Tokenization: A Global Unlock for Financial Markets

Authored by Colin Cunningham, Head of Tokenization & Alliances at Chainlink Labs.

It was 2008 and I was in the back half of my economics degree when the global financial crisis struck. Insulated from the world behind college walls, I observed former classmates struggling to land jobs and families around the country losing their homes. I couldn’t put my finger on the problem at that time, but as I’ve come to understand the underlying issues over the last 15 years – I believe they can be solved.

After a short stint on Wall Street and a decade in fintech, I discovered how blockchain-based technologies could create greater transparency that exposes hidden leverage, provides indisputable ownership claims for pledged collateral, and enables the automation of mission-critical risk management strategies that ensure solvency even in volatile market conditions.

But technology alone is not what excites me the most today. In the same way that the financial crisis took opportunities from billions across the world, tokenization—both the infrastructure and the ecosystem—will create them.

As the Head of Tokenization & Alliances at Chainlink Labs, I’m at the front lines of what I see as a seismic shift in the global financial system. Having previously worked at Centrifuge and currently chairing the Tokenized Asset Coalition — a 23-member organization focusing on formalizing our efforts toward awareness, advocacy, and adoption of tokenization at a global and institutional scale — my North Star remains bringing the global financial system onto blockchain-based technology through the tokenization of traditional assets.

Here’s why I’m excited about tokenization and why Chainlink is the foundation of tokenization opportunity.

A Multi-Hundred-Trillion-Dollar Opportunity

First, let’s discuss why I think tokenization is a generational opportunity. The market size is enormous, and this is becoming a more widely held view among many industry participants. For example, the WEF estimates that $867 trillion of value is ready to be disrupted by tokenization, with the potential use cases encompassing much more than just financial assets.

This is a long-term, generational prediction, and it is what we’re ultimately focused on: the tectonic shifts of global infrastructure underlying how the world works. On a smaller timeframe, however, this market is still set to become tens of trillions of dollars in the next decades.

This opportunity exists because tokenizing existing real-world assets offers major benefits: Moving assets from existing traditional finance rails to blockchain-enabled infrastructure presents multiple areas with 10x efficiency gains compared to the status quo.

There are many ‘superpowers’ of tokenized assets, but these have the greatest potential:

- Lower transaction costs and instant settlement, especially cross-border payments.

- Decreased risk and increased efficiency via programmable onchain data utilized within automated risk and portfolio management.

- Access to global liquidity via interoperability and fractionalizing, lending, and borrowing via blockchain-enabled composability

Let’s do a thought experiment and think through just how impactful these ‘superpowers’ can be.

Consider alternative assets such as private equity, private credit, real estate, carbon credits, and hedge funds. Today, alternative asset managers often require a $5 million or more minimum to invest in an alternative asset fund, as siloed infrastructure and a lack of standards make operating and administration costs high. This makes them inaccessible to the majority of investors. So despite individuals controlling over half of global wealth, they only allocate about 5% to alternative assets.

Tokenization superpowers completely change this. By automating backend workflows and risk management with smart contracts and seamlessly connecting financial services and investors across a composable onchain environment, the cost to offer tokenized alternative assets to individuals plummets. Ultimately, this could increase the liquidity for private equity issuers, open up new asset classes to individual investors, and, according to Bain and Company, could increase revenues for the asset management industry by $400B annually.

Tokenization is inevitable.

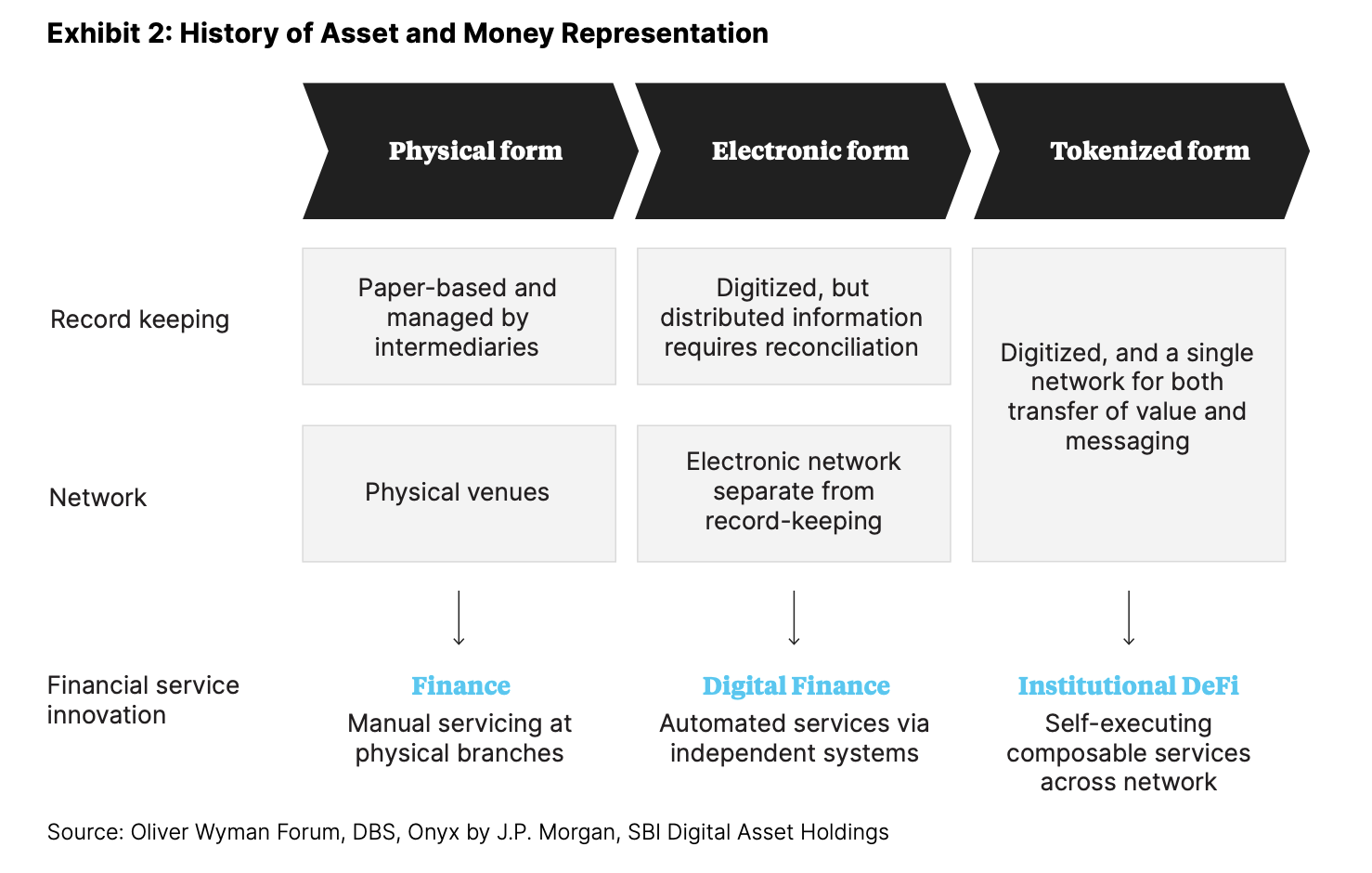

Take this inevitability and expand the opportunity to any and all asset classes in any jurisdiction – it’s clear we have a generational opportunity in front of us today. Blockchain technology will replatform all of the world’s assets into a superior format.

Tokenization isn’t happening simply to meet the demand for onchain assets—it’s happening because it is fundamentally a better way of doing things.

Tokenized Assets Need Utility To Unlock Liquidity

Creating a token representation of the underlying asset is a crucial first step, but that by itself does not inherently make it useful unless the tokenized asset has essential core properties.

There are three big challenges that must be overcome to provide utility to tokenized assets:

- The data and compliance problem—Tokenized assets need to be enriched with real-world information and data that is necessary for them to exist.

- The liquidity problem—Tokenized assets need secure connectivity across the multi-chain ecosystem, unlocking liquidity across different private and public blockchains.

- The golden record/cross-chain synchronization problem—Once the assets begin moving across chains, the data enabling them to operate needs to stay synchronized and up-to-date.

It is not until we overcome these three challenges that tokenized assets gain the properties they need to fulfill the vision of replatforming all the world’s value into the tokenized format.

This is where Chainlink plays a critical role. Chainlink services fulfill these essential requirements—when all three properties emerge in combination, the quality of the tokenized asset is bolstered.

Chainlink Is Essential Infrastructure for the Tokenized Asset Economy

The Chainlink platform is the DNA underpinning the tokenized asset economy, providing both the infrastructure and the ecosystem needed to realize this future.

With a fully-fledged platform offering key services, including Data Feeds, CCIP, Proof of Reserve, and more, Chainlink is the only infrastructure capable of solving all these core challenges.

At the same time, being at the convergence of the blockchain industry and capital markets, Chainlink also has the benefits of a wide-ranging ecosystem. The Chainlink platform has enabled tens of trillions in value, with a large number of integrations across DeFi and collaborations with organizations such as Swift, DTCC, and ANZ Bank. Some protocols may have many DeFi integrations, while other organizations may have a large presence in capital markets, but no one has both other than Chainlink.

How Chainlink Enables Both Sides of the Tokenized Asset Economy

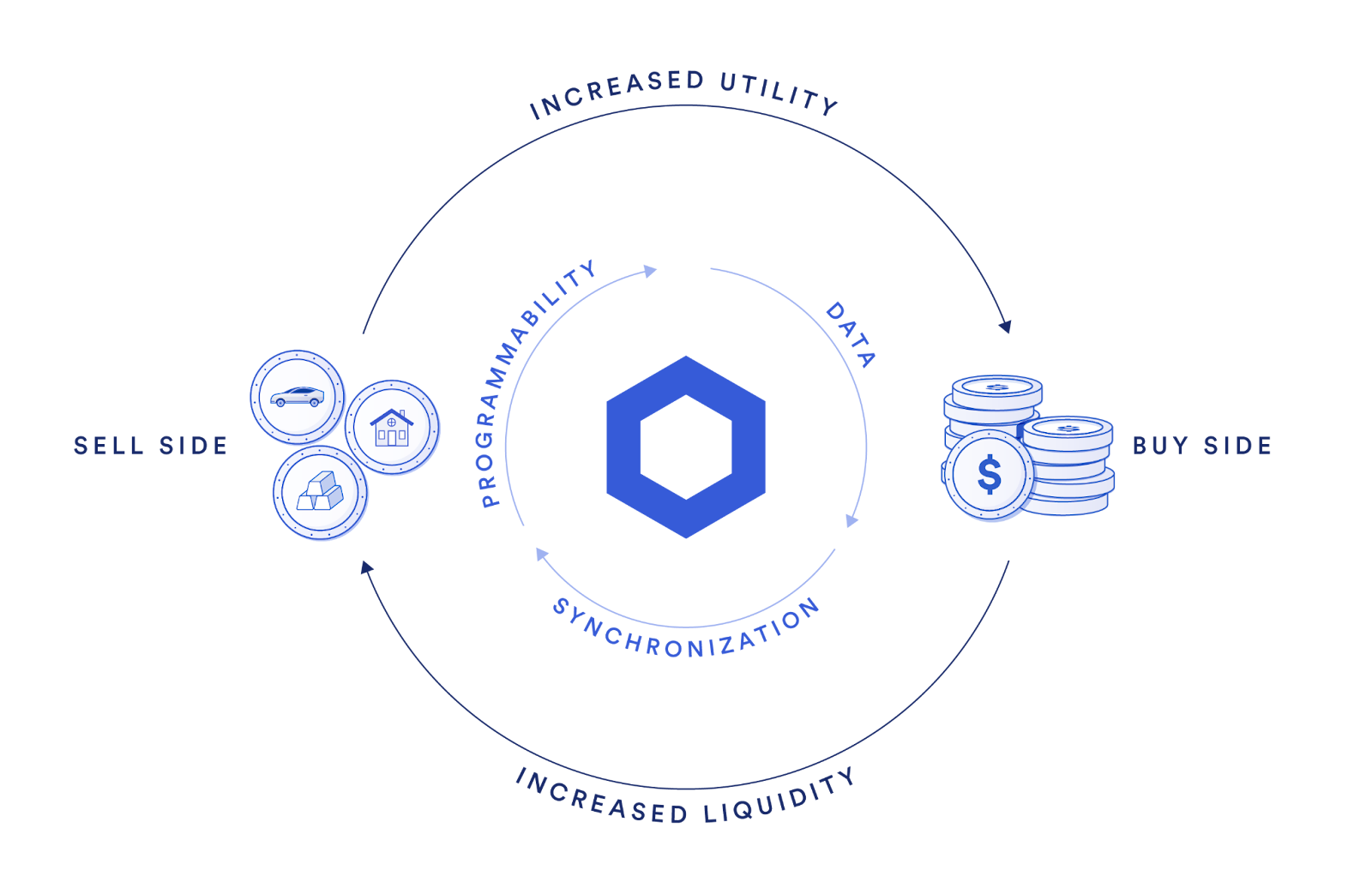

There are two sides to the tokenized asset economy:

- Buy side: Asset managers, pension funds, family offices, DAOs, and individuals.

- Sell side: Corporate banks, investment banks, broker-dealers, real estate brokers, and market makers.

Each side of this ecosystem—alongside service providers supporting both sides—encompasses both TradFi and DeFi organizations, but due to its unique position, offering, ecosystem, and momentum, Chainlink enables both.

Here’s what this looks like: Increased liquidity and enhanced utility together create a positive feedback loop, where Chainlink enhances sell-side assets with data, interoperability, and security, which can lead to heightened demand from the buy side, and in turn, drives greater liquidity, perpetuating the cycle further. By elevating tokenized assets to a superior standard than traditional assets, this positive feedback loop can help grow the entire tokenized asset economy.

The Chainlink platform is already serving this two-sided marketplace with data, interoperability, and security. 21Shares is using Chainlink Proof of Reserve to help verify ARKB BTC ETF reserves. Matrixport is using Chainlink to help secure the minting and cross-chain movement of tokenized short-term U.S. Treasury Bills. Chainlink supports a PYUSD Chainlink Price Feed on the Ethereum mainnet to accelerate the adoption of PayPal USD (PYUSD).

Realizing the Tokenized Future

This is why I’m excited to lead the tokenization effort at Chainlink Labs—Chainlink is the technology platform positioned at the nexus of the tokenized asset economy that solves the three core challenges of tokenization and has a large and growing ecosystem and momentum across both the blockchain industry and capital markets.

Chainlink is the only platform at the convergence of this large industry shift, and this gives me a chance to make the biggest impact I can.

For more on Chainlink’s role in the tokenization economy, visit our new tokenization webpage.

If you’re looking to enhance your tokenization strategy with Chainlink, reach out to our team.

Looking to understand the tokenization opportunity? This industry report provides a comprehensive overview of the growing tokenization market, with contributions from BCG, 21Shares, Paxos, Backed, and Chainlink. Access now.