How Chainlink Is The Largest Provider of Onchain Proof of Reserves

The financial system is undergoing a fundamental transformation—moving toward an onchain architecture that brings unprecedented transparency, security, and efficiency to how financial transactions are conducted.

This shift is accelerating alongside the great wealth transfer, as trillions of dollars move to younger generations who are more digitally native and open to engaging with onchain financial products. These digital-native investors are demanding real-time auditability, open infrastructure, and greater visibility into how assets are managed.

As more financial infrastructure moves onchain, various “proof of” mechanisms are becoming critical building blocks of this new architecture. These proofs go beyond transparency—they’re essential for security, regulatory compliance, and automated risk mitigation.

One of the most critical of these is proof of reserves—a mechanism for ensuring that digital assets are backed by verifiable reserves. In this blog, we explore why Chainlink is the largest and most battle-tested provider of onchain proof of reserves infrastructure.

Why Proof of Reserves is Essential for Onchain Financial Products

Stablecoins, tokenized real-world assets (RWAs), wrapped tokens, and other digital assets all require a reliable way to prove their backing. Without a transparent and verifiable proof of reserves mechanism, users, token issuers, and the broader financial system could be exposed to significant risks, including:

- Insolvency

- Depegging events

- Infinite mint attacks

- Collateral mismanagement

- Regulatory non-compliance

Most proof of reserves mechanisms rely on offchain methods—publishing reserve information on websites or in periodic reports. These approaches are not verifiable by smart contracts, lack automation, and can quickly become outdated.

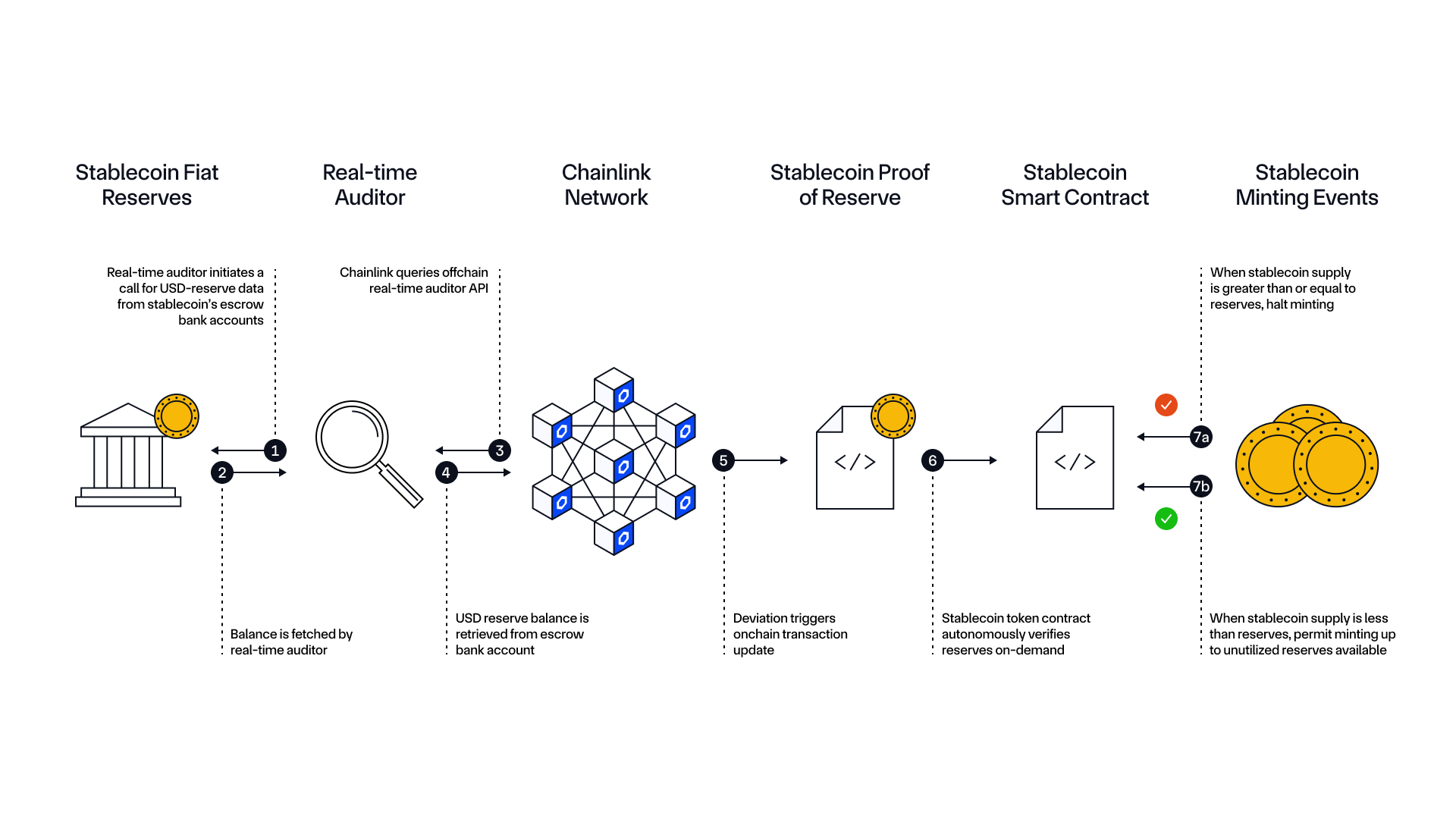

In contrast, onchain proof of reserves delivers real-time, cryptographically secure data directly to smart contracts, ensuring immediate enforcement of reserve requirements. This automated, transparent approach enables anyone to independently verify reserves directly onchain, eliminating the need for trust in centralized entities and delayed manual attestations.

Why Chainlink Proof of Reserve Is the Standard for Verifiable Data

Chainlink pioneered the onchain proof of reserves model with the launch of Chainlink Proof of Reserve in 2020. Since then, Chainlink Proof of Reserve has become the standard for verifying reserves across onchain financial ecosystems. For example, during periods of uncertainty or security incidents, users can turn to data.chain.link for near real-time pricing or reserve updates as the key source of truth.

Chainlink Proof of Reserve helps mitigate critical risks by delivering near real-time, automated verification of reserves. Unlike traditional audit systems that rely on periodic attestations, Chainlink Proof of Reserve uses decentralized oracles to provide automated, real-time verification. This enables smart contracts to react automatically to changes in reserves, enforcing rules like minting limits without manual intervention.

Its combination of maturity, scale, and security makes Chainlink Proof of Reserve the most battle-tested and trusted provider of onchain proof of reserves. The service leads across every key dimension, including:

- Reserves verified—With $17B+ reserves verified, Chainlink Proof of Reserve is the largest and most widely used solution for verifying onchain proof of reserves across multiple asset classes.

- Number of feeds—With 40+ active feeds, Chainlink supports the widest network of onchain Proof of Reserve integrations across diverse protocols and asset classes.

- Broadest adoption—Chainlink Proof of Reserve supports a wide range of onchain financial products, including ETFs, stablecoins, tokenized funds, wrapped BTC, liquid (re)staking tokens, and more.

- Institutional ecosystem—Chainlink has built a network of trusted auditor and fund administrator partners to help maintain the highest standards of data accuracy, auditability, and compliance.

- Platform capabilities—Chainlink Proof of Reserve integrates seamlessly with other Chainlink services—such as CCIP, Data Feeds, Automation, and more—to provide an integrated stack for building advanced onchain applications. This provides 360° token protection, enabling protocols to secure reserves, enforce issuance policies, increase adoption across DeFi, and interact across chains—all with the same infrastructure.

- Specialized expertise—Chainlink Labs has a dedicated team focused on developing and improving Proof of Reserve, spanning across product, research, and engineering.

- Battle-tested infrastructure—Chainlink Proof of Reserve is backed by the same oracle infrastructure that has enabled $20 trillion in onchain transaction value, with a 5-year track record of reliability.

- Future-proof—With the upcoming Chainlink Runtime Environment (CRE) upgrade, Chainlink Proof of Reserve will become part of a broader developer platform of modular infrastructure components. This will unlock new possibilities for creating advanced, multi-layered workflows involving Proof of Reserve that span both onchain and offchain environments.

Secure Mint: Programmatic Protection Against Overminting

Chainlink Proof of Reserve not only delivers transparency but also provides a powerful layer of security through a mechanism called Secure Mint, which ensures that token issuance cannot exceed available reserves.

One critical threat in digital asset systems is the infinite mint attack—where an issuer mints more tokens than it has backing for. This often leads to depegging, insolvency, or complete protocol failure.

Chainlink Proof of Reserve directly mitigates this risk with Secure Mint—the mechanism ensures that tokens can only be minted if there’s cryptographic proof that enough reserves exist. If backing is insufficient, issuance is automatically halted at the smart contract level.

Secure Mint is already live in production with assets like the TUSD stablecoin, Matrixdock’s Short-term Treasury Bill tokens, and Banco Wenia’s Colombian Peso-backed stablecoin.

Key Chainlink Proof of Reserve Users

Chainlink Proof of Reserve is the trusted solution behind some of the most prominent issuers and protocols in the onchain finance ecosystem:

Stablecoins, Money Market Funds, and Other Tokenized Assets

- Apex Group, a global fund administrator with over $3T in assets under management, leverages Chainlink Proof of Reserve to enhance the onchain verifiability of tokenized asset reserves across its broader fund services.

- Fasanara is a global investment firm managing over $4B in assets. The firm is using Chainlink Proof of Reserve to help increase the visibility and integrity of asset reserves related to FAST, their onchain tokenized money market fund.

- TrueUSD (TUSD) is using Chainlink Proof of Reserve to ensure transparency and reliability and is the first USD-backed stablecoin to programmatically control minting with Chainlink Proof of Reserve.

- Ethena Labs, the issuer of $4.9B+ stablecoin USDe, launched its USDe Proof of Reserves solution with Chainlink as an Attestor.

- Superstate is an asset management firm modernizing investing through tokenized financial products. The firm adopted Chainlink Data Feeds into Superstate’s tokenized $400M treasury fund and is integrating Chainlink Proof of Reserve to further enhance the onchain verification of AUM data.

- Backed is a leader in bringing real-world assets onchain, offering tokenized versions of traditional assets. Backed leverages Chainlink Proof of Reserve for its tokenized assets.

- Matrixdock issues the Short-Term Treasury Bill token (STBT) that is backed by short-term Treasury bills and pegged 1:1 to the USD. The project is using Chainlink Proof of Reserve—and other Chainlink services—to enhance the utility and liquidity of STBT.

- Wenia, part of Bancolombia Group, one of the largest financial conglomerates in Latin America, is using Chainlink Proof of Reserve to increase the transparency of its stablecoin backed 1:1 by the Colombian Peso.

- Paxos, a leading issuer of regulated stablecoins and tokenized assets, is adopting Chainlink Proof of Reserve to further integrate its tokenized gold products into DeFi.

- Adapt3r provides access to short-term U.S. Treasury Bill yields onchain. Adapt3r is integrating Chainlink Proof of Reserve for collateral verification.

ETF Issuance

- 21Shares is one of the largest crypto ETF issuers. The firm adopted Chainlink Proof of Reserve to increase transparency of the ARK 21Shares Bitcoin ETF (ARKB), a $4B fund, issued alongside Ark Invest, and enhance reserves transparency for its 21Shares Core Ethereum ETF (CETH).

Bitcoin Financialization

- BitGo is the issuer of WBTC, the largest wrapped Bitcoin token by market capitalization. BitGo leverages Chainlink Proof of Reserve to enhance transparency and auditability for WBTC.

- Coinbase issued cbBTC, a wrapped Bitcoin product on Base, that uses Chainlink Proof of Reserve to enhance reserves transparency.

- 21Shares adopted Chainlink Proof of Reserve to increase transparency of its wrapped Bitcoin product on Ethereum and Solana, 21BTC.

- Solv, the issuer of the $1.3B+ TVL SolvBTC, is using Chainlink Proof of Reserve to provide onchain transparency into its total protocol TVL.

Liquid Staking

- Lido, the largest liquid staking protocol by TVL, is using Chainlink Proof of Reserve to help verify the reserves backing stETH.

- Ether.fi is using Chainlink Proof of Reserve to enhance transparency and deliver up-to-date data verifying the reserves of staked assets on its platform.

Growing Onchain Finance with Chainlink Proof of Reserve

In the new onchain financial economy, transparency isn’t just a feature—it’s a necessity for enhancing transparency, security, regulatory compliance, and introducing automated risk mitigation.

For over five years, Chainlink Proof of Reserve has set the standard for onchain proof of reserves and verifiable data. Join industry leaders who trust Chainlink Proof of Reserve to secure billions in onchain assets. Reach out today.