Banks and Blockchains: A Structural Shift

On the surface, modern banking feels instant. You tap a card and pay for coffee. You click a button and buy a stock.

Under the hood, however, the system is far more complex than it appears.

Modern banking is built on coordination. Every payment, settlement, and trade requires a web of institutions—banks, clearinghouses, custodians—to agree on who owns what, when. Today, each of these institutions maintains its own private ledger of the same events.

In banking, this constant “comparing of notebooks” is known as reconciliation. It is why a wire transfer can take days to settle, why operational risk persists across multi-day processes, and why back-office complexity costs the industry billions each year.

Blockchain is increasingly being explored as a way to address these coordination challenges. It introduces a shared, tamper-resistant layer that enables institutions to synchronize records, automate execution, and reduce reconciliation across multi-party environments.

In this blog, we’ll explore how blockchain’s role in banking is evolving into an execution and coordination layer that works in conjunction with, rather than replaces, existing financial infrastructure.

How Blockchains Provide Key Benefits to Banks?

A blockchain is a distributed digital ledger that records transactions in a tamper-resistant, verifiable way.

In traditional workflows, Bank A sends a message to Bank B saying, “I sent you money.” Bank B then updates its own database. If those records don’t match, manual reconciliation or intervention is required.

In a blockchain-based workflow, both institutions instead reference a single, shared ledger state.

This shift delivers four foundational benefits:

- Shared recordkeeping: Multiple institutions reference the same ledger state, reducing duplicative reporting and reconciliation.

- Tamper resistance and auditability: Once recorded, transactions are difficult to alter without detection, strengthening traceability and audit controls.

- Programmability: Smart contracts enable conditional execution of business logic, such as automated settlement or compliance checks—for example, releasing funds only once a digital asset has been delivered.

- Interoperability: When paired with secure messaging and standardized protocols, these systems can connect traditional financial infrastructure with distributed networks.

So why now? Banks are exploring blockchain because it directly addresses long-standing infrastructure constraints. While customer-facing experiences have modernized rapidly, much of the underlying banking stack still relies on batch processing, message-based coordination, and manual reconciliation.

A shared, programmable state layer makes it possible to reduce operational friction, accelerate settlement, and introduce automation—without requiring replacement of existing systems.

As a result, banks are increasingly creating production-grade blockchain systems that work alongside traditional infrastructure, adopting incremental, standards-based models that deliver measurable efficiency gains while preserving regulatory compliance and operational continuity.

Benefits of Blockchain for the Banking Sector

Faster Transactions and Settlement

In traditional markets, settling a trade can take over a day (often T+1), tying up capital and increasing counterparty exposure. Blockchain-based settlement can significantly shorten this cycle, particularly when combined with coordinated Delivery-versus-Payment (DvP) and Payment-versus-Payment (PvP) workflows.

By enabling atomic settlement, where the exchange of assets and payment occur simultaneously, blockchain workflows materially reduce settlement risk, free up liquidity, and lower the operational burden associated with multi-day post-trade processes.

Greater Security and Operational Resilience

Blockchain systems use cryptography and consensus validation to protect transaction integrity across multi-party networks. This strengthens resilience in workflows where data consistency is critical, reducing reliance on centralized reconciliation points and on manual controls prone to delays, errors, and single points of failure.

Cost Reduction Through Automation

Smart contracts enable rules-based automation across financial processes such as reconciliation, exception handling, corporate actions, and compliance checks—areas that traditionally require significant manual intervention. By encoding “if-this-then-that” logic directly into execution workflows, banks can improve straight-through processing rates, reduce manual effort, and lower administrative costs.

Improved Transparency, Trust, and Compliance

A transparent public ledger provides a single, verifiable view of transactions and asset states across participants. When combined with privacy-preserving identity and compliance controls, blockchains can improve auditability and regulatory reporting without exposing sensitive data—strengthening trust across institutions, regulators, and clients alike.

Key Blockchain Use Cases in Banking

Payments and Money Transfers

Cross-border payments often involve fragmented messaging systems, multiple intermediaries, and delayed finality, each of which introduces latency, cost, and reconciliation overhead.

Blockchain-enabled workflows aim to improve coordination and settlement efficiency, particularly as stablecoins, tokenized deposits, and CBDCs mature alongside traditional payment rails.

In practice, institutions are exploring how existing messaging standards can be connected to blockchain environments to support programmable payments. By coordinating execution and settlement against a shared ledger state, banks can reduce operational friction and improve transparency without disrupting core payment infrastructure.

Clearing and Settlement

Clearing and settlement are among the most operationally complex areas in finance, requiring precise data synchronization across custodians, clearinghouses, broker-dealers, and asset servicers. Today, this coordination relies heavily on message-based confirmation and post-trade reconciliation across siloed systems.

Blockchain can serve as a common coordination layer for post-trade activity, reducing reconciliation overhead and providing more consistent access to verified records. As assets become tokenized, standardized reference data and coordinated workflows across both traditional and blockchain environments become increasingly critical to achieving faster, lower-risk settlement.

Trade Finance

Trade finance remains document-heavy and coordination-intensive, involving banks, logistics providers, insurers, and customs authorities. Disconnected systems and manual documentation introduce delays, disputes, and elevated fraud risk throughout the trade lifecycle.

Blockchain-based workflows can synchronize key trade events—such as shipment status, document issuance, and ownership transfers—across participants in near real time. By maintaining a shared, tamper-resistant record, institutions can reduce paperwork, accelerate settlement, and improve trust while preserving existing operational roles and responsibilities.

Identity Verification and Compliance

Identity and compliance are foundational to banking operations, yet remain costly and repetitive due to duplicated verification across institutions. Customers are often required to resubmit sensitive documentation multiple times, while banks independently perform similar checks on the same information.

Blockchain-based identity solutions—particularly those using verifiable credentials—enable individuals and institutions to prove specific attributes, such as KYC status or eligibility, without repeatedly sharing underlying personal data. This approach reduces duplication in compliance workflows, supports jurisdiction-specific regulatory requirements, and strengthens privacy protections.

Real-World Examples of Blockchain Adoption in Banking

Banks and market infrastructures are moving into production by integrating platforms that directly connect blockchains with their existing systems, standards, and regulatory frameworks.

These initiatives demonstrate how blockchain can be adopted pragmatically while preserving the infrastructure and controls institutions rely on. Across these initiatives, Chainlink has enabled use cases with a platform that powers critical data, interoperability, compliance, and privacy solutions.

Swift Connectivity and Cross-Chain Settlement

Chainlink and Swift have collaborated to enable financial institutions to connect to multiple public and private blockchain networks using existing Swift infrastructure and messaging standards. Leveraging the Chainlink Cross-Chain Interoperability Protocol (CCIP), these initiatives demonstrate how tokenized asset settlement workflows can be coordinated alongside traditional payment rails—without requiring banks to replace core messaging systems.

Under the Monetary Authority of Singapore’s Project Guardian, Swift, UBS Asset Management, and Chainlink successfully demonstrated the issuance and settlement of tokenized assets using existing fiat payment infrastructure, illustrating a practical, standards-based path to institutional adoption.

Standardizing Corporate Actions Across Global Markets

Chainlink has powered a global industry initiative involving 24 financial institutions and market infrastructures, including Swift, DTCC, Euroclear, UBS, DBS Bank, ANZ, BNP Paribas, Wellington Management, and Schroders, to address the longstanding complexity of corporate actions processing.

By combining oracle networks and blockchains with structured data extraction and validation, this work transforms fragmented, manual corporate actions workflows into standardized, near-real-time processes. The result is reduced operational cost, lower error rates, and significantly less reconciliation overhead across jurisdictions.

Tokenized Fund and Digital Asset Settlement

Chainlink has been leveraged in multiple major institutional initiatives involving tokenized assets and stablecoins.

Work with Kinexys by J.P. Morgan, Ondo Finance, and other market participants has demonstrated atomic Delivery-versus-Payment (DvP) settlement workflows that coordinate asset and payment legs to reduce settlement risk and operational complexity.

These demonstrations highlight how tokenized assets can settle with greater certainty and efficiency when execution and coordination occur within a shared, programmable environment.

Cross-Border Compliance and Identity Workflows

In Asia, Chainlink has enabled compliant cross-chain settlement under initiatives such as the Hong Kong Monetary Authority’s e-HKD+ program. In these initiatives, institutions including ANZ Bank, China AMC, and Fidelity International used Chainlink infrastructure to verify investor eligibility, enforce jurisdiction-specific controls, and execute tokenized asset transactions across borders.

These workflows demonstrate how blockchain-based settlement can meet regulatory requirements while preserving privacy and supporting cross-jurisdictional operations.

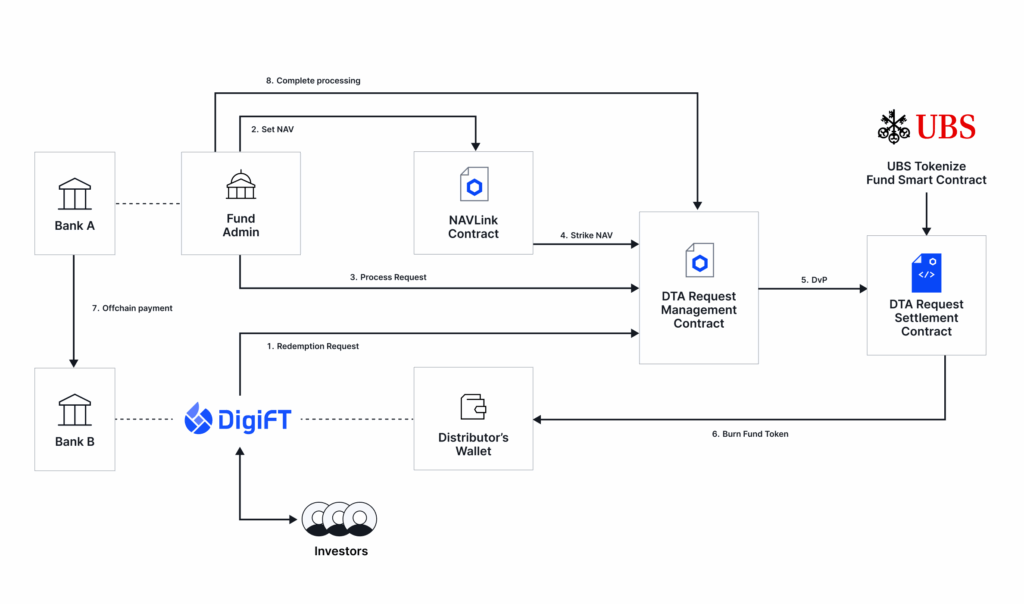

Integration With Institutional Messaging and Transfer Agency Systems

The Chainlinks Runtime Environment (CRE) enables financial institutions to initiate onchain fund workflows directly from existing enterprise infrastructure, including ISO 20022 messages transmitted via Swift. In collaboration with UBS Tokenize, Chainlink demonstrated how subscription and redemption requests for tokenized funds could be orchestrated onchain through standardized transfer agency workflows without replacing core banking systems or operational processes.

Challenges and Considerations

Despite progress, blockchain adoption in banking faces challenges as it evolves:

- Regulatory certainty around settlement finality, custody, and the enforceability of onchain activity across jurisdictions

- Integration with traditional enterprise systems, which cannot be replaced entirely, and must continue to support existing standards

- Interoperability across multiple blockchains, to avoid fragmented liquidity, duplicated processes, and new operational silos

- Scalability and operational reliability, ensuring blockchain-based workflows can support mission-critical activity with the uptime, performance, and controls expected in global financial markets

These realities explain why most institutional initiatives focus on standards-based integration, incremental deployment, and controlled automation.

Chainlink’s Role in Blockchain Adoption Across Banking

Sector

Modern banking adoption requires more than token issuance. It requires trusted data, secure cross-network coordination, and seamless integration with existing institutional workflows.

The Chainlink platform allows banks to operationalize blockchain-based processes in production environments by enabling:

- Standards-based connectivity between existing financial infrastructure and blockchain networks

- Secure cross-chain interoperability through Chainlink CCIP, enabling coordinated execution across multiple networks

- Institutional-grade data integrity for pricing, reference data, and asset lifecycle events

- Embedded compliance and identity frameworks that preserve privacy while enforcing policy and jurisdictional controls

This approach allows banks to modernize and integrate blockchain workflows that add value, while maintaining the reliability, security, and controls required by global capital markets.

By enabling standards-based connectivity between legacy systems and blockchain environments, Chainlink enables financial institutions to innovate across both traditional and onchain finance.