Chainlink Automation Open Beta Is Live: A Fully Decentralized Service for Smart Contract DevOps

We are excited to announce that the Chainlink Automation Open Beta is now opening up for initial users, community review, and feedback.

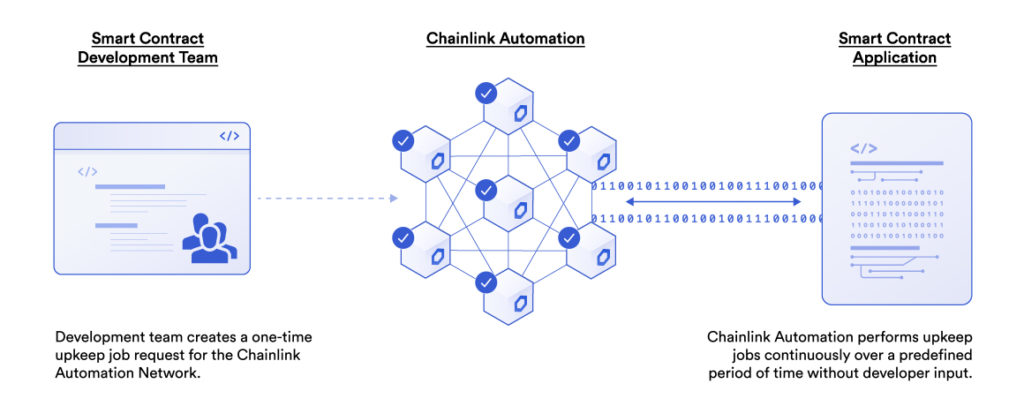

Chainlink Automation provides smart contract developers, decentralized applications (dApps), and decentralized autonomous organizations (DAOs) with a highly reliable, decentralized, and cost-efficient method of triggering smart contract functions and regular contract maintenance, creating a never-before-seen form of fully decentralized DevOps capabilities. Smart contract applications can use Chainlink Automation to strengthen the uptime guarantees of critical on-chain functions and achieve end-to-end decentralized automation without relying on an additional layer of trust. The result is DeFi and the broader smart contract economy having more robust infrastructure to scale and secure higher amounts of value for users.

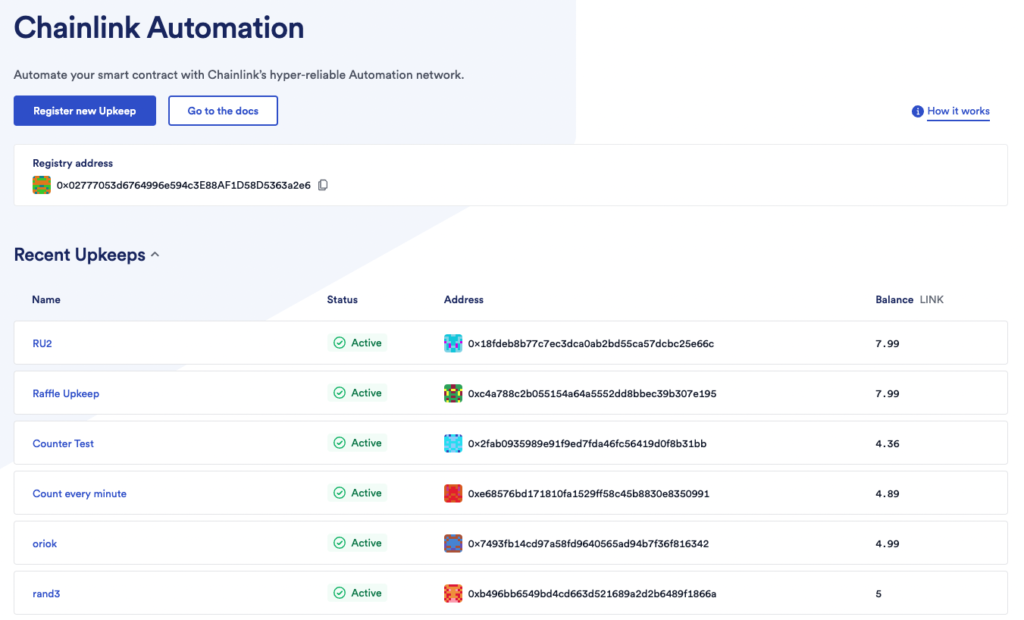

Chainlink Automation is currently in Open Beta with initial users, so we can gather final feedback and continue to improve the decentralized service’s experience based on user needs. To try the Chainlink Automation Open Beta, visit https://automation.chain.link. Development teams can also opt to register and manage Chainlink Automation jobs directly within the new OpenZeppelin Defender platform—a security operations suite for Ethereum and EVM-based projects—through the following link: https://openzeppelin.com/defender/

Please reach out to our team with any feedback. If you want to learn more about Chainlink Automation on a technical level, visit the Chainlink documentation: https://docs.chain.link/docs/chainlink-automation/introduction/.

Chainlink Automation can perform a variety of compute operations, monitoring, and time- and event-based tasks for smart contracts, such as:

- Execute limit orders on decentralized exchanges

- Mint tokens when reserves increase

- Harvest yield from vaults

- Rebase elastic supply tokens

- Trigger automated trading strategies

- Liquidate undercollateralized loans

- Release locked assets after periods of inactivity

- Top up token balances falling below a minimum threshold

As a new decentralized service available through the Chainlink Network, DeFi and other hybrid smart contracts can use Chainlink Automation as hyper-reliable transaction manager for various smart contract operations, initially on Ethereum. Since the Chainlink Automation Network leverages the same time-tested and battle-hardened pool of professional node operators that currently power Chainlink Data Feeds—now securing billions in smart contract value across DeFi—users receive strong liveness guarantees that critical contract functions will operate as intended. Developers can also eliminate the time, resources, and risks involved with performing maintenance operations manually or through centralized systems.

How Chainlink Automation Enhances Smart Contract Applications

Smart contracts are pieces of code that run deterministically on the blockchain. However, smart contracts have two fundamental limitations: 1) they are disconnected from external resources, limiting their ability to use real-world data or leverage off-chain computations as a means of augmenting on-chain functions, and 2) they are asleep by default, requiring some external entity to wake them up when it’s time to perform on-chain functions and change contract state. Chainlink is actively removing the first limitation for smart contract developers, commonly called the oracle problem, by provisioning an increasingly expansive array of high-quality external data feeds and trust-minimized off-chain computations. Chainlink Automation now provides a way to overcome the second limitation of reliably triggering regular contract functions.

Chainlink Automation fills the role of waking up smart contracts by issuing on-chain transactions that trigger the smart contract’s logic to execute on the blockchain. Chainlink Automation is distinct from Chainlink oracles. Chainlink oracles fetch external data or perform off-chain computation and then store the results on the blockchain, while Chainlink Automation lets the smart contract know when to execute a function. Oftentimes the smart contract will refer to the oracle report as part of its execution after being woken up by the Upkeep. Chainlink Automation allows you to define the exact set of conditions on which to trigger the execution of a function. This could be based on time (e.g., every day at 4 PM EST), events (e.g., the completion of a sports event), a computation (e.g., a loan is determined to be undercollateralized), or any combination.

In the early days of DeFi, development teams began decentralizing their oracle mechanism to improve their smart contacts’ end-to-end security and reliability. Chainlink Automation enables a similar phenomenon, empowering development teams to decentralize their automation mechanisms to enhance the security and reliability of their smart contract triggers. Since Chainlink Automation manages critical smart contract functions that are often time-sensitive and responsible for user funds, Chainlink Automation plays a vital role in guaranteeing timely execution of those functions and removing central points of failure like manually run automation services.

To best understand the role of Chainlink Automation, let’s look at two different use case examples involving Aave and Synthetix:

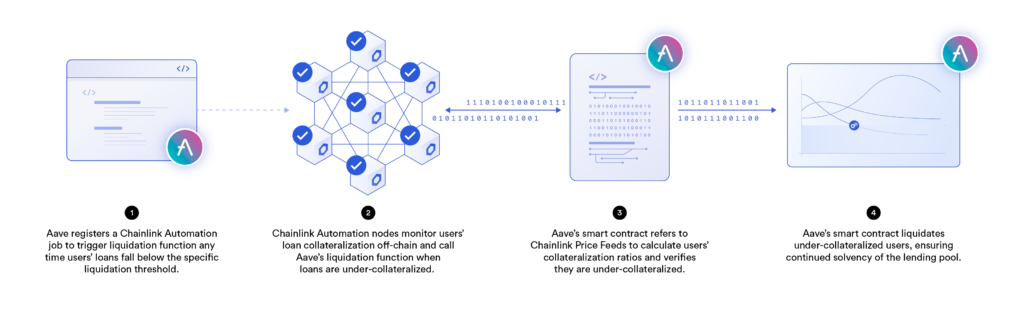

Aave

Aave is a decentralized money market where users supply collateral to receive on-chain loans. Since Aave loans are over-collateralized—the collateral value/outstanding loan value is greater than 100%—liquidating under-collateralized loans using Chainlink Automation is critical to keeping Aave lending pools solvent and protecting the capital of lenders.

- Aave registers a Chainlink Automation job to trigger its liquidation function any time users’ loans fall below the specific pool’s liquidation threshold (e.g., 150%).

- Chainlink Automation monitors the loan collateralization of users off-chain and call Aave’s liquidation function when under-collateralized loans are detected.

- Aave’s smart contract refers to Chainlink Price Feeds to calculate users’ collateralization ratios and verifies they are under-collateralized.

- Aave’s smart contract liquidates users when their collateralization ratio is below the specified liquidation threshold, ensuring continued solvency of the lending pool.

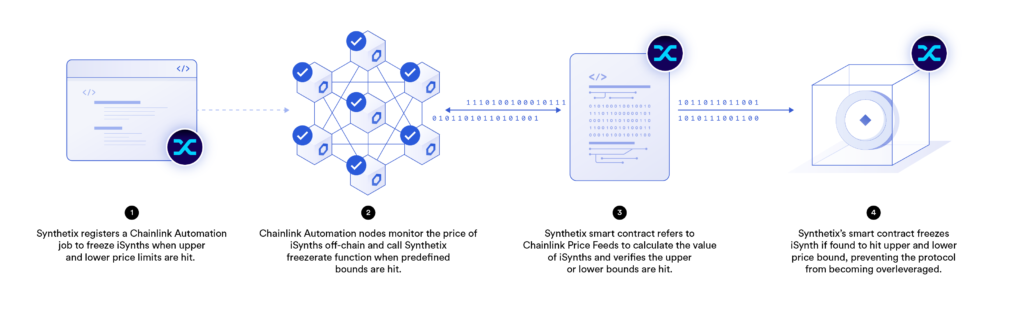

Synthetix

Synthetix is a decentralized derivatives protocol where users can get on-chain exposure to over-collateralized synthetic assets and trade them with zero slippage against a liquidity pool contract. Maintaining Synthetix requires several maintenance functions, including automating the freezing of iSynths—which inversely track the price of assets via Chainlink Price Feeds—when prices reach predefined upper and lower limits, providing end users with more effective leverage.

- Synthetix registers a Chainlink Automation job to freeze iSynths when upper and lower price bands are hit.

- Chainlink Automation monitors the price of iSynths off-chain and call Synthetix’s freezerate function when found to hit their predefined upper and lower bounds.

- Synthetix smart contract refers to Chainlink Price Feeds to calculate the value of iSynths and verifies the upper or lower bounds are hit.

- Synthetix smart contract freezes iSynths when upper and lower price bounds are hit, preventing the protocol from becoming overleveraged and protecting stakers in the liquidity pool contract.

Why Chainlink Automation Provides Development Teams a Superior Task Management Solution

Chainlink Automation utilizes a decentralized network of security-reviewed and historically proven node operators, already securing tens of billions in DeFi, and utilizing LINK in the existing highly reliable cryptoeconomics of the Chainlink Network. Nodes are selected based on a rotating jobs framework with automated time-based failover to avoid rising user costs from job competition. The architecture of the Chainlink Automation Network provides several unique benefits to users:

- High Uptime — Chainlink Automation is run by the same high-quality Chainlink nodes, which are already securing tens of billions of TVL throughout DeFi, across various network conditions. Chainlink nodes are operated by professional DevOps teams with established and well-documented on-chain reputations for providing high reliability for existing decentralized oracle networks like price feeds.

- Low Costs — The Chainlink Automation Network has several gas-optimizing features that can help lower the costs of running maintenance tasks, as well as a rotating node selection process to further lower and stabilize the costs of smart contract DevOps.

- Decentralized Execution — Chainlink leverages a decentralized pool of nodes for more secure contract automation, saving teams time and mitigating the risks around manual interventions or centralized servers.

- Transparent Reputation — Chainlink provides a robust reputation framework and set of on-chain monitoring tools for users to independently verify the historical performance of nodes.

- Trust-Minimized Verification – Chainlink Automation Network allows contracts to verify calldata when Upkeep jobs are executed before taking any significant actions, making Chainlink Automation suitable for use in trust-minimized dApps.

- Expandable Computation – Chainlink Automation Network can perform off-chain computations for smart contracts, allowing developers to build more advanced dApps at lower costs.

By outsourcing smart contract maintenance to Chainlink Automation, development teams can scale the security and reliability of their decentralized applications to match the increasing TVL they are responsible for securing on behalf of users.

We Want Your Feedback

We’re launching Chainlink Automation into Open Beta so that the community can participate in the final steps for validating key features, gathering feedback, and improving the developer experience based on your needs. We want to hear from you about how we can improve Chainlink Automation, so please share any feedback. We look forward to supporting development teams across the ecosystem and ramping Chainlink Automation into a robust off-chain service that will help power a new generation of highly efficient and secure hybrid smart contracts.

Start using Chainlink Automation in Open Beta today by visiting https://automation.chain.link or the Chainlink documentation at https://docs.chain.link/docs/chainlink-automation/introduction/. You can also register and manage your Chainlink Automation jobs directly within the OpenZeppelin Defender platform. For more details, refer to their recent integration announcement.

To learn more about Chainlink, visit chain.link, subscribe to the Chainlink newsletter, and follow @chainlink on Twitter.