The Evolution of Digital Assets and Tokenization in the United Kingdom

Op-ed by Jorge Lesmes, Global Head of Partnerships, Chainlink Labs

The United Kingdom is entering a practical phase in the evolution of tokenized financial assets. With one of the world’s deepest capital markets, a globally influential asset management industry, and a long-standing role as a hub for financial market infrastructure, the UK is well positioned to integrate tokenization into its existing financial system rather than treating it as a parallel experiment.

Regulatory engagement has played a central role in shaping this trajectory. Through the Financial Conduct Authority (FCA), HM Treasury, and the Bank of England, the UK has adopted a deliberately sequenced approach providing guidance, running consultations, and establishing sandboxes to allow innovation while maintaining high standards of market conduct and operational resilience. This has created an environment in which tokenization is increasingly viewed as an infrastructure evolution, not a speculative departure from established finance.

At the same time, market participants are beginning to translate this regulatory engagement into action. Index providers, asset managers, fintech firms, and infrastructure providers are moving from conceptual pilots to targeted, production-grade implementations that address real operational needs.

1. Tokenization as an Efficiency and Connectivity Lever

In the UK, tokenization is less about introducing entirely new instruments and more about re-engineering how existing instruments operate. Representing funds, securities, and reference data onchain creates opportunities to automate processes that remain costly and fragmented today, particularly in post-trade operations, data dissemination, and cross-platform coordination.

The potential benefits are especially relevant for a market like the UK, which intermediates capital flows globally. Improving the speed and consistency with which assets, data, and instructions move across institutions can reduce friction not only domestically, but across international value chains linked to London’s financial ecosystem.

Crucially, this transition does not imply abandoning existing infrastructure. Instead, tokenization is being layered onto current systems, requiring strong integration between blockchain networks, custodians, data providers, and compliance frameworks.

2. Infrastructure Comes First: Data, Compliance, and Interoperability

As UK initiatives mature, a consistent theme has emerged: the success of tokenization depends less on the token itself and more on the supporting infrastructure.

High-quality market data is a foundational requirement. Pricing, indices, and reference benchmarks underpin virtually every institutional financial activity, from portfolio construction to risk management. The move by FTSE Russell, part of the London Stock Exchange Group Business, to publish its global indices onchain via Chainlink’s DataLink reflects this reality. By making trusted benchmark data, used to track and manage trillions of pounds in assets, available directly on blockchain networks, this initiative enables tokenized products to rely on the same inputs as traditional funds and securities.

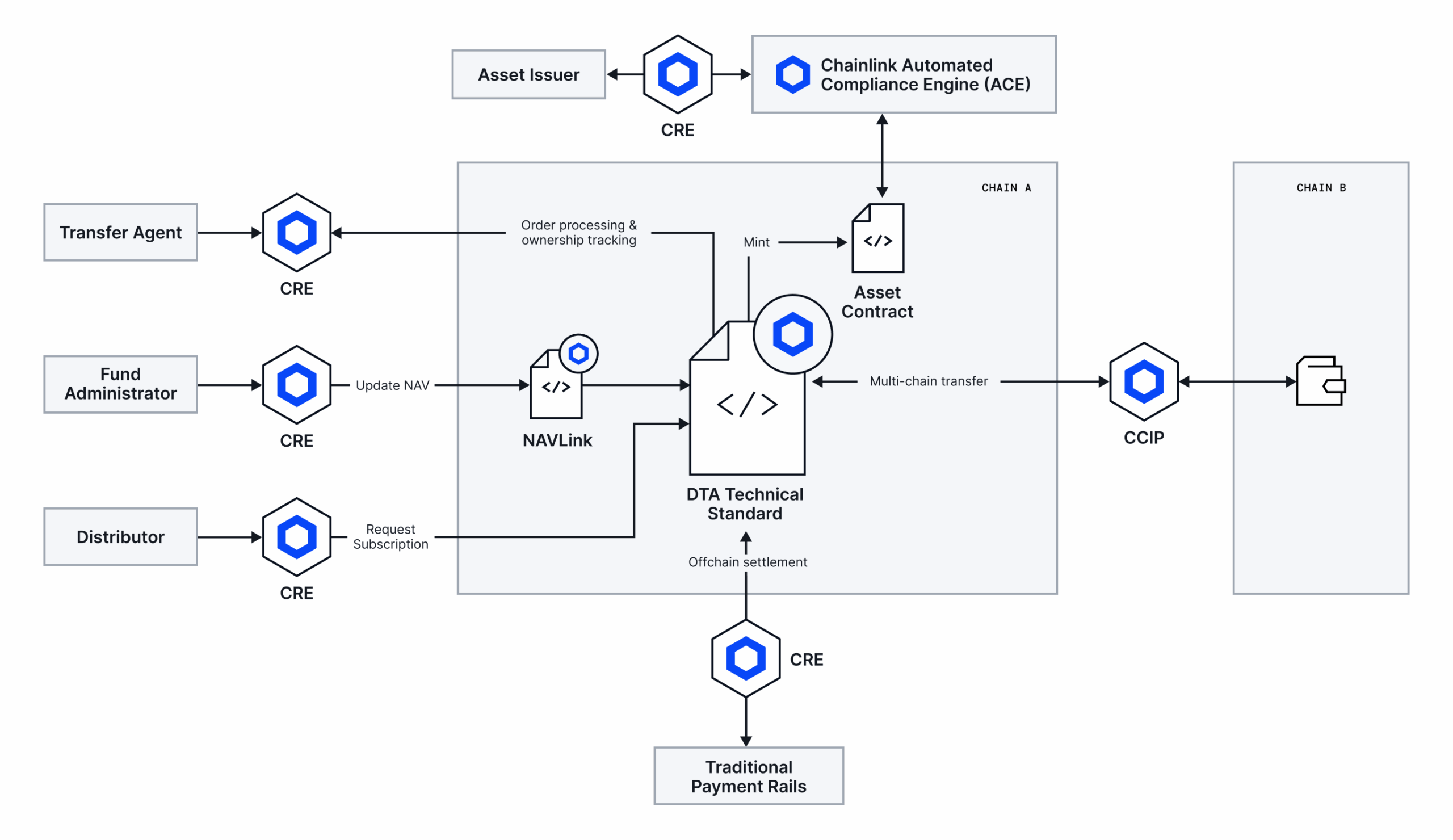

Compliance is another structural priority. UK institutions operate within robust governance and supervisory frameworks, and tokenized assets must meet these same expectations. As a result, there is growing interest in programmable compliance and policy enforcement mechanisms that can operate across different blockchain environments while remaining aligned with regulatory requirements. Infrastructure such as Chainlink’s Automated Compliance Engine (ACE) reflects this direction by enabling compliance rules, eligibility checks, and policy controls to be embedded directly into onchain workflows and enforced consistently across networks.

In the UK, this is complemented by market participants, which builds case management and regulatory reporting workflows on top of programmable compliance infrastructure which is working with Chainlink to align ACE with established regulatory frameworks for digital securities. Together, these efforts illustrate how compliance, reporting, and governance can evolve alongside tokenization without compromising regulatory standards.

Interoperability ties these elements together. In practice, tokenized assets in the UK will interact with multiple blockchains, legacy systems, and international counterparties. Standardized interoperability frameworks, such as Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and orchestration tools like the Chainlink Runtime Environment (CRE), are increasingly viewed as enabling technologies that allow assets, data, and workflows to move securely across these environments.

3. Institutional Momentum Across the UK Ecosystem

In the asset management and operations domain, Schroders participated in the Corporate Actions Lifecycle Management (CALM) project, led by Chainlink in collaboration with more than twenty financial market participants. The initiative is focused on modernizing corporate actions processing, an area that remains one of the most operationally complex and costly aspects of securities servicing due to fragmented data flows and manual reconciliation. By leveraging blockchain-based workflows and verifiable data infrastructure, the CALM project aims to automate key lifecycle events, improve data accuracy and timeliness, and reduce operational risk, closely aligning with the UK market’s emphasis on efficiency, transparency, and resilience.

At the intersection of traditional finance and decentralized finance, Chainlink’s work with Aave Labs and Euler Labs highlights another emerging direction. These efforts explore how institutional-grade data, risk controls, and compliance considerations can be integrated into onchain lending and liquidity markets. For UK-based institutions operating globally, such integrations offer a pathway to access programmable financial primitives while maintaining appropriate safeguards.

Together, these examples reflect a shift toward production-oriented use cases that address specific market inefficiencies rather than broad, exploratory pilots.

4. A Regulatory Environment Designed for Gradual Scale

The UK’s regulatory approach has been a key enabler of this measured progress. Rather than prescribing specific technologies, regulators have focused on defining outcomes—such as market integrity, consumer protection, and operational resilience—while allowing firms flexibility in how they meet those standards.

The FCA’s work on fund tokenization, combined with proposals for a financial market infrastructure sandbox, signals an openness to innovation within clear boundaries. This approach encourages institutions to invest in tokenization initiatives that are compatible with existing governance models, rather than forcing disruptive change. Within this framework, emerging infrastructure such as Chainlink’s Digital Transfer Agent could illustrate how core fund administration functions such as ownership records, transfer restrictions, and lifecycle events can be automated and synchronized across onchain and traditional systems while remaining aligned with regulatory and operational requirements.

Importantly, this regulatory stance also supports interoperability with other jurisdictions, allowing UK-based firms to participate in global tokenized markets as standards converge.

5. What This Means for UK Decision Makers

For banks, asset managers, infrastructure providers, and policymakers, tokenization in the UK is increasingly a question of execution rather than experimentation. The focus is shifting toward selecting infrastructure that can scale, integrating digital assets into existing workflows, and ensuring that governance and risk management evolve alongside technology.

Successful initiatives tend to emphasize trusted data, standardized connectivity, and early integration of compliance considerations. Neutral infrastructure providers that enable these capabilities—without locking institutions into closed ecosystems—are playing a growing role in the market’s development.