Analyze Decentralized Oracles in Real-Time With Chainlink’s Price Feed Visualizations

Transparency is a key principle in the DeFi ecosystem, ensuring that anyone can verify how decentralized finance protocols are engineered, as well as access critical market data around collateralization and fair pricing. Tools like Chainlink’s Price Feed visualizations help promote transparency across the DeFi space by showing the composition of decentralized oracle networks that validate and feed price reference data to smart contracts. Moreover, the visualizations provide an easy pathway for users to audit the actual price data that is published on-chain. This article is a guide to Chainlink Price Feed visualizations and their specific features that you can use to verify that DeFi asset pairs are priced fairly and securely.

How Decentralized Oracle Networks Secure DeFi Price Data

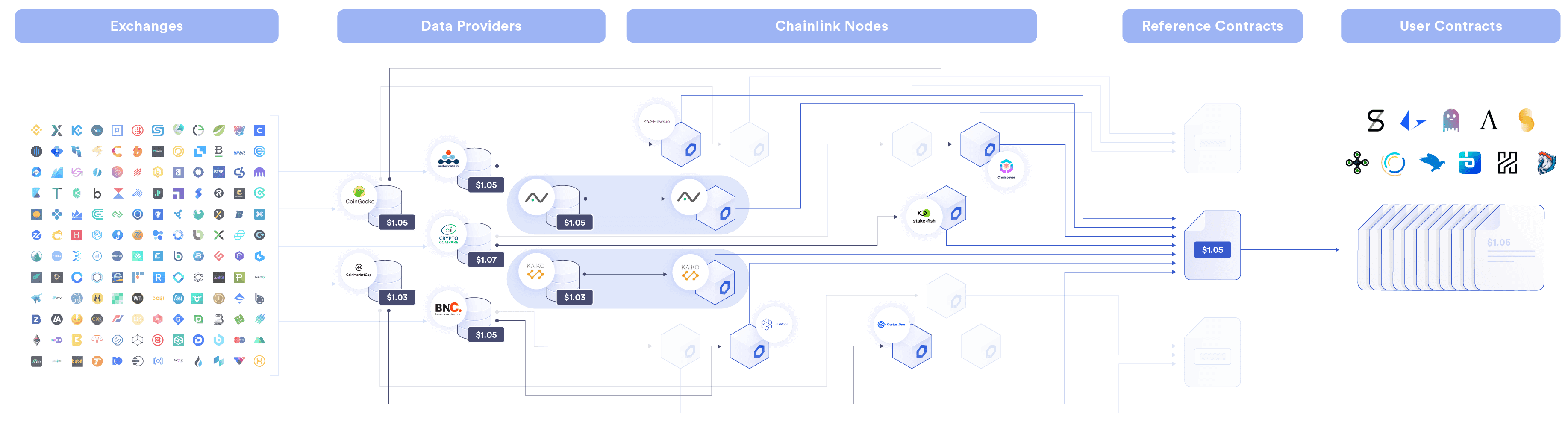

Chainlink Price Feeds source high-quality price data from reputable data aggregators by pulling data from their APIs. The data is then delivered on-chain via a decentralized oracle network composed of multiple independent security-reviewed node operators. Decentralization at both the data aggregation and oracle network levels protects against data manipulation and ensures availability for smart contracts that depend on highly reliable price oracles. Because of their security and reliability guarantees, Chainlink Price Feeds have become the industry standard oracle solution for DeFi, now securing billions of dollars in value and supporting a wide variety of use cases and markets, from derivatives to stablecoins.

DeFi Price Feeds

In addition to accuracy, security, and reliability guarantees, Chainlink supplies visualizations of price feed performance derived from on-chain data. The visualizations give smart contract developers and users the ability to independently verify how each price feed’s oracle network determines asset prices. They also allow users to easily access a variety of information about the infrastructure, functionality, and current/historical data of the decentralized oracle networks that secure these prices.

Asset Pairs

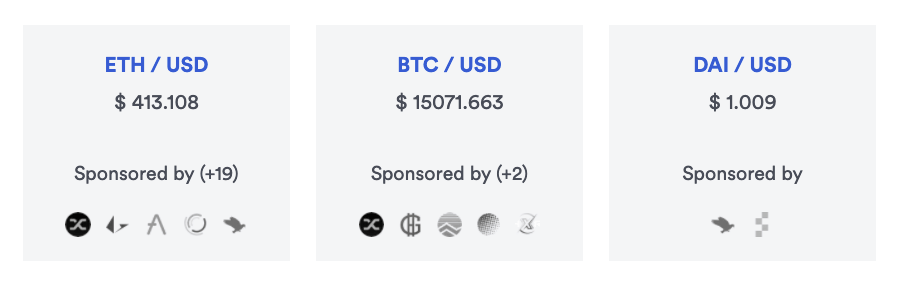

On the main Price Feeds page, each asset pair shows three core pieces of information:

- The two paired assets, e.g. ETH/USD

- The current price (stored on-chain in the Reference Contract) a smart contract would receive if it called that Chainlink oracle network for the price

- Which DeFi projects use and financially sponsor each Price Feed in production

Sponsors and Node Operators

At the bottom of the data.chain.link page, you can see a sample of the projects consuming Chainlink Price Feeds and the list of independent node operators that source and deliver price data. There is a wide variety of DeFi project types listed, including leading DeFi projects such as Aave, Synthetix, Nexus Mutual, and many more live on mainnet with Chainlink Price Feeds. Similarly, the node operators include many trusted DevOps and security teams, such as Deutsche Telekom MMS, who ensure reliable and secure data delivery to the Chainlink Network.

Individual Price Feed Pages

Clicking on an asset pair from the main page takes you into the individual Price Feed page for a given asset pair.

Oracle Visualization

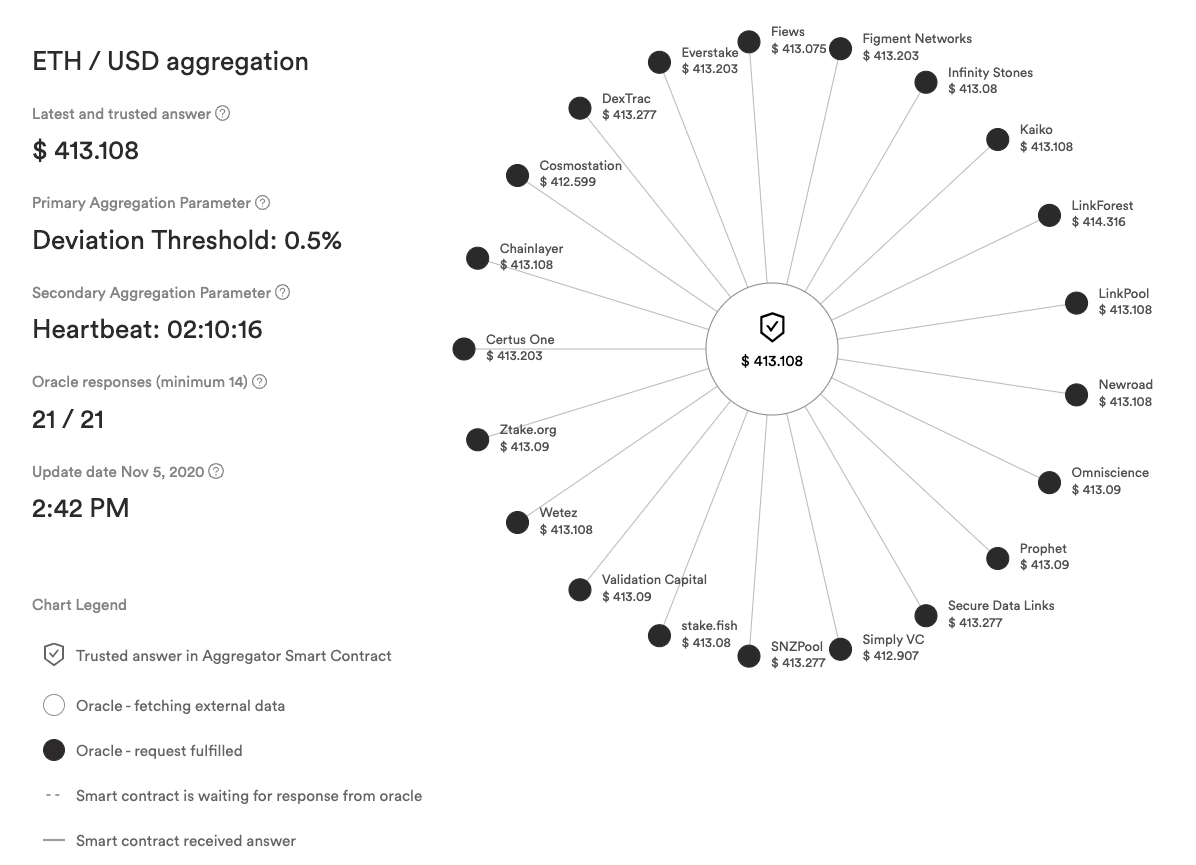

- Current price – This is the price data stored by the oracle smart contract on-chain. Chainlink uses a median of the aggregated price data to determine the current fair market price. Price points on the individual pages update dynamically in real-time with the oracle network.

- Node operators – The visualization identifies individual node operators and the most recent price submitted from each, allowing users to detect which oracles are online and whether any are submitting outlier data.

- Oracle request fulfilled – When the circle turns black, it indicates that the oracle smart contract has recorded the node’s submitted price.

- Oracle fetching external data – A white node circle shows that an oracle is fetching data from an external source or in the process of recording the data on-chain. An animated line also indicates that the oracle smart contract is waiting for a response from the individual node.

Elements in the animated visualization are interactive if you want more information about a given node or the trusted smart contract price. For example, hovering over a node operator shows the most recent price that node submitted, the gas used in the transaction, the block that recorded the transaction, and the exact time of submission. For more in-depth information about each node operator’s smart contract, click on a node to access links to Etherscan.

Latest and Trusted Answer

The price is the value stored on-chain in real-time by the oracle network.

Primary Aggregation Parameter: Deviation Threshold

The deviation threshold indicates when the feed will update. In the ETH/USD case, when the off-chain price, as reported by the data aggregators’ APIs, deviates 0.5% from the on-chain trusted price, the feed updates. Each Chainlink deviation threshold is customizable depending on the smart contract needs.

Secondary Aggregation Parameter: Heartbeat

Heartbeat is a countdown timer that updates the price on-chain when it reaches 00:00. It is a backup in the event that the deviation threshold does not trigger an update over the length of the heartbeat. If assets have very low price volatility, they may not reach deviation thresholds often, so the heartbeat ensures data feeds remain fresh.

Oracle Responses

This ratio shows how many oracles contributed to the last Price Feed update. The minimum number refers to the minimum number of oracles needed to submit a new price update. If it’s not reached, then the price update will not go through.

Update Date and Time

This field indicates the most recent date and time that the Price Feed updated the smart contract with a new trusted answer.

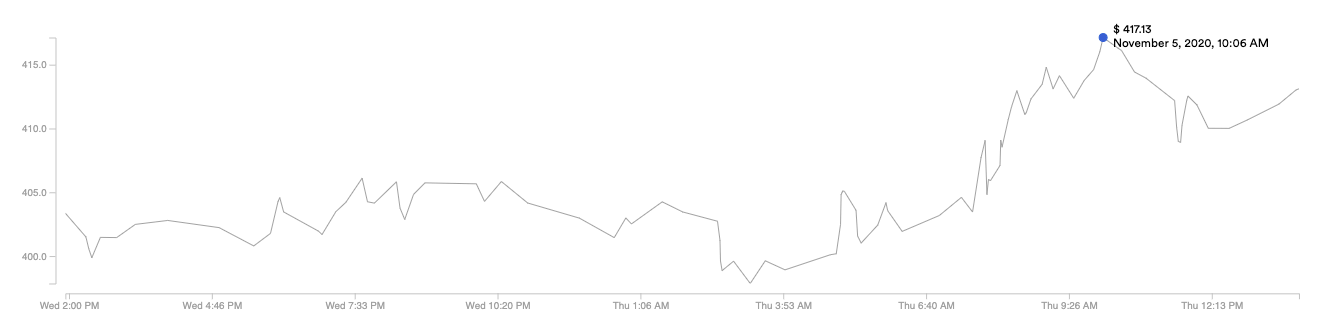

24hr Price History

This is an interactive chart showing asset price history over the past 24 hours.

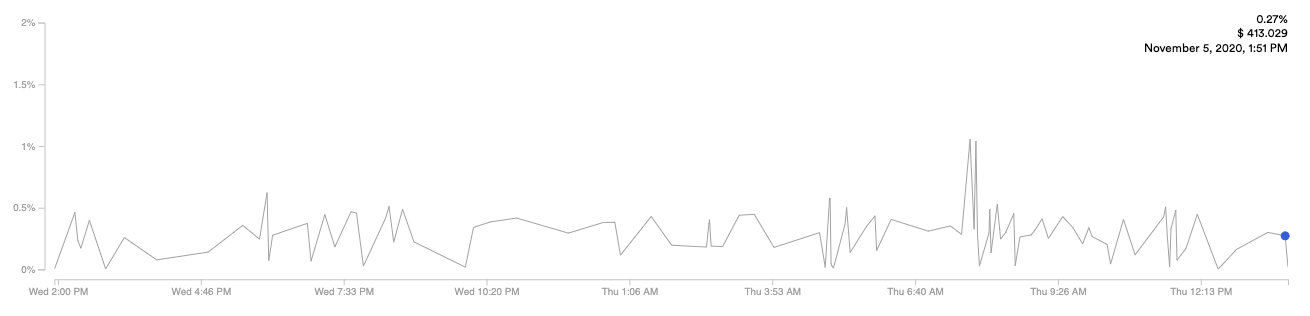

24hr Volatility

This is an interactive chart showing the percentage change in price volatility over the past 24 hours.

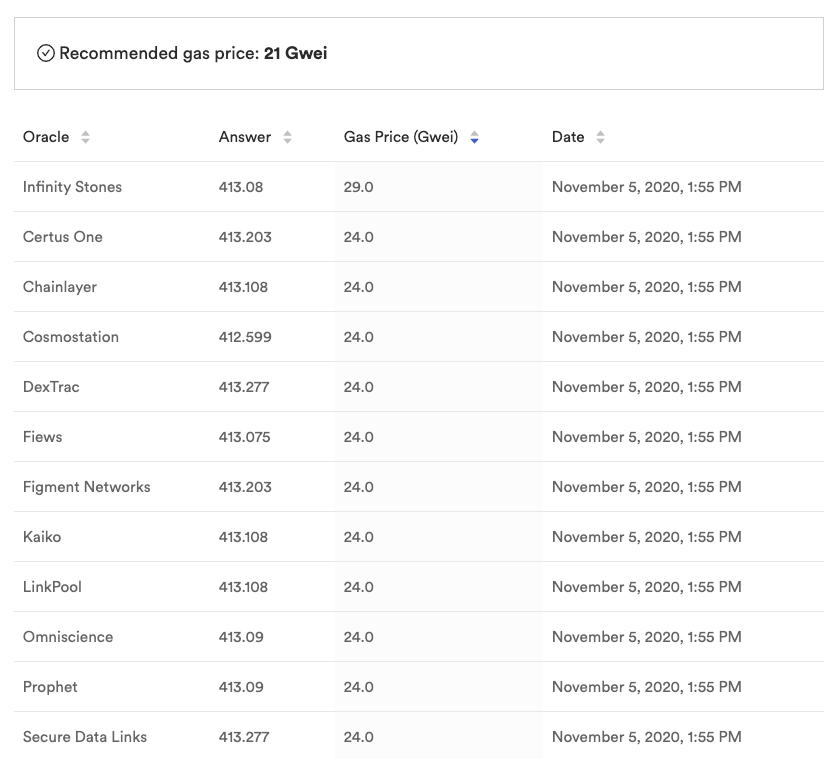

Oracles Data

This sortable chart shows what each oracle paid in gas to submit the latest price. The chart uses gas paid to recommend a gas price in GWEI for current submissions.

Providing Transparency and Verifiability Around DeFi Price Oracles

The DeFi ecosystem has a significant opportunity to redefine and rebuild financial systems with decentralized, transparent protocols. As a cornerstone of secure DeFi development, transparency ensures that these innovative financial applications are secure and auditable by the broader community. Chainlink’s visualizations bring increased transparency to the DeFi ecosystem so that anyone can verify that Chainlink oracle networks supply fair and accurate prices with robust market coverage. We hope this tool gives both developers and users increased confidence to build and participate in the growing movement of verifiable, transparent finance powered by smart contracts.

Learn More

If you’re a developer and want to build a DeFi product using Chainlink Price Feeds, check out our quick-start tutorial for a step-by-step guide on how to get started.

If you want to connect your smart contract to other existing data and infrastructure outside the underlying blockchain, visit the developer documentation or reach out to our team.

Website | Twitter | Discord | Reddit | YouTube | Telegram | Events | GitHub | Price Feeds | DeFi