The Future of Asset Management Using Smart Contracts and Blockchain Oracles

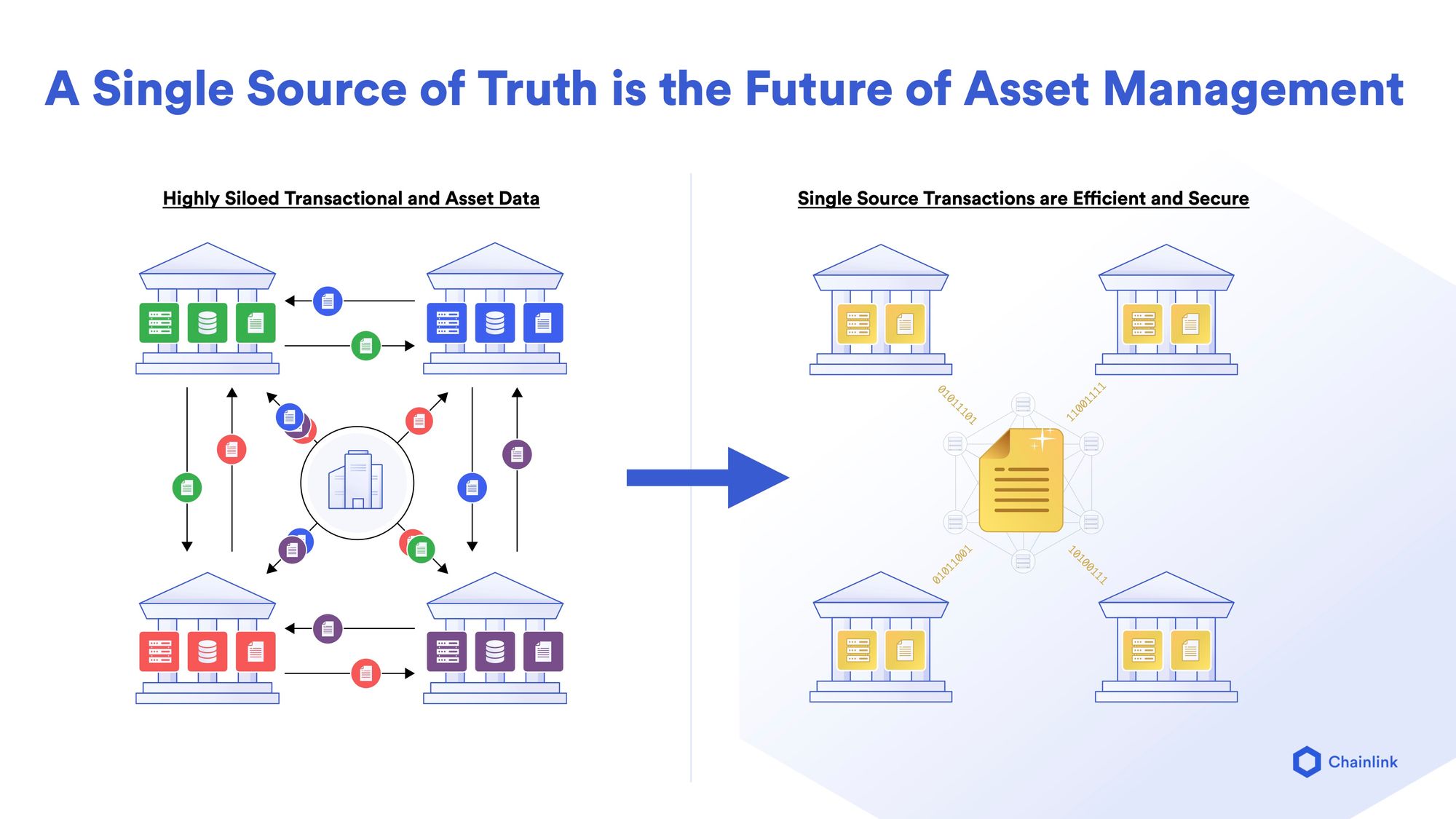

The asset management industry today is highly fragmented across disparate enterprise systems, resulting in siloed data around different asset classes, increased back office costs for asset managers, and ultimately heightened systemic risk that affects institutions and individual users alike. With the rapid wave of innovation in decentralized finance (DeFi) and increased institutional adoption of blockchain technology, smart contract based processes have emerged as the logical next step for the industry.

In his recent presentation at Fidelity Investments, Chainlink Co-founder Sergey Nazarov explored the state of modern asset management and explained the industry-wide implications of smart contracts, which are already bringing increased automation to traditional business workflows. This blog post is an excerpt of Sergey Nazarov’s talk that highlights how blockchains powered by Chainlink oracles can create single sources of truth for the asset management industry to reduce systemic risk, lower costs, and create new highly transparent asset classes.

Fragmentation in Today’s Asset Management Industry

In the current asset management industry, you see a lot of fragmentation around certain categories of assets—large categories with billions, sometimes trillions, dollars worth of assets—as well as around how those categories function. There is huge fragmentation across silos of data that belong to the individual institutions participating in asset transactions.

Then you have middlemen technology companies that seek to impose standards because they eventually want to extract monopoly rent. They want to make a messaging standard or an API standard of some kind, and if they’re not member-owned, they seek to eventually arrive at a for-profit extraction of monopoly rents. This increases both the complexity for the internal risk assessment and the management of assets, ultimately increasing the costs, which are then passed on to users.

But even beyond all that, we have a world right now where every company has its own database. Middlemen often sit between asset managers, the issuers of the assets, and other parties, and these middlemen are hugely inefficient. This creates systemic financial risk, and it creates huge amounts of costs for asset managers.

The fascinating thing is that the asset manager has massive purchasing power. They can impose certain structural changes on the market by virtue of purchasing power alone. This is a key point: an asset manager wants to impose certain structural changes to their own benefit instead of benefitting an asset issuer or a middleman. Since many of these assets are held by asset managers in holding companies, asset managers are in a unique position and are probably one of the largest beneficiaries of the shift to a single source of truth enabled by blockchain technology.

The Benefits of Smart Contracts for Asset Management

A single source of truth is the value proposition and the outcome that blockchain and smart contracts seek to deliver. Suppose you don’t have a single record that all the parties trust and everybody keeps their own record. In that case, our records might contain different information, or our records are formatted differently, and we cannot easily transfer the records between systems. Now you don’t have the information.

However, if we all have a single source of truth that we all trust, we can all append it with additional useful information. This appending of additional useful information into a single shared source of truth is often called the golden source of truth, which is what blockchain technology seeks to achieve. A blockchain seeks to achieve this in a way that doesn’t extract monopoly rent. So, a blockchain is not a technology provider putting you on their for-profit private system to extract monopoly rents in the long term—it’s an open-source network anyone can use. Blockchains will evolve into a public good because a single source of truth for the financial markets, or insurance, is a pivotal technological development for these industries

The closest analogy to what you have in the financial markets is member-owned computational and data storage resources, which have already expressed that they will be moving to a blockchain-based model. In every significant geography with real financial asset volume, you see more and more people going towards the single source of truth model. Blockchains and smart contracts are of extreme importance because they create a structural change in how people relate to assets, which will have a fundamental effect on both risk and returns.

Reduced Systemic Risk in Global Markets

To put this problem into perspective, we can look at the 2008 financial crisis as an example. Obviously, this crisis has layers upon layers of unique complexities depending on which institution you investigate. But at a very fundamental level, from a data and the recordkeeping point of view, you really have the same systems then that you have now. You had people going into one institution, generating a record about their credit worthiness, and gaining a loan. Then that record partially made its way to another institution, like an investment banker, or somewhere where the individual loans became packaged up. Then eventually, those packaged loans, with even less information now, made their way to asset managers.

In addition to incentives, this was, in my opinion, one of the largest factors that created this crisis. It’s basically because the people that had the relevant data didn’t transfer it—even if they wanted to transfer more data, they would have learned they weren’t able to. This lack of data transferability created a huge gap in the understanding of both credit risk assessment agencies and asset managers. By not having a single source of truth, this created a huge systemic financial risk and losses for asset managers and retail users. This is one of the flaws of the current system—its inability to properly assess risk since information is not reliably transferred, because there isn’t a container in which to transfer it. Each institution has their own container, and they take a little piece out and they send it to the next person. But there’s a bunch of information left in their container. They just don’t have a way to transfer the information so a person can trust and utilize it.

Lower Costs Via Smart Contract Automation

If we look at what would have happened if we had blockchains and smart contracts during the 2008 financial crisis, we would have people conversing in a single source of truth model using smart contracts. So, the loan originator would have had people come in, and they would have generated individual smart contracts for each loan holder. They then could have appended additional data like their FICO score to that contract, which could have been automatically updated on an annual basis to each individual record. Those individual records can then, at a much greater efficiency and therefore at a lower cost, be packaged up by investment banks who securitize and create the asset-backed securities. Very importantly, the final assets that make their way to the asset manager in the larger market are transparent. This reduces problems created by opaque baskets of hundreds of thousands of assets.

Ratings aside, asset managers and financial institutions would be able to dig into this incrementally detailed view of every single loan holder within a container. The container moves from institution to institution with each additional important insight appended to it. Then, when it finally reaches the market, you have a huge breadth and depth of data on each individual asset and its value. These underlying dynamics and the interaction with detailed data not only mitigate risk, but also allow asset managers to interact with more advanced assets and products, because now the quality of the data is so clear on an asset by asset basis. It’s now proven that smart contracts and blockchains generate all kinds of new assets at a much higher rate of efficiency.

The way this would have solved the 2008 financial crisis is if each individual asset would have had their own smart contract, and that smart contract as a container would have moved from the loan originator to the investment bank and then to the asset manager. Along the way, the container would be appended by FICO and other credit scores and other data that’s relevant to that specific individual contract. In my opinion, this may not have completely stopped the crisis, but it would have definitely softened the boom and bust cycle. The leverage credit cycle would have been significantly softened if the market, and specifically US asset managers, had the ability to look into the underlying asset fundamentals at a very high degree of accuracy—this is what I’m really talking about in the case of a single source of truth.

New, Transparent Asset Classes

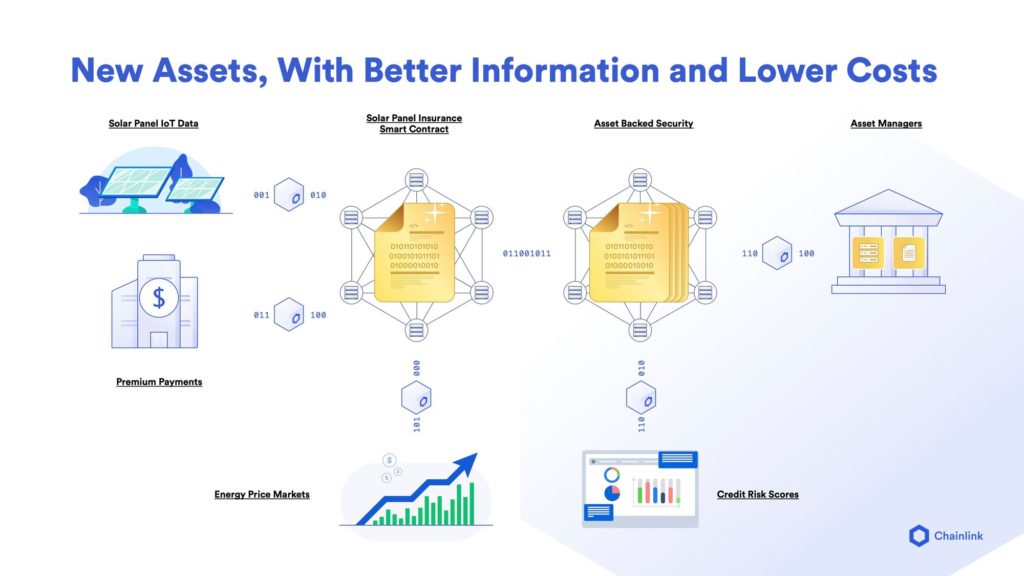

Smart contracts and blockchains not only enable greater efficiency for asset managers, but they also create entirely new assets that provide better information and much lower costs to managers and users. At the end of the day, what smart contracts act as is an extremely trustworthy digital container about an asset. It’s a digital container that from our 2008 financial crisis example can move between institutions, and therefore it’s actually worth it to add more data to it. Because if you add data to it, that data will underpin the value of that container, and also accentuate the value of the underlying asset. So now people have a reason to add more important information to that container, because they know it won’t be lost when it goes to the next institution that happens to own the asset. The container will continue to move between institutions, and you can keep adding data to it.

In this case, I think what we’re illustrating is a very exciting class of assets that we think has a very bright future in the form of insurance and securitized insurance. Since energy price markets are becoming more efficient, we can use solar panel fields as an example. You can arrive at a place where you have premium payments going into a single source of truth digital container. That digital container knows the underlying asset’s status through IoT data showing whether the solar panels are active and performing in terms of their expected capacity for generating energy. The container can also know important details about energy price markets. So, the container can have a certain sense of the underlying asset’s health, and whether a certain solar panel field is solvent based on the energy prices in that specific region. Then it can continue to acquire all of this information on a solar panel field by solar panel field basis. You now have an extremely granular level of data about the underlying asset that’s collected extremely securely and efficiently on an ongoing basis without human intervention. You get extreme data quality that’s not able to be manipulated at extremely low costs, and immediate transparency for asset managers and users.

If your users want to understand exactly what their underlying assets are, then this transparency can flow all the way to your users. Your users can now have more clarity on their investments, which I personally think is going to be a huge advantage in the medium term. Then, all of the details from each of these individual assets can flow into an asset-backed security. Because you have so many high-quality individual asset smart contracts, the composition of these into an asset-backed security is done more efficiently. Packaging these containers into asset-backed securities is something that can be extremely granular, so you can have certain assets removed and other assets added. This eliminates the fees and all of the other dynamics surrounding middlemen.

But the fundamental dynamic is that asset managers will become more competitive as they compose new assets and create more efficiencies. So I think that the world’s asset managers should push this dynamic as they are huge beneficiaries of this change. They don’t have any need to be middlemen to generate these assets. Asset managers don’t need to make money on fees from the transactional volume of moving assets. You want to hold the assets, and you want to give them to your users at a fair price, at a high level of security, and a high level of risk mitigation. Blockchains and smart contracts powered by decentralized oracles enable this reality to the maximum degree possible.

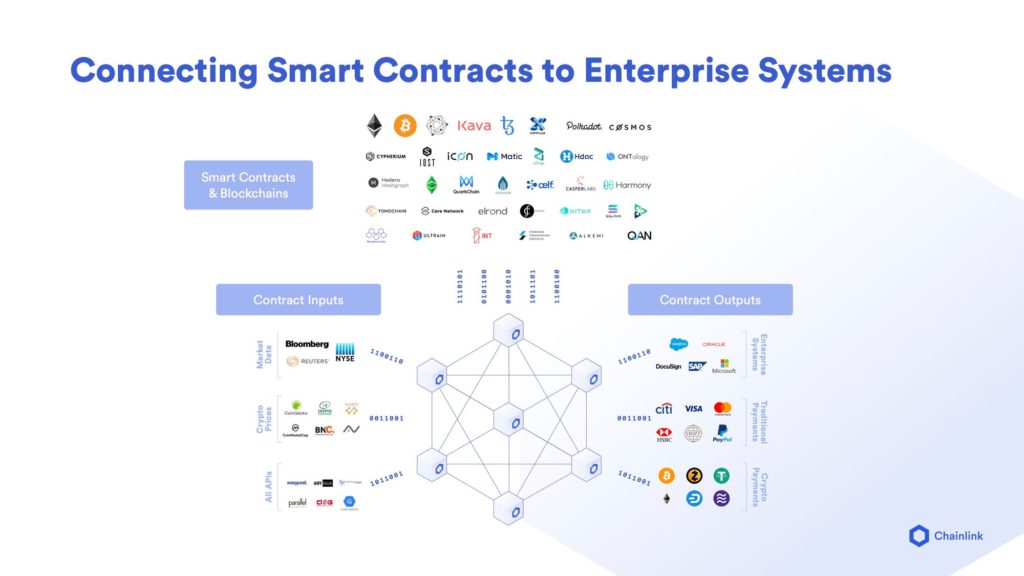

Chainlink as a Blockchain Integration Gateway for Enterprise Systems

Chainlink enables existing enterprise systems to connect to any blockchain environment. Not only does Chainlink’s oracle network provide the ability to put your data on-chain and connect to outbound payment systems, Chainlink acts as a bridge from your internal enterprise systems that you want to retain because you have built workflows on top of them. Your internal enterprise systems already control a lot of value, and creating new backend services to connect to each blockchain environment is difficult and inefficient. You want to connect all of your current systems and backend services to blockchains as an environment where you can conduct commerce. This is what Chainlink enables by connecting your enterprise systems to any blockchain.

Instead of a multinational asset manager or any other large enterprise assembling a blockchain team for every blockchain that they might want to integrate, you can easily integrate Chainlink to connect to any blockchain environment. Building your own connections to various blockchains will be unbelievably difficult because the communities are small, and integration support is limited for many exciting up-and-coming blockchains. This is true even for the blockchains that already have many assets on them as it’s still a challenge to hire knowledgeable developers.

Rather than having 50 or 100 blockchain keys for you to conduct commerce, it is a risk-adjusted approach to have blockchain capability built directly into your backend through a secure blockchain middleware. This is the other big problem that Chainlink solves for enterprises when they ask, “How do I connect to every blockchain where I want to conduct commerce, own assets, trigger transactions, or understand what’s going on in those blockchains?”