Early-Stage Web3 Startup Funding: An Introduction

Raising funds is one of the toughest but most important challenges for any startup that’s just getting off the ground—this is the case for those building in Web2 or Web3 alike. But unlike in Web2, the Web3 ecosystem affords budding founders the ability to leverage decentralized fundraising techniques that aren’t an option for traditional startup teams.

In a startup’s early stages, some of the more tried-and-true bootstrapping methods are often still the best options for Web3 founders too. It’s further down the fundraising path when the trajectories of Web2 and Web3 startups really start to diverge.

In this post, we’ll cover the following topics and how they apply to Web3 startups:

- The early stages in the lifecycle of a startup

- The bootstrapping process and sources of pre-seed funding

- How to prepare for fundraising with professional investors

- Sources of seed funding that are unique to the Web3 space

The Early Stages in the Lifecycle of a Startup

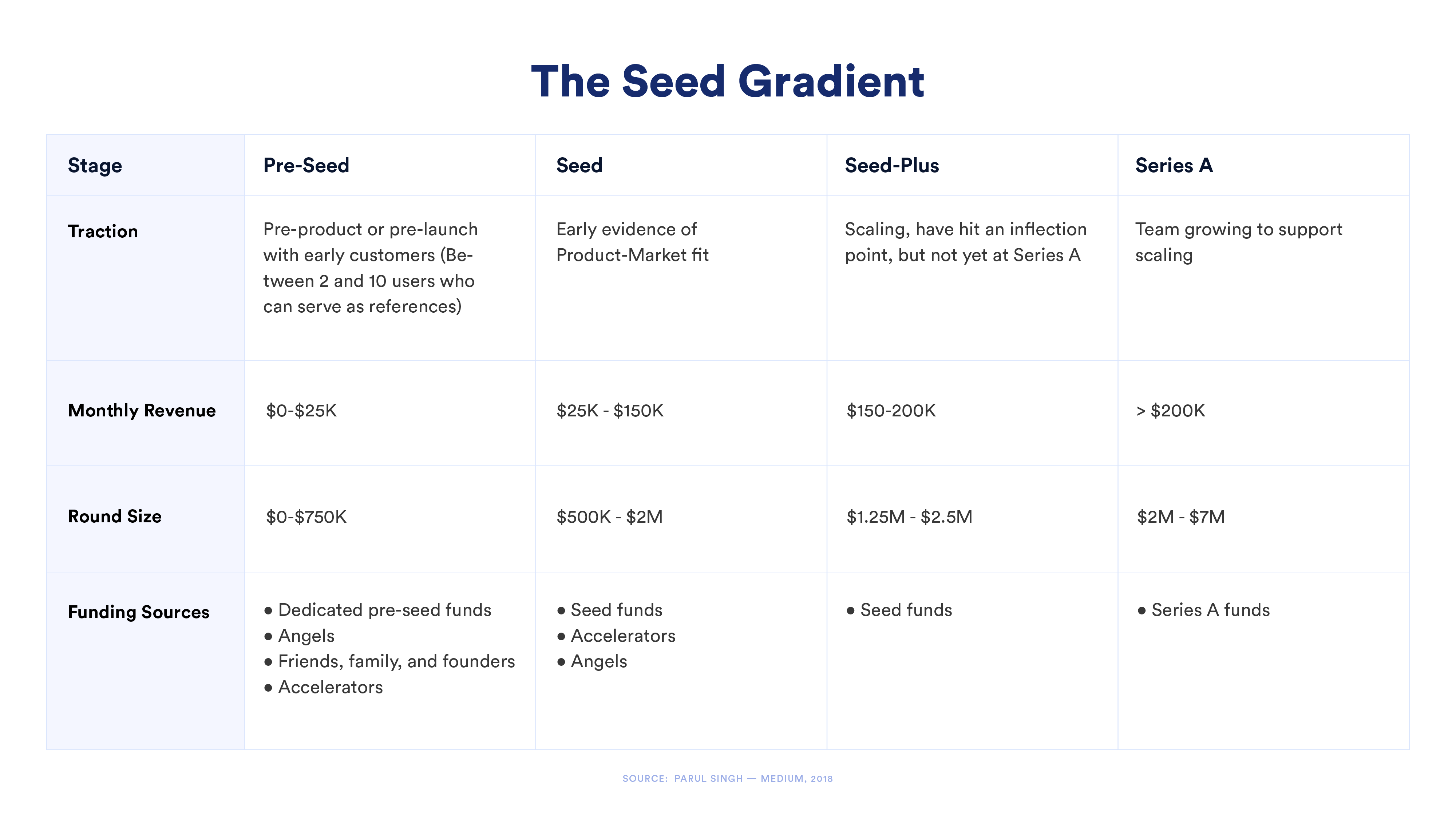

Traditionally, the seed stage is regarded as the first leg of a startup’s fundraising journey. However, some investors think of the seed stage as a “gradient” rather than a distinct stage. Early-stage investor Parul Singh breaks the gradient down like this:

According to a 2021 Forbes article, the average seed raise has risen from $1.5M in 2020 to $3.3M in 2021. Even in the pre-seed phase, some Web3 companies are raising rounds to the tune of $3M.

Despite this interest in the space, fundraising for Web3 startups is still a challenging process and there are differences in how this funding is sourced when compared to more traditional startups.

To understand these differences, let’s look at the early-stage fundraising stages in more detail.

Sources of Pre-Seed Funding for Web3 Startups

In the pre-seed stage, most founders are just fleshing out their ideas and building out a prototype. Many refer to this stage as “bootstrapping” rather than fundraising.

To bootstrap their startups, founders might use sources that don’t require giving up equity in the company, such as grants or loans. Alternatively, they can choose to invest some of their own money, or if they’re lucky they might have a personal relationship with an angel investor who is willing to provide them with early capital.

However, the majority of founders will have to turn to sources outside of their personal networks to get started. Grants are a key source of non-repayable funds, and they’re especially popular in the Web3 ecosystem.

Grants from Traditional Entities

Many traditional organizations from both the public and private sectors are looking to enter the Web3 space and spur innovation by offering grants to promising startups.

Some examples of these are:

- The European Commission’s Horizon program, which awarded €180 million in prizes and grants through Horizon 2020.

- Santander Bank’s Santander X Global Challenge, which offered blockchain startup grants from a pool of €120,000.

- The Unicef Venture Fund, which offered equity-free investments of up to $100,000 to startups that have the potential to benefit humanity.

Considerations

Pay close attention to the application criteria: These kinds of grants often have very precise requirements that specify that a startup must operate in a specific region or industry. Government grant programs in particular tend to focus on the use of blockchain technology for social good.

Also, many traditional grant programs or subsidies require founders to contribute a portion of the costs. For example, they might offer to subsidize 70% of the costs of developing a prototype with the founder or team expected to cover the remaining 30%.

Grants From Within the Web3 Industry

Within the Web3 industry itself, more established players are looking to build out their ecosystems by offering grants to startups that use their particular technology. This is especially true for organizations that manage ecosystems based on a certain blockchain, such as Ethereum, Cardano, or Solana. Competition for grants from larger companies or projects can be fierce, so another option is to look at the grant programs of newer, emerging blockchain networks. Once you have proven your concept on one chain, it’s easier to raise funds for expansion into others.

Examples of blockchain-specific grant programs:

- The Ethereum Ecosystem Support program

- The Polkadot Web3 foundation

- The Avalanche Multiverse incentive program

- The NEAR protocol grants program

- The Celo Foundation grant program

- The Harmony Ecosystem Fund

- The Interchain Foundation grants program

For a more comprehensive list of similar grant programs, see blockchaingrants.org.

There are also grants from Web3 organizations not tied to any specific blockchain, such as infrastructure companies and cryptocurrency exchanges.

Examples of more blockchain-agnostic grant programs:

- The Chainlink Community Grant Program, which offers grants to developer teams that are building tools for the Chainlink ecosystem or integrating Chainlink technology.

- Filecoin’s developer grants program, which aims to fund new products, businesses, and tools that enhance the utility of Filecoin.

- Kraken’s developer grants program, which supports development projects in established ecosystems such as those of Bitcoin and Ethereum.

- Coinbase’s developer grants program supports developers who are committed to growing and maintaining the crypto ecosystem

Considerations

These grants programs are often inundated with applicants and very quickly stop accepting new applications. That’s why it’s important to set up targeted Google Alerts so that you’re notified of any opportunity as soon as it’s announced.

Additionally, these kinds of grants are intended to foster engagement in a specific technical ecosystem, so you’ll be required to use a specific technology or address a specific use case that might not fit the nature of your startup.

As is the case with grants in general, the funding on offer is only enough to bootstrap your product, and you will immediately need to start searching for funding to sustain your development beyond the prototype phase.

Web3 Incubators, Accelerators, and Founder Communities

While they’re not always technically a source of funding, startup incubators and accelerators help new businesses in their early stages by providing training, mentoring, and workspace.

Incubator programs are designed to help entrepreneurs from day one, equipping them with the business skills they need for the next stages of fundraising. If you’re a blockchain startup, the next stages might not always involve traditional fundraising techniques, so it’s important to choose an incubator that specializes in Web3 startups.

Examples of Web3 incubators and founder communities:

- The Klaytn incubation program focuses on startups working in DeFi, the metaverse, GameFi, and the creator economy.

- R3 venture development is a fund that helps pre-seed to series-A startups working on an enterprise (B2B) solution using distributed ledger technology.

- dlab INCUBATE is an incubator powered by SOSV and EMURGO (backers of Cardano) that provides founders from across the globe with pre-seed funding and resources to develop and test blockchain-enabled products and services.

- Orange DAO is a community of Y Combinator alumni that funds early-stage Web3 startups.

Examples of Web3 accelerators:

- Alliance DAO is a Web3 accelerator and founder community.

- Outlier Ventures’ Base Camp is an Open Metaverse startup accelerator.

- Tachyon is an accelerator for early-stage blockchain and Web 3.0 startups.

Many more traditional accelerator programs such as Y Combinator, Techstars, and Antler also now invest in blockchain startups.

Founder-oriented resources such as incubator list and F6S also provide comprehensive lists of global startup programs, including those that specifically focus on blockchain startups.

While not essential, incubators are highly recommended for founders who lack experience in building a startup or pitching to investors. They provide essential guidance on challenges such as writing a business plan and navigating the go-to-market approaches specific to the Web3 industry.

Web3 Crowdfunding

The concept of crowdfunding has been around for a while, but in the Web3 space, it operates a little differently due to the use of blockchain technology. For example, Juicebox, dubbed a “decentralized Kickstarter,” is a popular platform powered by public smart contracts on Ethereum. Its goal is to enable DAO projects to raise funds from the wider Web3 community. According to a December 2021 announcement, Kickstarter itself intends to launch a new Web3-enabled platform that will help to crowdfund creative projects on the Celo blockchain. Gitcoin offers decentralized grants to help small projects and teams focused on open-source development. Like Gitcoin, DoraHacks offers continuous funding, grants, bounties, and hackathons, but is more focused on Asian markets.

Although these new sources are valuable additions to the bootstrapping process, the funding amounts will not be enough to sustain long-term product development. Founders will eventually need to raise larger sums of money so that they have enough runway to build out their product.

Seed Funding and Beyond for Web3 Startups

At this stage, fundraising is conducted by selling equity in the company to some kind of institutional entity or professional investor, be it an accelerator, angel investor, or early-stage venture capital firm.

This financial capital can then be converted into production capital, namely the net value gained from acquiring hardware, technology, and human resources. For Web3, these human resources could be new hires or contracted contributors acquired through a developer outreach program.

Regardless of the source of capital, all startups need to meet some basic prerequisites before starting the seed fundraising process. Firstly, they need to understand what investors are looking for when they assess the potential of a startup; secondly, founders need to understand what they themselves are looking for in an investor. This second point is especially important for Web3 founders, since many investors might be excited about the potential of Web3 startups but ill-suited to guide their growth.

Understanding What Investors Want To See in a Web3 Startup

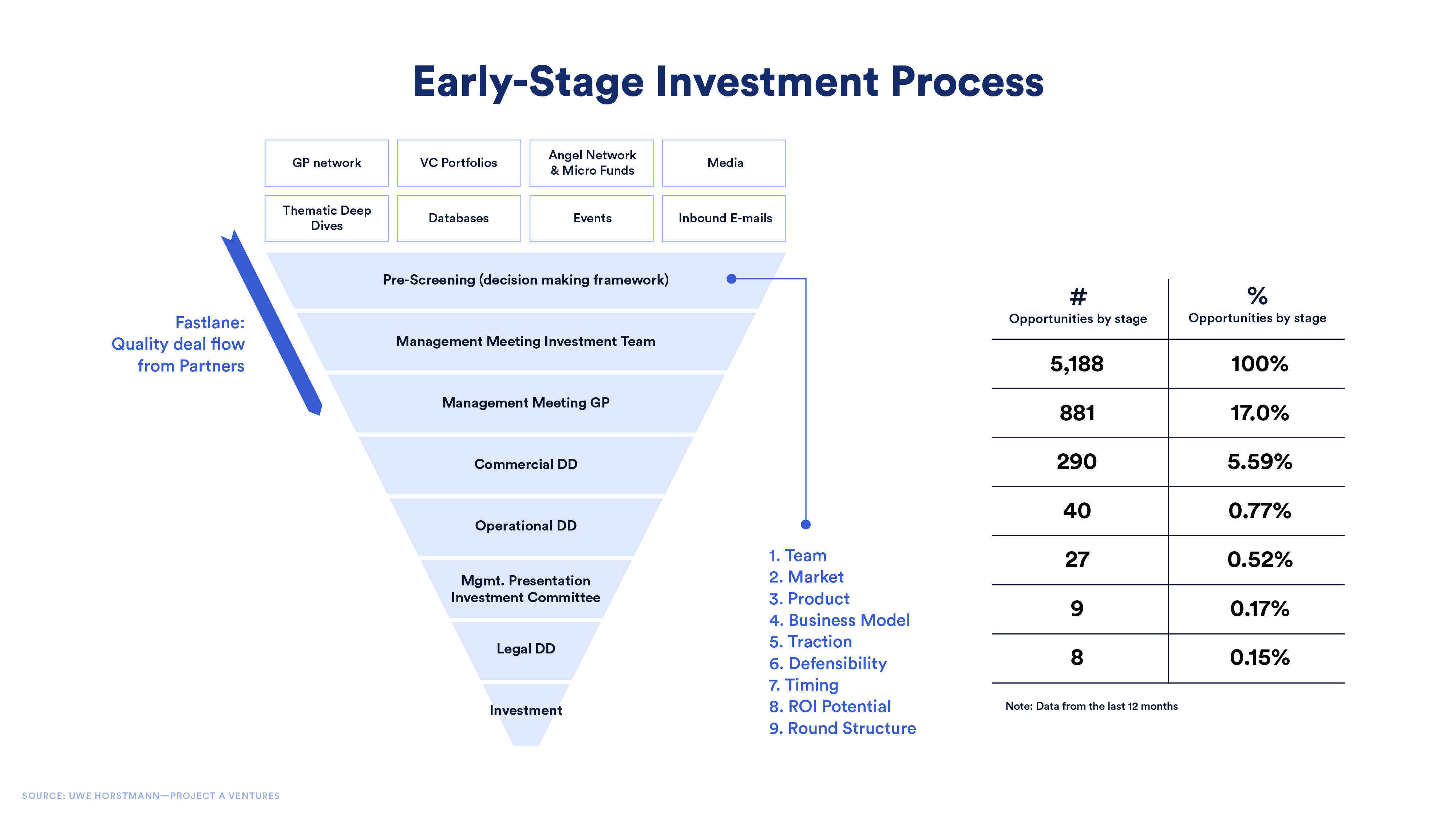

Traditional venture capital investors generally screen thousands of investment opportunities each year, and have developed a decision-making framework with which they can quickly pre-screen startups before kicking off a formal assessment process. Generally speaking, the same criteria can be applied to Web3 startups, although there will be differences in the details.

The following diagram illustrates an example deal flow pipeline for a venture capital firm, including how opportunities are sourced and the criteria used to filter opportunities through each assessment stage.

Many of these screening criteria are obvious and do not change dramatically for Web3. For example, qualities such as a founder’s track record or the strength of the product or go-to-market (GTM) strategy are equally as important for both Web2 and Web3 startups. However, qualities like defensibility and deal structure take on a different dynamic in Web3.

In Web3, Defensibility Is More About Switching Costs and Network Effects

The decentralized nature of Web3 generally requires that projects are open source and maintained by a distributed network of contributors. This means that any project can be forked and adapted. For example, at the time of writing, Defi Llama currently lists 254 forks of Uniswap, the pioneering protocol used by many decentralized exchanges (DEXs). Yet the Uniswap DEX still retains the top spot in terms of TVL (Total Value Locked) even though there are competing DEXs on the Ethereum blockchain (such as SushiSwap). This example illustrates that in Web3, defensibility is more about timing and community rather than having proprietary code. VCs are thus looking for products that have the potential to build a vibrant community and unique, sticky features that increase the cost of switching to any competitor that might fork the project further down the line.

Web3 Deal Structures Have Different Dilution Concerns

For Web2 startups, deal structure negotiations typically revolve around the proportion of ownership between current and future investors and the founding team. Once a startup moves into Series A, B, and C rounds, founders and early investors will have their ownership diluted. Thus many term sheets take this risk into account with contractual provisions that protect against dilution.

Yet, for Web3 startups, private funding rounds often don’t go beyond Series A. Once they reach a certain level of traction in their target markets, many Web3 startups turn to decentralized fundraising and no longer seek private funding rounds. Dilution is still a concern, but many Web3 startups primarily deal with this issue at the beginning of their fundraising journey rather than reevaluating it over the course of multiple private funding rounds.

Web3 Founders Also Need To Understand What They Are Looking for in an Investor

Although some Web3 projects are funded entirely by the community, most Web3 startups will benefit from a lead investor that will guide the project through the ups and downs of the market. This is, by nature, a long-term relationship. Although Web3 projects might see exponential growth in much shorter periods than Web2 startups, these growth spikes are highly coupled to the sentiment regarding the entire crypto market, which can be volatile.

Experienced investors, therefore, have much longer time horizons and don’t expect to see a return on their investment for many years. For this reason, the investor-founder relationship is often compared to a marriage where both parties need to be clear about what they want from the relationship. We’ve already covered what investors expect, so let’s look at what founders should consider.

Finding an Investor Who Understands Web3

2021 saw a large number of new investors jump into the space, and many are still learning the ropes. Although they may be highly enthusiastic about Web3, they might not be able to offer you much guidance on how to scale your company and grow your community.

Most Web3 startups, however, are looking for investment beyond pure capital. This includes value-adds such as:

- Guidance on equity distribution

- Guidance on building an open-source community

- Access to a wider network

- Access to commercial and operational expertise

When it comes to value-adds, it’s important for founders to do their due diligence on whether a VC’s existing portfolio companies have indeed received the support that they expected. This is because founders and VCs often have mismatched expectations around what this support should look like. For example, in its More Than Money report, Forward Partners found that three out of five founders felt “duped” by the level of support they received.

The Rise of Decentralized Investment

DAOs (decentralized autonomous organizations) offer another unique fundraising channel. Investor syndicates are nothing new, and many traditional syndicates can be found on platforms such as AngelList. But DAOs are attractive to Web3 founders because they allow for funding to be democratized instead of relying on VC approval.

For example, Syndicate DAO allows investors to form decentralized “investment clubs” and pool funds to invest in a project. Stacker Ventures is another example of a DAO-based project that invests in early-stage startups and aims to “align the incentives of community investors with founding teams”.

Web3 Is Transforming the Fundraising Process, but Founders Still Need To Focus on the Fundamentals

There are many ways for Web3 startups to raise funds, including bootstrapping, grants, and incubator programs. The Web3 space also introduces many new fundraising innovations, such as decentralized crowdfunding. Although many observers expect these innovations to transform how VC funds operate in Web3, founders need to remember that seed investors of any kind still expect to see the same fundamentals that traditional VCs look for: solid technology, a clear business plan, a realistic product roadmap, and reliable leadership.

Despite this, many founders struggle to acquire the skills, connections, and operational expertise that are required to win over an experienced investor. That’s why joining an incubator program or founder community that’s oriented specifically towards Web3 founders is such an essential step in funding an early-stage Web3 project.

Disclaimer: The information provided in this blog post is provided for education and informational purposes only. Nothing in this post is intended to be financial advice. You should not act on any of the information presented in this blog post without undertaking independent due diligence and consulting with qualified legal and tax professionals.