How Chainlink Is Helping Blockchain Cross the Chasm Into the Mainstream

Since its launch in 2017, the Chainlink Network has emerged as an essential bridge for feeding reliable, high quality data to and from blockchain networks, now securing over $4 billion in value for DeFi smart contracts and supporting a growing ecosystem of over 300 integrations. In his SmartCon keynote last month, Chainlink Co-Founder Sergey Nazarov explained in-depth how decentralized oracle networks are both accelerating innovation in decentralized finance and offering traditional institutions an abstraction layer for easily and securely interacting with the ever-expanding ecosystem of blockchain networks.

Below are key quotes and takeaways from Sergey’s discussion “Creating Definitive Truth,” as well as a snapshot of how Chainlink’s technologies are evolving to enable a global transition to a smart contract-based economy.

Definitive Truth About Real-World Data

In simple terms, the unique innovation of blockchain technology is the creation of “definitive truth”—a tamper-proof method of coming to agreement in a way previously unimaginable in computing systems. The Bitcoin blockchain first demonstrated this new form of agreement in its creation of a cryptographically-secured, immutable record around ownership of Bitcoin.

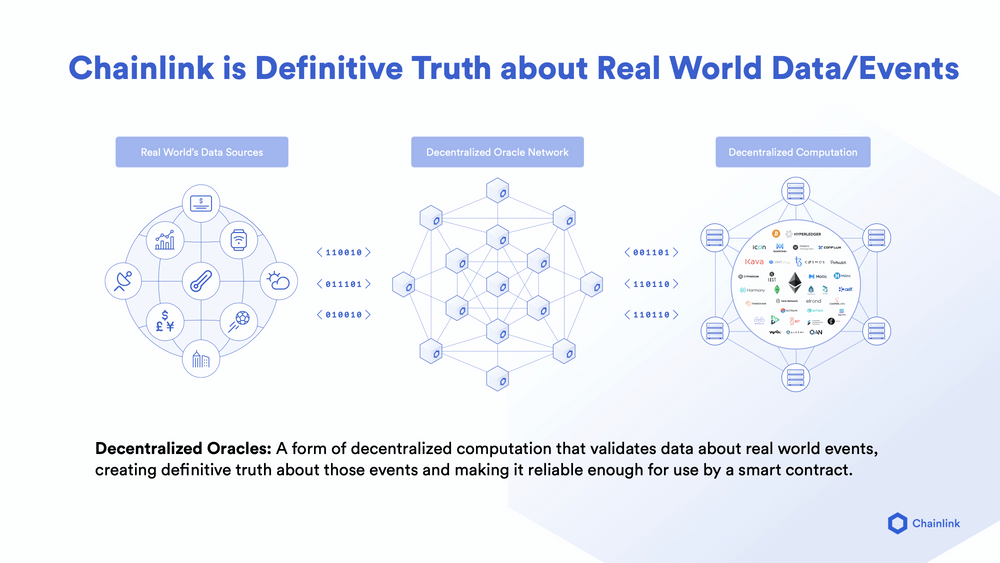

On a blockchain like Ethereum, we start to see definitive truth around a wider range of transaction types beyond payment: token generation, token movement, voting, lending, borrowing, and more. Whereas the Bitcoin blockchain reaches definitive truth about the state of address balances, a highly programmable blockchain like Ethereum achieves definitive truth about the state of smart contracts. The question is, what happens when we can build smart contracts not just about token movements and ownership, but about real-world data and events? This profound opportunity has been the central focus of Chainlink.

Because of their extremely secure architecture, blockchains by design are not built to digest real-world, “off-chain” data. This disconnect—between the promise of decentralized computation and the pervasion of our modern data and API economy—is known in the blockchain space as the oracle problem and has, until recently, been one of the major barriers to wider blockchain adoption.

The Chainlink Network has filled in this critical piece of the puzzle by providing decentralized oracle networks that meet the reliability and transparency guarantees of blockchains and allow smart contracts to securely interact with external data feeds and events.

“At Chainlink, we generate definitive truth about real-world data and events to a sufficiently high threshold for it to be useful to blockchain systems.”

Expanding Smart Contracts With External Data

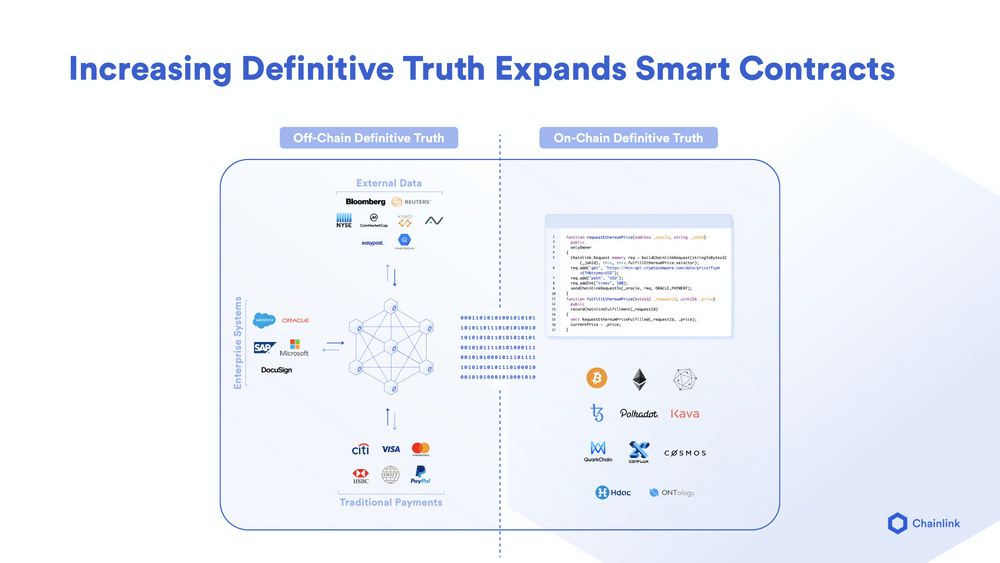

The more verifiable data a smart contract has access to, the more events it can trigger, and the more sophisticated blockchain-based applications can become. In the DeFi space, Chainlink’s decentralized oracle networks are already enabling smart contract developers to build financial products and instruments around data events far beyond on-chain token movement, such as synthetic assets tied to oil futures and crop insurance around verifiable weather data. With the added capabilities of oracle middleware, we’re seeing the focus in the blockchain space shift from tokens—whose data already exists on-chain—to more exotic financial products built around trusted, real-world inputs.

“DeFi is evolving almost in lockstep with the amount of data that’s available to it. As we add more and more data, you’ll have more and more products, more and more markets.”

As more people look for financial alternatives beyond our current low-interest rate, inflationary environment, more and more value will flow into DeFi platforms and applications. Users will develop an appetite for the consistent yields, efficiency, transparency, and variety of collateral driving DeFi.

Increasing Demand for Security Guarantees in Global Markets

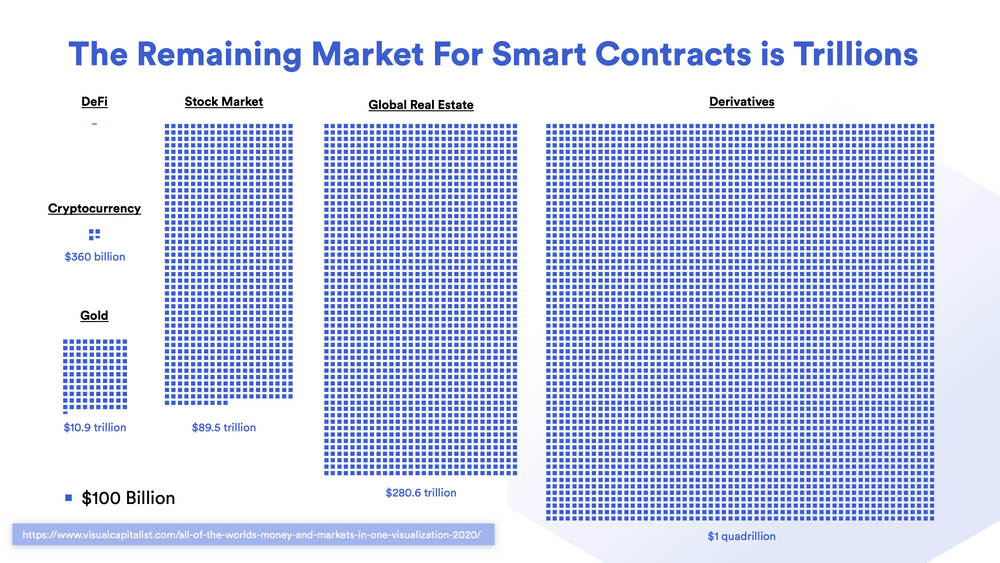

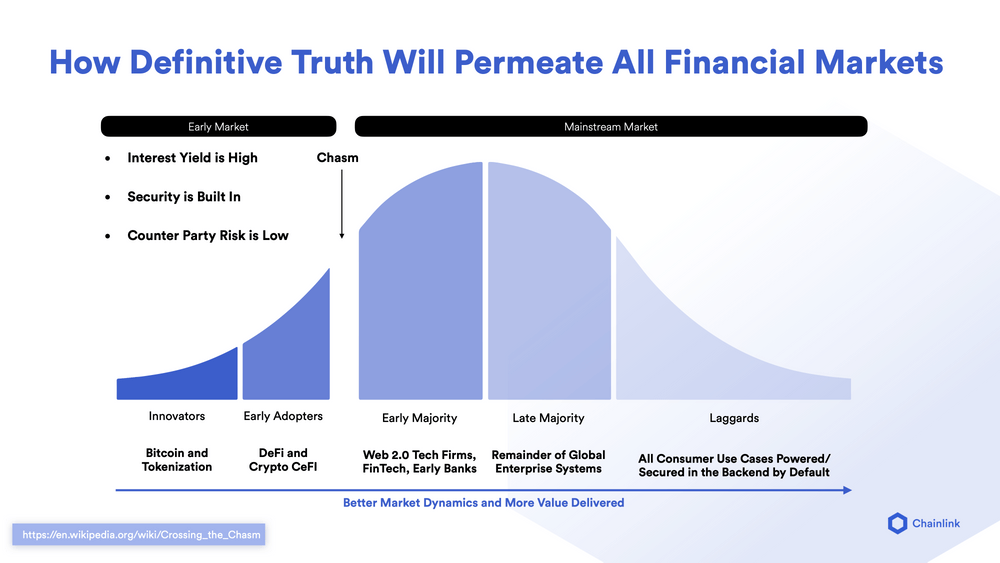

While the DeFi ecosystem has been rapidly expanding in recent months, the total value locked in DeFi smart contracts (currently around $12 billion) still only accounts for a small fraction of global market value, with nearly $90 trillion in the stock market alone.

In his keynote, Nazarov anticipated two possible scenarios in which users would transition to a smart-contract based economy—one slow and the other sudden. In the more gradual scenario, users would be attracted to the highly diversified, higher yield environment of DeFi that traditional markets can’t provide. In the more accelerated scenario, global economic shocks could call into question the solvency and brand-based guarantees of legacy systems and institutions, increasing demand for math-based contractual systems and markets designed around the definitive truth that decentralized networks can provide.

“The amount of value that is out there in systems that don’t have a fraction of the security, transparency, or various other guarantees that smart contract systems provide, is massive.”

DECO: Securing the World’s Data for Blockchain Systems

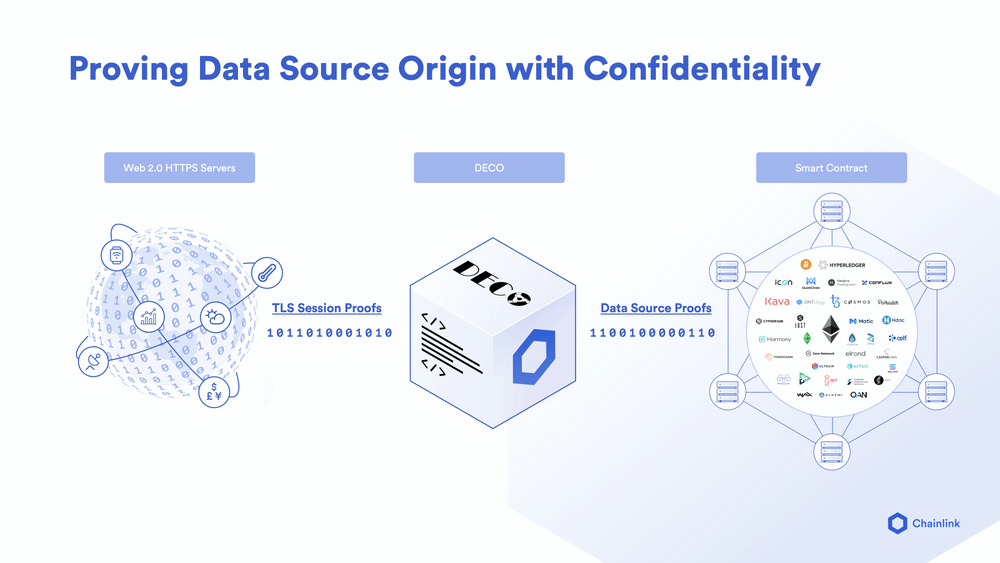

Beyond making verifiable real-world data available to blockchain networks, our industry has for years grappled with the challenge of achieving data confidentiality with the guarantees of decentralized computation. With the innovation of DECO, a privacy-preserving oracle protocol developed by IC3 and acquired by Chainlink, it is possible to make unique, premium, and private datasets available to blockchain systems, while maintaining industry-grade confidentiality requirements.

DECO allows all the world’s data currently in HTTPS/TLS format to be utilized by blockchain networks, providing cryptographic guarantees that data has been sourced from a specific, timestamped-TLS session, and without exposing sensitive data to the larger decentralized system (via zero-knowledge proofs). The DECO protocol’s ability to validate private, single-source data in a decentralized manner opens up a whole new array of smart contract use cases, from verifying collateral’s solvency without revealing specific holdings to conducting KYC/AML without exposing personally identifiable information.

“The consistent history of what happens when you make data more secure and more private, but still allow people to use it, is that people then compose that data into massive new industries.”

A Universal Blockchain Abstraction Layer for Enterprises

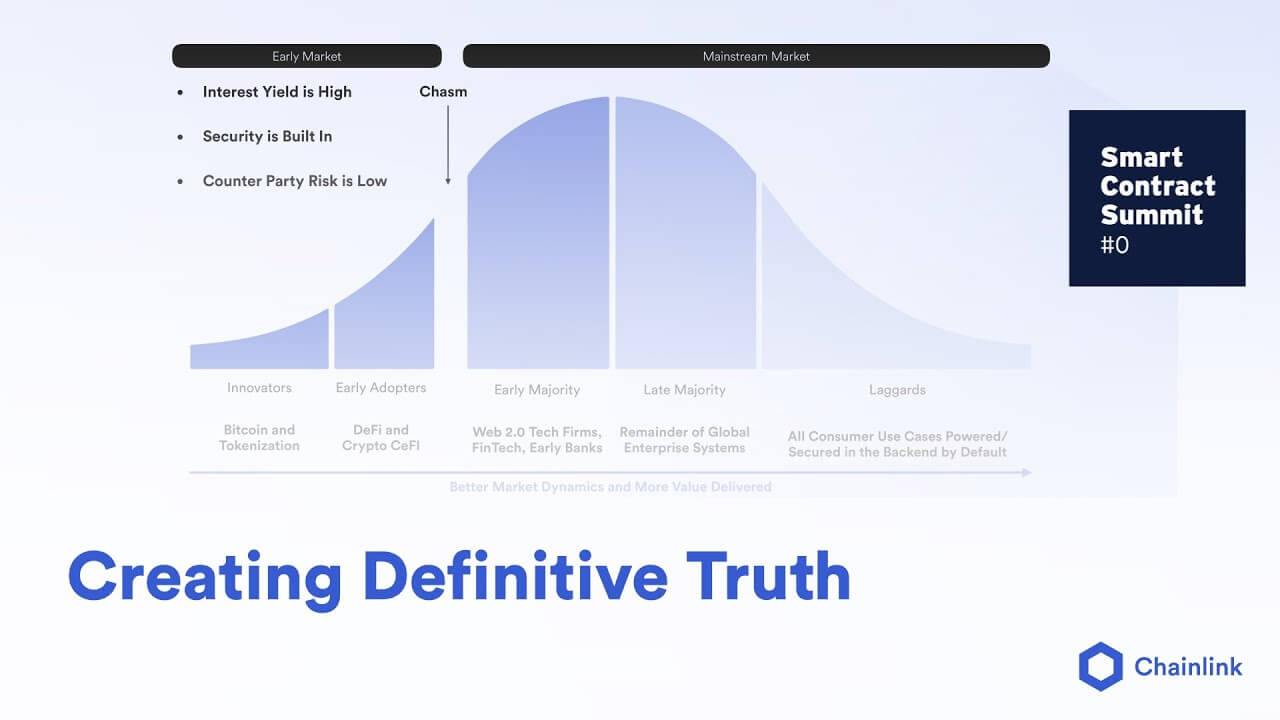

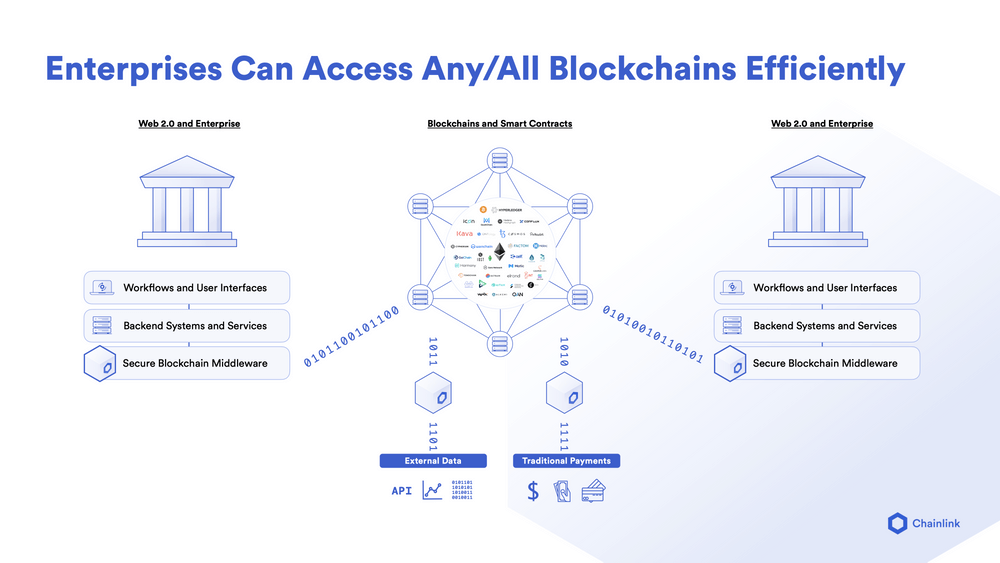

At the far end of the adoption life cycle, beyond the early DeFi adopters and fintech startups, are the major enterprise players who are hoping to capitalize on the emerging opportunities of the smart contract economy while cost-effectively integrating their existing systems with various blockchain networks. Rather than making a single purchasing decision about how they will interact with the growing ecosystem of blockchains, enterprises need a secure abstraction layer that allows them to easily interact with any chain and solve for use cases with different requirements across different geographies.

In this way, Chainlink can service ecosystem participants at all stages of adoption, by 1) accelerating the data cycle for developers to build more universally connected and sophisticated hybrid smart contracts, and by 2) creating an interface that enables Web 2.0 tech firms and eventually legacy enterprises players to efficiently transition to a more decentralized infrastructure with guarantees around data integrity, privacy, and reliability.

“Enterprises don’t care about choosing a blockchain winner. They care about conducting transactions … What you actually need is a single abstraction layer that can fit into their existing architecture and allow them to interact with all these blockchains.”

The Future of Global Transactions

A fundamental aspect of financial transactions—and one of the key pain points that smart contracts aim to solve—is counterparty risk: the risk that the counterparty you’re dealing with in a financial transaction will not follow through on their obligations. As smart contracts continue to permeate global markets and cross the chasm into mainstream adoption, users will realize that beyond the improved yields and exciting new categories of assets in DeFi is also a new standard for transparency, security, and risk management in financial transactions.

“The fundamental question that everybody should ask themselves when thinking about blockchain systems,” Nazarov noted, “is if brand-based guarantees are no longer acceptable, where do we go?” Definitive truth—the new paradigm for tamper-proof agreements—is becoming more and more in demand. As Nazarov made clear, “The signal that people value math-based guarantees is definitely there.”

Watch the video below for Sergey’s full SmartCon keynote. If you’re a developer and want to connect your smart contract to off-chain data and systems, explore our developer documentation and join the technical discussion on Discord. If you want to schedule a call to discuss a Chainlink integration in-depth, contact our team.