How Smart Contracts Can Decrease Information Asymmetry, Build Trust, and Revolutionize the Insurance Industry

Insurance is a multi-trillion dollar global industry driven by the need for businesses and individuals to manage risk. Instead of consumers taking on risk directly, they can transfer that risk to an insurance provider by purchasing a policy for a premium.

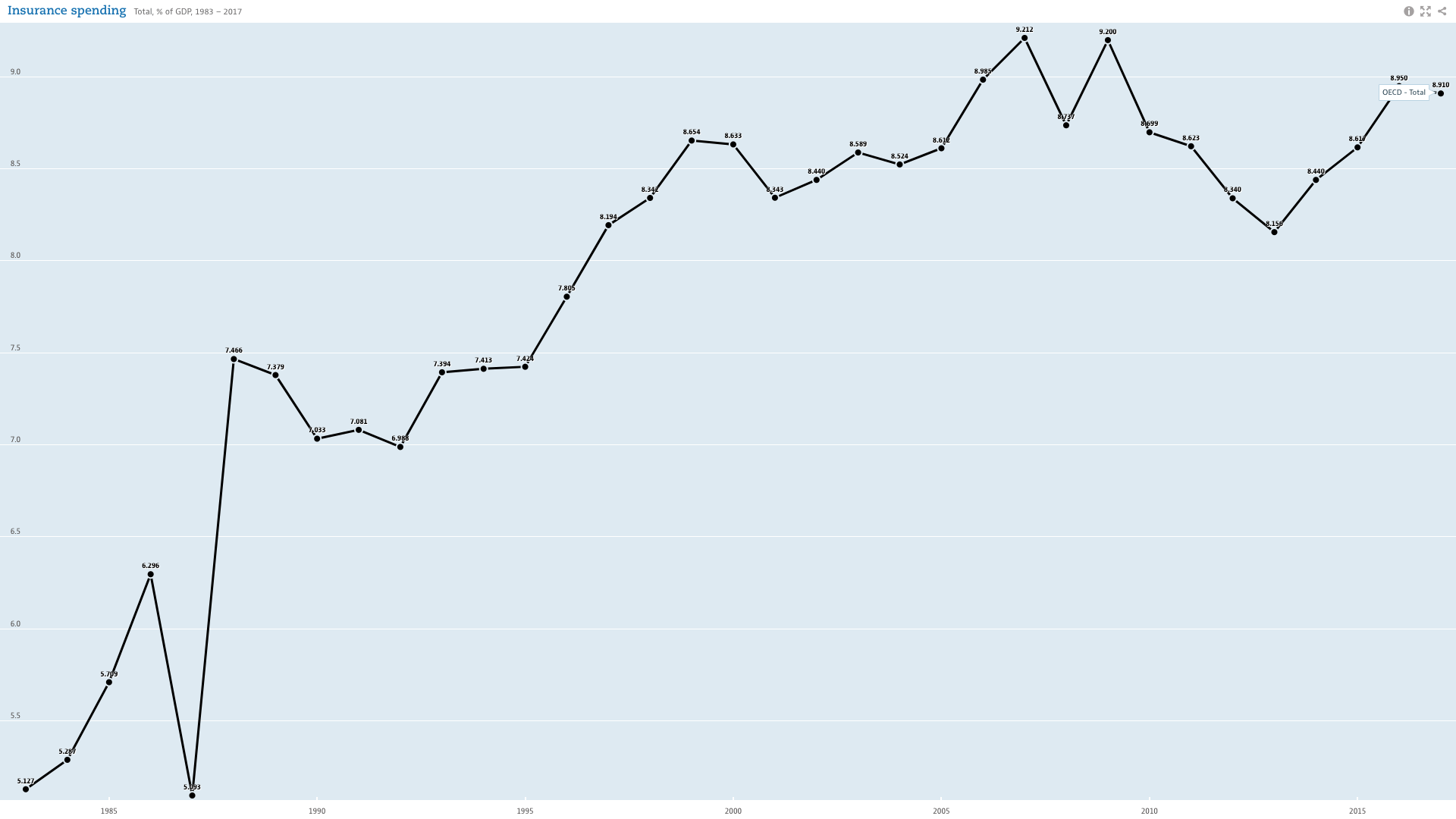

Insurance premiums account for close to 1/10 of the entire world’s economic activity. According to the Organisation for Economic Co-operation and Development (OECD), about 9% of worldwide GDP consists of direct gross insurance premiums.

Insurance is a driver of economic growth because most economic activity would not take place at scale without it. Airlines would not fly planes without insurance backing operational accidents. Consumers would not place bank deposits without deposit insurance guarantees. Auto manufacturers would not provide warranties for all automobiles without insurance for product recalls.

Insurance is a precondition to mass adoption of innovative technologies and a primary form of consumer protection. However, there are inherent trust problems that prohibit the insurance market from reaching its full economic potential. The combination of distributed ledgers, smart contracts, and decentralized oracles offers a way to upgrade the foundational infrastructure of insurance to benefit both insurance companies and policyholders.

The safety nets offered by new forms of digital insurance products will:

- Provide new risk transfer products to currently uninsured populations

- Unlock participation of less sophisticated users in mass adoption of crypto-native products and services

In this research article, we argue that insurance products of the future will be transformed by the next generation of digital insurance contracts and risk transfer products. These ideas are similar to predictions offered below by Renat Khasanshyn, a co-founder of the decentralized insurance platform, Etherisc, and an industry leader on the intersection of insurance, smart contracts, cryptoeconomics, and more.

Prediction 1: By 2022, new autonomous and semi-autonomous insurance products will become available to consumers.

- Parametric insurance models that are arbitrated fully or to a large degree directly by data

- Shifts claims processing from centralized entities to decentralized protocols

Prediction 2: By 2025, we will witness at least five decentralized autonomous organization (DAO)-style insurance cooperatives and/or non-custodial risk pools (Open Finance, aka DeFi) which allow its participants to:

- Share risk with peers.

- Transfer the risk to risk capital markets (crypto-native and traditional capital markets, such as reinsurance, and insurance-linked securities, such as catastrophe (CAT) bonds.

Prediction 3: By 2030, we will witness re-platforming of existing insurance products with digital agreements in use today through:

- Upgrading traditional insurance contracts to digital-first insurance contracts with unprecedented privacy, transparency, and verification

- Replacing centrally automated digital insurance contracts with various degrees of decentralization, thus eliminating single points of failure and drastically reducing direct and indirect compliance and regulation costs, while lowering insurance premiums to increase affordability for uninsured populations.

To understand the foundation for these predictions, let’s dive deeper into the current problems and future solutions emerging in the insurance industry.

The Problem of Information Asymmetry in Insurance

The insurance industry is plagued by information asymmetry, a situation that arises when one party in a transaction has better information than its counterparty(ies). The consumer purchasing insurance (policyholder) has a better understanding of their own assets’ (personal health, car, property, or other) actual worth and current state. Whereas the insurance company has less information and must rely on information provided by the policyholder to determine that insuree’s risk profile, premiums, and deductibles.

There are several dynamics that incentivize policyholders to exploit this type of information asymmetry. First, the policyholder is inclined to selectively share their information in order to receive the most favorable rates. Second, given the low probability of an insured event occurring, the policyholder often pays monthly premiums without ever seeing any type of tangible benefit. Furthermore, the policyholder’s claim payouts are subject to approval by the insurance company. The net result is a high incentive for the policyholder to seek an advantage over their insurance company by selectively withholding information.

Conversely, insurance companies are constantly bombarded with fraudulent claims. In the U.S., it’s estimated that non-health insurance fraud costs insurers $40 billion per year and can represent up to 10% of total claims. Policyholders often exaggerate positive attributes to receive lower rates, overreport negative attributes to collect higher victim compensation payouts, and sometimes file multiple claims for the same incident to turn a profit. The insurance industry expends a considerable amount of resources to fight fraud, which leads to higher policy premiums to cover the associated increase in administrative costs, underwriting procedures, claims processing, and dispute resolution.

Information asymmetry causes imbalances in the pricing and value of insurance policies. While many policyholders are honest, insurance companies need to account for bad actors by raising the baseline costs on all premiums in order to reliably turn a profit. It makes underwriting policies and processing claims more time consuming, costly, and complicated for everyone. Higher premiums and longer processing times further erode trust between insurers and insurees, and increase the incentive for policyholders to commit fraud. It’s an unhealthy cycle of mutual distrust that could be alleviated by technological intervention.

Bridging the Trust Gap in Traditional Insurance Agreements

Smart contracts are digital contracts that run on decentralized infrastructure with automated execution based on if/then parameters, such as “If x happens, execute y.” They replace the claims processing portion of traditional insurance agreements with high-trust, transparent, and tamperproof data-driven policy arbitration that neither side can exploit or manipulate.

Digitization

While some future insurance agreements may come in the form of DAOs, most insurance contracts – especially in the corporate world – are written legal contracts signed between both parties. This creates a pressing need for dynamic contracts that are human and machine readable, often referred to as Ricardian contracts. Not only do Ricardian contracts bring physical contracts into the digital world; they can enable quicker amendments – simultaneously and across formats, when needed – and allow codeable and non-codeable clauses to coexist.

Startups such as OpenLaw and Clause (which created a foundation for developing legal templates called Accord Project) are pioneering solutions that merge existing legal contracts with new DLT infrastructure.

Decentralized Infrastructure

Smart contracts are software programs running on and stored in a distributed ledger, such as a blockchain. Using a distributed ledger as a backend brings certain valuable properties to the contract that are not found on traditional backend systems, particularly determinism, tamperproofness, and reliability.

Decentralized infrastructure means the maintenance, execution, and settlement of a smart contract is automatic and determined proactively by data, rather than reactively by manual input from humans. This decentralized infrastructure gives the contract high availability processing, storage redundancy, and tamperproofness from either party in its end-to-end execution.

Data-Driven

Whereas current insurance agreements rely on the interpretation of a claims processor, a smart contract executes directly from data, e.g. life insurance that’s triggered by a death certificate. Data-driven insurance smart contracts shift the information asymmetry closer to information parity. The insurance provider has verified proof that a claim occurred because it’s triggered by trusted data-generating entities, such as a multitude of IoT devices. This can substantially reduce costly manual claim verification and bring insurance policies closer to a 1:1 ratio of perceived risk to actual risk.

To maintain data privacy for users, insurance smart contracts can be managed by an opt-in/opt-out clause for data sharing, wherein a policyholder can choose to opt out of sharing their data or opt in for additional products and/or lower premiums. For example, a user could share the IoT data from their car for a discount on their premium.

Streamlined

Because smart contracts are automated and redundantly stored across distributed networks, they are faster, cheaper, and less prone to error. Automation allows claims processing to be streamlined and digitally verified using real-time data. There are numerous insurance agreements that can use the Boolean logic of smart contracts to increasingly replace the backend work. Thus, the insurance industry stands to save billions of dollars in claims processing, administration costs, legal fees, and manual labor for data entry. Some of these savings will be passed on to consumers in the form of lower premiums and faster settlements.

Connectivity and Confidentiality

In order for insurance smart contracts to offer more superior end-to-end execution than today’s digital agreements, they need to connect with external inputs and outputs from traditional infrastructure. They also require confidentiality, either by law or for consumer preference, when dealing with sensitive information. Chainlink plays a foundational role in bringing both connectivity and confidentiality to insurance smart contracts.

Connectivity Through Chainlink Decentralized Oracle Networks

An insurance smart contract operates by consuming and pushing external data. It needs both data inputs to trigger the smart contract and access to other systems for triggering a settlement. It is important that the external connection maintains the same valuable properties of the smart contract: determinism, tamperproofness, and reliability.

Chainlink offers the first decentralized oracle network to facilitate bidirectional data flow into and out of the smart contract with the same properties of its decentralized backend. Chainlink can give insurance contracts access to data inputs, such as IoT sensors, web APIs, and satellite/drone imagery, that can trigger a smart contract. It also gives smart contracts access to many settlement outputs, such as payment systems, other blockchains, and backend databases such as the cloud. Any API can be reliably and securely leveraged by a smart contract through a Chainlink oracle.

Confidentiality Using Trusted Execution Environments

As part of future integrations, the use of trusted hardware such as Intel SGX can allow Chainlink oracles to function within trusted execution environments (TEE) – hardware that provides a protected environment on which code can run. TEEs provide complete confidentiality for data flowing both in and out of the contract, keeping data hidden even from the oracle itself.

TEE-based oracles such as Town Crier ensure the integrity of data by providing signed attestations that guarantee data hasn’t been tampered with in any way. TEEs allow sensitive information, such as private data in IoT devices, personal logins, or digital DLT identities, to be handled by oracles and used for the signature approval of a smart contract.

TEEs will likely play a large role in the insurance industry of the future, because they allow sensitive personal data to be shared anonymously with an insurer in order to provide a true risk calculation of an individual without the insurer gaining access to the user’s sensitive data. For example, policyholders could share health data from an IoT wearable, such as a Fitbit, with their insurance company using a TEE oracle. This would allow the policyholder to prove to their insurer that they exercised enough to receive a discounted rate, without the insurance company being able to hold their sensitive health information. The incentive to file fraudulent claims may be significantly reduced if the data for insurance products is sourced via digital identities and IoT devices with high integrity and privacy preserving features.

New Smart Contract Insurance Models

If smart contracts are fully connected with adequate confidentiality, numerous current insurance models could be replaced by smart contracts, while other new models could be brought to market.

Internet of Things (IoT)

IoT devices consist of sensors and actuators that collect readings regarding a variety of external occurrences. Some popular measurements from IoT devices are speed, location (GPS), sound, precipitation, electricity, magnetism, distance, pressure, and chemical composition. IoT data can be sent to an insurance smart contract to determine whether or not certain events took place. If specific events take place as outlined in the smart contract, payouts can be automatically issued to the respective parties.

- Car insurance smart contracts can use IoT sensors to monitor driving activity, crash dynamics, and road conditions to determine discount rates and accident claims.

- Large equipment equipped with internal sensors can monitor for system malfunctions and trigger payouts for serial defect warranties or issue automatic maintenance requests.

- Smart home appliances data can settle claims based on the determination of fires, floods, gas emissions, or any other internal damage.

- IoT wearables and other biotech sensors can be connected to health insurance contracts to trigger checkups and calculate discounts based on exercise routines, weight, and heart rates.

Web APIs

Insurance smart contracts can use data available from notable web APIs to trigger different types of policies.

- Life insurance contracts can access death certificates, cremation records, obituaries, and police reports to certify deaths and distribute assets to the relevant parties.

- Flight and train insurance can use transportation schedules to issue payouts for late or canceled trips.

- Crop insurance can use weather data, GPS, or drone imagery to confirm weather patterns and issue payouts.

Etherisc is an example of a decentralized flight insurance product that recently launched on the Ethereum testnet Rinkeby, which leverages Chainlink’s decentralized oracles to connect with flight status data via the flightstats.com web API. Check out Etherisc’s recent blog to learn more.

In this video, Chainlink Co-founder Sergey Nazarov explains how hybrid smart contracts enable technologically-enforced agreements with real-world inputs that empower users in emerging markets with new solutions such as crop insurance for hedging economic risk:

Decentralized Insurance

Smart contracts can be used to develop revolutionary new insurance products, such as micro-insurance, peer-to-peer insurance, and decentralized autonomous insurance pools. Decentralized insurance brings shared responsibility to coverage, flexibility to product designs (such as new pay-per-use models), and access to previously uninsurable markets.

“Insurance has always been rooted in communities coming together to protect themselves against risk. Now that we have blockchain, the scope of that community has grown into a distributed worldwide one. Ethereum enables us to pool risk together without the need for a centralised insurance company, because it allows people to financially coordinate – this is a core principle of insurance. That’s why Nexus Mutual is fully owned by its members who protect themselves against high risk events and who have control of the decision making power.

“The traditional insurance industry can be challenged by using Ethereum to coordinate risk sharing among members; enabling cheaper products to more people, and the ability to enter new markets extremely quickly. This technology has sparked a fundamental change to insurance which will continue to develop over the next decades, but it has already enabled huge steps towards disrupting the industry.” – Hugh Karp, Founder of Nexus Mutual

Moving the Insurance Industry Towards Information Parity

Chainlink-enabled smart contracts offer a way for the insurance industry to move from a manual, trust-based system to a more automated, trust-minimized system. Information asymmetry is reduced as the industry shifts toward a 1:1 information equilibrium between the insurance provider and policyholder.

The claims process changes focus from personal interpretation to the execution of an “incident,” deterministically verified through IoT data and source with user privacy in mind. Trust is re-established because neither party can tamper with the outcome once it’s sent to the blockchain. Efficiency increases as everything is automated. Both policyholders’ premiums and insurance companies’ costs decrease because fraud is drastically reduced.

DLT is poised to ignite a paradigm shift towards higher trust-based models of insurance refocused around information parity. This transformation won’t happen overnight and will require common industry standards from a technological and regulatory standpoint. However, it’s advantageous for insurance companies to begin actively investigating what Chainlink-enabled smart contracts can bring to their business and how they will positively influence trust between insurers and policyholders.

Building Next Generation Insurance Products Today

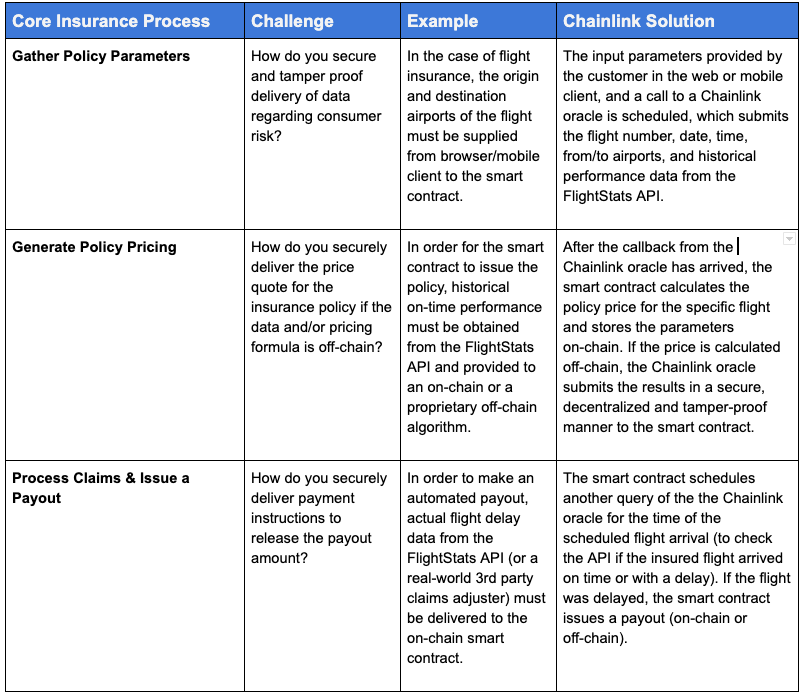

If you are a smart contract developer interested in launching a DAO-style insurance cooperative, or an insurance industry professional interested in re-platforming your existing insurance products, Chainlink offers pre-built solutions for each of the three challenges you may face:

Next Steps

The next step in launching a successful insurance oracle project is to try it out. Let’s execute a Chainlink project from start-to-finish using a simple tutorial. It’s easy and we will walk you through setting up a new contract with testnet LINK and subsequently deploying, funding, and using that new contract:

- Step 1: Identify a specific use case you would like to write an insurance contract on.

- Step 2: Determine if there is already a Chainlink built for your use case, if not check how to write an external adapter for the data you need.

- Step 3: For the sake of simplicity, let’s use the Flightstats adapter, already provided on the website and familiarize yourself on how to get this data through a CL node, using a testnet.

- Step 4: Familiarize yourself with the different assets and ways you can make payouts on Ethereum. You’ll most likely need some kind of conversion tool, for instance ETH to USD.

You can also check out an overview of the main components of Chainlink’s solution for smart contract-based insurance as presented by Sergey Nazarov, Co-Founder of Chainlink, at the InsurTech Silicon Valley Summit:

Contact Us

If you are a developer of an insurance product powered by smart contracts and you have encountered an issue, or an entrepreneur or current business looking to explore this new model, reach out to us here.