Industry Report: Why Onchain Finance Is Inevitable

The world’s largest financial institutions are quickly realizing the opportunity for blockchain technology to redefine capital markets. Forward-thinking banks and financial services companies are already moving operations on-chain to unlock deep liquidity for previously illiquid assets, reduce costs via automated workflows, and develop higher-integrity markets.

This industry brief provides an overview of the opportunities driving these institutions on-chain, along with key technical considerations to successfully capitalize on this massive economic shift.

Tokenized Assets

Tokenized assets are digital tokens stored on-chain (on a blockchain) that represent physical and traditional financial assets, such as commodities, currencies, and bonds. They can deepen liquidity, reduce counterparty risks, and make opaque processes more transparent.

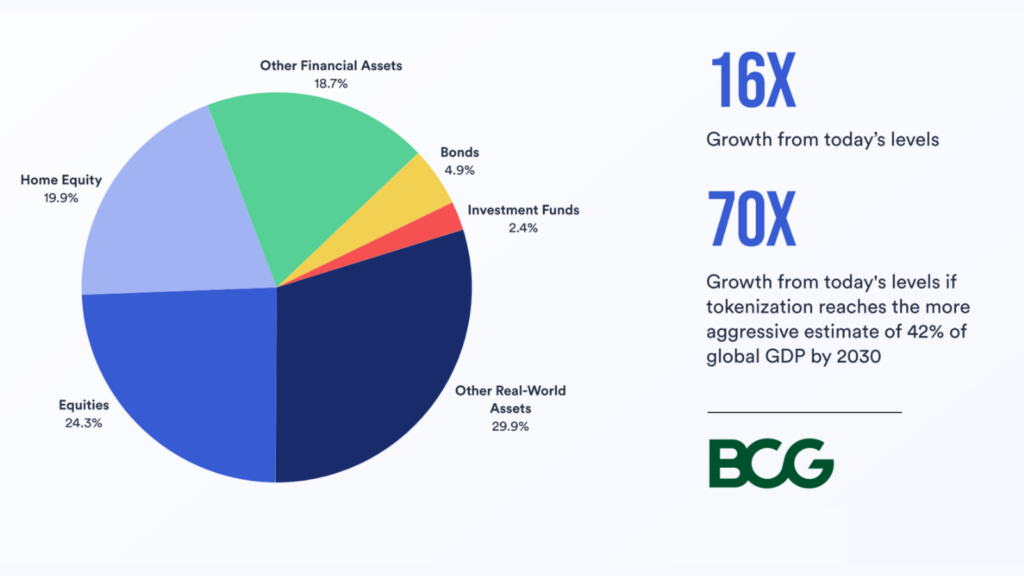

Early adopters can take advantage of a multi-hundred-trillion-dollar opportunity:

- $867T of value in traditional markets poised for disruption by tokenization (World Economic Forum, 2021)

- 80x expected growth rate of tokenization in private markets by 2030 (Citi, 2023)

- 97% of institutional investors agree that “tokenization will revolutionize asset management” (BNY Mellon and Celent, 2022)

Smart Contracts, Smarter Markets

Running on top of blockchain networks, smart contracts are tamper-proof computer programs that execute according to preset logic. They enable backend financial operations processes to be automated, such as distributing fund data, capturing proxy votes, and distributing dividends.

Why financial workflows are being automated:

- 24/7/365 payment windows to move cash and securities (BNY Mellon and Celent, 2022)

- T+0 securities settlement time achievable with blockchain technology (DTCC, 2022)

- 83% of senior decision-makers are looking to accelerate turnaround times for processes by adopting digital assets (Infosys, 2023)

Seamless Interoperability for Global Liquidity

Blockchain interoperability refers to the capability of blockchain networks to communicate with each other, sending and receiving instructions, data, and tokenized assets. Because on-chain markets are inherently isolated, seamless and secure interoperability is essential for a thriving blockchain-based global financial system.

The industry needs an interoperability standard:

- 100+ blockchains have been built, with varying technical attributes to support specific uses (Goldman Sachs, 2021)

- 77% of institutional investors want access to staking pools for enhanced yield on crypto assets (BNY Mellon and Celent, 2022)

- 72% of global institutional investors indicated a preference for working with an integrated provider for all digital asset needs (J.P. Morgan and Celent, 2022)

Chainlink: The Gateway to On-Chain Finance

Chainlink is the industry-leading Web3 services platform and gateway to on-chain finance for banks, asset managers, and other financial services companies. It has successfully enabled over $12T in transaction value for blockchain applications across a multi-year history of high uptime and tamper-proof security, even during the most volatile and unpredictable conditions. Financial institutions can use Chainlink’s abstraction layer to easily and securely access both public and private blockchain networks using their existing systems.