Chainlink Bounty Winners: ETHGlobal 2021 MarketMake Hackathon

The next Chainlink Virtual Hackathon kicks off March 15! Sign up today to compete for $125k+ in prizes.

The ETHGlobal 2021 MarketMake Hackathon was an impressive outing for smart contract developers to embrace the innovative fervor in DeFi and build advanced new dApps with Chainlink oracles. We continue to see explosive growth in the smart contract ecosystem, as developers both build traditional financial instruments on decentralized infrastructure and unlock completely new DeFi primitives and markets. Chainlink’s widely adopted oracle network is helping dApp developers securely access a full range of off-chain data resources, ensuring that as smart contracts continue to lock in more value, they can depend on hyper-reliable external inputs and computations.

We are pleased to award a total of $5,000 in prizes, with $1,000 to each winning project that used Chainlink oracles to showcase a unique externally connected smart contract application. These prizes encouraged developers to explore creative approaches to DeFi applications while using the Chainlink Network’s secure and reliable data infrastructure to connect their smart contracts to a vast array of off-chain data, API services, and computation.

Thank you to all participants, sponsors, and judges at ETHGlobal’s MarketMake 2021 for creating an environment for developers to level up their smart contract skills and #BuildwithChainlink.

Chainlink MarketMake Hackathon Winners

The winners below are highlighted in alphabetical order.

Audits R Dead: Streamlined DeFi Insurance

Audits R Dead is an Ethereum-based insurance protocol submitted by Evert Kors and Jack Sanford that provides insurance coverage for smart contract exploits or hacks by incentivizing security analysts to research and score insurance risk for DeFi protocols. Analysts are compensated through protocol fees and the yield of the insurance pool. Their detailed assessments of protocol risk inform insurance premiums, coverage policies, and risk/reward tradeoffs for stakers.

Additionally, Audits R Dead allows policyholders and insurers to use staked funds as governance tokens using an internal swap function. The Audits R Dead team uses the Chainlink AAVE/USD Price Data Feed to securely price stablecoin swaps into AAVE, enabling the platform’s governance function while maintaining an accurate level of insurance coverage in a USD base. These governance strategies are configurable for each protocol covered by Audits R Dead.

Audits R Dead is designed to reduce the cost of auditing and increase security through risk-adjusted protocol reviews. The project also opens up active governance participation as a core primitive in DeFi insurance. Using Chainlink’s tamper-proof oracles ensures that automated swaps for governance are secure, and not a honeypot for potential attackers.

DigiU.Lab: Ethereum-BSC DeFi Swaps

Developers Aleksandr, Boris Povar, Sergey Pylypiv, and Bogdan Sivochkin created DigiU.Lab decentralized exchange with liquidity pools on both Ethereum and Binance Smart Chain (BSC). This allows users to swap tokens from an Ethereum wallet to a BCS wallet (and vice versa) right in the DEX interface, simplifying the cross-chain experience.

The DigiU.Lab DEX uses Chainlink oracles as a bridge between EVM chains. They developed a Chainlink External Adapter script to call data from one chain and trigger a smart contract on another chain. The DigiU.Lab DEX works on any EVM-compatible blockchain that has Chainlink natively integrated. In this hackathon project, a Chainlink oracle on Ethereum detects a token swap request, then activates a Chainlink oracle on BSC, which initiates a transfer from the liquidity pool to the user’s BSC wallet. A similar process allows users to add liquidity on either side of the pool.

A trust-minimized cross-chain DEX provides DeFi users more options for moving assets without relying on centralized financial rails. By enabling secure smart contract-based cross-chain exchange, DeFi protocols and users can begin to develop automated ways to take advantage of yield across the growing multi-chain ecosystem.

Gearbox Protocol: Undercollateralized Margin Trading

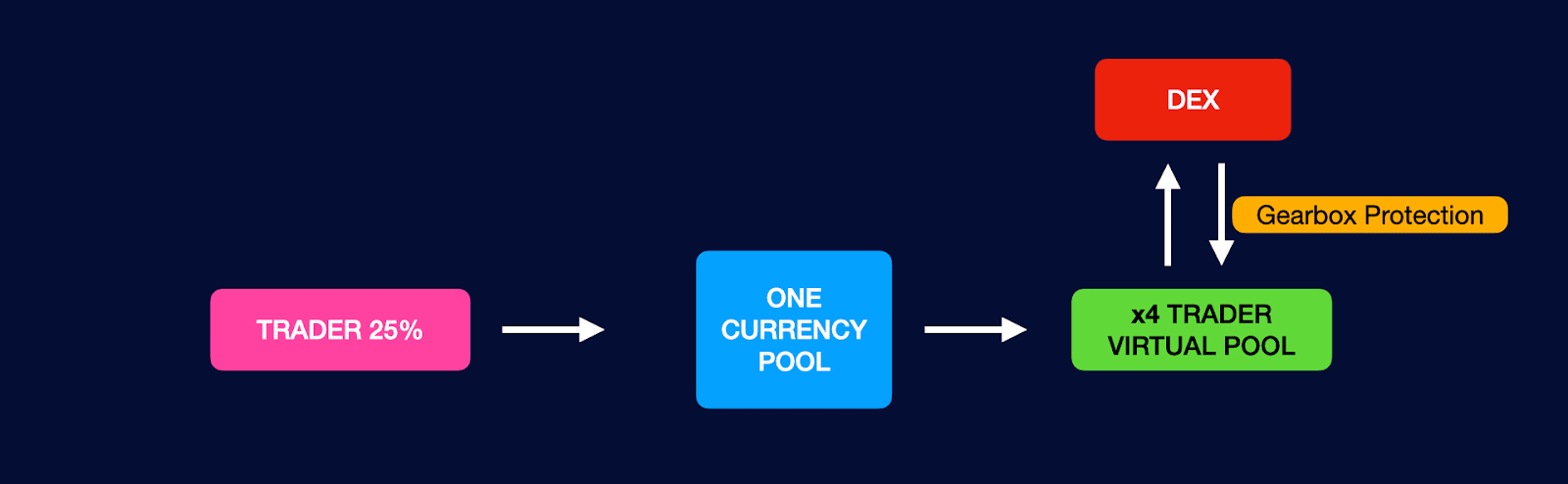

Gearbox Protocol, developed by Mikhail Lazarev, allows users to leverage four times their deposited collateral for margin trading. From Gearbox, LPs stake approved assets that users can borrow to trade on leveraged positions. Users can then trade on a variety of whitelisted DEXs through Gearbox, trading with positions continuously monitored on-chain for risk factors that might result in liquidation.

Gearbox uses tamper-proof price data secured by Chainlink oracles to determine a risk score for a user’s portfolio. Users must maintain a valid risk level, or their collateral will be liquidated, providing LP staking revenue. Chainlink provides secure and reliable price data to ensure that liquidations happen according to fair and accurate portfolio evaluations.

Quadratic Treasury (Q2T): Decentralized Funding for Public Goods

Q2T extends the quadratic funding model to provide funding to projects based on successful milestones. Teammates Alex P., Evgeni Shavkunov, Markus Vasemägi, Milena Monova, and Carlos Noverón build Q2T so donors can submit funds that are unlocked and distributed from a smart contract according to successful project development releases, timelocks, or a variety of other milestone markers.

When a project successfully meets a milestone, a predetermined amount of funding is released. This reduces the resources projects need to expend to promote grant funding so they can focus on shipping code. Quadratic Treasury’s funding model also allows for a larger pool of funds to be used to accrue and redistribute returns earned from treasury management. Q2T achieves Sybil-resistance by leveraging Aave’s Native Credit Delegation to prevent a few large donors from funding projects with many wallets.

Q2T uses custom Chainlink External Adapters to determine when milestones are met. First, milestones are efficiently validated peer-to-peer and off-chain in the Q2T system. When a milestone is created in Q2T, it generates a unique hash and sends it to the validator smart contract. The smart contract uses the Chainlink External Adapter to verify the milestone hash on the backend. Once the hash is validated, the Chainlink oracle triggers a `request fulfilled` event, which in turn triggers the fulfill function to distribute the allocated funds to the correct address.

Q2T provides a good example of using Chainlink External Adapters to bring useful off-chain data on-chain to automate and decentralize financial flows, ensuring these processes are fair and transparent.

Whiskey MarketMaker: DeFi Exposure to Small-Batch Whiskey

The team at Whiskey MarketMaker, Jasper and Tillman Degens, created a DeFi platform where small-batch whiskey distilleries can list maturing bottles of whiskey as an on-chain token. Investors can deposit ETH for ERC1155 tokens that represent bottles of small-batch whiskey, wait for the whiskey to mature, track the value of whiskey over time, and redeem or sell the rights to the bottles once they’ve reached maturity. The deposited ETH is used in an Aave interest-bearing pool until redemption.

Whiskey MarketMaker uses the Chainlink ETH/USD Price Data Feed to calculate the cost of each bottle at deposit and redemption in ETH. In this method, the distillery receives early orders to predict budget and resource demand for long timeframes, and the user earns interest from deposited funds while waiting for redemption, all while getting early access to an appreciating “liquid” asset.

Join the Spring 2021 Chainlink Virtual Hackathon

Congratulations again winners, and thank you to all the developers who used Chainlink in the ETHGlobal MarketMake 2021 Hackathon. We look forward to seeing how these unique hackathon builds develop into mature projects that attract users across the DeFi space and beyond.

The Spring 2021 Chainlink Virtual Hackathon officially kicks off March 15, so make sure you sign up. This is our biggest hackathon yet and a great opportunity to level up your smart contract development with Chainlink, learn from top teams in the space, and compete for over $125k in prizes. Registration will remain open until the hackathon midway point. Sign up now.

If you want to quickly get your smart contract application connected to Chainlink, visit the developer documentation and join the technical discussion in Discord.