Growing Bitcoin Adoption Using Externally Connected Smart Contracts

Since its release by Satoshi Nakamoto over a decade ago, Bitcoin has become a world-wide phenomenon as a new decentralized monetary asset separate from traditional fiat currencies issued by central banks. Chainlink has long been a supporter of Bitcoin as a more reliable digital form of sound money, with many of our founders and core team members having participated in its research and adoption since 2011. Chainlink’s enablement of DeFi products that use Bitcoin as a sound form of collateral will greatly increase user demand for Bitcoin within the cryptocurrency ecosystem and beyond.

Chainlink aims to directly complement Bitcoin’s capabilities by extending its value proposition without modifying its blockchain, allowing Bitcoin to maintain its unique security properties. By combining Chainlink, Bitcoin, and/or Bitcoin-secured smart contracts, new and innovative decentralized applications can be built that leverage the valuable properties that the Bitcoin blockchain provides, particularly as a store of value, medium of exchange, form of collateral, and decentralized computing network with extensive hashing power.

Some of the unique value-adds that the Chainlink Network provides to the Bitcoin ecosystem include:

- Supplying on-chain price feeds and datasets regarding BTC and the Bitcoin blockchain, ultimately servicing the increasing demand for Bitcoin-based financial products like derivatives and money markets.

- Providing smart contracts with on-demand data regarding the current collateralization of BTC reserves backing $2B+ of wrapped Bitcoin, including both WBTC and renBTC, as a means of protecting users against fractional reserve practices.

- Delivering off-chain data and various other oracle services to smart contract networks secured by Bitcoin, including RSK and Stacks, in order to expand Bitcoin as a conditional settlement layer.

- Allowing smart contracts on any blockchain to trigger and track payments on the Bitcoin blockchain as a mechanism for enabling automated physical settlement in BTC that is triggered from an external blockchain network.

Chainlink directly enhances the capabilities of Bitcoin-centric applications, as well as extends the ability for external systems to trigger actions on the Bitcoin blockchain. Let’s explore in more depth some of the added benefits the Bitcoin ecosystem can attain via Chainlink.

Enhancing the Bitcoin Ecosystem with Chainlink Oracles

Due to its global recognition, wide distribution, and provably scarce supply, Bitcoin is commonly seen as being a sound alternative to fiat due to its ability to hedge against inflation and provide exposure to an uncorrelated asset class. As such, institutions such as MicroStrategy are allocating larger portions of their treasuries into Bitcoin as a hedge against macroeconomic factors. As Bitcoin continues to be seen as a reliable store of value, there is an increasing demand to also use Bitcoin as a form of collateral or means of settlement within the smart contract based decentralized finance (DeFi) economy.

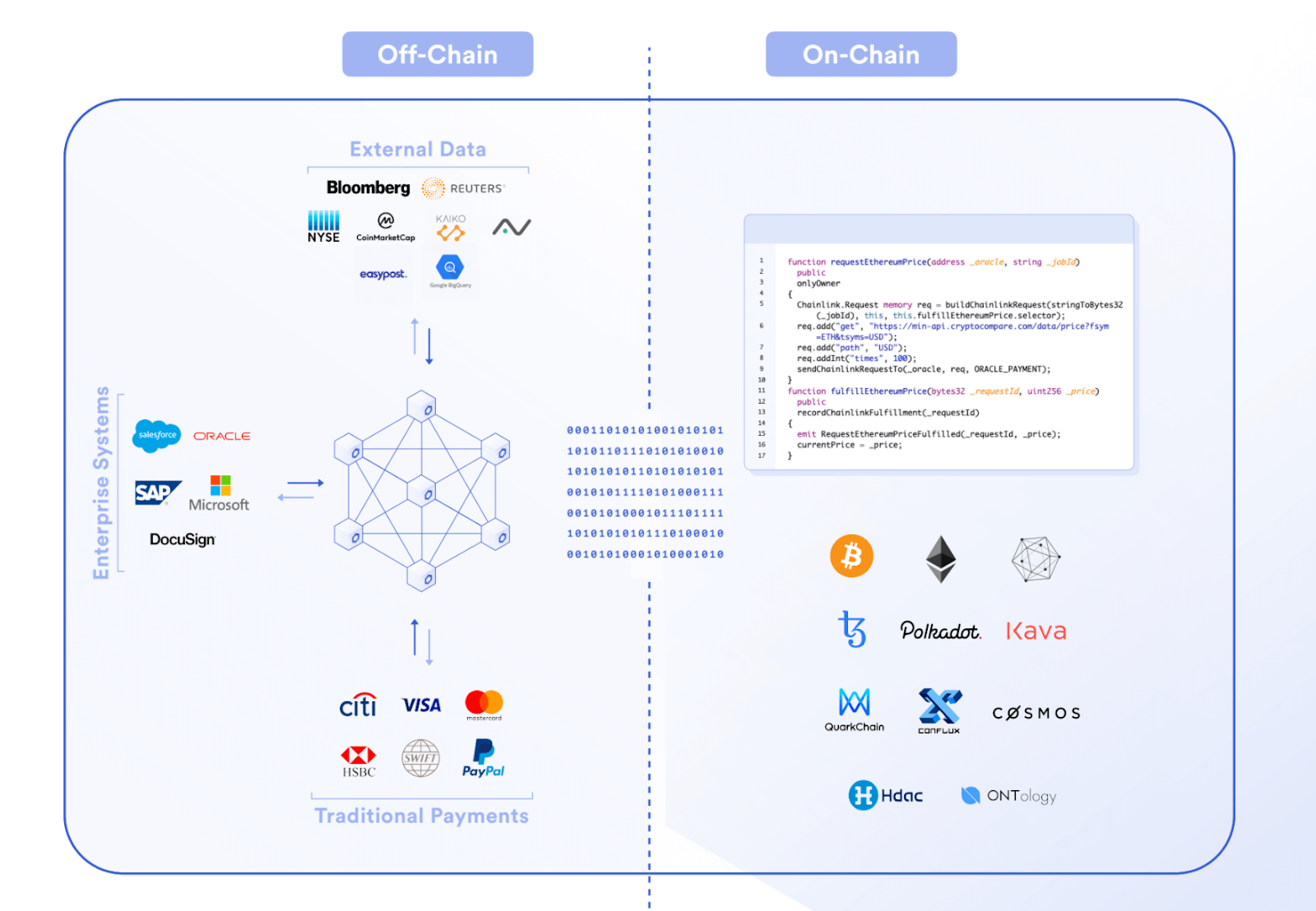

As an unbiased and blockchain agnostic oracle network, Chainlink provides secure middleware for reading data and writing data between disparate systems. Chainlink is not a blockchain and does not compete with Bitcoin, but instead focuses on providing the middleware infrastructure needed to power price feeds for on-chain Bitcoin financial products, deliver key datasets about the Bitcoin blockchain, trigger transactions on the Bitcoin blockchain from external networks, and support Bitcoin-based smart contract platforms with their oracle requirements.

Bitcoin Price and Data Feeds for BTC-based Financial Products

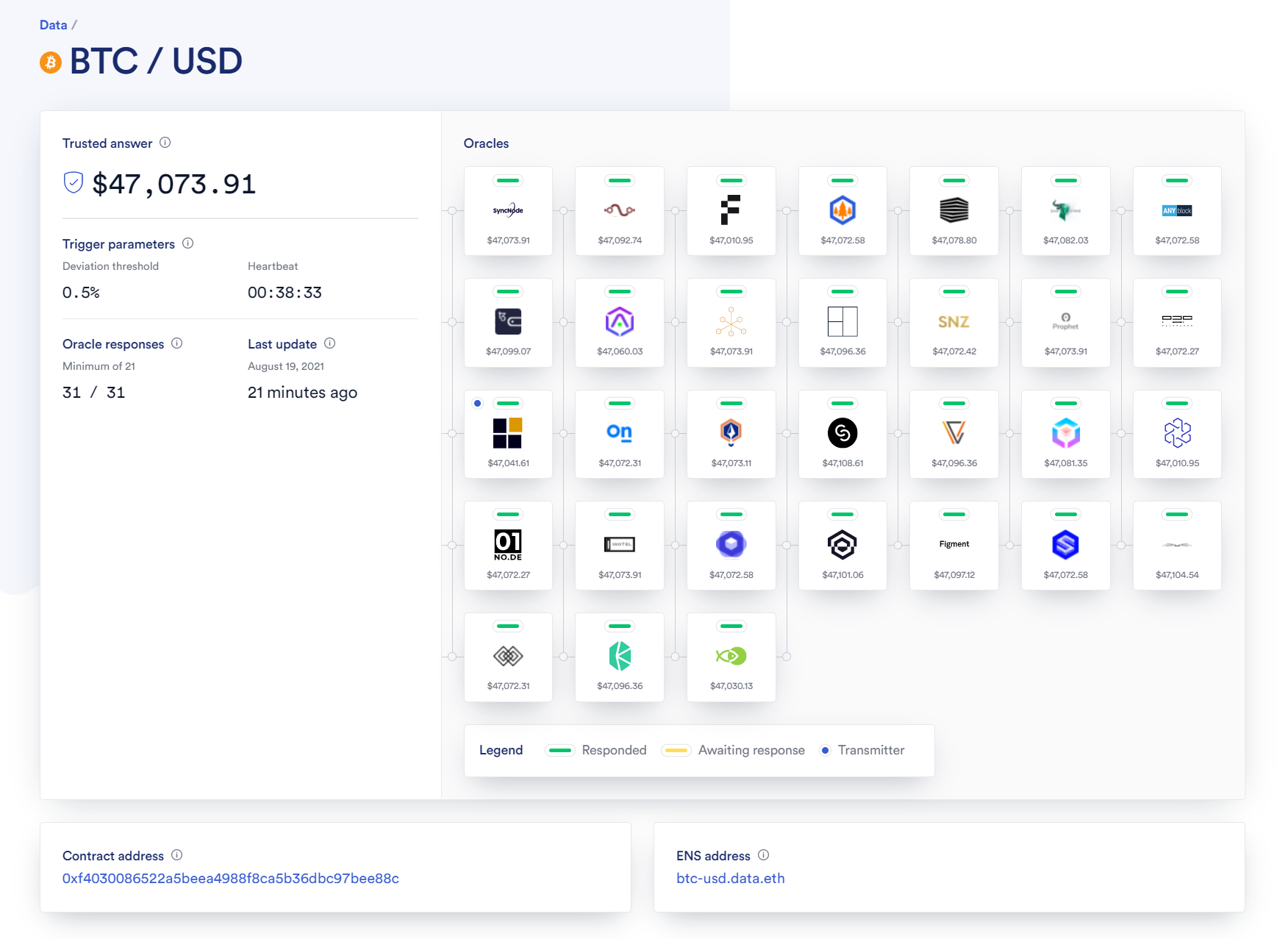

Whether it be decentralized protocols or centralized exchanges, there are an increasing number of Bitcoin-based financial products being built on-chain and off-chain such as futures, options, synthetic assets, automated trading strategies, and more. All of these applications require BTC price feeds as a means of determining the outcome of the financial product. Additionally, there is increasing demand for more exotic derivatives products that use other Bitcoin datasets such as BTC dominance, Bitcoin’s total marketcap, current hashrate, and more.

Chainlink has facilitated the growth of Bitcoin-based financial products by providing the most decentralized and widely used BTC/USD price feed in the space as a means of triggering their execution or serving as a tamper-resistant circuit breaker. The BTC/USD network can also be used in combination with other oracle networks to generate new price feeds for BTC paired against other cryptocurrencies like ETH or LTC as well as fiat currencies like the GBP or AUD.

Additionally, Chainlink is increasingly providing additional datasets regarding the Bitcoin blockchain that are required to service the demand for more advanced derivatives products. Supporting such a wide range of Bitcoin financial products both on-chain and off-chain further increases investors ability to adjust and manage their Bitcoin exposure, which ultimately drives more demand and liquidity.

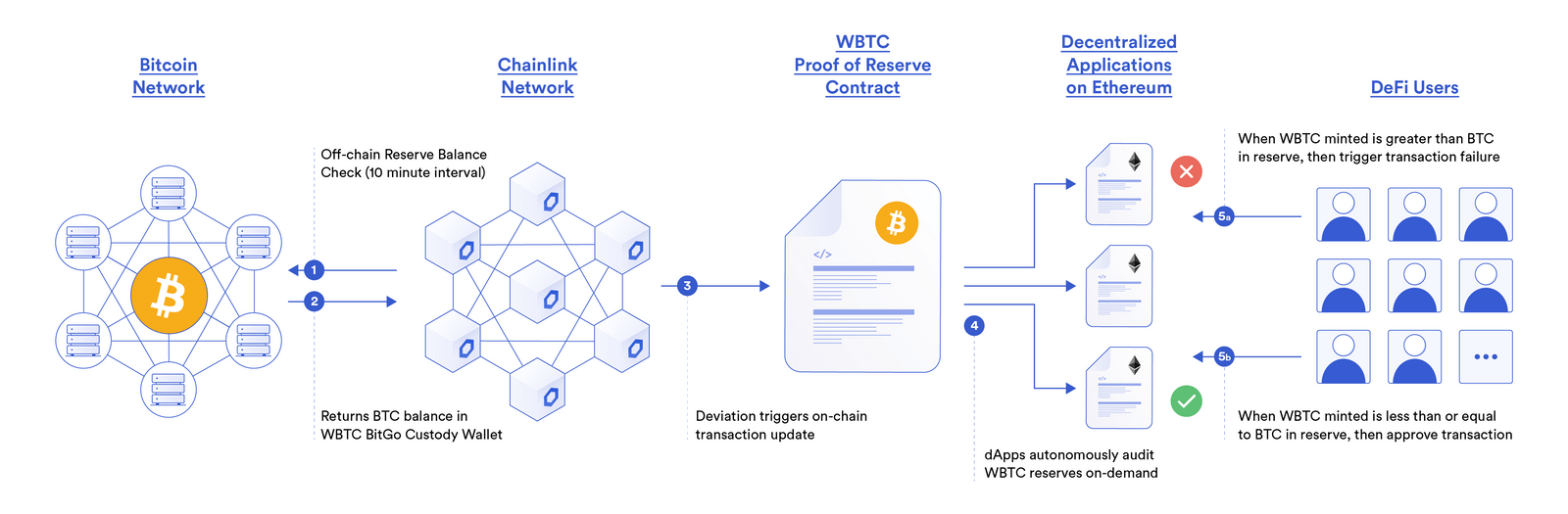

Proof of Reserve Data Feeds for Wrapped Bitcoin

Another notable way Chainlink provides additional value to Bitcoin is through its Proof of Reserve reference data feeds—decentralized oracle networks that consistently update on-chain the current collateralization of $2B of wrapped Bitcoin on the Ethereum network. With the Chainlink Proof of Reserve data feed tracking over 90% of all wrapped Bitcoin, including both BitGo’s WBTC and Ren Protocol’s renBTC, DeFi applications are able to autonomously audit these token’s reserves on-demand in order to protect users against any potential fractional reserve activities or black swan events.

The Chainlink Proof of Reserve feeds provide additional security and transparency guarantees to DeFi applications using wrapped forms of Bitcoin, both in a manner that can be automated and where the costs are shared across applications. This is particularly important for applications using wrapped Bitcoin as collateral such as Aave, Maker, and Compound, which need to ensure all loans on the platform are always properly overcollateralized. Proof of Reserve not only benefits the DeFi ecosystem, but perfectly aligns with Bitcoin’s store of value proposition as sound money due to no fractional reserve practices. This will further increase demand to acquire, tokenize, and lock up Bitcoin across more ecosystems due to the increased level of trust created.

External Data for Smart Contracts Secured by Bitcoin

Another way in which Chainlink directly adds value to the Bitcoin ecosystem is by providing data feeds and oracle services to smart contracts operating on networks secured by the Bitcoin blockchain and its global network of miners. Chainlink’s external data delivery extends the capabilities of smart contracts on these networks and allows for advanced decentralized applications that require secure and reliable access to off-chain data, events, and payments. In this regard, Chainlink is already providing external data to smart contracts on the RSK and Stacks blockchains, both of which are secured by Bitcoin.

Utilizing Chainlink oracles within Bitcoin-powered smart contracts allows for the creation of advanced decentralized applications that both gain the security of Bitcoin and the connectivity of Chainlink. Through the delivery of external data, Chainlink is directly increasing Bitcoin’s utility and value of being a global decentralized settlement layer. As a natively blockchain-agnostic oracle network, Chainlink will continue to support all smart contract networks, including those secured directly by the Bitcoin blockchain.

Trigger and Track Bitcoin Transactions from any Blockchain

A notable way Chainlink adds value to the Bitcoin ecosystem is by providing the ability for smart contracts, on any blockchain network, to trigger and/or track payments on the Bitcoin blockchain. This allows for the creation of Bitcoin-native applications such as decentralized peer-to-peer marketplaces, transparent derivatives that settle in Bitcoin, and much more. Particularly, it creates a dynamic where Chainlink is able to bring Bitcoin to all blockchain networks without BTC ever leaving its native blockchain, greatly increasing Bitcoin’s utility as a global asset and means of financial settlement.

Chainlink nodes are capable of directly triggering Bitcoin payments by holding funds escrowed within a Trusted Execution Environment such as Town Crier, where a private key is held and not even the node operator is able to decipher it or see the computation being requested (including the addresses involved). This can also involve a large collection of oracles to form a multi-signature transaction to prevent any one oracle from being able to manipulate or prevent a transaction from occurring.

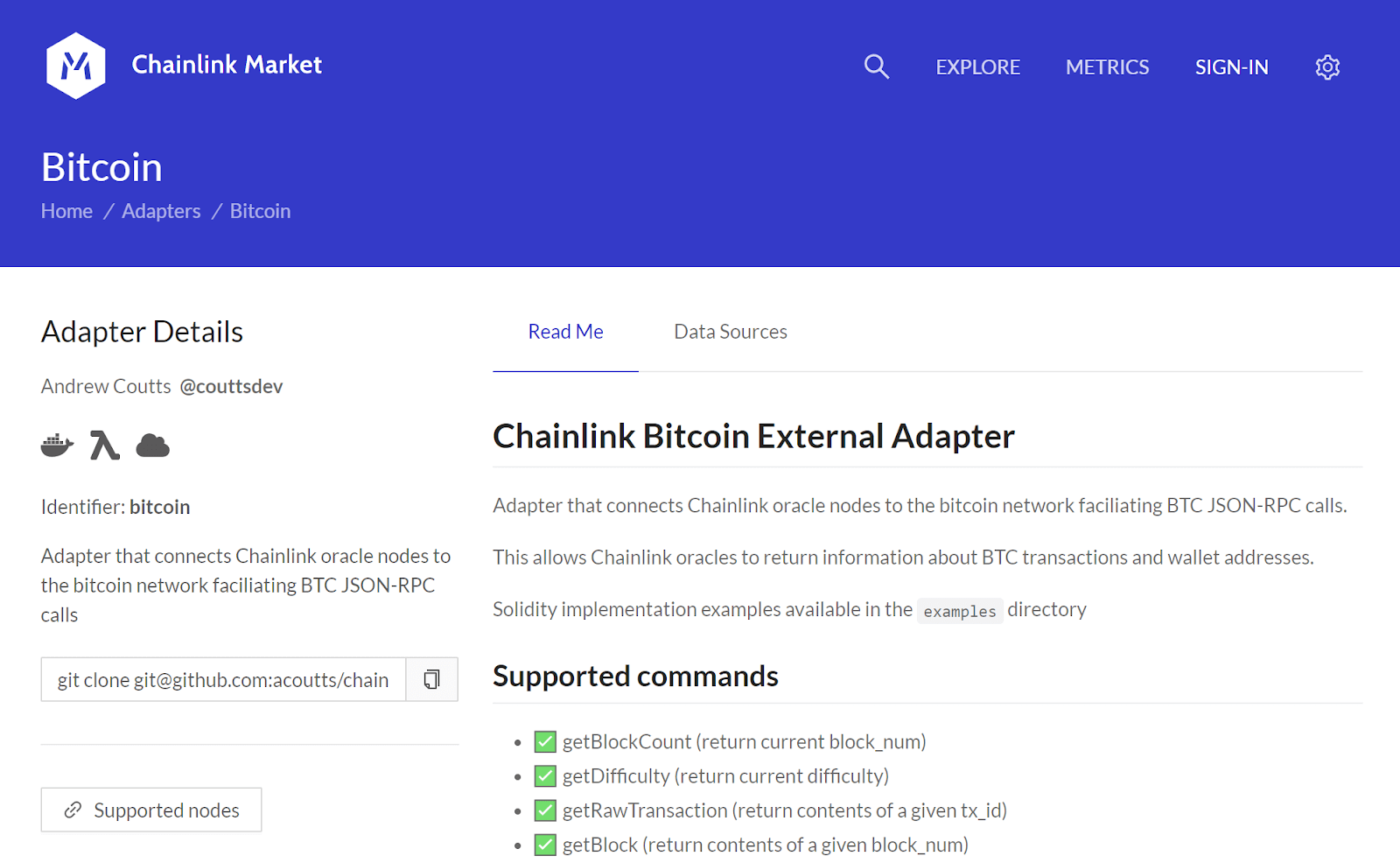

The subsequent tracking of Bitcoin payments by smart contracts is made possible through a modular external adapter that enables any and all Chainlink nodes to validate and deliver data regarding the current state of the Bitcoin blockchain to any other network. This allows smart contracts to process and verify cross-chain payments and open the door for a broad range of Bitcoin-enabled services. It’s not just a concept either, as Chainlink Labs (previously SmartContract.com) has been triggering payments on the Bitcoin blockchain on the behalf of blockchain-based smart contracts since 2014.

Conclusion

As the leading blockchain-agnostic oracle network, Chainlink provides additional value and capabilities to Bitcoin and Bitcoin-enabled smart contracts. In fact, Chainlink is already providing a large amount of additional value to the Bitcoin ecosystem, such as on-chain price feeds, Proof of Reserve contracts, oracle services to Bitcoin-secured blockchains, triggering/tracking Bitcoin transactions, and more. This not only benefits the Bitcoin ecosystem, but pushes forward the adoption of cryptocurrency and smart contracts as a whole.

If you’re a developer and are interested in using Chainlink to boost the capabilities of your Bitcoin-based smart contracts, please reach out to us here. Documentation for using Chainlink on Bitcoin secured networks like Rootstock can be found here. For more information on connecting your smart contract to the BTC/USD Price Feed on mainnet, please refer to our developer documentation here.

Website | Twitter | Discord | Reddit | YouTube | Telegram | Events | GitHub | Price Feeds | DeFi