Empowering Agentic AI Within Financial Systems Requires Zero-Knowledge Proofs and Privacy-Preserving Technologies

Anthony Butler is a former senior advisor to a G20 central bank, Chainlink advisor, and former CTO of IBM Services, Middle East and Africa.

Introduction: The Rise of Agentic AI

Financial markets are entering a new era with the emergence of “agentic AI”—a paradigm where autonomous, specialized agents reason, act, and collaborate to address complex, multi-step challenges. These agents operate independently but excel when interacting with one another, leveraging their unique capabilities to achieve shared objectives efficiently, such as running compliance checks, creating a comprehensive credit memo, and even simulating the impact of monetary policy.

In my experience working with AI systems, the most significant breakthroughs often emerge not from individual systems but from their ability to collaborate. This shift toward agentic AI reflects a larger trend in AI development: moving from isolated tools to interconnected systems designed to work together seamlessly.

These systems are distinct from other AI applications due to their ability to integrate the following characteristics:

- Perception: Agents gather and interpret data relevant to their specialization, whether through direct interaction with their environment, user input, or querying external systems.

- Reasoning and planning: Agents analyze contextual information, assess goals, and develop strategies and plans, combining autonomous decision-making with human-aligned objectives.

- Tool use and collaboration: Agents interact with other agents and external systems, employing tools and shared resources to execute tasks effectively. These tools could be custom-developed for an agent or systems that are external to the agent itself, such as an enterprise application or internet-hosted service.

- Execution: Agents act upon their decisions, coordinating workflows to achieve outcomes that sometimes require the collective effort of specialized participants.

This set of capabilities allows agents to adapt to evolving conditions, collaborate seamlessly, and perform complex tasks autonomously, particularly processes or use cases that cannot be distilled down to a linear workflow. As such, they provide an alternative to the brittleness of codified and rule-based systems which often break or require human intervention when faced with unforeseen situations. Agents, by contrast, are able to adapt to these situations, albeit in a non-deterministic way.

Whilst there are many activities within industries such as finance or the public sector where the autonomous and adaptable nature of agentic AI can deliver significant value, there are also risks and challenges that come with this autonomy.

For example, how do agents establish trust with other agents and with the various stakeholders in these systems when they are acting, in some cases, in a capacity that a human was previously engaging in? When agents make decisions, how can we ensure their decisions are based on reliable, real-world data? These are some of the questions we must address to unlock the full potential of agentic AI.

Architecture of Agents

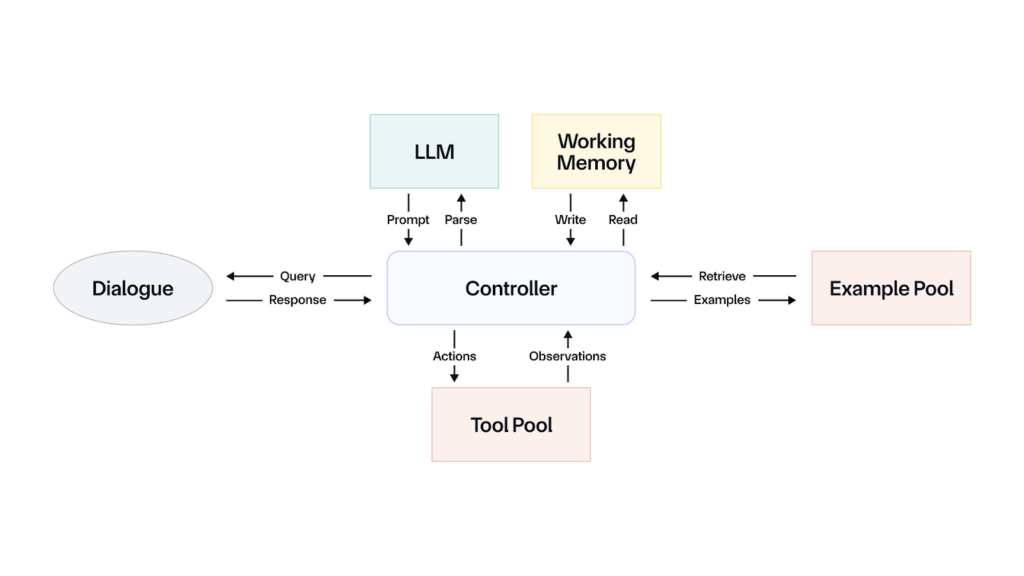

There are several emerging patterns of agent architecture, but the simplest and most widely used is one called the RAISE framework. As the diagram below shows, an agent consists of a controller which is the code that receives the input and orchestrates its activities; an LLM which essentially provides the reasoning and planning capability; a working memory which keeps track of the work performed by the agent thus far in a given task context; a set of tools that the agent can call on as required; and a set of examples that can further guide it. The agent itself runs as a loop where it will receive the goal or objective, develop a plan, use tools to execute a step in the plan, compare with examples, and then provide to the user to get a response.

Collaboration in Multi-Agent Systems

Whilst single agents can be deployed, the real value of agentic AI is its ability to deploy multiple specialized agents in a collaborative ecosystem to deal with complex contexts. Each agent contributes expertise to a larger system, working in tandem to address complex problems that a monolithic AI approach cannot solve efficiently.

In finance, agentic AI can create interconnected systems where specialized agents work together to handle complex workflows. Consider the credit analysis process:

- A planning agent determines the tasks required to evaluate an institutional borrower’s creditworthiness.

- A data-gathering agent compiles financial statements, credit reports, and other documentation.

- An analysis agent calculates key metrics like debt ratios and flags risks.

- A validation agent reviews findings and identifies errors, passing them back iteratively for refinement.

- A memo-preparation agent consolidates the results into a final credit memo for human review and approval.

This multi-agent system operates efficiently within the institution, but its potential extends further. Future agents could interact with third-party agents representing borrowers, regulatory bodies, or other financial institutions to share and validate data securely. Such collaboration could drastically reduce manual effort and improve decision-making accuracy.

However, collaboration introduces challenges. How can agents trust each other in decentralized systems without centralized oversight? How can sensitive data be exchanged securely? Addressing these challenges is critical to scaling agentic AI effectively.

Challenges in Scaling Agentic AI

To realize its potential, agentic AI must overcome four key challenges:

- Establishing trust between agents: In decentralized environments, agents must both validate the reliability of data and decisions from others without central oversight; and they must have a mechanism to give other agents trust in the output of their tasks.

- Protecting privacy: Collaboration often requires agents to share sensitive data. Striking a balance between information exchange and privacy is a persistent hurdle, particularly as agents are scaled in financial and other regulated industries.

- Ensuring interoperability: Diverse systems, architectures, and regulatory frameworks complicate seamless collaboration. Standardized protocols and technologies are essential to bridge these gaps.

- Accessing reliable real-world information: Agents need accurate, real-time data, but ensuring its integrity in dynamic or adversarial contexts is a persistent challenge.

These challenges underscore the privacy paradox: agents need data to function effectively, but accessing or sharing this data increases the risk of breaches, misuse, and regulatory violations. Solving this paradox is essential to the success of agentic AI.

The Privacy Paradox

Agentic AI thrives on context-rich data. The better the data, the more informed and precise an agent’s decisions. But this dependency introduces some risks. For example:

- Data breaches: Sensitive information shared between agents could be exposed to unauthorized entities, particularly if some of the agents sit outside of the organisational perimeter.

- Data manipulation: Agents may rely on tampered or unreliable data, undermining trust in the system. This challenge can be particularly material if the agent is part of a multi-agent system that spans jurisdictions or firms; or if the agent is interacting with sensitive external systems where incorrect data or actions could have major real-world consequences.

- Regulatory complexity: Privacy laws like Europe’s GDPR or Saudi Arabia’s PDPL introduce additional compliance requirements that complicate multi-agent collaboration.

Traditional privacy controls, such as centralized data storage, rigid access policies, or network-based security controls, are poorly suited for decentralized, autonomous systems. Solving this paradox requires privacy-preserving architectures that enable secure, trust-based collaboration without compromising sensitive information.

Zero-Knowledge Proofs: A Foundation for Trust

Zero-knowledge proofs (ZKPs) offer a cryptographic solution to the privacy paradox, allowing one party (an agent) to prove the validity of a statement without revealing any additional information.

Whilst they have been widely used in the DeFi and Web3 world, ZKPs may also play a critical role in establishing trust in decentralized, multi-agent systems.

Key benefits of ZKPs for agentic AI:

- Inter-agent trust: Agents can validate each other’s outputs securely, ensuring reliable collaboration without revealing unnecessary details. For example, when an agent performs a task within its organisational boundary and then passes the output to another agent, it also supplies a zero-knowledge proof that proves that its task had been completed according to the standards and requirements of the organisation.

- Credential verification without disclosure: Agents can prove compliance with requirements (e.g., regulatory adherence) without exposing sensitive data and they can also prove they have the appropriate authorisation from their owners.

- Minimized attack surfaces: ZKPs limit data exposure, reducing vulnerabilities and enhancing security.

- Reliable decision-making: Agents can verify the authenticity of external data, ensuring that decisions are based on trustworthy information. For example, agents may leverage data from a decentralised oracle network or Chainlink Data Feed to provide important real-world context to inform its decisions and actions.

By leveraging ZKPs, agentic AI enables secure, efficient, and private collaboration, even in environments with low initial trust.

Applications of Agentic AI in the Financial Sector

Agentic AI promises to reshape the financial sector by automating complex processes, enhancing risk management, and improving decision-making. Its ability to deploy specialized agents that work autonomously and collaboratively with each other – and humans – unlocks new efficiencies and capabilities across a range of applications.

Ensuring Compliance

In the regulatory sphere, both the regulators and the regulated entities themselves face the monumental task of overseeing vast and complex financial ecosystems. Agentic AI can streamline this effort by continuously monitoring transaction data for anomalies, ensuring compliance with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations. These agents can help validate compliance autonomously (whilst also maintaining a real-time view of how regulations are evolving), flagging high-risk transactions for human review while maintaining strict privacy protocols. By leveraging zero-knowledge proofs (ZKPs), they ensure sensitive customer data remains confidential, addressing one of the industry’s most pressing challenges: balancing transparency with privacy.

Performing Credit Analysis

As described earlier, credit analysis, a traditionally labor-intensive process, also stands to benefit. Financial institutions often compile and review extensive datasets to evaluate creditworthiness. Agentic AI can break this process into specialized tasks: one agent gathers financial data, another calculates key risk metrics like debt-to-income ratios, and a third consolidates these findings into a comprehensive credit memo. These agents collaborate seamlessly, ensuring faster and more accurate evaluations—particularly critical in high-stakes institutional lending.

Guiding Monetary Policy

Central banks, tasked with implementing monetary policy, can also harness the power of agentic AI. Agents monitor key economic indicators—such as inflation, GDP growth, and employment rates—synthesizing insights to guide policy decisions. By simulating the impact of interest rate changes or open market operations, these systems allow central banks to fine-tune their interventions with greater confidence and precision, mitigating unintended consequences across sectors.

Managing Tokenised Assets

Tokenized assets, such as digital bonds or tokenized real estate, are becoming integral to modern finance, and agentic AI provides the infrastructure to manage them effectively. Agents can track asset performance, validate collateral values, and integrate these assets into lending and investment portfolios. For central banks exploring tokenized green bonds to support ESG goals, agents can ensure compliance, monitor market conditions, and provide real-time analytics to policymakers.

Orchestrating Payments

In payment systems and cross-border transactions, agentic AI offers unparalleled speed and security. Agents can leverage an oracle network to handle currency conversion, compliance checks, and settlement processes in seconds, ensuring seamless transfers across jurisdictions. In a CBDC framework, for instance, agents could help coordinate international payments, maintaining compliance with local regulations while minimizing delays—making cross-border payments as frictionless as domestic transactions.

Enhancing Security

Fraud detection and cybersecurity also benefit from agentic AI’s reasoning and autonomous execution capabilities. Specialized agents monitor transaction patterns, detect anomalies, and respond to potential breaches autonomously. For example, an agent identifying a phishing attack could isolate compromised accounts and alert human operators in real time, preventing widespread disruption.

By integrating agentic AI into financial operations, institutions, and regulators alike can achieve unprecedented levels of efficiency, resilience, and trust. From ensuring liquidity to safeguarding against fraud, these systems are transforming the financial landscape, paving the way for a more adaptive and robust global economy.

Conclusion: A Vision for the Future

As agentic AI advances, its integration with zero-knowledge proofs (ZKPs) may be instrumental in establishing the trust needed for these systems to succeed. ZKPs enable agents to validate critical information—whether verifying compliance, assessing transactions, or authenticating data—without exposing sensitive details. This capability directly addresses the fundamental challenges of privacy, security, and transparency that have long limited autonomous, multi-agent ecosystems.

The application of ZKPs within agentic AI unlocks transformative potential across industries, particularly in finance. What sets ZKPs apart is their ability to foster trust in systems where it would otherwise be scarce. This trust enables agents to operate confidently in decentralized environments, collaborating across institutional and regulatory silos without compromising data integrity. Businesses, in turn, gain the ability to innovate faster, optimize processes, and expand securely into new markets.

The convergence of ZKPs and agentic AI represents an exciting opportunity for industries to embrace a trust-first approach. By embedding ZKPs at the core of agentic systems, organizations can address the privacy paradox upfront and lay the foundation for greater value creation through the adoption of agentic architectures.