Chainlink Digital Asset Insights: Q3 2024

By Daeil Cha, Product, at Chainlink Labs

Introduction

The Chainlink standard continues to see adoption across the tokenization landscape, with recent developments in Q3 underscoring how Chainlink’s decentralized infrastructure plays a pivotal role in enabling smart, scalable, and secure tokenized real-world assets (RWAs). Companies such as 21Shares, Lympid, Superstate, and Sygnum are leveraging Chainlink services like Data Feeds, Proof of Reserve, and the Cross-Chain Interoperability Protocol (CCIP) to bring critical onchain transparency, connectivity, and real-time data to tokenized assets, including U.S. Treasury bonds and Ethereum ETFs. These integrations provide verifiable, onchain asset backing, which enhances user trust and facilitates the growth of decentralized finance (DeFi) applications such as collateralized lending and automated asset management. Chainlink’s infrastructure continues to enable firms to set new standards for transparency and reliability in both traditional and decentralized finance.

Growth in Tokenized Assets Continues

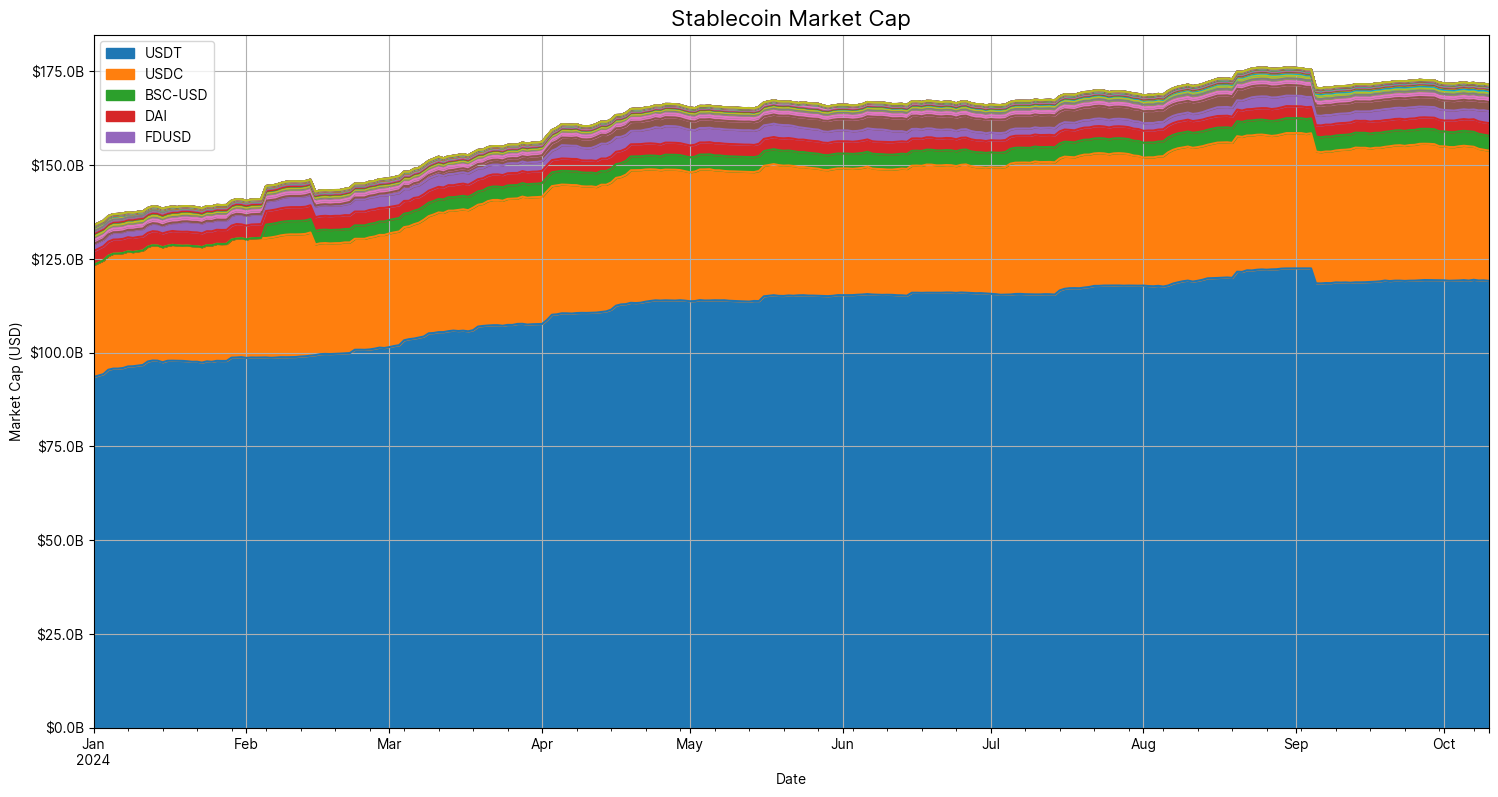

While both centralized and decentralized markets saw some volatility this quarter, tokenized assets steadily continued to show wider adoption. The market cap of stablecoins grew about \$5.3 billion, or 3.2%, during Q3 2024, and about $37.5 billion, or 28.1%, year-to-date.

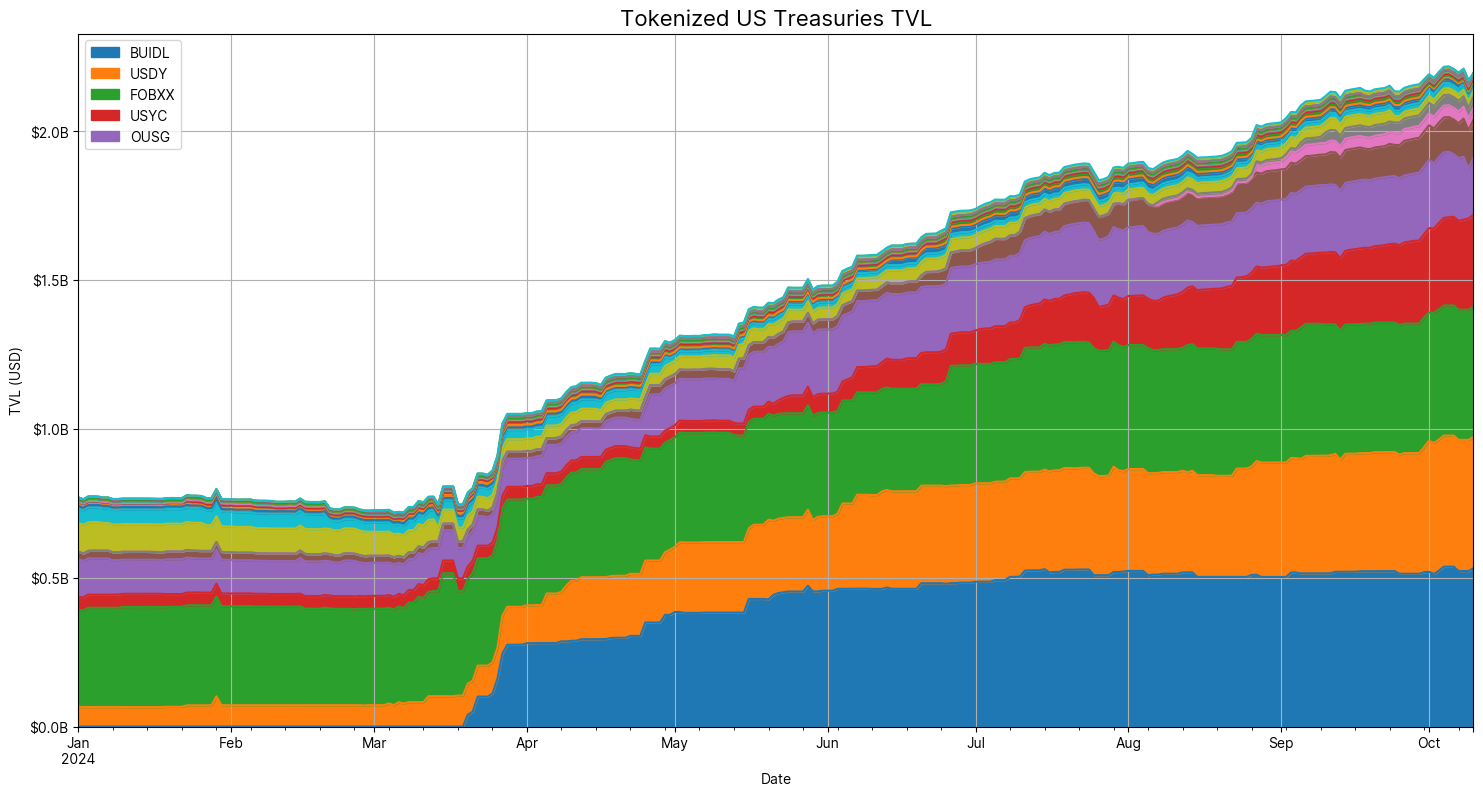

A newer tokenized asset, tokenized Treasuries, is seeing a faster rate of growth. The TVL of tokenized Treasuries grew \$456.0 million, or 26.2%, during the quarter, and about $1.4 billion, or 185.3%, year-to-date.

Tokenized Treasuries have grown this year despite volatility in traditional public markets. This could signal users’ growing confidence in tokenized RWAs as well as an increased desire for tokenized assets beyond just stablecoins. The next section discusses Superstate, a manager of a tokenized Treasury fund that recently announced that it is adopting the Chainlink standard.

Superstate Leverages Chainlink Data Feeds and Proof of Reserve

Superstate, an asset management firm focused on modernizing financial products, has integrated Chainlink’s decentralized infrastructure to enhance the transparency and utility of its USTB tokenized fund. USTB is a tokenized short-duration U.S. government securities fund, providing onchain access to traditionally offchain assets. The integration of Chainlink Data Feeds ensures that USTB’s net asset value (NAV) is securely reported onchain, which increases transparency by delivering reliable, verifiable NAV data to onchain environments while fostering composability in decentralized financial applications. This transparency is crucial for building trust with users and enhancing the utility of USTB across DeFi markets. The availability of this data enables developers to potentially create new products, such as collateralized lending markets and automated asset management services, contributing to the broader adoption of tokenized real-world assets. Moreover, Chainlink Proof of Reserve will soon be integrated into USTB, providing real-time, onchain verification of the fund’s assets.

This collaboration demonstrates Chainlink’s role in enabling enhanced utility for tokenized real-world assets, supporting innovation in asset management, and creating new opportunities for DeFi. The integration marks a significant step toward bridging traditional finance with blockchains, providing a secure, transparent foundation for future financial products.

21Shares Integrates Chainlink Proof of Reserve for CETH

21Shares, a prominent issuer of crypto exchange-traded products (ETPs), recently integrated Chainlink Proof of Reserve into its Core Ethereum ETF (CETH) to boost transparency. The integration provides real-time, publicly verifiable data on the reserves backing the ETF. This integration enhances confidence among users by ensuring that the underlying assets—ether in this case—are appropriately auditable onchain. By leveraging Chainlink decentralized oracle networks, 21Shares can offer continuous, automated validation of these reserves, significantly improving transparency compared to traditional audits. Chainlink Proof of Reserve has already been implemented in ARK’s and 21Shares’ Bitcoin ETF ARKB, and this additional integration represents a significant step toward the future of transparent, efficient, and secure financial markets enabled by Chainlink technology.

Sygnum and Fidelity International Utilize Chainlink for NAV Data

Sygnum, a digit asset banking group, and Fidelity International have partnered with Chainlink to bring the net asset value (NAV) data of Fidelity’s Institutional Liquidity Fund onchain. This collaboration leverages the Chainlink standard to enhance transparency and real-time accessibility of NAV data for tokenized fund assets. This onchain data delivery allows for greater user confidence by making the NAV of the fund continuously verifiable and transparent, a critical feature for the growing demand for tokenized RWAs in DeFi.

By integrating Chainlink’s oracle infrastructure, Sygnum and Fidelity are able to bring a high level of automation and reliability to the process of fund management. Chainlink’s secure and decentralized data feeds ensure that NAV data, calculated by external fund administrators, is brought onchain efficiently and in a tamper-resistant manner. This enhances the utility of tokenized assets, enabling new use cases such as collateralized lending, automated asset management, and programmable finance, further bridging traditional finance with the blockchain ecosystem.

Lympid Integrates CCIP and Proof of Reserve

Lympid facilitates the adoption of tokenized real-world assets (RWAs) through fractional ownership. It allows users to buy traditionally illiquid, high-value assets such as luxury watches, horses, or real estate by breaking them down into smaller, more accessible units. This approach opens up new opportunities for retail users, allowing participation with as little as $30, democratizing access to high-value assets. Lympid ensures a compliant, insured, and custody-backed environment, providing a secure and trusted framework for users. By bringing valuable physical assets onchain, Lympid enables more efficient trading, liquidity, and access to a broader audience. The platform not only reduces the barriers to entry but also enhances transparency in the ownership and transfer of these assets, which has been a challenge in traditional asset markets.

Lympid’s integration of Chainlink CCIP and Proof of Reserve strengthens its value proposition. Chainlink CCIP enables secure and reliable cross-chain transfers of tokenized assets, ensuring that Lympid’s users can move these assets across different blockchains with confidence. Further, Chainlink Proof of Reserve provides real-time onchain verification that the tokenized RWAs backing Lympid assets are fully collateralized and accounted for. This integration enhances transparency and reliability, giving users confidence in the legitimacy and security of their assets. Through this collaboration, Lympid is positioned to offer a more secure and scalable platform for tokenizing RWAs, helping push the boundaries of what is possible in DeFi and asset tokenization. Through the Chainlink standard, Lympid can enhance the reliability and accessibility of its offerings, fostering further innovation in the RWA sector.

Reach Out to Our Team of Experts

To find out how your organization can benefit from using the Chainlink standard, reach out to our team of experts.

This post is for informational purposes only and contains statements about the future. There can be no assurance that actual results will not differ materially from those expressed in these statements, although we believe them to be based on reasonable assumptions. Interactions with blockchain networks create risks, including risks caused by user input errors. All statements are valid only as of the date first posted. These statements may not reflect future developments due to user feedback or later events and we may not update this post in response.