Chainlink Launches Data Streams for U.S. Equities and ETFs To Power Secure Tokenized RWA Markets Onchain

We’re excited to launch Chainlink Data Streams for U.S. equities and ETFs—real-time, high-throughput market data that is now available onchain to power the next generation of tokenized financial products. These Data Streams are being adopted by leading DeFi protocols, such as GMX, Kamino, and GMX-Solana.

Now live with leading U.S. equities and ETFs, Chainlink Data Streams are providing real-time, high-throughput pricing for TradFi assets such as SPY, CRCL, QQQ, NVDA, AAPL, MSFT, and much more. These Data Streams are now available across 37 different blockchain networks.

With this launch, developers can access real-time, context-aware data for U.S. equities and ETFs directly onchain, enabling use cases such as tokenized stock trading, perpetual futures, and synthetic ETFs—all with institutional-grade reliability. This breakthrough unlocks a new era of advanced financial products by bringing capital markets data onchain, along with unique features like market hours enforcement, staleness detection, and high-frequency pricing from premium data providers. Ultimately, these Chainlink Data Streams are accelerating the convergence of traditional finance and onchain innovation.

“With Chainlink Data Streams’ fast, reliable, and context-rich market data, production-ready tokenized financial products tied to U.S. equities and ETFs can now be launched directly onchain. This is a significant leap forward for tokenized markets—closing a critical gap between traditional finance and blockchain infrastructure. We’re excited to be collaborating with Kamino and GMX, two of the most forward-thinking DeFi teams whose work continues to accelerate the convergence of traditional and decentralized finance.”—Johann Eid, Chief Business Officer at Chainlink Labs

“Chainlink Data Streams for equities and ETFs mark a major milestone in delivering decentralized, institutional-grade pricing infrastructure that’s foundational to expanding DeFi beyond crypto-native assets. Via the highly reliable Chainlink data standard, we can enable the creation of perpetual markets on a wider range of high-quality assets that our community and issuers want to support. This unlocks entirely new trading opportunities while enhancing platform security and deepening user trust.”—Jone Zee, GMX Communications

“Bringing tokenized U.S. equities onchain—particularly for use cases like lending on Solana—requires high-frequency, reliable market data. Chainlink Data Streams deliver the performance and decentralization that top DeFi teams like Kamino need to build with confidence. By leveraging Chainlink Data Streams, we can create a seamless user experience without compromising on security or trust. The launch of Data Streams for U.S. equities and ETFs is a critical milestone toward a truly composable onchain financial system that matches the scale and sophistication of traditional markets.”—Thomas, Co-Founder Kamino

To start building with Chainlink Data Streams for U.S. equities and ETFs, visit the official documentation.

The State of Tokenized Equities Markets

Tokenized real-world assets (RWAs) are exploding in adoption across onchain economies, with a current market size exceeding $275 billion, according to RWA.xyz. And the momentum is just beginning. With the RWA market projected to reach $30 trillion by 2030, tokenization is rapidly becoming a foundational pillar of global finance. Yet despite this growth, U.S. equities remain largely absent from the trend due to the lack of reliable, context-rich infrastructure needed to support secure and scalable tokenized equity products.

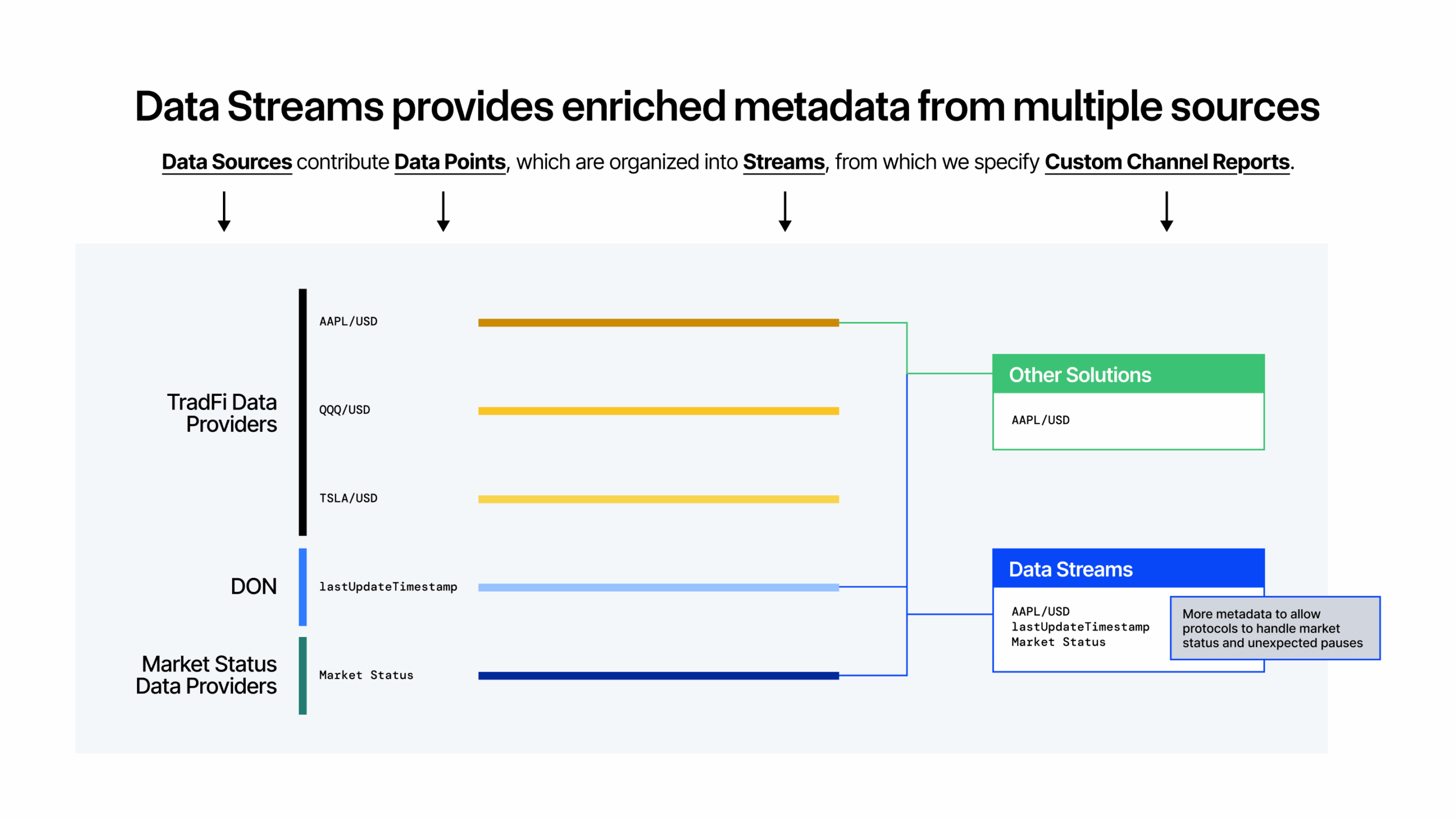

Most onchain data solutions only offer a single mid price and lack critical features that make them unsuitable for institutional-grade financial services involving U.S. equities.

Beyond pricing data, tokenized equities and ETF products onchain require:

- Market hours tracking

- Staleness detection

- Circuit breaker readiness

- Event-aware logic

Without these capabilities, tokenized products are exposed to potential mispricings, unfair liquidations, regulatory gaps, and other critical risks. Chainlink’s battle-tested infrastructure aims to address these challenges with unmatched reliability and data richness.

How Chainlink Infrastructure Advances Tokenized Equities

Establishing reliable onchain markets for U.S. equities requires not only low-latency, high-integrity market data, but also critical context delivered onchain. Unlike crypto markets, traditional financial markets don’t operate 24/7 and may be subject to unexpected disruptions—creating significant challenges for always-on blockchain applications. These include pricing gaps, stale data during off-market hours, and uncertainty during events like halts or outages.

Chainlink Data Streams for equities and ETFs address these issues by delivering real-time, context-rich market data with sub-second latency, enabling developers to build sophisticated tokenized products that remain reliable even with non-continuous data inputs.

Key features include:

- Comprehensive market metadata—In addition to pricing data, Data Streams provide contextual metadata to power smarter, more resilient applications. At launch, supported metadata includes the following, with additional data types coming in the future:

- Pricing algorithm: A mix of last price and mid price to ensure robust and reliable pricing.

- Market status indicator: Built-in market hours logic, allowing smart contracts to determine whether a market is open, closed, or in an unknown state.

- Staleness indicator: A lastUpdateTimestamp, enabling applications to assess data freshness. For example, even if a market is technically “open,” a trading halt or geopolitical shock may render the data unsafe. Data Streams solve this by pairing market status with timestamped data freshness, enabling protocols to programmatically assess whether data is safe to use. Without this capability, protocols risk mispricing, manipulation, or user losses.

- End-to-end customization—Chainlink’s modular and programmable data infrastructure allows protocols to define custom channel reports that match their unique needs, accelerating integration and supporting differentiated use cases.

- Circuit breaker readiness—Designed to support protocols that need safeguards like market pauses and position freezes during unexpected market interruptions, such as trading halts, stock suspensions, or U.S. exchange outages. This brings more robust risk management to DeFi protocols.

- Proven reliability—Backed by Chainlink’s battle-tested infrastructure and robust data aggregation, Data Streams deliver secure, low-latency, and highly available market data, giving protocols the tools to mitigate manipulation, detect stale data, and maintain logic integrity even during unexpected events.

How Chainlink Data Streams Deliver Real-Time Market Data

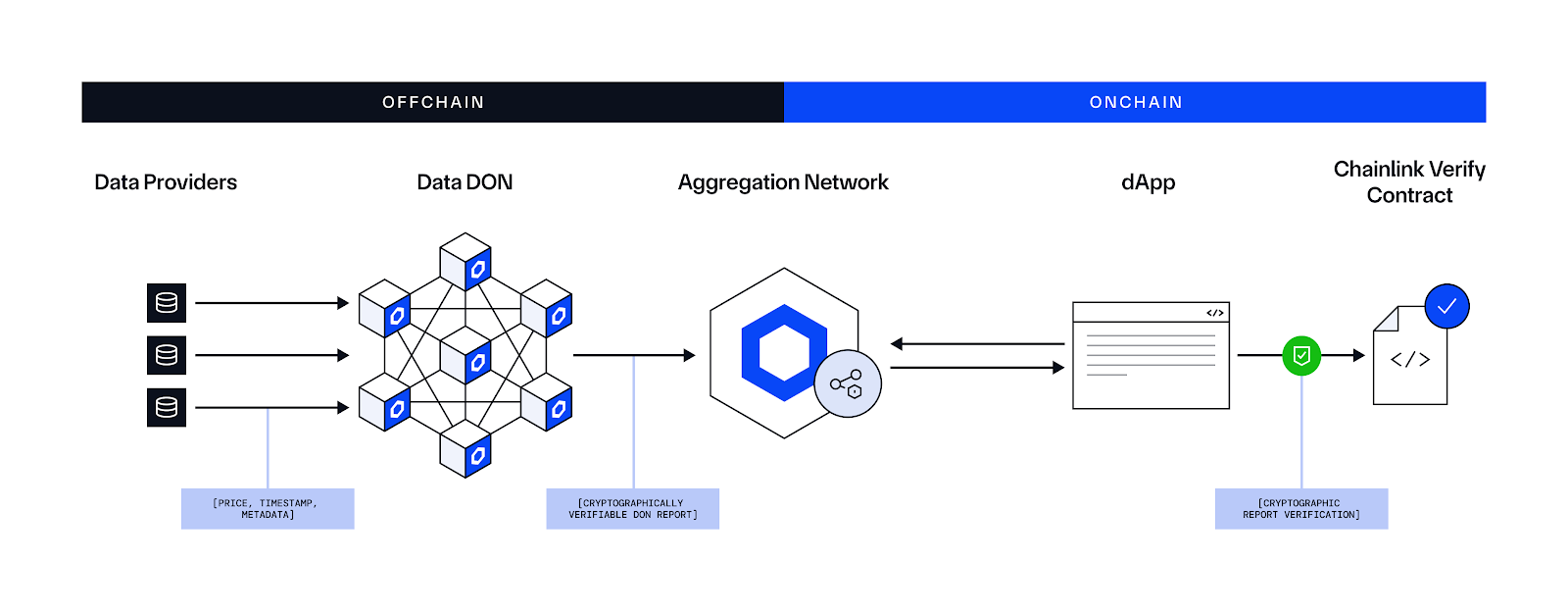

Data Streams aggregate inputs from multiple primary and backup data sources to enhance uptime and reliability, which are processed through decentralized oracle networks (DONs) and delivered onchain via a structured schema.

Each data point is timestamped, allowing protocols to:

- Differentiate between fresh vs. stale prices

- Automatically pause trading during market closures or halts

- Implement context-aware risk management in real time

Chainlink’s data schema is designed for advanced DeFi composability, providing structured, context-rich pricing that supports accurate liquidations, trading halts, collateral valuation, and responsive strategy adjustments. It also differentiates between real-world prices—sourced from traditional markets during exchange hours—and tokenized stock prices, which are available 24/7 onchain. Access to both data types unlocks arbitrage opportunities and supports the development of strategies to capture price spreads or manage risk more effectively.

Key Use Cases for U.S. Equities Enabled by Chainlink Data Streams

Chainlink’s context-rich Data Streams unlock a new generation of secure, compliant, and composable tokenized products:

- Perpetuals—Build perps for U.S. equities and ETFs, with native support for trading hours, halt detection, and real-time market metadata.

- Lending/borrowing—Incorporate tokenized U.S. equities and ETFs into onchain lending markets as collateral or borrowable assets, with accurate and timely valuation.

- Synthetic ETFs and structured products—Combine multiple Data Streams to create custom index products with transparent, verifiable composition and pricing.

- Vault protocols and arbitrage—Design arbitrage and yield strategies by monitoring divergences between real-world prices and tokenized stock prices with real-time, context-rich market data provided by Data Streams.

- Brokerage platforms—Build real-time brokerage layers for U.S. stocks and ETFs that include institutional-grade safeguards powered by Data Streams.

- Treasury management—Enable DeFi treasuries to gain synthetic exposure to equity markets using high-quality market data and risk logic.

Scaling Onchain Capital Markets With Chainlink

The launch of Chainlink Data Streams for U.S. equities and ETFs is a critical milestone in scaling onchain capital markets. Just as Chainlink Price Feeds were foundational to DeFi’s early growth, Data Streams is accelerating the growth of onchain tokenized equity markets, unleashing a new wave of financial innovation.

With new U.S. legislation, such as the GENIUS Act, signaling that the blockchain industry is ready to scale, the launch of Data Streams for U.S. equities and ETFs comes at a critical inflection point. Institutions are actively entering the tokenized asset industry, and the infrastructure is now ready to bring capital markets onchain. Chainlink Data Streams is set to power this next wave of growth, helping bring all of capital markets onchain.

Whether you’re launching tokenized assets, building perpetuals or synthetic ETFs, or innovating legacy infrastructure, Chainlink provides the institutional-grade data you need to operate with security, reliability, and scale. Future planned upgrades include:

- Expanded coverage of equities and ETFs

- Support for additional asset classes such as forex, commodities, and OTC markets

- Ongoing partner integrations

- Additional contextual data

- Chainlink SDK and developer tooling updates

If you’re looking to build with Chainlink Data Streams for U.S. equities and ETFs, reach out to our team.

To learn more about Chainlink, visit chain.link, subscribe to the Chainlink newsletter, follow Chainlink on Twitter and YouTube, and follow Chainlink Labs on LinkedIn.