Key Takeaways

- As thousands of blockchains emerge and institutions seek to connect their existing systems to onchain environments, interoperability has become critical.

- True end-to-end interoperability goes beyond simple cross-chain transfers, requiring a standard that also supports existing system integration, data, compliance, privacy, and orchestration.

- Chainlink is the only interoperability standard capable of solving all interoperability challenges faced by institutions for moving global finance onchain.

Global finance is undergoing a fundamental transformation as assets, payments, and market infrastructure move onchain. Tokenized assets are expected to grow to $30 trillion in the next decade, while major institutions and financial market infrastructures are adopting the technology, such as Swift, which has announced the creation of a “blockchain-based ledger”.

Tokenization enables faster settlement, programmable assets, and entirely new financial products. But tokenized finance cannot scale through point solutions or isolated blockchains. Institutions must operate across multiple chains, existing systems, regulatory regimes, and data sources at the same time. This requires end-to-end interoperability through a single standard that unifies cross-chain connectivity, existing system integration, trusted data, compliance, privacy, and orchestration. Chainlink is the only platform that solves this full stack of interoperability challenges, making it the foundational standard for institutional tokenization at a global scale.

With tokenized assets issued across hundreds of disconnected public and private blockchains, supporting advanced blockchain transactions and tokenized asset applications that institutions now require demands a wide range of interoperability requirements. That is why transferring an asset across different blockchains is just the first interoperability challenge. Institutions also need to:

- Avoid siloed liquidity through secure and reliable cross-chain interoperability.

- Connect existing systems to blockchains and instruct onchain transactions using established messaging standards.

- Ensure cross-chain transactions meet data, compliance, and privacy requirements.

- Orchestrate financial workflows across a variety of onchain environments and existing financial networks and infrastructure.

True interoperability must unify digital assets, payment rails, and existing institutional systems into one programmable fabric. This is why establishing a universal standard for end-to-end interoperability is critical to the success of institutional tokenization on a global scale.

In this blog, we’ll discuss how Chainlink has established the only end-to-end interoperability standard capable of supporting tokenization at a global scale.

Challenge #1: Cross-Chain Interoperability

Hundreds of public and private blockchains now operate in parallel, each with unique standards, finality assumptions, governance models, and compliance rules. The result is isolated liquidity, disconnected applications, and duplicate asset versions, making it extremely difficult to operate securely and efficiently at any scale.

The current multi-chain landscape resembles the pre-TCP/IP internet, where networks were unable to interoperate, forcing every connection between networks to be customized and built from scratch. Without a common blockchain interoperability standard, there will be a growing list of bespoke bridging solutions, each introducing its own unique trust assumptions and security risks that institutions have to spend time and resources understanding and integrating before implementing their core business logic.

For the multi-chain ecosystem to operate at scale, blockchains must have a shared and open interoperability standard, one built on a secure and reliable foundation and that supports key cross-chain functionalities. To that end, interoperability solutions must enable cross-chain token transfers and messages. Creating a shared layer for data and value to move across the onchain economy not only enables liquidity to move to where there’s demand, but it also enables assets and applications to be managed and kept synchronized across networks securely, efficiently, and in real-time.

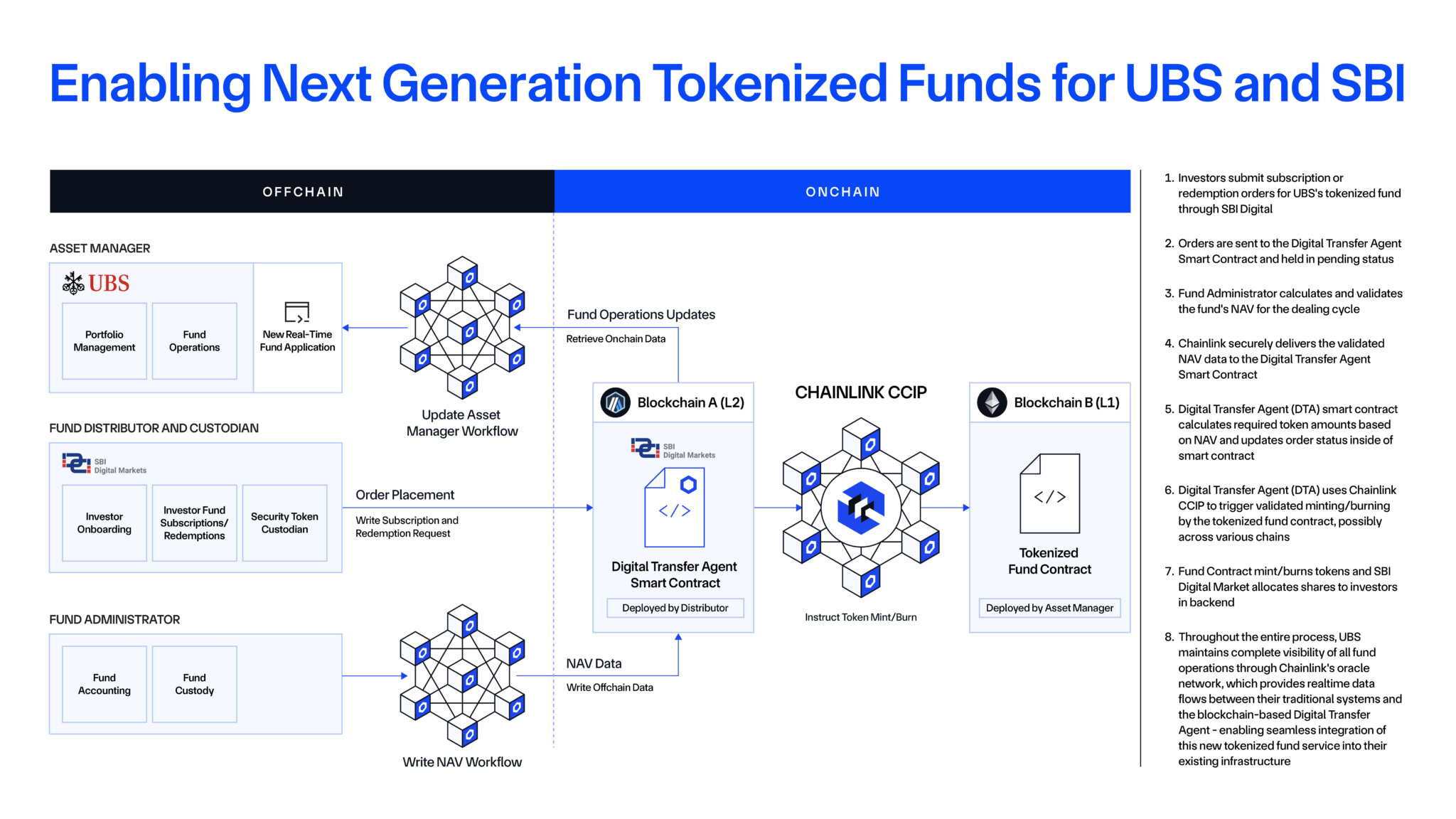

An example of how this problem is being solved is through a collaboration between SBI Digital Markets, UBS Asset Management, and Chainlink under the Monetary Authority of Singapore (MAS) Project Guardian. Together, they successfully demonstrated how the combination of Chainlink infrastructure and the Digital Transfer Agent (DTA) technical standard enables the creation of tokenized funds with automated fund management operations and transfer agency processes. The solution enables tokenized funds to maintain their share register on one blockchain while using Chainlink CCIP for the processing of fund lifecycle activities like subscriptions and redemptions on another blockchain.

“This architecture creates a foundation for our own onchain financial products and services to meet immediate user demand for tokenization and tokenized funds in particular. This new way of launching fund structures and administering them via smart contracts empowers both fund managers and their service providers to deliver new onchain financial products and lower operational costs to investors, both things they are actively looking for.” — Winston Quek, CEO at SBI Digital Markets

Challenge #2: Existing System Interoperability

The current global financial system is underpinned by core infrastructure that is proven to secure trillions in value daily, hardened by decades of testing, regulation, and operational excellence. This existing infrastructure is not obsolete—rather, it is indispensable—and core to key processes used by market participants like custodians, transfer agents, fund administrators, payment systems, CSDs, and more.

The goal of onchain finance should not be to replicate or replace all of these trusted systems, but instead to integrate them directly with blockchains in a secure and standardized way. However, the key challenge is that these systems were not designed for blockchain connectivity, meaning institutions have had to rely on many different custom/bespoke integrations to get connected to onchain environments, many of which are resource-intensive and prone to delays and errors.

Having a universal interoperability standard that extends beyond cross-chain communication to also define how offchain systems—banking infrastructure, data providers, enterprise platforms, web APIs, etc.—directly integrate with onchain systems would create a universal standard for operations across global finance more broadly. This would accelerate the adoption of tokenization within existing capital markets and establish a common framework for how the majority of tokenized asset transactions occur as a hybrid set of onchain/offchain components.

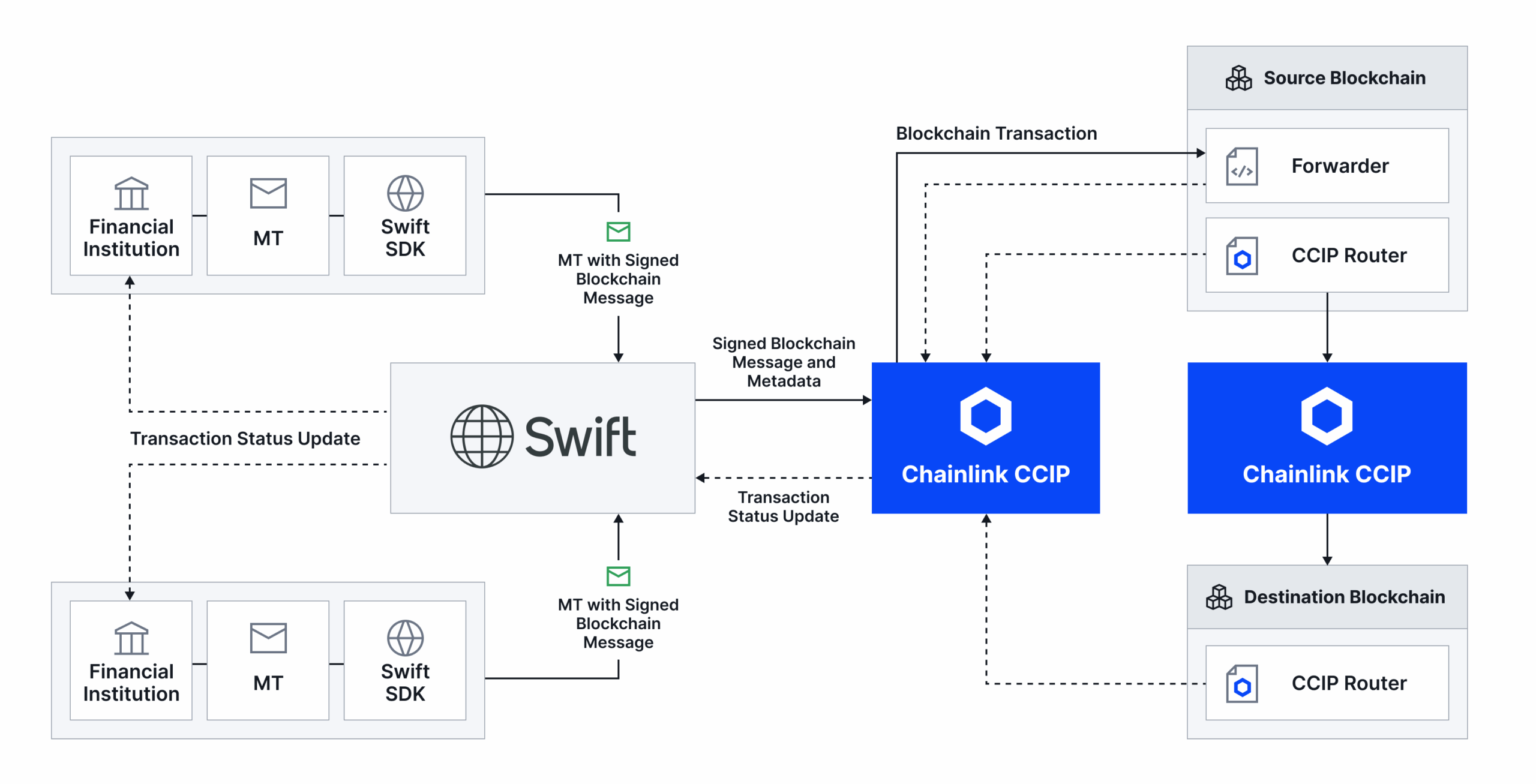

A solution to this can be seen through an initiative announced at Sibos 2025, where Chainlink and 24 of the world’s largest financial institutions and market infrastructures, including Swift, DTCC, Euroclear, SIX, UBS, and Wellington Management, continued their work on creating a unified infrastructure for streamlined corporate actions processing. The Chainlink Runtime Environment (CRE) orchestrates and validates multiple AI model outputs about new corporate actions events, transforms the confirmed outputs into ISO 20022 messages, and delivers them to financial institutions through the Swift network. Chainlink’s Cross-Chain Interoperability Protocol (CCIP) distributes the confirmed records in real-time to DTCC’s blockchain ecosystem and additional public and private blockchains. Chainlink CRE and CCIP serve as the orchestration and interoperability layers of the Chainlink platform, powering the processing, validation, and cross-system distribution of corporate actions data throughout this solution.

“Delivering scalable digital market infrastructure means aligning new solutions with the systems institutions already trust, and the Chainlink Runtime Environment makes this alignment seamless by enabling new technologies to integrate within existing workflows. Our corporate actions industry initiative with Chainlink and major financial institutions shows that industry-wide coordination around standards and interoperability are key to reaching global scale.” — Stéphanie Lheureux, Director, Digital Assets Competence Center, Euroclear

Challenge #3: Data, Compliance, and Privacy

Beyond connectivity across chains and existing systems, a universal interoperability standard must also embed the key building blocks necessary for powering tokenized asset transactions, namely data, compliance, privacy, and orchestration.

Just like in the traditional financial world, almost all onchain transactions will need some type of data, whether that is NAV, AUM, KYC/AML, as well as embedded compliance policies and conditions that must be met for the transaction to be approved. This can range from identity and investor accreditation requirements to internal business rules around transaction limits and operating hours. Furthermore, many transactions will need some form of privacy to meet consumer and regulatory requirements. As a result, an interoperability standard can only truly take off if it also supports the essential components that most advanced transactions beyond simple payments require.

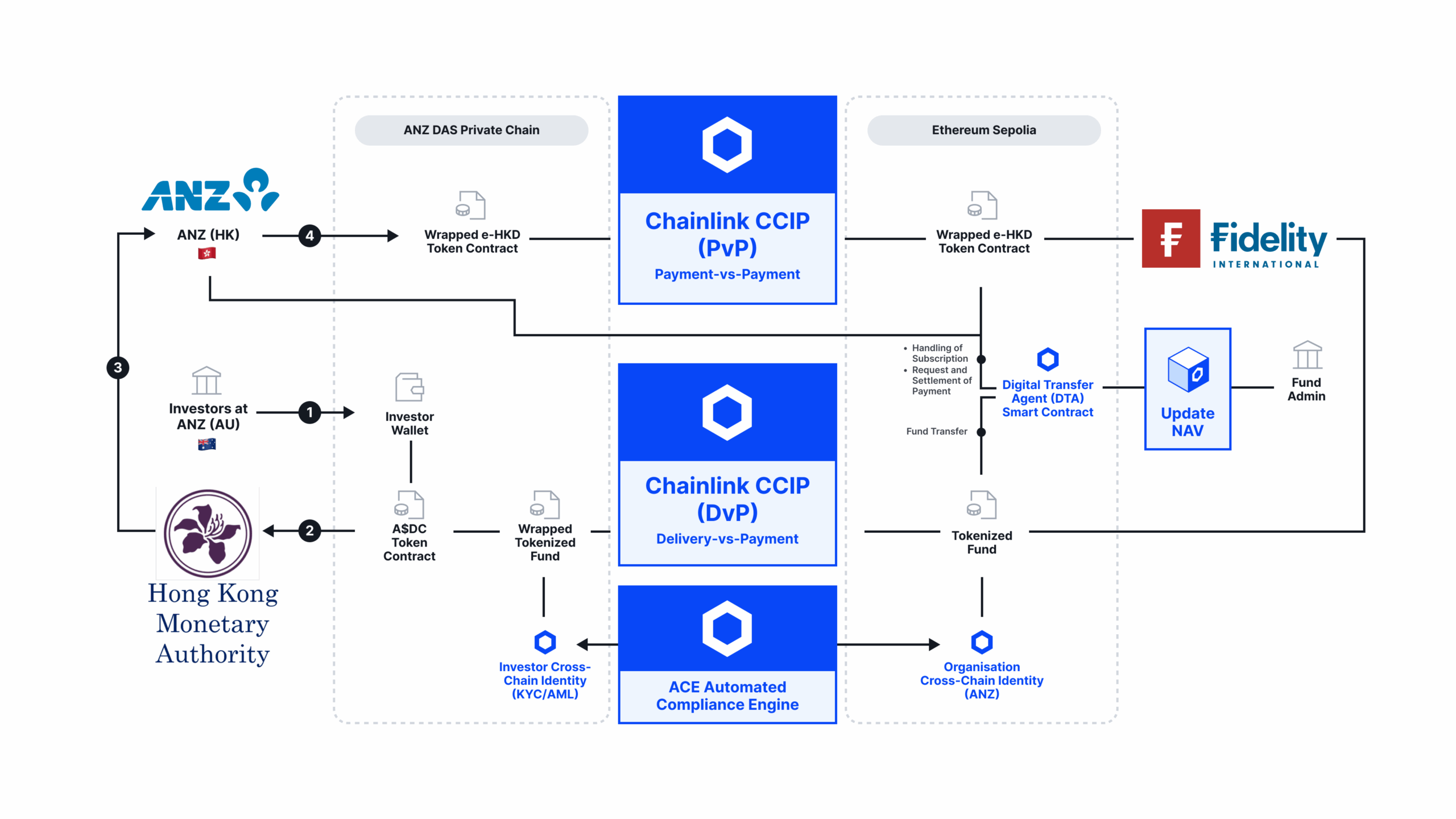

An example of this was highlighted by the Hong Kong Monetary Authority (HKMA), which released a report on Phase 2 of its e-HKD program, publishing the results of multiple industry initiatives, including a key cross-chain settlement solution powered by Chainlink with ANZ, China AMC, and Fidelity International.

In the solution, ANZ, China AMC, and Fidelity International leveraged Chainlink CCIP and ACE to meet both institutional cross-chain interoperability and compliance requirements for secure cross-chain settlement of tokenized assets.

The solution addresses the three biggest challenges of institutional tokenized asset transactions by unifying trusted data, cross-chain connectivity, and automated compliance into a single workflow. It provides secure, high-quality data to accurately price assets and support transfer agent operations; enables seamless value and data movement across blockchains using Chainlink CCIP; and enforces compliance by verifying onchain identity proofs against jurisdiction-specific regulatory policies through Chainlink’s ACE.

Another example of this was highlighted in phase two of the Central Bank of Brazil’s (BCB) Drex project, which is focused on cross-border trade. Chainlink connected BCB with the Hong Kong Monetary Authority (HKMA) to orchestrate seamless and secure trade settlement across jurisdictions in a compliant manner. Additional participants included Banco Inter, Standard Chartered, the Global Shipping Business Network (GSBN), and 7COMm.

The Chainlink platform enabled seamless communication across the Drex platform, the Hong Kong Ensemble Network, and GSBN’s trade finance system. The Chainlink Runtime Environment (CRE) translated messages between networks, triggered electronic Bill of Lading transfers, and connected offchain systems like GSBN’s API. Chainlink CCIP provided secure cross-chain messaging, allowing key events like contract execution and credit release to stay in sync across all platforms.

Additional examples of such solutions include Chainlink’s work with Apex Group and Bermuda Monetary Authority (BMA) on creating institutional-grade stablecoin infrastructure supporting the BMA’s embedded supervision initiative, and with the Global Legal Entity Identifier Foundation (GLEIF) to deliver an institutional-grade identity solution for the blockchain industry.

Challenge #4: Orchestration

The final challenge of interoperability is orchestration—the ability to securely coordinate complex financial processes that span multiple blockchains, external systems, regulatory logic, and institutional workflows through a single piece of code. Traditional smart contracts execute isolated functions on a single chain, but institutional asset lifecycles involve far more: data from pricing and compliance systems, multi-chain execution, identity verification and compliance functions, existing system integration, and conditional business logic that must run securely and reliably in parallel.

Without an orchestration layer that unifies these components and processes, institutions must build and maintain a web of bespoke integrations and custom logic, slowing adoption, increasing operational risk, and fragmenting liquidity across disparate systems.

This is why a universal interoperability standard must include not just connectivity across chains, systems, and data sources but also orchestration that brings these capabilities together into composite workflows that can power real-world financial operations at scale.

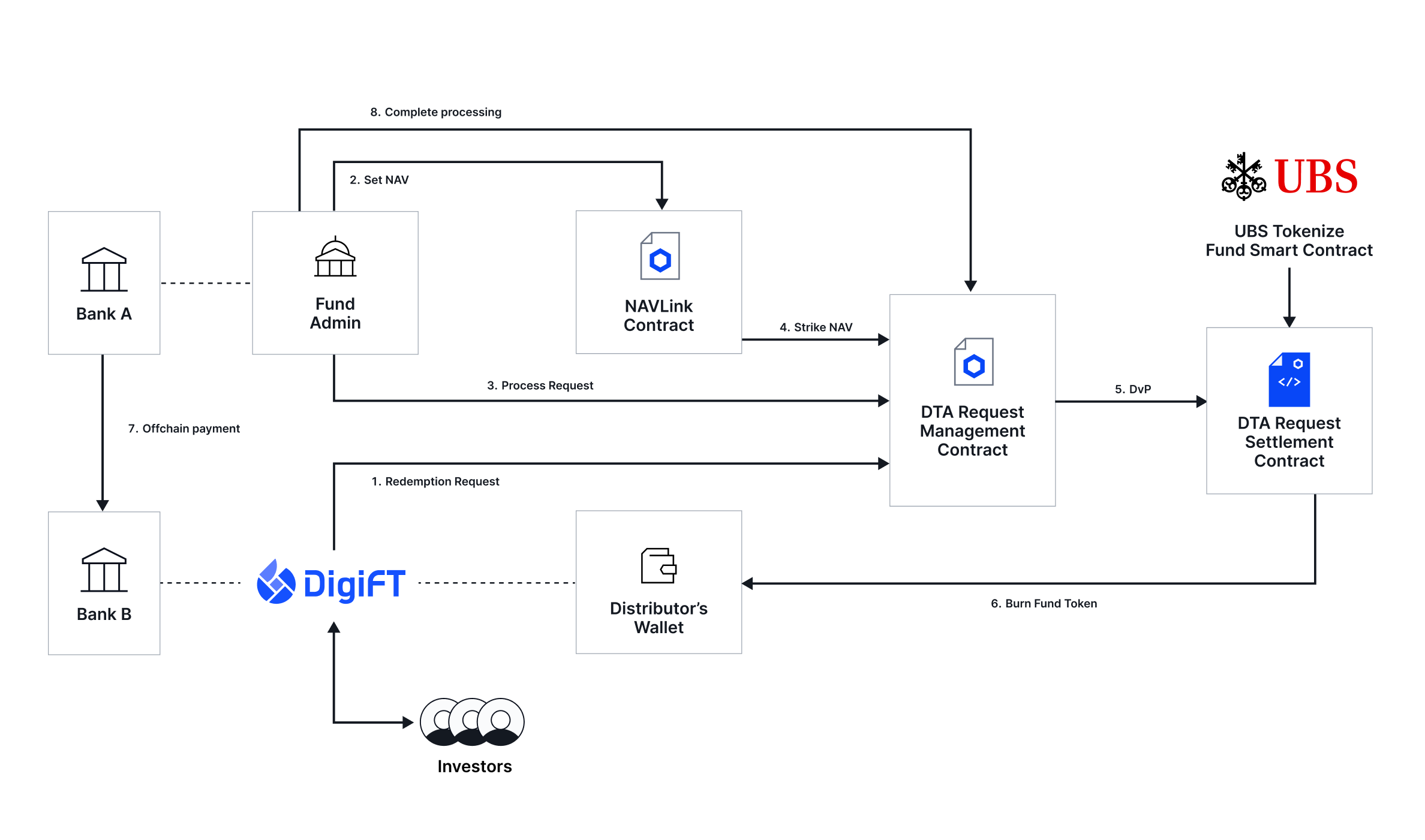

As a solution to this challenge, UBS has successfully completed the world’s first in-production, end-to-end tokenized fund workflow leveraging the Chainlink Digital Transfer Agent (DTA) technical standard. In this solution, the DTA technical standard leverages key Chainlink platform capabilities, including:

- Chainlink Runtime Environment (CRE) for orchestration across onchain environments and existing in-house systems used by financial institutions.

- Cross-Chain Interoperability Protocol (CCIP) for interoperability across any public or private chain.

- Automated Compliance Engine (ACE) for programmable compliance.

- NAVLink for robust pricing inputs required for fund subscriptions and redemptions.

Solution: The Chainlink Platform for End-to-End Interoperability

Chainlink solves the full spectrum of institutional interoperability challenges by providing a unified platform that connects disparate blockchain networks and existing systems while supplying the data, cross-chain connectivity, compliance, privacy, and orchestration required for advanced onchain transactions. The platform is fully modular—institutions can adopt only what they need, from simple cross-chain transfers to the complete end-to-end workflow stack.

Powered by the Chainlink platform, institutions can build and run workflows that:

- Span multiple blockchains

- Connect to existing systems

- Enforce compliance and identity

- Use privacy-preserving services

- Are orchestrated within one unified environment

As the only oracle platform to achieve ISO 27001 & SOC 2 compliance, Chainlink delivers unparalleled security and reliability, having enabled over $27 trillion in onchain transaction value. Many of the world’s largest financial services institutions have adopted Chainlink’s standards and infrastructure, including Swift, Mastercard, Euroclear, and many others.

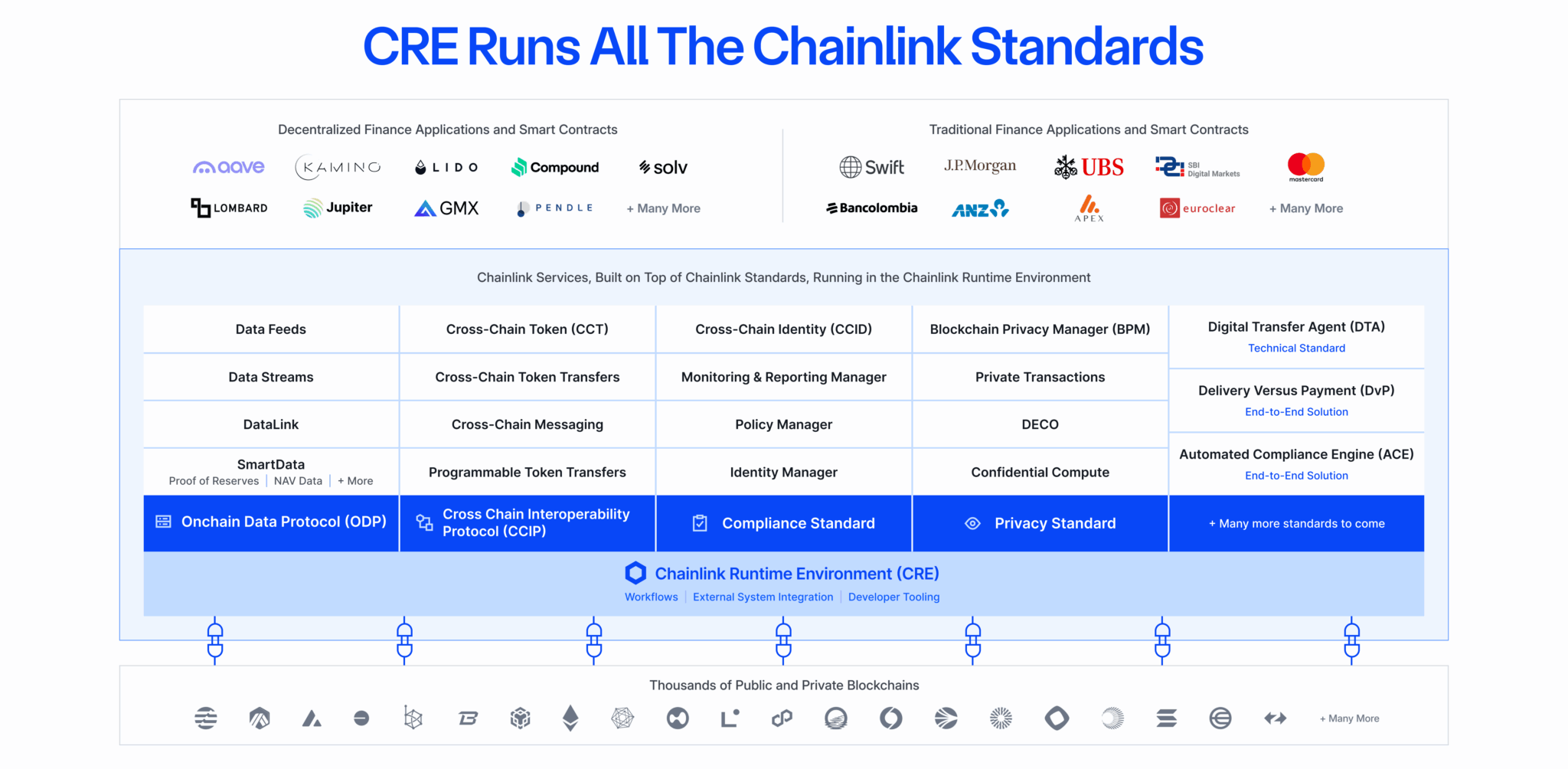

At the core of Chainlink is the Chainlink Runtime Environment (CRE), an orchestration layer that enables institutional-grade smart contracts—complex financial workflows that operate across blockchains and offchain systems, addressing a key pain point of integrating existing systems with blockchains. Built upon CRE are open standards, each addressing a key dimension of end-to-end interoperability:

- Data standard—Underpinned by the Onchain Data Protocol (ODP), the Chainlink data standard defines how offchain data is aggregated, verified, and published across any blockchain. By standardizing how data moves across chains and systems, ODP creates a shared information fabric for tokenized finance.

- Interoperability standard—Powered by Chainlink’s Cross-Chain Interoperability Protocol (CCIP), the Chainlink interoperability standard enables seamless, secure transfer of data and value across both public and private blockchains. It also supports the Cross-Chain Token (CCT) standard, which makes any token natively transferable across chains without modifying its code.

- Compliance standard—Based on the Onchain Compliance Protocol (OCP), the Chainlink compliance standard defines how identity, policy, and regulatory requirements are enforced in onchain workflows. Together with Chainlink’s Automated Compliance Engine (ACE), institutions can extend their existing compliance infrastructure onchain and ensure compliance rules and verified identities are portable across networks, preserving trust as assets move globally.

- Privacy standard—The Chainlink privacy standard is a collection of privacy oracle services that conceal sensitive data and provide confidential computing. Through the Chainlink privacy standard, institutions can incorporate privacy into key parts of a transaction, such as its data, logic, computations, and external connections.

CRE unifies these standards on a single platform and makes them composable into workflows that interact across onchain and offchain systems. The result is a single, cohesive interoperability standard that can power the end-to-end lifecycle of tokenized asset transactions while meeting institutional-grade requirements for security, compliance, and reliability.

Powering the Future of Global Finance With Chainlink

As global finance transitions to onchain market infrastructure, the ability to connect blockchains, existing systems, and standards through a single interoperability standard will define the next generation of markets.

Chainlink is the only technology platform that provides that foundation—uniting data, compliance, privacy, cross-chain connectivity, and orchestration into one stack that enables institutions to operate seamlessly across blockchains and existing systems. By uniting blockchain technologies with the systems that already secure trillions in value today, Chainlink is providing the universal interoperability standard powering the future of onchain finance at a global scale.