The U.S. Department of Commerce and Chainlink Are Now Bringing Government Macroeconomic Data Onchain

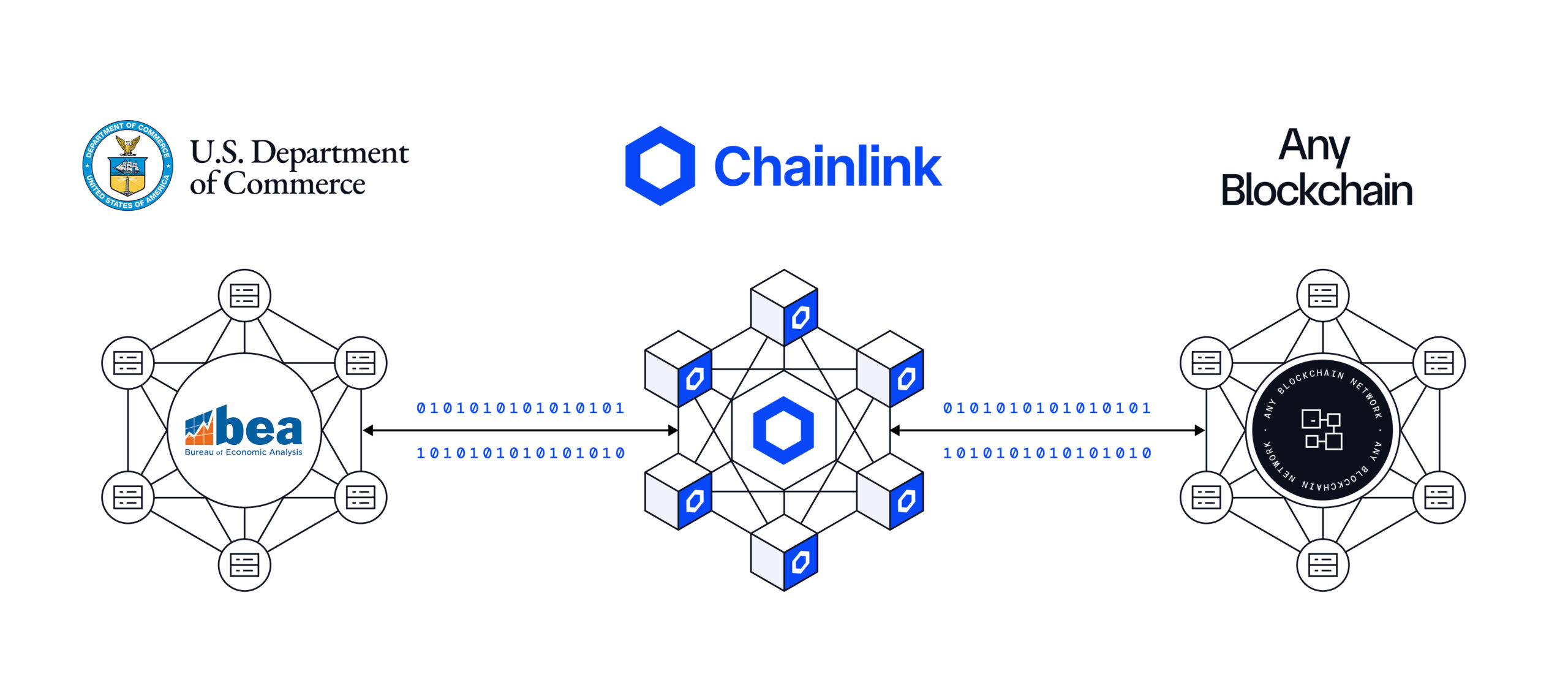

We’re excited to announce that Chainlink and the United States Department of Commerce (DOC) have worked together to bring U.S. government macroeconomic data onchain from the Bureau of Economic Analysis (BEA). These new Chainlink Data Feeds securely deliver critical information around key U.S. economic data onchain, including Real Gross Domestic Product (GDP), Personal Consumption Expenditures (PCE) Price Index, and Real Final Sales to Private Domestic Purchasers.

Bringing U.S. government data onchain unlocks innovative use cases for blockchain markets, such as automated trading strategies, increased composability of tokenized assets, the issuance of new types of digital assets, inflation-linked products, perpetual futures markets, real-time prediction markets for crowdsourced intelligence, transparent dashboards powered by immutable data, and DeFi protocol risk management based on macroeconomic factors.

The following six data points on the U.S. economy are now available for consumption onchain:

| U.S. Government Macroeconomic Data | Data Type | Data Description |

| Real GDP — Level | Raw numbers (billions, chained 2017 USD) | Real GDP is a measure of the value of domestically produced goods and services adjusted for inflation. It shows the overall size of the economy in real terms. |

| Real GDP — Percent change (Annual rate) | QoQ SAAR % | Quarter-over-quarter percent change at an annual rate in real GDP. It tells the story of whether the economy is expanding or contracting in real terms. |

| PCE Price Index — Level | Index (2017=100, headline PCE) | PCE Price Index is a measure of the change in price of domestic consumer goods and services. This metric is often used as an inflation indicator and sometimes as a sentiment indicator for changes in consumer behavior. |

| PCE Price Index — Percent Change (Annual Rate) | QoQ SAAR % | Quarter-over-quarter percent change at an annual rate in the headline PCE price index. This metric shows the pace of consumer price inflation in the economy |

| Real Final Sales to Private Domestic Purchasers — Level | Raw numbers (billions, chained 2017 USD) | Real Final Sales to Private Domestic Purchasers is a measure of the total value of goods sold to the US Domestic market adjusted for inflation. This metric is often used as an economic indicator of domestic economic momentum or as an indicator of domestic demand. |

| Real Final Sales to Private Domestic Purchasers — Percent Change (Annual rate) | QoQ SAAR % | Quarter-over-quarter percent change at an annual rate in real final sales to private domestic purchasers. Indicates the underlying strength of private consumption and investment. |

This data is updated monthly or quarterly as applicable, and is initially being made available across ten blockchain ecosystems, starting with the following chains: Arbitrum, Avalanche, Base, Botanix, Ethereum, Linea, Mantle, Optimism, Sonic, and ZKsync. Support for additional blockchain networks can be incorporated over time based on user demand.

As the industry-standard oracle platform, Chainlink supports one of the largest ecosystems in Web3, leveraging secure data oracles to build advanced onchain applications—making this work a natural step forward in expanding the scope of trusted data available onchain.

Developers can begin integrating these feeds today into their onchain applications by following Chainlink’s official documentation.

How Chainlink Is Working With the U.S. Government

In 2025, Chainlink accelerated its work with the U.S. government by meeting with several key officials and regulators to make policy recommendations that accelerated the growth of the blockchain industry. This included several meetings with the SEC to address three core unanswered questions on broker-dealer and transfer agency compliance using public blockchain infrastructure, ultimately resulting in the SEC releasing interpretive guidance on the subject.

Chainlink also engaged with the U.S. SEC Crypto Task Force around the importance of compliance frameworks—highlighting how Chainlink ACE embeds compliance logic into onchain infrastructure. Additionally, Sergey Nazarov recently met with Senator Tim Scott, Chairman of the Senate Banking Committee, on the crypto market structure bill and how it would enable the blockchain industry to rapidly grow in the United States.

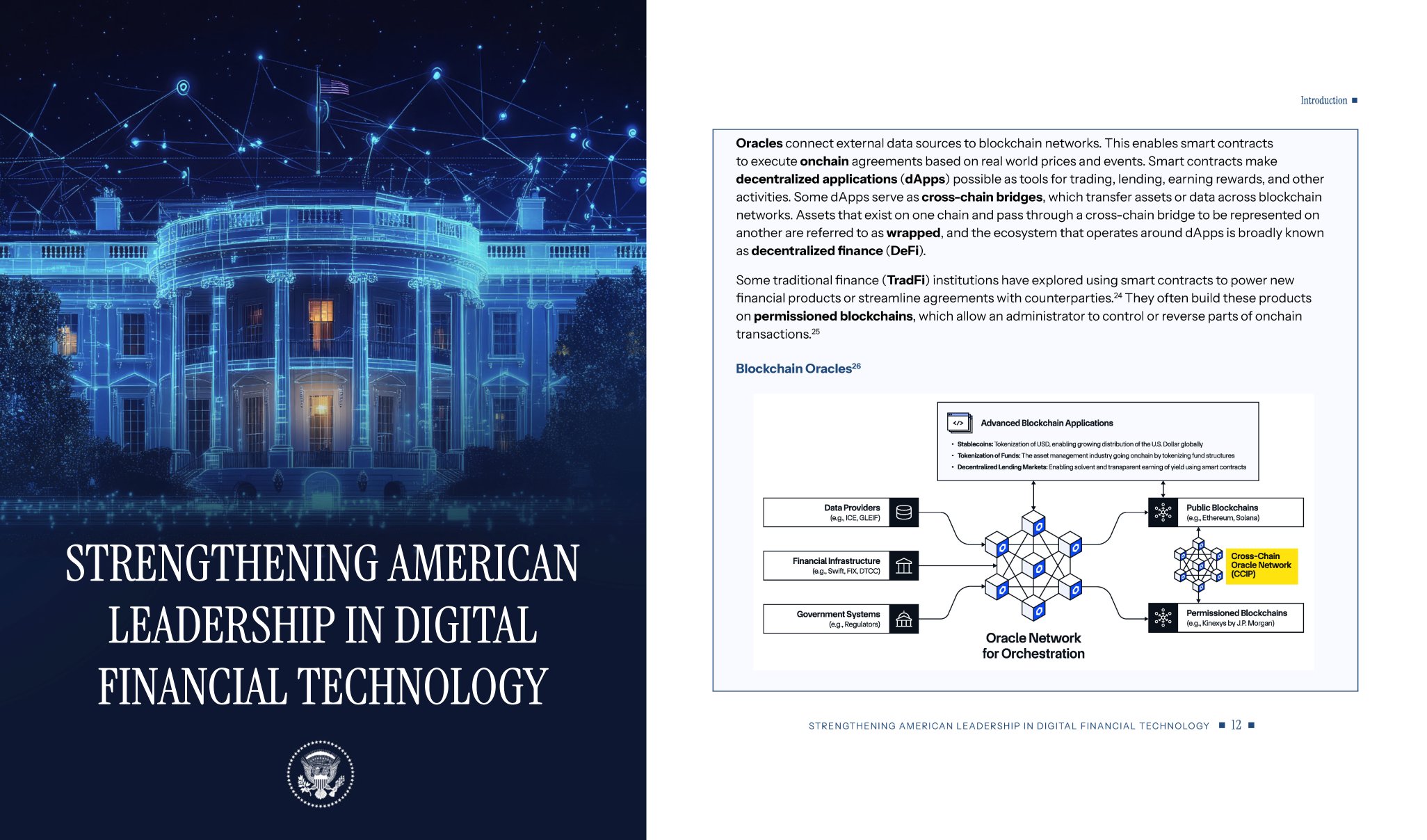

In July, the White House published a report from The President’s Working Group on Digital Asset Markets that highlighted how Chainlink is critical infrastructure for powering stablecoins, tokenized funds, and the onchain economy. The landmark policy initiative underscored a growing global consensus that oracle infrastructure is critical for secure, interoperable, and compliance-ready digital assets, which are key for the blockchain industry to reach its full potential.

To raise further awareness of state-level acceptance of blockchain technology, Chainlink worked with Blockchain Association to launch Tokenized in America, a webpage featuring a first-of-its-kind scorecard that tracks how all 50 states are engaging with blockchain technology and digital asset policy.

During the signing of the GENIUS Act—a landmark U.S. law establishing a federal framework for stablecoins—Chainlink co-founder Sergey Nazarov joined senior government and digital asset leaders as U.S. President Donald Trump signed the GENIUS Act into law.

Building on Chainlink’s growing engagement with U.S. regulators and policymakers, the work with the U.S. Department of Commerce marks a key milestone in advancing government adoption of blockchain technology. By bringing macroeconomic data from the Bureau of Economic Analysis onchain, Chainlink is showcasing how trusted oracle networks can serve as critical infrastructure connecting public institutions with blockchain markets, unlocking new innovations while supporting compliance and regulatory progress in the United States.

Why Chainlink Is the Industry Standard Powering Onchain Innovation

As the industry-standard oracle platform, Chainlink provides the protocols and standards for how hundreds of DeFi applications across dozens of blockchains consume critical financial data to secure tens of billions of dollars in DeFi TVL. Chainlink features one of the largest ecosystems of users in the crypto industry—totaling over 2,400 integrations—which includes top protocols such as Aave, Lido, Compound, GMX, and more. Additionally, many of the world’s largest financial institutions and market infrastructures—such as Swift, Euroclear, Fidelity International, UBS, and ANZ—have adopted Chainlink to accelerate their work on adopting blockchains and tokenized assets.

By working with the U.S. Department of Commerce to bring U.S. macroeconomic data onchain, Chainlink’s growing ecosystem of Web3 and institutional users now have secure access to new categories of data to unlock new markets. This data is being brought onchain through Chainlink Data Feeds—secure infrastructure that has been used over the past half-decade to enable tens of trillions of dollars in transaction value. Chainlink Data Feeds provide an enterprise-grade solution for onchain data access, having already achieved an ISO 27001 certification and a SOC 2 Type 1 attestation, providing financial institutions greater confidence in utilizing the Chainlink platform. Chainlink Data Feeds are underpinned by the Onchain Data Protocol (ODP), serving as one pillar within the greater Chainlink Platform.

If you’re an organization interested in integrating Chainlink’s U.S. government macroeconomic data, reach out to us directly or dive into the Chainlink documentation.

To learn more about Chainlink, visit chain.link, subscribe to the Chainlink newsletter, follow Chainlink on Twitter and YouTube, and follow Chainlink Labs on LinkedIn.