Unlocking Synthetic Derivatives With Chainlink Oracles

Together with Synthetix we have developed a novel pricing mechanism to power a new synthetic derivatives product that gives users on-chain exposure to oil. This innovation is one in a growing number of examples of how Chainlink is bringing synthetic assets from traditional markets to DeFi through the provisioning of secure oracles with access to high-quality data.

Financial systems have evolved significantly since the days of direct barter. Today, there exists a whole suite of financial products from loans and 401k plans to weather insurance and credit default swaps. The only limit now is one’s own imagination, as investors can get financial exposure to just about anything for the right price.

Throughout history, the creation of financial products has been mostly restricted to large financial institutions. This is predominantly because of the risk and capital involved with offering exotic financial products and the financial regulations surrounding it.

Decentralized Finance (DeFi) has arguably for the first time in history created a new permissionless financial framework that allows anyone in the world to build standard and unique financial products alike and offer them to the general public. Right now, anyone with an Internet connection can obtain a stable-rate loan on Aave, gain long exposure to gold on Synthetix, swap assets with instant access to AMM liquidity on DODO, and much more.

A key part of empowering this new financial infrastructure is access to data. Chainlink is providing a standard open-source framework where anyone can build any price oracle design or access existing ones via Chainlink Price Reference Data Contracts. Many of these initial price oracles are focused on cryptocurrencies because it’s what most DeFi products are built around. However, Chainlink’s Price Reference Data has since expanded to include commodities, FX rates, and indices. This is really just the beginning of what’s possible.

Building a Unique OIL/USD Price Feed with Synthetix

We are pleased to announce that together with Synthetix we provisioned a novel price feed for sOIL, a synthetic digital asset tied to a non-expiring Crude Oil Price Index. This was accomplished through the combination of the SIP-62 futures reference pricing algorithm and a Chainlink-powered decentralized oracle network.

Creating the reference price feed for sOIL required a novel approach to creating an accurate and reliable price feed outside the typical design pattern. The complication was due to the fact that commodities such as oil are usually only traded as monthly futures contracts. This means there can be multiple different price points for the same asset due to having several futures contracts that exist in parallel with varying expiry dates.

Utilizing price data from only the most recent futures contract introduces significant risk. This is best exemplified by a recent flash crash where the West Texas Intermediate (WTI) crude oil futures contract for May 2020 dropped 300% in a day just before expiry, ultimately settling at a price of negative $37 per barrel. While not a common occurrence by any means, such market dynamics exist and need to be mitigated against.

In order to offset these price anomalies, we diligently worked with Synthetix to create an OIL/USD Price Reference Feed which employs a dynamic weighting scheme of the two futures contracts nearest to expiration. The nearest contract is initially weighted most heavily, but as the expiry date approaches, weight is progressively shifted out of the near contract in favor of the next month’s futures contract. Once the front month fully expires, the nearest two live contracts become the first and second months, and the dynamic weighting process repeats.

This ensures that any volatility around a futures contract expiry has minimal effect over the final reference price point generated and published on-chain by Chainlink price feeds. An event like the WTI oil flash crash described above would have had little to no effect over the reference price point generated.

A Wide Open Market For Developing Customized Financial Products

sOIL is a great case study showcasing that DeFi developers are on the precipice of going far beyond cryptocurrency price feeds and starting to create financial products that provide exposure to food, energy resources, rare earth metals, real-world assets, equities, NFTs, weighted asset baskets, and much more.

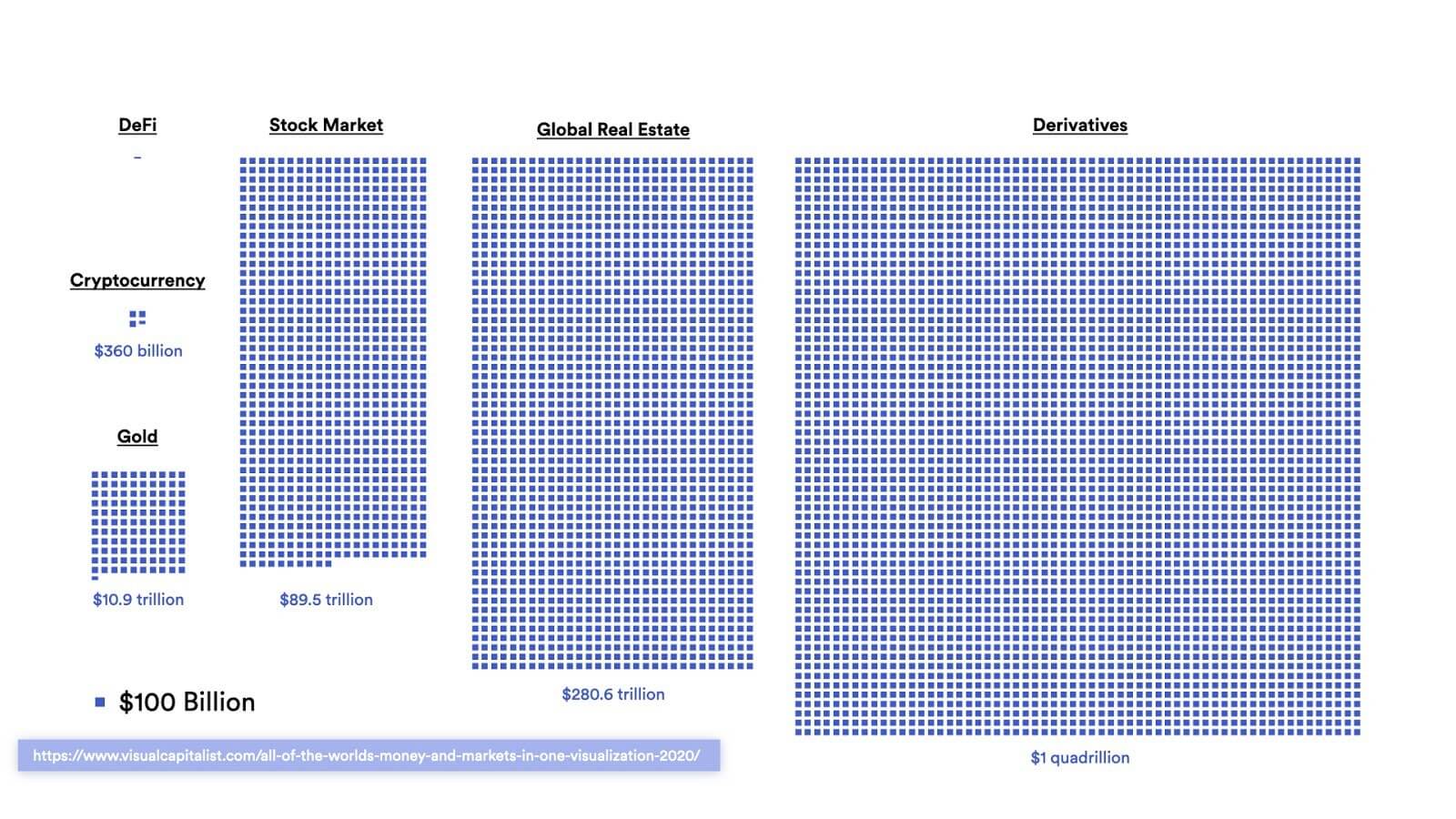

While DeFi has experienced explosive growth recently, achieving over $13B in total value locked, the global market for crude oil alone is over $1.7T and the derivatives market is estimated to have a notional value to be between $500 trillion to $1.2 quadrillion. Traditional financial markets are orders of magnitude larger than cryptocurrency markets; DeFi has only begun to scratch the surface of tapping into it.

Chainlink is foundational infrastructure for providing on-chain exposure to traditional assets or completely new financial products. Prior to the sOIL integrations, Chainlink is already offering live price feeds on Ethereum mainnet for gold, FX rates, cars, Ethereum fast gas, and more. Now with this new price oracle model, we can easily apply to many other industries where price discovery primarily takes place in monthly futures contracts such as corn, coffee, sugar, wheat, and platinum, among many others.

Creating price feeds based on futures markets opens up new lucrative revenue streams for traditional data providers who already may have decades of experience tracking real world asset markets. This is exemplified by high quality data providers leveraging the Chainlink Network to sell futures oil data to applications like Synthetix.

There is an exponential growth in use cases by enabling on-chain exposure to any real-world asset imaginable. With just an internet connection, a farmer in Sudan could hedge against the price of cotton falling. A factory worker in Southeast Asia can increase her exposure to copper after noticing an increase in demand for natural resources. A family in Venezuela can gain exposure to precious metals to fight hyperinflation.

Importantly, none of these use cases require the participants to wait for the local government or bank to provide access to these products. DeFi’s permissionless infrastructure is available to developers anywhere in the world to build customizable applications and price feeds that service global and local markets.

It’s not limited to speculation either; synthetic assets can be used as collateral to take out loans, represent insurance against unexpected events, or be included as part of a DAO’s investment strategy. In fact, smart contracts are flexible enough where a whole village of farmers could pool money together to collectively hedge their crops against a rainy season.

On-chain exposure to traditional financial markets will continue to become more and more accessible without ever having to leave your digital wallet. Additionally, new financial products will also emerge that have never before been possible to create. We don’t entirely know where the future will lead us, but we do know the potential here is limitless.

Start Building With Chainlink Today

Start using Chainlink Price Reference Data today by visiting the developer documentation and joining the technical discussion in Discord. If you want to schedule a call to discuss the integration more in-depth, reach out here.

Website | Twitter | Reddit | YouTube | Telegram | Events | GitHub | DeFi