Chainlink Unveils Monumental Upgrade To Power Onchain Finance

In his recent SmartCon 2024 keynote, Sergey Nazarov explored how TradFi and DeFi are converging into a single unified Internet of Contracts through Chainlink. This post is based on his presentation.

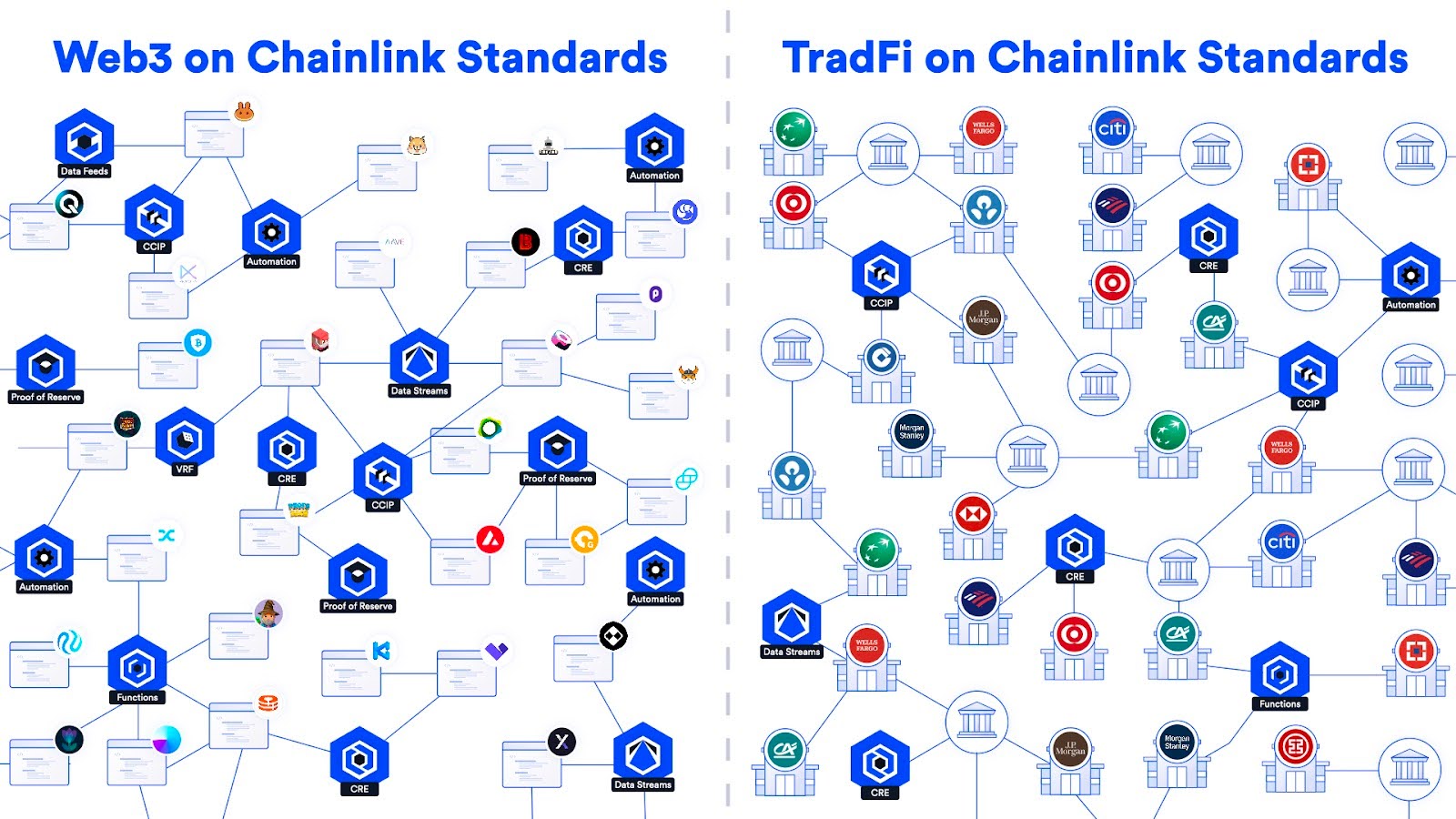

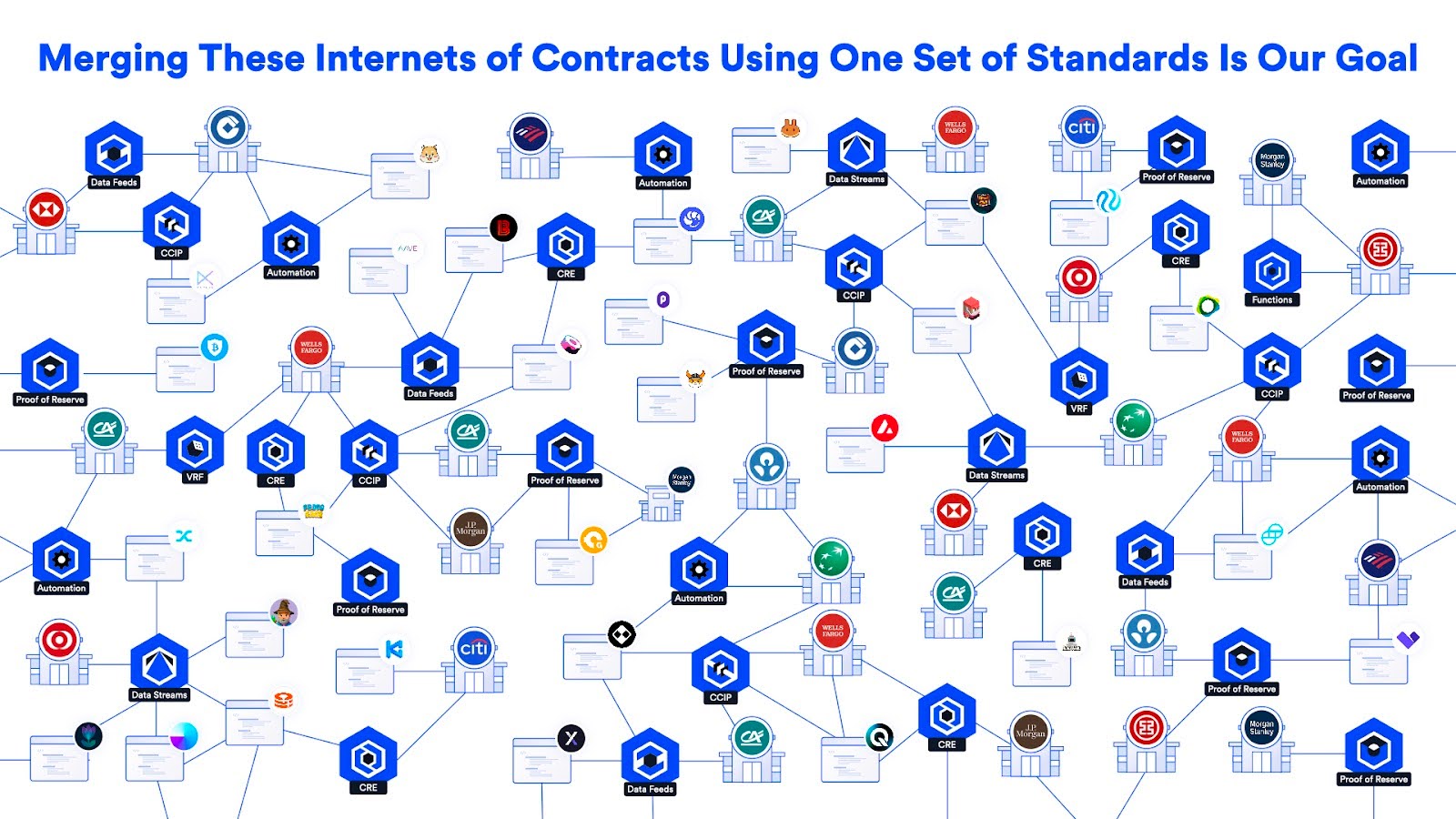

Our fundamental goal is to establish a global standard—one that works across both DeFi and traditional capital markets. These two sectors are set to converge, and when they do, we expect it will create an economic boom by combining into a single global Internet of Contracts. Chainlink’s mission is to lead this transformation by creating the standard powering this new onchain financial system.

Currently, these two worlds—DeFi and TradFi—are evolving in separate directions. We’ve already made significant strides in establishing Chainlink as the standard for DeFi by powering a significant portion of it, securing $75+ billion in DeFi TVL at its peak. Now, we’re also making progress in becoming the standard for TradFi capital markets.

The ultimate goal is to create applications that work seamlessly together, defining the standard for how value is transacted across the entire financial system. That’s what success looks like—building a global standard that powers the Internet of Contracts, which we expect will lead to the economic boom that will result from merging these two worlds into a single global market.

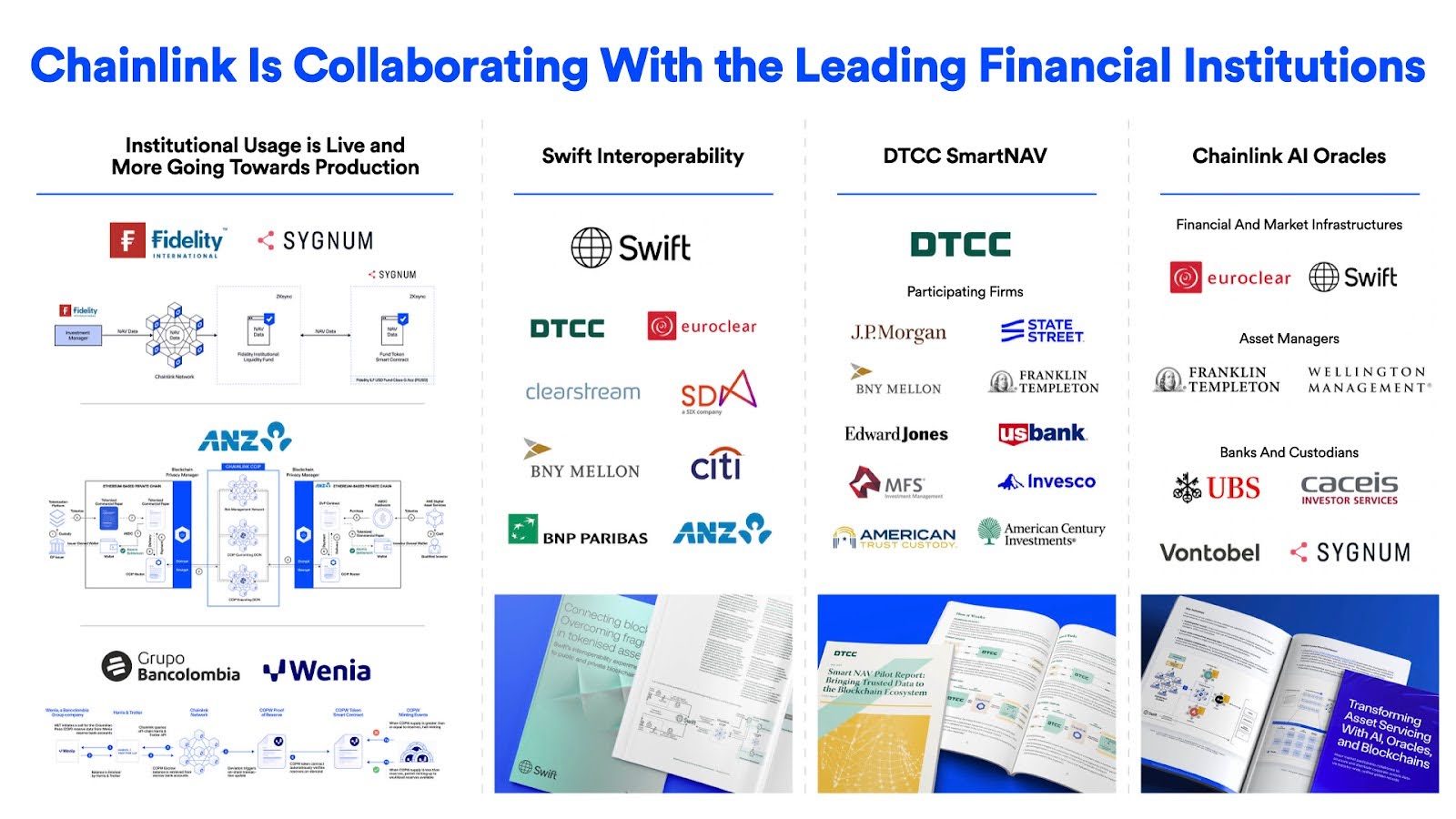

We’ve made significant progress within TradFi markets. In addition to DeFi, we have implementations in production for large asset managers, multiple collaborations with major financial market infrastructures, and we’re in various stages of implementation with some of the biggest banks and asset managers in the world. Just like we’ve successfully established Chainlink as a global standard for the DeFi community, this year we’ve made great strides toward creating the standard for capital markets.

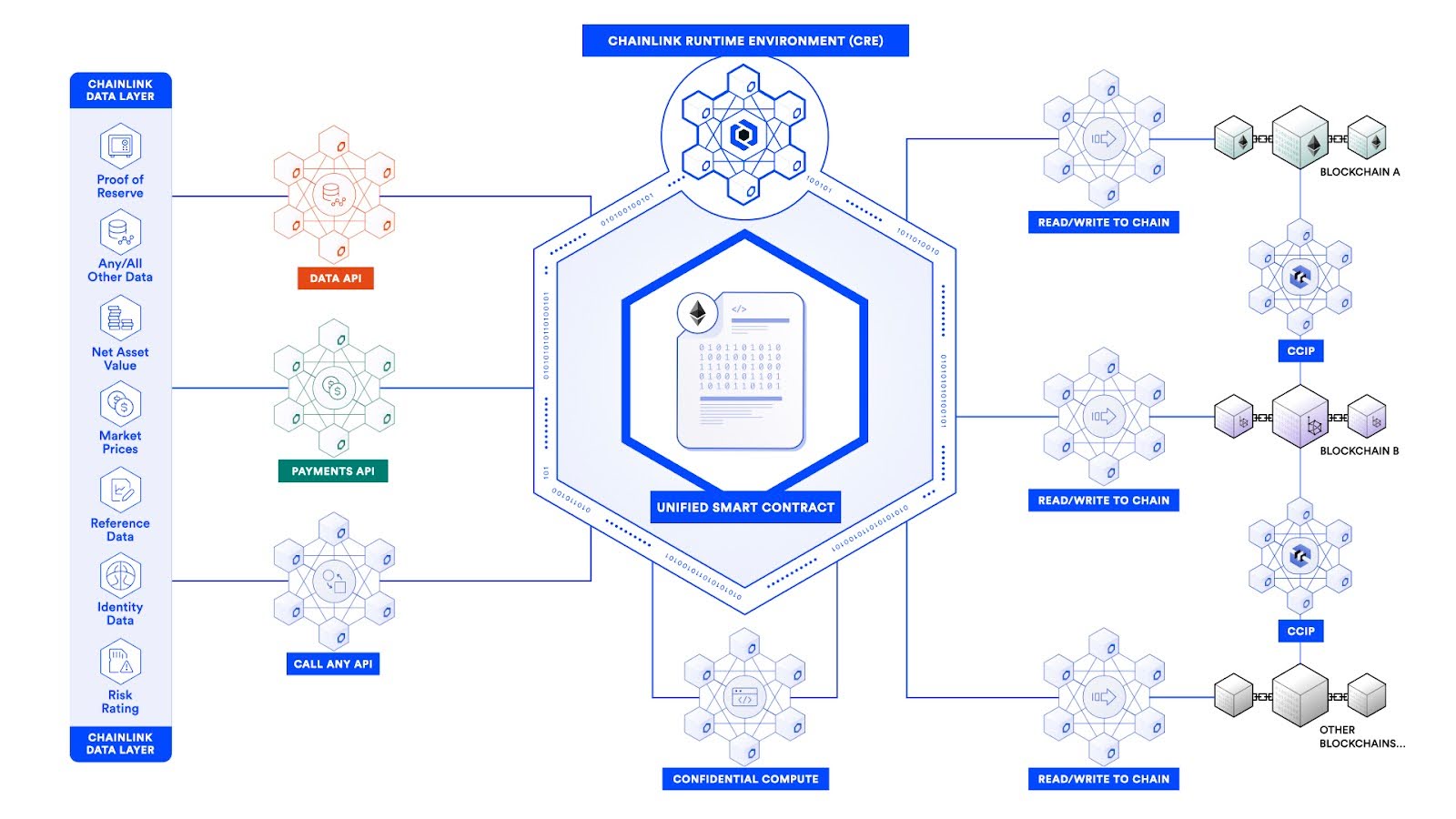

We’ve achieved this by providing a comprehensive set of services: data, proof of reserves, identity, cross-chain, and more—all integrated into contracts. One key lesson we’ve learned along the way is the need for a unified system to weave together these services, blockchains, smart contracts, and payment systems into a single application.

Introducing the Chainlink Runtime Environment (CRE)

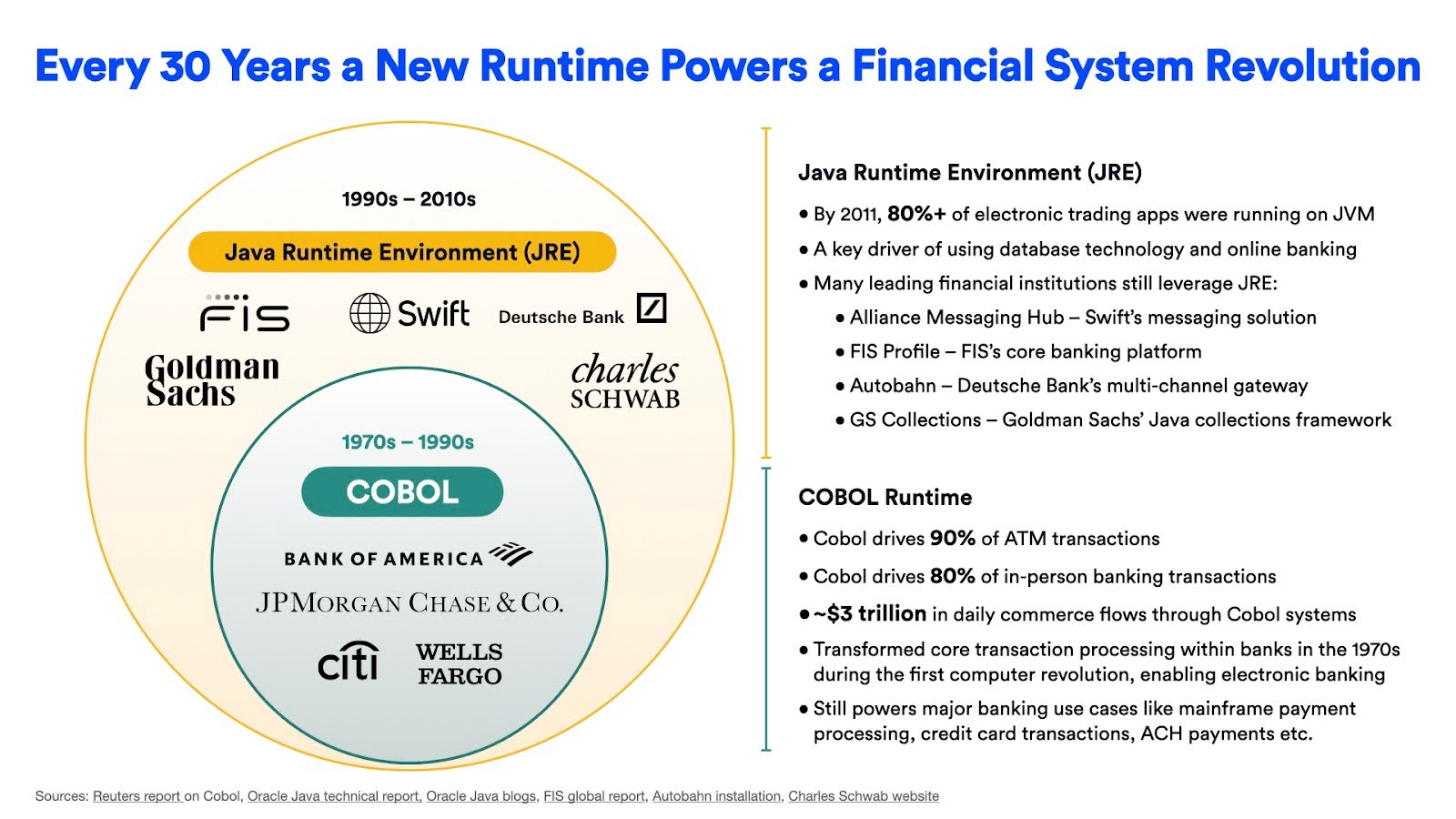

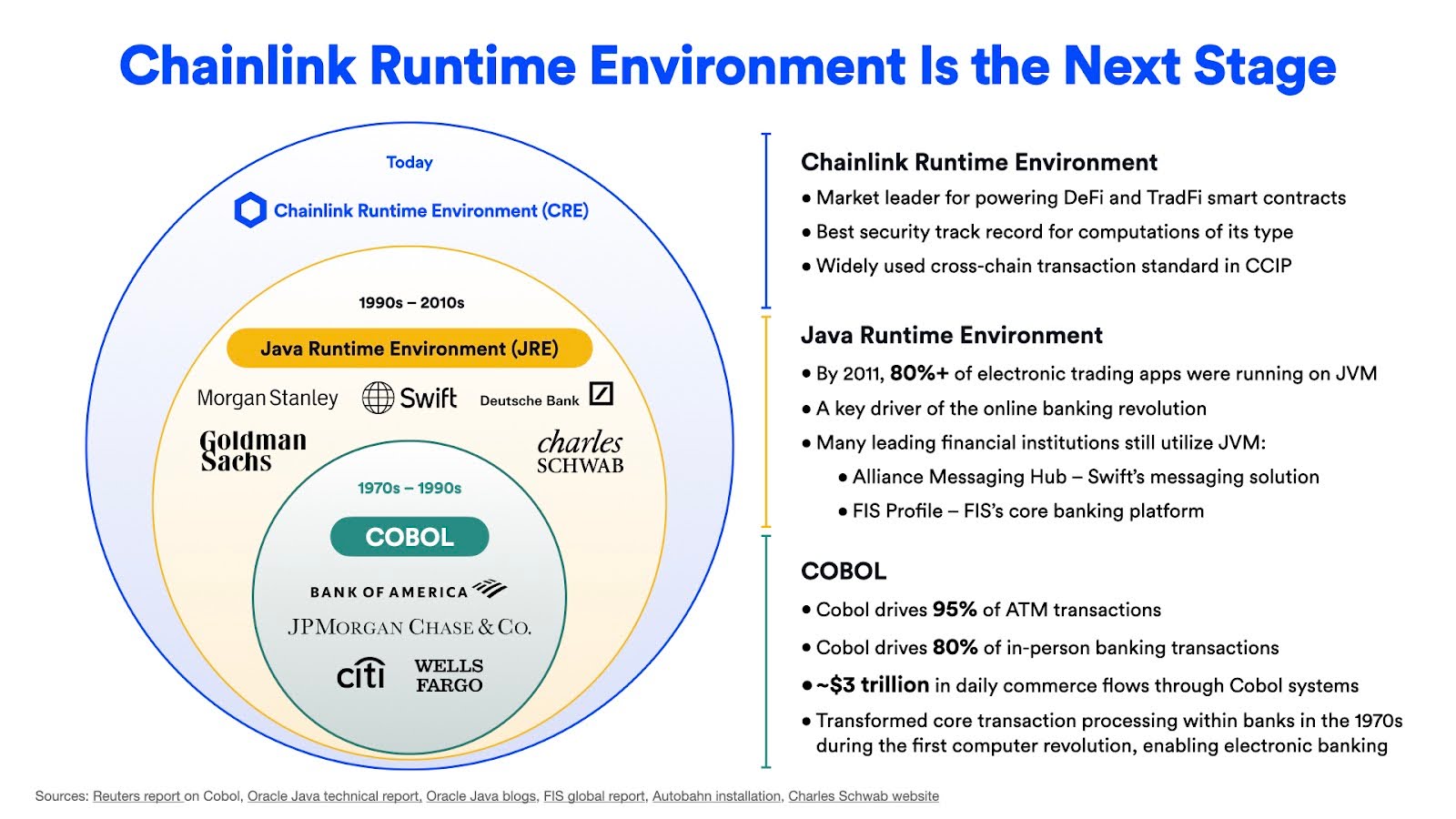

Looking back at the history of financial applications, each economic boom has been driven by the simplification of new technologies. In the 1970s, the introduction of COBOL as a runtime technology simplified interactions with databases and created the first electronic banking transactions. Similarly, in the 1990s, the Java Runtime Environment (JRE) simplified the interaction between new database technologies and the Internet, paving the way for online banking.

Now, as the world’s value migrates across hundreds of chains and thousands of oracle networks, the opportunity to unify these systems into a single application has emerged. The goal is to allow developers to create advanced applications much more quickly than before—within days or even hours. This simplification is what has driven economic booms in the past, and it’s what we aim to do now with the Chainlink Runtime Environment.

The Chainlink Runtime Environment (CRE) is designed to play the same role that COBOL and JRE played in previous economic booms in the last few decades. The CRE will coordinate blockchain technologies, oracle networks, and smart contracts into a unified application. By simplifying the complexities of interacting with multiple systems, the CRE will provide developers with an environment to easily integrate existing data, systems, and new blockchain technologies into a single application—this is the next step in simplifying blockchain application development.

We’ve already seen this work with the Swift network. Through the CRE, we integrated Swift messages with multiple blockchains to create a seamless transaction flow. A small amount of engineering resources was needed to achieve this, demonstrating the CRE’s power in simplifying complex systems. This solution was showcased at Swift’s Sibos conference and received a strong response. The ability to coordinate Swift messages and blockchain events securely and efficiently is just one example of how the CRE will simplify cross-chain interoperability and make complex systems more manageable.

The adoption of the Chainlink Runtime Environment is a critical piece of our vision for the future. It’s designed to unify these complex services into one cohesive application, allowing developers to write code in languages they’re already familiar with, such as Go and TypeScript, with other languages like Rust under consideration. We believe this will lead to widespread adoption and make it easier for developers to build applications that integrate smart contracts, blockchain technologies, data, and payments—ultimately leading to the creation of a global, interconnected network of contracts.

Privacy Is the Key to Unlocking Institutional Adoption

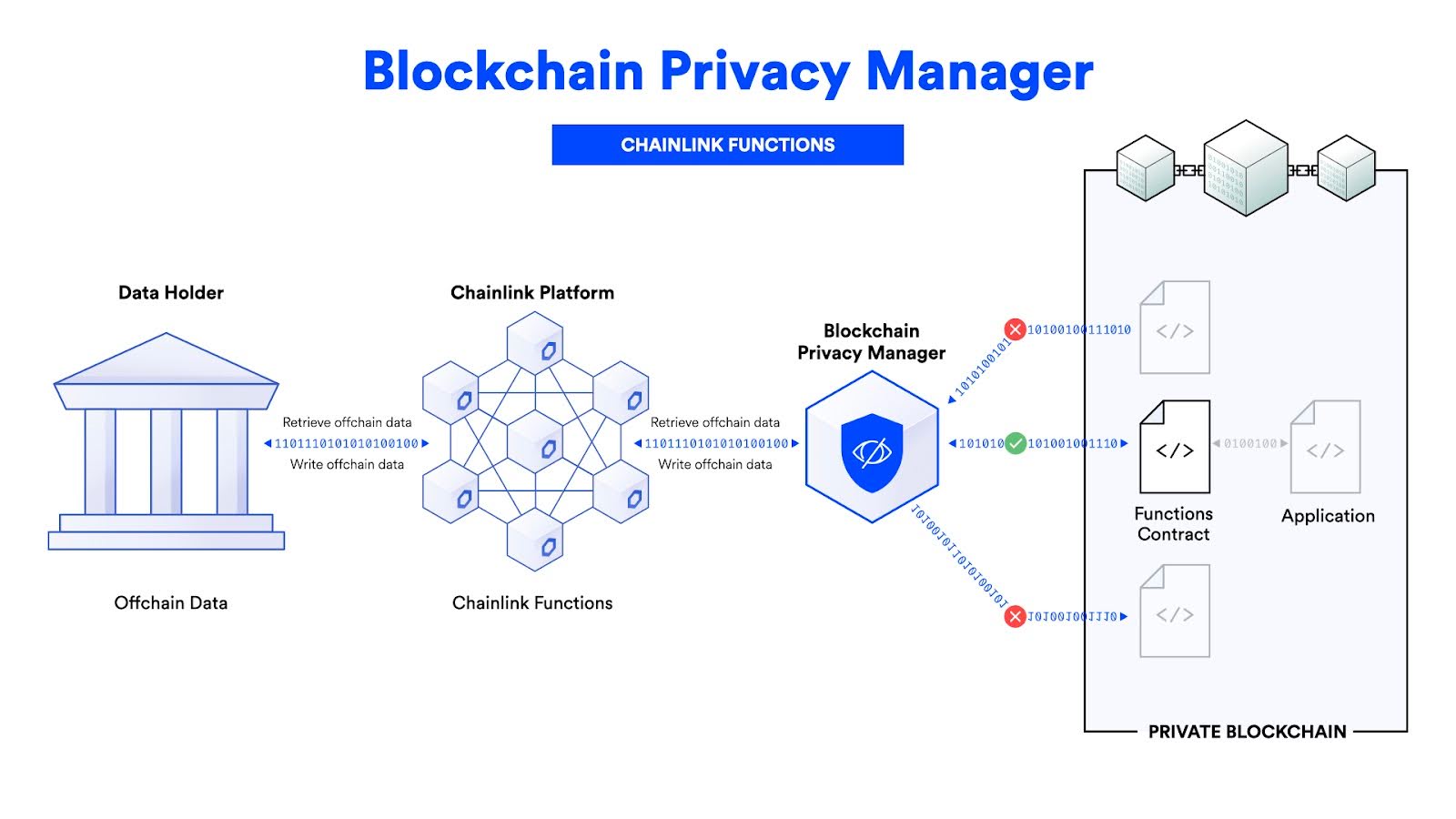

As we continue to innovate, we are also addressing privacy in blockchain transactions. For institutional transactions, privacy is essential, and that’s why we’ve introduced the Blockchain Privacy Manager. This tool helps manage privacy across various chains by defining what information can and can’t leave a chain. We’ve also applied this tool to Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to create private transactions, essential for institutional users.

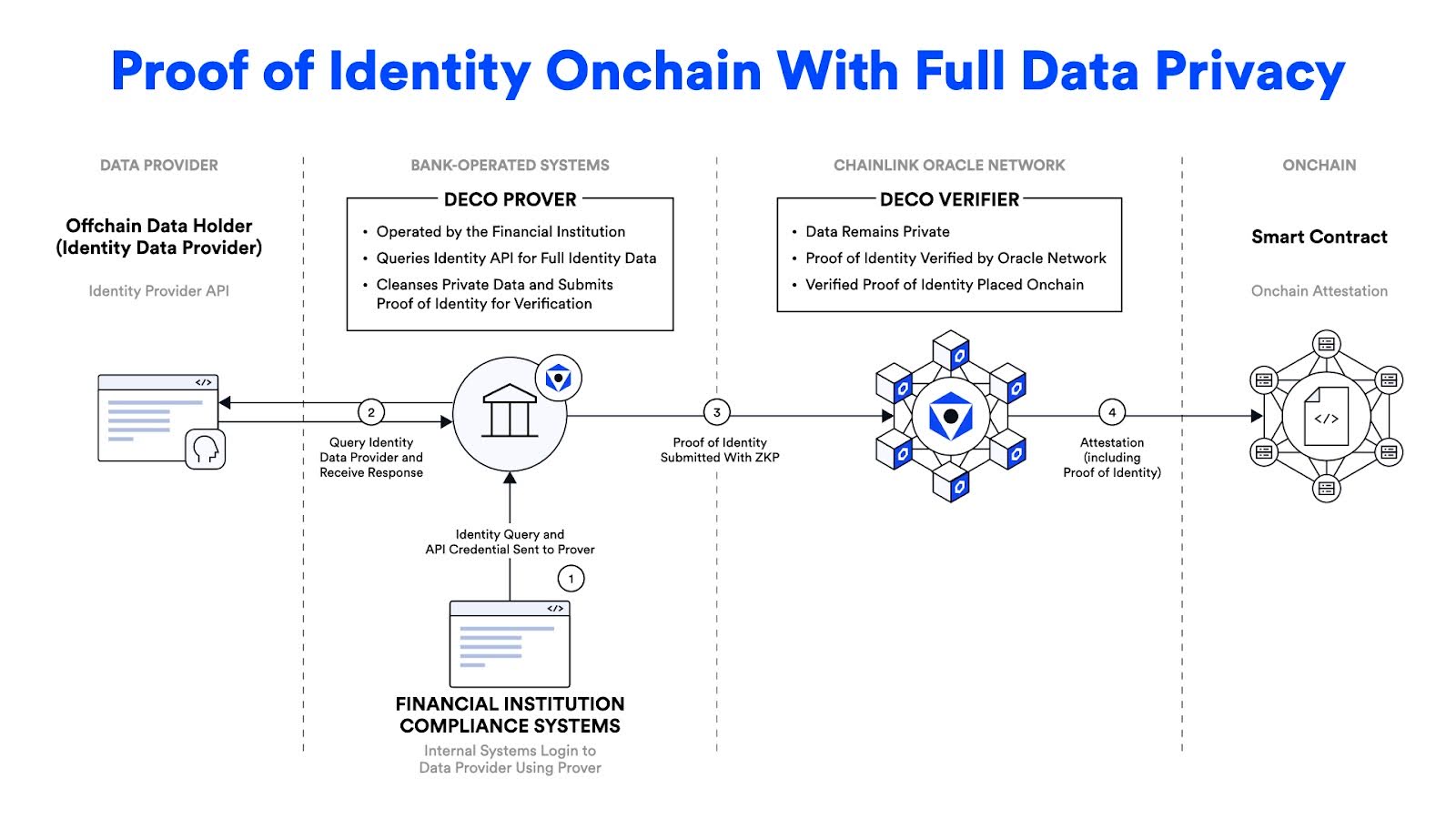

Additionally, we’re releasing tools like the DECO Sandbox, which allows developers to apply zero-knowledge proofs to any API and prove data information without revealing sensitive details. This is a significant advancement for privacy, especially in sectors like identity management and proof of funds, where confidentiality is crucial.

SmartData Leads to SmartAssets

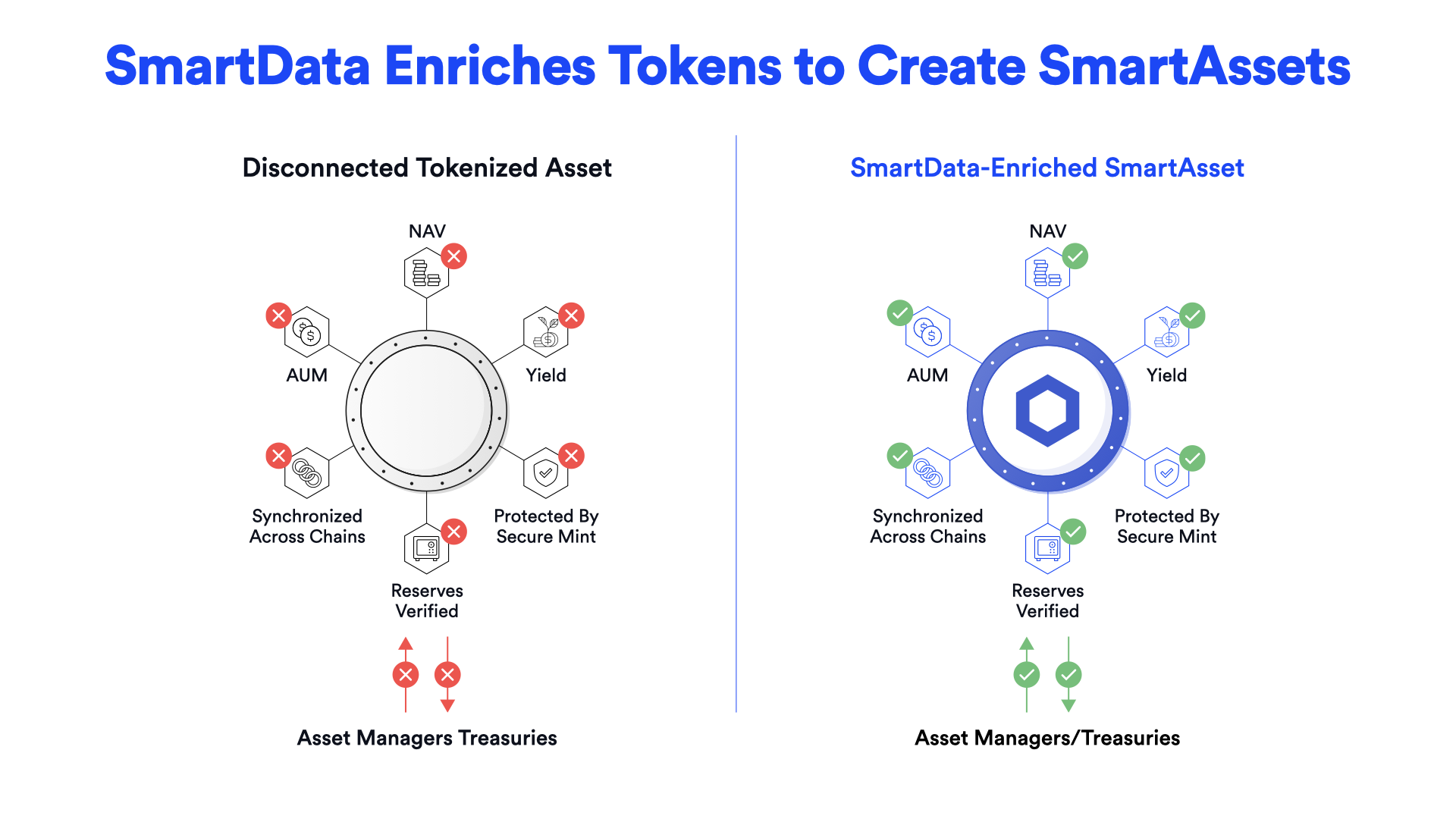

We also recognize the importance of creating data standards. Chainlink is rapidly becoming the standard for proof of reserves, a critical element in the reliability of stablecoins and commodity-backed assets. The work we’re doing with the SmartData standard will further expand the types of data that can be reliably transmitted onchain, leading to the creation of SmartAssets that are enriched and controlled by highly reliable data feeds.

The Next Evolution of Chainlink CCIP

Finally, our vision extends to the continued evolution of CCIP. With features like Programmable Token Transfers, CCIP is being adopted by major blockchains as their canonical bridge solution, providing a reliable and secure way to transfer tokens across chains. The ability to conduct transactions and manage payments seamlessly across multiple blockchains will play a key role in the growth of this technology.

The goal is to create a unified standard that spans both the DeFi and TradFi worlds. Through the Chainlink Runtime Environment, we are bringing that vision to life. We’re laying the groundwork for an interconnected global economy driven by smart contracts, and as we continue to develop these technologies, we believe Chainlink will be at the epicenter of the next economic boom.