Introducing Smart Value Recapture (SVR): A Chainlink-Powered MEV Recapture Solution For DeFi

We’re excited to introduce Chainlink Smart Value Recapture (SVR)—a novel oracle solution that enables DeFi applications to recapture the non-toxic Maximal Extractable Value (MEV) derived from their use of Chainlink Price Feeds.

The initial version of Chainlink SVR was built in collaboration with BGD Labs, Flashbots, and other contributors to the Aave DAO and focuses on enabling DeFi lending protocols to recapture oracle-related MEV from liquidations. Built on top of Chainlink infrastructure, SVR systematically reduces unnecessary third-party dependencies and eliminates the need to integrate intermediary smart contracts, making it a very minimal lift for existing Chainlink Price Feed users to adopt SVR.

Chainlink SVR is live on mainnet and has been adopted by leading DeFi protocols, such as Aave. The value recaptured by SVR not only provides DeFi protocols like Aave with new revenue streams, but it also supports the long-term economic sustainability of the Chainlink Network, ultimately ensuring the DeFi economy has access to the most secure and reliable infrastructure.

The initial version of SVR-enabled Price Feeds leverages Flashbots MEV-Share and a novel onchain “Dual Aggregator” contract architecture to provide efficiency and enhanced fallback security. A future, fully custom implementation is planned to introduce further improvements, including increased decentralization, a DON-based auction system, enhanced gas efficiency, and cross-chain capabilities.

How Oracles in DeFi Create MEV Opportunities

Maximal Extractable Value (MEV) refers to the value derived from the ability of block proposers (within blockchain networks) to include, exclude, or change the order of transactions in the blocks they produce. Today, these transaction ordering opportunities are identified by searchers, who bid via a competitive auction for the right to order transactions in the block. The value is then captured by the participants of the block building process such as searchers, builders, and validators.

As a sub-set of MEV, “Oracle Extractable Value” (OEV) refers to the MEV created during the transmission of oracle reports onchain and their subsequent consumption by onchain applications. The most common OEV opportunity is seen with lending protocols, namely during the liquidation process where searchers compete for the right to liquidate an at-risk position and earn a liquidation bonus reward. On Ethereum, the process of auctioning blockspace is commonly achieved through Flashbot’s MEV-Boost, enabling searchers to backrun a price oracle report update with a liquidation transaction via transaction bundling.

Today, the value associated with oracle-related MEV, such as liquidations, is captured by the searchers, builders, and validators of a blockchain network, with none returning back the DeFi protocols, end-users, and oracles that originally generated the oracle-related MEV. Recapturing this non-toxic MEV would ultimately return value back to its originator.

Note: The term “OEV” can be considered to be a misnomer, as it does not refer to oracles actively extracting value away from users, but rather relating the existence of oracle-related MEV. We use the term “OEV” here as it’s commonplace to use in reference to this type of MEV.

Why Chainlink SVR?

Chainlink Labs and the broader Chainlink community have been actively researching solutions around MEV for a number of years, such as research on Fair Sequencing Services (FSS) and Protected Order Flow (PROF). As a subset of MEV, we’ve also engaged in research around OEV and how DeFi protocols can recapture this value and to help support the economic sustainability of oracles. We’ve analyzed various OEV designs in order to realize a solution that maximizes security, reliability, and long-term economic viability.

From our research, we’ve successfully developed the initial version of an OEV solution called Smart Value Recapture (SVR). Chainlink SVR is built specifically for backrunning as it pertains to liquidations and cannot be used for frontrunning or sandwich attacks, which are toxic forms of MEV that harm the user experience.

We believe Chainlink SVR is best suited for DeFi protocols wanting to recapture the MEV they generate, as Chainlink Price Feeds already help secure many of the largest DeFi protocols and have a proven track record of security and reliability. In integrating a Chainlink-powered MEV recapture solution, DeFi protocols can retain Chainlink security and reliability while also further increasing the economic sustainability of themselves and the Chainlink infrastructure they rely on.

Some of the notable benefits of Chainlink SVR include:

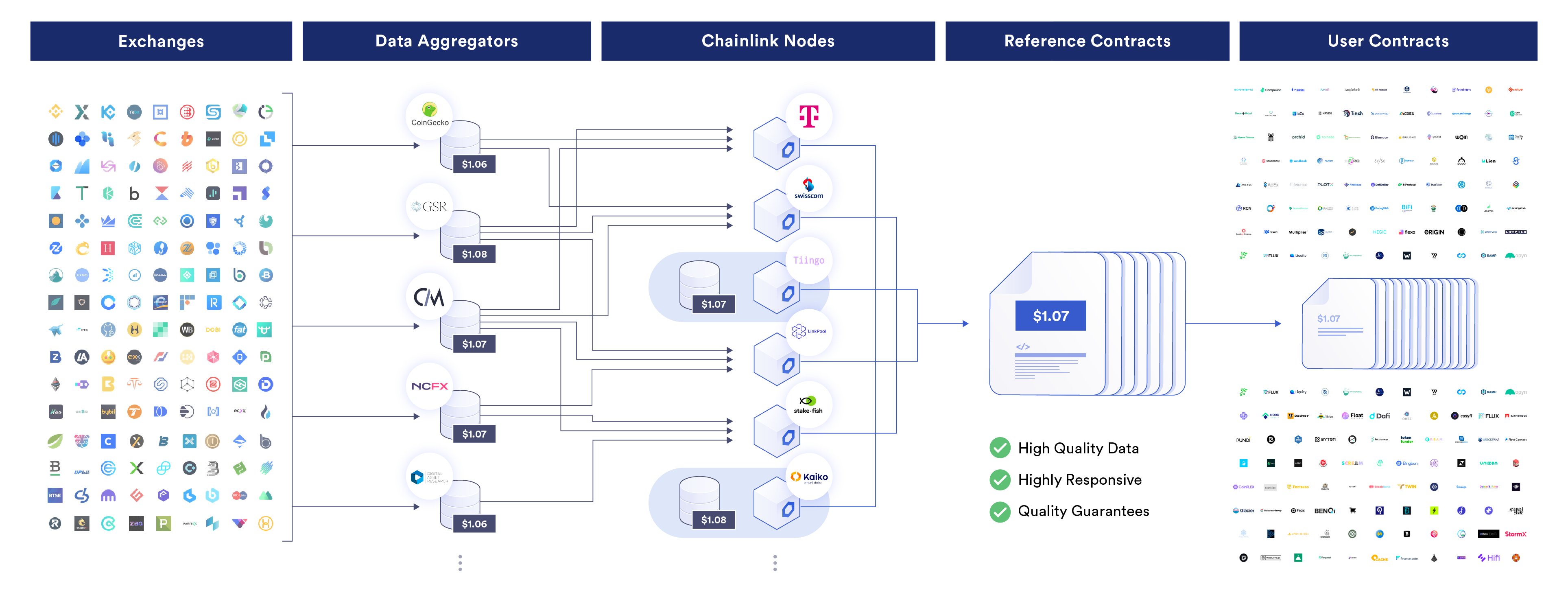

- SVR is underpinned by the same time-tested and battle-hardened decentralized oracle network (DON) infrastructure that has powered Chainlink Price Feeds for the past 5+ years—which have successfully secured \$75 billion in DeFi TVL at its peak and enabled trillions in transaction value.

- SVR reduces unnecessary third-party vendor risks to protocols already consuming Chainlink Price Feeds, reducing their overall attack vector and preventing unnecessary third parties from siphoning economic value.

- SVR doesn’t require DeFi protocols to integrate intermediary contracts or to “wrap” Chainlink Price Feeds, ensuring more efficient smart contract workflows that remove the need for DeFi protocols to materially change how they consume oracle data.

- With Chainlink being the most widely used oracle solution across DeFi, SVR can drive economies of scale where the most opportunities and highest revenue potential for searchers and subsequently DeFi protocols exists.

Based on real-world testing, we believe Chainlink SVR can expect to achieve a realistic value recapture rate of approximately 40% (i.e., for every \$100 that would have been leaked via liquidation MEV, \$40 was recaptured). While some alternative solutions have claimed to achieve a higher efficiency rate for recapturing liquidation MEV, we have not seen conclusive real-world data to showcase this. We believe that 40% is a conservative but realistic estimate—real life performance data will inform actual results.

The initial version of SVR is only the beginning. Over time, Chainlink SVR aims to transition into a highly configurable, highly decentralized, generalizable, and cross-chain OEV solution built entirely on Chainlink’s battle-tested infrastructure. We are excited to see protocols maximize MEV revenue recapture across any supported chain while also eliminating unnecessary risks and timing delays introduced by alternative OEV solutions.

How The Initial Version of Chainlink SVR Works

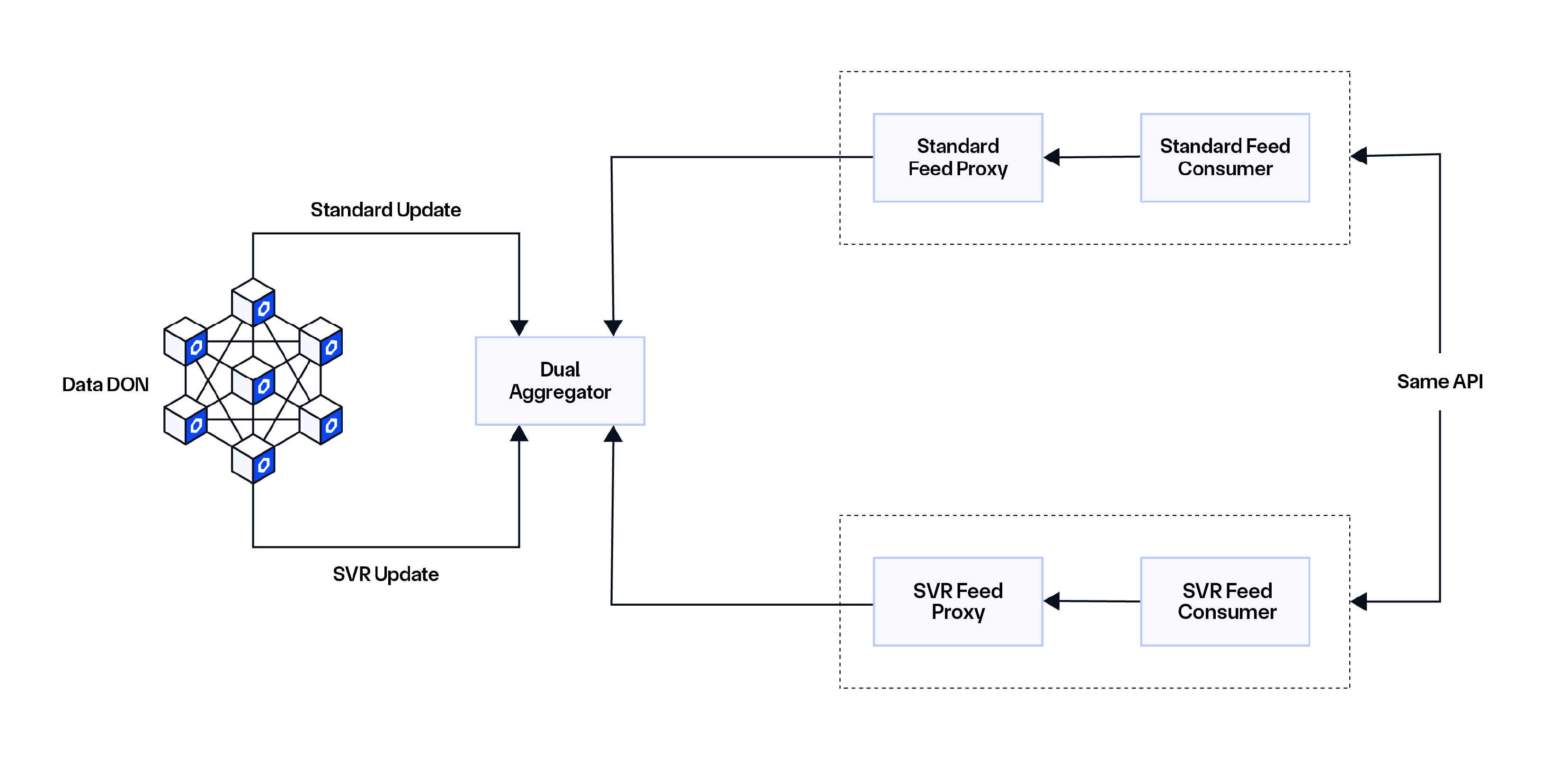

The initial implementation of Chainlink SVR consists of a parallel set of Chainlink Price Feeds, powered by the same established DON architecture that secures existing Price Feeds.

SVR-enabled Chainlink Price Feeds were deployed in order to recapture liquidation-related MEV for lending protocols that integrate the solution, while still retaining the standard Chainlink Price Feeds as a fallback. The “Dual Aggregator” Price Feed design enables a single Chainlink Data DON to produce oracle reports exactly the same as they do today while transmitting the oracle report onchain via different methods. SVR Feeds are based on existing Chainlink contracts and interfaces, greatly reducing the integration burden on existing Chainlink users since minimal code changes are required (potentially even as minimal as pointing to the new aggregator or SVR feed).

The oracle report sent to the SVR-enabled Price Feed transmits updates onchain via Flashbots MEV-Share, where the right to bundle a liquidation transaction with the oracle report update is auctioned to searchers in a permissionless manner. In parallel, the same oracle report is also transmitted onchain via the public mempool to the existing standard Price Feeds, which serves as a fallback to mitigate potential risk scenarios. Users of the standard Price Feed are completely unaffected by anything SVR-related, as it is opt-in.

In the case of a transmission failure by the SVR-enabled Price Feed (i.e., MEV-Share failure), there is a fail-safe mechanism to ensure that the feed can still report a price to the DeFi protocol. When the SVR-enabled Price Feed is determined to be stale by a configurable time period, it will return the latest price report from the standard Price Feed before the cutoff point. This delay is necessary to avoid liquidators extracting value by bypassing the value recapture mechanism provided by Chainlink SVR.

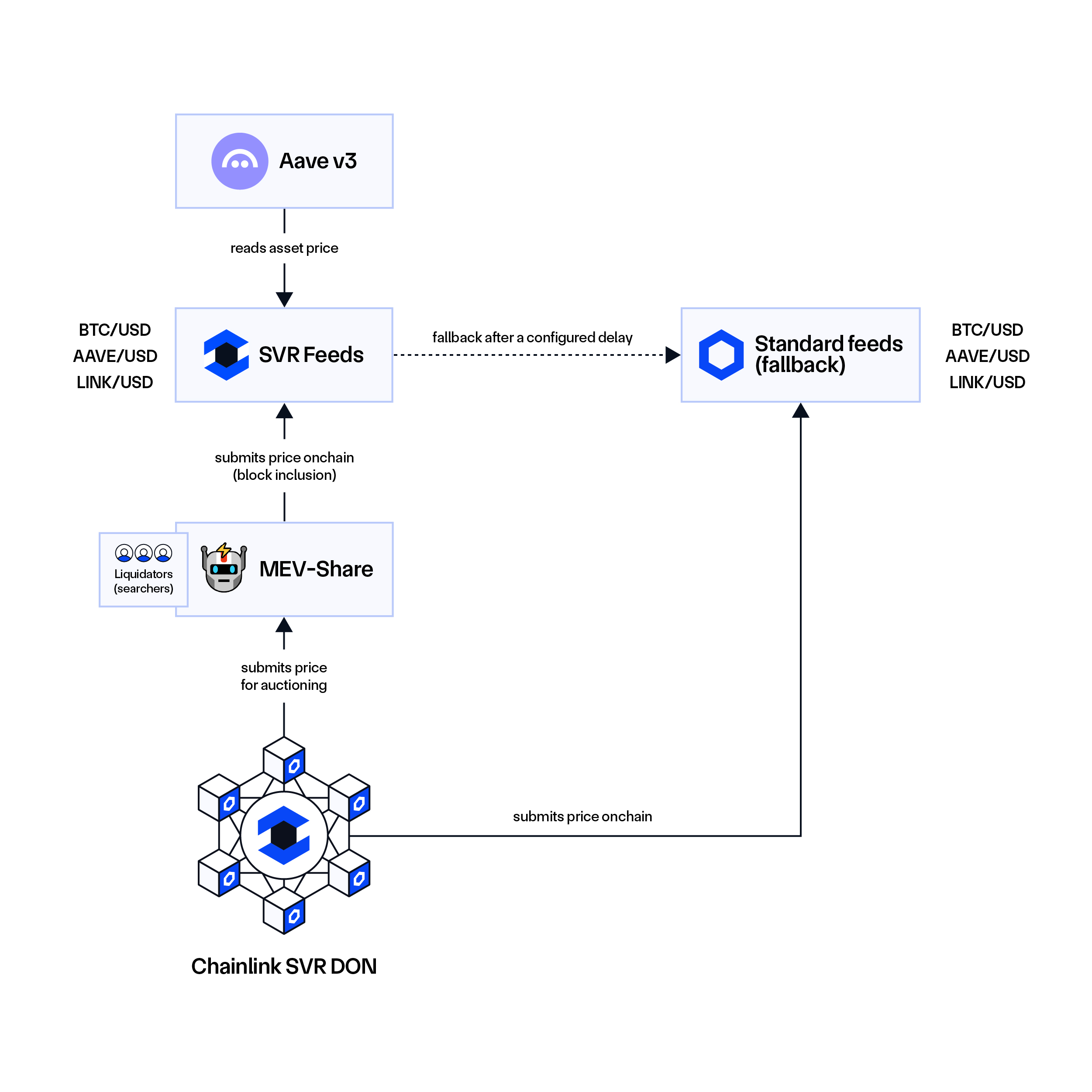

The figure below provides a high-level overview of how SVR is integrated within Aave V3 on Ethereum.

The flow in the figure works as follows:

- The Chainlink Data DON produces a price oracle report exactly as today (i.e., by a heartbeat or deviation threshold). However, the price report is transmitted twice, from different accounts.

- One price report is transmitted to the standard Price Feed via the public mempool (the same as today).

- Another price report is transmitted to an SVR Price Feed contract through a Flashbots Protect RPC endpoint.

- MEV-Share is an open-source protocol that selectively shares data about transactions, such as price oracle updates, with searchers who bid to include the transactions in bundles shared with builders. Builders then select the highest searcher bid and include the relevant backrun and liquidation transactions in a block. If no bid is placed, then the price oracle report is published onchain without any backrunning liquidation transaction.

- When the price report and the backrunning liquidation transactions are published onchain, then:

- The price report updates the SVR Price Feed.

- The backrunning transaction uses the price update to liquidate the relevant positions.

- Most of the value is recaptured by Aave and Chainlink.

- In the described example, the SVR feed returns an updated price. However, if no fresh price is available (e.g. if MEV-Share fails), the feed contract connected to Aave has a fail-safe mechanism that returns a price from the standard Chainlink Price Feed at an adjustable delay.

Economics

The oracle-related MEV recaptured by Chainlink SVR is planned to be split at a standard rate between integrating DeFi protocols and the Chainlink Network. This split provides DeFi protocols with an additional revenue stream while also supporting the economic sustainability of Chainlink oracles by covering transaction gas costs and other ongoing infrastructure expenses. Note that the SVR fee splits with users, and the use of SVR fees within the Chainlink Network, may be subject to change in the future, with the goal of generating sustainable economics between DeFi protocols and the oracles that power them.

Because of the deep, long-standing partnership between the Chainlink and Aave communities and Aave’s role as a launch partner, the initial discounted fee split with Aave is 65% to the Aave ecosystem and 35% to the Chainlink ecosystem for the first six months.

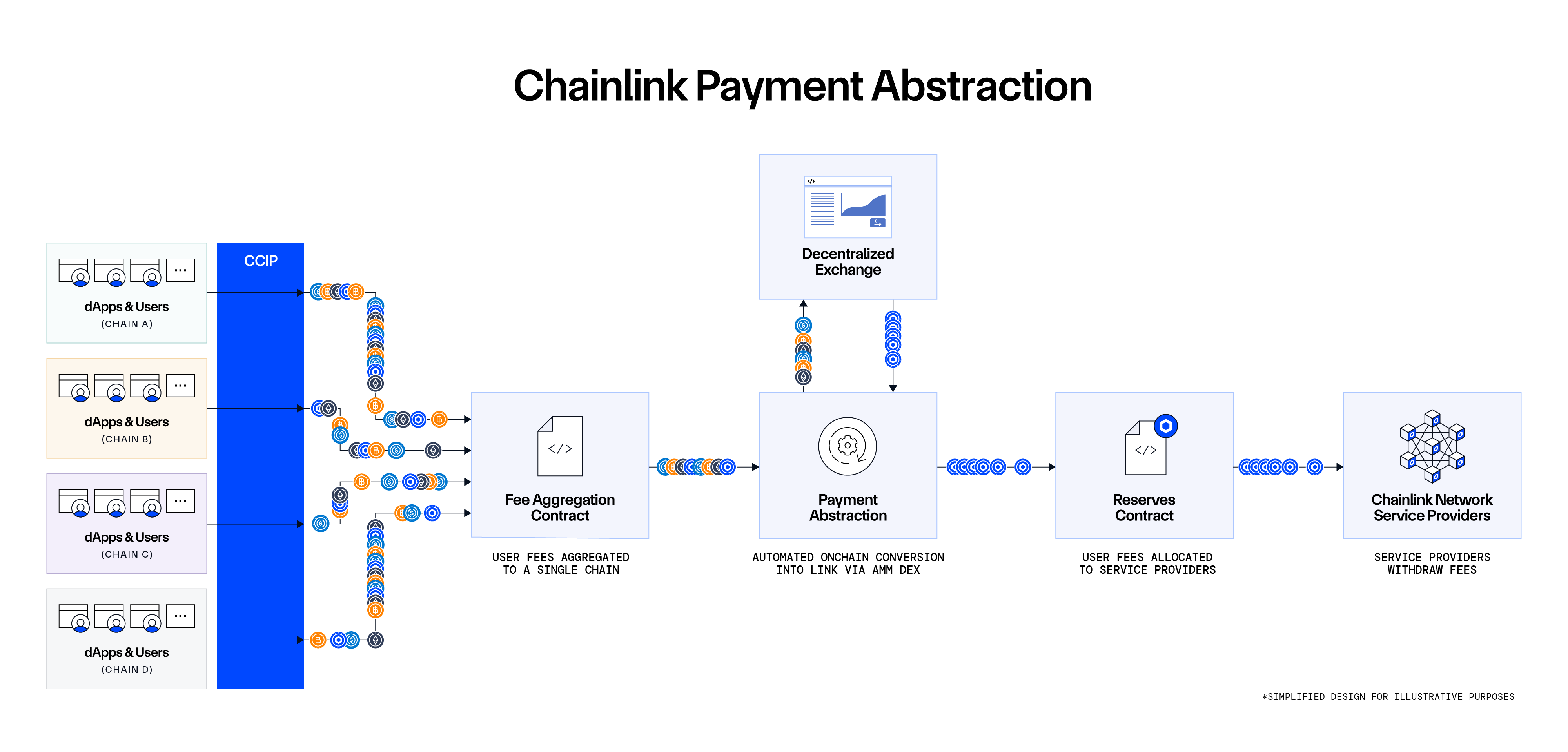

Chainlink SVR is the first Chainlink service to be connected to the Payment Abstraction system. Payment Abstraction is a system of onchain smart contracts that significantly help reduce billing and payment friction for users and developers interacting with Chainlink services. The system is designed to convert fee tokens into LINK via existing Decentralized Exchange (DEX) contracts. More information about Payment Abstraction and the use of SVR fees within the Chainlink Network can be read here.

Interested in Recapturing MEV Through Chainlink SVR?

If you’re a DeFi protocol interested in integrating Chainlink SVR to recapture MEV, check out the docs or reach out to discuss an integration.

—

Disclaimer: This post is for informational purposes only and contains statements about the future, including anticipated product features, development, and timelines for the rollout of these features. These statements are only predictions and reflect current beliefs and expectations with respect to future events; they are based on assumptions and are subject to risk, uncertainties, and changes at any time. There can be no assurance that actual results will not differ materially from those expressed in these statements, although we believe them to be based on reasonable assumptions. All statements are valid only as of the date first posted. These statements may not reflect future developments due to user feedback or later events and we may not update this post in response. Please review the Chainlink Terms of Service, which provides important information and disclosures.

Note: This blog was updated after publication to reflect current economic parameters.