Building Trust in AI Agentic Workflows

This is a guest post from Laurence Moroney, Chainlink Advisor and former AI Lead at Google.

AI agents have become the hottest topic in artificial intelligence. The goal—to enhance workflows with processes that are intelligent, reflective, and semi-autonomous.

The opportunity to take agents to the next level by using blockchain technologies is immediate and obvious.

In this article, we’ll take a look at how one can do this through a simple scenario, where an agentic workflow between a financial advisor and their client is enhanced using blockchain, oracles, and zero-knowledge proofs.

Trust in Finance

In the world of financial advising, trust is the foundation of every successful client relationship. Yet the methodologies for earning trust are largely social and time-consuming.

Additionally, traditional financial advisory models face persistent challenges: clients must trust that their advisors are acting in their best interest, while advisors need to protect proprietary data and methodologies.

What if there was a better way? A system where clients could verify their advisor’s claims without seeing sensitive data, where recommendations could be proven optimal without revealing proprietary strategies, and where an intelligent agent could facilitate the entire process?

The Scenario

Sarah, a financial advisor at Acme Wealth Management, has developed sophisticated models for retirement planning. She meets with her client, Michael, who wants to ensure he’s on track for retirement in 15 years.

Sarah has access to:

- Proprietary market analysis and investment algorithms

- Performance data from similar client portfolios

- Risk assessment frameworks that her firm has developed

- Historical returns for various investment strategies

Michael needs to:

- Trust that Sarah’s recommendations are in his best interest, not just generating fees

- Verify that the expected returns are realistic and based on sound data

- Understand how his personal information is being used

- Be confident that Sarah’s firm isn’t hiding relevant information

The traditional solution relies almost entirely on trust, reputation, and regulatory oversight—all important but imperfect, expensive, and time-consuming.

Let’s explore how a blockchain-enhanced agentic AI approach can improve this.

Tools for a Solution

While solutions for a system like that where Sarah advises Michael are commonplace, let’s explore how blockchain technologies can be used to transform the relationship.

- Verifiable Credentials: Sarah’s qualifications, certifications, and track record can be stored as immutable, verifiable credentials on a blockchain. Michael can independently verify this. By exploring her expertise, education, and performance history, he can have more peace of mind than he would by relying solely on her firm’s marketing materials.

- Trusted Market Data Through Oracles: Financial models are only as good as their inputs, and typically Michael would only see assertions about the results in printed literature. By using Chainlink oracles, Sarah’s recommendations can incorporate verifiably accurate, real-time data from multiple sources such as:

- Market indices and benchmarks

- Economic indicators

- Interest rates and inflation details

- Commodity prices

- Exchange rates

As such, Michael can trust the recommendations as they are based on current, accurate, verifiable market conditions without being beholden to a single, particular data provider.

- Zero-Knowledge Proofs (ZKPs) for Private Data Analysis: The most powerful application perhaps comes from ZKPs, which allow one party to prove the truth of something without revealing the underlying information. For example, Sarah could:

- Prove her investment recommendations match Michael’s risk profile without revealing any proprietary algorithms or analysis

- Demonstrate that her strategy has historically outperformed benchmarks without revealing her other clients’ specific details

- Show that her fee structure is competitive

- Verify that her projections for Michael’s portfolio are mathematically sound without exposing confidential algorithms or systems

- Smart Contracts for Agreement Terms: The transactional nature of this relationship is perfect for smart contracts to build an automated, friction-free, fast system to run. For example:

- Automatic execution of any recommendations once agreed upon

- Calculation of fees can be transparent and instantly triggered

- Predefined conditions for portfolio rebalancing can be automated

- Clear triggers for alerts or interventions

- Using AI as the Intermediary: With all the additional trust baked into the system through blockchain technologies, an AI agent can now tie the ecosystem together, serving as the interface between Sarah, Michael, and the entire blockchain infrastructure:

- It can be queried by Michael to understand the complex financial arrangements

- It can help Sarah generate ZKPs for her recommendations

- It can monitor smart contracts and oracle data feeds to inform and alert all parties as relevant

- It can maintain the verifiable record of any and all interactions and communications (and can store these onchain)

Exploring How This System Would Work

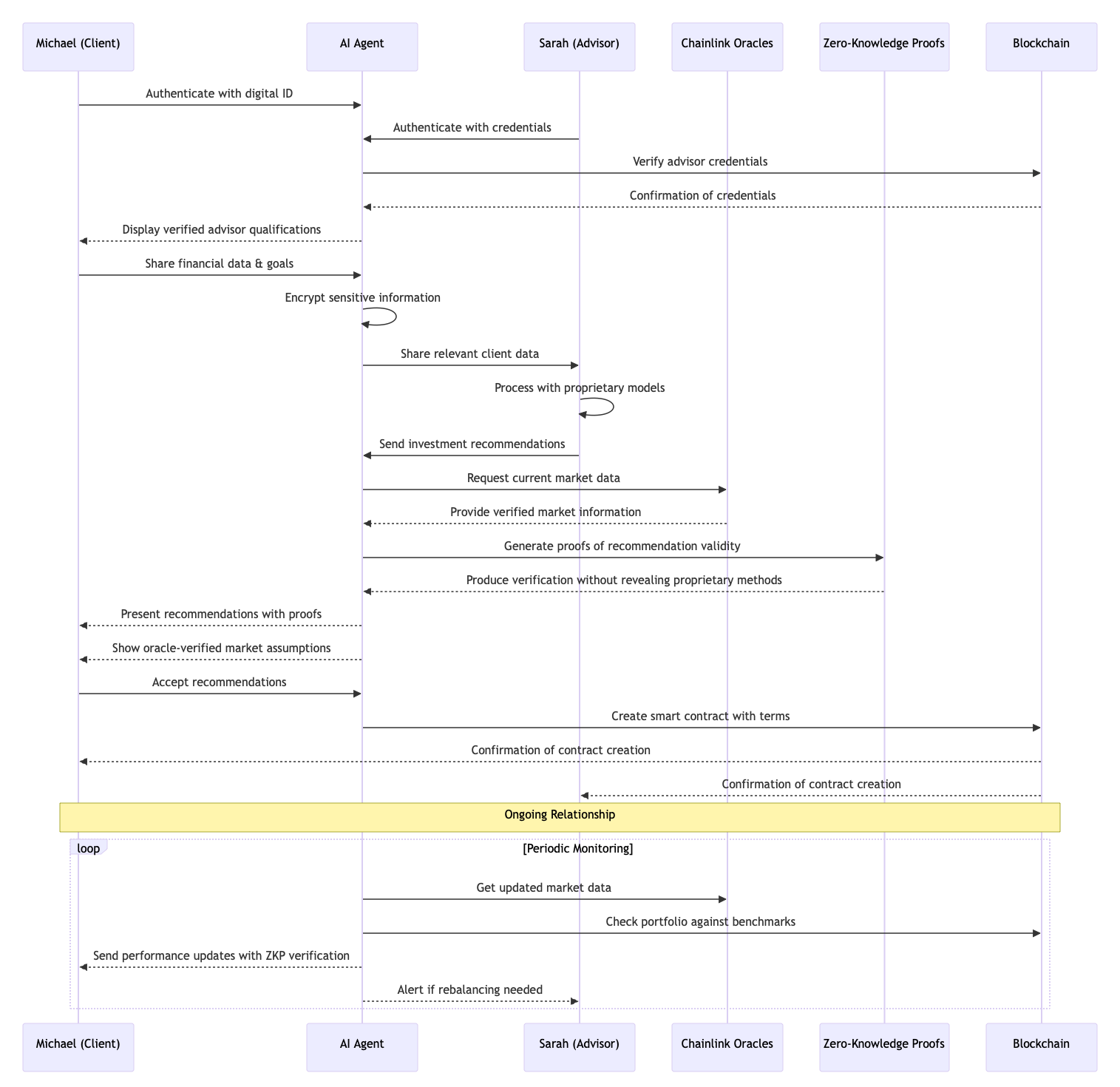

The detailed workflow of the interaction between Michael and Sarah, enhanced by an AI agent with blockchain technology, is shown in Figure 1.

The relationship generally follows seven steps.

Step 1: Introduction and Authentication

Michael and Sarah check that the agent is as expected, and verify its identity using its blockchain ID. They both authenticate to the AI agent using their blockchain identities. At this point, Michael can instantly verify Sarah’s details to see if he wants to hire her for her services.

Step 2: Information Sharing

Michael decides to engage Sarah’s services, so he shares his financial information with her AI agent. It will encrypt sensitive details and interpret and parse the data to decide which parts are available for analysis. This greatly reduces the cognitive load on Sarah, allowing her to focus on the important parts.

Step 3: Analysis

Sarah has a number of proprietary models that she uses for the analysis of Michael’s portfolio. Her agent assists her in generating ZKPs from her conclusions. These ZKPs could do things like:

- Verify that she used Michael’s correct information

- Confirm that the calculations follow mathematically sound principles

- Prove that her recommendations align with Michael’s stated goals and aren’t just selling products from her company

Step 4: Prediction and Verification

With her analysis of Michael’s portfolio complete, Sarah now turns to recommendation generation. With the help of the agent and her suite of financial models, she can now pull verified, accurate market and other data with the use of Chainlink oracles. This will allow her (once her recommendations are complete) to demonstrate that she used current, accurate, and verifiable information in creating her recommendations.

Step 5: Recommendation Presentation

Sarah can now present her recommendations. For each element of her financial strategy, she can provide:

- Verification end-to-end that it is optimal given Michael’s targets

- Proof that her assertions of similar strategies have performed as she claims

- Confirmation that her fees are being used appropriately

- Verification of the models that she used without revealing proprietary information

Step 6: Agreement and Implementation

After negotiation and tweaking of the plan, Michael is satisfied, and he approves. A smart contract can then encode the agreement terms, which also sets up automatic execution and monitoring of the portfolio, and that agreement goals are being met.

Step 7: Ongoing Relationship

The agent can continually monitor portfolio performance on their behalf. Desired, trusted, benchmarks can be pulled from Chainlink oracles, and can alert both parties as necessary. For example, rebalancing of portfolios can often incur a large capital gains tax hit for Michael, and optimal times to reduce this through wash sales could be triggered from real-time market data.

—

A system like this has clear benefits for the client (Michael), giving him greater confidence in Sarah and the system she employs to help him. He can verify any claims without needing advanced financial knowledge, can be comforted by a reduced risk of conflicts of interest, and, importantly—has a clear, immutable record of all advice received and actions taken.

Similarly, for Sarah—she can protect her proprietary methods and data, demonstrate her expertise through verifiable means, differentiate from her competitors through provable performance, and ultimately build better relationships with her customers and grow her customer base.

For the industry as a whole, compliance costs can be reduced because of automated verification. The enhanced transparency is a massive boost, in particular as it doesn’t compromise confidentiality.

Conclusion

The above system, integrating AI, blockchain technology, and oracles in a financial advisory situation is clearly beneficial and bleeding-edge. All of the pieces are available today. Financial firms that would embrace this model would likely gain significant competitive advantages and could revolutionize the advisory business. While this scenario was for private financial planning, it’s easy to see how it could be seamlessly adapted for B2B scenarios.

The future of financial planning and advising isn’t just about better investment strategies—it’s also about creating and enhancing relationships through verifiable trust. Technology such as blockchain is the key to this. When it’s combined with artificially intelligent agents, a new revolution in how business is done more efficiently is at hand!