Advancing Innovation in Ethereum Staking With Chainlink ETH Staking APR Feeds

With the successful implementation of The Merge and the subsequent Shapella upgrade, Ethereum staking has become the preferred source of yield for ether on a risk-adjusted basis. Concurrently, staking has evolved into a prominent area for experimentation and innovation, with novel primitives—such as liquid staking tokens (LSTs) and restaking protocols—emerging as a way to increase the productivity of staked assets securing the Ethereum network.

To support this ongoing innovation, Chainlink recently launched an on-chain source of truth for the global ETH staking rate of return—Chainlink ETH Staking APR Feeds. This article aims to provide insight into the data calculation underlying these feeds and their vital role in fostering a robust and reliable source of truth for the global Ethereum staking rate to support innovative new use cases within the Web3 ecosystem.

The Necessity of an On-Chain Reference Rate for ETH Staking Yield

Traditional finance benchmarks such as the Secured Overnight Financing Rate (SOFR) and the London Interbank Offered Rate (LIBOR) are utilized by financial institutions to determine the applicable rates for a wide variety of financial products, such as loans and mortgages. These reference rates serve a dual purpose: They facilitate the pricing and negotiation of terms between lenders and borrowers, and introduce more predictability into financial transactions.

While not a direct comparison due to the inherent structural differences between the two markets, the cryptocurrency ecosystem may also find similar reference rates—such as a global staking reference rate for ether—useful as a benchmark for financial activity, while being able to leverage blockchain technology and oracle networks for increased tamper-resistance.

With its industry-standard Data Feeds infrastructure, Chainlink already supports a large portion of the DeFi ecosystem and has been at the forefront of the DeFi movement since its inception. As protocol-level staking becomes one of the most popular sources of sustainable yield, an on-chain baseline measure of the global ETH staking rate of return becomes necessary for assessing the risk/reward profile of other yield-generating opportunities accessible to all participants in the Ethereum economy.

A dependable on-chain baseline provides the following benefits for ecosystem participants:

- Validators—Without a dependable on-chain baseline, validators lack effective references to understand the risk/reward dynamics of their operation. Additionally, a reference rate helps validators gauge whether the additional risk and complexity associated with complementary staking services, such as additional middleware or restaking products, is justified.

- Users—An industry-wide reference rate empowers DeFi users to explore a broader range of trading and hedging strategies while helping them better understand the risks and tradeoffs associated with the products they are interacting with. More broadly, a baseline reference makes the take rate of staking-as-a-service providers more clear to market participants.

- Builders—An on-chain baseline can facilitate the creation of novel on-chain financial products.

Some example use cases enabled by the creation of an on-chain baseline for the ETH staking rate of return:

- Financial instruments that enable users to hedge their staking exposure.

- Interest rate swaps, enabling users to access a more predictable, fixed rate of return from staking ETH.

- As an input to funding and lending rate calculations to ensure protocol yields stay competitive within the DeFi landscape.

The Complexities of Calculating the ETH Staking APR

Given the deterministic nature of the staking return calculation and the open, permissionless nature of the Ethereum blockchain, it’s often assumed that anyone should be able to easily calculate the global staking rate of return. However, the Ethereum protocol does not provide a clear, easy-to-parse audit trail for reward and penalty calculations, and calculating the global rate of return is computationally expensive. As a result, no such reliable reference rate has previously existed.

To address these data constraints, Chainlink is leveraging the same time-tested Data Feeds architecture that has enabled over $7T in value to be transacted across numerous different blockchains and layer-2 networks to provide a valuable baseline reference for global ETH staking rates.

Chainlink ETH Staking APR Feeds: A Tamper-Proof Reference for Ethereum Staking Rates

Chainlink ETH Staking APR Feeds provide a trust-minimized and tamper-proof source of truth for the global rate of return from staking as a validator to secure the Ethereum network.

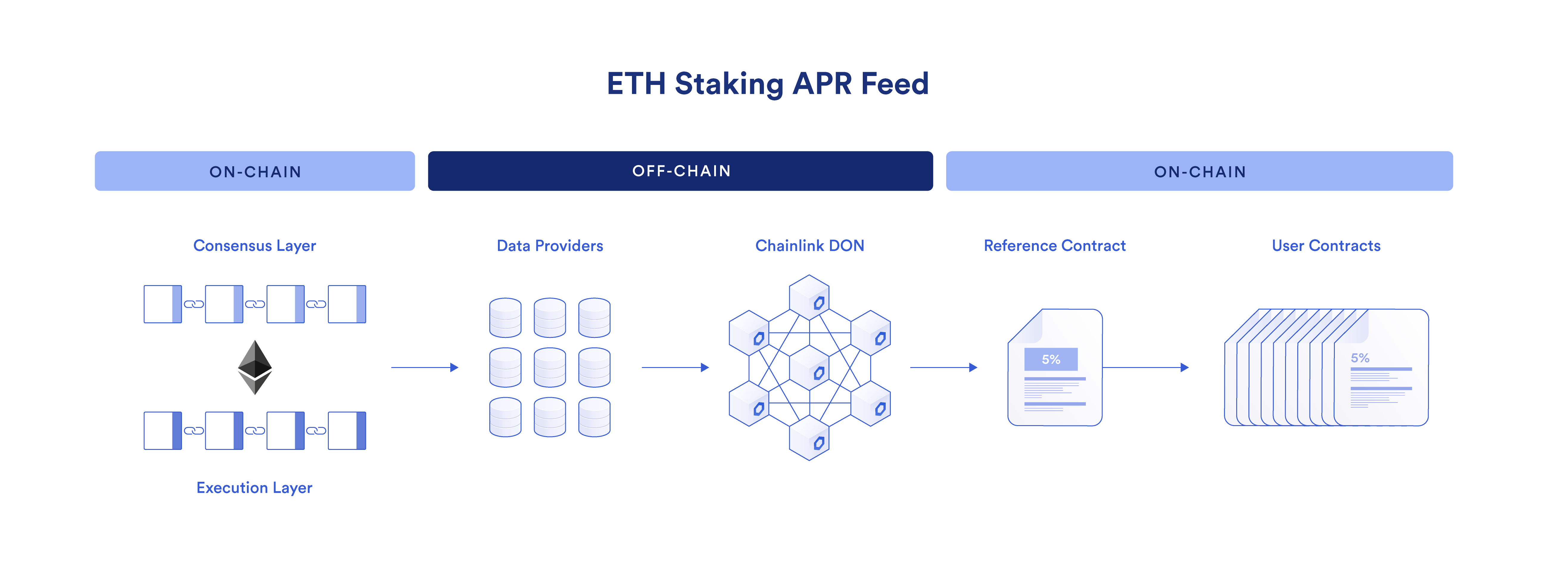

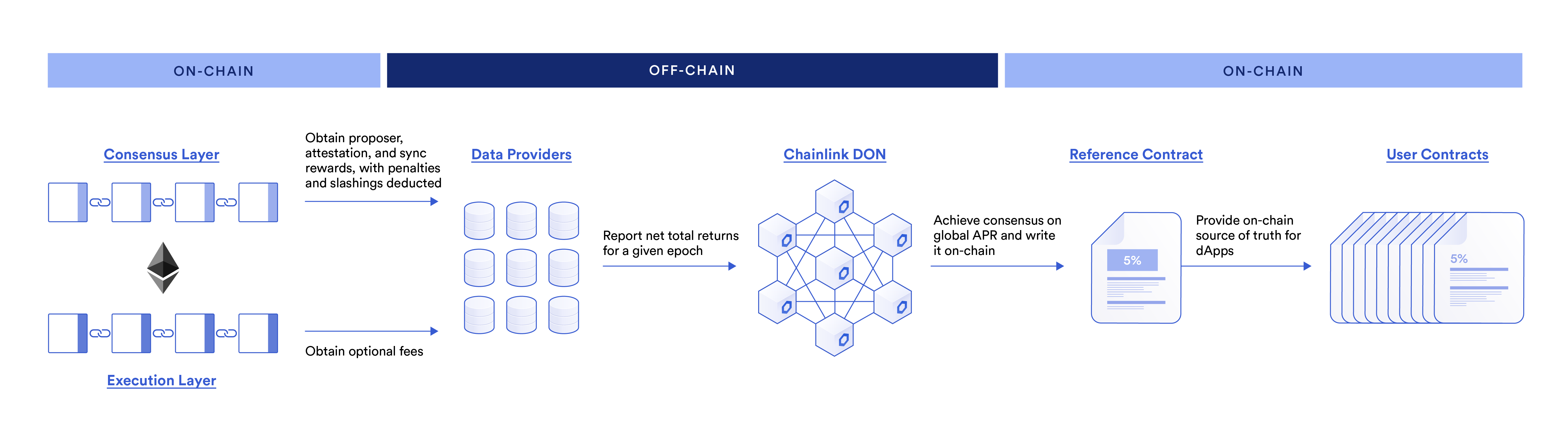

To enable the creation of Chainlink ETH Staking APR Feeds, data providers compile data from both the consensus and execution layers and use off-chain computation to compute the net returns for each epoch. Rewards (proposer, attestation, and sync rewards) are obtained from the consensus layer, with any penalties (inactivity leaks) and slashings deducted. From the execution layer, data providers obtain the optional fees (referred to as “tips”) that are included with individual transactions. These fees are added to the rewards to derive the net total returns for a given epoch.

The net total returns for each epoch only include endogenous returns from the Ethereum protocol. Other sources of exogenous yield, such as MEV payments, are intentionally excluded because those returns are generated outside of the Ethereum protocol and can introduce other risks. This approach differs from the self-reported yield estimates of various staking pools, which compete on yield and often choose to incorporate different strategies around capturing exogenous sources of yield. As a result, Chainlink ETH Staking APR Feeds provide a more precise baseline measurement of the returns from staking that individual validators and users can leverage to better evaluate other opportunities to generate yield (and compare exogenous yields available to stakers). In the future, Chainlink plans to offer additional feeds that are inclusive of other sources of yield such as MEV payments.

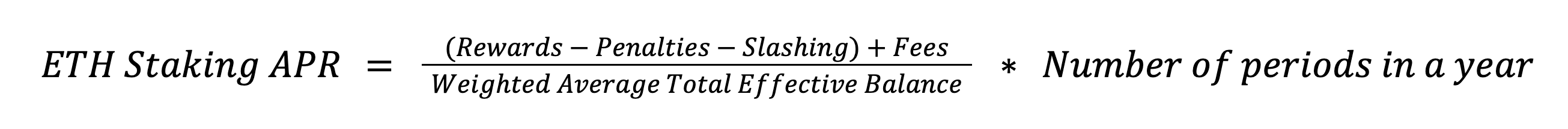

Data providers report returns as an annualized percentage rate (APR) to the Chainlink decentralized oracle network (DON). The net total returns are divided by a weighted average of the total effective balance for all the validators in the validator pool over a given sample period.

The effective balance, used to calculate rewards, is a function of the actual balance held in a validator’s wallet, capped at 32 ETH. Any amount exceeding 32 ETH in a validator’s wallet is effectively idle stake that does not generate returns, although some validators may find it advantageous to maintain a buffer above 32 ETH. In the case of an outage resulting in penalties, this buffer could ensure that the validator’s effective balance remains above 32 ETH, enabling the validator to continue to generate the maximum amount of rewards. The weighted average is determined by summing up the total effective balance for each epoch and dividing it by the total number of epochs in the sample period.

The rate of return is measured over two rolling timeframes: the past 30 days (~6,750 epochs) and the past 90 days (~20,250 epochs). These periods were selected as they are commonly used settlement periods for interest rate swaps. The rate of return is annualized by multiplying the current rate by the number of periods in a year, e.g. the number of 30-day periods in a year or the number of 90-day periods in a year. There are plans to introduce a total return index measure, which would allow users to calculate an APR over any chosen period using just the index value at the start and end of that period.

The Chainlink DON achieves consensus on the global APR value and writes it on-chain, where it can be utilized by other protocols and applications. Due to the data constraints, different APR calculations may result in slightly different rates. To address these small discrepancies in the reference rate calculation, the DON takes the median value from the data providers and writes the median of those median values on-chain.

How To Get Started With Chainlink ETH Staking Rate Feeds

Chainlink ETH Staking APR Feeds provide a secure, tamper-proof reference for the global rate of return from staking as a validator on Ethereum. Data providers use off-chain computation to calculate returns at an epoch level, achieve consensus on the staking rate, and write the results on-chain to be utilized by DeFi applications.

If you’d like to integrate Chainlink ETH Staking APR Feeds, read the official documentation or connect with an expert.