Chainlink Price Reference Data for DeFi

All Price Reference Oracle Networks Powered by Chainlink in One Location

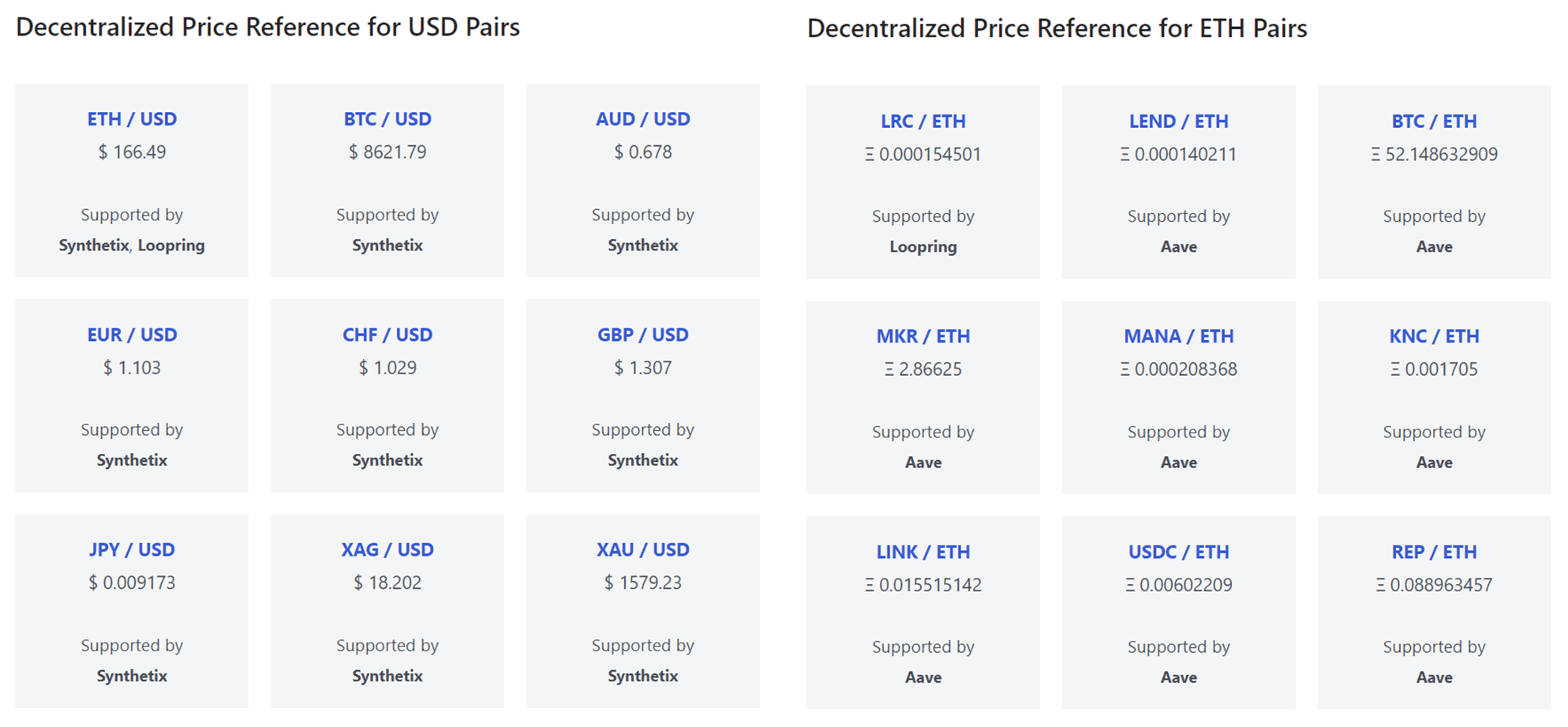

The DeFi ecosystem now has access to the largest collection of on-chain market data in the entire existence of building open financial products on Ethereum! With over 30 Decentralized Oracle Networks now live on Ethereum Mainnet and in use by leading DeFi applications like Synthetix, we can now say that the DeFi space is slowly growing with the help of high-quality on-chain data.

Use the new Chainlink Price Reference Data For DeFi to explore and gain access to this growing list of cryptocurrency, fiat currency, and commodity prices available on-chain and secured by Chainlink’s decentralized oracle networks.

Collectively, these decentralized oracle networks secure over 100M USD in value for a variety of leading DeFi products across numerous financial markets, such as ETH/USD, BTC/USD, XAG/USD, MKR/ETH, and more.

Chainlink’s Price Reference Data oracle networks vastly expand the amount of secure and reliable data accessible to Ethereum Dapps, greatly accelerating the rate at which new DeFi products can be successfully launched. Chainlink Decentralized Oracle Networks for Price Reference Data are a shared community resource supported by its users, who pay less for using these oracle networks than it would take for them to broadcast the same data individually, while benefiting from a significant increase in the security created by the decentralization of oracle networks.

The Need for Chainlink Reference Data

DeFi requires constant access to real-time market data, especially prices, to reliably execute the logic underpinning applications. For instance, money (Ampleforth), derivatives (Synthetix), lending (Aave), and decentralized exchange (Loopring) protocols are all examples of applications that need to quickly know the price of certain assets before performing a core on-chain function.

Even if the contract logic is composed of high-quality code, the outputs of the smart contract are fully dependent on the quality of the inputs received. This means that securing accurate market data is as crucial to the security of decentralized finance as the underlying smart contract itself.

While a few Dapps can operate solely using on-chain data, conservatively, 90+% of DeFi applications need a steady connection to off-chain data to function in a trusted, robust, and economically sustainable manner. Most price discovery happens outside of blockchain networks (off-chain), such as on major exchanges, and prices vary across these platforms. As a result, obtaining the most reliable price for an asset requires aggregation from multiple off-chain data sources.

The only way for a blockchain to obtain this off-chain information is through oracles. However, aggregating data on-chain is expensive, especially since most projects need a consistent stream of on-chain price updates to keep pace with market volatility. Chainlink decentralized oracle networks fill this need.

The Underlying Design of Oracle Reference Data Networks

Chainlink’s decentralized oracle networks are composed of security-reviewed, Sybil-resistant, and fully independent nodes. These nodes are run by leading blockchain DevOps and security teams, many of which have extensive experience running POS nodes that secure millions of dollars in value across multiple blockchain networks.

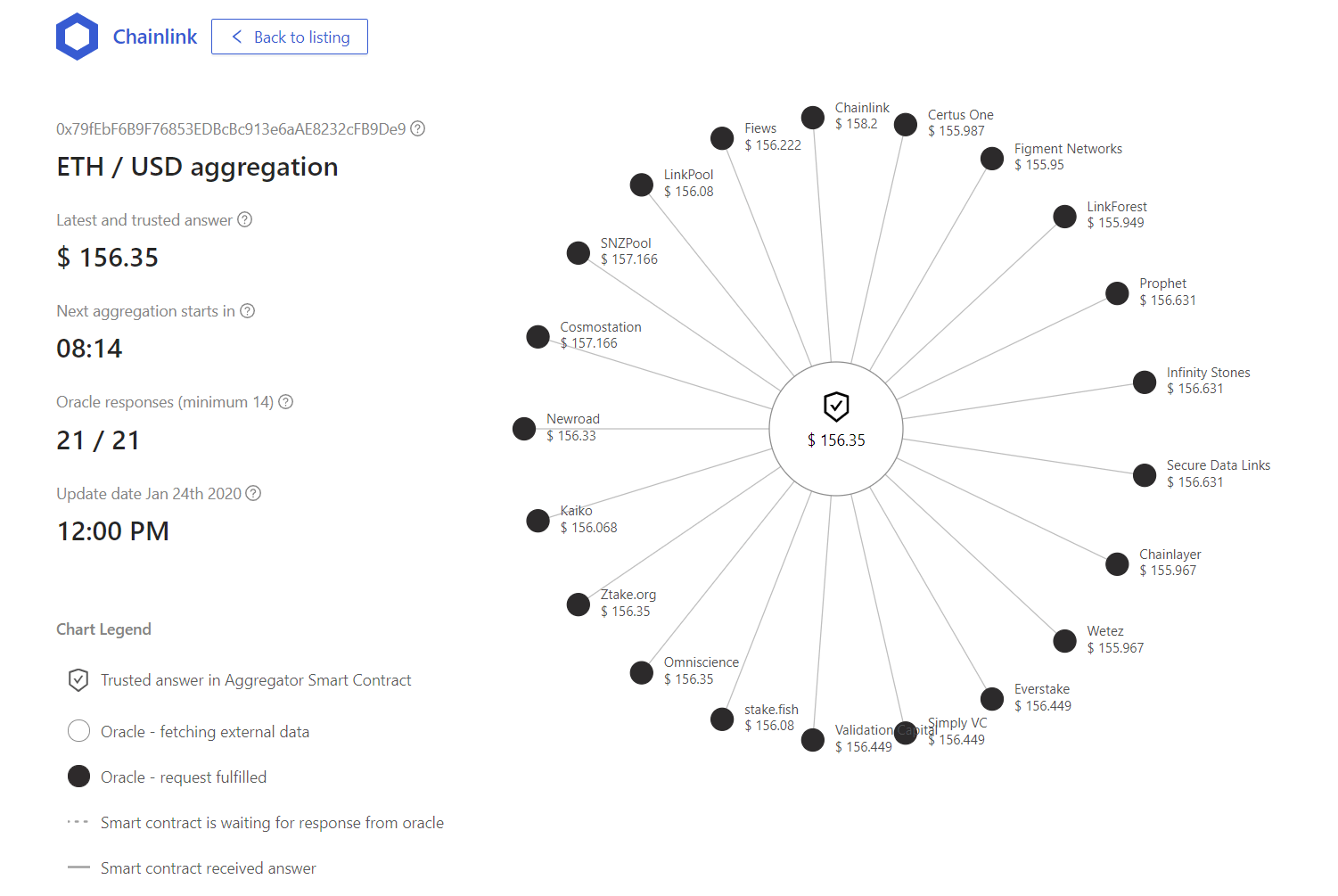

Every time there is a request for an on-chain price update, each node in the network is tasked with retrieving and submitting the current price. The responses are then aggregated together off-chain and pushed on-chain as a single price update. Incorporating decentralization at the node level ensures high availability for all Chainlink-powered price reference data oracle networks.

They also maintain data quality via redundancy, by having each node retrieve the price from an API such as CoinMarketCap, CoinGecko, etc., which aggregates data from many sources. Currently, there are seven data aggregators being used on most networks. Thus, the on-chain price update is a cumulative aggregation of individual nodes that retrieved the price from a trusted data aggregator. This ensures that DeFi applications constantly interact with high-quality market data.

Supporting projects can call these reference contracts to access up-to-date price feeds that trigger the execution of core product functions. The on-chain updates can be programmed to occur based on time (hourly, daily, etc.), price deviation (such as every 1% change in price), or a customized combination adapted to the specific user’s needs.

Gaining Deeper Insights into Chainlink Reference Data

The new Chainlink Price Reference Data for DeFi resource enables easy access to all the price reference data supplied by Chainlink oracle networks from one user interface. It’s a great resource for locating the recently launched reference data and allows users to easily access a wealth of information about the infrastructure, functionality, and current/historical data of the decentralized oracle networks that secure these prices.

Some of the operational details available to explore for each Chainlink Price Reference Oracle Network include:

- Oracles and Dapps Involved: Explore the individual oracles securing a particular price feed, as well as the Dapps that support and use particular price reference oracle networks. Users can know exactly who is securing their data and how many live applications leverage certain reference data.

- Oracle Network Functionality: Stay informed about the current on-chain price, the next price update, and historical data regarding the frequency and actual price updates recorded on-chain by each decentralized oracle network. Users can understand how the reference data contract is programmed, as well as perform analysis on its historic functionality.

- On-Chain Metrics for Nodes: Examine live data regarding the performance of individual nodes that make up a decentralized network, such as the amount of gas used, individual price submissions, and the exact block on which they submitted data.

We encourage you to explore the different network visualizations and operational details in more depth and provide any additional feedback to improve the user experience via our Discord.

Build Your Own Price Reference Oracle Network

If you are a DeFi project and would like to build your own customized oracle reference data network powered by Chainlink, as showcased by supporting projects, please reach out to us here.

You can easily use these oracle networks to quickly and securely launch, add more capabilities to and/or just greatly improve the security of your smart contracts.