How Chainlink Enables Unified Golden Records for Tokenized Assets

Tokenization—the representation of real-world assets (RWAs) as digital tokens on a blockchain—is “the next generation for markets,” according to Larry Fink, CEO of BlackRock. In fact, 97% of asset managers agree that tokenization will revolutionize asset management, with the Boston Consulting Group forecasting the market size for tokenization to reach $16 trillion by 2030.

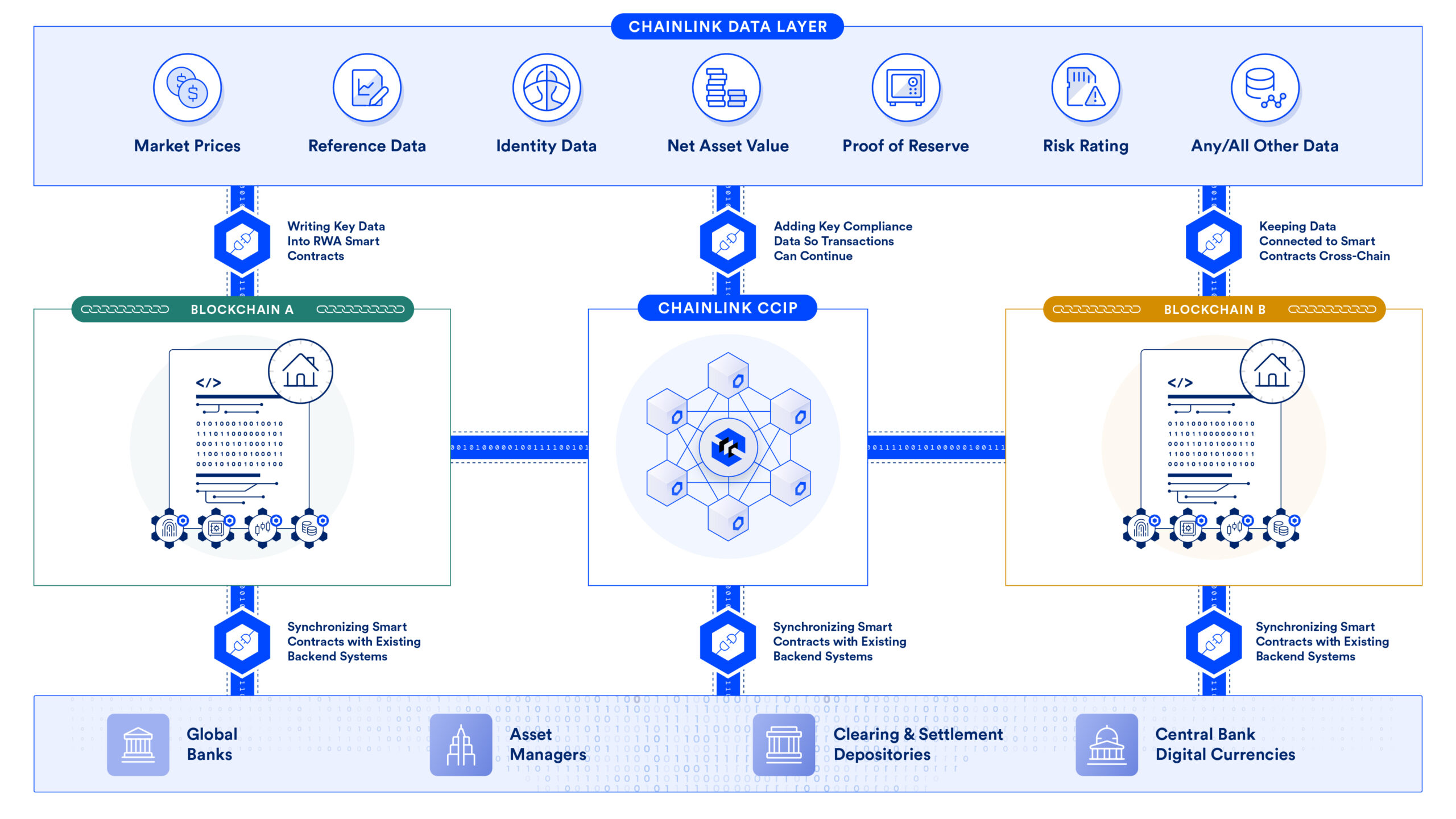

However, realizing tokenization at scale presents challenges, particularly because of the multi-chain landscape, where buyers, sellers, asset issuers, and other market participants are fragmented across numerous public and private blockchains, each tailored to specific geographies, businesses, or use cases. So not only must tokenized assets be transferable cross-chain, but the data required to facilitate transactions of tokenized assets such as net asset value (NAV), proof reserves, pricing information, identity data, and more must be consistently available onchain.

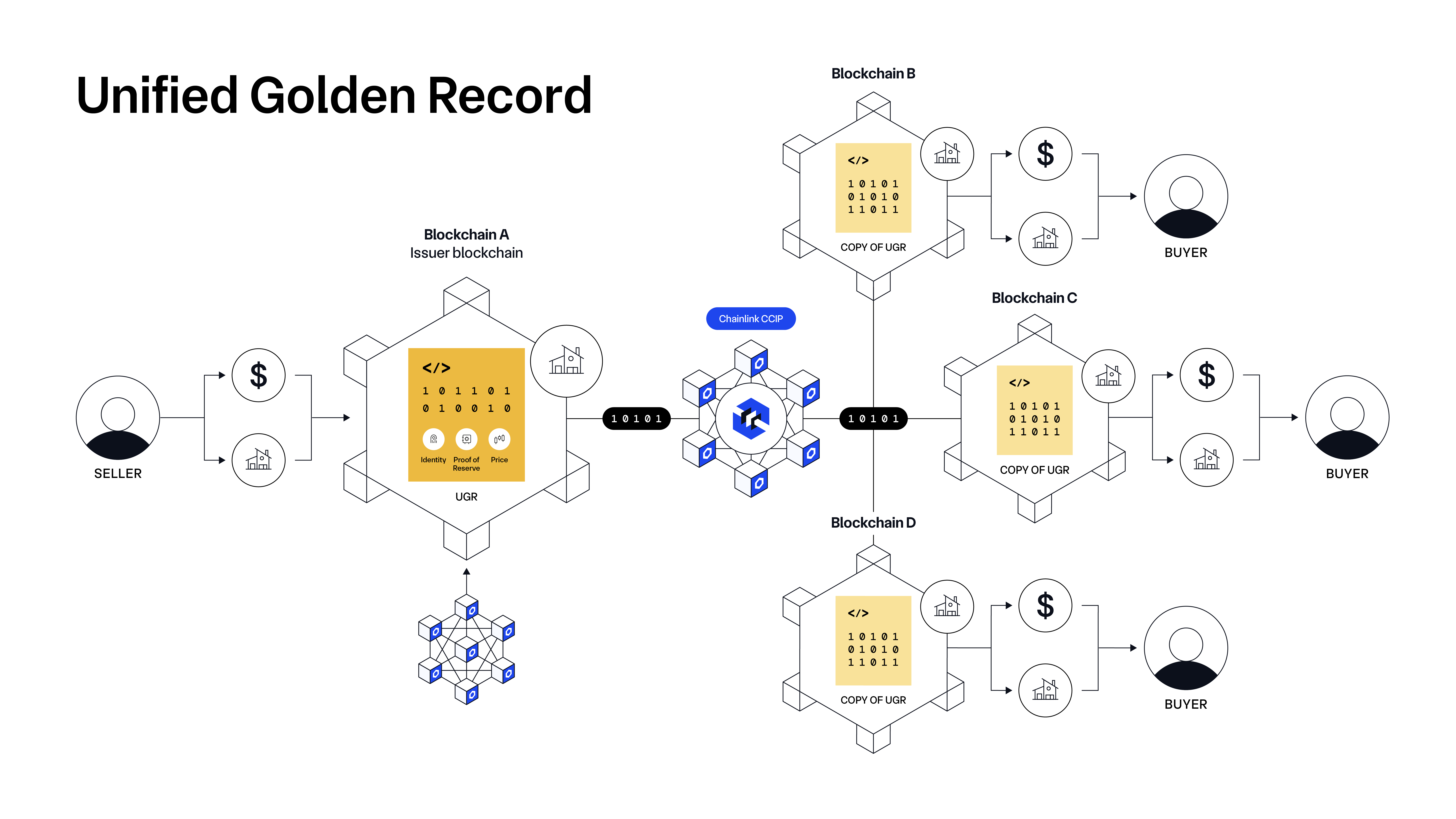

We at Chainlink Labs believe that the current approaches to tokenization fall short because they only focus on the “asset receipt” being onchain but not other key data related to the assets. Bringing the two together onchain is the key to unlocking robust and compliant secondary markets for tokenized assets. This requires a unified golden record for each tokenized asset—a single data container that provides the asset’s ownership and key data, all of which is easily verifiable, fairly accessible, and able to be programmed upon by all participants.

The following post explores how Chainlink uniquely enables a unified golden record in asset tokenization, helping unlock deeper liquidity, more efficient workflows, and smarter, more programmable financial instruments and services. To learn more about the tokenized asset megatrend, check out our industry report: The Definitive Guide to Tokenized Assets.

Current Challenges With Tokenization

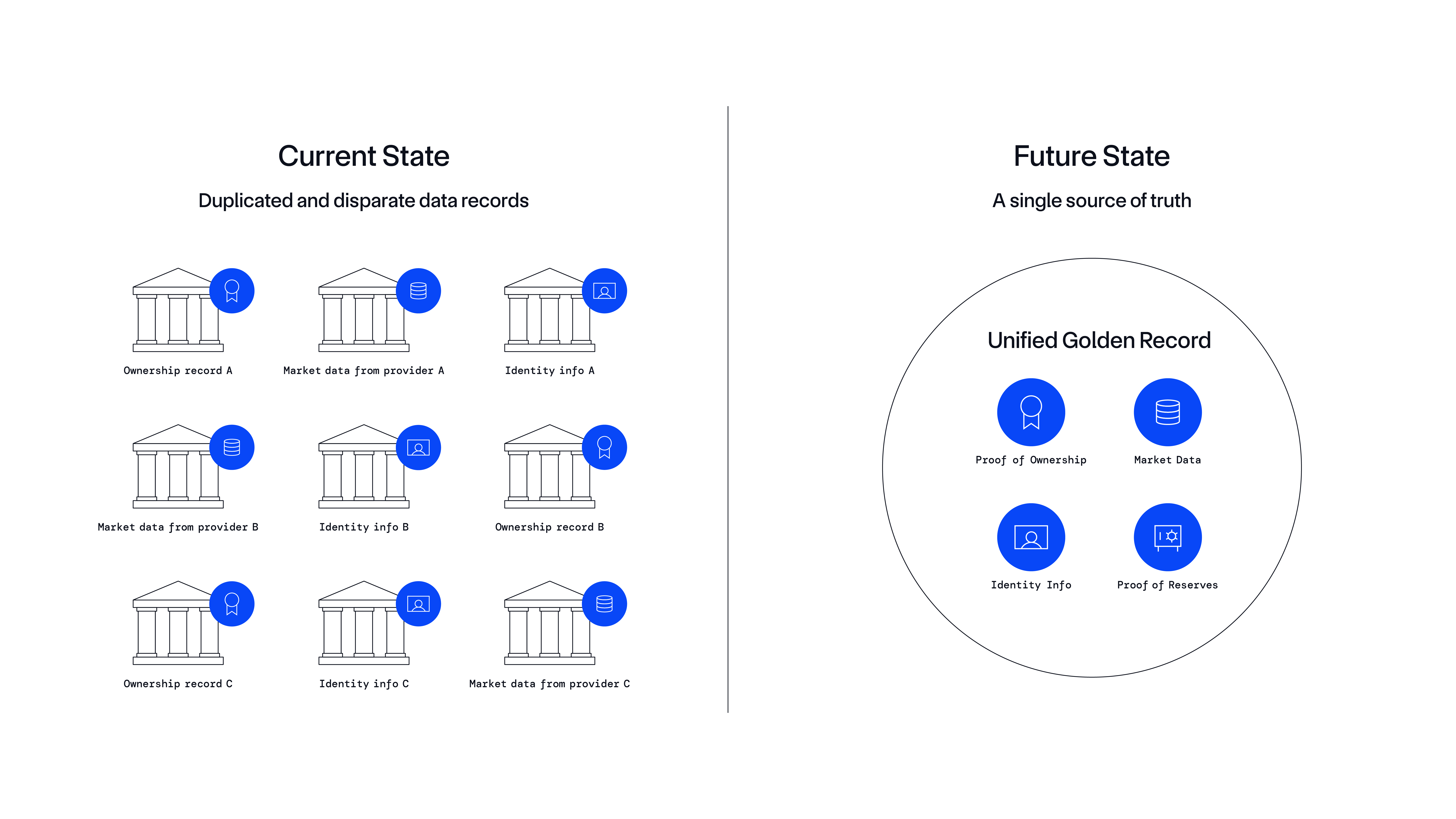

In the traditional financial system, asset data—such as reference data, pricing information, ownership history, identity checks, auditor attestations, etc—resides in numerous disparate backend systems across different market participants, including banks, asset managers, and financial market infrastructures. During financial transactions, asset data must be gathered and oftentimes duplicated between counterparties for all participants to get a common view of market activities.

Unfortunately, some key data may exist outside of a counterparty’s purview, making performing full due diligence challenging and even impossible in some instances. Furthermore, discrepancies and information asymmetries inevitably emerge during the synchronization process due to mismatched or missing data, resulting in failed trades, reconciliation problems, and other errors that drive up costs and settlement times.

“Between 2020 and 2022, the process failed hundreds of times at funds with $342 billion in assets … During the first 10 months of 2022, the analysis found that those responsible for striking NAVs seriously bungled the process almost 130 times, an 18% increase from the same period in 2021. The number of fund shops reporting such mistakes increased even more, by over 29%.”— Calculating NAV Is Hard, Ignites Analysis

Blockchains introduced a shared distributed ledger for verifying and storing asset ownership and transaction data, serving as a single source of truth among all market participants. However, blockchains only track ownership of assets issued on their own networks. Furthermore, the existence of hundreds and eventually thousands of different blockchains means that tokenized assets, liquidity, and data about such assets will originate and move across different blockchains. Data about tokenized assets will also reside and be dynamically updated within a variety of offchain databases and systems, all of which need to remain in sync with onchain networks.

Thus, for a highly reliable, single source of truth about a tokenized asset—a unified golden record—to exist and improve upon the same synchronization problems currently found in traditional finance, it must be available on any blockchain, remain credibly neutral to prevent information asymmetries, and synchronize in real-time with existing offchain infrastructure and data sources.

Without a unified golden record, asset tokenization will mostly be limited to users holding ownership receipts for relatively opaque assets, rather than being bearer instruments fully enriched with all the information needed to access their value and risk profile. Liquid and efficient secondary markets are unlikely to form around tokenized receipts because market participants will have to coordinate with a variety of businesses and systems to obtain all the information and approvals needed to make informed decisions and execute transactions.

For example, prospective purchasers may need to coordinate with multiple counterparties to check the NAV of a tokenized money market fund, confirm if a tokenized carbon credit is valid or redeemable, or verify if there is an outstanding debt on a piece of real estate. This simplified model of tokenization is reminiscent of the data synchronization problem that led to the 2008 Financial Crisis, where investors didn’t have all the underlying data about the assets they were holding, creating significant information asymmetry and systemic risk.

The Need for a Unified Golden Record

A unified golden record is a verifiable, persistent, updateable, and interoperable data container that lives on a blockchain and is embedded within a tokenized asset’s smart contract. It serves as a single source of truth for the asset, which can be referenced by all market participants, including investors, banks, asset issuers, asset managers, and FMIs.

A unified golden record for a tokenized asset provides all market participants with a shared source of truth that includes asset ownership and supplementary information. Realizing unified golden records requires three key capabilities:

- Data Enrichment—To ensure that tokenized assets are trusted and accessible across various jurisdictions and organizations, a unified golden record must include key offchain data such as market pricing, reference data, compliance checks, identity verifications, ownership records, auditor attestations, and proof of reserves. This data is foundational to issuing assets and facilitating transactions in capital markets.

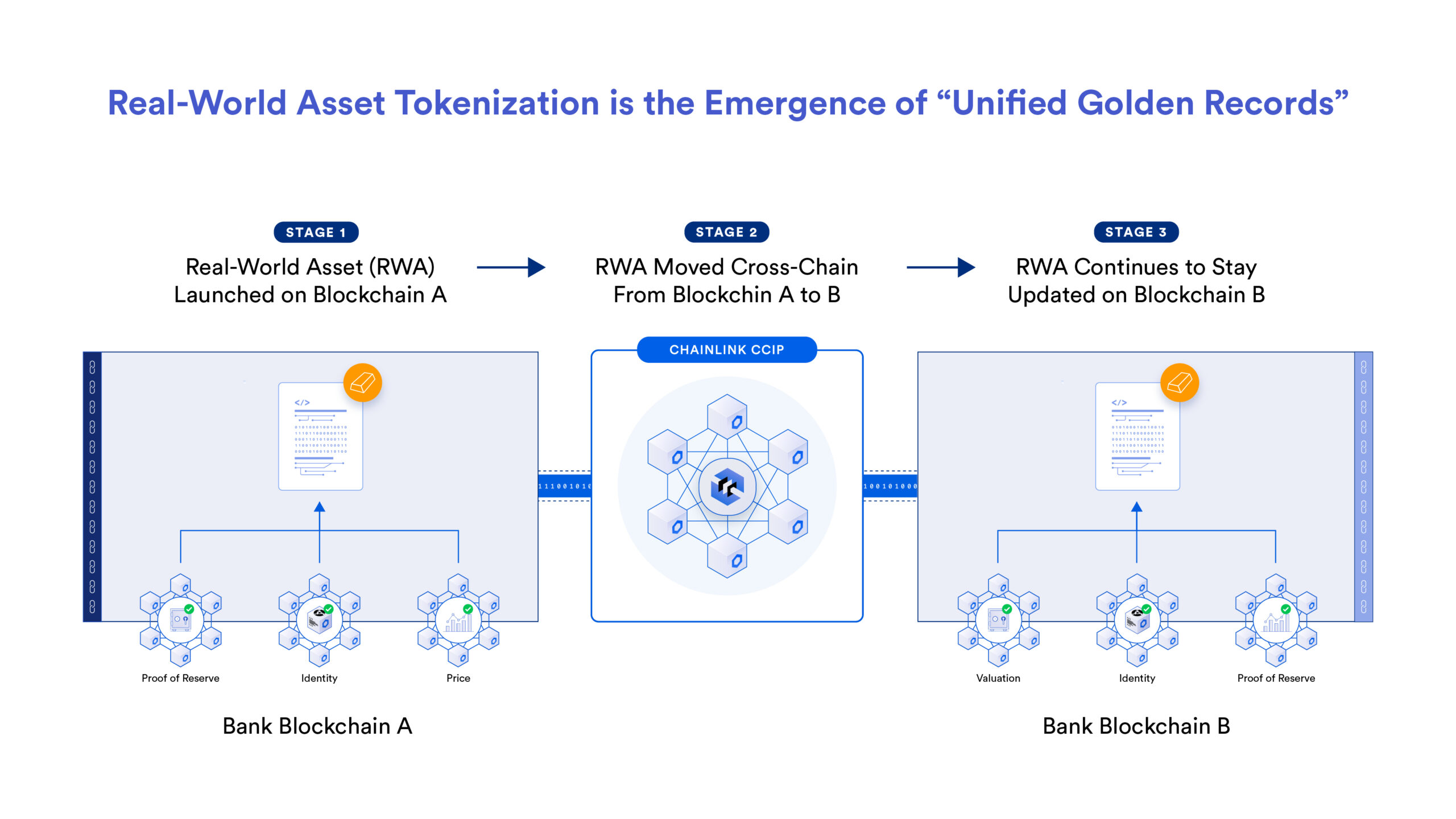

- Cross-chain Interoperability—Ensuring that tokenized assets are composable across disparate blockchains and can be transferred wherever market demand exists is critical for realizing enhanced liquidity within onchain finance. As such, a unified golden record must remain attached/embedded within the tokenized assets as it moves across different onchain environments, including both public blockchains and private DLT networks.

- Continual Synchronization—As the asset and its data move across various chains, it must continue to be updated with offchain data. This is critical to maintaining the unified golden record amongst an increasingly complex web of public and private blockchain networks. It’s also a prerequisite to programming automated actions and services based on a unified golden record, as outdated information can lead to costly errors and time delays.

Market participants can pull publicly available data that’s embedded in the unified golden record into their existing backend systems at any time or use that data to trigger more complex and automated onchain actions, such as verifying the collateralization of a tokenized asset used to secure an onchain loan.

Introducing Unified Golden Records Powered by Chainlink

As more assets get tokenized, the need for an accurate, decentralized, and tamper-proof unified golden record increases, particularly if financial institutions are to realize the full automation, transparency, and programmability benefits that derive from distributed ledgers and tokenized assets.

Let’s look at how Chainlink is the only platform that uniquely supports each unified golden record capability.

High-Quality Data to Enrich a Unified Golden Record

The “garbage in, garbage out” theory refers to the concept that the quality of an output from a system is determined by the quality of its inputs. If flawed, inaccurate, or poor-quality data enters a system, the resulting output will also be flawed, inaccurate, or of poor quality.

Blockchain technology stands out for its ability to create a unified understanding or single source of truth among different parties. Once information is verified and recorded onchain, it becomes a verifiably trusted reference input for everyone involved. This consensus is essential in driving coordination efforts where a collective agreement is needed for the system to function effectively.

Chainlink plays a vital role in ensuring that offchain data about tokenized assets brought onto a blockchain and used as inputs in tokenized asset transactions are secure, accurate, and credibly neutral for all participants. Chainlink helps maintain data accuracy by having a decentralized network of professional service providers (i.e., node operators) collect and aggregate data from across multiple independent sources to provide aggregated onchain updates to the unified golden record in real-time. The combination of multiple layers of decentralization and robust cryptoeconomic incentives ensures a high level of tamper resistance and accountability.

This decentralized infrastructure could help prevent black swan events such as the recent NYSE glitch, in which the listed price of several securities dropped by up to 99.9% due to a failure of its centralized infrastructure. It’s also key to incentivizing collaboration, as no counterparty can solely own, monetize, and manage the infrastructure used to facilitate transactions.

Seamless Data and Asset Flow Across Blockchain Networks

Chainlink addresses the interoperability requirement of a unified golden record by offering a platform where unified golden records are interoperable between blockchains rather than consolidated on a single ledger. This approach is more robust, future-proof, and viable for critical data management, as getting the entire world to agree on a single distributed ledger is highly impractical, inefficient, and limits scalability. Chainlink Co-founder Sergey Nazarov further expands on why a multi-chain approach is where the blockchain industry is moving in his short talk: How CCIP Enables an Internet of Contracts.

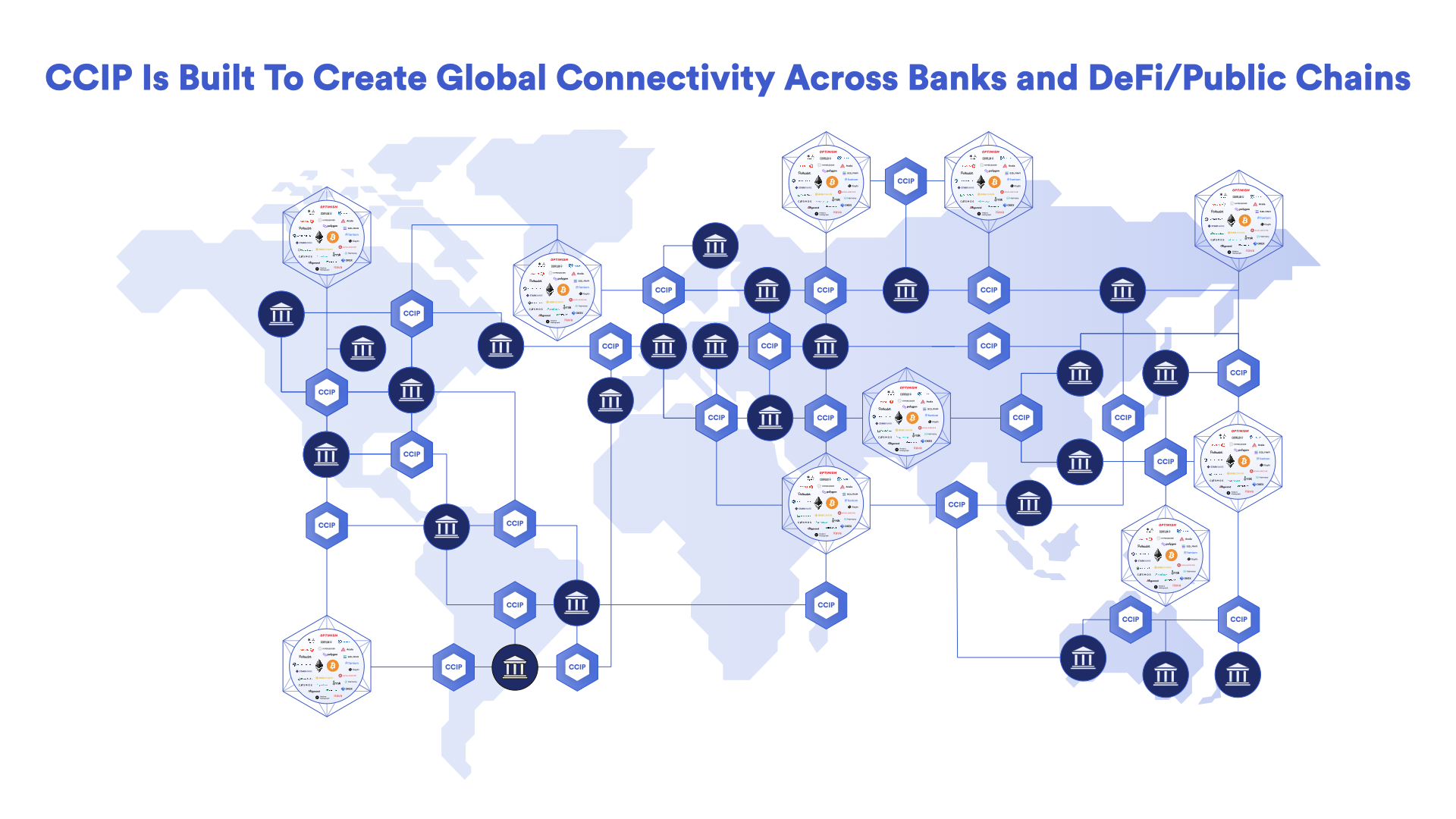

To solve the blockchain interoperability problem, Chainlink launched the Cross-Chain Interoperability Protocol (CCIP)—the cross-chain interoperability standard that securely connects both major public blockchains and private bank distributed ledger technologies (DLTs) into one Internet of Contracts. Major financial institutions and financial market infrastructures (FMIs) are already adopting the Chainlink platform and CCIP to unlock the full potential of tokenized assets, such as Swift, DTCC, ANZ Bank, and a number of other industry participants.

Interoperability ensures that diverse systems can work together and share data without the need for homogenization, which often leads to vendor lock-in and stifles innovation. A unified golden record built on an interoperable foundation like CCIP enables disparate systems across the global financial ecosystem to interact while ensuring that data maintains its integrity and relevance regardless of its point of origin or current residence and that relationships with existing systems are able to persist.

Synchronization and Composable Services

Centralized market infrastructure requires high levels of standardization to function effectively (particularly when automated), yet it must also be flexible enough to adapt to the rapidly changing needs of global markets. The generalized and decentralized nature of a Chainlink-powered universal golden record drives efficiencies through synchronization and composability—the ability to connect existing infrastructure onchain and construct additional services on top of existing ones.

By having a single, shared, trusted, fair, and consistently up-to-date unified golden record that all participants have access to and can easily connect to and program on top, financial entities can develop and integrate new applications and processes that interact seamlessly with it. This composability promotes greater operational efficiency as it negates the need for manual administrative approvals and redundant confirmations and reconciliations from each stakeholder—paving the way for a more streamlined financial landscape.

Use Cases Unlocked by A Unified Golden Record

Some example use cases where Chainlink is already laying the foundation for unified golden records include:

Delivering NAV Data Onchain

One important data point within a unified golden record for tokenized funds is their net asset value (NAV). NAV is the price per share of the fund, which is important from a legal, accounting, and market perspective when conducting financial transactions of tokenized fund shares. A collaboration between DTCC and Chainlink recently explored Onchain NAV solutions, which can be read about in the full report: Smart NAV Report: Bringing Trusted Data to the Blockchain Ecosystem.

Another example involves a collaboration between Chainlink, Fidelity International, and Sygnum to bring NAV data onchain. This production use case for tokenized assets provides transparency and accessibility around key asset data for Sygnum’s recently issued onchain representation of Fidelity International’s $6.9 billion Institutional Liquidity Fund.

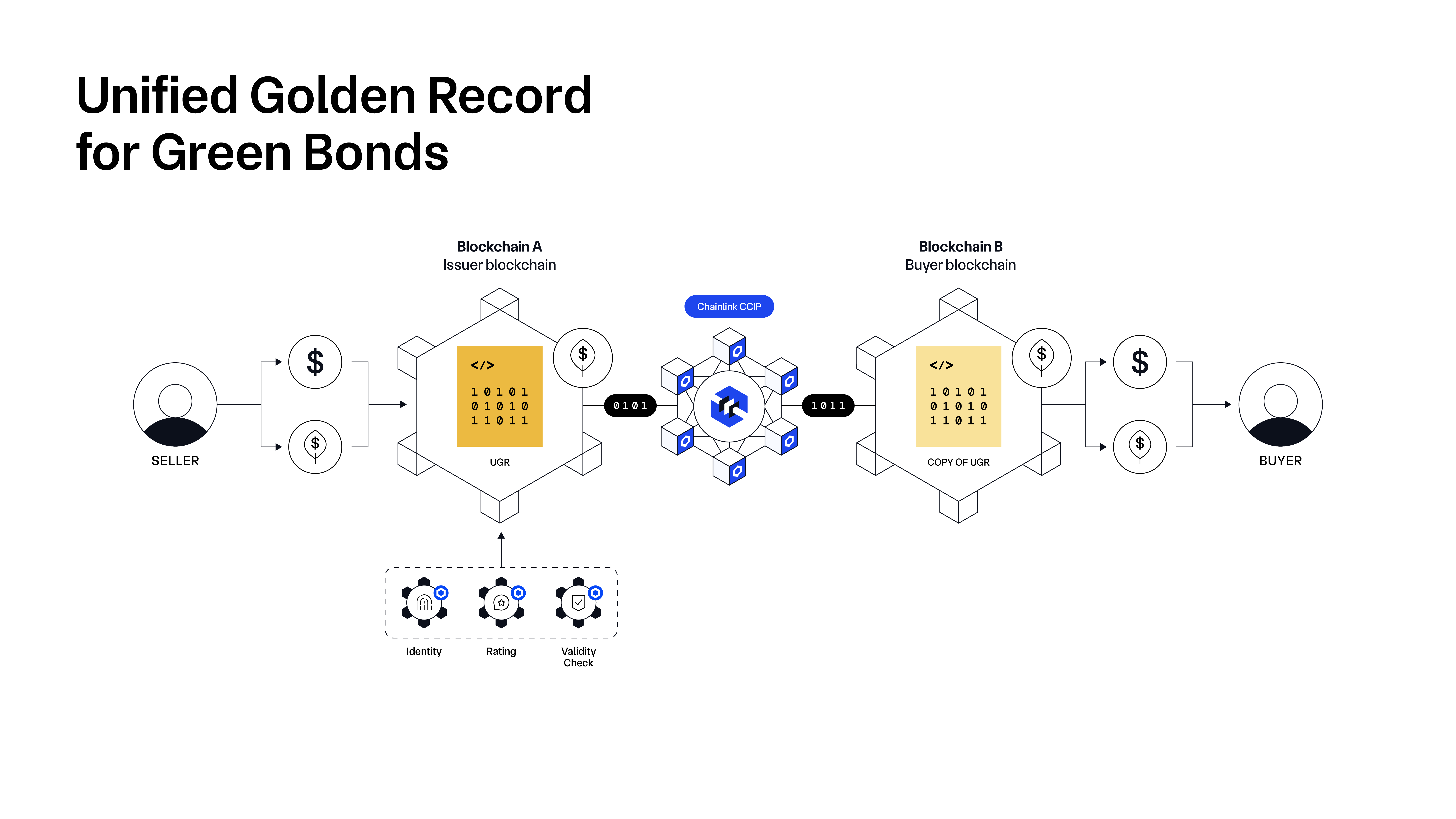

Verifying the Validity of Green Bonds

Green bonds have emerged as a way to support specific climate or environmental-related projects. Unfortunately, there are a variety of fraudulent green bonds and double-counting practices. This also includes “greenwashing,” where bonds are being sold but are no longer valid. Companies buying such bonds are at risk of reputational damage, financial loss from underperforming assets, legal penalties for non-compliance, and overall failure to achieve genuine ESG objectives.

Tokenization is emerging as an attractive infrastructure to support green bonds given their historical lack of standardized infrastructure and means of ensuring validated and accurate data for green financing purposes. However, for tokenized green bonds to scale, potential buyers must be able to verify certain information about green bonds before purchasing them, such as their issuers, regulatory compliance, financial viability, ownership, and more. A unified golden record powered by Chainlink can not only make all financial and non-financial information available onchain and verifiable by the entire financial ecosystem, but also enable more robust and efficient secondary markets by introducing various post-tokenization utilities.

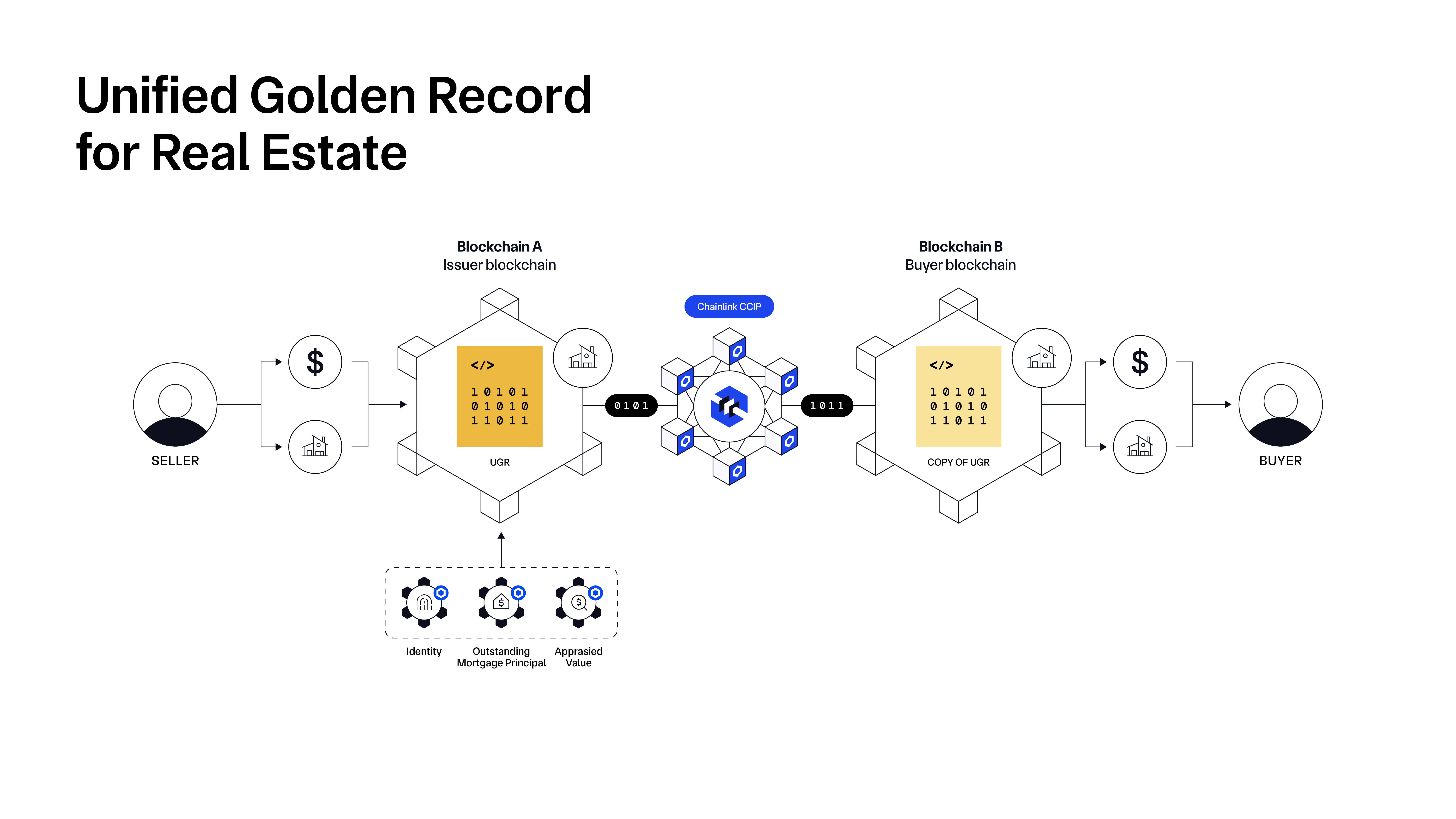

Checking the Current State of Real Estate

Tokenization is highly attractive in real estate (or real estate mortgages), especially considering that real estate ownership can be fractionalized into any number of tokenized shares, making it accessible to more investors. Prior to purchasing tokenized real estate, buyers will want to verify certain information about it, such as who owns the deed, whether there is any outstanding debt, or simply a reliable appraisal from a reputable appraiser.

Some examples of tokenized real estate assets and the associated data they might require include:

- Tokenized Real Estate Investment Trusts (REITs) require key data such as NAV, Funds from Operations (FFO), Dividend Yield, Property Type, Geographic Location, and Occupancy Rate so investors can accurately and reliably assess the risk of the underlying collateral and make data-driven investment decisions accordingly.

- Tokenized Commercial Mortgage Backed Securities (CMBS) require key data such as Credit Ratings, Unpaid Principal Balances (UPB), Yield to Maturity (YTM), Delinquency Rate, Loan-to-Value Ratio (LTV), and Debt Service Coverage Ratio (DSCR) for continuous risk management and risk-return analysis.

- Tokenized Special Purpose Vehicles (SPVs) Equity Shares require key data such as property NOI, Cap Rate, Appraisal Value, IRR, and Occupancy Rate for shareholders to make sound asset management decisions.

Chainlink can be used to retrieve this data from trusted off-chain sources and deliver it on-chain in a secure and timely manner, creating unified golden records while also enhancing the liquidity of the tokenized assets.

Unlocking Tokenized Assets at Scale With a Unified Golden Record

Imagine, 24/7/365 financial markets with superior risk management, increased collateralization options, reduced information asymmetry, and enhanced programmability for automated financial services. Or the banking and Web3 worlds converging on a single financial system with greater liquidity and access worldwide. Ultimately, the potential real-world impact unlocked by tokenization is massive, but it can only be realized through the establishment of unified golden records that serve as single sources of reliable and tamperproof truth about tokenized assets, which are connected to and across all blockchains, synchronized with existing offchain systems, and maintained in a fair and decentralized manner.

By leveraging Chainlink-powered unified golden records, financial institutions across various regions can securely interact via an easy-to-access platform that interfaces with both new blockchain-based platforms and legacy systems. Moreover, transparency, interoperability, and data privacy can become intrinsic characteristics of the financial substrate rather than afterthoughts. In essence, Chainlink’s interoperable platform doesn’t just enable unified golden records; it can advance a more secure, automated, and cohesive global financial ecosystem.

If you want to learn more about how Chainlink can support your tokenized asset, reach out to our team of experts. We also encourage you to listen to Chainlink Co-Founder Sergey Nazarov talk more in depth below about how Chainlink supports capital markets’ transition onchain, such as by enabling unified golden records.