7 Key Principles for Proof of Reserves

The rise of tokenized treasuries, stablecoins, and other digital assets is accelerating the shift of global finance onto blockchains, raising important questions about transparency and trust. The traditional audit model, built for quarterly snapshots and trust-based verification, is no longer adequate in an always-on financial system.

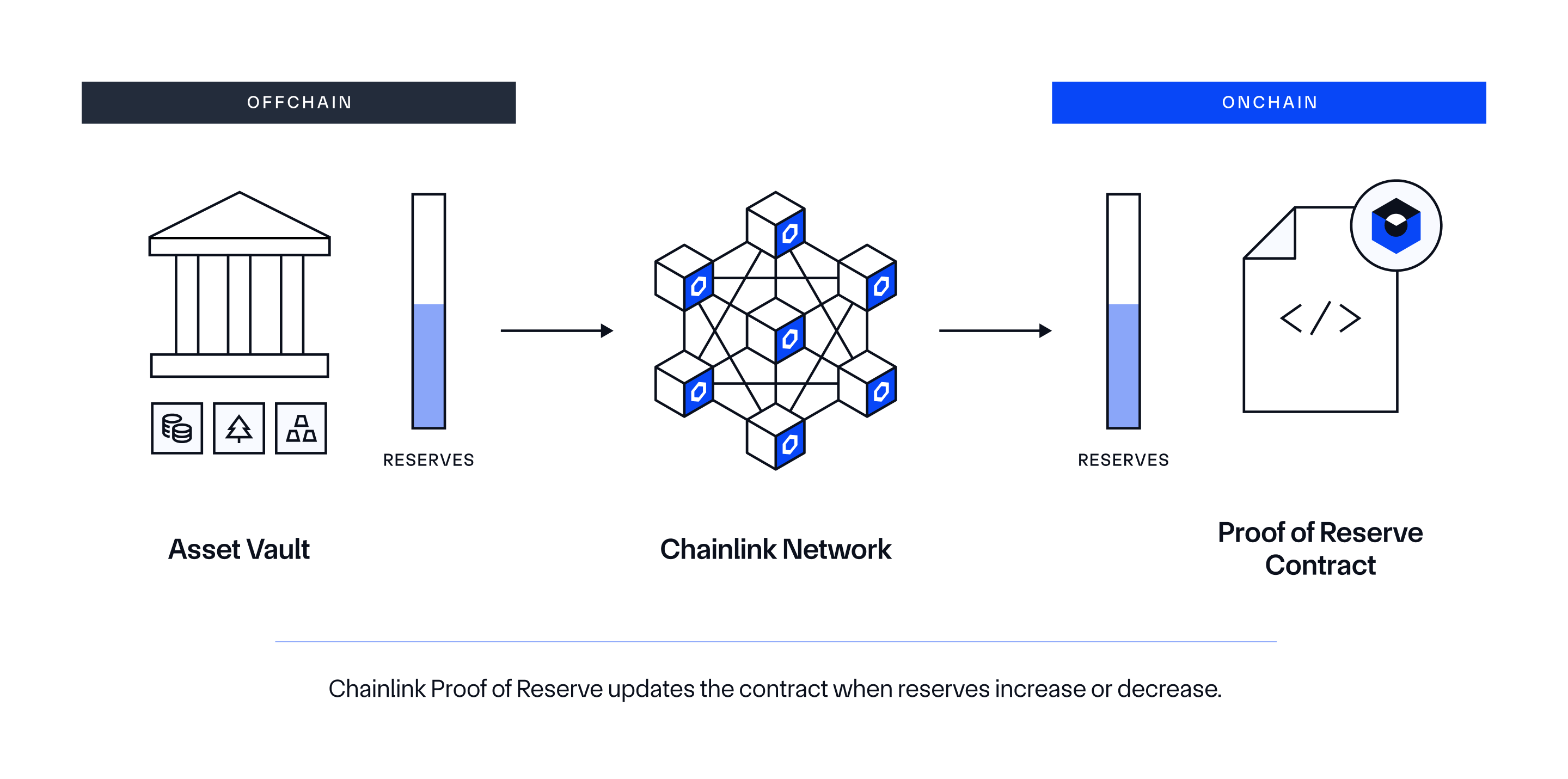

This is where proof of reserves comes in. With the right framework in place, proof of reserves supplements delayed attestations with real-time, cryptographic verification that financial assets are fully collateralized.

However, as recent market collapses have shown, not all “proof” is created equal. If Proof of Reserves is to serve as the foundation for modern financial infrastructure, it must meet clear, effective standards—and policymakers must be able to recognize the difference between what works and what merely looks like it works.

In this blog post, we outline seven key principles for an effective proof of reserves system, along with common pitfalls to avoid.

1. Onchain Publication

Proof of reserves must be published directly on public blockchains, ensuring transparency and accessibility to reserves data that would otherwise remain opaque, alterable, or limited to private disclosures. Public blockchains serve as neutral ground where regulators, investors, and everyday users can all independently verify the same information.

2. Real-time Visibility into Reserve Changes

Proof of Reserves must provide real-time visibility into changes in reserve levels. These updates need to occur automatically as new reserve data becomes available, allowing continuous oversight by users and regulators.

Systems that expose reserve data only at fixed intervals, be it monthly or quarterly, create large windows where reserves can drift, be misrepresented, or even disappear without detection. This exact “gap” problem has been the main culprit in previous financial market disasters such as the FTX collapse.

3. Cryptographic Verification

Proof of reserves must provide a tamper-proof record of what reserve data was observed and when. After retrieving reserve values from a designated source, independent parties(such as oracle nodes) cryptographically sign the reported result and publish it onchain. This creates a publicly verifiable record that reflects a specific point in time, ensuring that once data is observed, it cannot be altered or replaced.

4. Verification by Independent Parties

Proof of reserves must be verified by independent third parties—such as oracle networks or attestors—that are not affiliated with the entity being verified. These verifiers should retrieve reserve data directly from trusted sources, like custodians or auditors, rather than relying on data provided by the issuer itself. This ensures that the verification process is based on externally sourced, authenticated information and that no single actor can control or manipulate the outcome.

5. Proven Verification Infrastructure

The infrastructure used by independent parties to verify proof of reserves must be battle-tested, secure, and operationally reliable. It’s not enough for a proof to be validated by multiple entities—those entities must also use systems that have consistently delivered reserve attestations in high-value, production environments. Reserve verification depends not just on decentralization, but also on battle-tested systems that have demonstrated resilience, uptime, and correctness over time.

6. Full Coverage of All Asset-Backed Tokens

Proof of reserves must cover every asset or token that is presented as being backed by reserves. This includes stablecoins, wrapped tokens, tokenized funds, and all other collateralized assets. If an asset implies collateral backing, it must be included in the proof.

The point of emphasis is that the most well-known assets, such as Bitcoin or Ethereum, aren’t the only assets of importance. It is essential not to cherry-pick a narrow set of assets and instead apply the same level of verification standard to all collateralized assets.

7. Proof Requirements for All Custodians and Issuers

Any entity that custodies third-party funds, including centralized exchanges and traditional custodians, or issues tokenized representations of those funds, such as stablecoin issuers and tokenized asset platforms, must provide proof of reserves.

This responsibility cannot be limited to one or two categories of institutions while others are allowed to operate without transparency. If an entity holds assets on behalf of users or creates claims to value through tokenization, it should be held to the same reserve transparency standards, no matter what form it takes or what label it operates under.

Building On the Foundation of Proof of Reserves

Proof of reserves establishes a strong foundation for transparency in onchain finance. As adoption grows and tokenized financial products become more sophisticated, new technologies will complement Proof of Reserves systems. These include:

- Secure Mint, which directly integrates Proof of Reserves into the token minting process, ensures that tokens cannot be created without corresponding assets in reserve.

- Proof of Composition, which provides visibility into the specific makeup of reserve assets. This helps to identify concentration, liquidity, or duration risks that wouldn’t be obvious from total balances alone.

- Proof of Solvency, which allows organizations to demonstrate that their total assets exceed liabilities.

Conclusion

Proof of reserves has already proven itself as a critical safety measure for onchain finance but how it’s implemented determines how well it will protect users. The strength of a proof of reserves system comes down to a handful of essential qualities: where proofs are published, how often they’re published, who verifies them, what types of assets they cover, who must provide them, and where the data comes from.

These seven principles offer a clear framework for assessing whether a proof of reserves implementation delivers meaningful transparency, or just the appearance of it.

It’s time for policymakers, institutions, and token issuers to adopt these principles as a baseline. With the right standards in place, proof of reserves can serve as a trusted foundation for the next generation of global financial infrastructure.

Related Articles

- How Chainlink Is the Largest Provider of Onchain Proof of Reserves

- Chainlink Proof of Reserve for Strategic Bitcoin Reserves and Digital Asset Stockpiles

- 8 Blockchain Use Cases for Governments

- Secure Mint Explained: How Chainlink Proof of Reserves Enhances the Security of Stablecoins, Tokenized Assets, and Wrapped Tokens