Chainlink in 2025: The Final Stage of Blockchain Adoption Is Underway

In a recent interview, Chainlink Co-Founder Sergey Nazarov discussed the Chainlink community’s achievements in 2024 and articulated his outlook for Chainlink and the overall adoption of the blockchain industry in 2025. This post is based on his interview.

Chainlink’s 2024 Milestones in DeFi and Capital Markets

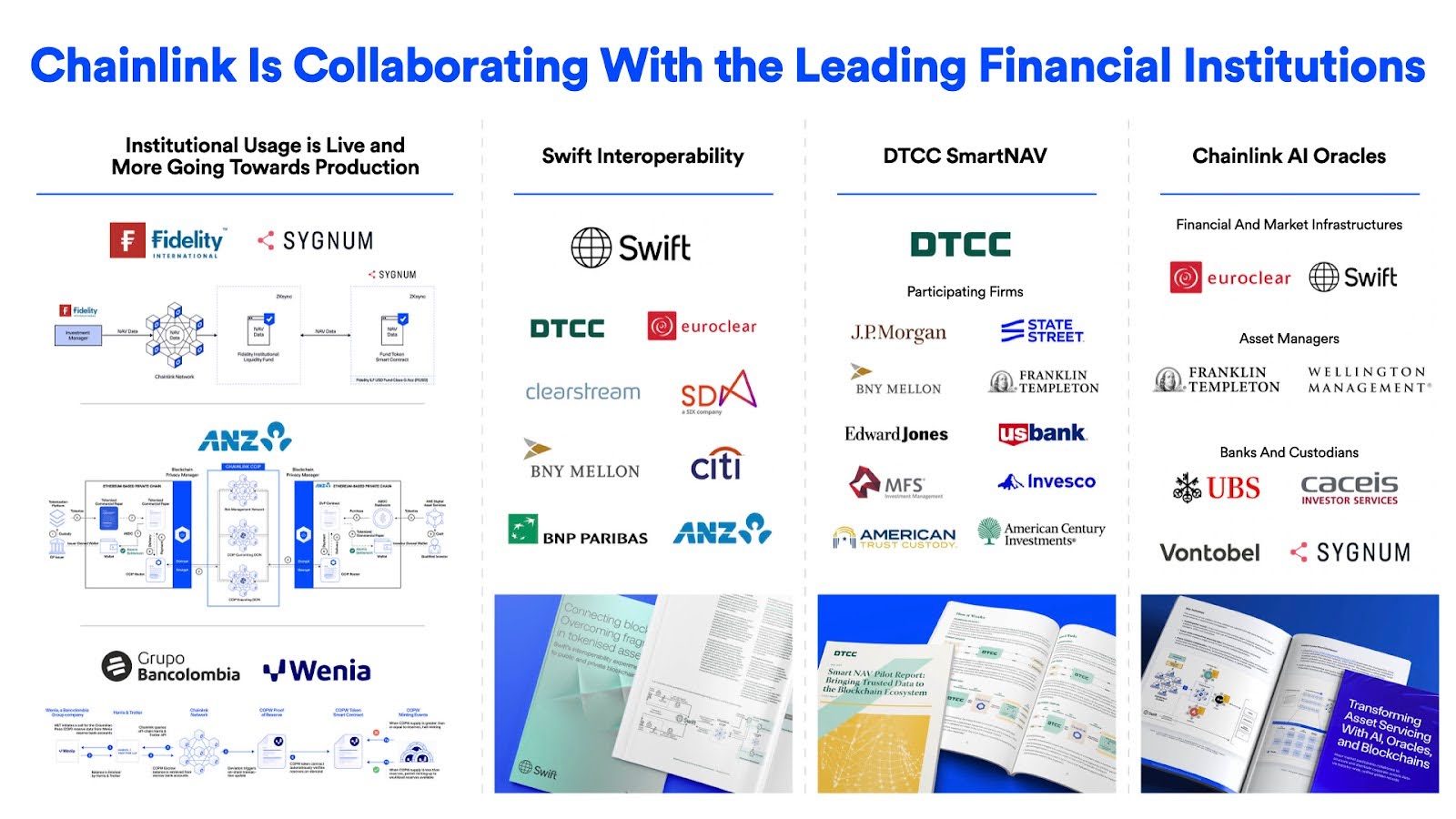

2024 was a pivotal year for the crypto industry, and specifically for the Chainlink community. We continued to solidify our lead in powering the majority of DeFi. We also saw a huge amount of adoption in the capital markets. This adoption is starting to form the future of our industry, given the amount of value that exists within the traditional capital markets. That value can’t be found anywhere else, and it’s the source of capital that’s going to allow our industry to grow to the next stage.

This reality is already becoming evident through the issuance of tokenized funds, but it’s going to go far beyond that. 2024 was a pivotal year in which multiple central banks and governments started working with Chainlink in various dimensions to build a global financial system that runs on the Chainlink standard. The value of the Chainlink standard for the global financial system is that it creates highly reliable agreements and transactions that are fundamentally better than what currently exists.

The financial system, however, is already built on a set of existing technologies, and those technologies won’t be going away because banks and asset managers heavily rely on them. Instead, we must seamlessly integrate these existing technologies with onchain systems.

The challenge in 2025 will be continuing to build what the DeFi community needs so the market share and adoption of Chainlink in the public chain DeFi community continues to grow—as it has been over the last years—as well as to remain highly secure and reliable, as we have for the 5+ years that Chainlink has been live in production. At the end of the day, the DeFi community will remain the hotbed of innovation, where there exists lots of new, permissionlessly created forms of yield, financial products, methods of managing risk, and more. DeFi will continue to be where the world’s financial innovation comes from.

In parallel, there will continue to be a very large capital markets community of asset managers, banks, and financial market infrastructures that are regulated in ways that make them comfortable with depositing their assets into this new onchain financial system. Expanding into the capital markets is the next stage in the growth trajectory of Chainlink. This expansion involves the Chainlink standard defining how onchain transactions for capital markets work in a technical way, which allows capital markets participants to transact both with each other and with the DeFi community onchain.

The Convergence of DeFi and Capital Markets

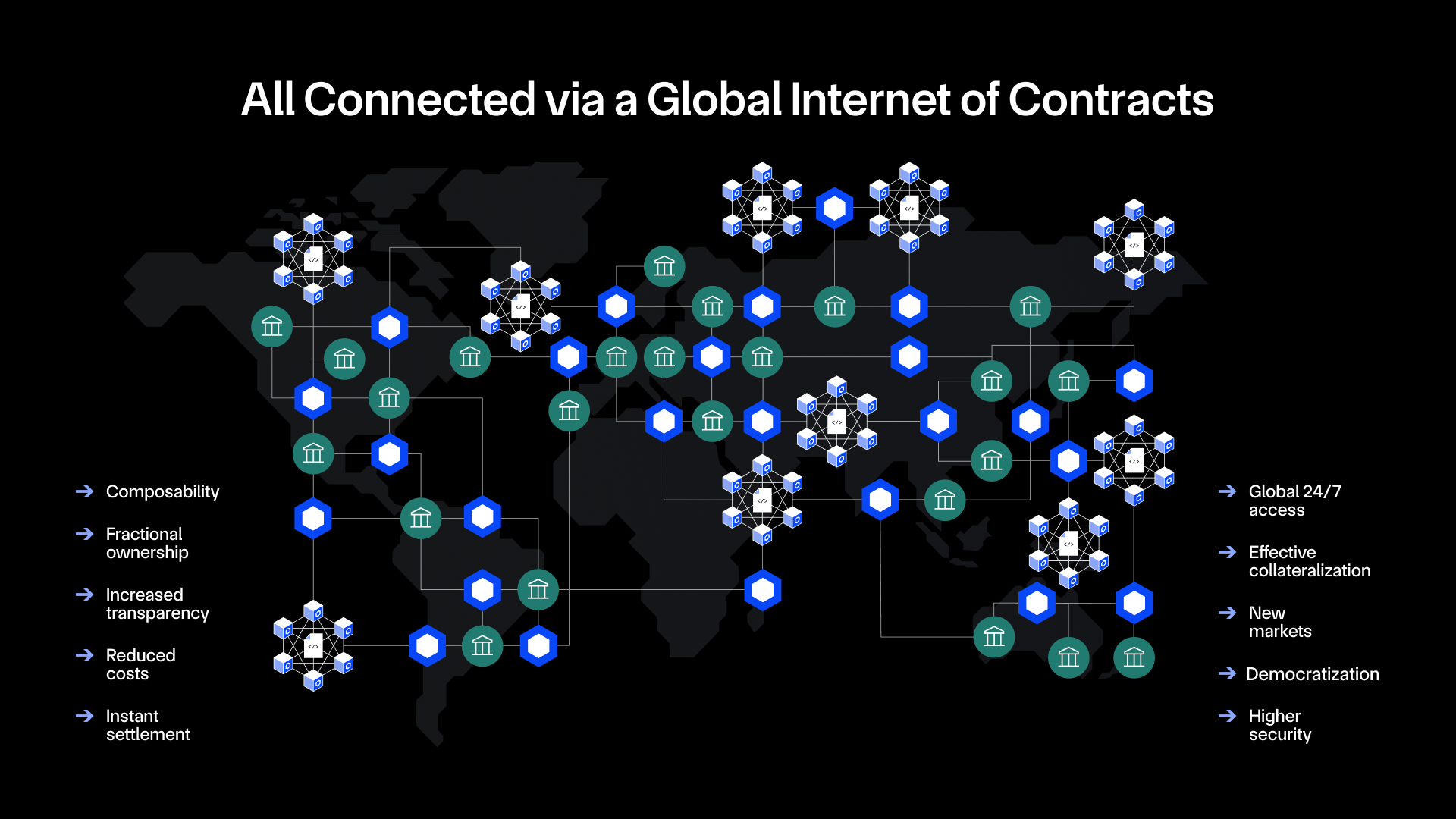

Eventually, we’ll see the highly regulated institutions and the DeFi community merge into a single Internet of Contracts. This was well underway in 2024 and will only continue to accelerate in 2025.

The regulatory environment in the US should massively accelerate the adoption of blockchain technology. It’s now very clearly aligned with our industry’s goals of creating a highly transparent and interoperable global Internet of Contracts. This is where I see our industry going now—becoming the way that financial transactions occur both inside the US and globally.

What the Chainlink community needs to continue to do in the coming years is work with the existing systems, standards, and legal systems to define how to technically implement this new global financial system. We’re already very well on our way, thanks to our great work as a community in previous years. 2025 is going to be the year where we’re going to see a lot of that great work come to fruition with very valuable, high-end, high-quality institutional use cases.

At the same time, I see DeFi realizing that the institutional world understands the value of onchain applications, and has high-quality assets and established consumer brands that they can bring onchain. Their assets will diversify the risk of DeFi and provide access to various forms of collateral that DeFi historically hasn’t had access to, which should create more yield and various other exciting opportunities for these assets. These two groups—DeFi and the institutional world—are inevitably destined to work together to create the Internet of Contracts.

Similarly to how, in the early days of the Internet, there were big companies and innovative startups sharing data with each other, now there is a global set of standards that are accepted across jurisdictions and legal systems as the reliable way to define transactions. These transaction standards allow value and information to be sent across chains, provide identity and various other forms of data onchain, and enable the interconnected web of systems and participants that allow different categories of counterparties and users to interact with each other.

This means that whether you’re a retail consumer or one of the largest institutions on Earth, the system should be able to meet your requirements. It should allow you to easily put value into the system as a consumer or institution and efficiently create interactions between these two groups in a way that reduces risk and creates returns for both.

This is fundamentally what the financial system should be doing, and it should do it with less risk and fewer systemic financial issues. This is where we’re going after we get past creating all the blockchain, smart contract, and oracle network adoption in the capital markets community. The next stage will be government adoption of blockchains. This is going to be the next and final stage of blockchain adoption, which the Chainlink community is now in the process of setting up in 2025.

Towards the Final Stage of Blockchain Adoption

Pre-2025 were the years when Chainlink captured the DeFi ecosystem, the blockchain gaming ecosystem, and many key blockchain use cases by being the most secure and reliable infrastructure that allows those use cases to work. Chainlink also entered the capital markets industry—and by making the most secure way to transact, send value and data, and prove things like identity, we were able to capture an outsized portion of that initial market share.

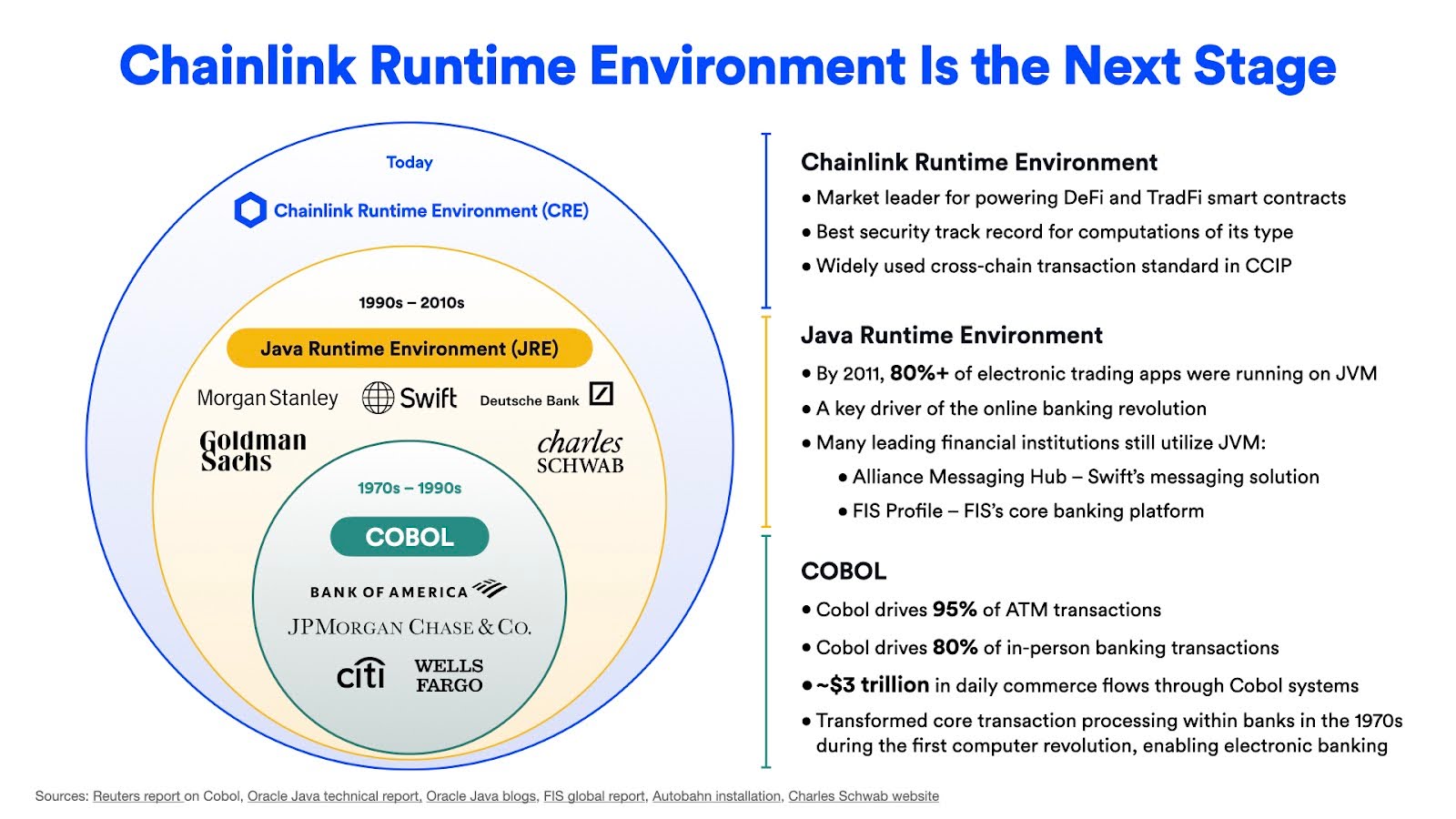

In 2025, we need to rapidly capture the capital markets opportunity, as we already have been, but even more rapidly as that opportunity is now growing. We need to set Chainlink up to be the global standard for the DeFi startup community, the capital markets community, and the governments of the world as the way that their central banks and information transfer systems operate. All of those systems will be operating onchain, and all of those systems will need data, identity, connectivity, and all the other services that Chainlink will provide through the Chainlink Runtime Environment (CRE).

Last year was also a pivotal year for the evolution of the Chainlink platform, with CRE introduced at SmartCon. It was launched in early access and we’ve been consulting with various user groups to understand exactly what CRE should provide for the blockchain community. 2025 is on track to be the year that CRE goes into general access and becomes more available to a larger user group. That’s what we and the community are working towards.

If you have all of the data connected with the systems where people want to use the data; if you’re the way that all of the existing systems interact with the new systems; and if you have the methodology for coordinating all of these complex old and new system interactions, then such a system is in a key position to shape how the world works. That is what Chainlink is moving towards.

We already have the data connections. We’re already the most reliable and widely accepted source of data into blockchains. Now, we’re becoming the most reliable and secure method of cross-chain transactions. Next, we are providing more and more information from an identity point of view. Then, with the appearance of CRE, we can efficiently coordinate all of these key building blocks into a single application or into a single transaction that is so complex that any other system just won’t be able to do it.

The transactions in the blockchain world so far have been relatively simple. My private key signs an address. It sends a transaction from an address that sends tokens to your address, either on a chain or across a chain. Maybe there’s a little bit of data that’s necessary from a price point of view. However, the transactions that are now going to happen in this more advanced world are going to be extremely complex, with many different stages requiring many pieces of data: market data, reference data, identity data, connectivity—not just on one chain, but across multiple other chains—as well as integration and interaction with multiple external existing traditional systems.

The ability to solve the complexity of this end-to-end interaction between data, identity, and legacy systems will allow complex transactions to come into existence. If these complex transactions don’t emerge, the blockchain industry won’t move forward. Everybody in the world now wants our industry to move forward, including the US and many other global governments.

We’re in a unique position where Chainlink is the only set of standards that can, in one system, solve these problems and make these complex transactions work. It’s continuing to expand what’s possible with onchain transactions, starting with the highly financial nature of how blockchains and oracle networks interact, but then moving on to all the other use cases where data, connectivity, identity, and all these other key factors for using blockchains are critical—which are the vast majority of use cases.

2025 is the year when capital markets adoption really starts to take off, and government and central bank adoption starts to take on a new trajectory. We are starting to create the foundation that can support the final stage of blockchain adoption. If it began with startups and has now progressed to banks, it’s going to end where all large economic, financial, and technical trends end—governmental endorsement and adoption.

We’re now in the middle stage of that trajectory and it’s starting to accelerate. We as an industry will eventually reach the final stage of government adoption in the next few years, where blockchains, oracle networks, and smart contracts are ubiquitous. They will secure all the value, transmit all the data, and reliably prove all the identity requirements that are needed for people to transact and interact with each other.

This is the world we’re moving towards, and 2025 is going to be a pivotal year. I’m very excited and looking forward to doing it together with all of you.

To learn more about Chainlink, visit chain.link, subscribe to the Chainlink newsletter, and follow Chainlink on X, LinkedIn, and YouTube.