What Is Chainlink? A Beginner’s Guide

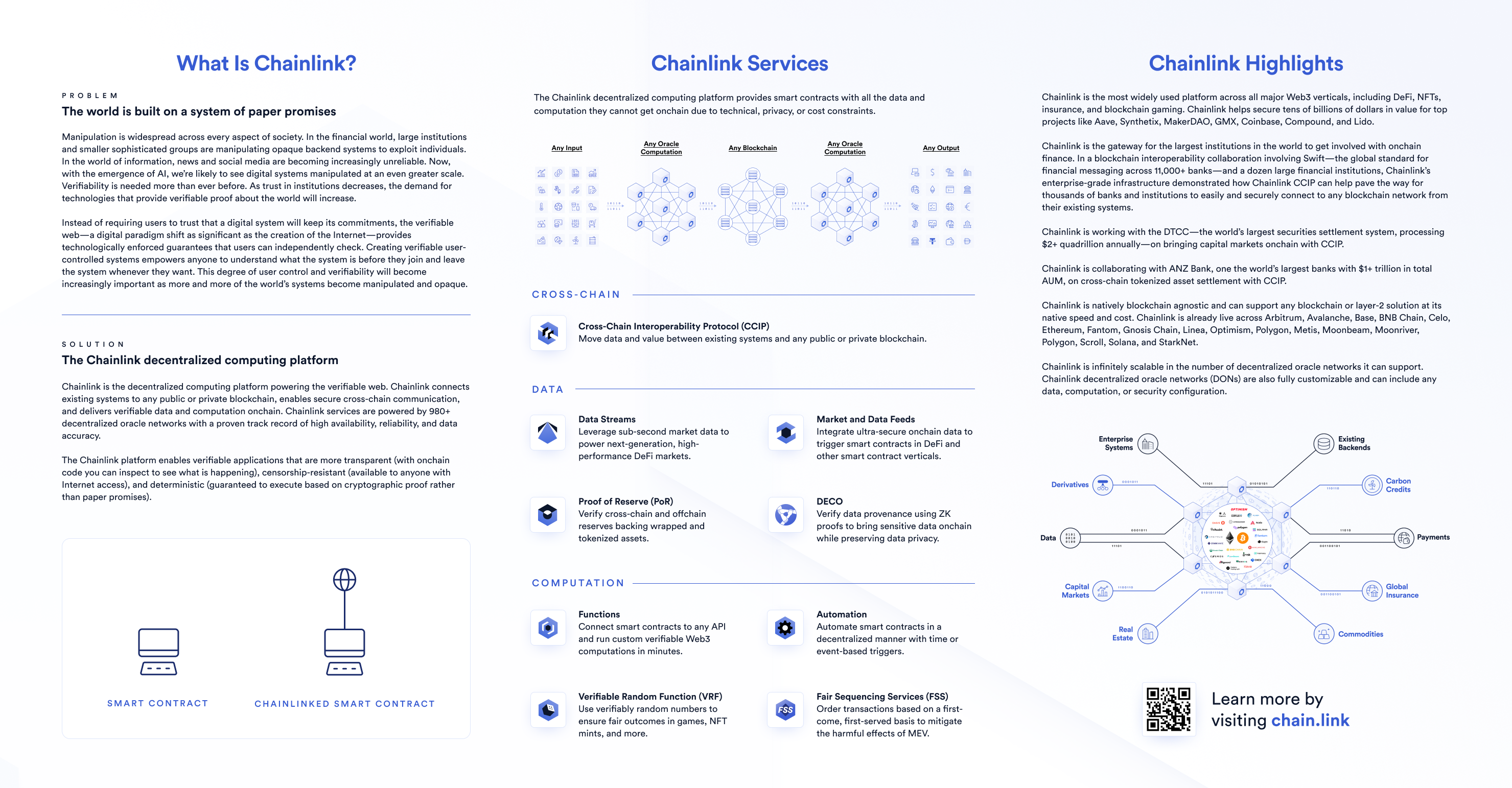

Chainlink is the industry-standard Web3 services platform that has enabled trillions of dollars in transaction volume across DeFi, insurance, gaming, NFTs, and other major industries. As the leading decentralized oracle network, Chainlink enables developers to build feature-rich Web3 applications with seamless access to real-world data and off-chain computation across any blockchain and provides global enterprises with a universal gateway to all blockchains.

With cryptocurrency and blockchain technology gaining mainstream attention and Chainlink establishing itself as a key component of many blockchain applications, more people are entering the industry and asking the fundamental question: what is Chainlink?

In order to help those new to blockchains, smart contracts, and oracles, we’ve created a simple overview to showcase the value of the Chainlink oracle network and how it enables blockchain technology to reach its full potential. This guide provides context on Chainlink by answering three key questions:

- What is the underlying value proposition of blockchains and smart contracts?

- Why is there an inherent limitation to smart contracts that Chainlink must help resolve?

- How does Chainlink’s solution unlock the full potential of smart contracts?

How Blockchains Eliminate Counterparty Risk

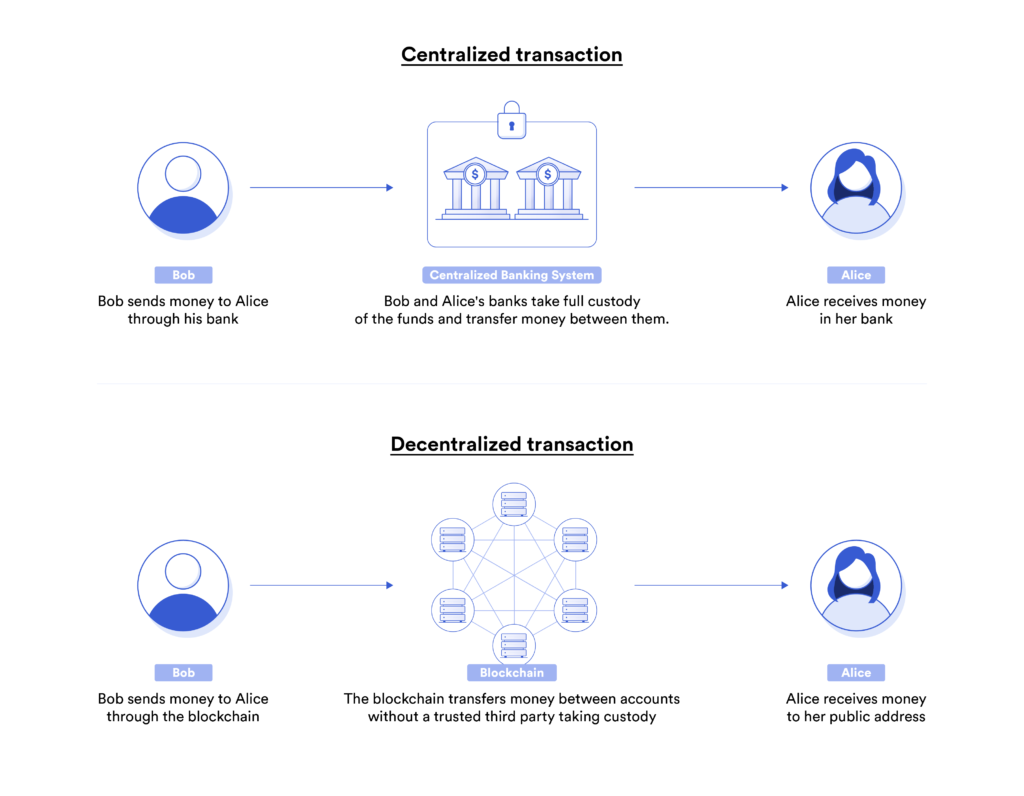

To fully comprehend the importance of Chainlink, it’s critical to first understand the underlying value of blockchains and smart contracts. Generally, a blockchain is a decentralized network of computers that performs computation and stores data in a shared ledger. A blockchain differs from traditional, centralized computer systems in that:

- No single person or group controls it.

- Everyone in the world has equal access to send it commands.

- The applications running on it and the data stored in it cannot be tampered with or deleted.

- All transactions processed over time are recorded in a continuously growing ledger.

- Transactions are paid for via a native cryptocurrency.

Blockchains achieve these properties by having thousands of computers run the same software, process the same transactions, store the same data, and consistently cross-check one another to reach consensus as a network about what is valid. All these network operations are backed by monetary incentives that reinforce honest behavior and consensus. By redundantly validating and storing transactions across a large decentralized network of financially incentivized participants, blockchains make it extremely expensive and impractical to manipulate the shared ledger.

Thus, blockchains are extremely secure and reliable systems for performing computation and storing data for processes involving two or more independent parties. The fundamental benefit of blockchains is that they mitigate counterparty risk—the risk that the other party in a contract won’t uphold their end of the agreement. For example, if someone wants to make a digital trade with a stranger, how do they decide who sends money first, whether they have enough funds, and that the funds can’t be spent twice (commonly known as the double spending problem)? Traditionally, users would employ a third party such as a payment processor or clearinghouse to facilitate the trade or arbitrate a dispute. However, a blockchain serves as a more reliable, tamperproof, and unbiased system for settling transactions. Users know that when they send a transaction to the blockchain, it will execute exactly as instructed.

A blockchain’s decentralized architecture is why Bitcoin and other cryptocurrencies have emerged as such strong forms of money: users can trust that no central administrator will inflate the supply (capped at 21M BTC) and that the underlying Bitcoin blockchain showing who owns Bitcoin has been validated by thousands of computers across the world. Also, the decentralized design of the blockchain allows users to exchange value directly, “peer-to-peer”, removing custodial middlemen who can siphon off fees and censor transactions, ultimately allowing users to retain ownership over their assets and data.

However, blockchains can support many use cases beyond simply moving and recording money on a ledger. Some highly programmable blockchains allow a more expressive set of commands, specifically through running applications on the network that trigger actions based on specific, predefined events (if x event happens, then execute y action). For example, if Flight 777 is canceled tomorrow, issue an insurance payout of $77; if not, then don’t make the payment. These blockchain applications, which can process a wider range of logic, are referred to as “smart contracts,” and have been the subject of much of the development around blockchains since Ethereum first introduced them at scale in 2015.

Problem: Smart Contracts Can Reintroduce Counterparty Risk

The problem is that a smart contract requires data (e.g. flight departure information) to execute commands, but most of the data it needs to digitize and automate real-world agreements is not stored on blockchains. The smart contract cannot fetch external data either, because blockchains are like black boxes with no built-in ability to connect with the outside world. This means that asset prices, sports scores, Internet of Things (IoT) sensors, web data, enterprise systems, and the multitude of other real-world datasets are simply not available on the blockchain, severely limiting the types of smart contracts developers can create. How does one develop a flight insurance agreement without flight data?

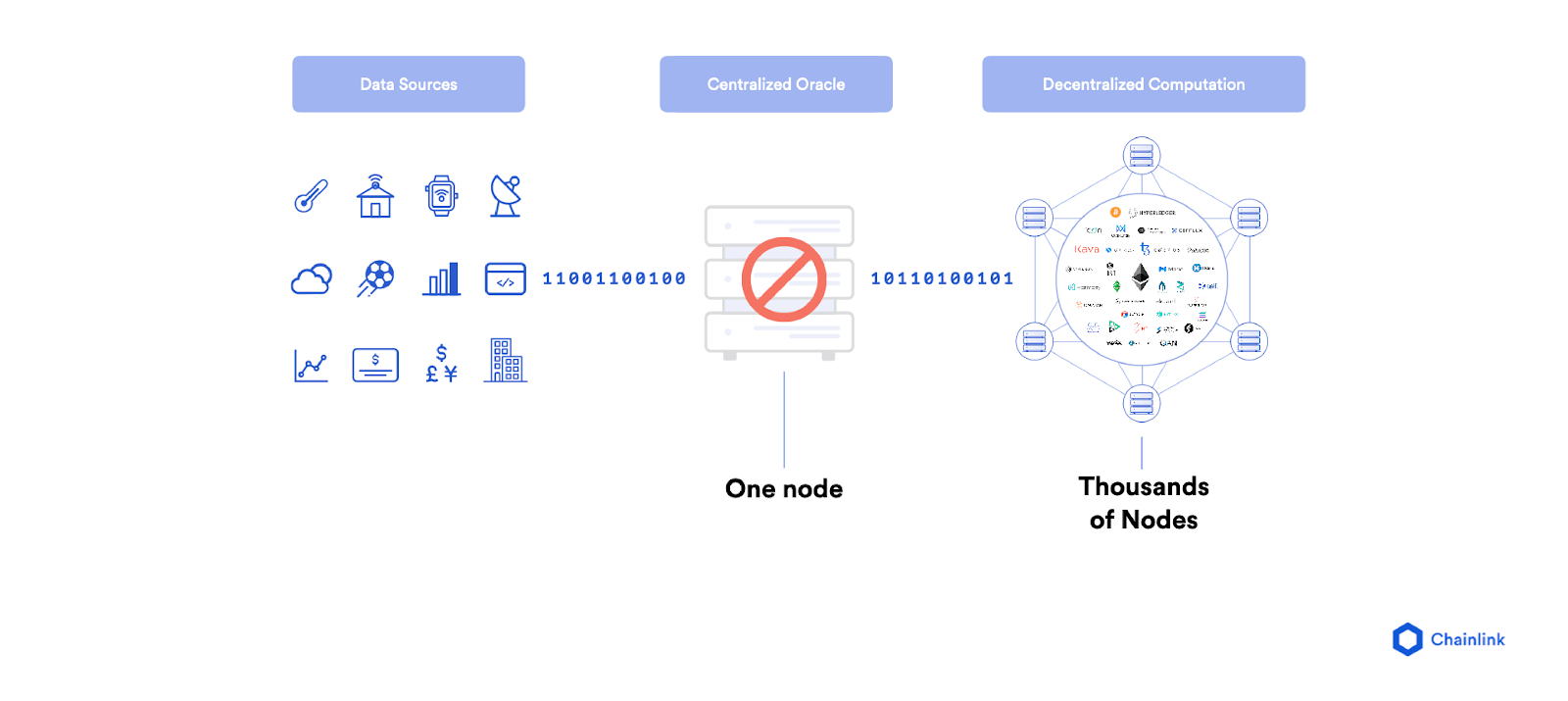

The only way to efficiently get data into the blockchain is for a software component called an “oracle” to input it into the blockchain. The challenge then becomes, how to design an oracle mechanism with the same security and reliability properties of the underlying blockchain so as to retain the underlying value proposition of the smart contract, e.g. extreme reliability without counterparty risk. If a single, centralized oracle is responsible for inputting the data used to trigger the smart contract, then that oracle has complete control over the smart contract’s outcome. This introduces a serious point of failure known as the oracle problem, which puts the entire smart contract at risk.

Solution: The Chainlink Decentralized Oracle Network

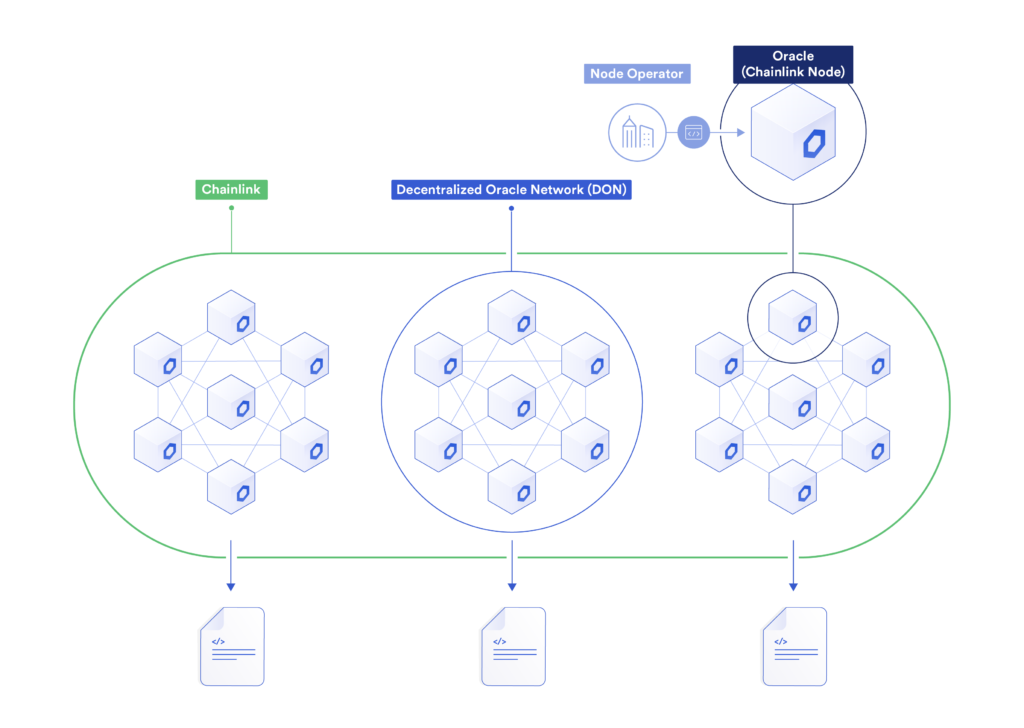

Chainlink, a decentralized oracle network, was developed to allow smart contracts to automate the transfer of data between blockchains and outside systems in a highly secure and reliable manner. It uses a similar model to a blockchain in that there is a decentralized network of independent entities (oracles) that collectively retrieve data from multiple sources, aggregate it, and deliver a validated, single data point to the smart contract to trigger its execution, removing any centralized point of failure.

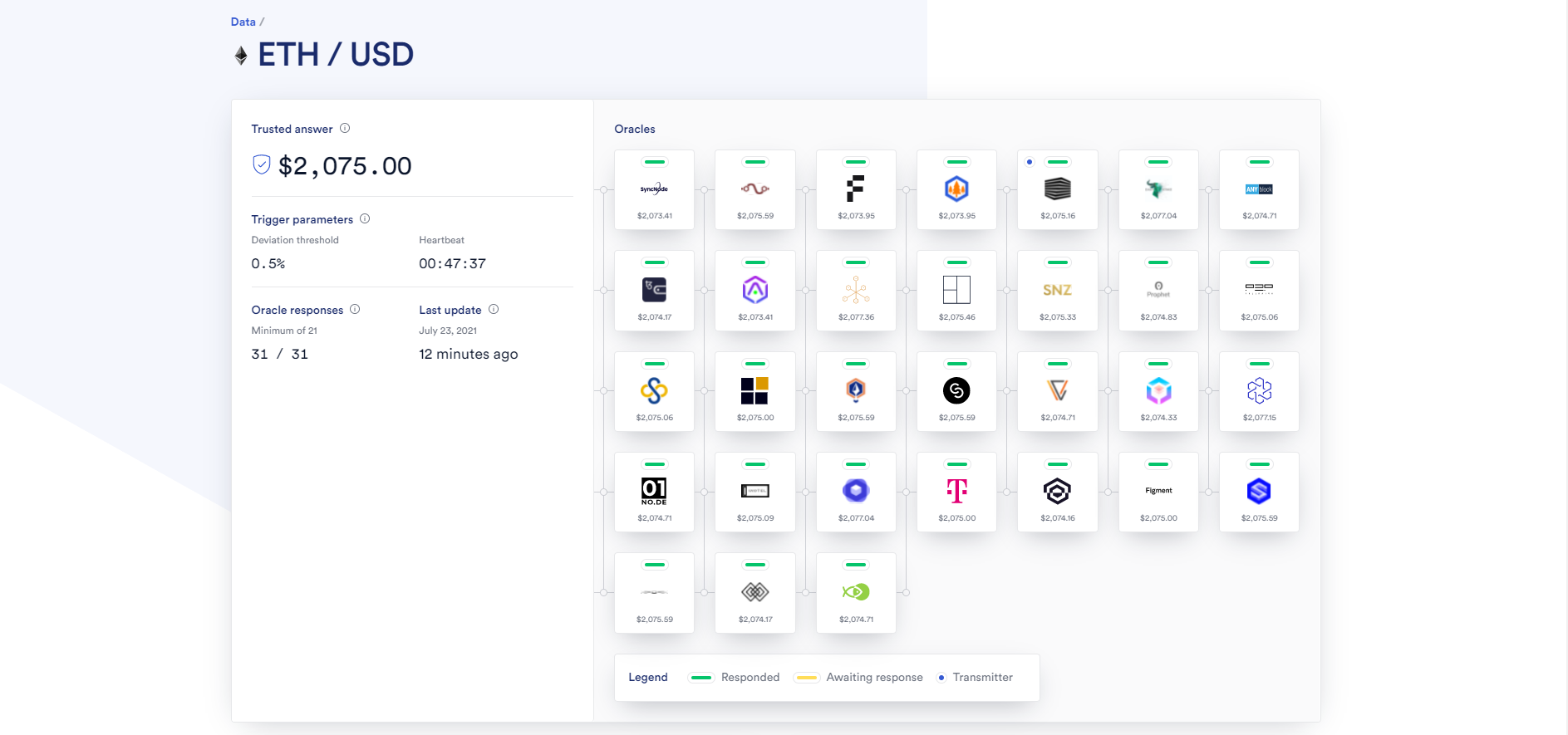

For example, Chainlink provides the USD price of Ethereum’s native cryptocurrency ETH to blockchains via the ETH/USD Price Feed, which uses numerous independent oracle nodes and data sources to source and deliver the price data (pictured below). The ETH/USD price oracle can then be used by a blockchain application to get the current price of ETH when being used as collateral to obtain a loan or to settle a prediction made about the future ETH price.

Chainlink also provides multiple layers of security that go beyond decentralization to ensure users can trust the oracle network:

- Generalized architecture – Chainlink is a flexible framework for building and running oracle networks, meaning users can construct and/or connect to customized oracle networks without dependencies on other oracle networks.

- Data signing – Chainlink oracles sign the data they input on-chain with a unique cryptographic signature, allowing users to prove its origin as being from a specific oracle node.

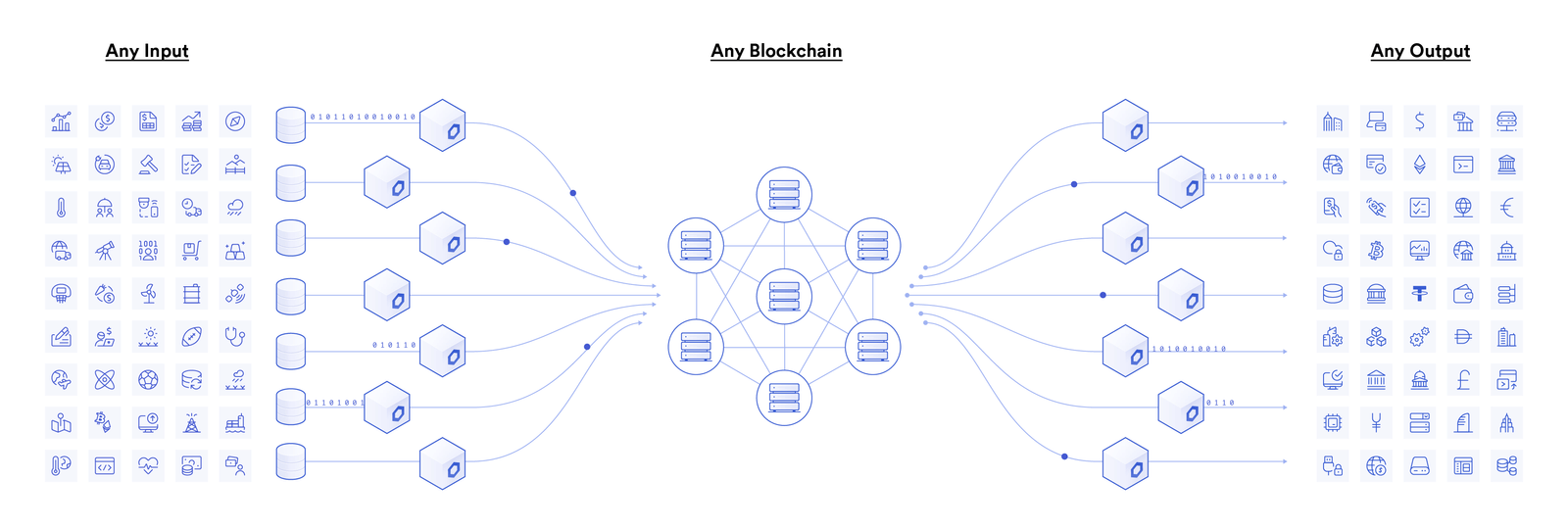

- High-quality data – Chainlink provides smart contracts with data from any external system including premium data providers and allows smart contracts to send commands to other systems such as to make a payment on a traditional payment rail.

- Blockchain agnostic – Chainlink can run natively on any blockchain without dependencies on other blockchains, meaning it can support public blockchains, enterprise blockchains, and more.

- Service-level agreements – Chainlink will eventually allow users to define the terms of the oracle job requested in on-chain smart contracts, which may require that oracle nodes put down a security deposit that is only returned to the node if they perform according to pre-agreed upon terms (e.g. data is delivered on time).

- Reputation systems – Chainlink oracles’ historical performance is publicly available via signed data on-chain, allowing users to select oracles based on historical performance metrics such as average response time, completion ratio, average security deposit, and more. Node operators also have the option of providing additional data like their identity, geographic location, and third-party certifications.

- Optional features – Chainlink is also developing additional security approaches for features like oracle and data privacy, advanced oracle computations, and more.

Use Cases of Chainlink

By providing strong security and reliability guarantees on par with the blockchain, more advanced smart contracts are being created using Chainlink oracles. While we have already outlined 77 Smart Contract Use Cases Enabled By Chainlink, some of the main ones include:

Decentralized Finance (DeFi)

Many traditional financial products like loans, payments, derivatives, asset equity, and more are being built on the blockchain using smart contracts to increase their security and transparency and reduce barriers to entry. These DeFi applications use Chainlink to price assets, access interest rates, verify collateralization, and more, which enable these products to perform functions like issue a loan at fair market value, automate the issuance of dividends, and settle an options contract.

Insurance

Smart contracts are also being leveraged to create parametric insurance contracts on the blockchain. Chainlink is currently being used in production to provide weather data to the Arbol crop insurance market, enabling farmers all over the world to obtain parametric crop insurance simply with an Internet connection, which is settled in a fair and timely manner according to the amount of rainfall, temperature, or other evaluators the policy is set to (e.g. if it rains more than x amount this year, pay out y settlement).

Gaming

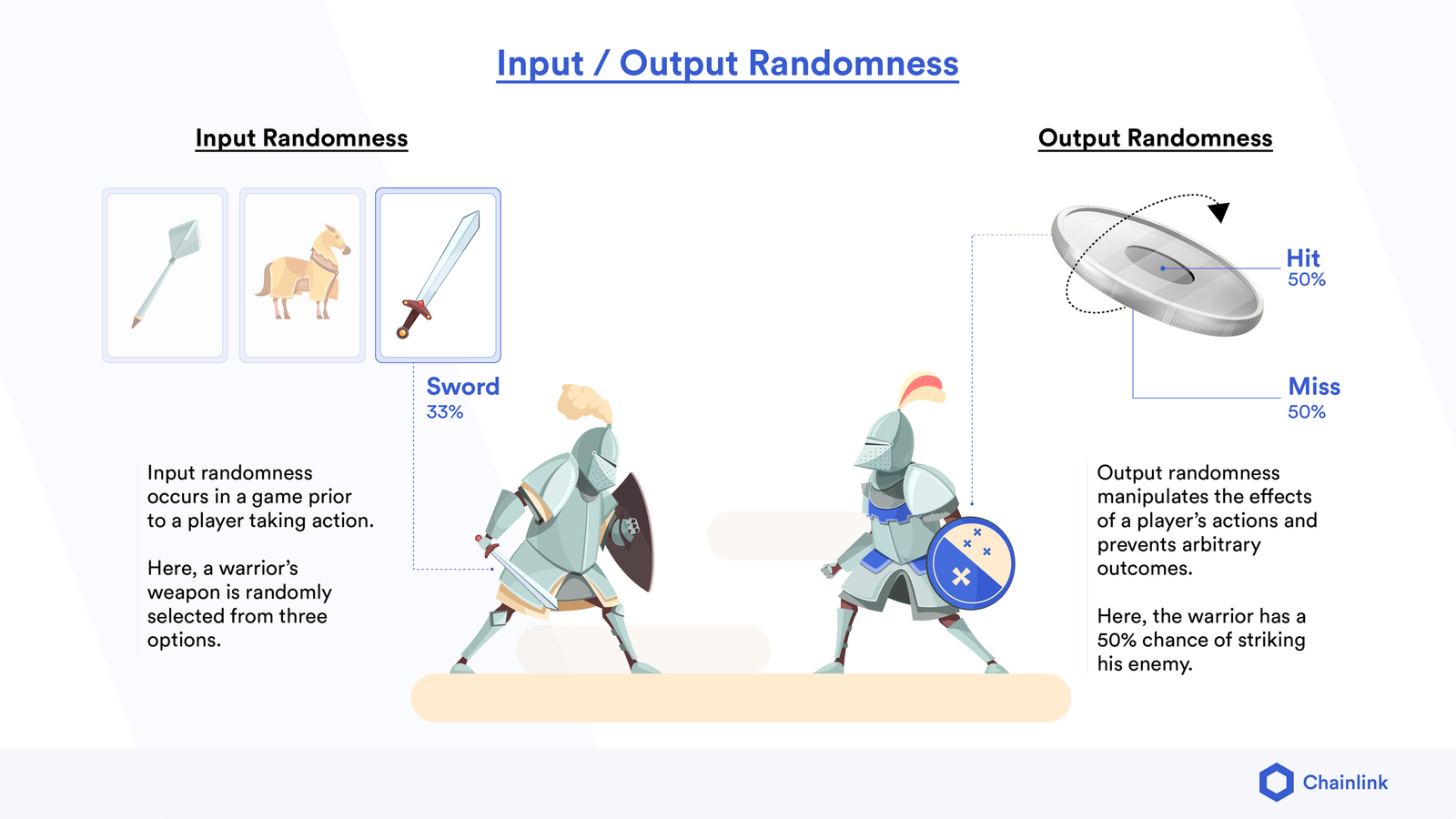

Developers are also beginning to launch smart contract-based gaming applications on the blockchain that often incorporate non-fungible tokens (NFT) as scarce digital collectibles. One of the key building blocks of many blockchain games is a source of randomness to generate random in-game scenarios or determine the lucky winner of prizes. Chainlink provides a randomness solution called VRF, which generates randomness and delivers it to the smart contract in a manner where users can prove it is fair and unbiased, as neither the players, game creators, or external entities can tamper with or manipulate the randomness to their advantage.

Traditional Systems

Another key use case of Chainlink is providing traditional systems like data providers, IoT networks, websites, and enterprises a way to make their data and services available to any blockchain network. Since the Chainlink Network is blockchain-agnostic, Chainlink oracles serve as an integration gateway for connecting current digital and data infrastructure to any/all blockchain networks. An industry-standard interoperability framework using oracle networks like Chainlink to connect traditional systems with blockchains was outlined in the recent World Economic Forum report co-authored by Chainlink Co-founder Sergey Nazarov titled Bridging the Governance Gap: Interoperability for Blockchain and Legacy Systems.

These are just some of the many capabilities Chainlink provides to allow smart contracts to interact with external data and systems with a high degree of security and reliability. The end result is the ability for blockchain-based smart contract applications to enable extensively more use cases across a more diverse set of markets.

If blockchains are decentralized computers and smart contracts are decentralized applications, then Chainlink can be thought of like a decentralized Internet that finally allows smart contracts to interact with the outside world while maintaining blockchain technology’s fundamental guarantees around security, transparency, and trust.

Additional Resources

If you are new to blockchain technology and want to dive deeper, we recommend reading the following educational series in order:

- What Is a Blockchain?

- What Is a Smart Contract?

- What Are Data and APIs?

- What Is the Oracle Problem?

- What Are Chainlink Node Operators?

- Hybrid Smart Contracts Explained

If you want something more technical, we encourage you to read the original Chainlink whitepaper, Chainlink 2.0 whitepaper, developer documentation, and browse through the Chainlink blog for a wide variety of resources.

To stay up-to-date with the latest news, follow the official Chainlink Twitter, and subscribe to the Chainlink newsletter.