Chainlink’s Work With Major Tokenized Asset Platforms and Stablecoin Issuers

Tokenized assets and stablecoins are becoming the dominant use cases in the blockchain industry, with a combined market size projected to reach tens of trillions of dollars by the 2030s. The tokenization of real-world assets, from funds and treasuries to equities, is accelerating, while stablecoins continue to underpin global onchain liquidity and payments infrastructure.

Chainlink provides the foundational infrastructure enabling this transformation. Through the launch of the Chainlink Runtime Environment (CRE), institutions can securely build, operate, and connect tokenized assets and stablecoins across chains and markets. This unified platform ensures reliable data, interoperability, compliance, and privacy, powering onchain finance with the same guarantees of trust and connectivity that institutions expect in traditional financial systems.

In this collection, you’ll find major Chainlink announcements and integrations that are advancing the tokenized asset and stablecoin ecosystem, demonstrating how Chainlink’s infrastructure is accelerating the adoption of tokenization globally.

STABLECOINS & PAYMENTS

1. Chainlink and Apex Group Advance Institutional-Grade Stablecoin Infrastructure in Support of the Bermuda Monetary Authority’s Embedded Supervision Initiative

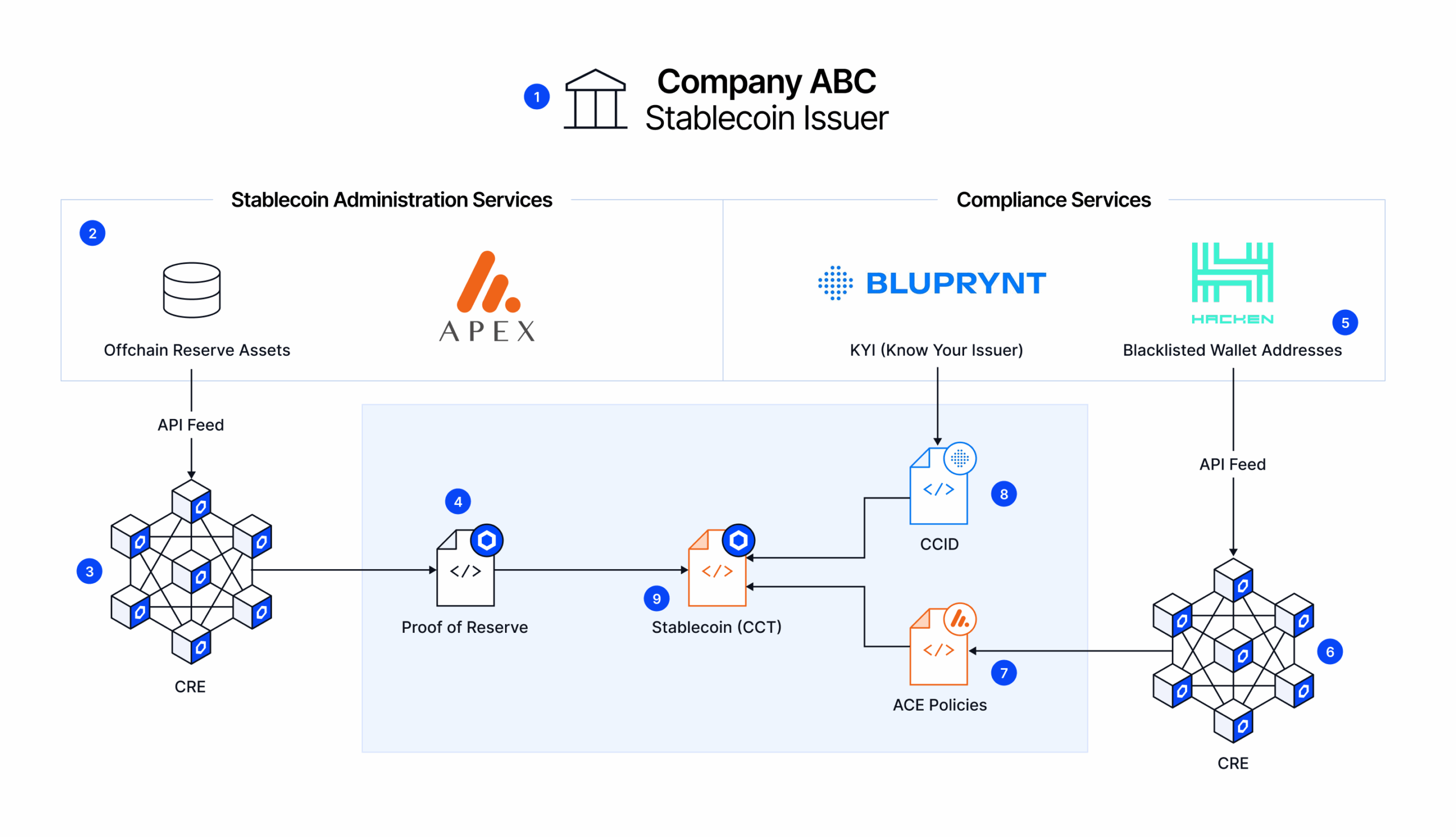

Chainlink and Apex Group have successfully created an institutional-grade stablecoin infrastructure solution supporting the Bermuda Monetary Authority’s embedded supervision initiative.

Conducted in collaboration with the Bermuda Monetary Authority as part of its Innovation Hub, the solution enables a unified, compliance-forward, institutional-grade stablecoin framework powered by the Chainlink Cross-Chain Interoperability Protocol (CCIP), Automated Compliance Engine (ACE), and Proof of Reserve.

The Bermuda Monetary Authority (BMA) serves as the regulator for Bermuda’s financial services sector, responsible for issuing the Bermudian dollar and overseeing institutions such as banks and insurers. As of 2023, Bermuda hosted over 1,200 registered insurers that collectively underwrote more than $277 billion in gross premiums. In 2022, the banking sector reported its consolidated assets as $26 billion.

In the solution, Chainlink serves as the official infrastructure provider, enabling regulated asset issuers to operate through a full-stack oracle platform. CCIP powers cross-chain token transfers using the Cross-Chain Token (CCT) standard, enabling zero-slippage interoperability across public and private blockchains. ACE enforces jurisdiction-specific regulatory and operational policies directly onchain. Chainlink Proof of Reserve posts real-time reserve data onchain, providing ongoing transparency into the collateral backing the stablecoin. Secure Mint ensures supply is only issued when properly collateralized, helping prevent infinite mint attacks.

The solution also brings together several Chainlink ecosystem participants. Apex, a global services provider with $3.5 trillion in assets, provides reserve custody, management, and tokenization infrastructure. bluprynt, a trusted identity issuer backed by Robinhood, links verified entities to mint authority wallets. Hacken, a blockchain security and compliance platform with more than $430 billion in verified assets, delivers real-time compliance and risk dashboards for enhanced onchain visibility.

2. Chainlink CCIP Powers Cross-Chain Transfers of Circle’s USDC To Solana

Transporter now supports cross-chain transfers of @circle’s USDC to and from Solana, powered by Chainlink Cross-Chain Interoperability Protocol (CCIP). As one of the largest stablecoins in the world, USDC can now move across chains with enhanced security, transparency, and trust.

This integration brings Chainlink’s battle-tested interoperability infrastructure to Solana via Transporter, the CCIP-powered bridge for moving value across chains. With support for native Solana USDC now live, users gain secure access to high-performance USDC transfers between Solana and leading chains like Ethereum, Base, and Avalanche.

USDC’s cross-chain connectivity on Transporter is enabled by Chainlink’s Cross-Chain Token (CCT) standard, which ensures native asset fungibility, tamper-proof transaction routing, and programmable settlement logic. This unlocks a foundational layer for building internet-native capital markets powered by trust-minimized stablecoins.

now live on Transporter: cross-chain transfers of @circle’s USDC to and from @solana

one of the largest stablecoins in the world

now secured by the interoperability standard

unlocking internet capital marketsmove USDC to/from Solana with https://t.co/15FBPjPSd4 pic.twitter.com/lpmvKz6j9M

— transporter. (@transporter_io) November 24, 2025

3. Chainlink CCIP Powers GHO’s Cross-Chain Expansion To Base

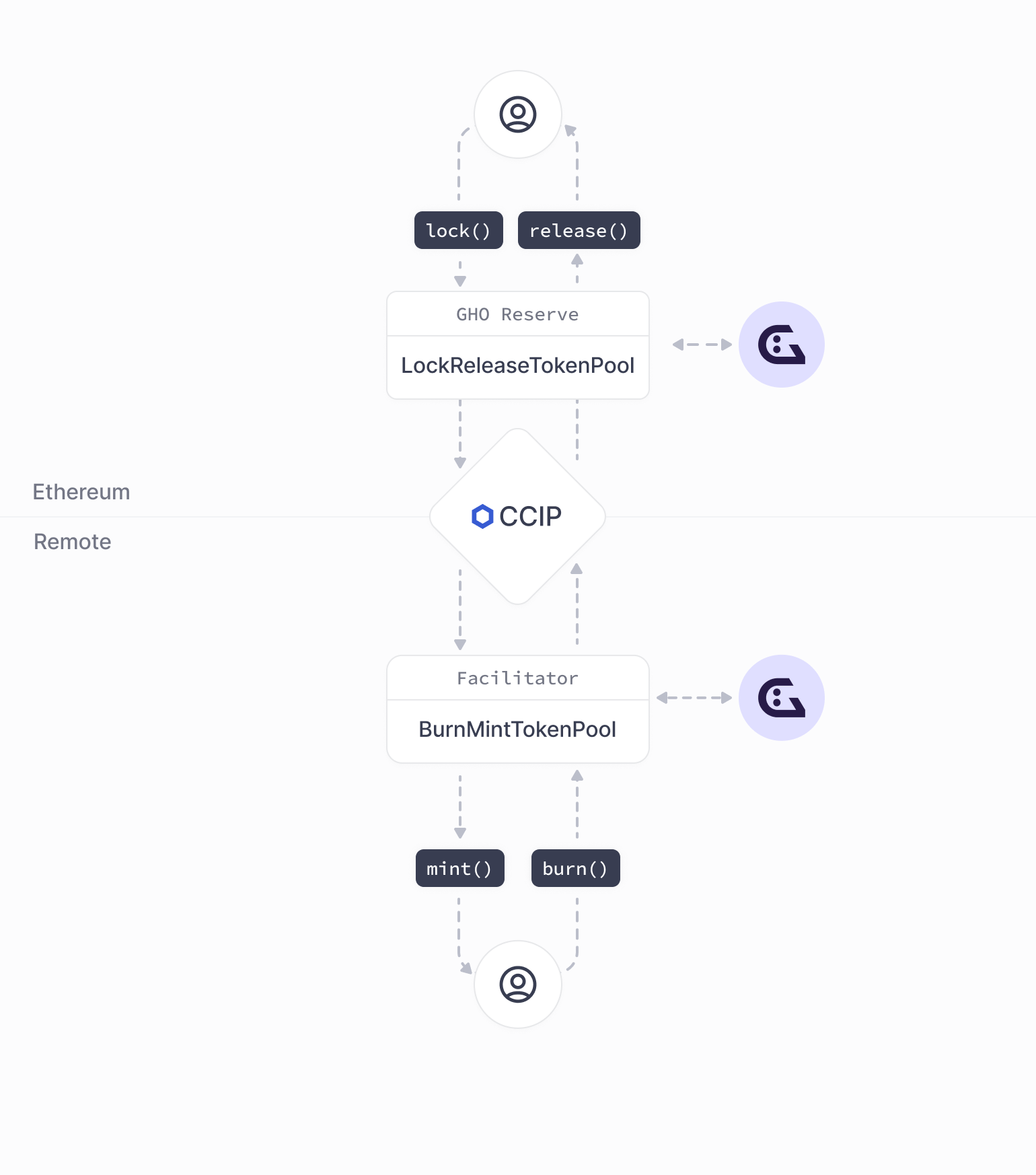

GHO’s expansion to Base builds on the GHO Cross-Chain Architecture adopted by Aave Governance. This architecture utilizes Chainlink CCIP, the standard for secure cross-chain interoperability, and the Cross-Chain Token (CCT) standard to enable GHO interoperability across supported networks: Ethereum, Arbitrum, and Base, giving Aave Governance granular control over cross-chain activity, including features like configurable rate limits, programmable token transfers, and risk management monitoring for transaction flows.

GHO uses a lock-and-mint model enabled by Chainlink CCIP, where tokens are locked on Ethereum while an equivalent amount is minted on the other network, keeping the total supply constant. As additional chains are supported, transfers between non-Ethereum chains will use a burn-and-mint model enabled by Chainlink CCIP for maximum capital efficiency and fungibility, while still being backed by reserves on Ethereum. This achieves security and flexibility for GHO’s future expansion across multiple blockchains. Backed by Chainlink’s battle-tested infrastructure, CCIP is widely adopted across DeFi and capital markets and supports existing Aave deployments, helping to achieve smooth and secure cross-chain expansion for GHO.

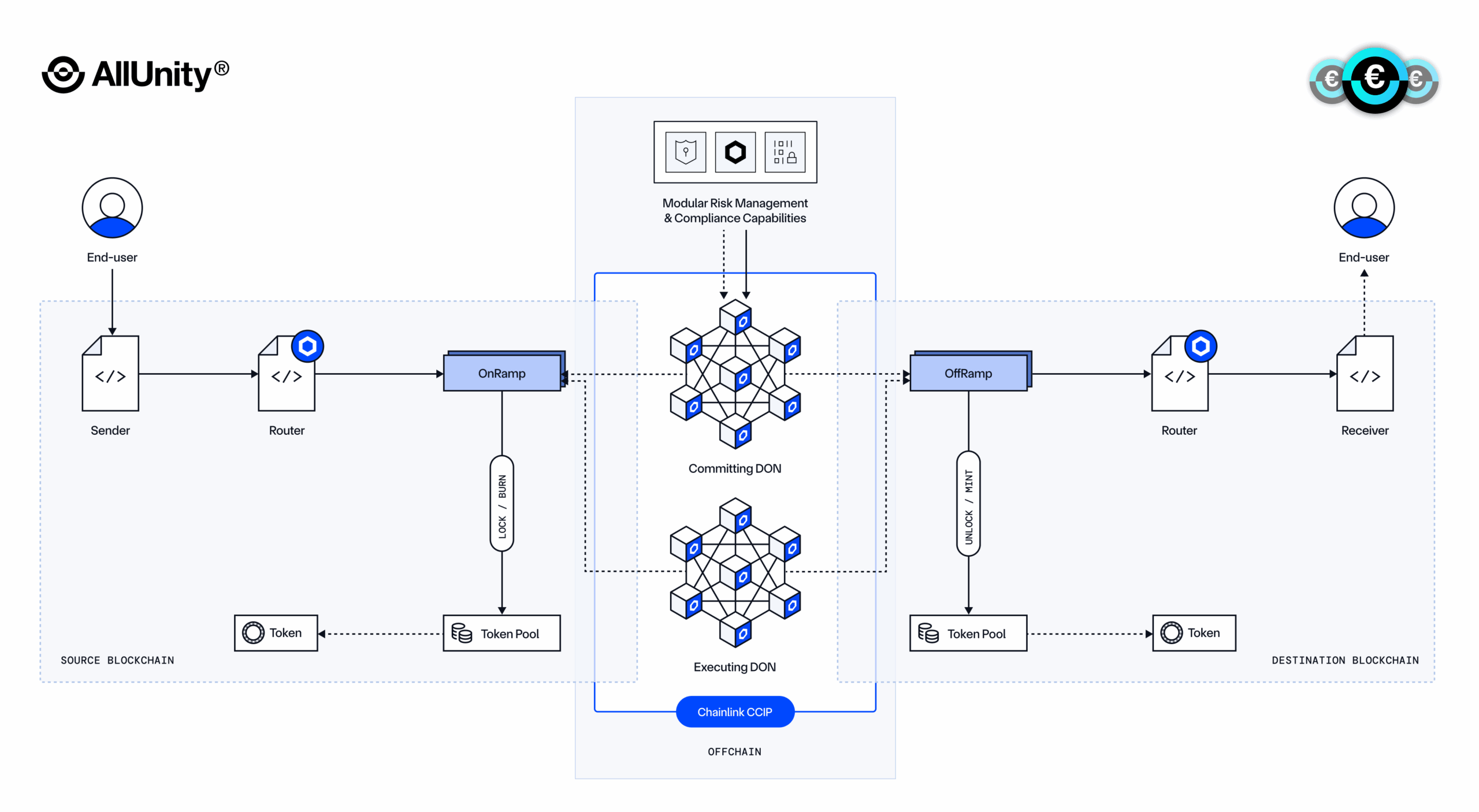

4. AllUnity Enters Strategic Partnership With Chainlink To Power Cross-Chain Stablecoin Payments Across Europe

AllUnity, the regulated e-money institute and the issuer of Germany’s first fully euro-backed MiCA-compliant stablecoin EURAU, has entered into a strategic partnership with Chainlink. By integrating Chainlink CCIP, EURAU evolves into a truly multi-chain stablecoin, meeting institutional requirements for interoperability, data integrity, and regulatory compliance across multiple jurisdictions. Leveraging CCIP’s burn-and-mint model, EURAU will benefit from native, zero-slippage cross-chain transfers while maintaining 1:1 parity of value and supply across all supported networks, a critical requirement for institutional-grade interoperability.

Via CCIP, EURAU will be natively issued first across Arbitrum, Base, Ethereum, Optimism, Polygon, and Solana, with future expansion to blockchain networks, such as Canton. This establishes a future-proof framework that provides AllUnity with unified liquidity, seamless interoperability, and scalable infrastructure to support the next generation of financial markets.

5. OpenEden Adopts Chainlink CCIP and Proof of Reserve To Supercharge USDO’s Interoperability and Transparency

OpenEden—a leading real-world asset (RWA) tokenization platform—integrated the Chainlink interoperability and data standards to strengthen USDO’s cross-chain functionality and onchain transparency, and is adopting Chainlink Price Feeds for reliable onchain pricing data. OpenEden leverages Chainlink’s CCT standard to provide USDO with secure cross-chain interoperability and real-time verifiable data on Ethereum and Base.

“One of USDO’s key features is full DeFi composability. By integrating Chainlink’s CCIP and Proof of Reserve, USDO gains added security, transparency, and cross-chain interoperability. Chainlink’s proven infrastructure also provides us with the reliability and trust needed for USDO to thrive in decentralized finance.”—Jeremy Ng, Founder and CEO of the OpenEden Group

6. x402 by Coinbase Is The First Payments Partner for The Chainlink Runtime Environment (CRE)

x402 is a protocol launched by Coinbase that enables APIs, apps, and AI agents to transact seamlessly over HTTP. x402 is now the first AI payments partner for the Chainlink Runtime Environment (CRE). Through this partnership, AI agents can discover, trigger, and pay for CRE workflows leveraging x402’s programmable payments layer, unlocking:

- Programmatic payouts from proprietary data—Chainlink ensures data authenticity, CRE enables execution, and x402 orchestrates payments between agents and providers.

- Monetizing CRE workflows—Builders can publish public or private workflows that anyone, including agents, can pay to use.

- An onchain, native protocol stack for agentic workflows—AI agents discover CRE workflows, verify results with Chainlink, pay autonomously using x402, and settle real-world outcomes onchain.

This marks a major shift from manual transactions to economically expressive AI that can participate directly in the onchain economy.

Erik Reppel, coauthor of the x402 whitepaper and Head of Engineering at CDP, said:

“Seeing industry leaders like Chainlink team up with x402 reinforces what we’ve long believed: onchain payments will power the future of AI. We’re excited to see what developers build with CRE and x402, creating new seamless, secure ways to transact onchain.”

7. GSR and Chainlink Form Strategic Partnership to Launch Stablecoin Enablement Program Powering The Next Wave of Stablecoin Innovation

GSR, a global crypto trading firm and liquidity provider, and Chainlink have partnered and launched a stablecoin enablement program powering the next generation of institutional-grade stablecoins.

The program provides stablecoin issuers with access to Chainlink’s industry-standard oracle platform, including its data, interoperability, privacy, and compliance standards, alongside GSR’s capital markets expertise, liquidity provisioning, and go-to-market support.

Together, Chainlink and GSR are enabling stablecoin protocols to meet the growing demand for trusted, cross-chain stablecoins that are designed for institutional usage, built-in compliance, and real-world utility.

Builders looking to bring secure, scalable stablecoins to market can already apply to the program: Apply here.

TOKENIZED FUNDS

1. Galaxy Integrating Chainlink CCIP and NAVLink to Power Tokenized Fund for State Street

Galaxy is integrating Chainlink CCIP and NAVLink to power the first tokenized fund with $4+ trillion AUM asset manager State Street. Through Chainlink, Galaxy leverages highly secure cross-chain interoperability and real-time NAV reporting.

State Street and Galaxy Asset Management are set to launch the tokenized liquidity fund that uses stablecoins for around-the-clock investor flows in 2026.

Galaxy is integrating Chainlink CCIP & NAVLink to power the first tokenized fund with $4+ trillion AUM asset manager @StateStreetIM.

Via Chainlink @galaxyhq leverages highly secure cross-chain interop & real-time NAV reporting.https://t.co/U1ykSnbbYj pic.twitter.com/kmO8x63Y0p

— Chainlink (@chainlink) December 11, 2025

2. Securitize and VanEck Bring VBILL to Aave Horizon and Adopt Chainlink NAVLink Feeds

Securitize and VanEck bring VBILL to Aave Horizon as an eligible collateral asset powered by Chainlink, the industry-standard oracle platform. Horizon’s infrastructure is powered by Chainlink’s NAVLink oracle framework and LlamaGuard NAV, delivering risk-adjusted NAV data for Securitize-managed tokenized funds like VBILL. This ensures every collateral position on Horizon reflects secure, institutionally reliable pricing.

Launched earlier this year in partnership with Securitize, VBILL is VanEck’s first tokenized fund. By integrating VBILL into Aave Horizon, qualified institutions can now borrow stablecoins against their VBILL holdings, turning tokenized Treasuries into productive onchain collateral for the first time. Together, Securitize’s TSSO and Chainlink’s NAVLink are delivering trusted NAV data onchain to provide transparency and consistency in how VBILL is valued within Horizon. This integration helps maintain accurate pricing and enhances the reliability of tokenized Treasuries as collateral, a critical component for institutional adoption.

“Horizon enables overcollateralized lending against RWAs within an institutional-grade compliance framework,” said Carlos Domingo, Co-Founder and CEO of Securitize. “Integrating VanEck’s VBILL with Aave and Chainlink expands access to one of the most trusted forms of onchain collateral and demonstrates how regulated assets can now move fluidly through DeFi.”

3. Spiko to Integrate The Chainlink Interoperability Standard to Enable Compliant Cross-Chain Access to $380M+ in Regulated Money Market Funds

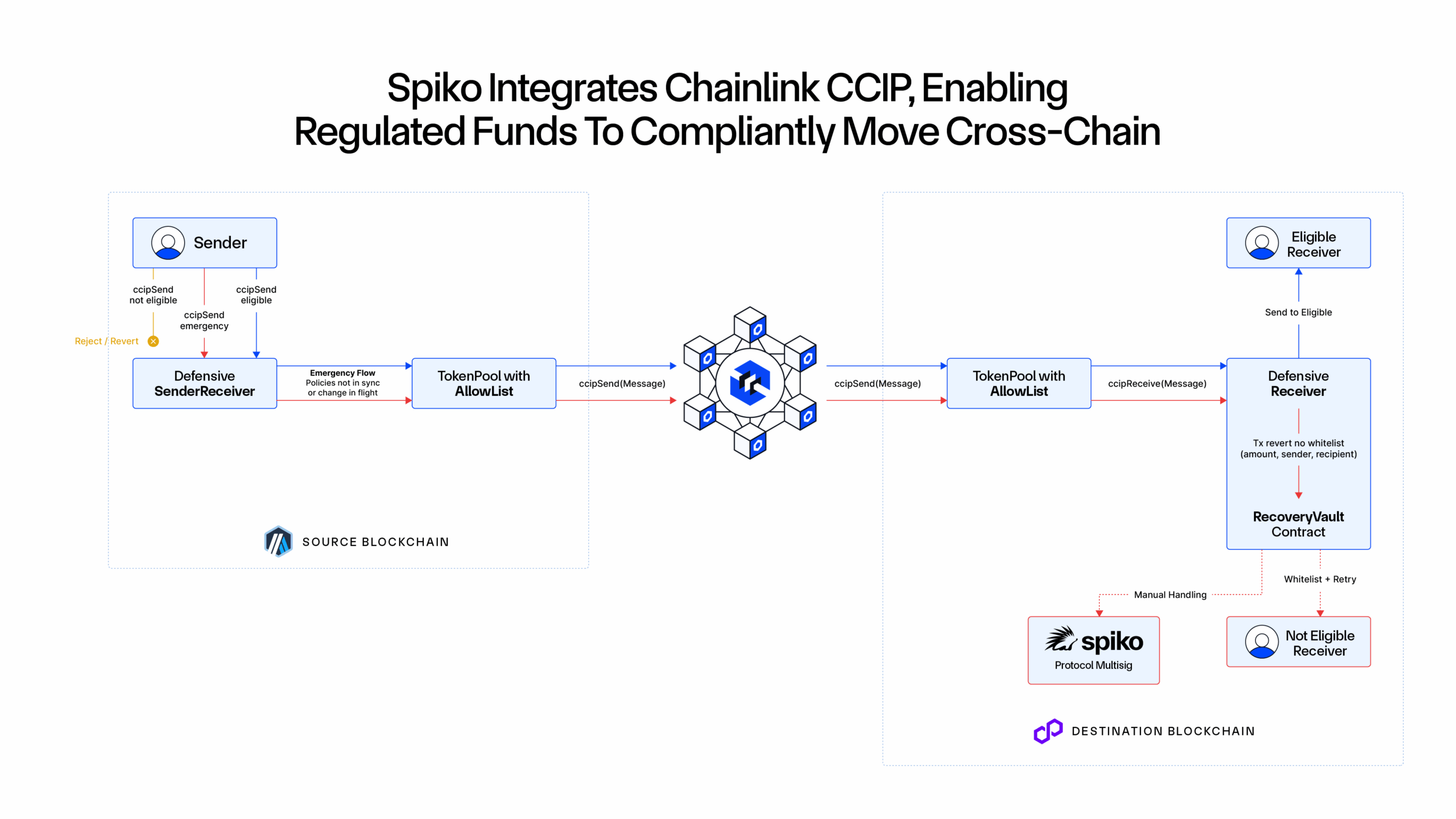

Spiko, a platform delivering next-generation infrastructure for regulated asset management and capital markets, and Chainlink, announced a strategic integration via the Chainlink interoperability standard. By leveraging Chainlink CCIP, Spiko will enable its $380M+ in regulated onchain money market funds to move securely and compliantly across multiple blockchains.

Spiko’s institutional-grade Money Market Funds, approved by the French Financial Markets Authority (AMF) and securely held by one of the world’s largest depositary banks, now benefit from cross-chain interoperability powered by Chainlink CCIP. This marks a major milestone in bringing traditional financial instruments fully cross-chain with regulatory compliance at their core.

After carefully evaluating the security properties of various interoperability providers, Spiko is adopting Chainlink as its preferred interoperability solution for EUTBL and USTBL, its tokenized money market funds backed by euro and dollar-denominated treasury bills.

This integration will build on Spiko’s earlier adoption of Chainlink SmartData, which provides real-time NAV reporting for its tokenized money market funds. Together, SmartData and CCIP provide a unified infrastructure for automated fund operations and secure cross-chain distribution.

Leveraging Chainlink CCIP, Spiko can implement its configurable set of pre-defined compliance policies cross-chain. These policies can include general operational rules, identity verification checks (e.g., KYC/AML compliance), jurisdictional restrictions, and asset-specific constraints. Spiko plans to implement automated compliance controls that ensure every cross-chain transaction adheres to regulatory and investor eligibility requirements. With CCIP, transactions are only finalized if the recipient is on an approved allowlist. If a transaction does not meet compliance conditions, the assets are securely rerouted to a recovery wallet, enabling return, retry, or manual review, ensuring operational continuity and safeguarding against misrouted funds.

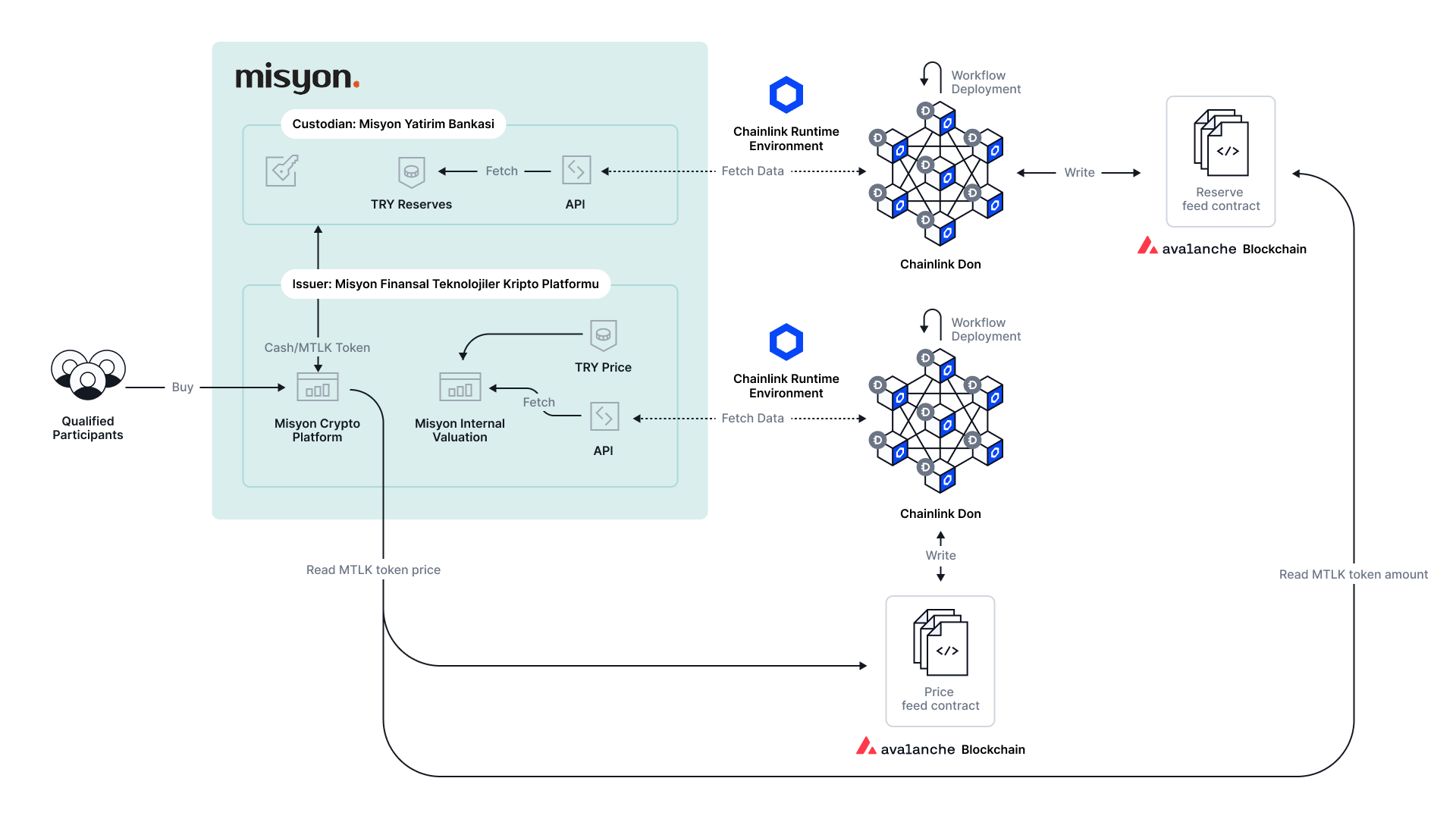

4. Misyon Bank Adopts the Chainlink Standard To Enable Onchain Data Feeds and Reserve Verification for Its Tokenized Asset Platform

Misyon Bank, a pioneering financial institution in Turkey, has adopted the Chainlink standard in production to enable onchain data feeds and reserve verification for its tokenized asset platform. With Chainlink Data Feeds and Proof of Reserve on Avalanche, powered by the Chainlink Runtime Environment (CRE), Misyon now supports verifiable infrastructure that enhances transparency and reinforces trust for its users.

This in-production integration introduces one of Türkiye’s first crypto asset platform with onchain, cryptographically verified data for both prices and reserves – secured through Chainlink Data Feeds and Proof of Reserve and running on the Chainlink Runtime Environment (CRE). The Chainlink Runtime Environment is a secure offchain computing environment for coordinating activity across blockchains and existing systems. This milestone now allows customers to independently verify the reserves and token prices of crypto assets, elevating the standards of transparency and security in crypto asset investments across the country.

5. Superstate Integrates Chainlink To Enhance the Transparency and Utility of the USTB Tokenized Fund

Superstate is an asset management firm modernizing investing through tokenized financial products. The firm adopted Chainlink Data Feeds into Superstate’s tokenized treasury fund, the Superstate Short Duration US Government Securities Fund (USTB) with $800M+ in AUM. This integration enables Superstate to securely bring net asset value (NAV) data onchain, enhancing the composability of the fund across onchain financial markets.

Tokenized real-world assets, like Superstate’s USTB, require high-quality offchain data for market pricing. Superstate has addressed these needs by integrating Chainlink Data Feeds for onchain NAV data, enhancing transparency and utility for USTB. Additionally, Superstate is integrating Chainlink Proof of Reserve to further enhance the onchain verification of AUM data.

TOKENIZED EQUITIES & ETFS

1. Ondo and Chainlink Announce Landmark Strategic Partnership to Jointly Bring Financial Institutions Onchain

Ondo Finance, a leader in tokenized real-world assets (RWAs) and Chainlink, the industry-standard oracle platform, announced a new strategic partnership, establishing Chainlink as the data standard for Ondo tokenized stocks & ETFs and partnering to make CCIP the preferred solution for traditional financial institutions’ cross-chain initiatives.

Ondo Global Markets is the largest platform bringing tokenized stocks & ETFs onchain, with over 100 tokenized assets already live and more than $350 million in total value locked (TVL). By leveraging Chainlink’s institutional-grade data infrastructure, Ondo tokenized stocks and ETFs will be priced with best-in-class, reliable data inputs across all supported blockchains.

To ensure resilient market data, Chainlink provides custom price feeds for each tokenized equity. These Chainlink data feeds capture all economic and corporate action events, such as dividends, delivering comprehensive valuations directly onchain.

The adoption of Chainlink enables Ondo Global Markets to serve institutions, asset managers, traditional financial intermediaries, and protocol developers eager to participate in onchain capital markets. This partnership between Ondo and Chainlink marks a major milestone in the evolution of onchain finance, unlocking entirely new use cases and accelerating enterprise adoption.

Ondo and Chainlink Unite to Bring Global Finance Onchain

Starting today, Ondo and @chainlink are joining together in a landmark strategic partnership to bring financial institutions onchain, building the infrastructure to tokenize trillions.

Together, we will work with leading… pic.twitter.com/qaTqaIpNbN

— Ondo Finance (@OndoFinance) October 30, 2025

2. Dinari Announces Collaboration with Chainlink to Bring Real-time Verifiability to the S&P Digital Markets 50 Index

Dinari, the leading provider of tokenized U.S. equities and ETFs across 85 countries, today announced a collaboration with Chainlink, the industry-standard oracle platform, to make the S&P Digital Markets 50 Index one of the first to operate verifiably onchain. The index, which is planned to launch in the fourth quarter of 2025, was developed in collaboration between Dinari and S&P Dow Jones Indices (S&P DJI), one of the world’s leading index providers.

The index will track 35 U.S.-listed companies driving blockchain adoption and 15 major digital assets. Later this year, Dinari plans to tokenize the index through dShares™, its fully backed tokenized-equities product, creating an investible version with unified exposure to both U.S. equities and crypto. Chainlink’s oracle platform will supply verified, real-time pricing and performance data to power the onchain, tokenized benchmark, ensuring it remains accurate, transparent, and aligned with trusted financial sources.

“Financial systems depend on trusted data and transparent infrastructure,” said Gabe Otte, CEO and Co-Founder of Dinari. “Working with S&P Dow Jones Indices and Chainlink allows us to bring that same standard of reliability to tokenized benchmarks, ensuring the S&P Digital Markets 50 operates with integrity and verifiability onchain.”

“The integration of Chainlink’s decentralized oracle network provides a crucial intermediary for the soon-to-be-launched S&P Digital Markets 50 Index,” said Cameron Drinkwater, Chief Product & Operations Officer at S&P Dow Jones Indices. “This collaboration ensures data integrity and connectivity that will bring the S&P Digital Markets 50 Index to market in a transparent, reliable and efficient manner.”

Tomorrow’s financial system needs trusted, real-time market data.

Dinari and @SPDJIndices are partnering with @chainlink to provide transparent, verifiable data for the S&P Digital Markets 50 Index — the first benchmark to combine top U.S. equities and digital assets. pic.twitter.com/fnDrSg8FQj

— Dinari (@DinariGlobal) November 5, 2025

3. Kamino Is Integrating xStocks Powered by the Chainlink Data Standard to Enable Tokenized Equities Lending

Kamino integrated xStocks on Kamino Lend, powered by the Chainlink data standard, enabling users to borrow against their tokenized equities, directly onchain. With this, Kamino becomes the first major borrowing and lending protocol in DeFi to onboard tokenized equities as collateral, marking a significant milestone for Solana and DeFi at large.

Via its V2 infrastructure, Kamino has launched a new xStocks Market designed specifically for users to deploy their xStocks as collateral and borrow stablecoins against them. At launch, 8 xStocks are available as collateral on Kamino: SPYx, QQQx, GOOGLx, APPLx, NVDAx, TSLAx, MSTRx, and HOODx.

Integrated by Kamino earlier this year, Chainlink is the official provider of xStocks price feeds on Kamino. Having recently joined the xStocks Alliance as the official oracle infrastructure provider, Chainlink is developing a bespoke xStocks oracle solution that delivers market data onchain with high accuracy, and sub-second price latency, significantly enhancing the ability to verify corporate actions in near real-time.

Chainlink Data Streams’ custom solution for xStocks delivers a CEX-like user experience for xStocks users on Solana, with highly efficient, low-cost onchain execution without sacrificing on security and decentralization. This creates a vertically integrated stack that connects tokenized stocks and ETFs to blockchains, providing Kamino and its users with a robust, reliable data solution.

PLATFORMS & NETWORKS

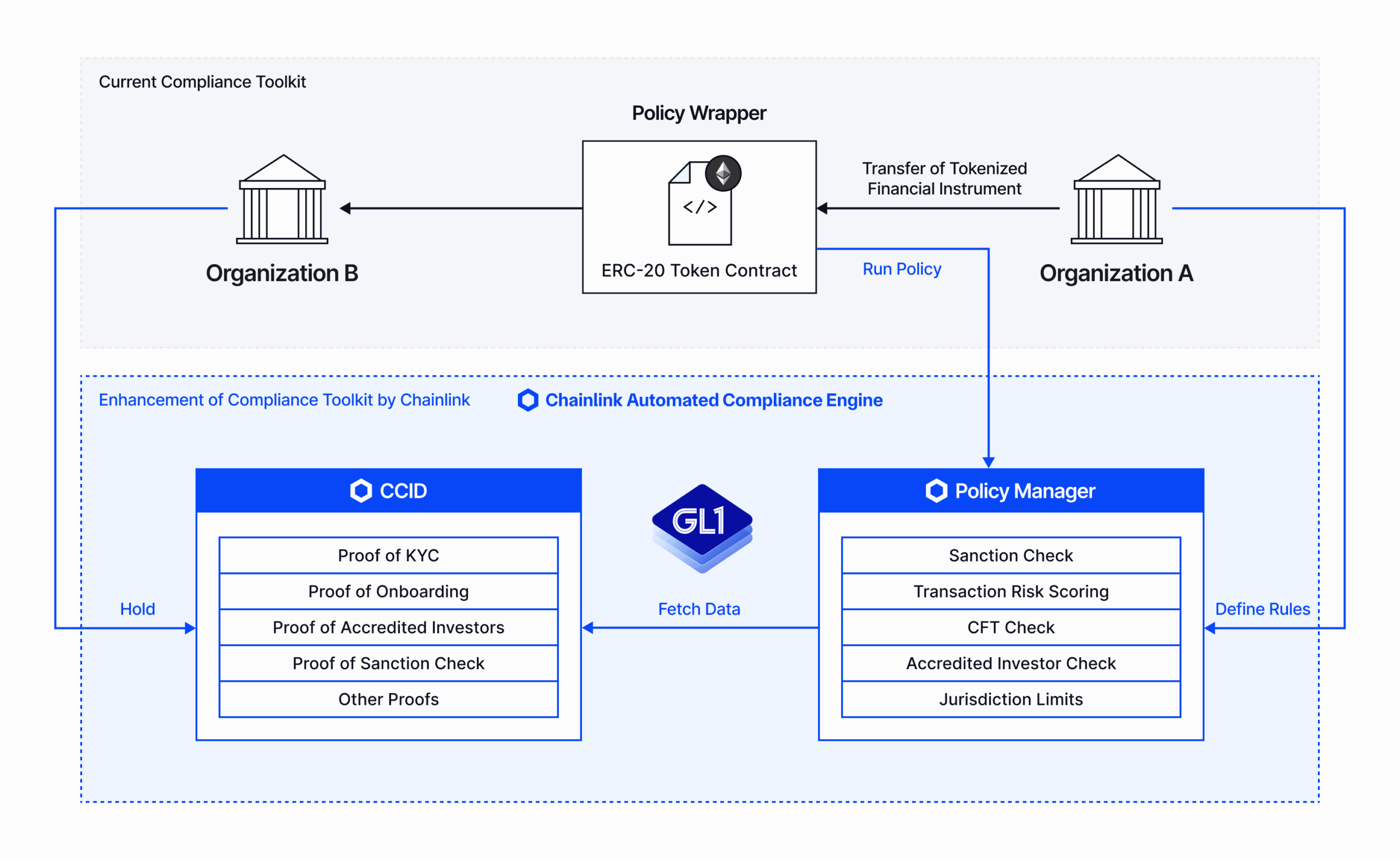

1. Global Layer One (GL1) Is Integrating The Chainlink Automated Compliance Engine (ACE) To Power The Next Generation of Compliant Digital Asset Transactions

GL1 is developing the common standards, specifications, and toolkits needed to build open, interoperable shared ledger infrastructures for regulated digital assets, including tokenized deposits, securities, and stablecoins.

Its Programmable Compliance (PC) Toolkit provides a framework for encoding and automating policy and regulatory requirements directly within digital assets and onchain transactions

Together, Chainlink ACE and GL1’s PC framework are providing dynamic, policy-driven compliance capabilities for onchain transactions, and to ensure transactions are conducted by verified entities operating under enforceable policy constraints.

Each participant, whether a regulator, issuer, or financial institution, is represented by a Cross-Chain Identity (CCID), a core component of Chainlink ACE that provides a reusable cryptographic identity enabling verified credentials and attestations to be recognized across multiple blockchains. Confidential data remains offchain, while verifiable proofs are recorded onchain, creating a privacy-preserving identity layer for compliant financial transactions.

2. Hastra, Incubated by Leading Home Equity Lender Figure, Is Integrating Chainlink As Its Official Infrastructure Across All of Hastra’s Yield Products

Hastra, a new DeFi platform incubated by Figure, a leading home equity lender with $19B+ in unlocked equity, is integrating Chainlink as its official oracle infrastructure across all of Hastra’s yield products.

Via the Chainlink data and interoperability standards, Hastra delivers high-integrity data that powers wYLDS, PRIME, and additional yield primitives across Solana, with CCIP enabling future expansion to the multi-chain ecosystem.

@chainlink is the official oracle infrastructure we’ll be leveraging across all Hastra yield primitives, delivering high-integrity data.

This enables PRIME, wYLDS, and any future yield primitives to function reliably and securely across Solana. pic.twitter.com/DudCFGZ4cC

— Hastra (@HastraFi) November 21, 2025

Powered by Chainlink Data Streams, Hastra’s PRIME market—including Phantom’s CASH—surpassed $350 million in TVL in 2026, making it the leading lending market on Kamino and one of the largest across Solana.

3. Canton Network and Chainlink Enter Into Strategic Partnership To Accelerate Institutional Blockchain Adoption

Canton Network has joined the Chainlink SCALE program to accelerate institutional adoption by providing access to Chainlink’s industry-standard data and cross-chain infrastructure on the Canton Network. Chainlink Labs will also join Canton Network as a Super Validator, becoming a key participant in the Global Synchronizer. The Canton Network supports over $6 trillion in onchain real-world assets, processes $280 billion in repos daily, and is backed by a network of 500 validators and over 30 super validators.

By joining the Chainlink Scale program, the Canton Network is equipping institutions with cost-efficient and highly secure Chainlink services. As part of the program, the Canton Network will cover certain operating costs of Chainlink oracle nodes that supply the network with a variety of data solutions and other oracle services. As a result, Canton will expand its connectivity, resilience, and transparency—supporting innovation across tokenized and on-chain assets, stablecoins, payments, and digital identity solutions.

This partnership builds on the recent news of Chainlink Labs joining the Canton Foundation (CF), the governance body overseeing the Global Synchronizer—the interoperability layer of the Canton Network.

With Chainlink’s industry-standard infrastructure soon to be available on Canton, institutions and developers alike will have new opportunities to collaborate, build, and scale on a blockchain network purpose-built for regulated financial markets.

“As one of the most recognized leaders in decentralized services, Chainlink’s commitment to the Canton Network represents an important milestone in expanding the connectivity of capital markets,” said Yuval Rooz, CEO of Digital Asset. “By bringing its community and solutions to Canton, Chainlink not only strengthens our governance and resilience, but also broadens the opportunities for innovators across traditional and decentralized finance.”

4. Onchain Asset Manager Maple Finance Expands Cross-Chain With Chainlink

Onchain asset manager Maple Finance (\$4+ billion AUM) upgraded to Chainlink CCIP by adopting the Cross-Chain Token (CCT) standard to make $500M+ of syrupUSDC natively transferable across Ethereum and Solana.

Users can also natively mint the yield-bearing stablecoin on Solana, expanding Maple’s multi-chain reach and advancing its mission to deliver institutional-grade yield to onchain borrowers.

In December 2025, Maple’s cross-chain deposits powered by Chainlink CCIP surpassed $3 billion.

Maple’s cross-chain deposits powered by @chainlink have surpassed $3B.

The largest onchain asset manager continues to scale. pic.twitter.com/rwabv8Wcxm

— Maple (@maplefinance) December 15, 2025

5. Balcony Partners with Chainlink To Power $240B+ in Onchain Property Assets

Balcony, the leading platform for government-sourced real estate tokenization, is partnering with Chainlink, the industry-standard oracle platform, to integrate the Chainlink Runtime Environment (CRE) into Balcony’s Keystone platform to power more than $240 billion in onchain property assets. The partnership bolsters Balcony’s ability to unify government-sourced property data into a single, verifiable system.

CRE enables Balcony to leverage verifiable, government-sourced parcel data onchain, establishing the foundation for transparent, programmable tokenized real estate assets. Integration of CRE into Keystone unlocks liquidity, increases accessibility, and raises trust in the world’s largest asset class.

“Meeting regulatory standards is essential for bringing real estate onchain. The Chainlink Runtime Environment delivers the secure and compliant execution layer that allows Balcony—the largest government-sourced global platform for real estate tokenization—to stream authenticated property data onchain and enable compliant digital real estate markets,” said Gregg Lester, Co-CEO, President of Balcony. “Our partnership with Chainlink underlines our deep commitment to support local and state governments.”

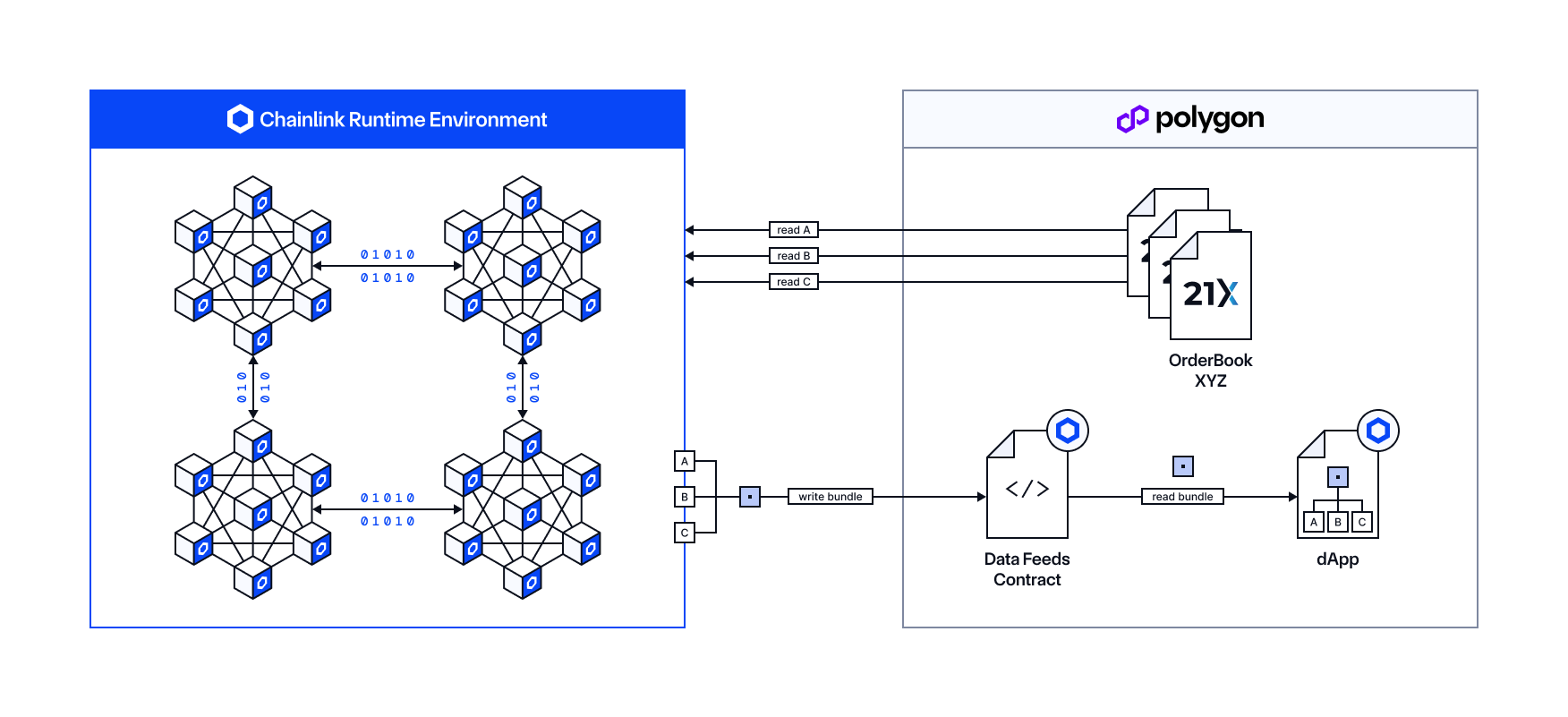

6. First EU-Regulated Onchain Exchange 21X Adopts Chainlink Live in Production

21X, the first blockchain-based exchange for tokenized securities licensed under the EU’s DLT Regime, adopted Chainlink to deliver market data onchain for its tokenized securities.

Live-in-production and powered by the Chainlink Runtime Environment (CRE), Chainlink enables verifiable post-trade data, including last traded prices and bid-ask offers for securities listed on the 21X platform to be accessed directly on the Polygon blockchain in real-time.

This integration enables EU-regulated tokenized equities, debt securities, and funds to be used as collateral in lending protocols and traded in secondary markets, along with unlocking an array of other use cases across the onchain economy.

Black Manta Capital Partners’ USMO, a tokenized note backed by the UBS USD Money Market Fund, is the first security on 21X to have its data delivered onchain via Chainlink.

“The Chainlink standard enables 21X to securely and reliably bring real-time, verifiable market data for tokenized securities onchain. By integrating Chainlink into our regulated DLT trading venue, we’re delivering the transparency, auditability, and collateral utility that institutions require to move onchain—while remaining fully compliant under BaFin supervision. Adopting Chainlink is a foundational step in bridging traditional capital markets with the blockchain economy.”—Max Heinzle, CEO of 21X

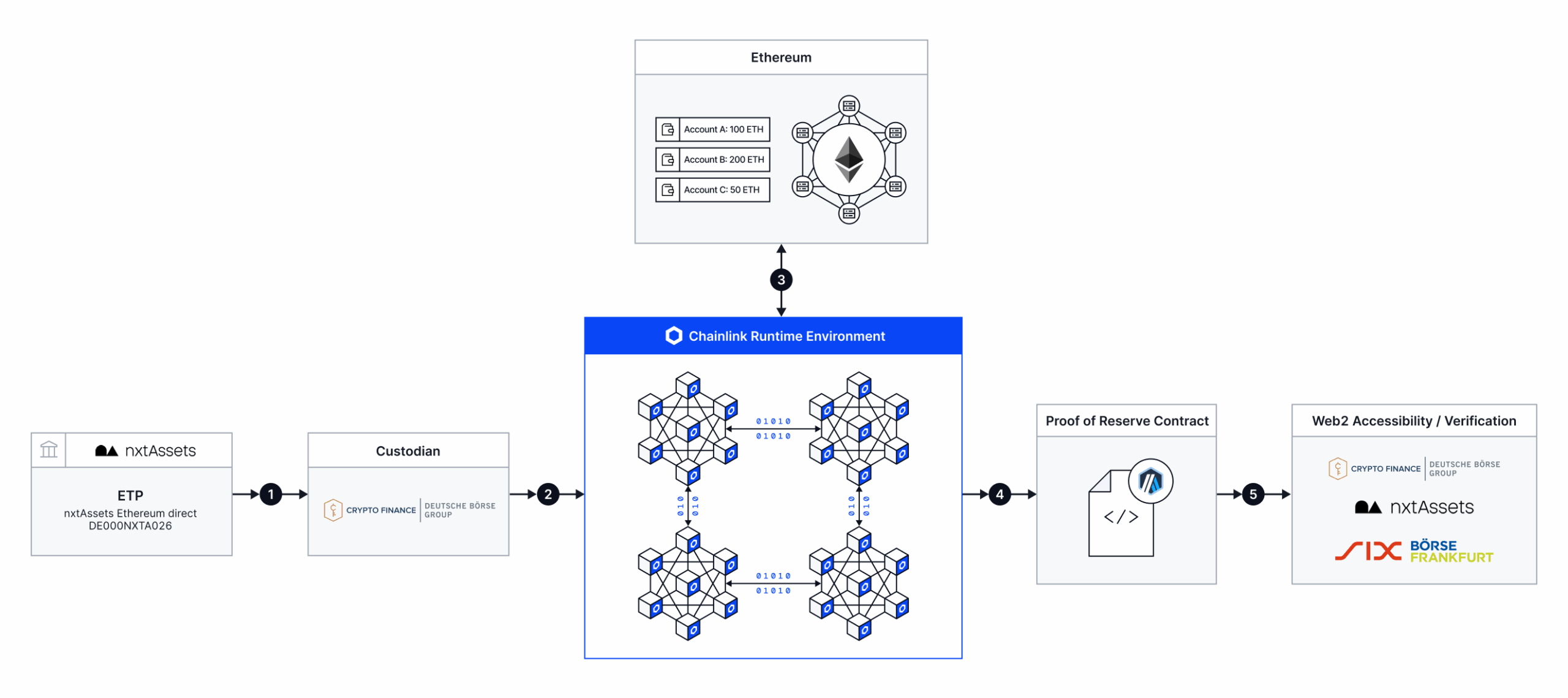

7. Crypto Finance Live With Chainlink Proof of Reserve To Bring Trust and Transparency to nxtAssets’ Digital Asset ETPs

Crypto Finance, a provider of professional digital asset solutions for institutional clients and part of Deutsche Börse, has adopted the Chainlink standard live in production.

Chainlink Proof of Reserve now enables direct verification of assets custodied by Crypto Finance for nxtAssets’ physically backed Ethereum and Bitcoin Direct exchange-traded products (ETPs), with reserve data orchestrated by the Chainlink Runtime Environment (CRE) and published on Arbitrum.

8. Virtune Integrates Chainlink Proof of Reserve Across Its $450M+ Digital Asset ETPs, Elevating Institutional Transparency

Virtune AB, a leading Swedish regulated digital asset manager and issuer of crypto ETPs, announced it has integrated the Chainlink standard for verifiable data across its digital asset ETPs. Virtune is deploying Chainlink Proof of Reserve, with the target of implementing it across all of its crypto ETPs, starting with the following products: Virtune Bitcoin ETP, Virtune Bitcoin Prime ETP, Virtune Chainlink ETP, Virtune Arbitrum ETP, Virtune Polygon ETP, Virtune Staked Solana ETP.

With over $450 million in assets under management (AUM) across 19 ETPs and more than 150,000 investors, these products are listed on major European exchanges such as Nasdaq Stockholm, Nasdaq Helsinki, Deutsche Börse Xetra, Euronext Amsterdam, and Euronext Paris.

Chainlink Proof of Reserve verifies and publicly reports the aggregated total of these distributed holdings without revealing the individual wallet addresses. Even if funds are moved for key rotation or other routine purposes, Chainlink Proof of Reserve helps reassure stakeholders that reserves remain fully intact and that Virtune’s crypto ETPs are always 100% physically backed by the underlying crypto assets.

“Providing transparency into the assets backing our crypto ETPs is core to our mission at Virtune. Chainlink Proof of Reserve is the industry benchmark for onchain reserve verifications, and integrating it enables us to deliver real-time, tamper-proof insights into our reserves. This is a significant step toward reinforcing trust in our products and setting a higher bar for accountability in the crypto ETP space.” —Christopher Kock, CEO & Co-founder, Board member at Virtune

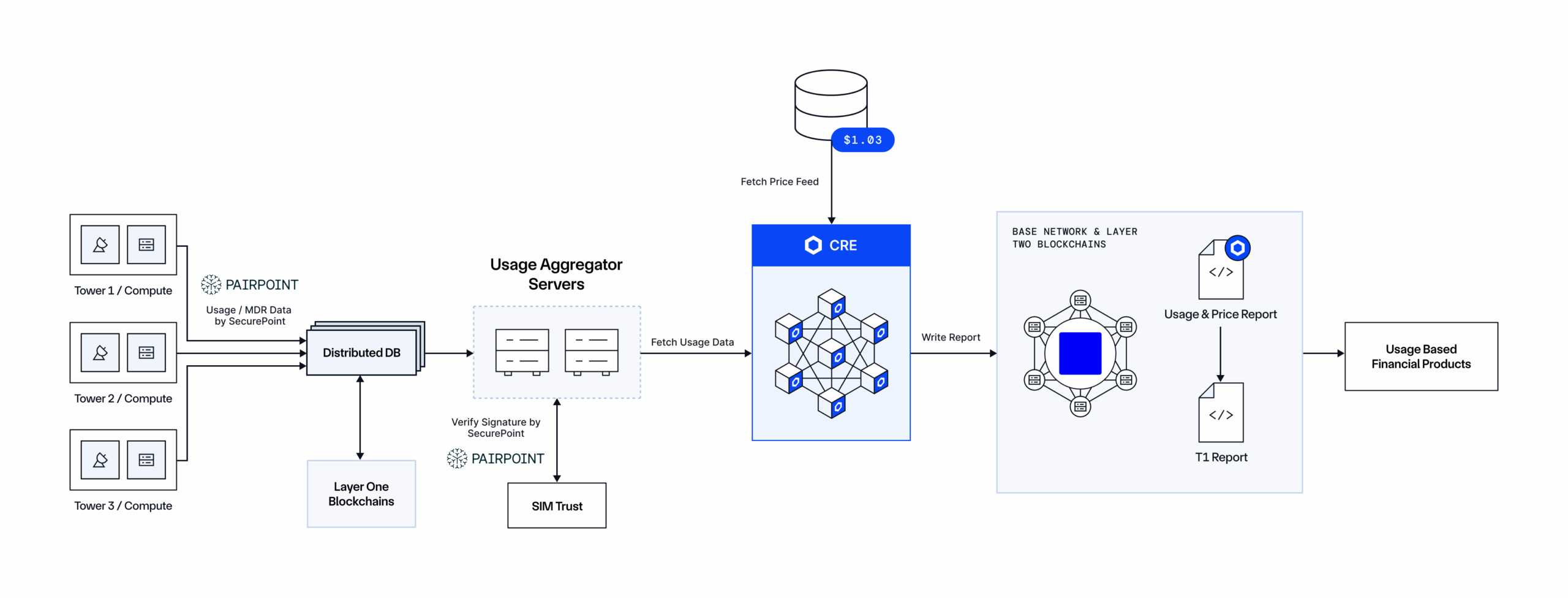

9. Pairpoint and Chainlink Collaborate to Unlock Asset-as-a-Service Financing for Telecom

Pairpoint, a joint venture by Vodafone and Sumitomo Corp, and Chainlink, the industry-standard oracle platform, announced that they are working together on a new usage-based, asset-as-a-service solution for financing the integration of AI compute capabilities into existing telco towers.

The solution is based on a new secure ‘Proof of Use’ protocol and is similar to tokenized real-world asset products, where assets are tokenized on blockchains and investor rewards are linked to usage of the asset. The solution can also be used by traditional finance in new areas like AI financing, where historical data on borrowers and market sectors is limited, and initial risk needs to be rebalanced with expected growth.

To ensure secure and verifiable integration between offchain telco infrastructure and blockchains for trusted recording of usage data, Pairpoint is using its SecurePoint technologies, Nillion, and the Chainlink Runtime Environment (CRE) to orchestrate key processes. CRE is the secure global orchestration layer for creating and executing institutional-grade smart contracts across blockchains and existing systems, with built-in data connectivity, compliance-enforcement, privacy, and security.

Pairpoint will leverage CRE to support asset-as-a-service financing solutions across the telco sector by integrating SecurePoint and CRE with APIs providing usage and pricing data from the connected assets and then relaying that data securely onchain. Backed by Chainlink’s secure and verifiable infrastructure, the solution ensures that the data written to the blockchain is both accurate and tamper-resistant, thereby establishing a trust-minimized foundation. The data is then used to calculate rewards for investors. This not only unlocks a dynamic framework for tokenizing infrastructure and financing key institutional infrastructure investments, but these tokenized assets can potentially become composable within DeFi protocols in the future, such as for collateral in a lending protocol, bringing even more utility to investors.

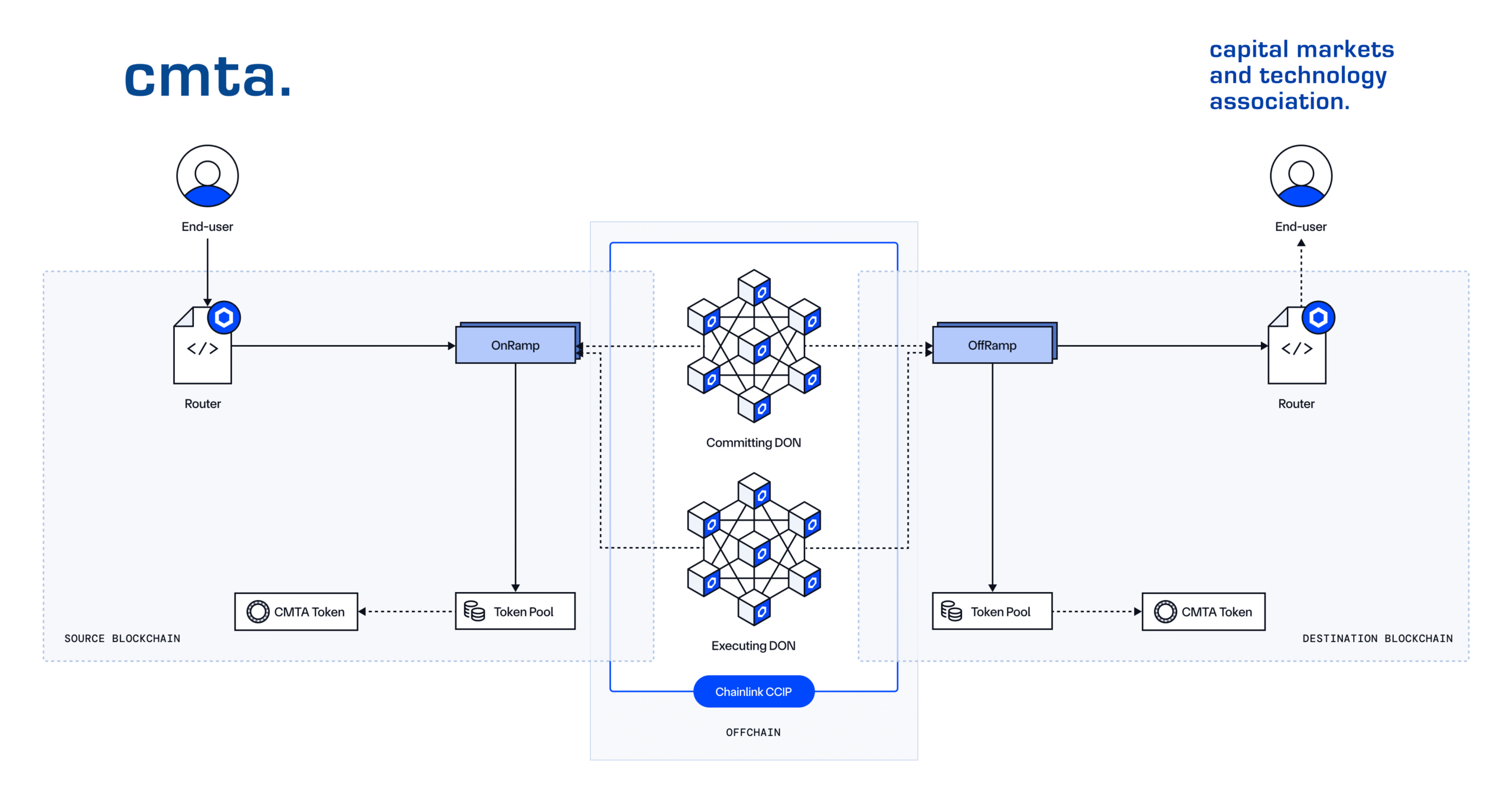

10. CMTA Adopts the Chainlink Interoperability Standard

- Enable cross-chain interoperability via CCIP, without changing token code

- Allow the CMTAT CCIP admin to enable the token in CCIP without the need to request assistance from Chainlink.

TOKENIZED COMMODITIES

1. Matrixdock Enables Tokenized Gold to Move Cross-Chain With CCIP and Unlocks Onchain Gold Pricing With Price Feeds

Matrixdock, a tokenized RWA platform founded by Matrixport, has adopted the Chainlink interoperability and data standards for its tokenized gold-backed token, XAUm.

Users can securely transfer XAUm, one of the largest gold-backed tokens by TVL, across Ethereum and BNB Chain via Chainlink CCIP, while Chainlink Price Feeds provide tamper-proof market data to help ensure reliable markets around XAUm.

“Supported by Chainlink’s robust infrastructure, XAUm embodies the convergence of the intrinsic value of gold and blockchain-native agility. Together with Chainlink, we are building the foundational infrastructure for a modernized capital market, where real-world assets like gold can move with the speed, transparency, and interoperability that the future of finance demands.”—Eva Meng, Head of Matrixdock

2. GEMx Has Adopted Chainlink CCIP and Proof of Reserve To Support Tokenized Emerald Markets

GEMx is a platform bringing the emerald market onchain. By leveraging Proof of Reserve Secure Mint and CCIP, GEMx can mitigate against infinite mint attacks by preventing the issuance of unbacked tokens and enables secure transfers of its token across Avalanche and Ethereum.

Read the Case Study on Institutional-Grade Emerald Tokenization

3. Uranium Digital Is Integrating Chainlink Proof of Reserve To Increase Transparency of the Tokenized Uranium On Its Platform

Uranium Digital is creating the first institutional-grade spot and derivatives market for uranium trading. The platform will redefine the uranium market by enhancing liquidity, improving price transparency, and expanding access to a broader audience. Proof of Reserve will ensure that the underlying uranium assets are independently verifiable and accessible onchain at all times.

To learn more about Chainlink, visit chain.link, subscribe to the Chainlink newsletter, and follow Chainlink on Twitter, YouTube, and Reddit.

Disclaimer: This post is for informational purposes only and contains statements about the future, including anticipated product features, development, and timelines for the rollout of these features. These statements are only predictions and reflect current beliefs and expectations with respect to future events; they are based on assumptions and are subject to risk, uncertainties, and changes at any time. There can be no assurance that actual results will not differ materially from those expressed in these statements, although we believe them to be based on reasonable assumptions. All statements are valid only as of the date first posted. These statements may not reflect future developments due to user feedback or later events and we may not update this post in response.