Automating Policy Enforcement With Smart Contracts

Rising regulatory demands are driving the need for solutions that reduce operational overhead and mitigate risk. Blockchain technologies present an exciting opportunity to overcome persistent inefficiencies in the compliance processes of financial institutions worldwide. Through the use of smart contracts and oracles, institutions can increase the efficiency of their compliance processes and enable new ways of enhancing auditability and transparency.

On the other hand, onchain policy enforcement is essential for institutional adoption of blockchain at scale. To meet the same regulatory requirements and internal standards that govern traditional systems, institutions must be able to enforce policies directly within blockchain environments.

Automating compliance processes with smart contracts addresses both challenges, offering a scalable way to manage cost and risk more effectively.

In this post, we explore policy enforcement, the challenges around today’s processes, and the opportunity for automating compliance through smart-contract-based policy enforcement.

What Is Policy Enforcement?

Policy enforcement refers to how financial institutions ensure they comply with external regulatory requirements and internal business rules. Policy enforcement is critical for managing operational, financial, legal, and reputational risks. Examples of policies enforced by institutions are highlighted below.

Customer and Counterparty Controls

- AML, CFT, and KYC policies: Verify customer identities and monitor transactions to prevent financial crimes.

- Sanctions Screening: Prevent transactions with sanctioned individuals, entities, or countries.

- Investor accreditation: Restrict investment access to investors that meet defined accreditation criteria.

Data Protection and Privacy Controls

- Data privacy controls: Enforce policies governing customer data handling to comply with privacy regulations like GDPR.

Transaction and Trading Rules

- Transaction limits: Cap the size and frequency of transaction amounts to manage exposure and prevent misuse.

- Jurisdictional restrictions: e.g., limit cross-border transactions to comply with international sanctions or local regulatory requirements.

- Trade restrictions: Prevent conflicts of interest or insider trading by enforcing blackout periods or restricting trading activities by insiders or during sensitive corporate events.

Asset Handling and Custody Requirements

- Custody controls: Define who can hold or manage specific financial instruments, ensuring asset safety and compliance.

- Transfer Restrictions: Restrict movement of digital or tokenized assets based on predefined rules, such as limiting transfers to pre-approved (whitelisted) wallet addresses to comply with the FATF ‘travel rule’ requiring Virtual Asset Service Providers (VASPs) to collect and transmit beneficiary and originator information.

Risk Management Constraints

- Exposure limits: Establish limits on counterparty, credit, or market exposure to prevent concentration.

- Collateral requirements: Enforce minimum collateral or margin requirements prior to trade execution to mitigate counterparty risk.

- Investment mandates: Govern portfolio construction through predefined specific rules on asset allocation or permissible investments.

Effective policy enforcement is supported by audit and control mechanisms, ensuring policy processes are effective and operating as intended.

Key Challenges Around Traditional Policy Enforcement Processes

“Complying with disparate jurisdictional regimes presents challenges that have contributed to increased costs and affected the speed of transactions.”—Bank for International Settlements (BIS)

Increasing Regulatory Requirements

Financial institutions worldwide face escalating compliance standards. Regulatory bodies frequently introduce new requirements and expectations, which place substantial demands on institutions to maintain and demonstrate adherence, increasing complexity and oversight responsibilities.

Complexity Operating Across Jurisdictions

Complying with diverse regulatory frameworks across multiple jurisdictions compounds complexity, cost, and operational inefficiency. Institutions navigating many different jurisdictions encounter significant barriers to scaling compliance processes globally, hindering operational agility, transaction speeds, and global competitiveness.

Pressing Need to Reduce Cost and Risk

Fragmented and manual compliance processes significantly drive up operational costs and introduce execution risks. Institutions are increasingly seeking streamlined solutions that uphold regulatory rigor while reducing both the financial burden and operational risks.

How Smart Contracts Can Enforce Policies for Digital Assets

Smart contracts can enforce policy rules at both the asset and workflow levels. No transactions occur and no assets move unless all pre-coded requirements are met. While distinct, these levels are complementary and can meet or even enhance the standards for compliance across traditional systems.

Asset-Level Smart Contracts

Controls can be encoded directly within a tokenized asset’s own smart contract. This ensures that any transaction involving that specific asset inherently complies with predetermined rules, such as asset-specific transfer restrictions, jurisdictional limits, and investor accreditation requirements. Transactions involving the asset will only execute if all embedded rules are satisfied.

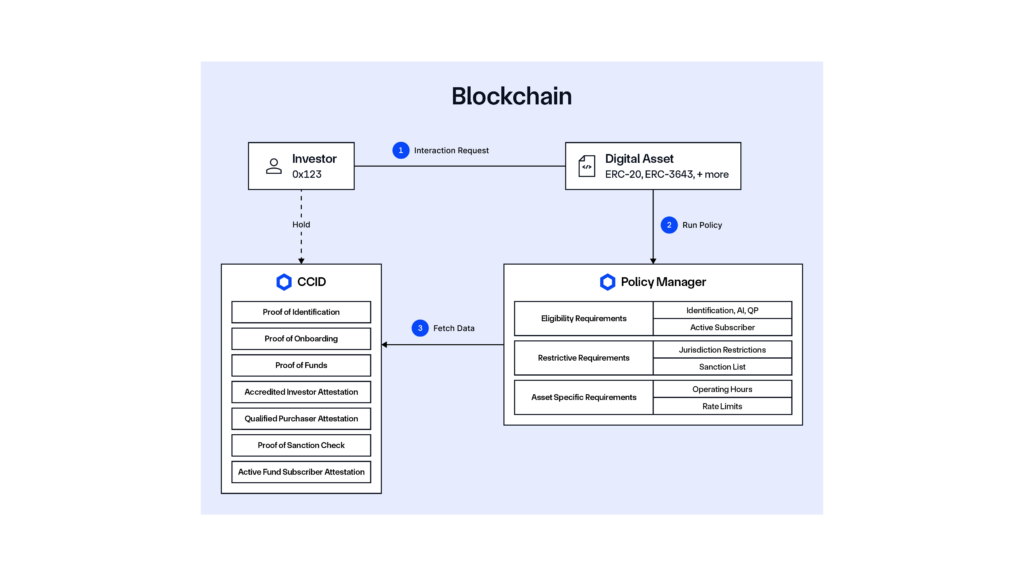

These controls can be embedded within smart contracts using Chainlink’s Policy Manager service, which is part of Chainlink’s Automated Compliance Engine (ACE). Chainlink ACE is a unified and modular standard to solve all onchain compliance problems and bring institutional capital onchain, enabling anyone across traditional or decentralized finance to build, manage, and execute complex financial transactions across multiple jurisdictions, counterparties, digital assets, and execution environments, including public and private chains—all in a compliance-focused and privacy-preserving manner.

The Policy Manager is a customizable rules engine that enables users to define, manage, and enforce compliance policies directly within smart contracts. Policy enforcement can be implemented to satisfy regulatory requirements (e.g., investor sophistication certification) or internal business rules (e.g., transaction limits, collateral requirements).

Process-Level (Workflow) Smart Contracts

Compliance rules can be enforced within broader transactional or operational workflows that are governed by smart contracts. These contracts can orchestrate multiple steps across different assets or counterparties, enforcing compliance at key stages of a process rather than solely at the asset itself. Approval workflows, AML checks, and multi-party transactions all require process-level smart contracts to support compliance onchain.

Combining Asset- and Process-Level Smart Contracts

By embedding compliance at both asset and process levels, organizations can achieve comprehensive, layered policy enforcement. Asset-level contracts ensure intrinsic compliance specific to each asset, while process-level contracts manage overarching rules governing complex transactions or business processes. Together, these layers offer robust, automated compliance controls that minimize manual intervention, reduce errors, provide traceability, and facilitate enhanced transparency across the entire transaction lifecycle.

This proactive, automated enforcement approach ensures institutions can enforce internal rules globally and seamlessly comply with requirements as assets move across various jurisdictions. Instead of addressing violations in post-trade processes, institutions can prevent them through smart contract-powered policy enforcement.

Advantages of Smart Contracts for Policy Enforcement

“More than half of financial institutions say that between 31-60% of their KYC review tasks are still being completed manually, which helps explain why nearly two-thirds (62%) are now focusing on investing in technology to help automate many tasks.”—Fenergo

Smart contracts can help proactively prevent policy violations, enhance operational efficiency, and scale compliance processes as regulatory complexity grows.

Real-Time Compliance Onchain

Policy enforcement via smart contracts prevents transactions that fail to meet preset rules from being executed. Compliance rules are checked instantly when transactions are initiated, which supports proactive, continuous oversight. For instance, programmable policy enforcement can limit maximum transaction amounts or cumulative volume limits, instantly rejecting transactions that exceed predefined thresholds.

Consistent Global Controls

Embedding compliance rules directly into onchain transaction processes facilitates regulatory adherence across jurisdictions, reducing operational risks and improving regulatory alignment. For example, smart contracts can automatically apply geo-fencing logic and allowlists, preventing transactions involving restricted jurisdictions or sanctioned entities, ensuring global consistency and regulatory adherence.

Lower Operational Costs

Automating compliance onchain streamlines operations and enhances efficiency, enabling financial institutions to scale their compliance frameworks without increasing costs proportionally. An example is automated AML/KYC checks, where customer identities can be instantly verified using digital credentials.

Auditability and Enhanced Transparency

Blockchain-based compliance enforcement provides clear, permanent, and verifiable records for regulators and stakeholders. Compliance checks performed during transactions are recorded immutably within smart contracts, creating audit trails that simplify regulatory oversight and can be leveraged to enhance transparency.

Reduction of Errors

Smart contracts enforce rules precisely and consistently. For example, asset custody requirements can be hard-coded to ensure digital assets move only between pre-approved wallets or custodians, improving transaction processes while also enhancing auditability.

Real-World Examples of Institutions Transforming Traditional Processes With Smart Contracts and Chainlink

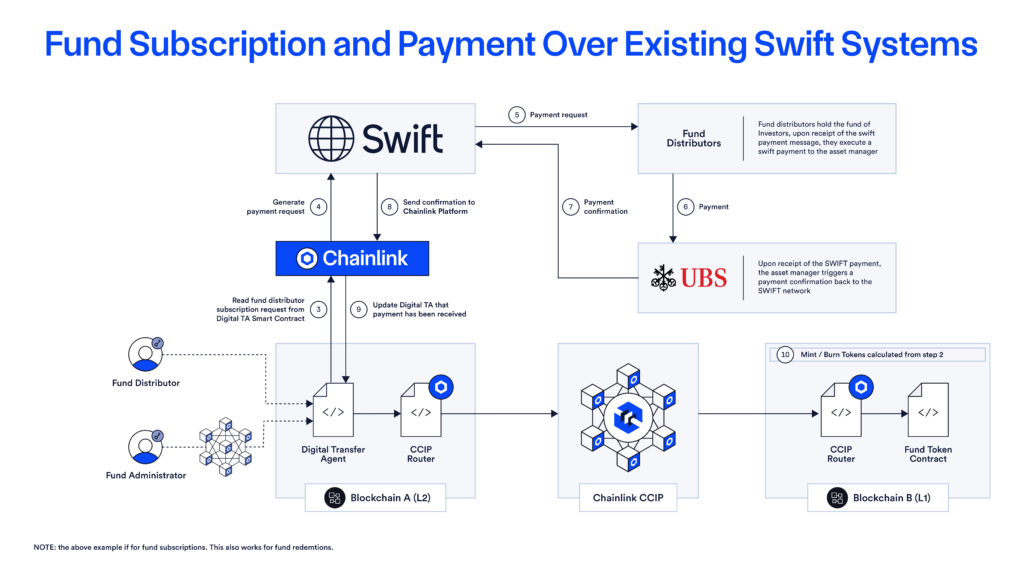

Swift, UBS Asset Management, and Chainlink: Successfully Bridge Tokenized Assets with Existing Payment Systems

As part of the Monetary Authority of Singapore (MAS) Project Guardian, Swift, UBS Asset Management, and Chainlink demonstrated the issuance and settlement of tokenized funds using traditional Swift fiat payment rails. As a result, digital asset transactions can be settled using the existing Swift fiat payment systems already used by 11,500+ financial institutions, across 200+ countries and territories.

“For digital assets to be adopted globally, they must seamlessly integrate with both existing payment systems and digital currencies. Our work with UBS Asset Management and Chainlink in MAS’ Project Guardian leverages the global Swift network to bridge digital assets with established systems. This initiative aligns with our strategy to provide our community of financial institutions with a secure and scalable way to transact across multiple digital asset classes and currencies, leveraging Swift’s existing infrastructure.”—Jonathan Ehrenfeld, Head of Strategy, Swift

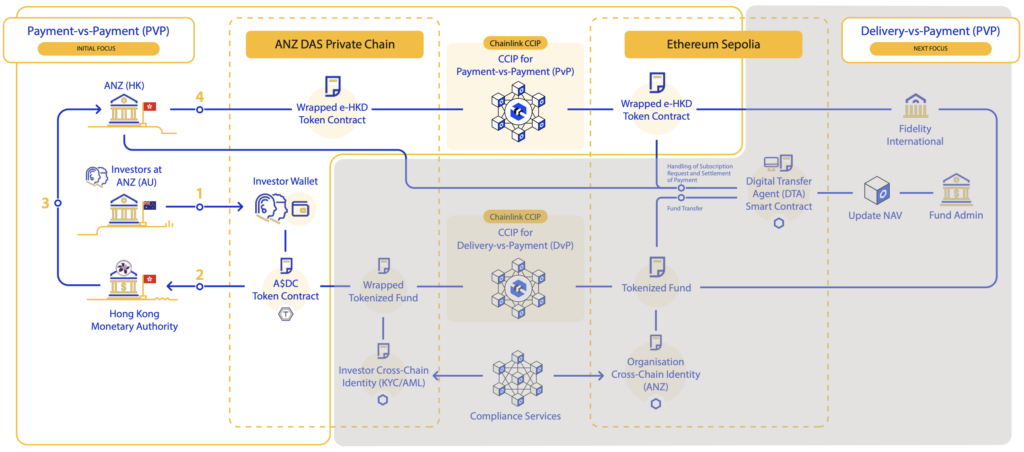

HKMA e-HKD Phase 2: ANZ Bank and Fidelity International Leverage Onchain Identity Verification via CCID

Visa highlighted how, under the Hong Kong Monetary Authority (HKMA) e-HKD+ program, the Chainlink Cross-Chain Interoperability Protocol (CCIP) and Automated Compliance Engine facilitated the secure exchange of ANZ Bank’s A$DC’s stablecoin with Hong Kong’s e-HKD+ CBDC, which was then used to enable the purchase of a Fidelity International tokenized fund. Chainlink enabled Fidelity International and ANZ to show how secure, privacy-preserving, and compliance-ready infrastructure can accelerate tokenized fund operations at scale.

ANZ, ADDX, and Chainlink Introduce Privacy-Enabled Cross-Chain, Cross-Border Connectivity for Tokenized Commercial Paper

Under the Monetary Authority of Singapore (MAS) Project Guardian, ANZ, ADDX, and Chainlink collaborated on a use case supporting the entire lifecycle of tokenized commercial paper. The use case leverages ADDX’s investment platform, ANZ’s Digital Asset Services, and CCIP Private Transactions—a privacy-preserving capability powered by the Chainlink Blockchain Privacy Manager—to expand access to tokenized assets across borders while helping users meet confidentiality requirements.

“While we see significant potential for blockchain technologies to streamline the entire asset lifecycle, transaction confidentiality, and meeting compliance obligations remain paramount. We look forward to exploring the privacy-preserving capabilities of Chainlink CCIP to support our customers with end-to-end private transactions.”—Richard Schroder, Head of Digital Asset Services at ANZ

Bancolombia Group’s Wenia Taps Chainlink To Increase Transparency of Its Stablecoin

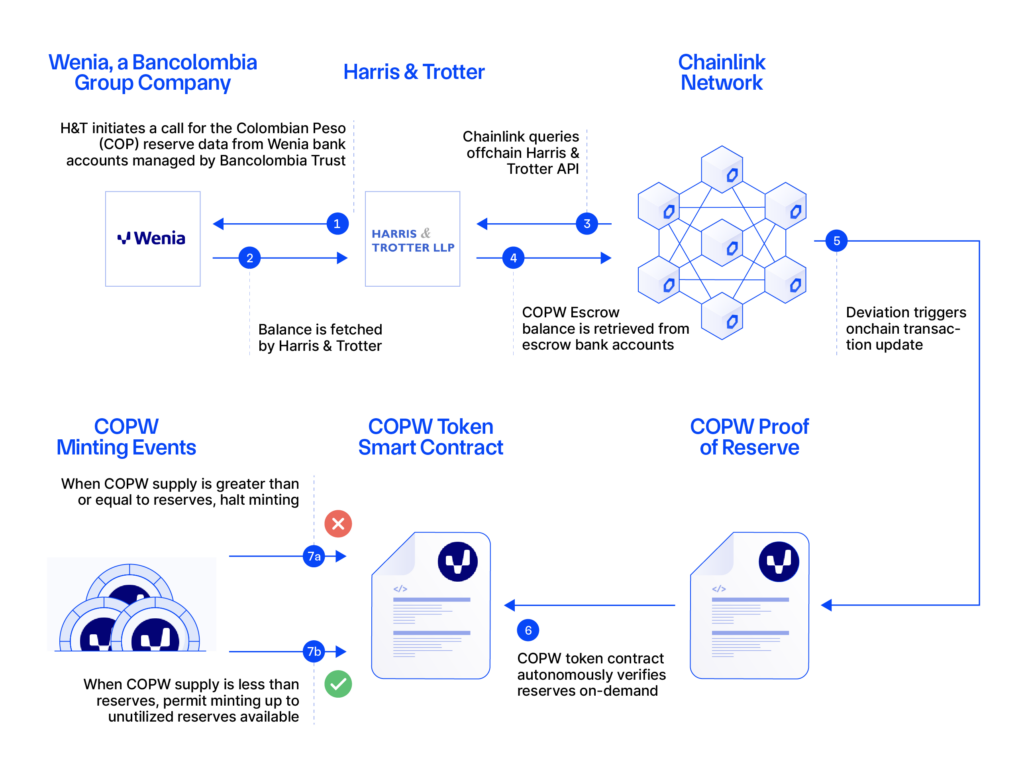

Wenia—the digital asset company from the Bancolombia Group, one of the largest financial conglomerates in Latin America—is using Chainlink Proof of Reserve to bring end-to-end transparency to the Colombian Peso reserves backing its COPW stablecoin. Proof of Reserve is integrated directly into the stablecoin’s minting function, helping to protect users against the risk of infinite mint attacks where additional COPW is issued without sufficient available reserves.

“Onchain Proof of Reserve data is a critical component to digital asset adoption, serving as a stepping stone toward increasing consumer confidence in using stablecoins and other tokenized assets.”—Pablo Arboleda, CEO of Wenia

Conclusion

As digital assets become mainstream, blockchain-based compliance will become the standard for global finance. By embedding policy enforcement directly into smart contracts using Chainlink ACE, firms can operate with greater resilience, efficiency, and transparency. With automated policy enforcement, compliance teams can scale oversight, streamline controls, and contribute more strategically to business growth, without requiring additional operational load. By adopting programmable compliance today, leaders can ensure their firms remain agile, compliant, and competitively positioned as the world moves onchain.