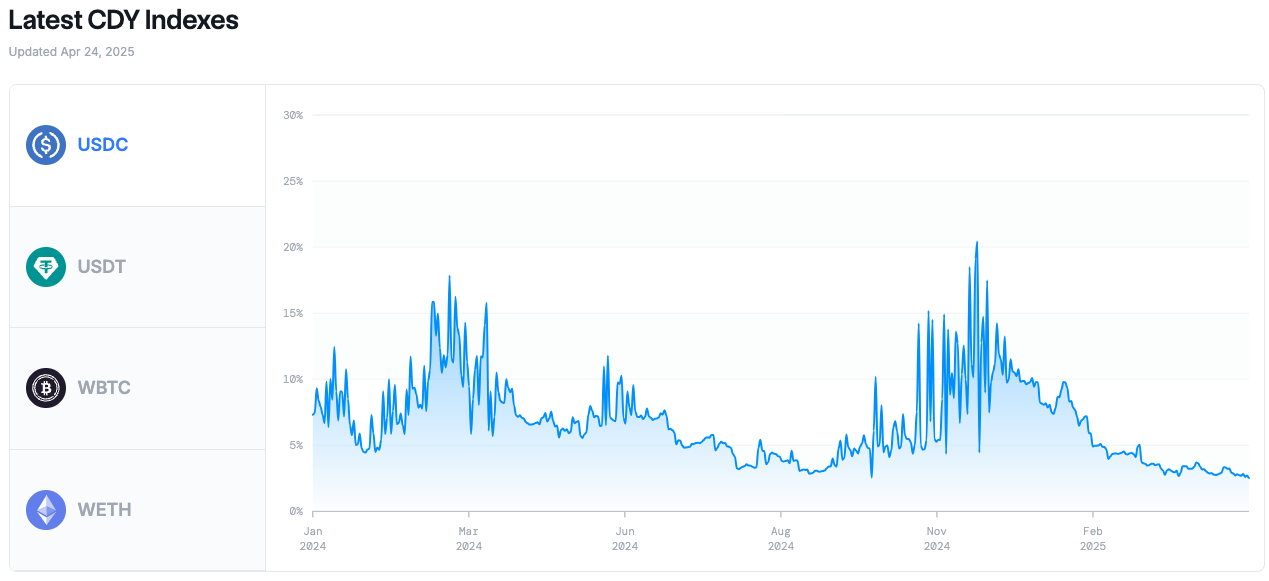

Thus, if either bill passes in its current form, stablecoin holders can not automatically receive yield from the issuers and will need to find another way to generate returns on their assets. DeFi lending markets are broad, deep, actively maintained, liquid, and transparent, and they provide an onchain venue for asset holders to earn yield for supplying their tokens into lending pools. Billions of dollars of fiat-backed stablecoins are currently earning yield on DeFi lending protocols, and given the increasingly fragmented nature of DeFi, it will only become more difficult to track market-wide lending yields for tokens. Our CDY Indices help solve this problem by tracking the lending yields of the vast majority of total value locked (“TVL”) in DeFi lending protocols for a given token.

Historically, U.S. banks and brokers did not automatically sweep clients’ uninvested cash into yield-bearing instruments and return the yield to clients; instead, clients would have to opt into these programs themselves. Recently, equity brokerages have been competing by offering clients cash sweep programs, and some automatically opt-in offerings (see Fidelity’s Cash Management Account). In this model, brokers sweep uninvested client cash into money markets and pass yield (less fees) back to clients. With the release of Chainlink’s CDY Indexes, the DeFi market and crypto exchanges can easily replicate this model to offer yield for their clients via their stablecoin and other non-yield-generating digital asset holdings.

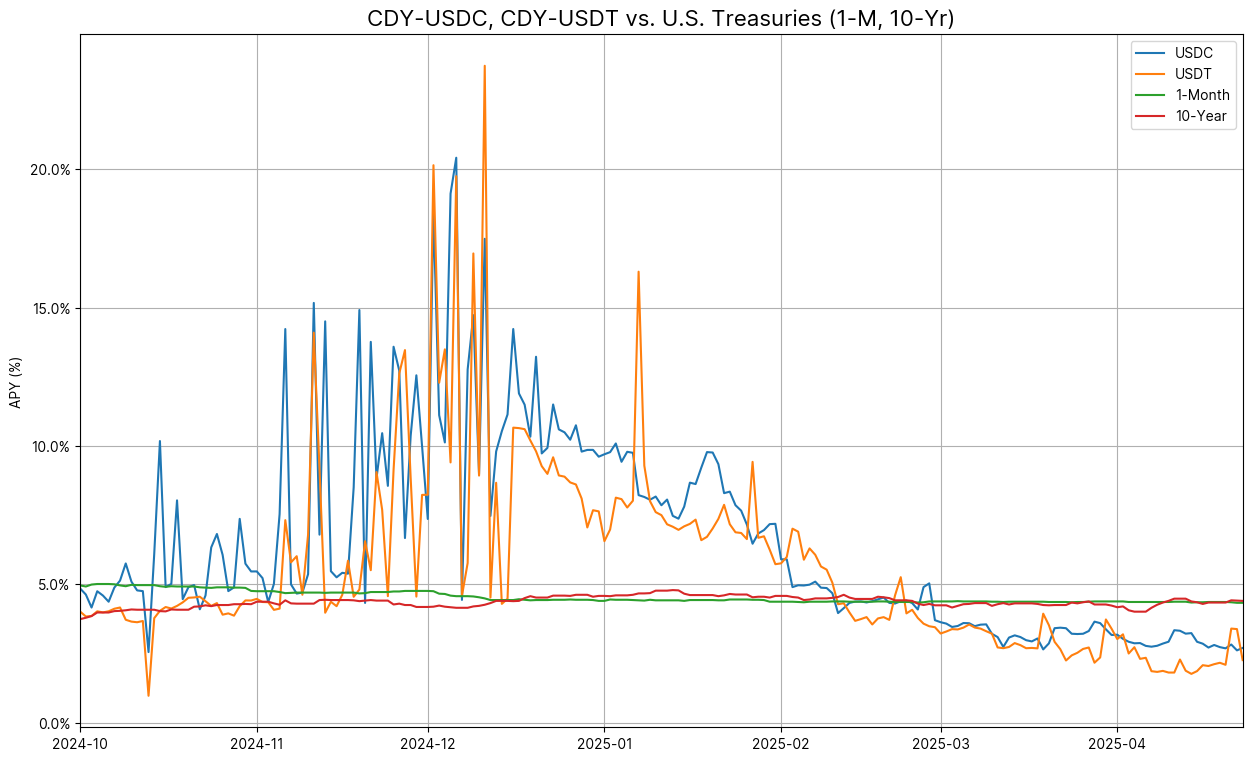

DeFi lending yields can be very dynamic and are not necessarily correlated with U.S. Treasuries; in fact, these yields can sometimes be several multiples higher than Treasury yields. The CDY Indices enable 1) users to capture opportunities that would otherwise not be transparent; 2) DeFi protocols to set competitive lending rates; 3) financial institutions to earn yield for their clients’ assets, 4) brokers to settle trades on a trusted lending rate, and 5) investment managers to set a benchmark return. The chart below shows the CDY-USDC and CDY-USDT indexes against U.S. Treasuries (1-Month, 10-Year) for the past two quarters.

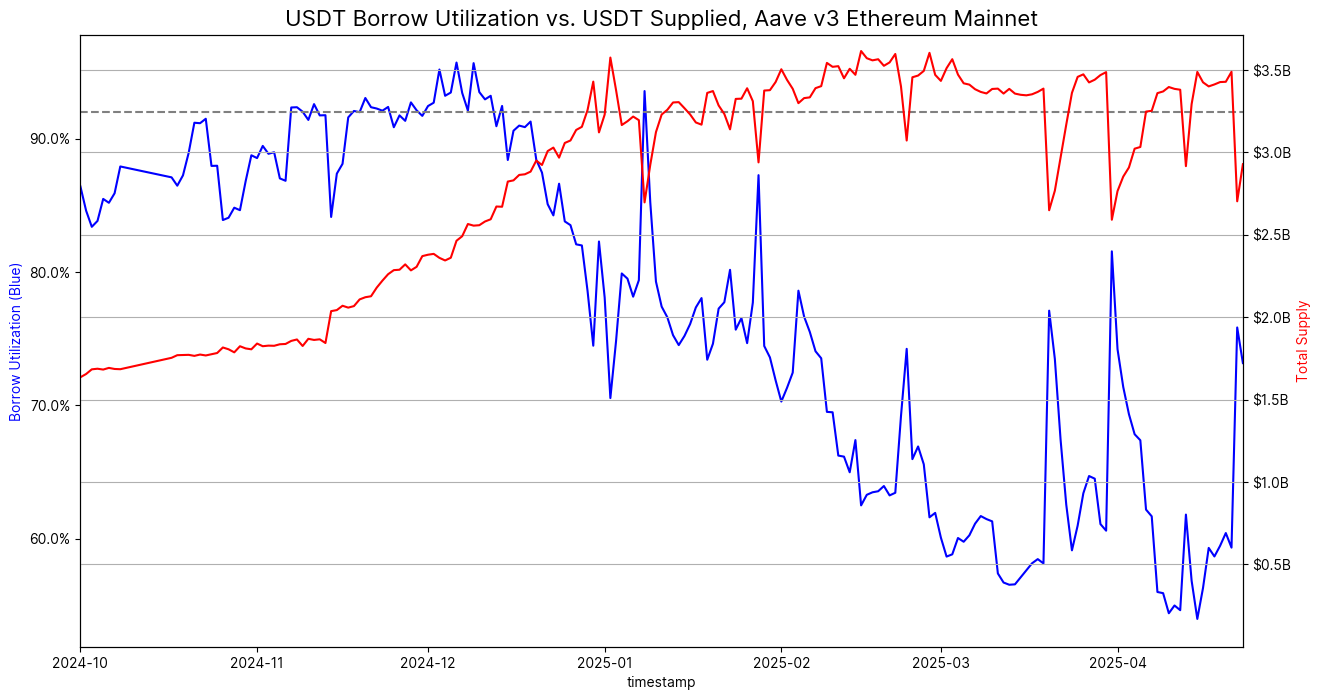

During market downturns, lending yields can become depressed as many borrowing positions are prone to liquidation (especially users who borrow stablecoins against crypto-native assets), and users become risk-averse. These downturns and liquidations can reduce the utilization of the borrowed tokens, thus lowering their lending yields—this is what happened in the first quarter this year. According to this dashboard, Aave v3 on Ethereum mainnet saw several large liquidations this quarter, including during the downturn in crypto markets on February 3, when \$169m in debt was liquidated (of which $122m was USDC and USDT). Interestingly, the lending supply of stablecoins ended somewhat flat over the quarter, implying suppliers have confidence in the robustness of stablecoins and lending protocols. The following chart plots USDT borrow utilization (blue) against supply (red) on Aave v3 on Ethereum mainnet. The dashed horizontal line represents optimal utilization for USDT on the protocol.

Requirements for Stablecoin Issuers

The proposed requirements for stablecoin issuers in both bills are extensive. Here we review the requirements laid out in Section 4 of the GENIUS Act where Chainlink’s ecosystem can provide value.

Let’s look at the first section (bold emphasis is ours):

(1) IN GENERAL.—Permitted payment stablecoin issuers shall—

(A) maintain reserves backing the outstanding payment stablecoins of the permitted payment stablecoin issuer on an at least 1 to 1 basis, with reserves comprising—

(i) United States coins and currency (including Federal reserve notes) or money standing to the credit of an account with a Federal Reserve Bank;

(ii) funds held as demand deposits … or insured shares at an insured depository institution … ;

(iii) Treasury bills, notes, or bonds … ;

(iv) repurchase agreements with the permitted payment stablecoin issuer acting as a seller of securities and with an overnight maturity that are backed by Treasury bills with a maturity of 93 days or less;

(v) reverse repurchase agreements with the permitted payment stablecoin issuer acting as a purchaser of securities and with an overnight maturity that are collateralized by Treasury notes, bills, or bonds on an overnight basis … ;

(vi) securities issued by an investment company … that operates as a money market fund … and that are invested solely in underlying assets described in clauses (i) through (iv);

(vii) any other similarly liquid federal government issued asset approved by the primary Federal payment stablecoin regulator … ;

(viii) any reserve described in clauses (i) through (vii) in tokenized form, provided that such reserves comply with all applicable laws and regulations;

Chainlink Proof of Reserve has the capability to verify and communicate that any of these assets are backing stablecoins. The interesting standout is (viii), which indicates that tokenized versions of these assets can act as reserves. In this scenario, Chainlink provides value in at least three ways:

- Data Feeds: Chainlink already provides price feeds for the largest stablecoins (i.e., tokenized cash), and its infrastructure is ready to provide prices from high-quality data sources for other qualified tokenized reserve assets.

- Proof of Reserve: Just as with stablecoins, Chainlink Proof of Reserve can verify the reserves of these tokenized assets.

- CCIP: Chainlink CCIP can help distribute the validation of tokenized reserves across multiple blockchains.

In a later section, the bill lays out monthly certification requirements:

(3) MONTHLY CERTIFICATION; EXAMINATION OF REPORTS BY REGISTERED PUBLIC ACCOUNTING FIRM.—

(A) … A permitted payment stablecoin issuer shall, each month, have the information disclosed in the previous month-end report required under paragraph (1)(D) examined by a registered public accounting firm.

Where paragraph (1)(D) is as follows:

(D) publish the monthly composition of the issuer’s reserves on the website of the issuer, containing—

(i) the total number of outstanding payment stablecoins issued by the issuer; and

(ii) the amount and composition of the reserves described under subparagraph (A).

These sections describe the fundamental information that provides the basis for trust in stablecoins; if the bill passes and these monthly certifications become required, onchain users will benefit knowing that Chainlink Proof of Reserve can verify and deliver the number of outstanding tokens issued as well as the amount and composition of the reserves backing those tokens. Chainlink Proof of Reserve provides smart contracts with the data needed to calculate the true collateralization of any onchain asset backed by offchain or cross-chain reserves.

The bill also lays out capital and liquidity requirements:

(4) CAPITAL, LIQUIDITY, AND RISK MANAGEMENT REQUIREMENTS.—

(A) … The primary Federal payment stablecoin regulators shall, jointly, or in the case of a State qualified payment stablecoin issuer, the State payment stablecoin regulator shall … issue—

(i) capital requirements applicable to permitted payment stablecoin issuers …

(ii) regulations implementing the liquidity standard under clause (i);

(iii) reserve asset diversification and interest rate risk management standards …

(iv) appropriate operational, compliance, and information technology risk management standards, including Bank Secrecy Act and sanctions compliance …

While it’s not clear if issuers will be required to publish their capital levels and rate duration risk, Chainlink Proof of Reserve can deliver that information onchain (in addition to their respective requirements) if it becomes available.

While it’s difficult to predict the impact of this bill, stablecoin holders (and crypto participants in general) in the future may pay more attention to an issuer’s adherence to regulations instead of simply assessing the issuer’s reserves against outstanding tokens. This is somewhat analogous to the banking sector, where a bank may be solvent but not compliant with regulatory capital ratios, requiring the bank to pay some form of penalty, or at worst, be forced to close; so investors tend to pay more attention to a bank’s regulatory ratios than pure solvency measures.

Insolvency Proceedings

While adherence to regulatory requirements may become the new barometer of safety for stablecoin holders, it is still essential to examine insolvency scenarios. Circle’s recent S-1 reveals some uncertainty where other creditors (not including stablecoin holders) could potentially claim reserves in an issuer’s bankruptcy if the court doesn’t recognize the stablecoin holders’ beneficial ownership.

… it is possible that a U.S. court, in the case of USDC, or a French court, in the case of EURC, could instead determine that the reserve assets backing USDC and EURC, respectively, are property of our bankruptcy estate. If this were to happen, other creditors of Circle may be able to obtain recoveries from the underlying reserve assets and holders of Circle stablecoins could be treated as general unsecured creditors of Circle, which could result in Circle stablecoin holders receiving only partial recoveries rather than the full purported value of their stablecoin holdings.

The STABLE Act does not explicitly have a provision related to the priority of stablecoin holder claims in insolvency proceedings. By contrast, Section 10 of the GENIUS Act appears to directly address the uncertainty brought up by Circle’s S-1 and is designed to ensure that stablecoin holders have a very high priority claim on reserves. See the excerpt below (bold emphasis ours):

In any insolvency proceeding of a permitted payment stablecoin issuer under Federal or State law, including any proceeding under title 11, United States Code, and any insolvency proceeding administered by a State payment stablecoin regulator with respect to a permitted payment stablecoin issuer, the claim of a person holding payment stablecoins issued by the permitted payment stablecoin issuer shall have priority over the claims of the permitted payment stablecoin issuer and any other creditor of the permitted payment stablecoin issuer, with respect to required payment stablecoin reserves …. if a payment stablecoin holder is not able to redeem all outstanding payment stablecoin claims from required payment stablecoin reserves … , any remaining claim of a person holding a payment stablecoin … shall have first priority over any other claim, including over any expenses and claims that have priority under that subsection ….

So under this law, not only would stablecoin holders have priority over other claims, but they would also have first priority in the scenario that the holders cannot redeem all claims from the required reserves. In this context, at first glance it may not seem imperative to deliver an issuer’s creditors or capital structure onchain since stablecoin holders appear well protected, but given that recovering assets in a bankruptcy proceeding may experience very prolonged delays, stablecoin holders would likely be interested in capital structure data, if available, through Chainlink Proof of Reserve.

Interoperability

While brief, Section 11 in the GENIUS Act discusses interoperability standards (bold emphasis is ours).

SEC. 11. INTEROPERABILITY STANDARDS.

The primary Federal payment stablecoin regulators … prescribe standards for permitted payment stablecoin issuers to promote compatibility and interoperability with—

(1) other permitted payment stablecoin issuers; and

(2) the broader digital finance ecosystem, including accepted communications protocols and blockchains, permissioned or public.

The second clause, which is not in the STABLE Act, encourages stablecoin issuers to enable interoperability across both public and permissioned chains. Chainlink CCIP is a blockchain interoperability protocol that enables developers to build secure applications that can transfer tokens, messages (data), or both tokens and messages across chains. Given the inherent risks of cross-chain interoperability, CCIP features defense-in-depth security and is powered by Chainlink oracle networks which have a proven track record of enabling trillions of dollars in onchain transaction value. CCIP can help stablecoin issuers adhere to the standards set by regulators to ensure interoperability of payment stablecoins across different protocols and networks.

Conclusion

With significant regulatory frameworks for stablecoins emerging, potentially reshaping both traditional and decentralized financial landscapes, the proposed law will have profound implications for stablecoin issuers, users, and DeFi protocols. Chainlink is uniquely positioned to provide crucial infrastructure and services in this evolving environment. Through its Data Feeds and Proof of Reserve, Chainlink offers transparency and validation of stablecoin reserves and the potential inclusion of tokenized assets as reserves. The Chainlink DeFi Yield Indices address the issue of yield generation in a regulatory environment that prohibits issuer-provided yields, offering valuable insights into DeFi lending markets. Additionally, Chainlink CCIP can facilitate the necessary interoperability across various blockchains as mandated by regulatory standards.

Chainlink’s ecosystem ensures stablecoins remain reliable, transparent, and compliant, reinforcing trust and stability in the digital asset ecosystem as regulatory clarity increases.

Reach Out to Our Team of Experts

To find out how your organization can benefit from using the Chainlink standard, reach out to our team of experts.

This post is for informational purposes only and contains statements about the future. There can be no assurance that actual results will not differ materially from those expressed in these statements, although we believe them to be based on reasonable assumptions. All statements are valid only as of the date first posted. These statements may not reflect future developments due to user feedback or later events and we may not update this post in response.