How Governments Worldwide Are Exploring Blockchain Technology

From tokenized government bonds in the UK to onchain car titles in the U.S., governments worldwide are exploring blockchain technology.

These initiatives aim to enhance transparency, efficiency, and security in public services. While many are still in the early stages, they show a growing interest from governments to leverage blockchain technology across a broad range of sectors.

Why Governments Are Using Blockchain

Governments are exploring blockchain to address key challenges in public administration:

- Transparency—Blockchain’s immutable ledger can enhance trust in government systems and processes. Potential use cases include tracking land ownership, verifying identities, and publishing budgets or tax records with clear audit trails.

- Efficiency—Smart contracts can automate predefined processes, such as tax collection, customs clearance, or title transfers. This approach can reduce manual work, turnaround times, and costs.

- Data integrity—Blockchain ensures that sensitive data, such as property deeds or identity credentials, stays secure, verifiable, and tamperproof.

- Cost savings—By removing intermediaries and streamlining workflows, blockchain can lower administrative costs.

- Cross-border coordination—Shared blockchain infrastructure can streamline how countries interact on trade, finance, and compliance issues.

Examples of Government Blockchain Projects

United Kingdom—Tokenized government bonds

The UK government has launched a project to issue Digital Gilt Instruments (DIGITs). Each DIGIT will be a transferable UK government bond on a distributed ledger technology (DLT) platform.

United Kingdom—Wholesale CBDC

The Bank of England plans to explore a wholesale central bank digital currency (CBDC) to settle high-value transactions between banks. The project would test how a digital pound could streamline settlement for tokenized assets like government bonds. While not yet live, the initiative is part of broader efforts to modernize the UK’s financial infrastructure using blockchain technology.

South Africa—Blockchain-based property register

In Khayelitsha, Cape Town, a 2019 project registered nearly 1,000 government-subsidized properties on a blockchain-based property register. This initiative aimed to address challenges in traditional land registration systems by providing secure and verifiable ownership records.

India—Digital rupee

The Reserve Bank of India is exploring a Digital Rupee, focusing on both wholesale and retail transactions. The project aims to assess the use of CBDCs in improving efficiency and security for interbank settlements and public transactions.

United States—Blockchain car title management

The California Department of Motor Vehicles has digitized 42 million car titles using blockchain technology. This seeks to combat fraud and streamline the title transfer process through transparent and tamper-proof vehicle ownership records.

Australia—Blockchain Excise Platform

In collaboration with industry partners, Australia’s Taxation Office has developed the Blockchain Excise Platform. The project tracks excisable goods, such as spirits, from production through the supply chain to sale.

Uzbekistan—Blockchain-based sovereign bond tokenization

In May 2025, Uzbekistan announced the HUMO token—a blockchain-based asset backed by government bonds. The project aims to attract foreign investment and bring greater transparency to public finance.

Government Blockchain Projects Involving Chainlink

Some governments are already testing blockchain infrastructure with Chainlink. These projects focus on improving automation, transparency, and cross-chain connectivity for real-world use cases.

Singapore—Project Guardian

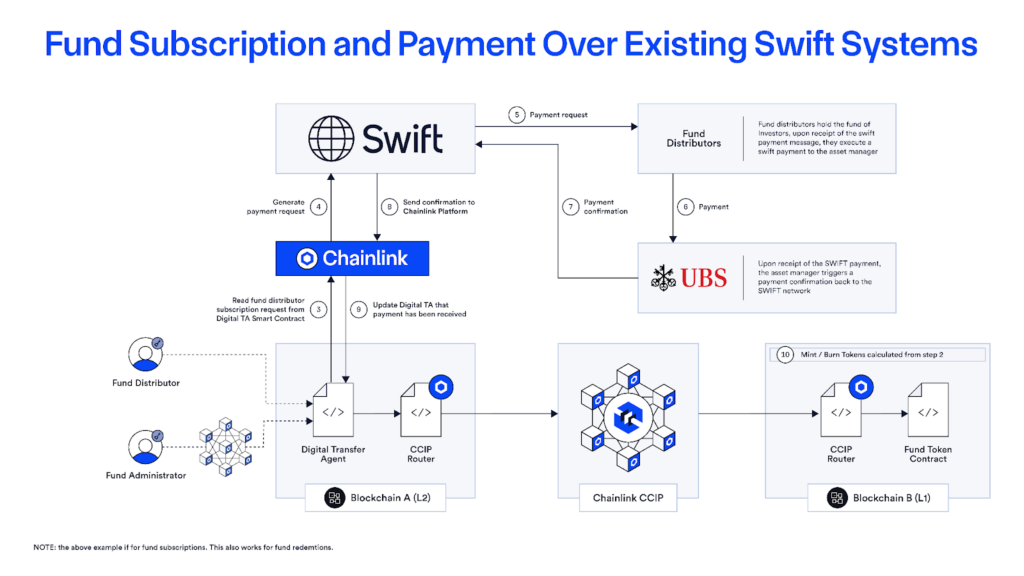

The Monetary Authority of Singapore (MAS) is leading Project Guardian, a regulatory sandbox for onchain finance. Chainlink worked with Swift and UBS to test how tokenized funds could settle across blockchains and traditional payment rails. Chainlink Cross-Chain Interoperability Protocol (CCIP) connected private and public blockchains to Swift’s messaging system to process fund subscriptions and redemptions.

Brazil—Drex CBDC Pilot

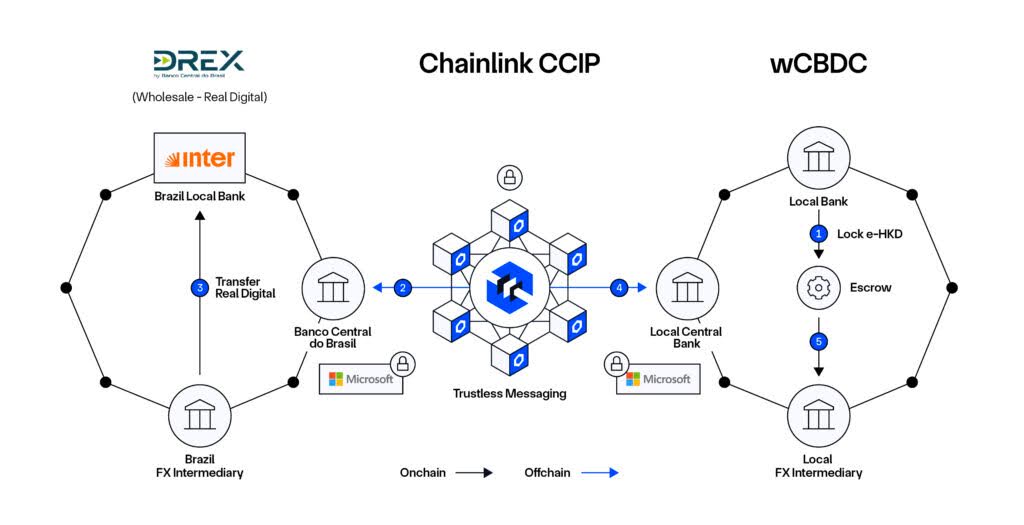

The Central Bank of Brazil selected Chainlink to join the second phase of its Drex (Digital Real Electronic Transactions) CBDC program. Chainlink is working with Banco Inter, Microsoft Brazil, and 7COMm to automate the settlement of cross-border agricultural commodity transactions. Chainlink’s CCIP will connect Brazil’s DREX platform with foreign central banks. The aim is to enable secure, efficient, and interoperable cross-border transactions. This government-led project demonstrates how Chainlink infrastructure can streamline real-world trade processes.

Conclusion

Blockchain started in the private sector, powering digital assets and decentralized applications. Now it’s steadily moving into the public sector. Governments are testing how blockchain can improve core systems, from cross-border payments to property records. There will be many more initiatives as infrastructure matures, regulation catches up, and use cases become clearer. What starts as a project could end up reshaping how entire sectors operate.