Sibos 2025: The Future of Digital Assets in Capital Markets | Highlights, Coverage, and More

Key Takeaways

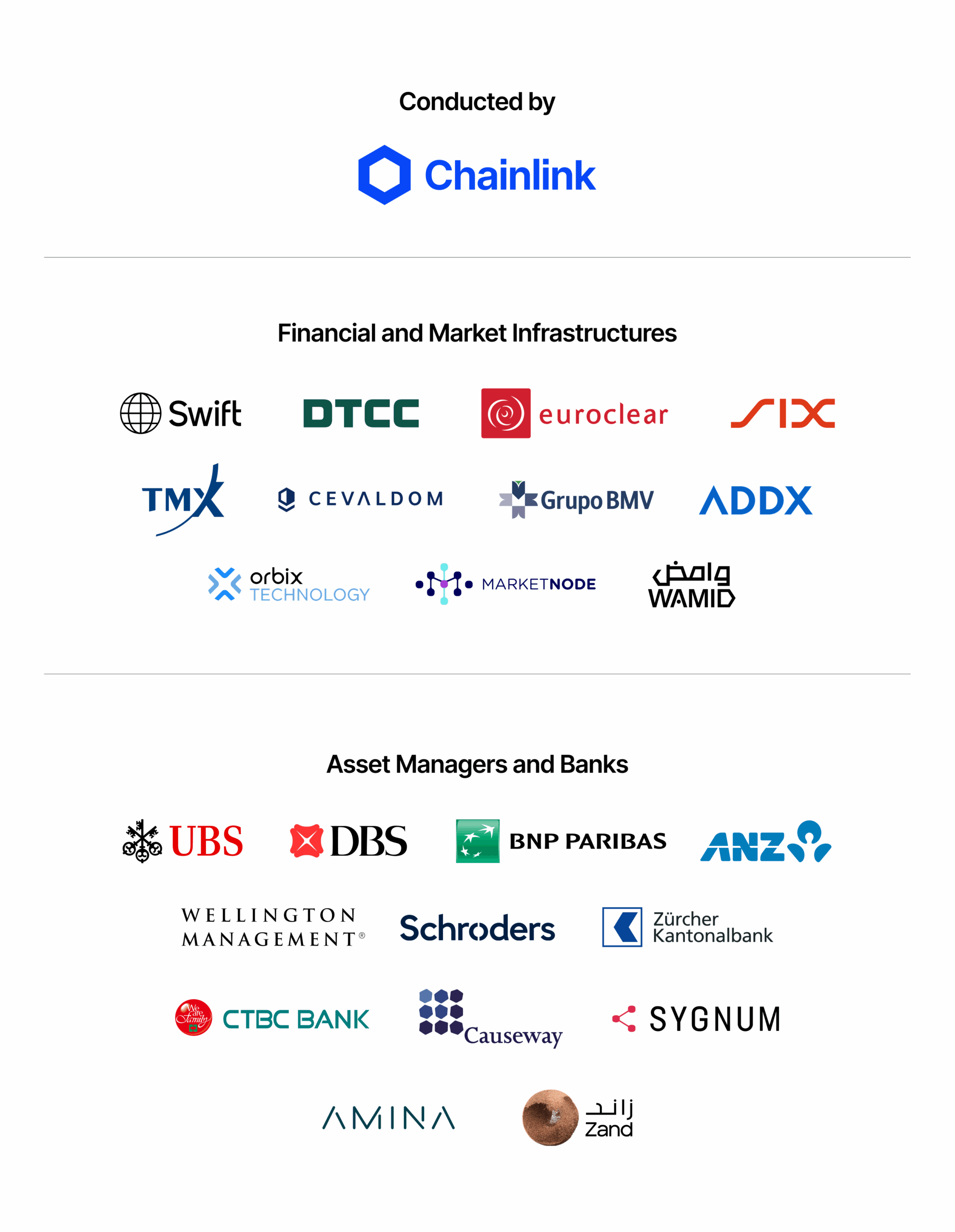

- Chainlink and 24 of the world’s largest financial institutions, including Swift, DTCC, Euroclear, and UBS, are transforming the validation and delivery of corporate actions data.

- Chainlink announces landmark technical solution to advance tokenized fund workflows with Swift messaging in collaboration with UBS.

- Chainlink introduces the Chainlink Digital Transfer Agent (DTA) technical standard, defining how transfer agents and fund administrators can expand their operations onchain to support tokenized assets.

Sibos, the premier financial services event organized by Swift, brings together thousands of finance industry leaders, decision makers, and experts from across the financial space, making it the perfect platform to educate key decision makers on the benefits of onchain finance and the Chainlink platform and accelerate digital asset adoption in global capital markets.

Chainlink had multiple leaders speak at Sibos, a large team of top capital markets representatives meeting with many of the top banks, asset managers, and financial market infrastructures, and a booth alongside the largest banks and financial institutions in the world.

Day 1

Major Announcement: Chainlink and 24 Leading Financial Market Participants Advance Industry Initiative To Solve $58 Billion Corporate Actions Problem

Chainlink, together with 24 of the world’s largest financial market infrastructures and institutions, including Swift, DTCC, and Euroclear, is establishing a new, unified infrastructure for streamlining corporate actions processing. This is accomplished by leveraging the Chainlink oracle platform, blockchains, and artificial intelligence (AI) to extract, validate, and deliver corporate actions data in a standardized format across both blockchain networks and traditional financial systems. Our work represents a transformative approach to how a cross-market standard for corporate actions processing can be implemented across the global financial system.

The full list of participants in this industry initiative includes financial market infrastructures Swift, DTCC, Euroclear, SIX, TMX, CEVALDOM, Grupo BMV, ADDX, Orbix Technology, Marketnode, and Wamid, as well as leading asset managers and banks UBS, DBS Bank, BNP Paribas’ Securities Services business, ANZ, Wellington Management, Schroders, Zürcher Kantonalbank, Vontobel, CTBC Bank, Causeway Capital Management, Sygnum Bank, AMINA Bank, and Zand Bank.

This implementation builds on Phase 1 of our work, where Chainlink, Swift, Euroclear, and six financial institutions demonstrated that large language models (LLMs) could extract structured data from unstructured corporate action announcements and publish it onchain as a onchain golden record—a single source of truth that all participants can easily access, verify, and build upon. While Phase 1 proved the technical viability of this approach and demonstrated that corporate actions processing could be reduced drastically, Phase 2 advances it into a production-grade solution that satisfies the requirements of today’s leading financial institutions.

Read the full report.

Sergey Nazarov Keynote: The Future of Digital Assets in Capital Markets

In his keynote, Chainlink Co-Founder Sergey Nazarov unveiled a multitude of new digital asset solutions, connecting traditional financial institutions to blockchain networks. This includes the global corporate actions initiative with Chainlink and 24 of the world’s largest financial institutions (Swift, DTCC, Euroclear, and more), facilitating secure connectivity between Swift and blockchains, and establishing compliance across blockchains and token standards through the Chainlink Compliance standard and Cross-Chain Identity (CCID).

Nadine Chakar, the DTCC’s Global Head of Digital Assets, also joined Sergey to discuss the rapid adoption of blockchain and oracle technology by existing financial institutions.

View the presentation slides.

Panel Discussion: Establishing a Unified Standard for Asset Servicing

In this panel discussion, leaders from Swift, DTCC, and Euroclear joined Sergey Nazarov to discuss Phase 2 of the global corporate actions initiative led by Chainlink. Chainlink brought together 24 participants, ranging from major financial market infrastructures to banks and asset managers, to demonstrate the success of creating onchain golden records that streamline the data collection needed to standardize and automate corporate actions data.

“This is the furthest we’ve ever been in trying to [solve corporate actions], and it’s thanks to the work that Chainlink has done in bringing together the leadership and using your data-savvy approaches to all of that.” — Nadine Chakar, Global Head of DTCC Digital Assets.

Participants:

- Sergey Nazarov, Co-Founder, Chainlink

- Nadin Chakar, Managing Director, Global Head of DTCC Digital Assets

- Jonathan Ehrenfeld, Head of Strategy, Swift

- Stéphanie Lheureux, Director, Digital Assets Competence Center, Euroclear

Interview: Chainlink and Swift Define Global Interoperability Standards

In this interview, Sergey Nazarov joins Global Custodian to discuss the long-term collaboration between Chainlink and Swift, the Chainlink interoperability standard that enables Swift to connect to any public or private blockchain, and the importance of the recent launch of the Chainlink Digital Transfer Agent (DTA) technical standard.

“Once Swift has a reliable … standardized way to interact with chains through the Chainlink set of standards, then that’ll trigger mass adoption.” — Sergey Nazarov, Co-Founder of Chainlink

Panel Discussion: Digital Assets Are Inevitable

Sergey Nazarov joined Euroclear and Standard Chartered on Global Custodian’s opening day panel to discuss the future of digital assets. The panel highlighted how conversations on digital assets have shifted from early exploration to real institutional adoption, stablecoins being adopted for large-scale use, tokenization evolving from pilots into production, and global institutions recognizing that open standards are critical to scaling these markets.

Participants:

- Sergey Nazarov, Co-Founder, Chainlink

- Stéphanie Lheureux, Director, Digital Assets Competence Center, Euroclear

- Waqar Chaudry, Head of Digital Assets, Financing & Securities Services, Standard Chartered

Swift Announces New Blockchain-Based Ledger

As a landmark moment for the global financial system and blockchain industry alike, Swift announced at Sibos 2025 it is launching a new blockchain-based ledger.

We congratulate our partner Swift and the broader Swift community on adopting blockchains and oracle networks as a key next step, validating the clear value that blockchain technology and oracle networks bring to modernizing the financial system.

As noted by Swift, the ledger is a natural extension of Swift’s progressive ecosystem innovation and live digital asset trials over the past two years.

Over more than seven years, Chainlink and Swift have collaborated across numerous initiatives, all with a common theme of enabling financial institutions to connect to blockchain networks using their existing infrastructure and messaging standards.

For a brief history of some of the crucial work that has taken place between Swift and Chainlink over the years, read this blog:

The Swift and Chainlink Partnership: Unlocking the Next Evolution of Global Finance.

Swift and Chainlink: Unlocking Global Digital Asset Markets at Scale

A few days before Sibos at The Chainlink Forum in NYC, Swift Chief Innovation Officer Tom Zschach and Chainlink Co-Founder Sergey Nazarov sat down for a fireside chat. They discussed the importance of interoperability in capital markets, Swift and Chainlink’s long-standing collaboration to build the critical infrastructure for enabling digital asset markets at scale, and what’s next for the digital asset industry.

Industry News

- Chainlink and 24 financial market participants progress industry initiative. Asset Servicing Times.

- Chainlink, UBS Advance $100T Fund Industry Tokenization via Swift Workflow. CoinDesk.

- Chainlink integrates Swift messaging to streamline tokenized fund workflows with UBS. The Block.

- Chainlink integrates with Swift to let funds process transactions onchain. Cointelegraph.

- Chainlink, Swift and UBS succesfully pilot tokenized fund solution to revolutionize $100 trillion industry. Cryptoslate.

- UBS Tokenize Pilot Trials Chainlink DTA With Swift Messaging. Bitcoin.com

- Chainlink, Swift Advance Blockchain Integration For UBS Tokenized Funds. Stocktwits.

- Chainlink Leads Initiative With 24 Financial Giants to Automate Corporate Actions Onchain. BSCNews.

- Chainlink and SWIFT Streamline Tokenized Fund Workflows with UBS. Coincentral.

- Chainlink Partners with UBS to Simplify Tokenized Fund Management. Coinpedia.

- Chainlink and Swift Enable Banks to Access Blockchains Without Infrastructure Upgrades. Cryptonews.

- Chainlink and Swift Partner on Landmark Breakthrough for Tokenized Funds. Coindoo.

Day 2

Major Announcement: Chainlink Advances Tokenized Fund Workflows With Swift Messaging in Collaboration With UBS

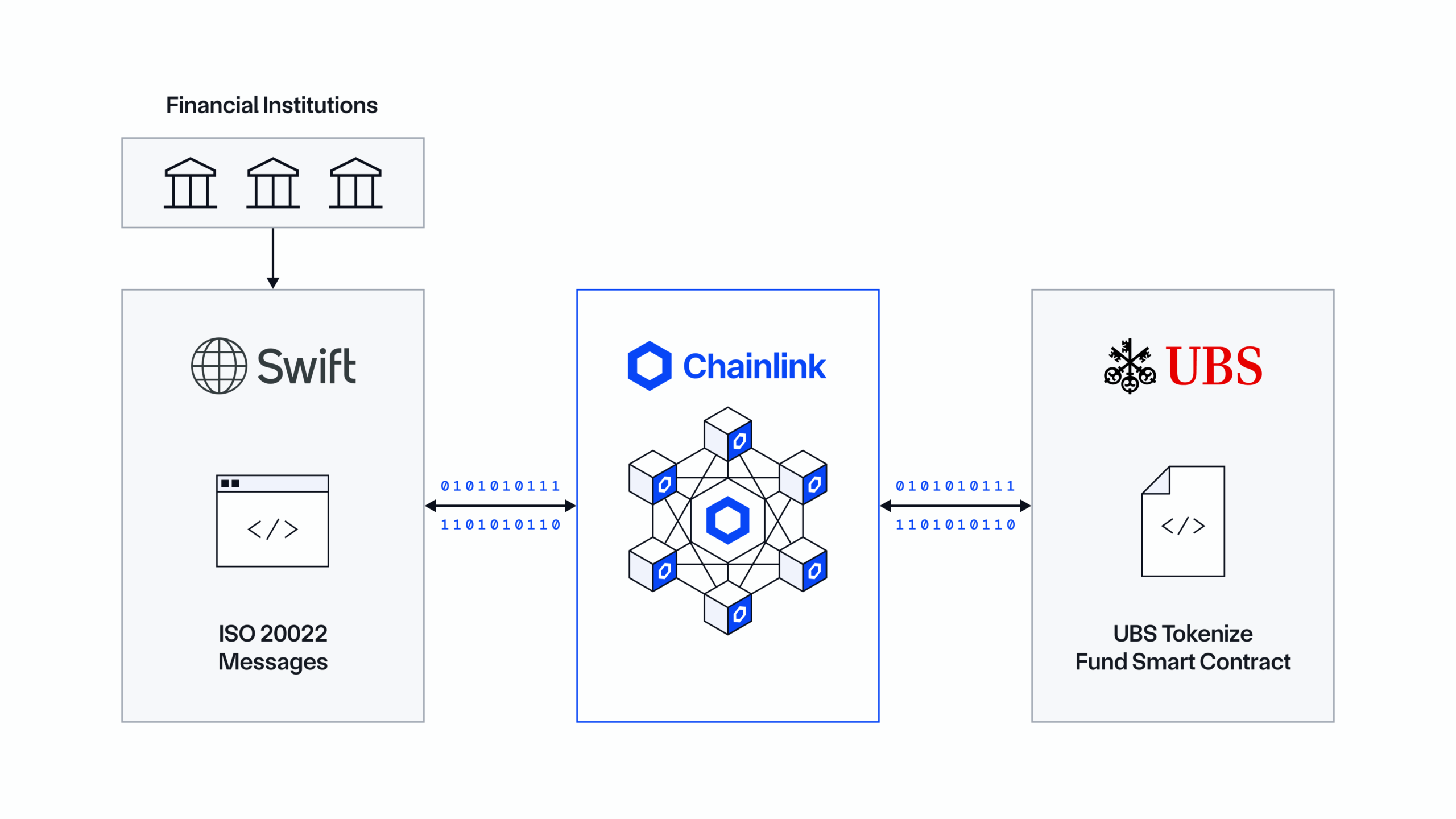

Chainlink announced a landmark technical solution enabling financial institutions worldwide to manage digital asset workflows directly from their existing systems using Swift messaging and the Chainlink Runtime Environment (CRE). With Swift messages and CRE, banks and institutions can seamlessly access blockchains through the same Swift infrastructure they have relied upon for decades. This shows how institutions can access blockchains without needing to upgrade to new infrastructure, replace their existing processes, or integrate new identity and key management solutions.

A first use case involved a technical and operational pilot with UBS Tokenize, the in-house tokenization unit of UBS. Subscriptions and redemptions for a tokenized fund smart contract from UBS were triggered using ISO 20022 messages through CRE and Swift infrastructure. CRE received the Swift messages, which then triggered subscription and redemption workflows in the Chainlink Digital Transfer Agent (DTA) technical standard.

This new development builds on Swift, Chainlink, and UBS’ past tokenized asset use case in the Monetary Authority of Singapore’s (MAS) Project Guardian in 2024, demonstrating the technical and operational possibility for settlement of tokenized fund subscriptions and redemptions using offchain cash settlement via Swift.

Major Announcement: Introducing the Chainlink Digital Transfer Agent (DTA) Technical Standard

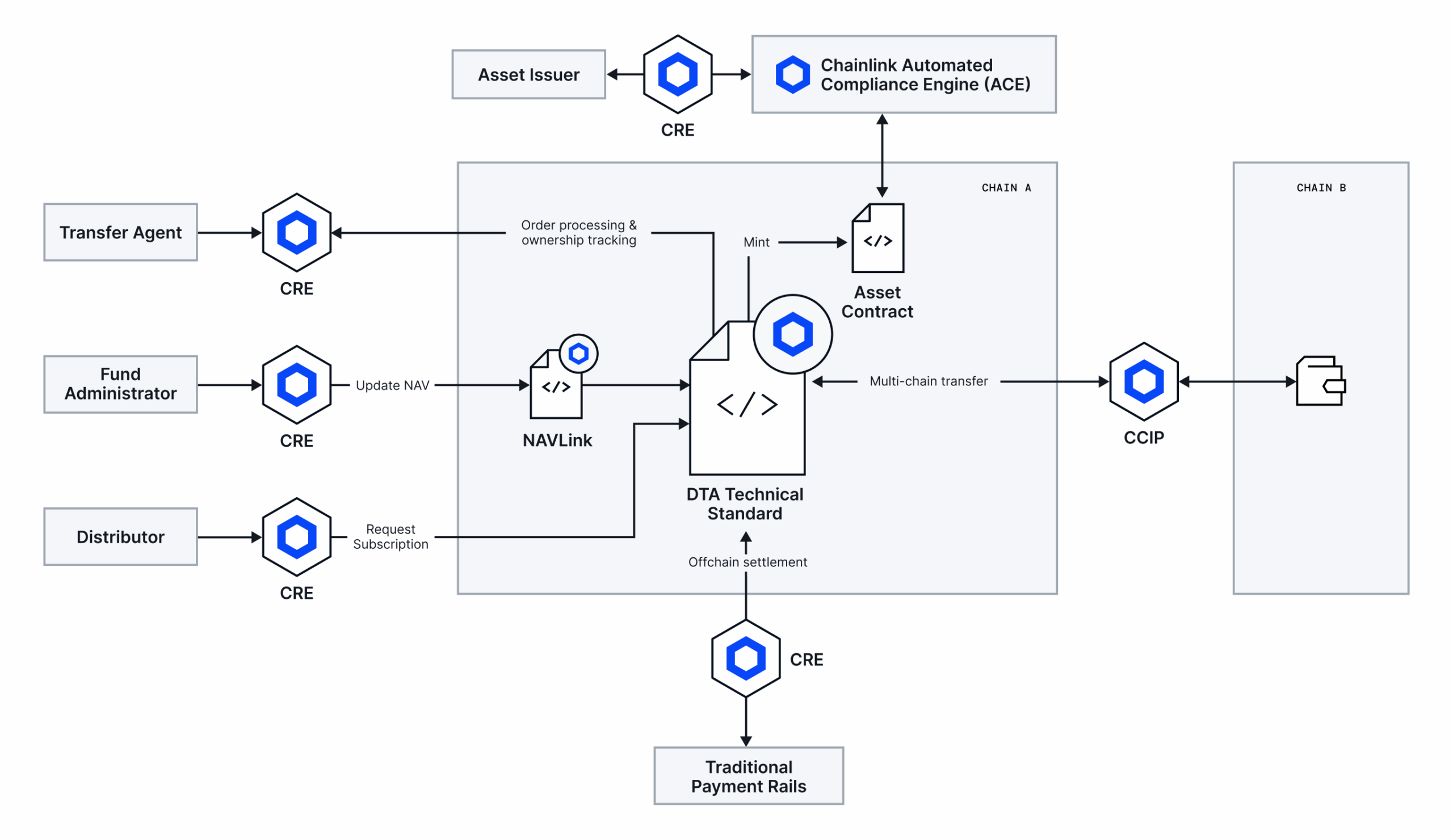

We’re excited to introduce the Chainlink Digital Transfer Agent (DTA) technical standard—a comprehensive set of technical standards that define how transfer agents and fund administrators can expand their operations onchain to support tokenized assets, while remaining aligned with existing regulatory frameworks.

The Chainlink DTA technical standard leverages multiple time-tested Chainlink capabilities to provide the easiest and most reliable path for market participants to launch their own onchain transfer agency services and capture the emerging opportunity of tokenized financial markets.

Now live in production, and starting with tokenized investment funds as the initial product use case, the Chainlink DTA technical standard allows transfer agents, fund administrators, issuers, distributors, and custodians to quickly and easily offer the following services:

- Real-time subscription and redemption processing of tokenized funds across multiple blockchains.

- Seamless integration of pre-built fiat and digital asset settlement workflows, reducing the need for manual reconciliation.

- Programmable compliance enforcement directly in the transaction flow, powered by Chainlink Automated Compliance Engine (ACE), eliminating fragmented eligibility checks.

- An onchain golden record of fund lifecycle activities that is automatically synchronized with each transaction rather than via delayed reconciliation.

- Cross-chain interoperability for tokenized funds, removing the siloed nature of single-chain tokenization initiatives.

- Transparent, auditable records that build regulator and market participant confidence, with extensibility to additional products beyond investment funds such as ETFs, corporate debt, and private equity.

UBS uMINT, the token corresponding to UBS Asset Management’s tokenized money market investment fund, is the first smart contract to begin adopting the DTA technical standard.

The Chainlink DTA technical standard is being built to seamlessly run on top of the Chainlink Runtime Environment (CRE) to leverage its core capabilities, such as compatibility with legacy systems, access to fiat settlement via established payment rails, and record reconciliation with offchain systems. Furthermore, the Chainlink DTA technical standard leverages multiple standards and services within the Chainlink platform, including:

- Cross-Chain Interoperability Protocol (CCIP) to enable multi-chain distribution of tokenized assets.

- Automated Compliance Engine (ACE) to enforce role-based controls and compliance requirements onchain.

- NAVLink Feeds to ensure accurate NAV pricing for tokenized fund subscriptions and redemptions.

If you are a financial institution and see the rising demand in tokenized assets as a large opportunity, contact Chainlink Labs to see how the Chainlink DTA technical standard can help you launch onchain transfer agency services. You can also explore the technical documentation and developer resources for a deeper look into the architecture and functionality of the Chainlink DTA technical standard.

Panel Discussion: Interoperating Platforms: Realising the Opportunity of New Models

In this panel discussion, leaders from Swift, BIS Innovation Hub, Goldman Sachs, and Santander Corporate & Investment Banking joined Fernando Vazquez, President of Capital Markets at Chainlink Labs, to discuss the importance of establishing an interoperable, multi-chain financial system, with shared ledgers, standards, and governance to avoid fragmentation and enable tokenization at scale.

Participants:

- Fernando Vasquez, President of Capital Markets, Chainlink Labs

- Jack Pouderoyen, Strategy, Swift

- Morten Bech, Centre Head at Switzerland, BIS Innovation Hub

- Abeetha Pitigala, Digital Assets Lead, Goldman Sachs

- John Whelan, Managing Director, Santander Corporate & Investment Banking

- Nick Kerigan, Managing Director and Head of Innovation, Swift

Panel Discussion: The Next Phase of Financial Markets

Fernando Vazquez, President of Capital Markets at Chainlink Labs, joined J.P. Morgan and State Street for a Global Custodian panel exploring the modernization of financial infrastructure through blockchain technology, building cross-system connectivity for tokenized assets, and the importance of creating data standards across global finance.

Participants:

- Fernando Vasquez, President of Capital Markets, Chainlink Labs

- Sam Cauvin-Welsh, Head of Core Product for Global Custody, J.P. Morgan

- Dan Hickey, Head of Custody Product and Network Management, State Street

Industry News

- Chainlink and 24 financial market participants progress industry initiative. Asset Servicing Times.

- Chainlink, UBS Advance $100T Fund Industry Tokenization via Swift Workflow. CoinDesk.

- Chainlink integrates Swift messaging to streamline tokenized fund workflows with UBS. The Block.

- Chainlink, Swift Advance Blockchain Integration For UBS Tokenized Funds. Stocktwits.

- Chainlink Leads Initiative With 24 Financial Giants to Automate Corporate Actions Onchain. BSCNews.

- Chainlink and SWIFT Streamline Tokenized Fund Workflows with UBS. Coincentral.

- Chainlink Partners with UBS to Simplify Tokenized Fund Management. Coinpedia.

- Chainlink and Swift Enable Banks to Access Blockchains Without Infrastructure Upgrades. Cryptonews.

- Chainlink and Swift Partner on Landmark Breakthrough for Tokenized Funds. Coindoo.

Day 3

Major Announcement: GLEIF and Chainlink Form Strategic Partnership to Bring Institutional-Grade Identity Solution to Blockchain Industry

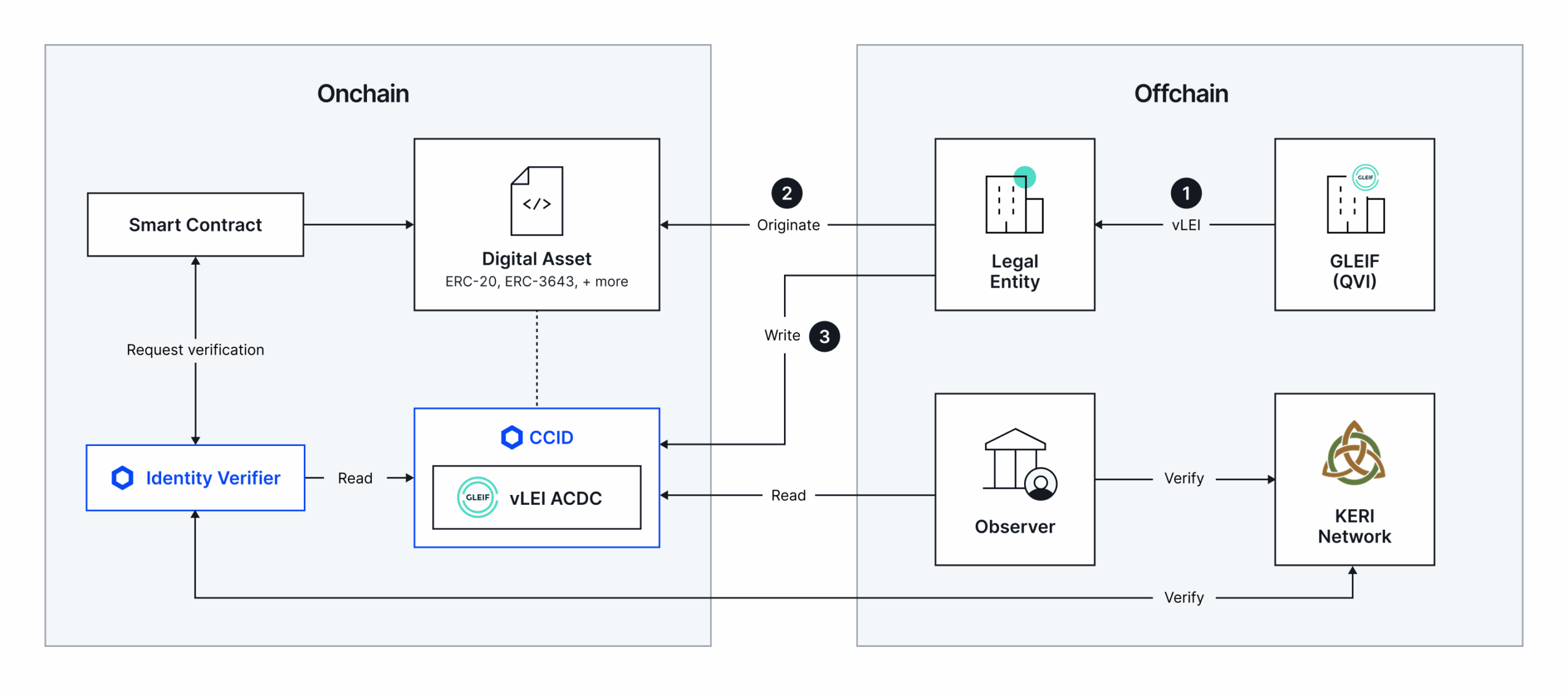

The Global Legal Entity Identifier Foundation (GLEIF) has entered into a strategic partnership with Chainlink to establish a new institutional-grade identity solution for the blockchain industry.

The solution combines GLEIF’s verifiable Legal Identity Identifier (vLEI) with Chainlink’s infrastructure for Cross-Chain Identity (CCID) and Automated Compliance Engine (ACE) to enable digital asset transactions that are verifiable, compliant, and trusted across jurisdictions while preserving user privacy.

While digital assets are set to transform global finance, the lack of a verifiable identity solution onchain has held back institutional adoption. By enabling verifiable identity data to be embedded directly into onchain assets and smart contracts, GLEIF and Chainlink are empowering institutions and tokenization platforms to:

- Programmatically verify asset provenance

- Automatically enforce compliance policies

- Reliably recover control over assets if private cryptography keys are compromised

- Seamlessly meet compliance requirements for regulatory frameworks across the globe

This removes the final hurdles for banks, asset managers, and institutional investors ready to implement digital asset solutions at scale and opens up hundreds of trillions in institutional capital to flow onchain.

This new solution unlocks a number of new capabilities for asset issuers and smart contract applications in order to realize the full potential of tokenized finance, including:

- Stablecoin issuers can prove their legal identity at the contract level, ensuring regulators, markets, and users can distinguish between genuine, reserve-backed stablecoins and fraudulent imitations.

- Asset issuers and smart contract applications can unlock seamless compliance with regulations across different jurisdictions, such as Europe’s Markets in Crypto-Assets Regulation (MiCA), the U.S. Financial Data Transparency Act (FDTA), and the Financial Action Task Force (FATF) requirements.

- Custodians and Virtual Asset Service Providers (VASPs) can verify that receiving addresses meet FATF Travel Rule requirements without exposing customer data.

- Banks and asset managers can issue tokenized assets with verifiable provenance throughout the asset’s lifecycle.

- Enterprises can restore control of compromised contracts using role-based recovery mechanisms.

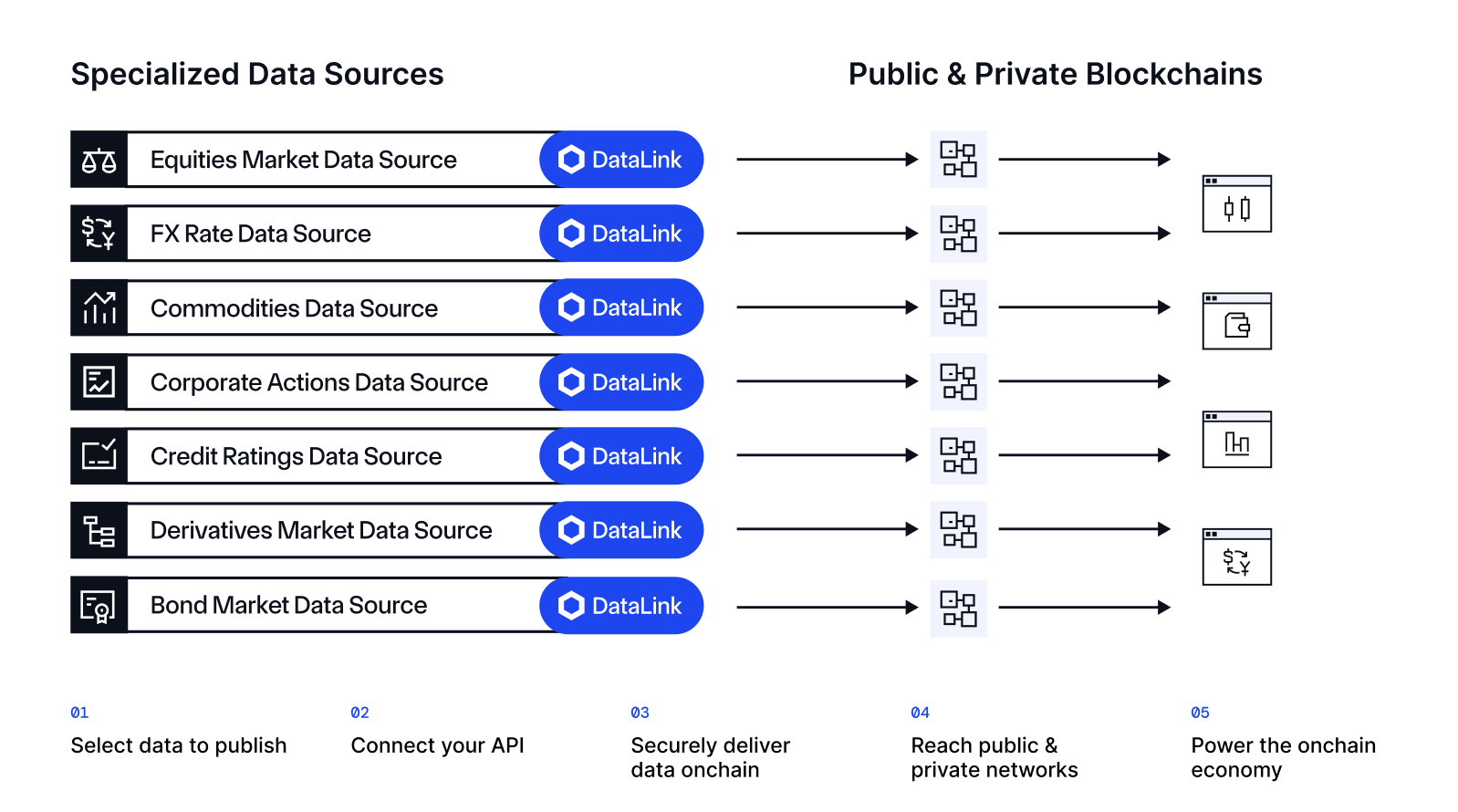

Major Announcement: Introducing DataLink: Bringing Institutional Market Data Onchain

We’re excited to introduce DataLink—the institutional-grade data publishing service powered by Chainlink. DataLink is a turnkey service that enables institutions to seamlessly publish data to blockchains and unlock the benefits of the onchain economy without the cost or complexity of building new infrastructure. By leveraging the Chainlink data standard to provide secure access to the same high-quality data institutions already rely on, DataLink accelerates institutional adoption of digital assets and enables organizations to rapidly scale onchain.

With demand for tokenized real-world assets expected to reach $30.1 trillion, DataLink empowers banking and capital markets institutions to establish leadership in the onchain economy and unlock new revenue streams. At the same time, developers building with DataLink gain faster access to institutional-grade data, enabling them to build new products more rapidly, launch assets, and support robust markets underpinned by high-quality data.

DataLink is launching on 40+ blockchain mainnets, with many more to come.

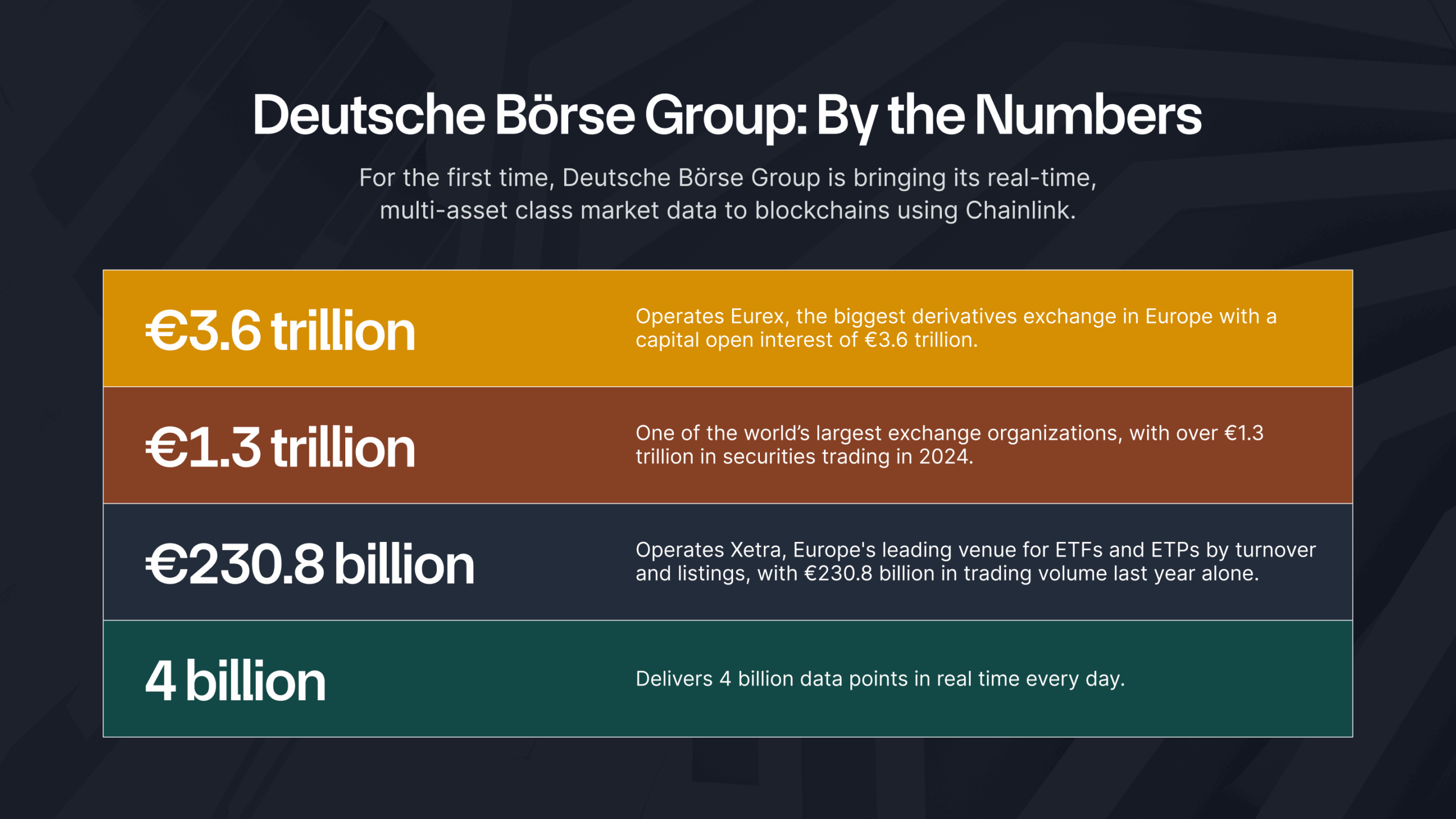

Major Announcement: Deutsche Börse Market Data + Services Forms Strategic Partnership With Chainlink To Publish Market Data Onchain Via DataLink

Deutsche Börse Market Data + Services, a business unit of Deutsche Börse Group, has formed a strategic partnership with Chainlink to publish its market data onchain for the first time via DataLink.

Real-time data from the largest exchanges in Europe, Deutsche Börse Group’s Eurex, Xetra, 360T, and Tradegate—trading venues covering equities, derivatives, forex instruments, and more—are being made available across blockchains via DataLink, a new institutional-grade data publishing service powered by Chainlink.

Deutsche Börse Market Data + Services delivers four billion data points in real time every day and has handled more than €1.3 trillion in securities trading last year. With DataLink, Deutsche Börse Group is bringing real-time, multi-asset class data onchain from:

- Eurex—Europe’s largest derivatives exchange, listing interest rate, equity/index, volatility, dividend, FX, and other futures and options. In 2024, Eurex recorded over 2.08 billion traded contracts in exchange-traded derivatives with a capital open interest of €3.6 trillion.

- Xetra—Europe’s leading venue for ETFs and ETPs by turnover and listings, with around €230.8 billion in trading volume last year alone.

- 360T—Deutsche Börse Group’s global foreign exchange unit operates one of the biggest FX trading venues in the world, predominantly used by some of the world’s largest corporations to hedge currency exposures. 360T serves more than 2,900 buy-side customers and more than 200 liquidity providers across 75 countries.

- Tradegate—A stock exchange specialising in executing private investors’ orders. Over 30 trading participants from Germany, Austria, and Ireland are currently connected and offer access to their customers from their own country and abroad. Since January, Tradegate has recorded a turnover of €247.8 billion with over 34 million transactions.

“Partnering with Chainlink to publish Deutsche Börse Group’s trusted market data onchain for the first time marks a major milestone in connecting traditional and blockchain-based financial markets. By making data from Xetra, Eurex, 360T, and Tradegate accessible onchain through the Chainlink data standard, we are empowering global financial institutions to build the next generation of regulated financial products on the same high-quality data that underpins today’s markets.” – Dr. Alireza Dorfard, Managing Director, Head of Market Data + Services at Deutsche Börse Group.

Panel Discussion: Transforming Data With AI

On Global Custodian, Sergey Nazarov joined leaders from BBH and CIBC Mellon to discuss how AI is transforming unstructured data into actionable insights that can reshape post-trade asset servicing.

Sergey highlighted how Chainlink’s corporate actions initiative enables institutions to:

“take data that was previously unusable and make it usable … making things that weren’t possible before, possible.”

Participants:

- Sergey Nazarov, Co-Founder, Chainlink

- Kevin Welch, Transformation Office, BBH

- Richard Anton, Chief Client Officer, CIBC Mellon

Industry News

- Chainlink Advances Tokenized Fund Workflows With Swift Messaging in Collaboration With UBS. Fintech Finance News.

- Deutsche Börse Market Data + Services partners with Chainlink. FX News Group.

- Deutsche Börse Market Data + Services Forms Strategic Partnership With Chainlink To Publish Market Data Onchain Via DataLink. Streetinsider.com.

- Deutsche Börse Market Data + Services partners with Chainlink. Asset Servicing Times.

- Deutsche Börse Taps Chainlink to Bring Market Data On-Chain, Deepening TradFi-DeFi Integration. A-Team Insight.

- Deutsche Börse Partners with Chainlink to Bring Market Data Onchain. LeapRate.com.

- Deutsche Börse Brings Europe’s Top Market Data On-Chain with Chainlink. CoinPedia.

Day 4

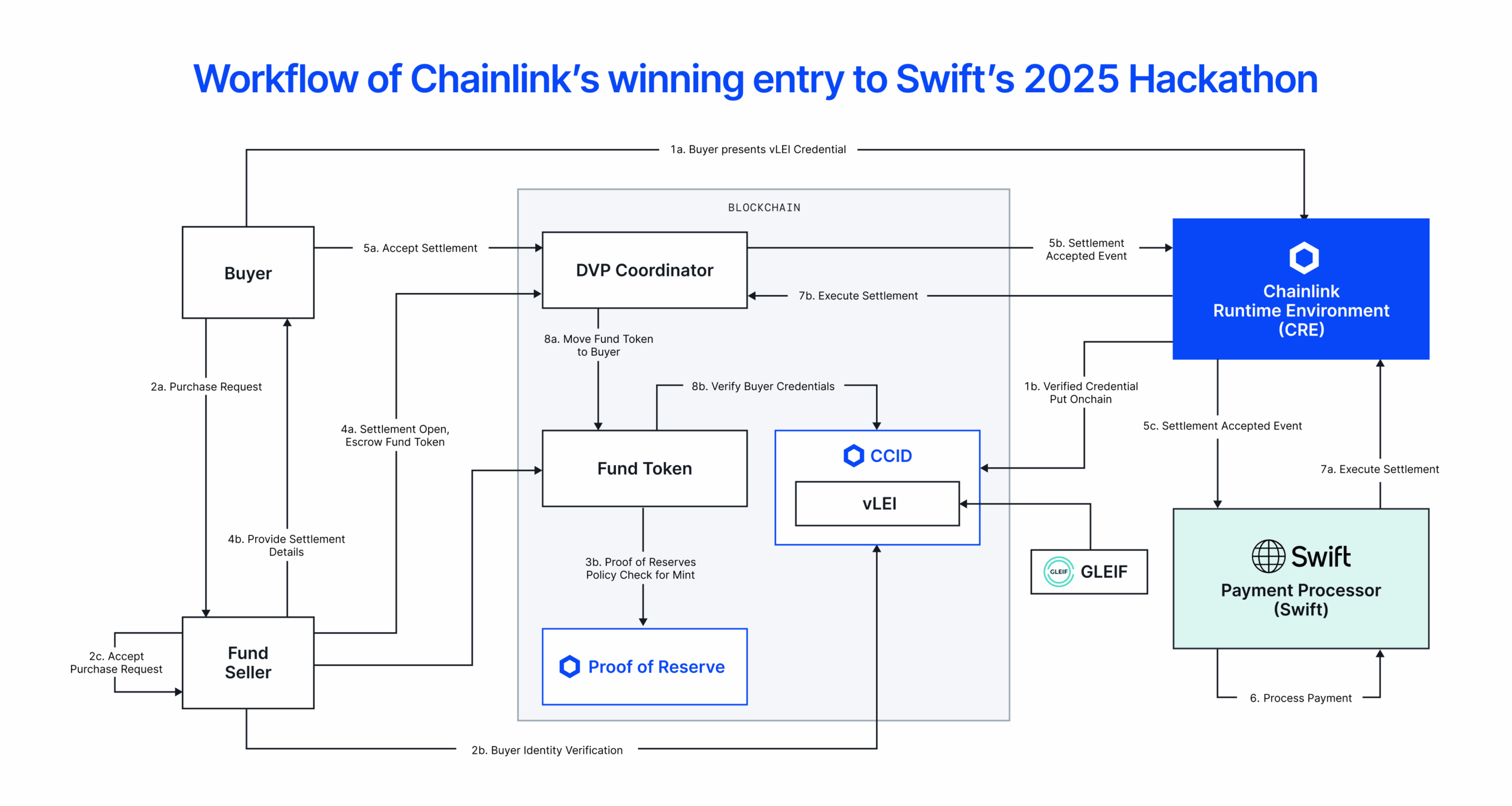

Major Announcement: Chainlink Selected as Winner of the Swift Hackathon 2025 Business Challenge

We’re excited to announce that Chainlink has been selected as the winner of the Swift Hackathon 2025 Business Challenge.

Chainlink’s winning solution unlocks fast, compliance-focused, and privacy-preserving digital asset settlement across borders and blockchains. We successfully demonstrated how Chainlink’s Automated Compliance Engine (ACE) and the Chainlink Runtime Environment (CRE), in conjunction with GLEIF’s vLEI and Swift messages, unlock a new cross-chain, cross-border model for the trading and settlement of regulated digital assets.

The same winning approach can be extended to power regulatory-compliant stablecoins, tokenized deposits, central bank digital currencies (CBDCs), digital securities, and other tokenized financial instruments.

GLEIF CEO Alexandre Kech discusses Chainlink’s winning solution at Swift’s 2025 hackathon that leverages GLEIF’s vLEI to unlock fast, compliance-focused, and privacy-preserving digital asset settlement across borders and blockchains:

Panel Discussion: The Year of Digital Assets

On Global Custodian, Sergey Nazarov joined executives from Swift and Citi to discuss the elevated excitement around digital assets at this year’s Sibos, the challenges of T+1, the importance of automation and standardisation, and the role of technology in building resilient post-trade processes.

Watch the full discussion.

Participants:

- Sergey Nazarov, Co-Founder, Chainlink

- Kelli West, Head of Securities, Swift

- Philip Van Dine, APAC Head of Banks and Market Infrastructure Sales, Citi

Industry News

- Chainlink and UBS demonstrate onchain connectivity with Swift. Finextra.

- GLEIF and Chainlink Form Strategic Partnership to Bring Institutional-Grade Identity Solution to Blockchain Industry. Fintech Finance News.

- UBS Pilots On-Chain Fund Workflows via Swift and Chainlink. Fintech Switzerland.

- Chainlink Partners With GLEIF to Deliver Institutional On-Chain Identity Solutions. Finance Feeds.

- Chainlink & major banks unite to cut $58 billion costs in global corporate actions. ITBrief Asia.

- Chainlink in slew of industry tie-ups for corporate actions, DLT integration, tokenized funds, on-chain identity, market data. Finadium.

- Chainlink Enables Tokenized Fund Workflows with Swift Messaging in Collaboration with UBS. Crowdfund Insider.

- GLEIF and Chainlink form strategic partnership to bring institutional-grade identity solution to blockchain industry. Identity Week.

- Chainlink and GLEIF Put Institutional Identity on the Blockchain. Blockonomi.

- Deutsche Börse Brings Europe’s Top Market Data On-Chain with Chainlink. Cryptorank.

- Deutsche Börse and Chainlink Bring Institutional Market Data Onchain for the First Time. The Crypto Basic.

- Chainlink Partners with GLEIF to Offer Institutional-Scale Blockchain Identity Solution. blockchainreporter.

Next Up: SmartCon in NYC—Where Worlds Converge

SmartCon brings governments, financial institutions, and leading Web3 projects together to discuss the blockchain technologies transforming markets, public services, and the global economy. The conference will enable leaders across capital markets, government, and Web3 to define how global markets move onchain, shape the next evolution of Web3, and discuss how onchain technology can strengthen trust, transparency, and efficiency in government systems.

Join us at SmartCon on November 4-5 to be a part of this pivotal moment in global finance and participate in the convergence of blockchain, finance, and policy in the epicenter of global markets.