Sergey Nazarov’s Key Insights from the White House Digital Asset Summit

In a recent interview, Chainlink Co-Founder Sergey Nazarov discussed his experience at the White House Digital Asset Summit in Washington, D.C., where he engaged with policymakers and industry leaders on the future of blockchain and digital assets. He shared his vision for how governments and the blockchain industry can collaborate to foster innovation. This post is based on his interview.

I found a few key things to be quite impressive. The first thing that struck me was the seniority of the government representatives in the room, even before the president joined us. The summit had the Secretary of Commerce, the Secretary of the Treasury, David Sacks, Congressional whip Tom Emmer, Bryan Steil, the chair of the subcommittee on digital assets, and a number of other key government representatives in attendance. There were also key people from the regulatory side at the SEC and the CFTC. These were not just their representatives—key senior officials were present, along with their teams.

Some common themes at the Digital Asset Summit centered around Bitcoin and the Strategic Bitcoin Reserve announcement, particularly how it should evolve following recent developments. Another major theme was the need for proper regulation—ensuring clear guidelines that allow fintechs, financial institutions, and DeFi protocols to participate in the U.S. financial system with legal clarity.

There were perspectives on how the U.S. must be the place where the asset originates—the country where the asset is created and then flows into the global financial system from the U.S. market. That was essentially my view, along with that of a few others. There were also one or two valuable perspectives on infrastructure and how to drive adoption within the U.S.

The Evolution of the U.S. Financial System

My position on the key topics regarding the evolution of the U.S. financial system is that, first and foremost, it should generate the base original asset that everyone else packages and repackages, whether it’s a DeFi protocol, neobank, or large financial institution. The base asset must originate in the U.S. before it can be repackaged by various groups, some based in the U.S. and some outside of it.

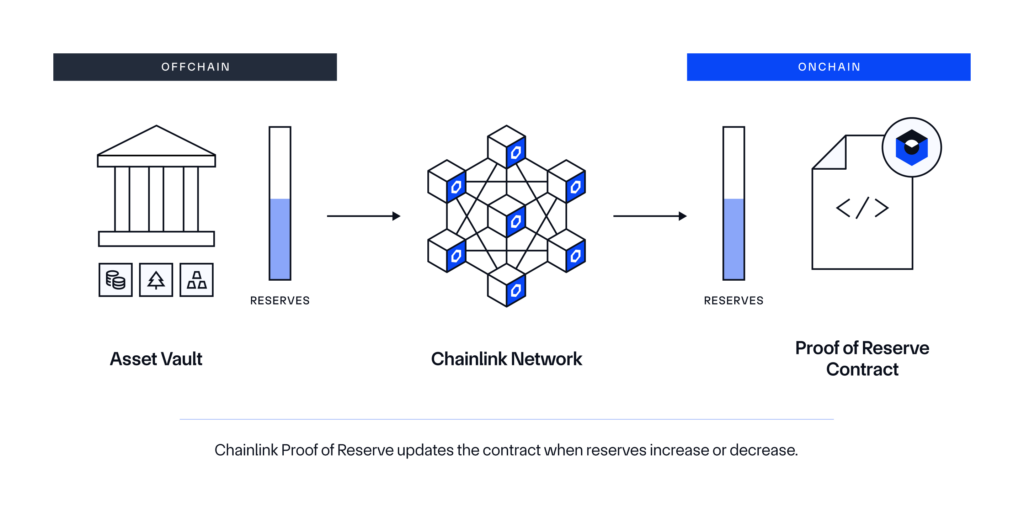

To create the best asset in the U.S. financial system, my view is that you need to build the most reliable asset. Blockchains, in addition to tracking and transferring ownership, serve as highly effective data transfer mechanisms. These include proof of reserves, proof of liabilities, proof of composition, and, by extension, proof of solvency. In my view, these proof mechanisms will play a role similar to that of risk agencies in the early stages of the Web1 and Web2 financial systems. Risk agencies were legislated into existence and upheld certain reliability guarantees for U.S. financial products, which were crucial in the early development of the financial system.

Similarly, I believe we should reach a point where asset-related information is reliably proven on a near real-time basis. This would eliminate the need for annual, monthly, or even weekly audits, replacing them with second-by-second audits. Such a system would create a more reliable base asset.

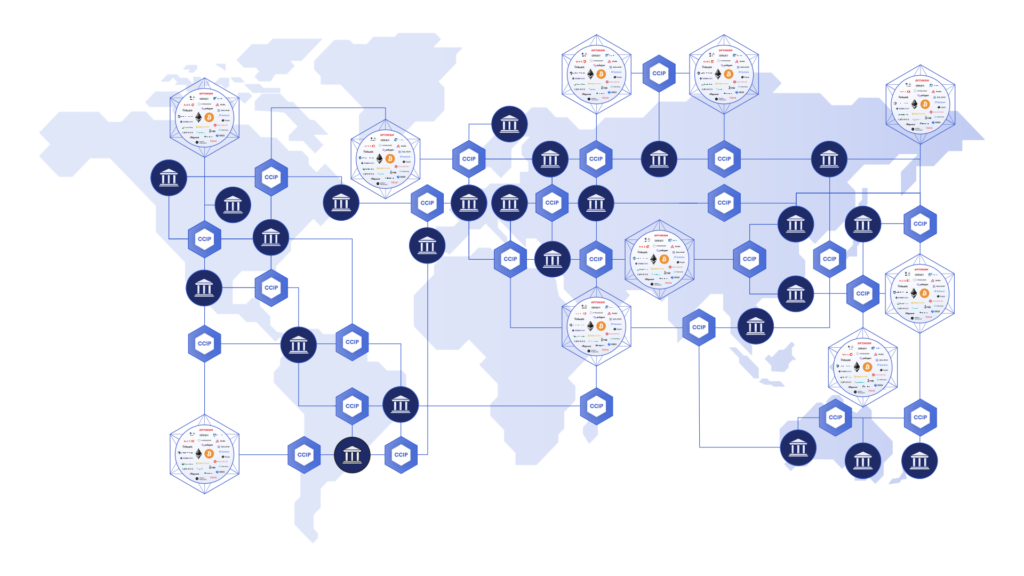

Once that more reliable base asset is established, it can be sold to an increasingly larger market as long as two key conditions are met. The first is that the base asset must be connected to all the chains where purchasing power exists. This is where a highly reliable and compliant cross-chain system like Chainlink CCIP is essential, enabling capital to flow seamlessly across blockchains and other environments and to be able to purchase the asset. The second key component is automating compliance. This is something I am deeply focused on as I engage with central banks, regulators, and financial institutions. Compliance costs are a significant driver of transaction costs in the traditional financial industry. If those costs can be reduced, the asset and the transactions become far more attractive.

If the U.S. can generate the most reliable, highest-quality asset of its kind in the global financial system, connect it to all the chains and environments where it can be purchased, and ensure it can be acquired, managed, and held at a low cost by automating compliance through oracle networks, identity oracles, and smart contracts, then we will have built the next generation of the U.S. financial system—what we call Financial System 3.0. In this system, assets are rapidly generated in the U.S., connected globally in a way that allows various chains and private keys to purchase them, and acquired with large amounts of capital that can comply in an automated, low-cost manner.

These are the three key properties that any financial system must meet in order to grow and succeed in our industry and in this new version of the global financial system. The U.S. financial system must also meet these same properties. That was my position at the White House Digital Asset Summit, and I believe it was well received by both government officials and industry leaders. This is crucial because both groups need to be invested in the vision of the United States Financial System 3.0.

Strengthening U.S. Government and Crypto Industry Collaboration

At the roundtable, everyone had only a brief window to direct questions or comments toward the president or government representatives. At this early stage, it is important for them to understand that our industry is very open to collaboration and has not yet reached its full potential. We are genuinely grateful to the president’s administration, his executive orders, his secretaries, David Sacks, Bo Hines, and others for helping unwind the suppression of our industry. Right now, there is broad agreement that the crypto industry in the U.S. has not yet reached its full potential, and it is encouraging that it is now beginning to be unlocked. This is a significant step for the U.S. financial system, and something we should appreciate.

This marks the beginning of a stronger relationship between the crypto industry and the U.S. government, as well as various regulators. Encouraging them to continue along this path of unlocking the full capabilities and potential of our industry is key. As stablecoin legislation advances, proof of reserves and general legislation take shape, and market structure laws become clearer, it will become evident how to conduct reliable, compliant onchain transactions. Once this clarity is achieved, discussions will naturally become more detailed.

We are currently in a very exciting and highly productive early stage where a significant amount of progress is being made. Thanks to the engagement of the most senior decision-makers, our industry’s growth is being taken seriously. Fundamentally, it is essential that they understand how much we appreciate this progress. Our industry is fully committed to taking full advantage of these opportunities and working hard to reach its full potential.

I believe the current administration and the climate in Washington, D.C., have three primary focus areas, driven by their significant economic impact. The first area is cryptocurrencies—things like Bitcoin, the Bitcoin reserve, and a digital assets reserve. The cryptocurrency market has grown large enough that policymakers in Washington now recognize its influence on the U.S. economy and national interests.

The second focus area is market structure. This involves defining what constitutes a security versus a commodity and how exchanges should operate based on those classifications. Establishing regulatory clarity on these definitions lays the foundation for the next version of the U.S. financial system, which will be built on blockchain. Once clear regulations are in place, banks, large institutions, fintech companies, and even DeFi teams will know whether issuing a token within the U.S. financial system makes it a security or a commodity and what compliance measures are required. This clarity will, in my opinion, unlock a massive market by giving investors and institutions confidence in their ability to participate legally.

The third focus area is stablecoins. Currently, between 2% and 5% of U.S. Treasuries are held in stablecoins. This has reached a significant enough scale that the U.S. government must now pay attention to how treasuries are being repackaged and rewrapped into an onchain format for transactions. In my view, stablecoins have greatly benefited the U.S. dollar, and I believe policymakers are beginning to understand that stablecoin markets, technology, and use cases function as U.S. dollar distribution mechanisms.

From their perspective in Washington, two major economic forces make stablecoins a priority. First, they are asking: what percentage of the economy is represented by this market? When it reaches 2%, 3%, or 4%, it becomes a significant part of the U.S. Treasuries market—making stablecoin holders among the top 20 to 30 largest holders of treasuries. That level of influence requires the U.S. government to manage, regulate, and mitigate risks associated with stablecoins.

Proof of reserves already exist in some of the proposed stablecoin legislation. However, I believe the stablecoin industry will be one of the first places where additional forms of proof—such as proof of composition, proof of solvency, and proof of liabilities—will take shape.

The second key realization is that stablecoins serve as a distribution mechanism for their respective currencies on a global scale. While many industries are experiencing deglobalization due to ideological or political factors, the blockchain industry continues to expand its global connectivity and growth. Other sectors, such as manufacturing and other key industries, are becoming more locally focused due to security and geopolitical concerns, making international cooperation more difficult. Because of this, it is crucial that stablecoins remain backed by the U.S. dollar to maintain the U.S. dollar’s role in the global financial system and, more specifically, in the new global financial system that operates on the Web3, oracle network, and blockchain technology stack.

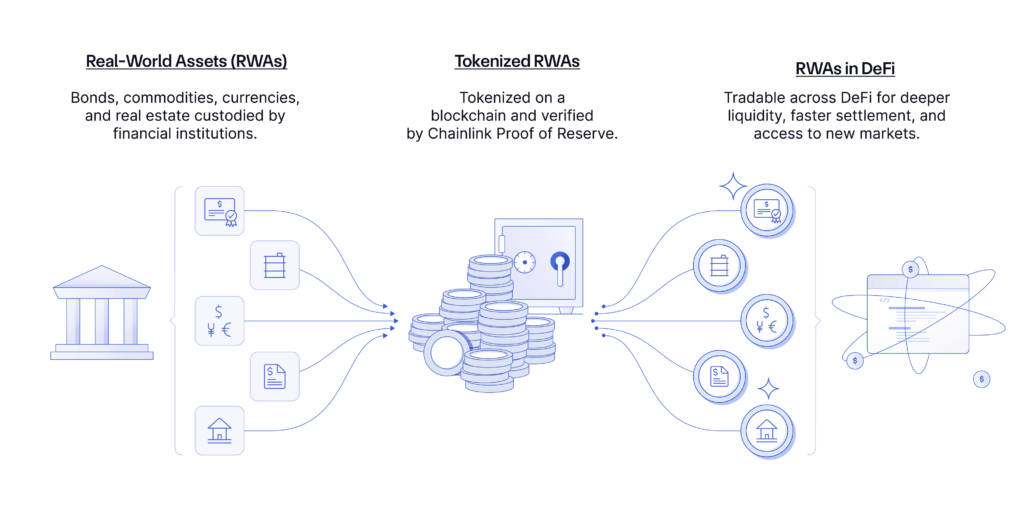

This dynamic economic force will continue to gain the attention of the U.S. government and other global regulators. Once a sufficiently large percentage of assets, such as mutual funds, money market funds, or other fund structures, are tokenized on a blockchain, the respective regulators and government agencies overseeing those industries will have to develop a framework for managing them. The same applies to real estate and commodities. If a significant portion of global gold becomes tokenized, the agencies responsible for regulating commodities will have to determine how tokenized gold should operate, including what needs to be proven about it from a proof-of-reserves perspective. For example, how do you ensure that a tokenized gold asset is properly minted and burned across chains to prevent theft or the creation of large-scale systemic financial risks?

Paving the Way to an Onchain Financial System With Key Technology Standards

This is only the beginning. As blockchain technology captures an increasing share of different asset classes, industry participants and government regulators overseeing each specific asset type will become more involved in determining how it should be structured in a risk-adjusted, secure, and reliable manner. This is where Chainlink plays an important role. Chainlink provides the infrastructure needed to ensure certain guarantees about these assets. Proof of reserves is a good example—how do we create legislation that ensures a stablecoin is fully backed by a U.S. dollar in a bank or treasury? How do we guarantee and verify that backing in near real-time so that it doesn’t turn out that some stablecoins in circulation are not actually backed by dollars in a bank account or treasury?

Because that would be a very serious failure mode. Once the market reaches a certain size, that failure mode could become so large that it would affect the broader economy. At that point, regulators and legislators would need to intervene to manage that risk. Once stablecoins grow large enough, their oversight is no longer optional—it becomes a responsibility that regulators and legislators must address.

This trend will continue. You will see larger and larger percentages of different asset types becoming tokenized—whether it’s hard assets like gold, various commodities, real estate, derivatives contracts, or currencies. Eventually, this will apply to nearly all existing assets. If tokenization surpasses even 5% of the total value of a given asset class, it would be extremely surprising if regulators, governments, and legislators weren’t actively ensuring that the asset was properly managed and regulated.

Even at just 2%, the portion of the market becomes large enough that any potential issues—fraud, theft, or systemic instability—could significantly impact that market, the asset class as a whole, or even the broader economy. Governments are responsible for maintaining economic stability, which means they cannot ignore this new format. At that point, their focus shifts to critical questions: How do we ensure that cryptocurrency, Bitcoin, and other crypto assets evolve in a way that strengthens rather than threatens the economy? How do we develop market structures that lay the foundation for real-world asset issuance by DeFi startups, digital asset issuance by fintechs and institutions, and other regulated tokenization models? This is a vital area where the U.S. needs to catch up.

Another pressing issue is the increasing role of stablecoins in the U.S. Treasury market. As stablecoins grow to represent a significant percentage of the total treasury market, the question becomes: How do we ensure they become a valuable and effective distribution mechanism for the U.S. dollar rather than just another segment of the market? How do we turn stablecoins into an economic advantage, ensuring that the U.S. dollar remains widely used in this new category of transactions?

But this is just the beginning. As the percentage of onchain assets continues to grow, regulators, legislators, and industry participants will need to adapt to this new format. The driving force behind this transformation is the power of cryptographic guarantees—a better way of conducting transactions, proving asset legitimacy, and structuring financial markets. These advancements will push the industry to a scale where governments must engage with the technology on a fundamental level.

At that stage, Chainlink—both as a community and as a set of technologies and open standards—will be in a strong position to provide solutions. The critical questions will be: How do we ensure that stablecoins function correctly? How do we verify cross-border transfers are secure? How do we confirm that generated assets are highly reliable and that the onchain version of an asset aligns with its offchain reality? How do we manage all of these risks in the emerging Web3 financial system?

This is what Chainlink is becoming—a set of global standards that multiple financial systems are adopting to manage these risks, navigate the complexity of data and cross-chain transactions, and define compliance in a way that automates regulatory requirements. This allows for the creation of the most reliable financial assets, ensures their seamless integration into liquidity pools across different financial systems, and enables capital to flow easily and efficiently across networks.

Ultimately, automating compliance on a massive scale is what everyone wants. We don’t want higher transaction costs due to compliance burdens. We don’t want riskier assets that fail to prove their legitimacy. What we need are highly reliable, real-time verified assets. We want transaction costs and compliance costs to be as low as possible. And most importantly, we want financial value to flow freely across borders, creating a global financial system that is more reliable, fair, and verifiable.

To learn more about Chainlink, visit chain.link, subscribe to the Chainlink newsletter, and follow Chainlink on X, LinkedIn, and YouTube.