How To Know When You Have Product-Market Fit—and What To Do Next

When discussing Web3 go-to-market strategies, we briefly touched on the concept of product-market fit. However, it’s a nuanced subject that deserves further investigation. Discussions often focus on how to achieve product-market fit without properly explaining how you’ll know when you’ve found it and what it means for your product strategy.

With this in mind, this guide attempts to answer the following questions:

- What does product-market fit look like for Web3?

- How do you know when you’ve achieved product-market fit?

- How do you measure product-market fit for Web3?

- Whose job is it to track product-market fit?

- What do you do when you’ve reached product-market fit?

What is Product-Market Fit?

The term product-market fit was coined by Marc Andreessen to describe a product that perfectly fulfills market demand. Originally, Andreessen did not provide a concrete description of how to tell when you have it. He posited that product-market fit is an unmistakable milestone—when reached, a startup will be overwhelmed by the volume of new customers and can barely keep up with demand.

However, Sean Ellis, the author of “Hacking Growth” added his own nuance to the definition. For Ellis, Andreessen seemed to depict product-market as an end goal rather than a continuous process. But this did not match his own experience. Ellis noted that he “really had to iterate and tighten around a product” during his time as marketing VP at Uporaor and LogMeIn. Ellis’s perspective is that product-market fit comes in iterations and needs to be measurable. This is why he invented the now famous “Sean Ellis test” to assess product-market fit

How Do You Track Product-Market Fit In Web3?

Tracking product-market fit in Web3 isn’t as straightforward as it is in Web2. For one, Web3 is decentralized and often anonymous. This makes it difficult to rely on traditional product analytics tools such as Google Analytics, Mixpanel, or Amplitude. There is no third-party cookie tracking to give you fine-grained insights into your audience—many would say this is a good thing.

Nevertheless, Web3 founders need some kind of quantifiable metrics that help them determine when they’ve found product-market fit. These metrics could be user feedback scores, TVL (total volume locked), number of transactions, number of unique wallets, floor prices for NFTs, and so on.

Beware of Misleading Metrics

As you can see, these metrics will depend heavily on the type of Web3 product being measured. Later, metrics will be covered in more detail, but first, it’s important to identify metrics that can be misleading.

Web3’s propensity for explosive network effects could be considered both a blessing and a curse. On one hand, it can allow projects to grow very quickly. On the other, it can obscure a project’s true utility. This is a problem because utility is traditionally a yardstick used to gauge product-market fit.

For example, a startup that has turbocharged its growth through giveaways and liquidity incentives has not necessarily achieved product-market fit. Often, this kind of adoption is driven through marketing and incentive engineering rather than utility.

Of course, utility is not a prerequisite for all types of Web3 projects. Many NFTs have no direct utility, but buyers are often attracted by the quality of the artwork as well as the project’s brand and community. Yet even in this case, it is difficult to tell whether purchase behavior indicates true product-market fit versus short-term speculation.

So what metrics are reliable? The answer has many elements. The first is the nature of the specific market that a Web3 product aims to target.

Are You Targeting a Blue Ocean or Red Ocean Market?

When trying to understand how to assess product-market fit, it’s useful to identify whether the product is addressing a “blue ocean” and “red ocean” market. This mental model was introduced in the 2004 book “Blue Ocean Strategy” by W. Chan Kim and Renée Mauborgne.

This concept is important because it helps to shape product strategy and indicates which metrics are useful for assessing product-market fit. This is especially true for Web3, where many new markets have yet to emerge.

Red Oceans

A “red ocean” is a market that is known and quantifiable, with established user demand, and where many products and brands compete for a share of the market.

In Web3, the markets for DeFi products and NFT collectibles could be now considered “red ocean” because there is established demand.

For example, the market share of a DeFi project is relatively easy to quantify. One can look at the TVL of a project and compare it to the total TVL of all DeFi protocols. At the time of writing, Defi Llama lists the total DeFi TVL at 88.53 billion USD, with MakerDAO having the largest share of that total at 9.5% or 8.56 billion.

Market share thus is easy to calculate because DeFi now has significant demand and there are many market players to compare oneself to.

Blue Oceans

A “blue ocean” market is one that is unknown and untapped. This means that startups need to manifest demand for their product and create a new type of market

Since blue ocean products are nascent by nature, a current Web3 example is hard to define. Some examples could be the many Web2 markets that are just beginning to cross over into Web3, such as parametric insurance and real estate.

One can also look back in time to the advent of stablecoins in 2014. One of the first stablecoins was BitUSD, yet it would have been difficult to calculate its market share back then since it was in a blue ocean market—there were few if any existing stablecoin products to compare it with. In this case, one would need to look at other metrics such as user feedback or product engagement.

User-oriented metrics are essential because the novelty of blockchain technology has historically inspired projects that offer solutions to non-existent problems. In some cases, there was no clear reason for why a certain product or service needed to be on a blockchain. This is because their founders did not take the time to find problem-solution fit—which is why user research is so crucial for projects that aspire to create blue ocean markets.

An Example of Iterating Towards Product Market Fit

DeFi protocol Compound offers a concrete example that embodies Sean Ellis’s notion of “iterating towards product-market fit”. Founded in 2018, Compound is a decentralized market for interest on crypto assets and runs as a smart contract on Ethereum.

In conversation with a16z’s Jesse Walden, Compound founder Robert Leshner describes how Compound iterated over three basic versions so that it could “incorporate feedback from users in the community and into a cycle of building a better product”.

According to Leshner, the iterations proceeded as follows:

- Test Version

This was an early unreleased version of the Compound smart contract that was intended for a small group of early users the founders knew personally. Its main purpose was to allow these users to privately test and sandbox the core idea of earning interest from crypto assets.

- Initial Mainnet Version

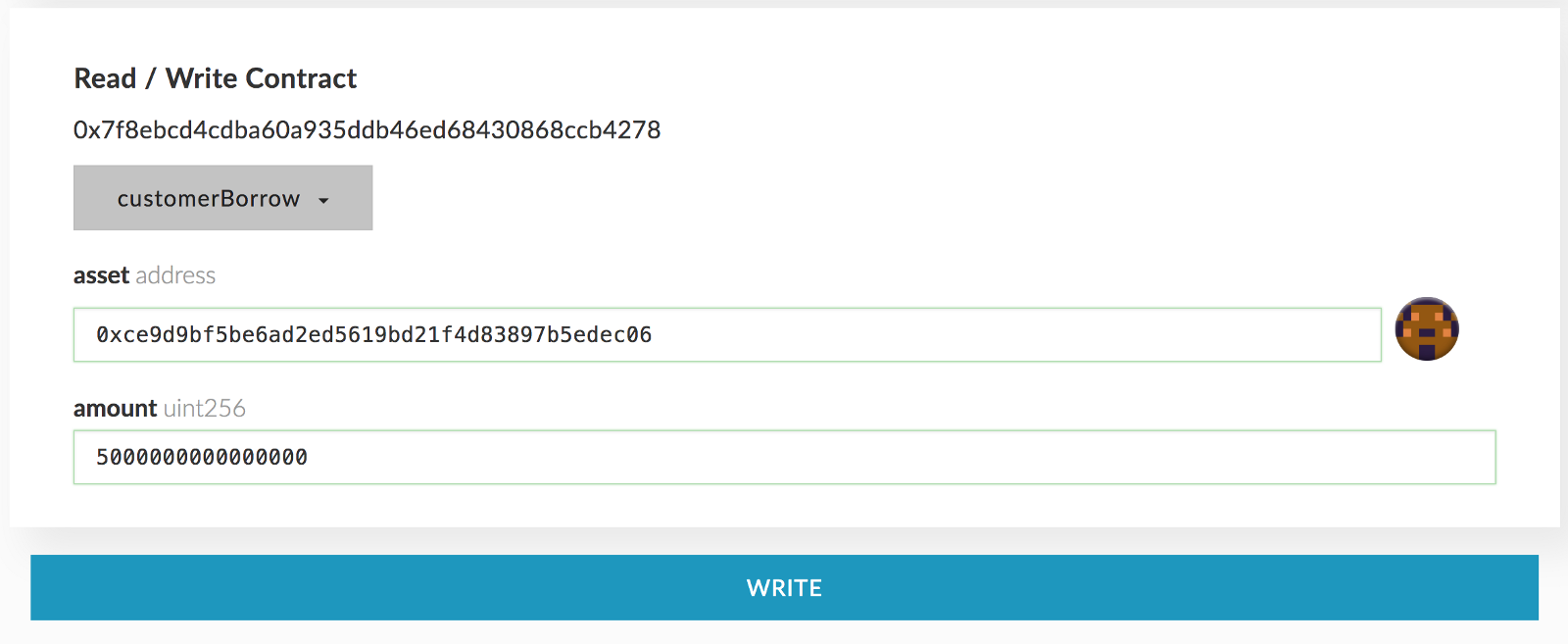

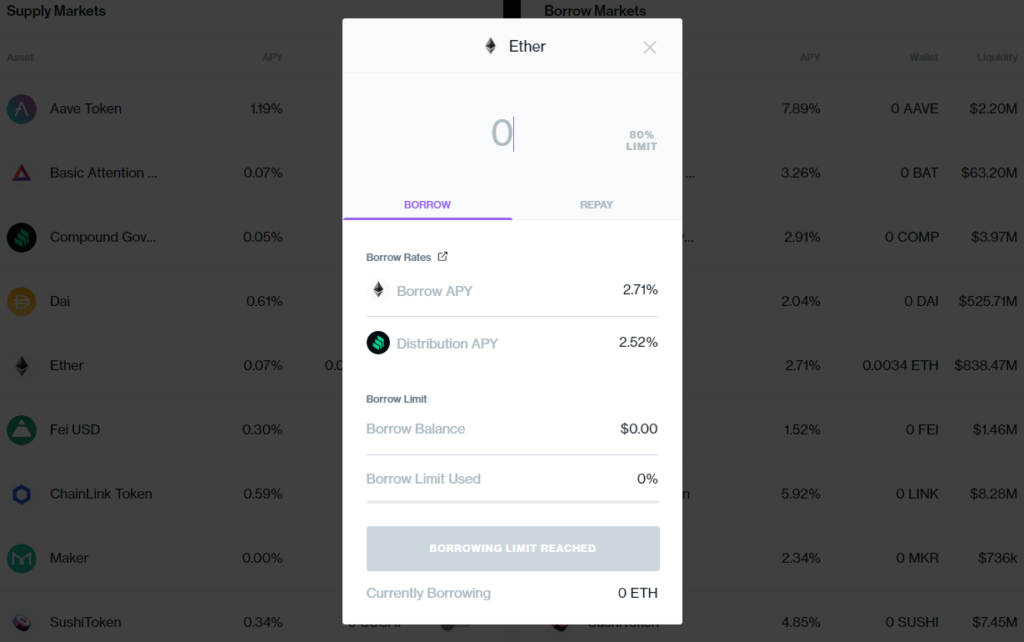

The first mainnet version of Compound was launched in 2018, and gave the founders the chance to get early feedback from the wider market. The original process for interacting with the smart contract was clunky and more oriented toward technical users, but the team learned a great deal about how to improve the product.

Early version of Compound user interface - Final Mainnet Version

The Compound team made some significant changes in response to user and developer feedback, such as introducing risk parameters for each asset and streamlining the codebase so that it was easier for developers to work with. This version is considered to be the “final” version—it could also be considered the version with which Compound found true product-market fit.

Current Compound user interface

How Do You Measure Product-Market Fit for Web3?

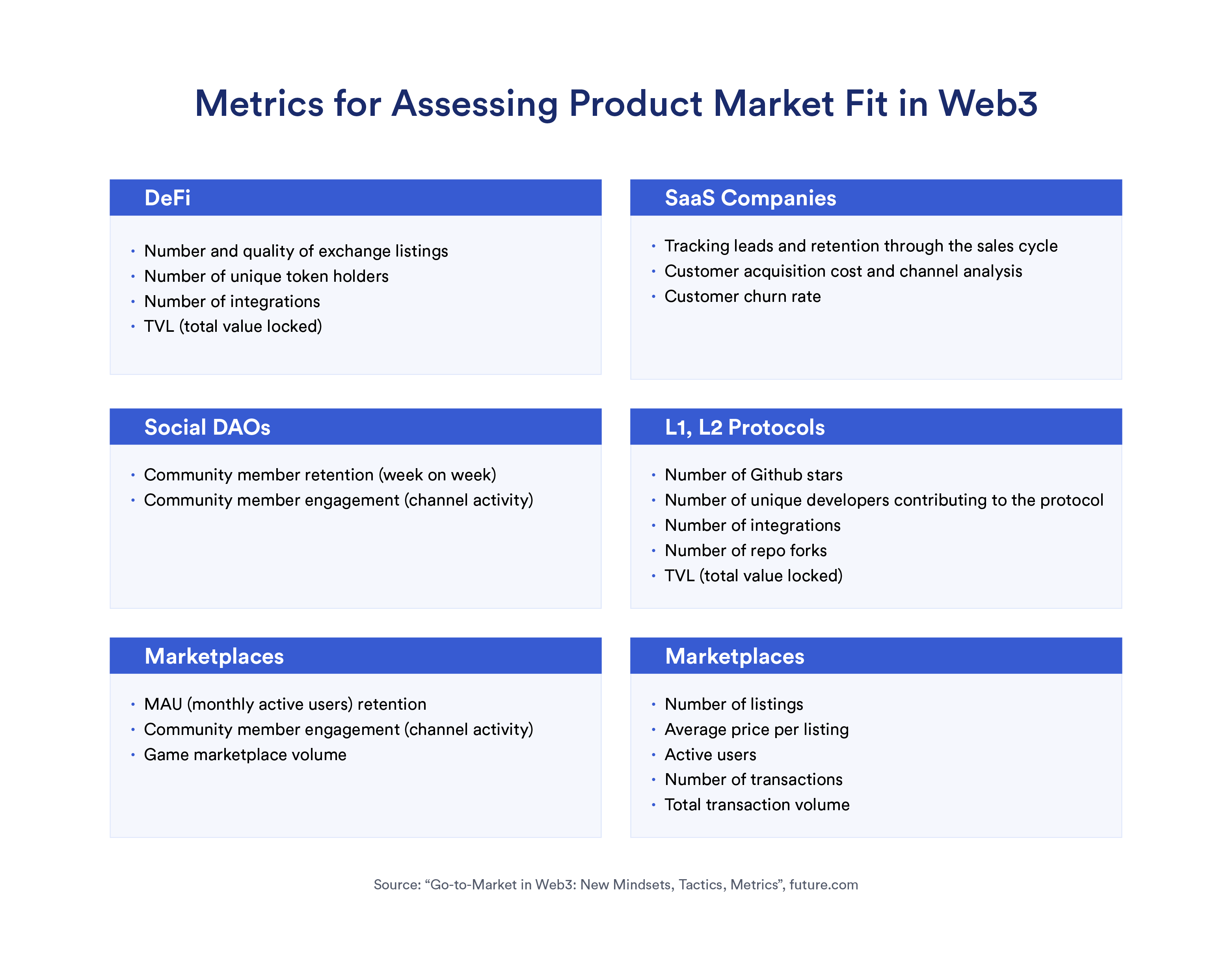

As we’ve noted, product-market fit looks different depending on the type of product you’re building. This also means that you’ll need to use different types of metrics to track it.

Go-To-Market Metrics That Can Signal Product-Market Fit

Metrics that measure the success of specific Web3 go-to-market strategies can signal product-market fit. In “Go-to-Market in Web3: New Mindsets, Tactics, Metrics”, a16z’s Maggie Hsu proposes the following metrics for the major Web3 verticals:

Yet these metrics only mean something when you have a benchmark to compare them to. In a red ocean market, this is relatively straightforward: You can compare your metrics to the established players and the overall market.

If you think you’re in a blue ocean market, the only point of comparison is a snapshot of your own metrics at an earlier point in time. In other words, the rate at which your metrics are improving.

A far better measurement of success, however, is to ask your users.

User Metrics

A popular benchmark is the so-called “Sean Ellis test” (Sean Ellis was the first marketer at Dropbox and the author of the test). This metric is particularly well suited to early-stage startups, It involves having users answer a simple multiple-choice survey question.

How would you feel if you could no longer use [product]?

-

-

-

-

- Very disappointed

- Somewhat disappointed

- Not disappointed (it isn’t really that useful)

- N/A – I no longer use [product]

-

-

-

According to Ellis, a product has likely reached product-market fit when at least 40% of users indicate that they would be “very disappointed” if they could no longer use the product. Ellis arrived at this 40% benchmark by comparing the results of the survey across a hundred startups that he had worked with. He found that those who had achieved above 40% were generally able to sustainably scale their businesses while those significantly below 40% always seemed to struggle.

Again, this metric won’t always work for projects that don’t have any clear utility, such as NFT art projects. That doesn’t mean that user surveys can’t provide any insight. For example, in early 2022 a group of Berlin-based art-market experts set out to assess buyer motivation for fine art NFTs. The result was the ART+TECH Report on NFT collecting. The report provides many detailed insights on buyer motivations. Of course, this report was intended to assess the state of an entire market. Nevertheless, the same survey methodology could easily be adapted to assess the motivations of a specific NFT community as well.

Community and Social Metrics

Note that community and social metrics show up often in Hsu’s list of go-to-market metrics. This is because community is intrinsically tied to the success of most Web3 startups. For NFT and gaming-based projects, in particular, community engagement can be an early indicator of product-market fit.

When deciding on specific metrics, a good starting point is this detailed list of community success metrics from community tooling vendor Commonroom. This list includes metrics such as the percentage of members who are actively contributing back to your community and the percentage of posts and messages with at least one reply.

Community-oriented Web3 projects should also monitor discussions outside of their native community platform—namely on other social media platforms. Here, it’s important to track metrics that measure social media engagement, such as reach, impressions, responses, and brand mentions.

For many Web3 startups, these metrics won’t be the core success metric, but they can offer supplementary feedback on how close a project is to product-market fit.

Whose Job Is It to Track Product Market Fit in Web3?

This is a question that is rarely addressed because the Web3 industry is still young and lacks standardized job roles. The question is nevertheless important to consider because, in such a fast-moving industry, true ownership is essential.

For very early-stage startups, the typical answer is “the founder—the founder does everything”. But In a traditional Web2 startup, it’s the product manager’s job to track product metrics. They have the time and the skills to run the right surveys and pull the right reports.

Yet in the Web3 space, product managers are not always a fixture. This is because many Web3 teams don’t understand what a product manager does. Indeed, many Web3 teams haven’t needed a product manager to find success.

Jason Shah, Alchemy’s head of product, points out that when creating a DeFi protocol or running an NFT drop, teams mainly just need a developer, a community manager, and a protocol designer (DeFi) or an artist (NFTs). He notes that Web3 teams usually hire a product manager when user experience (UX) becomes a priority or when there are a mix of activities that go beyond the capabilities of a single specialist (such as marketing, growth, business development, community management, product analytics, and so on).

Generally speaking, it’s not necessary to hire a product manager to track product-market fit, but it is useful to learn more about what a product manager does and decide who is going to wear the product manager hat in your team.

What Should Web3 Teams Do When They’ve Achieved Product-Market Fit?

Product-market fit shows that your startup is on the right track, but it doesn’t mean that you should stick to the same strategy. On the contrary, it’s a signal to change gear and start focusing on different goals.

If we return to the case of Compound, one can see that the team changed strategy after they found product-market fit. They did this in two ways:

- They focused more on developer community building

- They put more thought into how they could decentralize ownership.

Investing More in Community Building

Although the team had a native dApp, the Compound protocol was (and still is) the core product. This means that Compound needed developers to build on top of its protocol so that it could increase its reach. Once the team discovered that there was a market for their product, they invested more time in building a developer community. As Leshner puts it, “we spent a lot of time doing things that most people find boring,” which in concrete terms meant:

- Improving and expanding the technical documentation.

- Writing use cases and end-to-end tutorials.

- Answering questions and responding to messages from their developer community on Discord and Github.

- Updating their website to showcase products that other developers had built on the protocol.

Planning for Decentralizing Ownership

According to Leshner, decentralization is a bad idea if you’re still iterating on your MVP. You can’t adapt fast enough when you’re “designing by committee”. Instead, the aim was to “start from a position of extreme efficiency” meaning that the Compound team could work fast because they were making all the decisions.

However, once they found product-market fit, this perspective shifted. They began to iterate their way towards community ownership. This culminated in several significant milestones:

- Issuance of a governance token

In April 2020, Compound allocated COMP tokens to their users based on their on-chain activity. This token gave its holders the right to propose and vote on any network decision. This included decisions about usage incentives, the assets that the platform would support, and Compound’s governance mechanism itself. - Handing over the admin key

Many projects use an admin key to authorize significant changes to the codebase and upgrades to the network protocol. Often, a centralized team holds the admin key, which means that the external developers cannot make major changes. This was also the case with Compound, but in June 2020 the team handed over control of the admin key to their community. This meant that the community could implement the changes that they voted for.

Of course, not all Web3 projects are destined for decentralization. For example, Web3 teams that have built products such as exchanges, NFT marketplaces, and infrastructure platforms often opt to remain more centralized. For these teams, finding product-market fit is often a signal that they should start looking into new Web3 markets.

Looking at New Web3 Markets

For most dApps and technology providers, each blockchain represents a single discreet market. Thus, it is a common pattern for these products to first find product-market fit on one specific chain and later expand support for newer chains. For example, Chainlink technology initially supported Ethereum but was later upgraded to support other EVM-compatible chains such as Avalanche and Polygon, and non-EVM chains such as Solana. This product-market fit can be a signal to invest in more research on the next chain to support.

New markets can also be assessed in terms of verticals such as the GameFi and NFTs. For example, in February 2022, blockchain infrastructure provider Alchemy released an NFT API to simplify the task of building NFT-based projects. Alchemy had already found product-market fit with its core product, Supernode, and was thus able to expand its product suite to address the burgeoning NFT market. Without the signal of product-market fit for Supernode, it would not have made sense to divert resources into supporting a new market.

Product-Market Fit Is an Iterative Process Rather Than a One-Time Event

Product-market fit is often discussed as though it is a one-time event, when in reality it is a quality that can be attained but then easily lost. Thus, product-market fit needs to be continuously reassessed. Such reassessment is crucial when external conditions change, such as when market sentiment changes or when the market becomes saturated with increased competition. It’s also vital to reassess product-market fit when setting new internal objectives such as breaking into new markets or integrating with a new technical ecosystem.

In either case, you need to look at whether your product still solves user problems or adds enough value. The same product that your users originally loved might not fit the current state of the market, or it might fall flat when you try to introduce it to new markets.

This is why it’s important to continuously monitor the metrics that signal product-market fit—especially those that signal market and community sentiment towards your product.