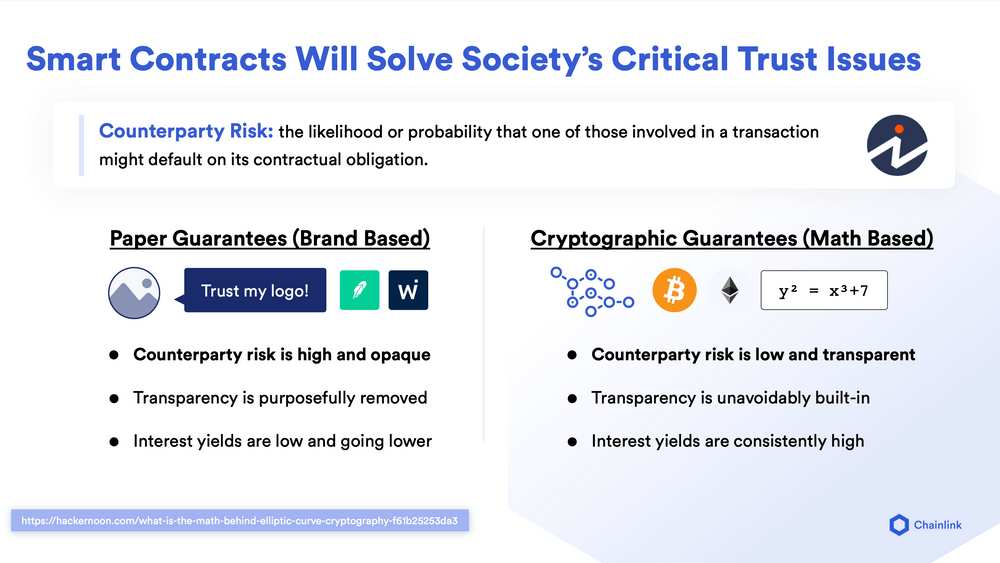

Brand-Based vs. Math-Based Agreements

Today, the relationships that most people have with existing institutions are brand-based agreements—paper promises that require you to trust an organization to follow through on their obligations because of their reputation alone. Brand-based agreements always face counterparty risk, the probability that one party in a transaction will default on its contractual obligations. With smart contracts, a new form of agreement has emerged—math-based agreements, which use cryptography and immutable software logic to automatically settle agreements according to the contract’s parameters. The trustless nature of math-based agreements means people no longer have to rely on other parties to uphold their obligations, as the contract will invariably enforce cooperation according to its predefined terms.

With brand-based agreements, large organizations are sometimes financially incentivized to violate their contractual obligations if there’s no long-term detrimental impact to their reputation (see the economics of dishonest insurance companies). When large institutions do not follow through on their word, everyday people have no reasonable recourse, as legally pursuing large entities is costly and inefficient. Math-based agreements are now empowering common people to expect end-to-end transparency and automation around their financial transactions, especially in emerging markets where large institutions are more likely to default on their obligations since regulatory law is not well-established.

In a recent Real Vision podcast, Oracles and the Expansion of Blockchain Utility, Chainlink Co-founder Sergey Nazarov discussed brand-based and math-based contracts. This blog post is an excerpt of Sergey Nazarov’s talk, highlighting how blockchains and Chainlink oracles can help reduce counterparty risk and enable a future of fair, transparent, and efficient digital agreements.

The Problem With Brand-Based Contracts

Smart contracts, in the simplest terms, from a user’s point of view, are math-based contractual agreements. I think the way to contrast them is to think about brand-based contractual agreements. This will highlight the notion and utility of something called “tamper-proofness,” because a lot of the time, blockchains are explained in these technical parameters of tamper-proofness and reliability, and censorship-resistance and immutability, and these concepts don’t always transfer over to use cases.

What we need is an understanding of the contrast between how the world works today and how the world will work with math-based agreements. The thing that people maybe don’t think about so much, because it seems to be working, or it works in certain cases and so is good enough, is that the agreements they have around their bank accounts, their assets, financial instruments, are really brand-based agreements.

What brand-based agreements are is a logo—there’s a logo on a building somewhere, just like in the Wild West. The biggest building was the bank with the pillars, and everybody would put their money in the bank with the pillars, because it was the nicest and most impressive building, even more so than the church. That was the brand-based guarantee that the bank gave you in that kind of gold mining town. For the past hundreds, maybe even thousands of years, things haven’t really changed much for brand-based guarantees.

“I have a logo. My logo represents an institution or an entity. My institution or entity has been around for X amount of years, and I guarantee to you, on paper—on a paper document—that my relationship with you is such that your assets or your financial product or the value you hold in my institution is within your control. You will be able to access it. You will be able to buy and sell financial products. You will have a savings account that you will always be able to access. All the money in your savings account you can always access. All the money in a trading account you can always trade, and you can always liquidate it whenever you want.” All these types of guarantees are foundationally based on a logo. They’re based on the institutional promise that, “I have existed for a long time. I will continue to exist. I’m guaranteeing to you that this relationship that I manage for your value that you hold with me will function in a certain way.” And so those are brand-based agreements.

The Benefits of Math-Based Agreements

Now, what math-based agreements do is they basically say, “There’s no brand. There’s no thing that has existed for hundreds of years, that promises you things will work a certain way in a paper document. There is just math.” So there’s cryptography and mathematics that guarantee, at the level of physics and mathematics, that you have a certain relationship with a certain asset, certain financial product, or certain contract.

So what does that mean? Let’s take Bitcoin as an example. The relationship that a user has to a Bitcoin, regardless of the value of a Bitcoin, regardless of the value that a Bitcoin attains within the global market, is that they have something called a private key. So they have a cryptographically enforced way to sign and to mathematically prove that they have, and only they have, control over this digital good housed in this network of thousands of computers.

I’ll give you an example of where this really starts to make sense. If you look at the debt crisis that there was in Greece a few years ago, you saw people only being able to withdraw 66 Euros per entity and per person from an ATM. So whether you had a business as an entity, or you were an individual, you could only withdraw 66 Euros. You have similar situations in certain countries where things aren’t going as well as they could be, and you have ATMs and bank controls being locked up.

What you also see, in all those geographies, is Bitcoin wallet registration numbers growing by 300%, 400%, 600%, because people basically realized that their relationship with a certain asset was not what they thought. They thought their relationship was very deterministic. It was very direct. It was on the level of physics, and a certain amount of surety and guarantees. And what the reality is—it’s very different.

It’s like insurance policies. People don’t know what’s in their insurance policy. Realistically, people that rely on brand-based agreements to underpin their relationship with their assets have that same level of counterparty understanding. People are universally surprised when something goes wrong in a country, and the ATMs get locked up, and they shift to Bitcoin. The reason they shift to Bitcoin is it doesn’t matter if you have a billion dollars in Bitcoin. If you have that private key, if you have the mathematical proof in your hand to move that asset, there is no way that that can’t happen short of physics and mathematics starting to work differently.

And so this is the unique difference between brand-based and math-based guarantees. This difference actually goes much, much further than people think, and part of the reason that this difference is underappreciated is because—well, basically, while everything’s working, everything’s fine. That’s basically how the global financial system works. Everything’s working, so everything’s fine, and you don’t really need significant improvement for your assessment of counterparty risk, for your management of counterparty risk, because everything’s working. I can access my assets. I can liquidate them. I can do whatever I need to do with them.

Moving Towards a World of Math-Based Agreements

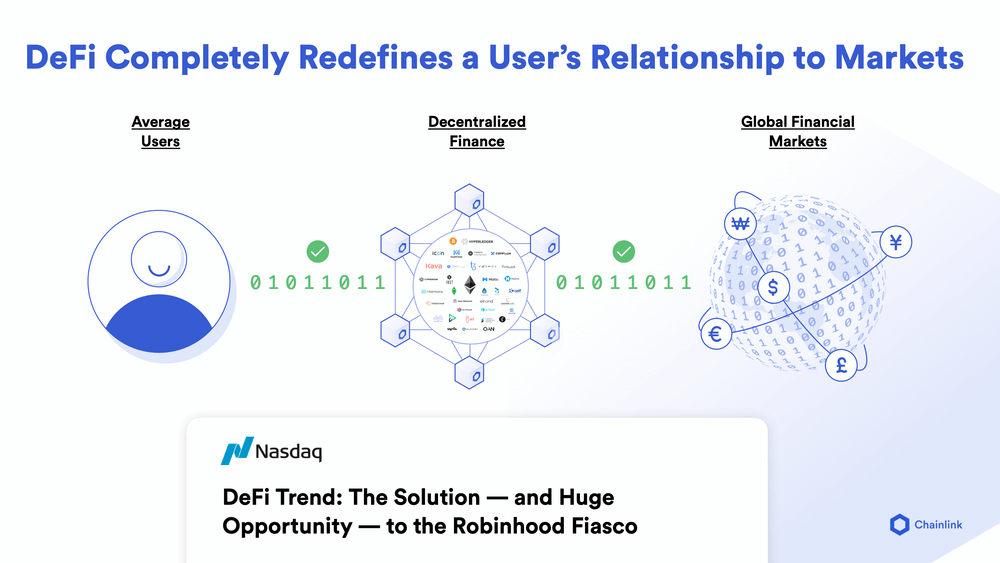

Let’s say there’s an unfortunate possibility that the global financial system is now in a direction where its underlying solvency and its underlying assumptions might result in certain issues where assets can’t be accessed. Counterparty risk becomes apparent in how faulty it is as a way to hold value, or hold assets. This is where the uniqueness of math-based agreements, even in their simplest form come in. Bitcoin is the simplest form of a math-based agreement. It’s the first one and the most adopted one. But it is by no means the only one. There are many, many other forms of math-based contractual agreements that have taken the form of other tokens. Now they’re starting to take the form of DeFi—decentralized financial products. But what they all fundamentally have is this level of control and this level of transparency and counterparty risk assessment and mitigation that traditional financial markets don’t have.

I think there’s a very important difference there that’s going to become more and more appreciated as the problem of underlying solvency surfaces. As the transparency of these smart contracts that work in these DeFi products begins to get valued, you also see people composing them in very useful ways. So fundamentally, from a user’s point of view, it’s a math-based contractual agreement. From a technological point of view, it’s basically a piece of code that represents an asset, or represents ownership, or represents a financial product, but this piece of code operates in a system of computers beyond the control of any one party. It’s beyond the control of the person holding the value. It’s beyond the control of somebody who’d want them to stop from liquidating their value, or controlling their value—and that’s the uniqueness of it.

Then because you’ve now taken contractual agreements, financial products, and ownership, and you’ve turned it into little pieces of code, now you can have many, many smart people building all kinds of configurations of those pieces of code, and that involves creating an ecosystem—which is what Chainlink is involved in. Once you create that ecosystem of people being able to combine these math-based contracts in the forms of pieces of code, you start to see an explosion of new financial products and assets, just like you saw an explosion of what internet companies could do.

Because once internet companies could compose little individual pieces of code into chains of code that interact with one another in meaningful, new ways, you saw e-commerce, you saw Uber, you saw all these other kinds of innovations that were really the composition of other pieces of code put together in unique ways. So you’ll, on the one hand, get a system that gives people an ability to properly manage counterparty risk. And on the other hand, you’ll get an ecosystem where people can finally compose and build financial products the way internet companies build web products—at the same speed, and at the same usability that people expect from the web.