Introducing Chainlink Automated Compliance Engine (ACE): Enabling Compliance-Focused Digital Assets Across Chains and Jurisdictions

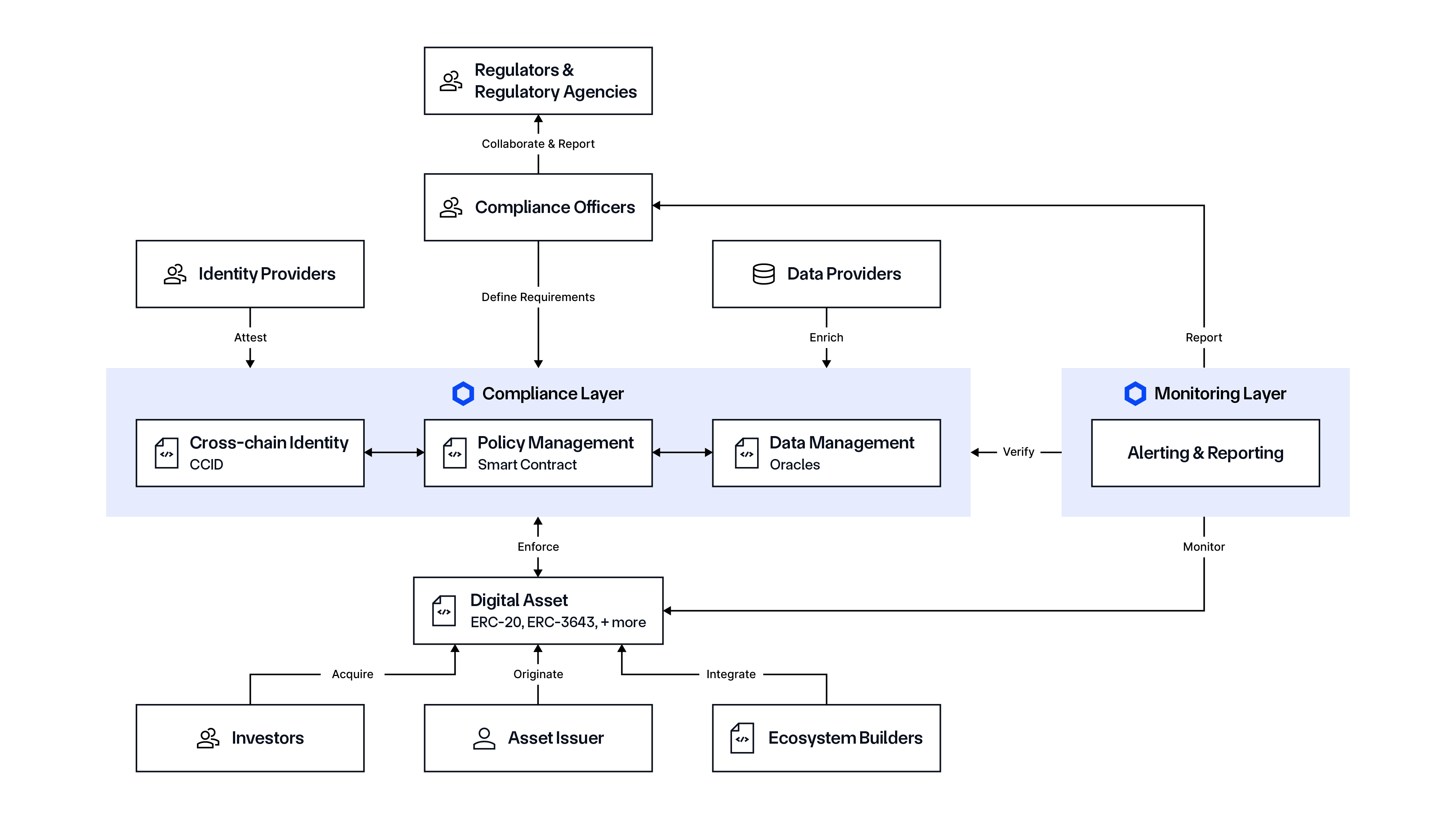

We’re excited to announce the launch of Chainlink Automated Compliance Engine (ACE)—a unified and modular standard to solve all onchain compliance problems and bring institutional capital onchain. Built on the Chainlink Runtime Environment (CRE) and launched in collaboration with Apex Group, GLEIF, and ERC-3643 Association, the Automated Compliance Engine enables real-time policy enforcement, secure identity management, and streamlined monitoring and reporting across public and private blockchains, unlocking access to $100+ trillion in institutional capital.

Chainlink ACE is unique in its ability to extend existing financial systems and financial market infrastructure for identity and compliance data to blockchains and tokenized assets, empowering institutions to automate policy enforcement, simplify regulatory processes, and confidently operate onchain. Doing so unlocks complex, compliance-focused financial transactions across multiple digital/tokenized assets, jurisdictions, counterparties, and execution environments, including public and private blockchains, while also maintaining privacy of sensitive data.

Chainlink ACE is currently in the early access phase. To inquire about early access, reach out here.

The Chainlink Automated Compliance Engine is launching in collaboration with multiple leading identity frameworks for tokenized assets, including:

- Apex Group is a prominent global financial services provider that services over $3.4 trillion in assets and provides institutional-grade tokenization solutions. Apex Group and Chainlink collaborated to strengthen institutional-grade compliance for tokenized assets. The collaboration centers around integrating Chainlink ACE with ERC-3643 permissioned tokens, starting with ONCHAINID, the open-source identity framework built into the token standard.

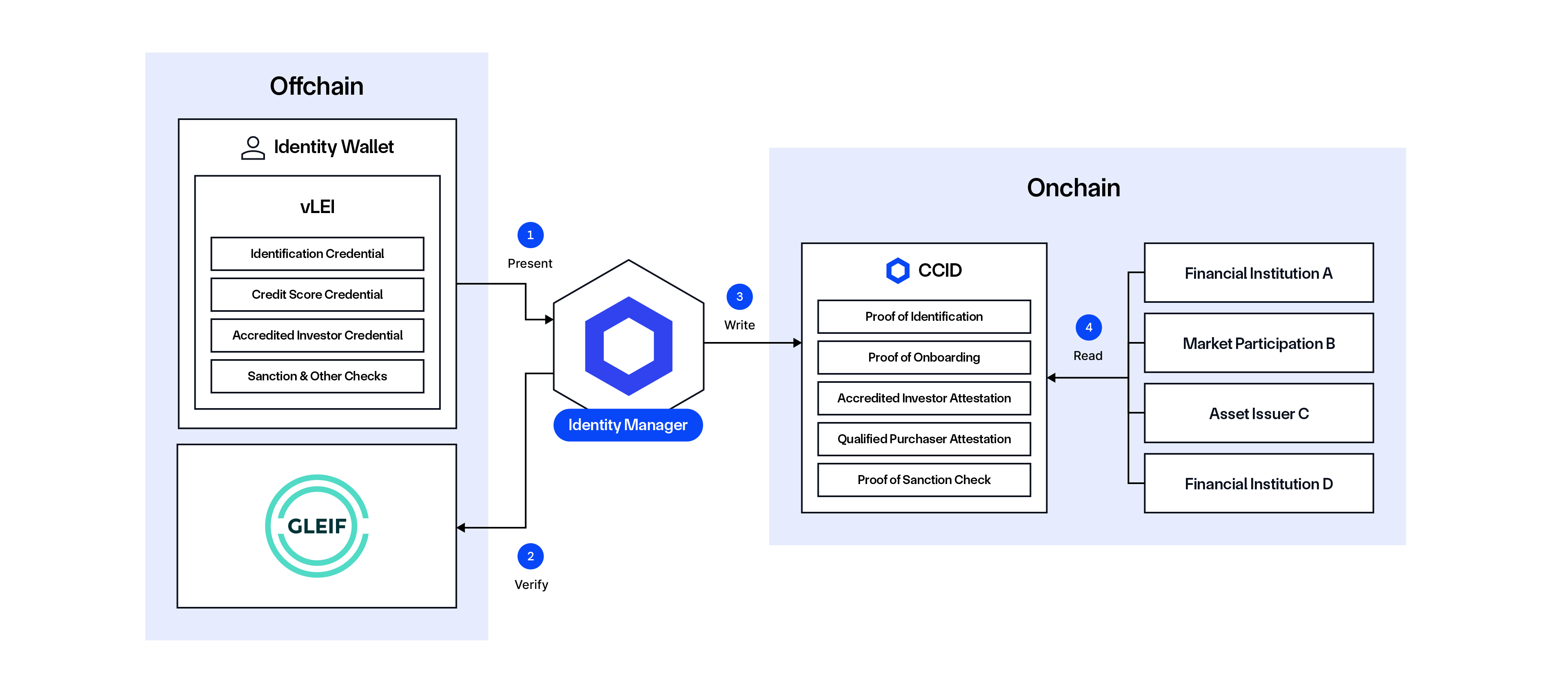

- GLEIF is the organization overseeing and ensuring the integrity of the only globally adopted and mandated G-20 initiated Legal Entity Identifiers (LEIs) standard, which enables reliable identification of legal entities in financial transactions. Integrating Chainlink ACE with verifiable LEI (vLEI) unlocks a compliance-first digital asset infrastructure, where GLEIF anchors global legal entity identities while Chainlink operationalizes it through decentralized infrastructure. The partnership brings verifiable legal entity identity (vLEI) data onchain for the first time.

- ERC-3643 Association, a non-profit organization dedicated to standardizing the tokenization market through ERC-3643, collaborated with Chainlink to engineer an implementation of ERC-3643 that leverages a combination of Chainlink ACE and GLEIF vLEIs for identity verification. ERC-3643 is a permissioned token standard that ensures compliance and controls.

These frameworks can be used with Chainlink ACE to support reusable digital identities, cross-chain compliant digital asset settlement, regulated asset usage in DeFi protocols, and more—enabling the global financial system to transition onchain in a scalable way.

The following blog outlines the opportunities and challenges for compliance within the blockchain industry, before providing a look into Chainlink ACE and the many use cases it unlocks for digital assets and onchain finance.

If you want a more technical breakdown of the Automated Compliance Engine, check out the technical overview blog.

The Opportunities and Challenges of Onchain Compliance

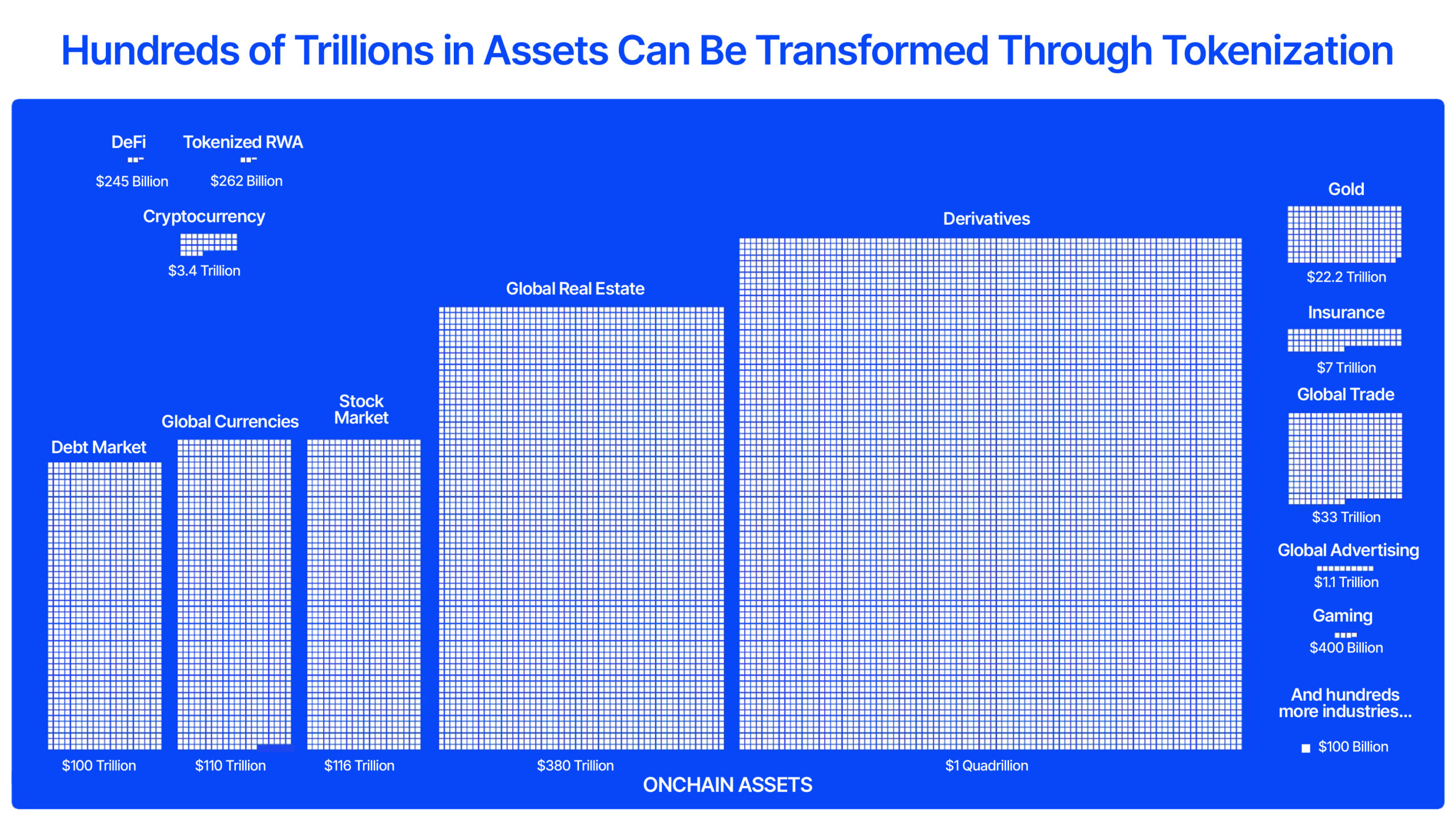

The global market for tokenized financial assets is accelerating, with major U.S. asset management institutions like BlackRock and Franklin Templeton already launching tokenized funds on public blockchain networks. The Boston Consulting Group projects ~$16 trillion in tokenized illiquid assets by 2030—roughly 10% of global GDP—while the World Economic Forum estimated that up to $867 trillion in financial assets could be disrupted by tokenization.

To achieve broad institutional adoption, tokenized assets and transactions need built-in compliance enforcement capabilities, such as identity verification (KYC), risk screening (AML), exploit protection, and asset-specific restrictions such as rate limits. But compliance doesn’t stop at rules—it also includes continuous monitoring, auditability, and real-time reporting to satisfy both internal governance and external regulatory demands. Not only do these compliance functions need to be implemented, but they need to be automated, or else institutions face escalating complexity, cost, and risk that threaten to stall the adoption of tokenized assets at scale.

Current compliance processes rely on siloed compliance systems and expensive onboarding processes, resulting in billions of dollars in onboarding costs for institutional investors. This not only drives up costs and reduces margins, but it lengthens onboarding times and creates inefficiencies—e.g., even if the same institutional client is known to multiple parties in a transaction, each regulated firm must verify that client’s identity independently. Furthermore, financial institutions are faced with a dilemma, where they must collect and store sensitive identity data to perform compliance, yet need to minimize data collection and protect personal information to comply with data protection regulations.

Then there is the challenge of how to apply existing compliance infrastructure to onchain transactions involving regulated tokenized assets. Initial attempts have been expensive, slow, or incomplete, such as relying on manual and duplicative processes, doing point integrations with dozens of different vendors, or using third parties to manage compliant/non-compliant lists of onchain addresses. Despite growing institutional demand, the industry still lacks standards for onchain KYC/AML enforcement and other compliance mechanisms onchain, along with fragmented identity mapping, identity frameworks that are not interoperable, and policy engines incapable of dynamically applying internal and jurisdiction-specific rules across chains.

Blockchains and oracle networks support a new and hybrid approach to onchain compliance. Instead of validating and storing customer data in-house, organizations can use cryptographic proofs that verify a user meets compliance requirements (e.g., jurisdiction, accreditation) without exposing sensitive data. These proofs can then be tied to digital identities onchain, enabling smart contracts to reference them to automatically enforce compliance while preserving users’ privacy. Relevant identity attributes can be shared on a need-to-know basis, while policies for what data and how to interact with it can be customized to each stakeholder’s needs, reducing unnecessary data exposure.

If implemented correctly, blockchain-based identity reduces the need to verify the same data repeatedly across different institutions, cutting costs and reducing onboarding time. Moreover, by integrating with existing offchain compliance systems, oracle networks allow institutions to extend their current infrastructure and existing standards into blockchain environments, avoiding costly rebuilds and enabling consistent enforcement across traditional and decentralized systems.

Chainlink ACE Provides an All-in-One Onchain Compliance Solution

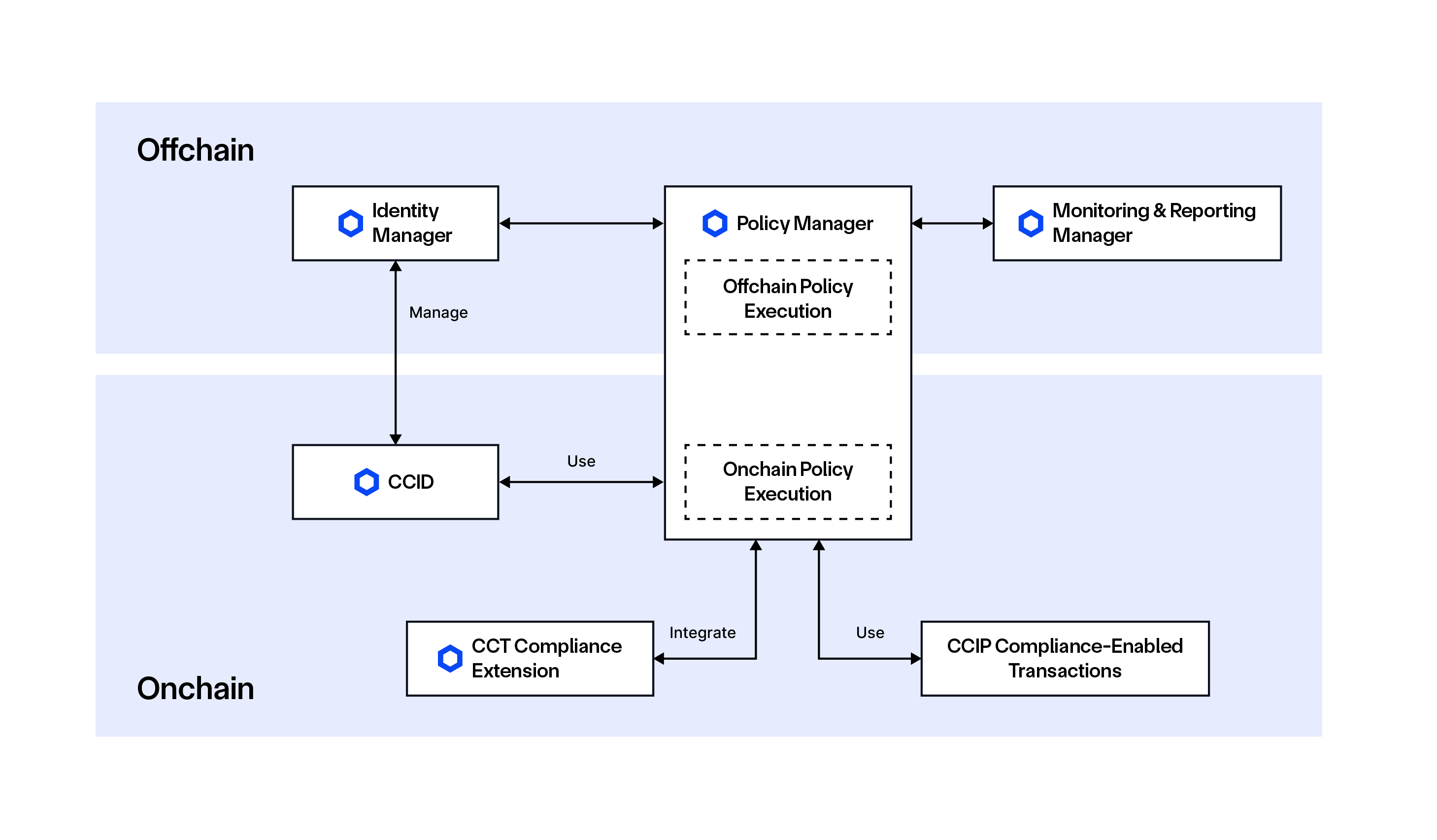

The Chainlink Automated Compliance Engine (ACE) unifies Chainlink’s compliance-related capabilities, tools, and services to facilitate the creation and lifecycle management of regulated financial instruments and tokenized assets on blockchain networks. It’s powered by the Chainlink Runtime Environment (CRE), which serves as the underlying infrastructure that combines cross-chain interoperability, offchain data integration, and automated compliance orchestration into a single unified offering.

Chainlink ACE is an extension of our existing work in creating privacy-preserving identity verification and asset transfers through the Chainlink Privacy Suite, including DECO (a novel zkTLS data verification system), Blockchain Privacy Manager (middleware for connecting Chainlink services and existing systems to private blockchains), and CCIP Private Transactions (privacy-preserving cross-chain asset transfers between private blockchains).

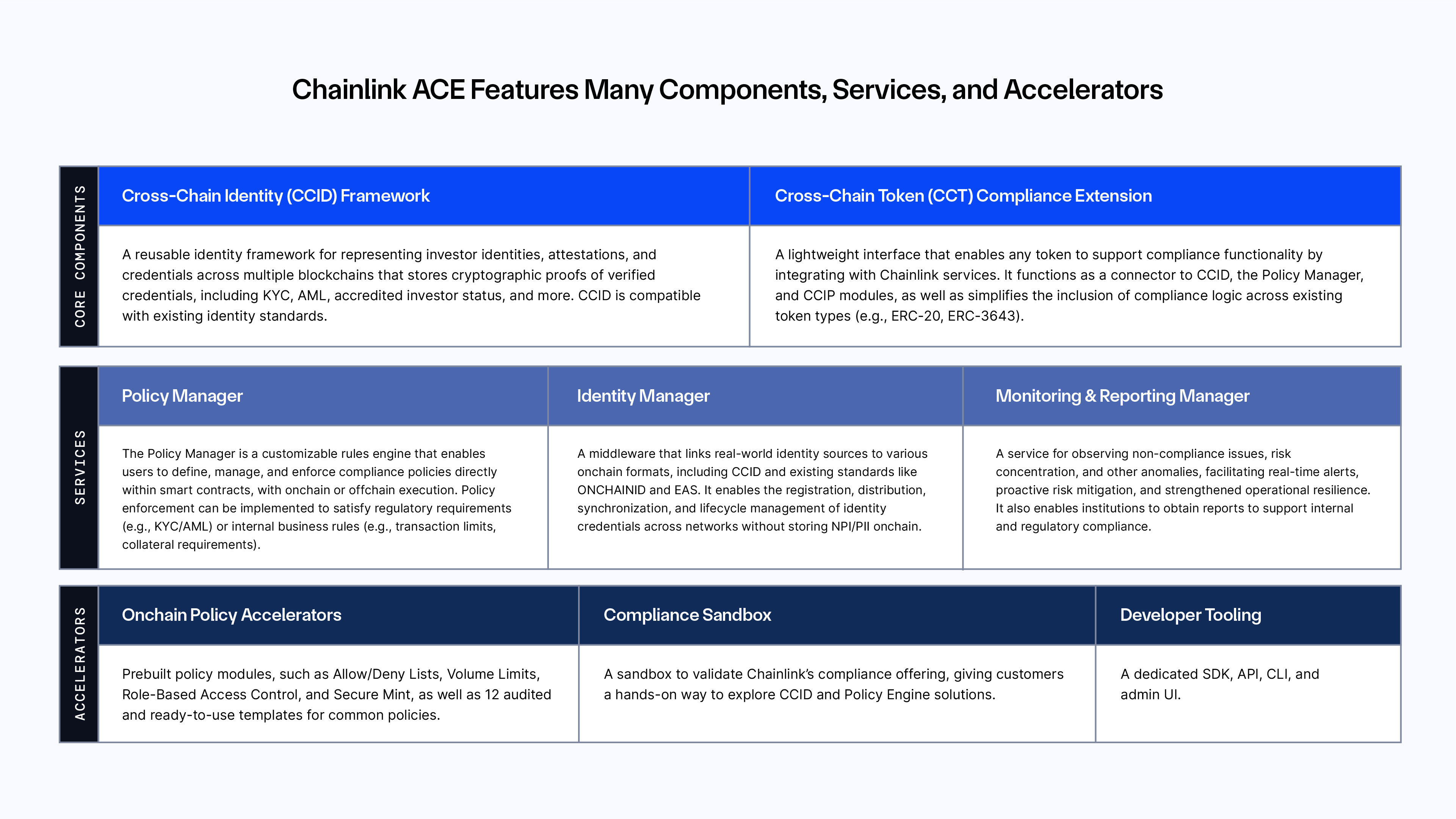

The diagram below outlines all the components, services, and tools available as part of Chainlink ACE, along with a short description of their specific functions. For a deeper dive into each, read the Technical Overview blog.

Chainlink ACE unlocks many unique capabilities, making it the ultimate all-in-one developer platform for financial institutions and DeFi protocols looking to incorporate compliance into their digital assets and applications:

- Extensive Connectivity: Support any public or private blockchain and enable existing compliance frameworks and infrastructure to be integrated onchain, such as existing identity/KYC providers, financial systems, credential issuers, and more. This abstracts away blockchains and eases the transition onchain for financial institutions, as they can reuse compliance workflows and systems they already operate.

- Modular and Composable: Deploy only what is needed, where it is needed, giving developers fine-grained control over policy enforcement, identity services, and integration with both onchain and offchain systems. Furthermore, Chainlink ACE enables developers to build, customize, and deploy compliance workflows that can be reused, modified, or upgraded without starting from scratch. Instead of relying on point-to-point integrations with individual vendors, data providers, assets, or jurisdictions, teams can extend pre-built components and reusable templates to meet specific regulatory needs.

- Superior Developer Experience: Accelerate time-to-market by leveraging easy-to-use templates, SDKs, and a wide collection of onchain and offchain systems already connected to the platform. Developers can build once and deploy across any chain, execution environment, or jurisdiction—removing the need for bespoke integrations or redundant logic. Ultimately, Chainlink ACE is agnostic to various asset types, jurisdictions, onchain or offchain execution environments, and token standards, removing any vendor lock-in to various compliance inputs and design patterns.

Industry Leaders Are Already Integrating With Chainlink ACE

Chainlink & GLEIF for Trusted Identity Data Onchain

Asset issuers and market operators need a scalable, reliable, and regulatory-compliant way to identify investors, exchange identity information among themselves, and enable identity-based interactions with compliant digital assets across blockchains. Chainlink teamed up with the Global Legal Entity Identifier Foundation (GLEIF) to deliver its verifiable Legal Entity Identifier (vLEI) onchain to solve these investor identification and KYC/AML challenges.

“We welcome the integration of the vLEI into Chainlink’s Automated Compliance Engine as a powerful example of how verifiable organizational identity can enhance compliance across blockchain ecosystems. As regulatory expectations evolve in both digital and traditional finance, we encourage all financial institutions to explore with their solution providers how adopting the vLEI can strengthen trust, interoperability, and auditability in their compliance frameworks.”—Alexandre Kech, CEO of GLEIF.

LEI is a 20-character, alphanumeric code designed to uniquely identify legal entities participating in financial transactions and to enhance transparency across global financial markets. GLEIF develops and governs vLEI, a cryptographically verifiable digital identity that enables automated, trusted verification of legal entities and the individuals authorized to act on their behalf. The vLEI builds on the LEI system to support secure, real-time identity management for digital interactions.

CCID is used to link onchain wallets to the LEI/vLEIs of real-world legal entities, and includes KYC/AML and AI/QP verification attributes through verifiable credentials issued by Virtual Asset Service Providers (VASPs), Identity Verification (IDV) solutions, and KYC providers. This enables smart contracts, asset issuers, trading platforms, and asset administrators to verify that counterparties involved in a transaction have completed the required identity checks, are not sanctioned, and are legally authorized to engage with regulated financial instruments. Unlike static allowlists, this approach enables dynamic, policy-based compliance that can be enforced onchain or offchain and remains interoperable across jurisdictions.

Check out the following report to learn more about how Chainlink and GLEIF unlock advanced use cases for blockchain-based markets: The Future of Digital Identity and Automated Compliance in Global Financial Services.

Apex Group and Chainlink Enable Compliant ERC-3643 Token Issuance Across Chains

Institutional issuers and asset managers need a scalable, interoperable, and standards-based way to issue permissioned tokens and enforce compliance policies across multiple blockchains. Apex Group is a leading global financial services provider that features enterprise-grade tokenization solutions, such as permissioned tokens via the ERC-3643 token standard, which has a built-in onchain identity framework called ONCHAINID. Apex Group and Chainlink collaborated to bring an institutional-grade compliance solution to tokenized assets through an integrated onchain-offchain model.

At the core of this collaboration is the alignment between the ERC-3643 token standard and the Chainlink Identity Service, which connects real-world identity sources to onchain formats, including ONCHAINID and CCID. This compatibility allows ONCHAINID credentials to be seamlessly registered, synchronized, and managed across blockchain networks via Chainlink ACE, significantly broadening the reach and utility of ONCHAINID across chains. This also lays the foundation for a broader hybrid compliance model, such as extending interoperability into Chainlink’s Policy Manager and a CCID-compatible ERC-3643 implementation.

“Having recently acquired Tokeny, Apex Group’s collaboration with Chainlink marks yet another milestone in our journey to bring compliance-focused digital asset infrastructure to institutional markets. Chainlink’s technology, combined with our existing tokenisation and on-chain finance capabilities, will set the standard for compliance on DLT. We are bridging key compliance requirements with seamless blockchain execution.”—Zion Hilelly, Chief Product Officer of Apex Group.

Chainlink also teamed up with the ERC-3643 Association to engineer an implementation of ERC-3643 that leverages a combination of both Chainlink ACE and GLEIF vLEIs for identity verification. In this ERC-3643 token implementation, the Asset Issuer configures compliance rules via the Chainlink Policy Manager, which runs offchain within the CRE. These policies are enforced onchain by the Policy Manager, which interacts with CCID to fetch LEI/vLEI credentials issued and verified through GLEIF. The Identity Manager ensures secure, real-time access to these credentials across various blockchain ecosystems. As a result, assets tokenized using the ERC-3643 standard can ensure that only identity-verified participants are able to access and transfer the asset, in compliance with regulatory and business rules.

“Partnering with Chainlink has enabled the ERC-3643 standard to become interoperable, dynamic, and policy-driven. By embedding Chainlink ACE and vLEI into the ERC-3643 framework, permissioned tokens can easily enforce jurisdiction-specific rules onchain. This shows how composable solutions and standards are key to upgrading finance onchain at speed.”—Dennis O’Connell, President of the ERC-3643 Association

Together, Chainlink, Apex Group, and the ERC-3643 ecosystem are advancing a fully interoperable and compliance-focused token standard—designed to meet the evolving needs of regulated financial institutions operating across global capital markets.

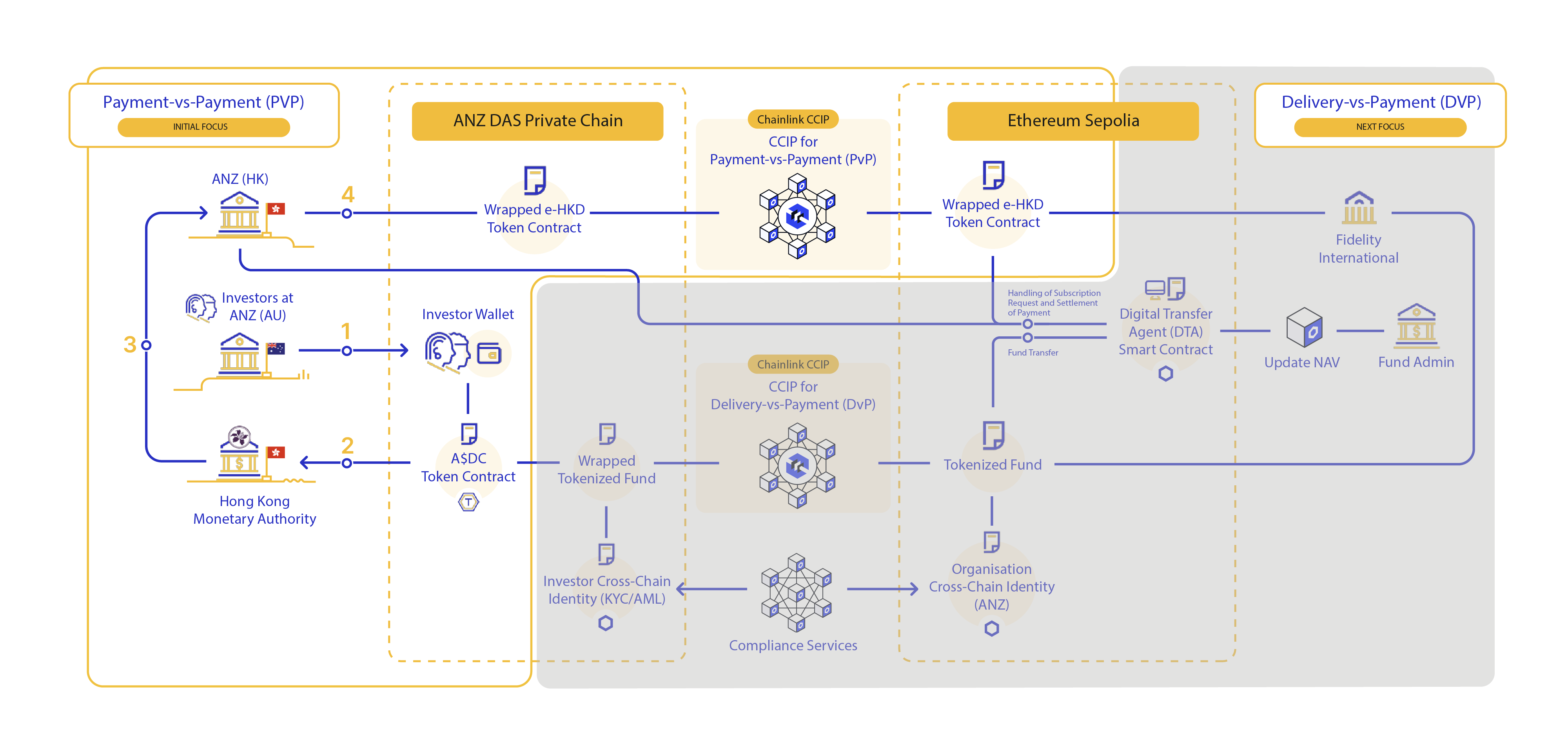

HKMA e-HKD Phase 2: ANZ Bank and Fidelity International Leverage Onchain Identity Verification via CCID

Visa highlighted how, under the Hong Kong Monetary Authority (HKMA) e-HKD+ program, the Chainlink Cross-Chain Interoperability Protocol (CCIP) and Automated Compliance Engine enabled the secure exchange of ANZ Bank’s A$DC’s stablecoin with Hong Kong’s e-HKD+ CBDC, which was later used to facilitate the purchase of a Fidelity International tokenized fund. By leveraging a combination of Chainlink CCIP, Chainlink ACE, and Chainlink Digital Transfer Agent (DTA) offerings, Fidelity International and ANZ demonstrated how secure, privacy-preserving, and compliance-ready infrastructure can accelerate tokenized fund operations at scale.

Chainlink ACE was used to read investors’ identity information from ANZ’s offchain identity registry and provide a verification onchain in the form of CCID. CCID can then be referenced during transactions to verify the investors’ identity.

Unlocking Countless Compliance Use Cases For Digital Assets

- CCIP Compliance-Focused Transactions—Leverage Chainlink ACE and CCIP to bring regulated tokenized assets onto public chains under tightly defined constraints, such as a settlement asset for a wide range of onchain workflows.

- Eligibility Allowlist—Manually specify wallets that are eligible to transact with a smart contract, which is then referenced when determining if a user can interact with a regulated asset, such as a tokenized fund. This is ideal when there is a small number of investors to manage.

- Compliance-Focused Tokenized Fund Subscription—Enforce compliance for all new investors wanting to subscribe to a tokenized fund.

- Cross-Chain Collateralized Loan—Ensure only eligible lenders and borrowers are able to participate in regulated lending pools.

- Pre-Transaction Eligibility Checks—Before allowing the transaction, check the transaction initiator’s wallet for valid KYC, AML, CFT, sanctions, jurisdictional, and/or accreditation credentials. The credentials can be embedded in a digital asset or applied to a protocol that wants to enforce compliance.

- Transaction Volume Rate Limits—Enforce specific transaction volume limits for assets or protocols, such as min/max transaction volume, max transaction volume per hour/day/etc, or if a transaction results in the user’s wallet having more than 49% ownership of the transacted asset.

- Secure Mint—Verify that the total supply of a token doesn’t exceed proof of reserve data attesting to the token’s total offchain reserves, prior to minting the asset.

- Asset Role-Based Access Control—Apply rules that define different administrative capabilities for the asset (or other smart contract), such as who can mint, forceTransfer, manage eligible investor allowlists, or change contract ownership and how.

- Hold Policy—Put a hold on assets in user wallets, such as if someone was sanctioned and shouldn’t be able to transact the asset anymore. Or, in a DvP scenario, use it to lock the payment asset in the wallet while delivery is being finalized (and vice versa).

Compliant Capital Is The Largest Driver of Future Growth in The Blockchain Industry

Onchain finance, powered by blockchains and oracle networks, offers a superior financial system that provides users enhanced security and reliability, increased transparency, and unparalleled composability and efficiency. However, for the majority of the world’s capital, which currently sits in traditional institutions, to transition into the onchain format and be used by onchain applications, compliance is the key hurdle that must be overcome to unlock nearly all future growth of the blockchain industry.

Chainlink ACE is the only comprehensive standard that enables financial institutions and DeFi protocols to build compliance logic into any and all parts of the asset lifecycle. Policy definition and enforcement can be fine-tuned to the exact needs of each stakeholder, and involve connectivity across any number of blockchains, offchain data providers, and existing systems, as well as a wide variety of existing compliance infrastructure and stakeholders for a seamless transition onchain. Using Chainlink ACE, developers can finally bring all the world’s capital onchain and create robust markets for assets and financial services—all in a compliance-focused and privacy-preserving manner.

This is the next era of the blockchain industry, and it’s starting now.

If you want an early preview or to start building with Chainlink ACE, reach out to us. To learn more about Chainlink, visit chain.link, subscribe to the Chainlink newsletter, follow Chainlink on Twitter and YouTube, and follow Chainlink Labs on LinkedIn.

—

Disclaimer: This post is for informational purposes only and contains statements about the future, including anticipated product features, development, and timelines for the rollout of these features. These statements are only predictions and reflect current beliefs and expectations with respect to future events; they are based on assumptions and are subject to risk, uncertainties, and changes at any time. There can be no assurance that actual results will not differ materially from those expressed in these statements, although we believe them to be based on reasonable assumptions. All statements are valid only as of the date first posted. These statements may not reflect future developments due to user feedback or later events, and we may not update this post in response. Please review the Chainlink Terms of Service, which provides important information and disclosures.