Tokenized in America: How the U.S. Financial System Gains Global Market Share by Embracing Blockchain Technology and Tokenization

- Countries worldwide are moving to redefine their role in the new onchain financial system, presenting a generational opportunity for forward-looking jurisdictions to lead in the issuance and distribution of tokenized assets.

- The United States is well-positioned to take a leadership role—but only if it embraces blockchain infrastructure and provides regulatory clarity.

- Tokenized in America is an industry resource developed by Chainlink and the Blockchain Association that outlines how the U.S. can lead in the global shift to tokenized financial infrastructure.

- Key innovations like onchain golden records and automated compliance will make tokenized assets issued in the U.S. more efficient, secure, and globally accessible.

Jurisdictions around the world recognize that blockchain-based markets will define the next era of finance. This shift represents a generational opportunity for countries that act early. Among them, the United States is uniquely positioned to lead, thanks to its deep capital markets, top-tier global financial institutions, and history of innovation in financial infrastructure.

While blockchain is often associated with cryptocurrencies and stablecoins, its most transformative potential lies in the tokenization of traditional financial assets—equities, bonds, funds, commodities, and real estate. Bringing these assets onchain unlocks faster settlement, greater transparency, and wider global accessibility.

By enabling institutions, fintechs, and startups to tokenize high-quality financial assets, the U.S. can lead in the global onchain financial system while reinforcing the resilience and reach of its own markets.

For countries that act early and decisively, tokenization offers the chance to become the preferred origin and export hub for global capital.

Challenge #1: Why the Origin of Tokenized Asset Issuance Will Define Global Leadership

By developing the technology and being home to the most impactful Web3 companies, the U.S. had a key structural advantage during the growth of the Internet that allowed it to be the primary beneficiary of the Internet boom. The U.S. does not currently have this same advantage within the blockchain industry today. Though 99% of the $210+ billion stablecoin market is denominated in U.S. dollars, many of the USD-backed stablecoin protocols operate offshore. More importantly, the wrapping and redistributing of U.S. dollars via stablecoins is just the initial “email” use case of blockchain assets. Decentralized finance (DeFi) is emerging as a neutral, global infrastructure that extends this model beyond stablecoins, enabling a wider range of financial assets to reach international markets.

To lead in this new environment, jurisdictions should aim to offer the most attractive and reliable tokenized financial products—financial instruments that are:

- Seamless to purchase and settle

- Contain onchain golden records of information synchronized in real time

- Move toward a real-time verification model

If U.S. institutions can set the global standard by issuing the most attractive tokenized assets that can be exported, repackaged, and adopted worldwide, the U.S. will lead in the new Web3 financial system just as early American technology companies led in the Internet.

Challenge #2: Unlocking Automated Compliance

The most costly part of today’s financial operations is compliance. Tokenized assets need an automated compliance solution that can embed key data such as accredited investor status or KYC/AML information to the asset itself, rather than requiring each financial institution to run duplicative compliance checks. Global banks and exchanges can then wrap and repackage financial assets tokenized in the U.S. with less costs and lower friction than traditional assets—replicating the success and U.S. leadership seen with stablecoins and the U.S. dollar.

Solution #1: Embedding Onchain Golden Records Within Each Tokenized Asset

To address the two challenges highlighted above and to ensure tokenized assets are of the highest quality, critical information needs to be embedded directly within the tokenized asset itself.

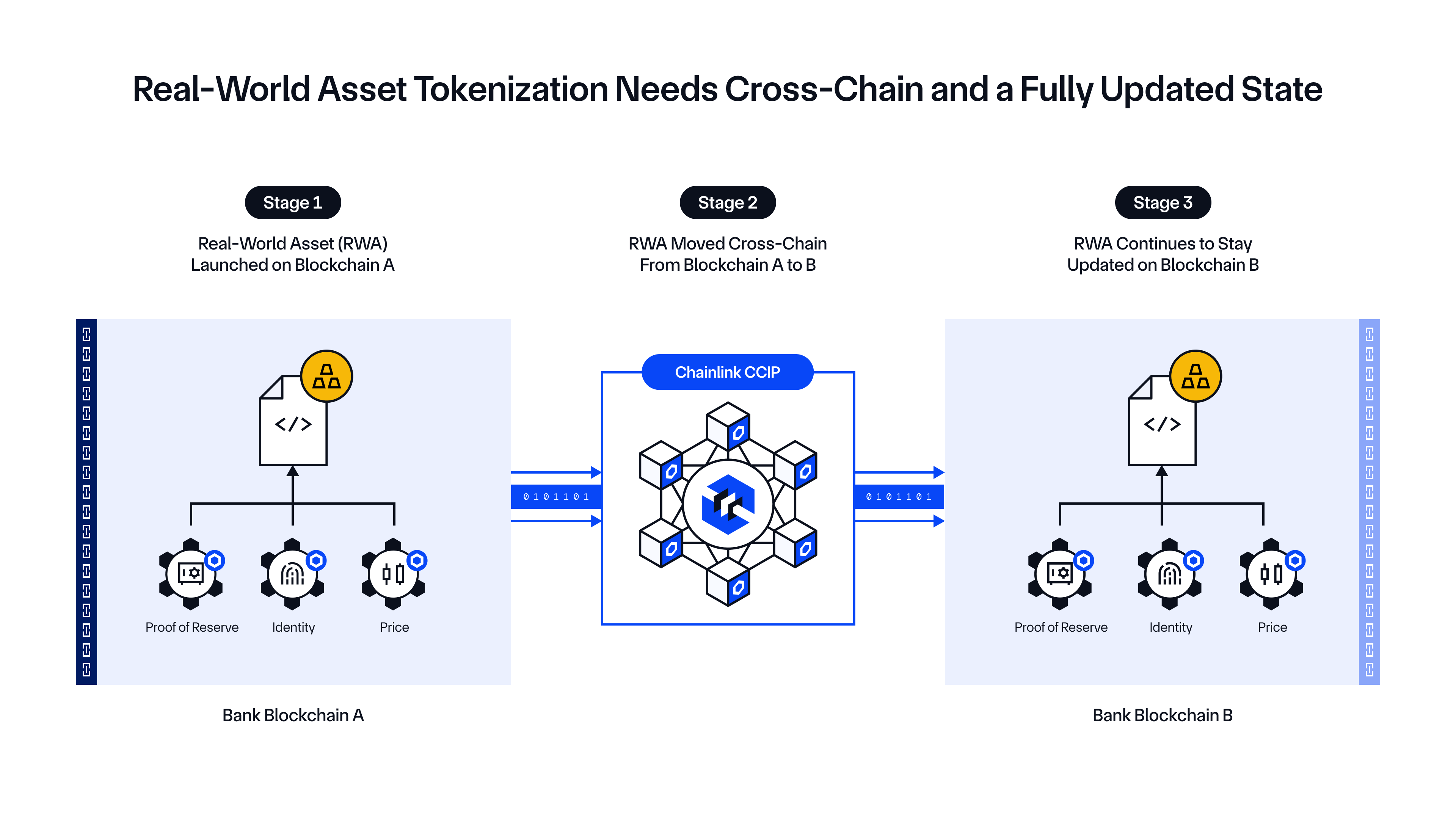

An onchain golden record provides a single, consolidated source of truth for tokenized assets, including the ownership record, compliance requirements, and critical financial price and identity data. Data must be continuously updated in near real time to ensure it remains accurate and can be evaluated transparently at any time by all market participants and financial regulators. Rather than using traditional, expensive, and error-prone methods where data is duplicated across several siloed financial institutions, the technical innovation of blockchains enables data to be stored within the tokenized asset itself. As the tokenized asset moves through various institutions and jurisdictions, the critical asset data moves with it.

Solution #2: Making Compliance Native to Tokenized Assets

To reduce the cost and friction of compliance, tokenized assets must be designed to carry verified regulatory data wherever they’re exported internationally. This transforms compliance from a repetitive, institution-specific process into an automated feature that travels with the asset across systems and borders.

A core part of this solution is the use of identity oracles. These oracles provide trusted, onchain attestations about key participant information, such as KYC and AML status, investor accreditation, and jurisdictional eligibility. Tokenized assets can reference these attestations through smart contracts, which allow them to automatically enforce compliance rules at the point of transfer or access. Compliance becomes a persistent attribute of the asset itself, not a step repeated at every stage of the cycle.

A Global Opportunity for Tokenized Asset Leadership

Jurisdictions now have a near-term window to redefine their role in global finance and establish themselves as a central hub for asset issuance and origination in the Web3 financial system.

The U.S., with its deep financial markets and regulatory maturity, has a distinct opportunity to help shape that future. By embracing blockchain innovation and enabling the large-scale issuance of high-quality, compliant tokenized assets, the U.S. can become the preferred origin point for globally accessible tokenized assets and continue its legacy as the financial center of the world.

Visit Tokenized in America, a resource developed by Chainlink and the Blockchain Association, to dive deeper into how the U.S. can establish leadership in tokenized asset markets, embrace blockchain-based financial infrastructure, and ensure its financial system remains globally competitive.